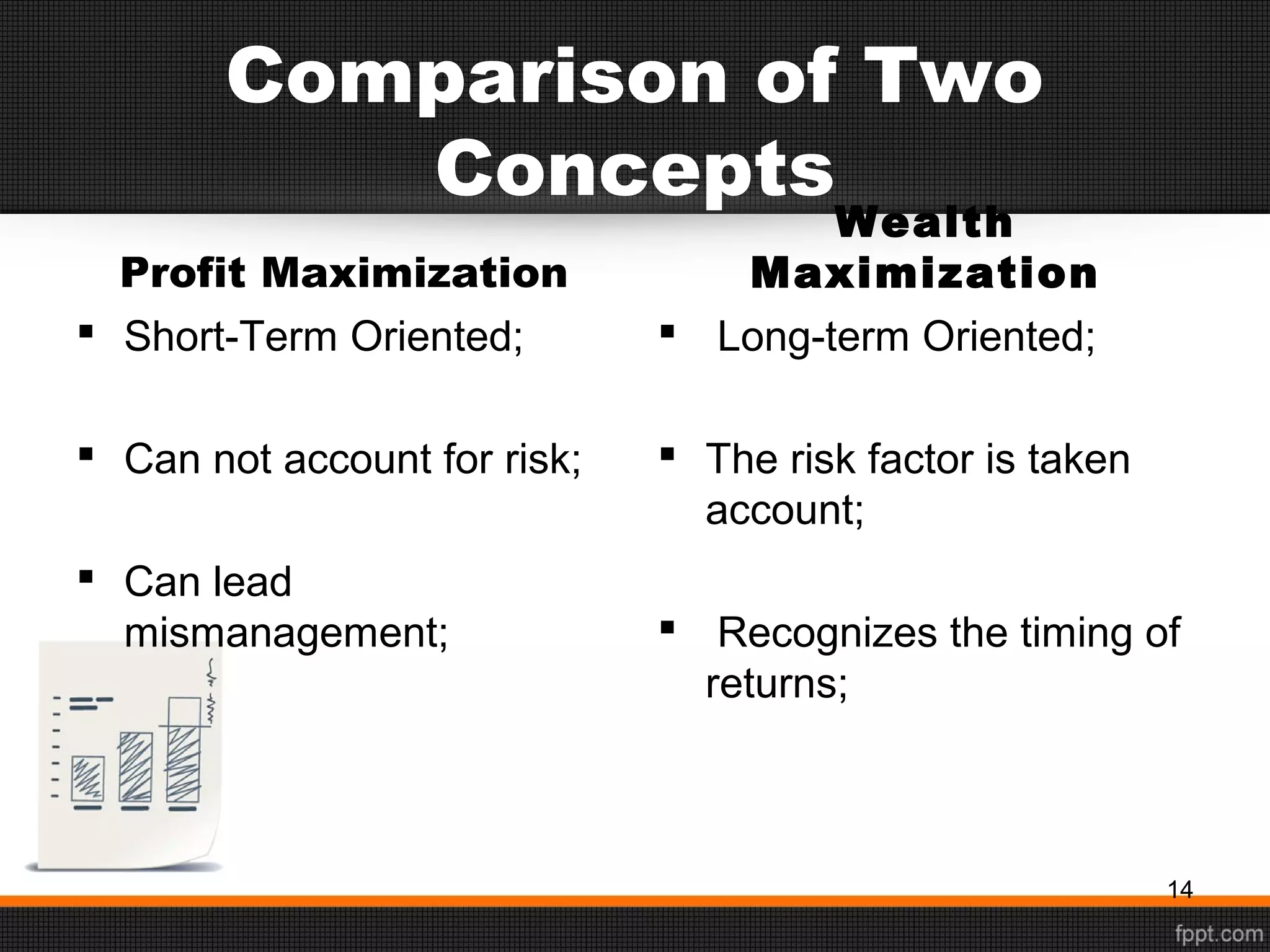

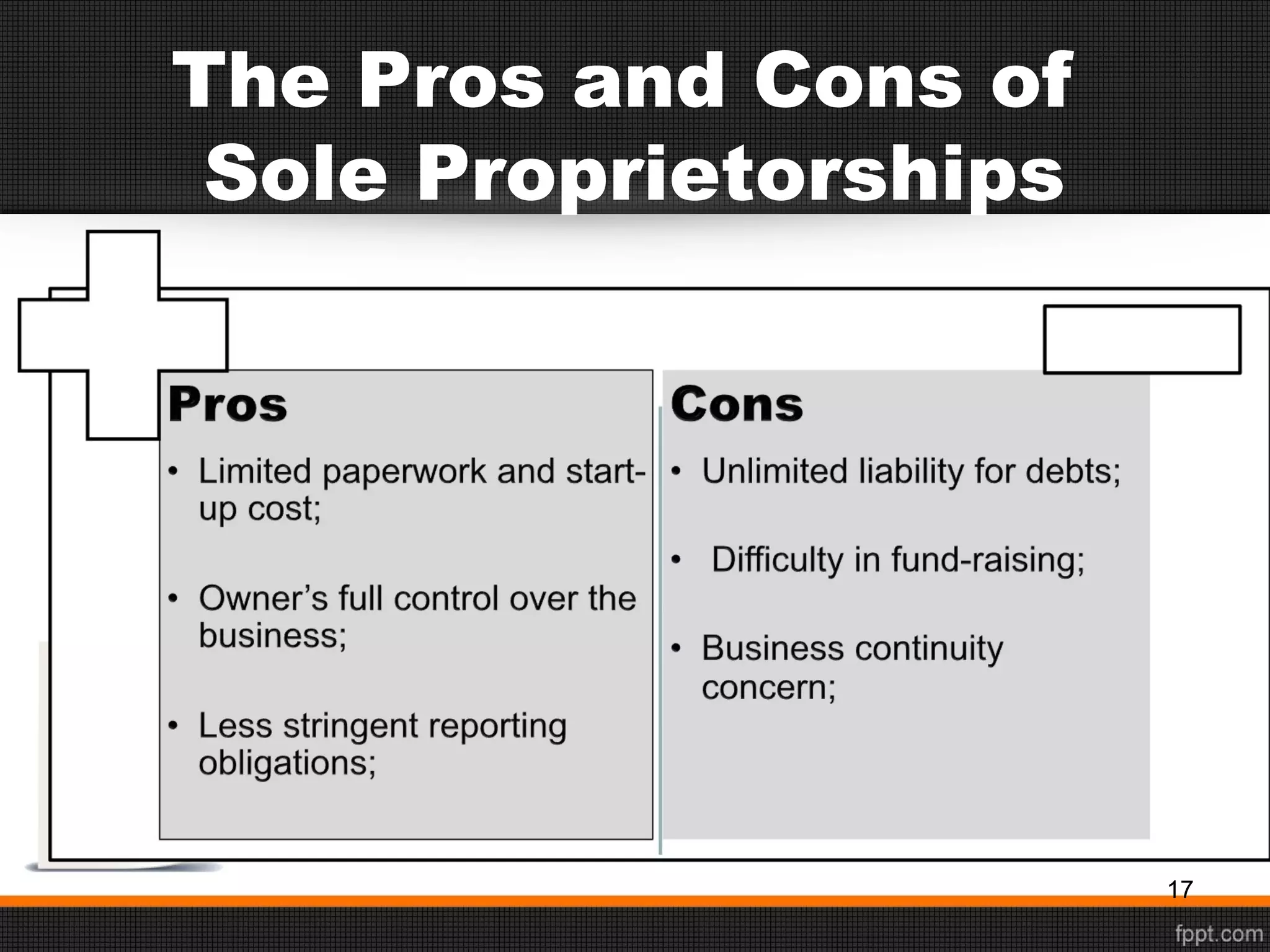

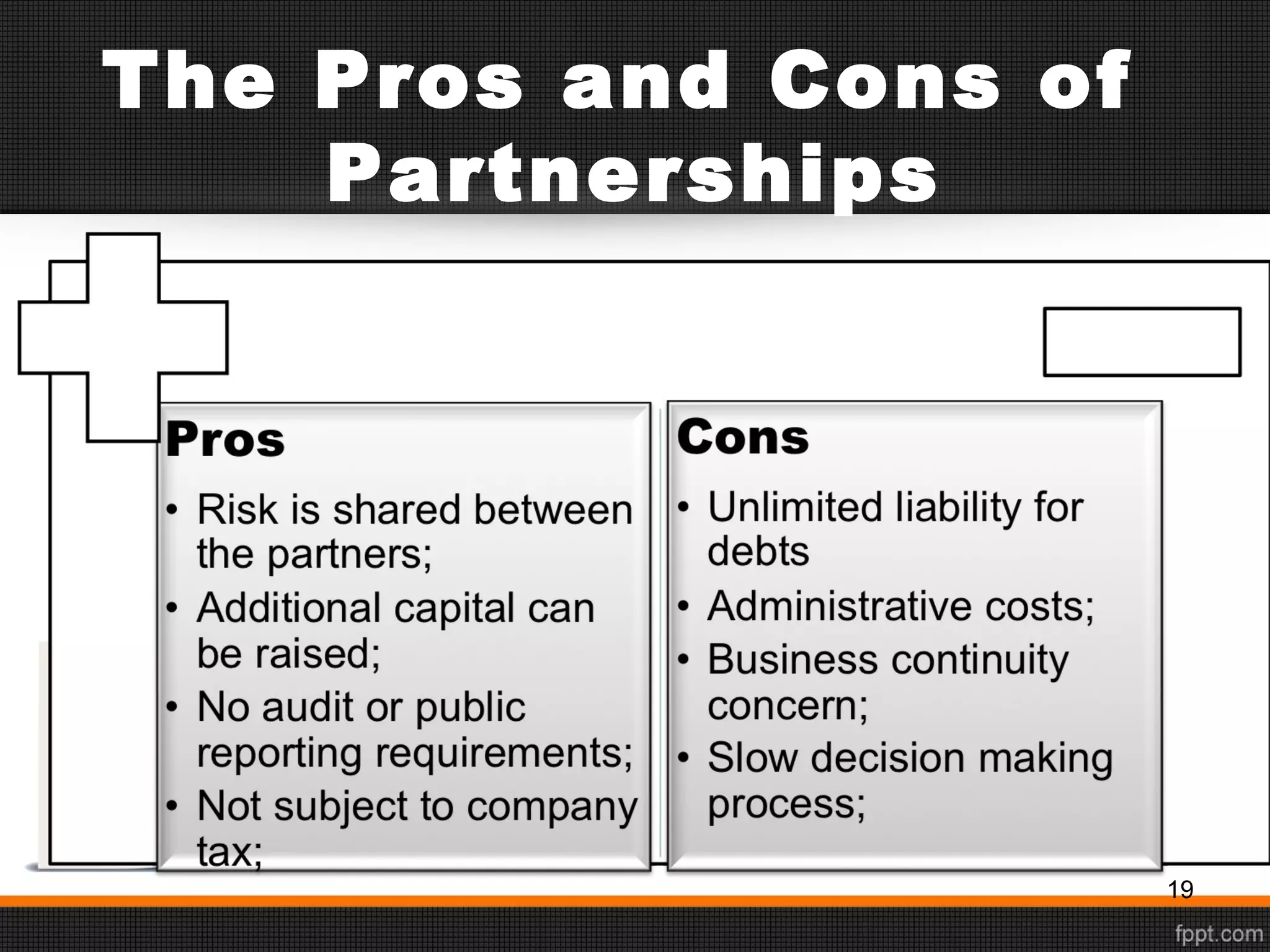

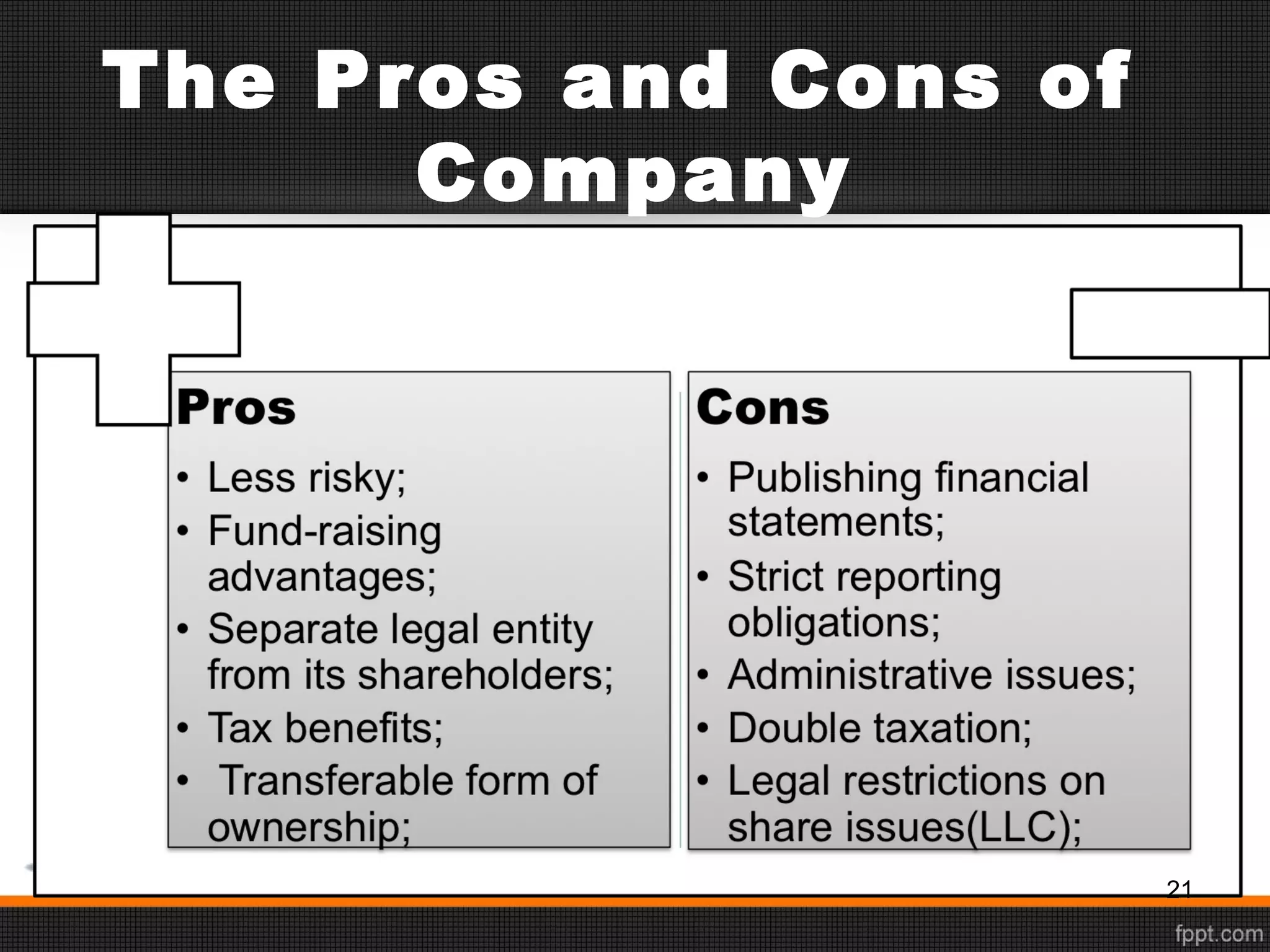

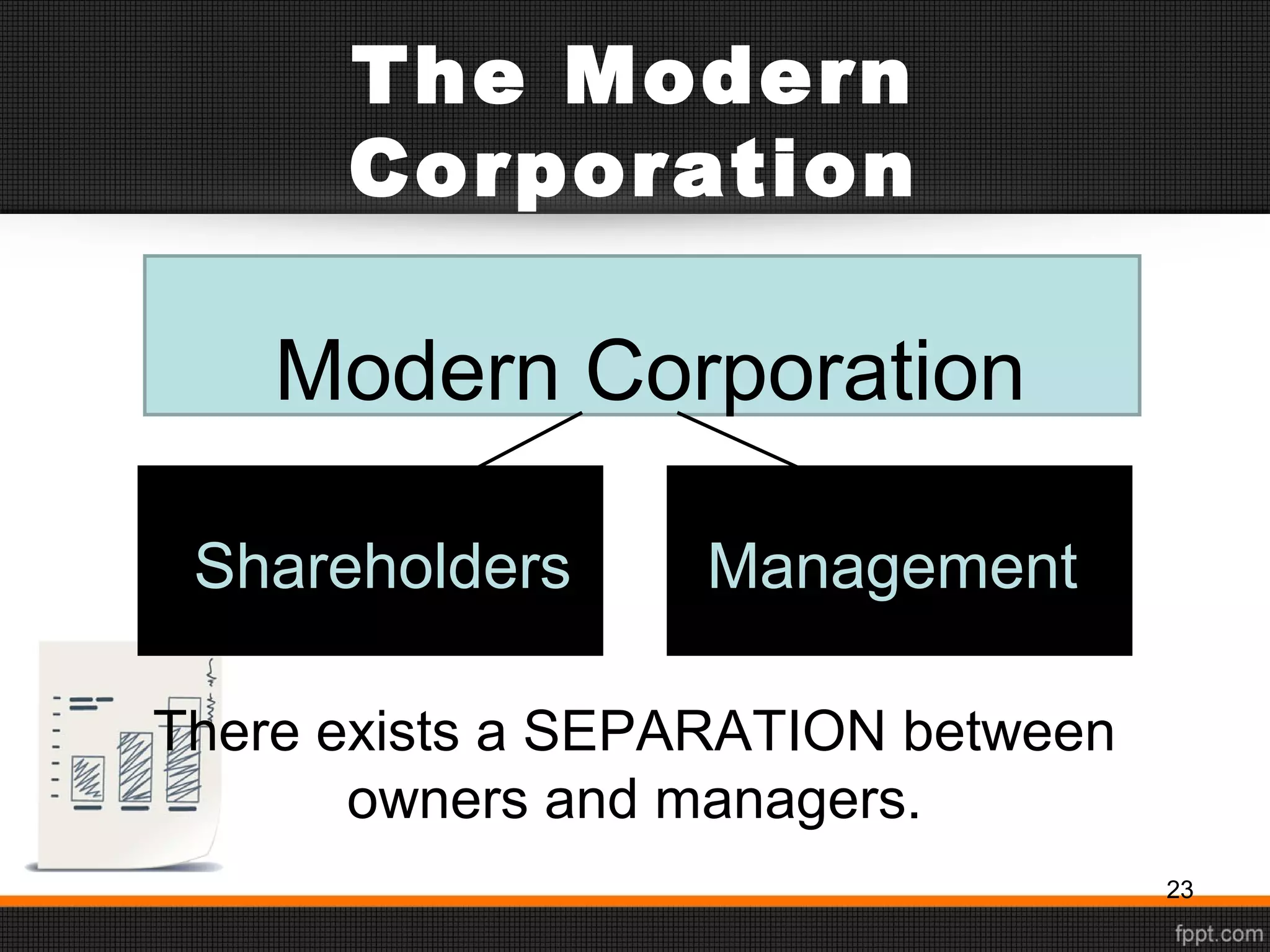

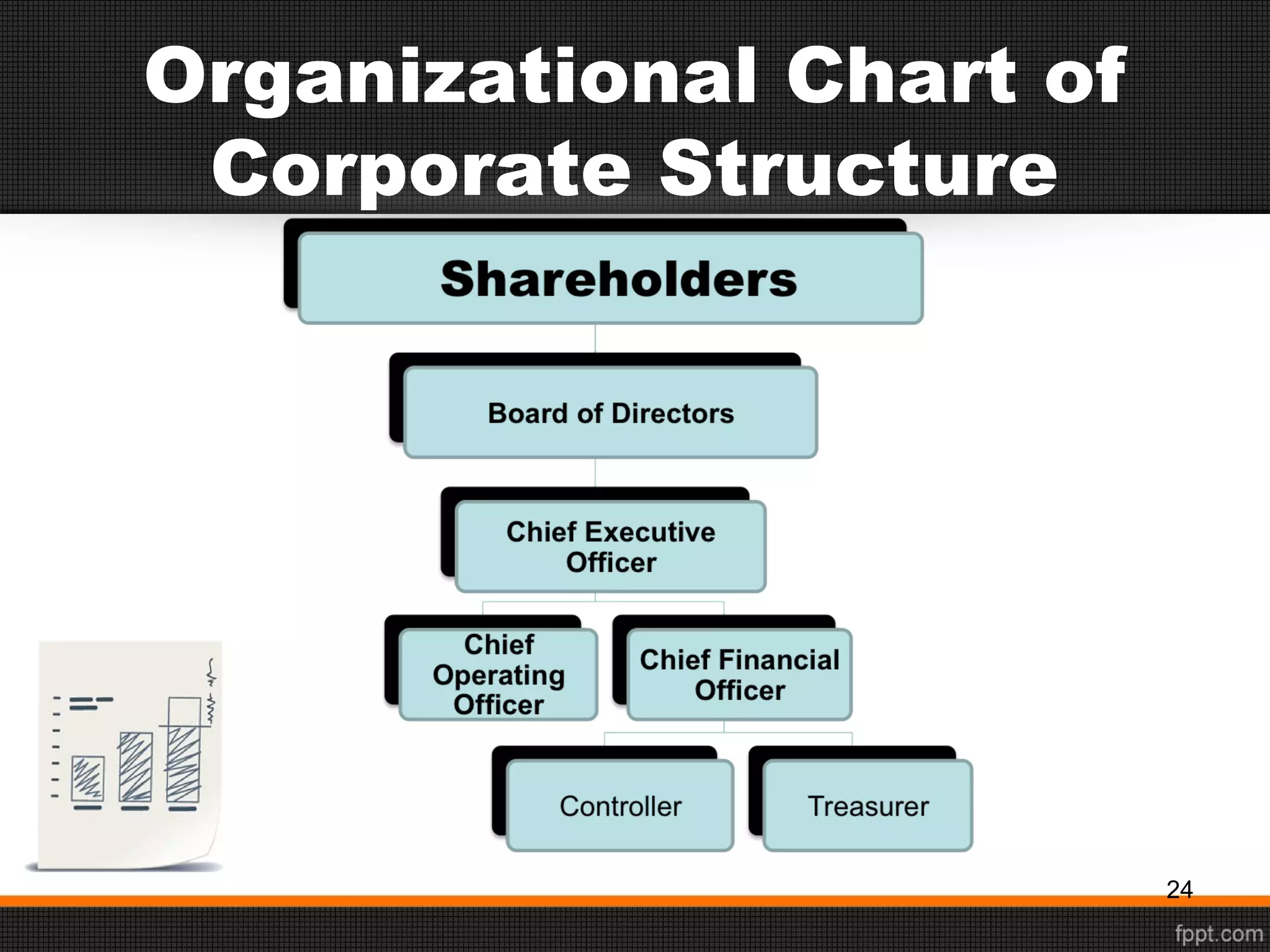

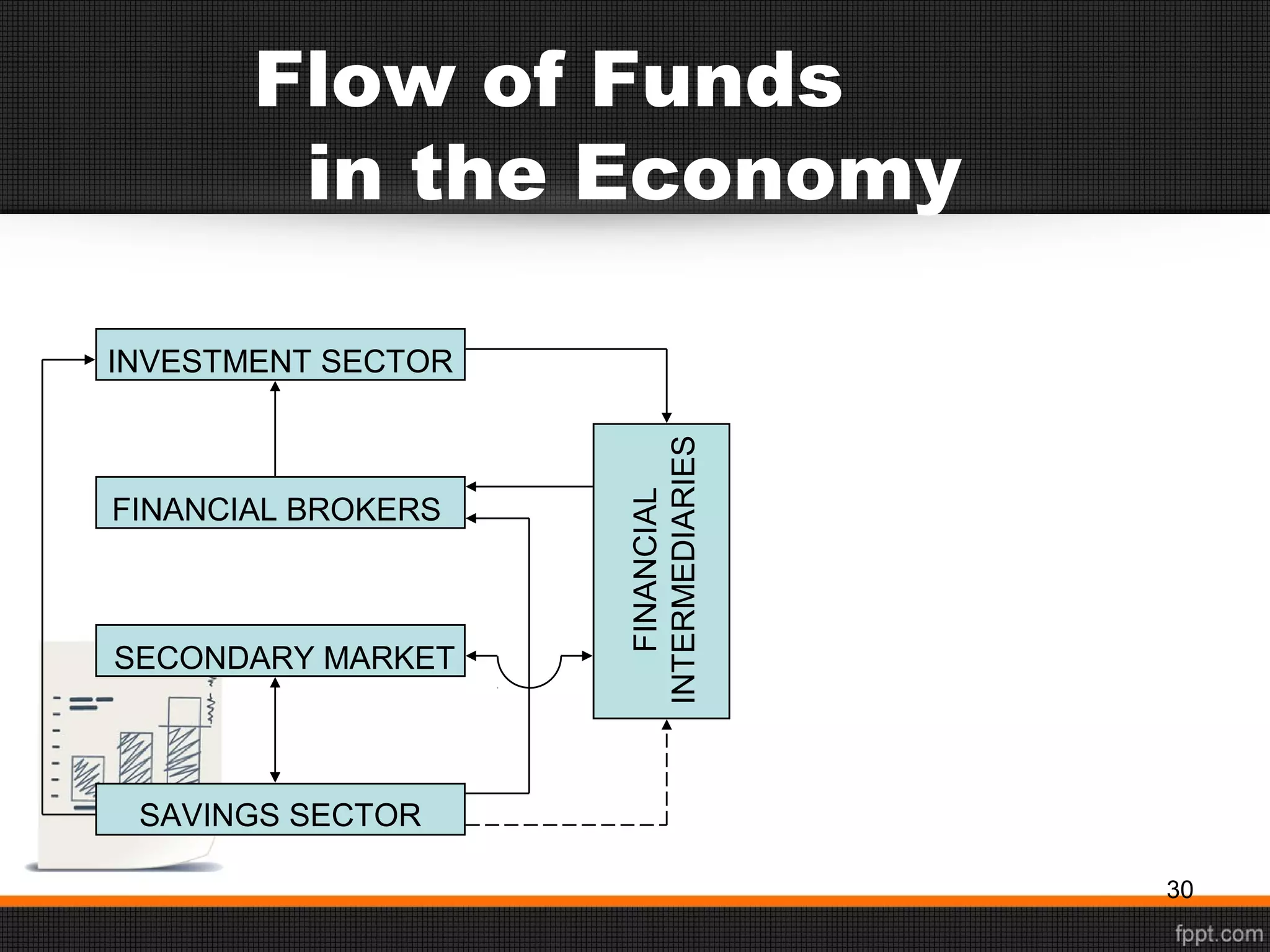

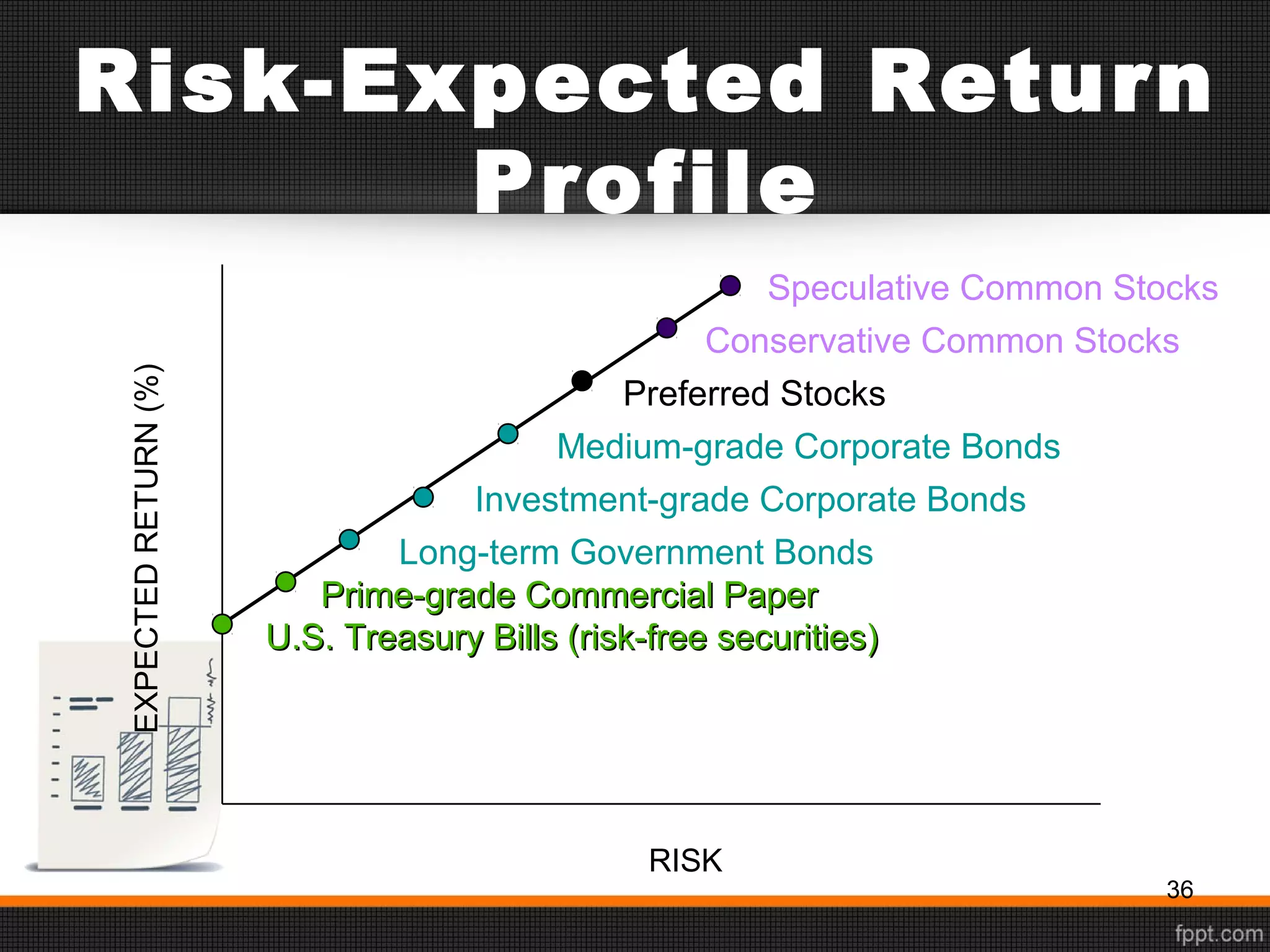

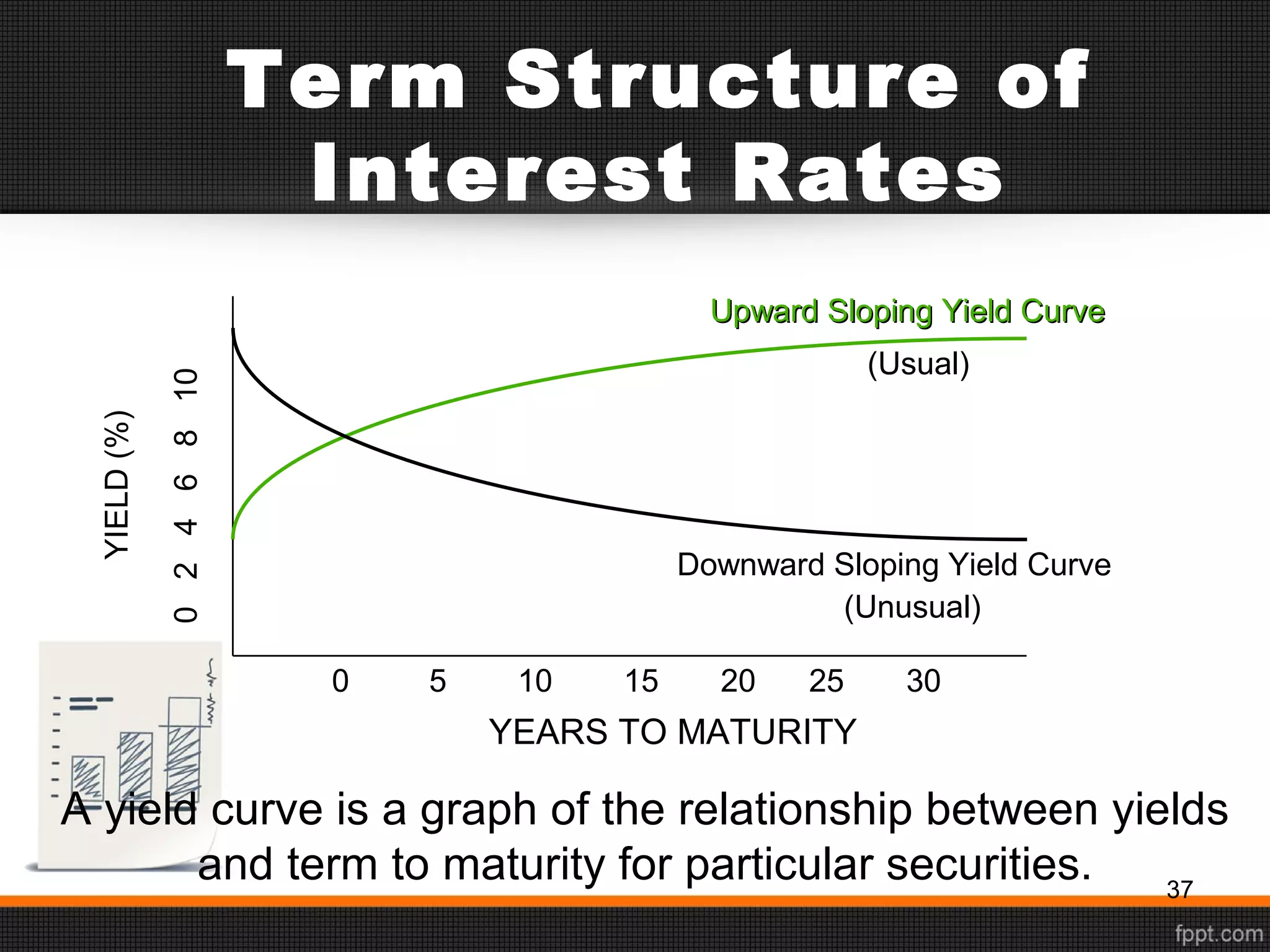

This document provides an overview of finance and key concepts. It discusses what finance is, the functions and areas of finance, and compares finance to accounting. It also outlines the goals of business as maximizing shareholder wealth. The document reviews types of businesses including sole proprietorships, partnerships, and companies. It then discusses the modern corporation's separation of owners and managers. Finally, it provides a brief tour of the financial environment, including financial markets, flows of funds, types of markets, and influences on expected security returns such as risk.