Construction Contract Accounting Problems

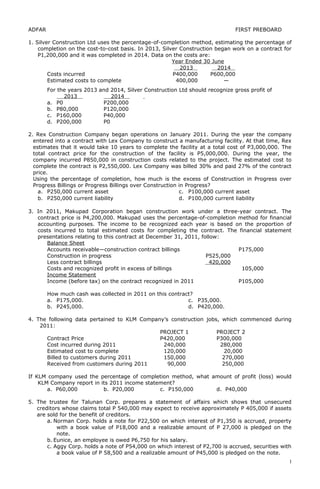

- 1. ADFAR FIRST PREBOARD 1. Silver Construction Ltd uses the percentage-of-completion method, estimating the percentage of completion on the cost-to-cost basis. In 2013, Silver Construction began work on a contract for P1,200,000 and it was completed in 2014. Data on the costs are: Year Ended 30 June 2013 2014 Costs incurred P400,000 P600,000 Estimated costs to complete 400,000 — For the years 2013 and 2014, Silver Construction Ltd should recognize gross profit of 2013 2014 a. P0 P200,000 b. P80,000 P120,000 c. P160,000 P40,000 d. P200,000 P0 2. Rex Construction Company began operations on January 2011. During the year the company entered into a contract with Lex Company to construct a manufacturing facility. At that time, Rex estimates that it would take 10 years to complete the facility at a total cost of P3,000,000. The total contract price for the construction of the facility is P5,000,000. During the year, the company incurred P850,000 in construction costs related to the project. The estimated cost to complete the contract is P2,550,000. Lex Company was billed 30% and paid 27% of the contract price. Using the percentage of completion, how much is the excess of Construction in Progress over Progress Billings or Progress Billings over Construction in Progress? a. P250,000 current asset b. P250,000 current liability c. P100,000 current asset d. P100,000 current liability 3. In 2011, Makupad Corporation began construction work under a three-year contract. The contract price is P4,200,000. Makupad uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2011, follow: Balance Sheet Accounts receivable—construction contract billings P175,000 Construction in progress P525,000 Less contract billings 420,000 Costs and recognized profit in excess of billings 105,000 Income Statement Income (before tax) on the contract recognized in 2011 P105,000 How much cash was collected in 2011 on this contract? a. P175,000. b. P245,000. c. P35,000. d. P420,000. 4. The following data pertained to KLM Company’s construction jobs, which commenced during 2011: PROJECT 1 PROJECT 2 Contract Price P420,000 P300,000 Cost incurred during 2011 240,000 280,000 Estimated cost to complete 120,000 20,000 Billed to customers during 2011 150,000 270,000 Received from customers during 2011 90,000 250,000 If KLM company used the percentage of completion method, what amount of profit (loss) would KLM Company report in its 2011 income statement? a. P60,000 b. P20,000 c. P150,000 d. P40,000 5. The trustee for Talunan Corp. prepares a statement of affairs which shows that unsecured creditors whose claims total P 540,000 may expect to receive approximately P 405,000 if assets are sold for the benefit of creditors. a. Norman Corp. holds a note for P22,500 on which interest of P1,350 is accrued, property with a book value of P18,000 and a realizable amount of P 27,000 is pledged on the note. b. Eunice, an employee is owed P6,750 for his salary. c. Aggy Corp. holds a note of P54,000 on which interest of P2,700 is accrued, securities with a book value of P 58,500 and a realizable amount of P45,000 is pledged on the note. 1

- 2. d. Gabo Corp. holds a note for P9,000 on which interest of P500 is accrued, nothing has been pledged for the note. How much may Norman Corp. and Eunice Corp. receive? a. P 27,000 ; P5,063 c. P27,000 ; P6,750 b. P 23,850; P 5,063 d. P23,850; P6,750 6. Sodium Corporation has a normal gross profit on installment sales of 30%. A 2002 sale resulted in a default early in 2010. At the date of default, the balance of the installment receivable was P40,000, and the repossessed merchandise had a fair value of P22,500. Assuming the repossessed merchandise is to be recorded at fair value, the gain or loss on repossession should be a. P0. b. a P5,500 loss. c. a P5,500 gain. d. a P17,500 loss. 7. Santos Co. Sells heavy duty batteries, which cost P7,000 at a total installment price of P12,000. A regular customer buys a unit and trades in his old unit for an allowance of P2,500. Santos spends P250 to recondition each unit traded in and then sells them at P3,250 each. A profit of 20% results from the sale of used batteries. What was the trade-in over(under) allowance granted to the customer? a. 150 over-allowance c. 500 over-allowance b. 150 under allowance d. 500 under allowance 8.Marilag Co., which began operations on January 1, 2010, appropriately uses the installment- sales method of accounting. The following information pertains to Marilag's operations for the year 2010: Installment sales P1,750,000 Regular sales 700,000 Cost of installment sales 1,050,000 Cost of regular sales 420,000 General and administrative expenses 140,000 Collections on installment sales 420,000 The deferred gross profit account in Marilag's December 31, 2010 balance sheet should be a. P168,000. b. P280,000. c. P532,000. d. P700,000. 9. On January 1, 2010, Jem Co. sold a used machine to Linn, Inc. for P210,000. On this date, the machine had a depreciated cost of P147,000. Linn paid P30,000 cash on January 1, 2010 and signed a P180,000 note bearing interest at 10%. The note was payable in three annual installments of P60,000 beginning January 1, 2011. Jem appropriately accounted for the sale under the installment method. Linn made a timely payment of the first installment on January 1, 2011 of P78,000, which included interest of P18,000 to date of payment. At December 31, 2011, Jem has deferred gross profit of a. P42,000. b. P39,600. c. P36,000. d. P30,600. Use the following information for questions 10 and 11: GPC Ltd began work in 2009 on contract #3814, which provided for a contract price of P2,400,000. GPC uses the percentage-of-completion method of accounting. Other details follow: 2009 2010 Costs incurred during the year P 400,000 P1,275,000 Estimated costs to complete, as at 30 June 1,200,000 0 Invoices during the year 450,000 1,950,000 Collections during the year 300,000 2,100,000 10. The amount gross profit to be recognized on contract #3814 in 2009 is a. P150,000. b. P200,000. c. P100,000 loss. d. P193,750. 11. Assume that GPC uses the completed-contract method of accounting. The amount gross profit to be recognized on contract #3814 in 2010 is a. P575,000. b. P875,000. c. P725,000. d. P600,000. 2

- 3. 12. Micah Builders, Inc. is using the completed-contract method for a P4,900,000 contract that will take two years to complete. Data at December 31, 2010, the end of the first year, are: Costs incurred to date P2,240,000 Estimated costs to complete 2,870,000 Billings to date 2,100,000 Collections to date 1,750,000 The gross profit or loss that should be recognized for 2010 is a. P0. b. a P210,000 loss. c. a P105,000 loss. d. a P92,400 loss. 13. Masikap Construction Co. has consistently used the percentage-of-completion method of recognizing revenue. During 2010, Masikap entered into a fixed-price contract to construct an office building for P12,000,000. Information relating to the contract is as follows: At December 31 2010 2011 Percentage of completion 15% 45% Estimated total cost at completion P9,000,000 P9,600,000 Gross profit recognized (cumulative) 600,000 1,440,000 Contract costs incurred during 2011 were a. 2,880,000 b. 2,970,000 c. 3,150,000 d. 4,320,000 14. On January 1, 2010, Piston Co. sold a used machine to Acto, Inc. for P350,000. On this date, the machine had a depreciated cost of P245,000. Acto paid P50,000 cash on January 1, 2010 and signed a P300,000 note bearing interest at 10%. The note was payable in three annual installments of P100,000 beginning January 1, 2011. Piston appropriately accounted for the sale under the installment method. Acto made a timely payment of the first installment on January 1, 2011 of P130,000, which included interest of P30,000 to date of payment. At December 31, 2011, Piston has deferred gross profit of a. P70,000 b. P66,000 c. P60,000 d. P51,000 15. LBC Corporation filed a bankruptcy petition on January 2011. On March 1, 2011, the trustee provided the following information about the corporation’s financial affairs: Assets Book value Realizable Value Cash P40,000 P40,000 Accounts receivable-net 200,000 150,000 Inventories 300,000 140,000 Plant assets-net 500,000 560,000 Total Assets P1,040,000 Liabilities Liabilities for priority claims P160,000 Accounts payable-unsecured 300,000 Notes payable, secured by Accounts receivable 200,000 Mortgage payable, secured by all Plant assets 440,000 Total Liabilities P1,100,000 The expected recovery percentage of unsecured creditors: a. 21.5% b. 41.5% c. 22.3% d. 40.0% 16. X and Y Inc., owes the Xylo Corporation P60,000 on account, which is secured by account receivable with a book value of P50,000. The unsecured portion is considered a claim under the bankruptcy law, X and Y has filed for bankruptcy. Its statement of affairs lists the accounts receivable securing the Xylo account with an estimated realizable value of P45,000. If the dividend general unsecured creditors are 80% how much can Xylo expect to receive? a. P60,000 c. P57,000 b. P58,000 d. P48,000 17. Makati Exports Corp. sold metal crafts to a foreign firm for FC70,000 and pertinent information on exchange conversion rates related to this transaction were as follows: Conversion Rate (Peso to FC) November 04 Receipt of order P27.40 November 22 Date of Shipment 27.50 December 31 Balance sheet date 27.60 3

- 4. January 06 Date of collection 27.00 The sale would be appropriately recorded at: a. P1,890,000 b. P1,918,000 c. P1,925,000 d. P1,932,000 18. Certain balance sheet accounts of a foreign subsidiary of Roman, Inc., on December 31, 2010, have been translated into Philippine peso as follows: Translated at Current Historical Rates Rates Note receivable, long term P240,000 P200,000 Prepaid rent 85,000 80,000 Patent 150,000 170,000 P475,000 P450,000 The subsidiary’s functional currency is the currency of the country in which it is located. What total amount should be included in Roman’s December 31, 2010 consolidated balance sheet for the above accounts? a. P450,000 b. P455,000 c. P475,000 d. P495,000 19. Zamora and Co., Inc. purchased a Mustang automobile with a little cash down and signed a note, secured by the Caddillac, for 48 easy monthly payment. When the company files for bankruptcy, the balance due on the Mustang amount to P6,000,000. The car has a book value of P8,000,000 and a net realizable value of P4,000,000. The unsecured creditors of Zamora and Co. can expect to receive 50 percent of their claims. In the liquidation, the bank that holds the note on the Mustang should receive: a. 8 Million c. 4 Million b. 6 Million d. 5 Million Use the following information for questions 20 and 21: On May 6, 2011, the statement of affairs of Ala-Pera Company, which is in bankruptcy liquidation, included the following: Assets pledged for fully secured liabilities…………….P120,000 (fair value, P110,000) Assets pledged for partially secured liabilities………… 60,000 (fair value, P40,000) Free Assets ……………………………………………. 120,000 Fully Secured liabilities ………………………………. 80,000 Partially secured liabilities ……………………………. 70,000 Unsecured liabilities with priority ……………………. 60,000 Unsecured liabilities without priority ………………… 90,000 20. The total estimated deficiency to unsecured creditors a. 0 b. 40,000 c. 20,000 d. 30,000 21. The costs per peso that unsecured creditors may expect to receive from Ala-Pera Company a. P0.90 b. P0.80 c. P0.67 d. P0.75 22. On October 1, 2010, Boni Co. purchased merchandise worth a total of 100,000 Swiss francs from its Swiss supplier, payable within 30 days under an open account arrangement. Boni Co. issued a 30-day, 6% note payable in Swiss francs. On October 31, 2010, Boni Co. paid the note. The following information on spot rates (P/SF) is provided: Buying Selling October 01, 2010 P24.03 P24.15 October 31, 2010 24.10 24.22 Boni Co.’s foreign exchange gain or loss on the transaction is: a. P 5,040 loss b. P 7,000 loss c. P12,075 gain d. P19,110 loss 4

- 5. 23. Paskin’s Corporation’s wholly-owned Canadian subsidiary has a Canadian dollar functional currency. In translating its account balances into US dollars for reporting purposes, which one of the following accounts would be translated at historical exchange rates? a. Accounts Receivable. b. Notes Payable. c. Capital Stock. d. Retained Earnings. Items 24 and 25 are based on the following information: Wantai, Ltd. is a Philippine company in Taiwan. Wantai’s functional currency is the Taiwan dollar (TWD). The following exchange rates were in effect during 2011: Jan. 1 1 Php = TWD.625 June 30 1 Php = TWD.610 Dec. 31 1 Php = TWD.620 Weighted average rate for the year 1 Php = TWD.630 24. Wantai reported sales of TWD1,500,000 during 2011. What amount (rounded) would have been included for this subsidiary in calculating consolidated sales? a. P2,380,952. b. P2,400,000. c. P2,429,150. d. P2,419,355. 25. On December 31, Wantai had accounts receivable of TWD280,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable? a. P444,444. b. P451,613. c. P142,600. d. P176,400. 26. Magneto Company began operations on January 2, 2009, and appropriately used the installment sales method of accounting. The following data are available for 2009 and 2010: 2009 2010 Installment sales .......................... P3,000,000 P3,600,000 Gross profit on sales ...................... 30% 40% Cash collections from: 2009 sales ............................... P1,000,000 P1,200,000 2010 sales ............................... -- P1,400,000 The realized gross profit for 2010 is A a. P1,4 40,000. b b. P1,040,000. c c. P920,000. d d. P780,000. 27. Shaggy Enterprises, which began operations on January 1, appropriately uses the installment method of accounting. The following information is available for its first year: Gross profit on sales ................................. 40% Deferred gross profit at December 31 .................. P120,000 Cash collected, including down payments ............... P225,000 What is the total amount of Shaggy's installment sales for the first year? a. P300,000 b. P345,000 c. P425,000 d. P525,000 28. Electro Marketing, which began operating on January 1, appropriately uses the installment method of accounting. The following information pertains to Electro's operations for the first year: Installment sales ...................................... P1,000,000 Cost of installment sales .............................. 600,000 General and administrative expenses .................... 100,000 Collections on installment sales ....................... 200,000 The balance in the deferred gross profit account at December 31 should be a. P400,000. b. P320,000. c. P240,000. d. P200,000. 5

- 6. 29. On May 1, 2009, Enviro Construction Company entered into a fixed-price contract to construct an apartment building for P3,000,000. Enviro appropriately accounts for this contract under the percentage-of-completion method. Information relating to the contract is as follows: 2009 2010 At December 31: Percentage of completion ........ 20% 60% Estimated costs at completion ... P2,250,000 P2,400,000 Income recognized (cumulative) .. P 150,000 P 360,000 What is the amount of contract costs incurred during the year ended December 31, 2010? a. P600,000 b. P960,000 c. P990,000 d. P1,440,000 30. J & J Construction, Inc. has consistently used the percentage-of-completion method of recognizing income. Last year J & J started work on a P4,500,000 construction contract, which was completed this year. The accounting records disclosed the following data for last year: Progress billings ..................................... P1,650,000 Costs incurred ........................................ 1,350,000 Collections ........................................... 1,050,000 Estimated cost to complete ............................ 2,700,000 How much income should J & J have recognized on this contract last year? a. P105,000 b. P150,000 c. P300,000 d. P350,000 31. Cronus Co. Started operations on January 1, 2008, selling home appliances on installment basis. For 2008 and 2009, the following information are available: 2008 2009 Installment Sales P1,200,000 P1,500,000 Cost of Installment sales 720,000 1,050,000 Collections For 2008 sales 630,000 450,000 For 2009 sales 900,000 On January 6, 2010, an installment sales account balance of 2008 was defaulted and the merchandise, with current market value of P15,000, was repossessed. The account balance defaulted was P24,000. The balance of the unrealized gross profit account as at the end of 2009 was a. 214,800 b. 275,000 c. 228,000 d. 450,000 32. Dionysus Motor Co. Sells both new and used cars. On October 1, 2011, a new car which cost P240,000, was sold for P330,000. A used car was accepted as down payment for a trade-in allowance of P120,000, the balance payable in fifteen equal monthly installments starting November 1, 2011. The company anticipated a resale price of P140,000 on the used car after reconditioning costs of P15,000 (used car sales are set to yield a gross profit of 25%). During 2011, all installments were collected. Assuming revenue is recognized by the installment method of accounting, the total gross profit realized in 2011 is a. P20,000 b. P43,450 c. P23,600 d. P59,333 33. Hemera Enterprises started operations on October 1, 2006. The following information are summarized for the first three months: Installment Receivable, Dec. 31 P1,500,000 Deferred gross profit, Dec. 31 unadjusted 1,050,000 Gross profit on sales 25% The realized gross profit on installment sales during the first three months amounted to a. 675,000 b. 1,125,000 c. 810,000 d. 1,350,000 34. Erebus Co. Sells heavy duty batteries, which cost P7,000 at a total installment price of P12,000. A regular customer buys a unit and trades in his old unit for an allowance of P2,500. Erebus spends P250 to recondition each unit traded in and then sells them at P3,250 each. A profit of 20% results from the sale of used batteries. What was the trade-in over(under) allowance granted to the customer? a. 150 over-allowance b. 500 over-allowance c. 150 under allowance d. 500 under allowance 6

- 7. The following March information is available for Allen Manufacturing Company when it produced 2,100 units: Standard: Material 2 pounds per unit @ P5.80 per pound Labor 3 direct labor hours per unit @ P10.00 per hour Actual: Material 4,250 pounds purchased and used @ P5.65 per pound Labor 6,300 direct labor hours at P9.75 per hour 35. Refer to Allen Manufacturing. What is the material price variance? a. P637.50 U b. P637.50 F c. P630.00 U d. P630.00 F 36. Refer to Allen Manufacturing. What is the material quantity variance? a. P275 F b. P290 F c. P290 U d. P275 U 37. Refer to Allen Manufacturing. What is the labor rate variance? a. P1,575 U b. P1,575 F c. P1,594 U 38. What is the labor efficiency variance? a. P731.25 F b. P731.25 U c. P750.00 F d. none of the answers are correct 39. Vulcan Co., uses the percentage of completion method. In May 2010, the company began work on a project that has a contract price of P5,000,000. At the end of 2011, a summary of the company’s cost data follows: 2010 2011 Cost incurred to date P1,125,000 P3,825,000 Estimated cost to complete 3,375,000 1,275,000 Total estimated cost P4,500,000 P5,100,000 In its income statement for the year 2011, the company would recognize a gross profit(loss) of a. (P100,000) b. (P200,000) c. P125,000 d. d. (P225,000) 40. Troy Construction Co. uses the percentage-of-completion method. In 2007, Troy began work on a contract for P5,500,000; it was completed in 2008. The following cost data pertain to this contract: Year Ended December 31 2007 2008 Cost incurred during the year P1,950,000 P1,400,000 Estimated costs to complete at the end of year 1,300,000 — The amount of gross profit to be recognized on the income statement for the year ended December 31, 2008 is a. P800,000 b. P860,000 c. P900,000 d. P2,150,000 41. Chronos Furniture uses the installment-sales method. No further collections could be made on an account with a balance of P18,000. It was estimated that the repossessed furniture could be sold as is for P5,400, or for P6,300 if P300 were spent reconditioning it. The gross profit rate on the original sale was 40%. The loss on repossession was a. P4,800 b. P4,500 c. P12,000 d. P12,600 42. Tartarus Company sold some machinery to Selene Company on January 1, 2007. The cash selling price would have been P568,620. Selene entered into an installment sales contract which required annual payments of P150,000, including interest at 10%, over five years. The first payment was due on December 31, 2007. What amount of interest income should be included in Tartarus's 2009 income statement (the third year of the contract)? a. P15,000 b. P47,548 c. P30,000 d. P37,303 43. On January 1, 2007, Triton Co. sold a used machine to Helios, Inc. for P350,000. On this date, the machine had a depreciated cost of P245,000. Helios paid P50,000 cash on January 1, 2007 7

- 8. and signed a P300,000 note bearing interest at 10%. The note was payable in three annual installments of P100,000 beginning January 1, 2008. Triton appropriately accounted for the sale under the installment method. Helios made a timely payment of the first installment on January 1, 2008 of P130,000, which included interest of P30,000 to date of payment. At December 31, 2008, Triton has deferred gross profit of a. P70,000. b. P66,000. c. P60,000. d. P51,000. Use the following information for questions 44 to 50: On January 1, 2012 SME J and SME K each acquired 25% of the equity of entities L, M, and N for P32,000, P29,000, and P18,500, respectively. SME J and SME K have joint control over the strategic financial and operating decisions of entities L, M, and N. Transaction costs of 2% of the purchase price of the shares were incurred by SME J and SME K. On December 31, 2012 Entity L declared dividends of P4,500 and Entity M, P7,500 for the year 2012. These dividends are to be paid by L and M in 2013. For the year ended December 31, 2012, entities L and M recognized profits of P15,000 and P21,000, respectively. However, entity N recognized a loss of P10,000 for that year. Published price quotations do no exist for the shares or entities L, M, and N. using appropriate valuation techniques the venturers determined the fair value of each of their investments in entities L, M, and N at December 31, 2012 as P35,000, P32,500, and P13,500, respectively. Costs to sell are estimated at 5% of the fair value of the investments. Neither SME J nor SME K prepares consolidated financial statements because they do not have any subsidiaries. 44. What is the profit (loss) to be recognized by SME K in 2012 from entity L under the fair value method? a. P4,125 c. P3,485 e. answer not given b. P3,000 d. P1,125 45. What is the profit (loss) to be recognized by SME J in 2012 from entity N using the fair value model? a. P(5,000) c. P(7,500) e. answer not given b. P(5,370) d. P( 370) 46. What is the profit (loss) to be recognized by SME J in 2012 from entity M using the cost model? a. P 3,750 c. P 2,590 e. answer not given b. P 4,900 d. P (1,160) 47. What is the profit (loss) to be recognized by SME K in 2012 from entity L using the cost model? a. P 1,125 c. P (640) e. answer not given b. P 485 d. P 3,750 48. What is the profit (loss) to be recognized by SME K in 2012 from entity L using the equity model? a. P5,140 c. (P690) e. answer not given b. P3,470 d. P 4,875 49. What is the profit (loss) to be recognized by SME J in 2012 from entity N using the equity model? a. P 3,750 c. P(6,045) e. answer not given b. P 5,250 d. P( 2,500) 50. What is the investment balance of SME K at the end of 2012 in entity N under the cost model? a. P12,825 c. P29,580 e. answer not given b. P13,500 d. P18,870 8