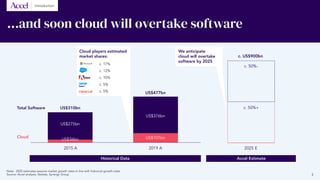

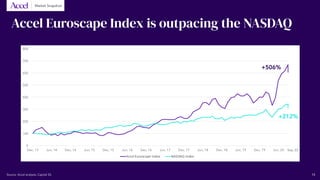

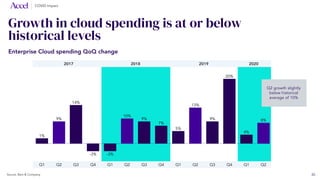

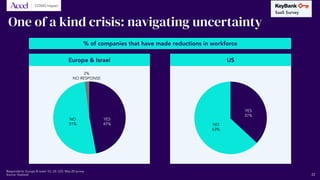

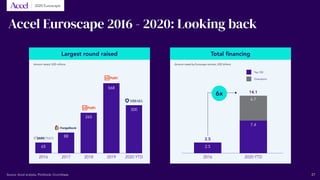

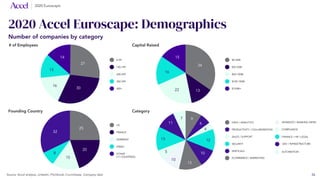

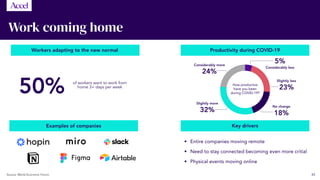

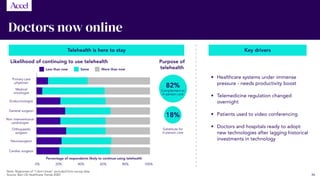

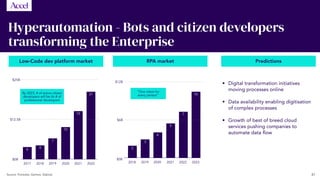

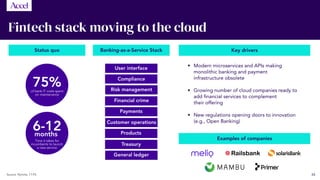

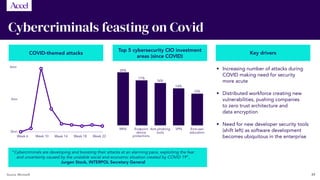

The document presents a comprehensive analysis of the software market from 2010 to 2020, highlighting the significant growth of cloud-based companies and their market capitalization, which reached $2.7 trillion by 2020. It emphasizes the emergence of European cloud decacorns and the growing investment in cloud technologies, forecasting that cloud will surpass traditional software by 2025. Additionally, the impact of COVID-19 on the industry is assessed, with data showing shifts in investment patterns and company performance amidst the pandemic.