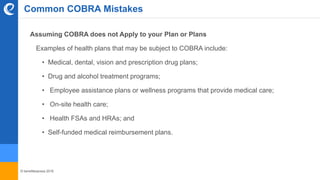

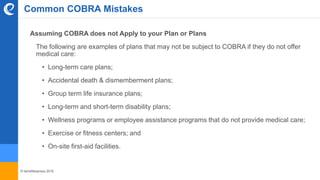

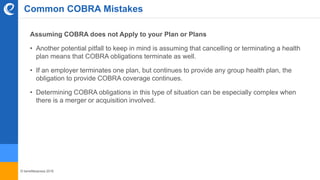

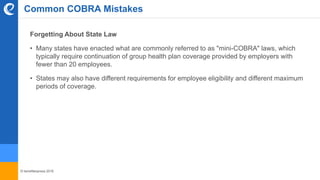

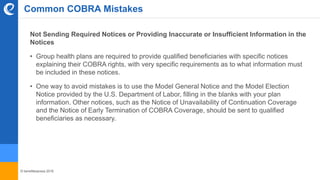

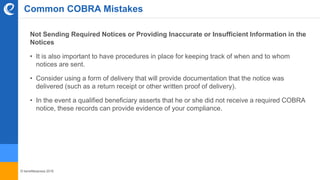

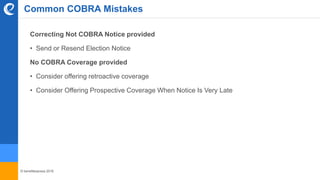

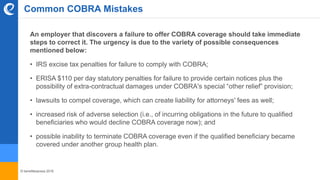

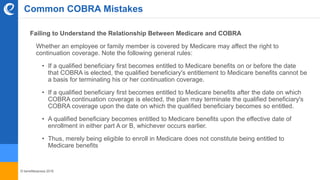

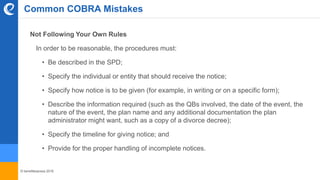

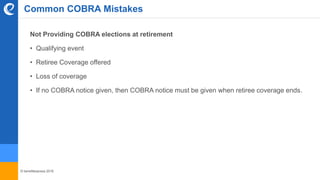

The document outlines key aspects and common mistakes associated with COBRA compliance for employers, particularly those with 20 or more employees. It emphasizes the importance of understanding which health plans are subject to COBRA, notifying qualified beneficiaries of their rights, and adhering to state laws. Furthermore, it highlights potential pitfalls related to premium calculations, notice requirements, and the relationship between COBRA and Medicare, while urging employers to maintain proper procedures to ensure compliance.