De assignment

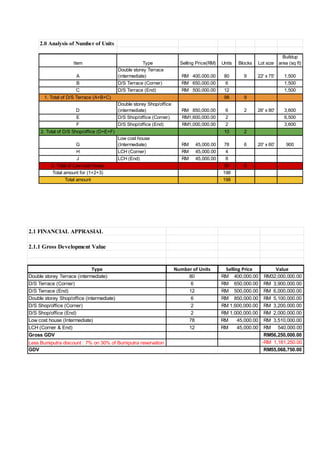

- 1. 2.0 Analysis of Number of Units Item Type Selling Price(RM) Units Blocks Lot size Buildup area (sq ft) A Double storey Terrace (intermediate) RM 400,000.00 80 9 22' x 75' 1,500 B D/S Terrace (Corner) RM 650,000.00 6 1,500 C D/S Terrace (End) RM 500,000.00 12 1,500 1. Total of D/S Terrace (A+B+C) 98 9 D Double storey Shop/office (intermediate) RM 850,000.00 6 2 26' x 80' 3,600 E D/S Shop/office (Corner) RM1,600,000.00 2 6,500 F D/S Shop/office (End) RM1,000,000.00 2 3,600 2. Total of D/S Shop/office (D+E+F) 10 2 G Low cost house (Intermediate) RM 45,000.00 78 6 20' x 60' 900 H LCH (Corner) RM 45,000.00 4 J LCH (End) RM 45,000.00 8 3. Total of Low cost house 90 6 Total amount for (1+2+3) 198 Total amount 198 2.1 FINANCIAL APPRASIAL 2.1.1 Gross Development Value Type Number of Units Selling Price Value Double storey Terrace (intermediate) 80 RM 400,000.00 RM32,000,000.00 D/S Terrace (Corner) 6 RM 650,000.00 RM 3,900,000.00 D/S Terrace (End) 12 RM 500,000.00 RM 6,000,000.00 Double storey Shop/office (intermediate) 6 RM 850,000.00 RM 5,100,000.00 D/S Shop/office (Corner) 2 RM 1,600,000.00 RM 3,200,000.00 D/S Shop/office (End) 2 RM 1,000,000.00 RM 2,000,000.00 Low cost house (Intermediate) 78 RM 45,000.00 RM 3,510,000.00 LCH (Corner & End) 12 RM 45,000.00 RM 540,000.00 Gross GDV RM56,250,000.00 Less Bumiputra discount : 7% on 30% of Bumiputra reservation -RM 1,181,250.00 GDV RM55,068,750.00

- 2. 2.1.2 Gross Development Cost Item Description RM/SF SF Cost (RM) Total (RM) 1 Land Cost 15.00 449,213 - 6,738,187.50 2 Building Cost a) Double storey Terrace (intermediate) 75.00 120,000 9,000,000.00 b) D/S Terrace (Corner & End) 85.00 27,000 2,295,000.00 c) Double storey Shop/office (intermediate) 70.00 21,600 1,512,000.00 d) D/S Shop/office (Corner & End) 80.00 20,200 1,616,000.00 e) Low cost house (Intermediate) 35.00 70,200 2,457,000.00 f) LCH (Corner & End) 40.00 10,800 432,000.00 Total Building Cost 17,312,000.00 g) Earth Works (5% of building cost) 5% 865,600.00 h) Infrastructure cost (10% of building cost) 10% 1,731,200.00 Total Construction cost 19,908,800.00 3 Administrative cost a) Professional fee (9% of construction cost) 9% 1,791,792.00 b) Admistrative fee (2% of GDV) 2% 1,101,375.00 c) Plan fees (RM2000/unit) 2,000.00 396,000.00 d) Contributions & fees (2% of construction cost) 2% 398,176.00 e) Advertisement (1% of GDV) 1% 550,687.50 f) Land conversion Commercial (20% land value of commercial lots) 20% 125,400.00 Residential (15% land value of residential lots) 15% 513,000.00 g) Subdivision (RM1500/unit) 1,500.00 297,000.00 h) Legal fees (RM2500/unit) 2,500.00 495,000.00 Total Administrative Cost 5,668,430.50 4 Financing Cost a) Bridging Finance (50% of construction cost @ 5.5% p.a. + BLR (6.5%) over 2 years) 9,954,400.00 12% 2,389,056.00 b) Interest on Loan for purchase of land (RM 6,500,000.00 @ 2.5% p.a. 6,500,000.00 9% 2,925,000.00 + BLR (6.5%) over 5 years Total Financing Cost 5,314,056.00 5 Contigencies (5% of construction cost) 5% 995,440.00 Gross Development Cost 38,624,914.00

- 3. 2.2 Cash Flow Cash Inflow 2013 Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 Sales Projection 1 Shop/Office 18.3 10,083,700.00 10% 10% 10% 2 Terrace 74.5 41,020,100.00 30% 20% 20% 3 Low Cost 7.2 3,964,950.00 50% Monthly Total 100% 55,068,750.00 24.2% 0.0% 0.0% 0.0% 0.0% 16.7% 0.0% 0.0% 20.3% 0.0% 0.0% % of cumulative sales 24.2% 24.2% 24.2% 24.2% 24.2% 40.9% 40.9% 40.9% 61.2% 61.2% 61.2% Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 1 Earthworks 1 100% 100% 2 Foundation 3 100% 8.1% 8.1% 8.1% 16.7% 20.3% 3 RC Framework 9 100% 2.7% 2.7% 2.7% 5.5% 5.5% 5.5% 12.3% 12.3% 12.3% 4 Walls, Doors & Window Frame 7 100% 5.8% 5.8% 9.9% 9.9% 9.9% 5 Roofing, Elec Wiring & Plumbing 7 100% 8.7% 8.7% 8.7% 6 Internal & External Plastering 8 100% 7.7% 7 Sewerage Works 5 100% 8 Drainage Works 6 100% 9 Road Works 2 100% 10 Infrastructure Works 6 100% Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 Sales Proceed 24.2% 16.7% 20.3% 1 Signing of S&P 10.0% 5,506,875 1,331,440 921,239 1,119,487 100.0% 2 Earthworks 3.9% 2,154,864 2,154,864 8.1% 8.1% 8.1% 16.7% 20.3% 3 Foundation 7.8% 4,309,728 347,332 347,332 347,332 720,970 876,120 2.7% 2.7% 2.7% 5.5% 5.5% 5.5% 12.3% 12.3% 12.3% 4 RC Framework 19.6% 10,774,321 289,443 289,443 289,443 589,848 589,848 589,848 1,319,947 1,319,947 1,319,947 5.8% 5.8% 9.9% 9.9% 9.9% 5 Walls, Doors & Window Frame 11.7% 6,464,592 377,778 377,778 640,614 640,614 640,614 8.7% 8.7% 8.7% 6 Roofing, Elec Wiring & Plumbing 11.7% 6,464,592 565,518 565,518 565,518 7.7% 7 Internal & External Plastering 11.7% 6,464,592 494,829 8 Sewerage Works 3.9% 2,154,864 9 Drainage Works 3.9% 2,154,864 10 Road Works 7.8% 4,309,728 11 Infrastructure Works 7.8% 4,309,728 100% 55,068,750 3,833,636 347,332 636,776 289,443 289,443 2,232,056 967,626 967,626 4,521,687 2,526,080 3,020,909 Q1 Q2 Q3 Q4 2013 2013 Q1 Q2 Q3 Q4 2013 Q1 Q2 Q3 Q4

- 4. CashInflow 2014 2015 Q1 Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 M1 Sales Projection 1 Shop/Office 18.3 10,083,700.00 10% 10% 20% 30% 2 Terrace 74.5 41,020,100.00 10% 20% 3 LowCost 7.2 3,964,950.00 50% Monthly Total 100% 55,068,750.00 9.3% 0.0% 0.0% 20.3% 0.0% 0.0% 3.7% 0.0% 0.0% 5.5% 0.0% 0.0% 0 % of cumulative sales 70.5% 70.5% 70.5% 90.8% 90.8% 90.8% 94.5% 94.5% 94.5% 100.0% 100.0% 100.0% 100.0% 2015 Q1 Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 M1 1 Earthworks 1 100% 2 Foundation 3 100% 9.3% 20.3% 3.7% 5.5% 3 RC Framework 9 100% 9.3% 20.3% 3.7% 5.5% 4 Walls, Doors & WindowFrame 7 100% 14.5% 14.5% 20.3% 3.7% 5.5% 5 Roofing, Elec Wiring & Plumbing 7 100% 11.1% 11.1% 11.1% 31.4% 3.7% 5.5% 6 Internal& ExternalPlastering 8 100% 9.0% 9.0% 9.0% 14.1% 14.1% 14.1% 17.7% 5.5% 7 Sewerage Works 5 100% 18.9% 18.9% 20.7% 20.7% 20.7% 8 Drainage Works 6 100% 15.1% 15.9% 15.9% 15.9% 18.6% 18.6% 9 Road Works 2 100% 50.0% 50.0% 10 Infrastructure Works 6 100% 15.1% 15.1% 16.1% 16.1% 16.1% 21.5% 2015 Q1 Item Description % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 M1 Sales Proceed 9.3% 20.3% 3.7% 5.5% 1 Signing of S&P 10.0% 5,506,875 511,038 1,119,487 201,674 302,511 2 Earthworks 3.9% 2,154,864 9.3% 20.3% 3.7% 5.5% 3 Foundation 7.8% 4,309,728 399,943 876,120 157,832 236,748 9.3% 20.3% 3.7% 5.5% 4 RC Framework 19.6% 10,774,321 999,857 2,190,300 394,580 591,869 14.5% 14.5% 20.3% 3.7% 5.5% 5 Walls, Doors & WindowFrame 11.7% 6,464,592 940,572 940,572 1,314,180 236,748 355,122 11.1% 11.1% 11.1% 31.4% 3.7% 5.5% 6 Roofing, Elec Wiring & Plumbing 11.7% 6,464,592 715,497 715,497 715,497 2,029,677 236,748 355,122 9.0% 9.0% 9.0% 14.1% 14.1% 14.1% 17.7% 5.5% 7 Internal& ExternalPlastering 11.7% 6,464,592 580,531 580,531 580,531 909,076 909,076 909,076 1,145,823 355,122 18.9% 18.9% 20.7% 20.7% 20.7% 8 Sewerage Works 3.9% 2,154,864 407,298 407,298 446,756 446,756 446,756 15.1% 15.9% 15.9% 15.9% 18.6% 18.6% 9 Drainage Works 3.9% 2,154,864 326,262 342,046 342,046 342,046 401,233 401,233 50.0% 50.0% 10 Road Works 7.8% 4,309,728 2,154,864 2,154,864 15.1% 15.1% 16.1% 16.1% 16.1% 21.5% 11 Infrastructure Works 7.8% 4,309,728 652,525 652,525 691,983 691,983 691,983 928,730 100% 55,068,750 4,147,437 2,236,599 1,296,028 8,438,838 1,561,600 1,887,863 3,407,433 1,441,326 1,441,326 3,973,212 847,989 2,601,620 2,154,864 2014 Q1 Q2 Q3 Q4 2014 Q1 Q2 Q3 Q4 2014 Q1 Q2 Q3 Q4

- 5. Cash Outflow 2013-2014 Item Description Months % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 Construction Cost 1 Earthworks 1 4.3% 865,600.00 865,600.00 2 Foundation 3 8.7% 1,731,200.00 577,066.67 577,066.67 577,066.67 3 RC Framework 9 21.7% 4,328,000.00 480,888.89 480,888.89 480,888.89 480,888.89 480,888.89 480,888.89 480,888.89 480,888.89 480,888.89 4 Walls, Doors & Window Frame 7 13.0% 2,596,800.00 370,971.43 370,971.43 370,971.43 370,971.43 370,971.43 5 Roofing, Elec Wiring & Plumbing 7 13.0% 2,596,800.00 370,971.43 370,971.43 370,971.43 6 Internal & External Plastering 8 13.0% 2,596,800.00 324,600.00 7 Sewerage Works 5 4.3% 865,600.00 8 Drainage Works 6 4.3% 865,600.00 9 Roadworks 2 8.7% 1,731,200.00 10 Infrastructure Works 6 8.7% 1,731,200.00 TOTAL CONSTRUCTION COST 100.0% 19,908,800.00 Monthly Total Cash Outflow (Before Retention) 1,442,666.67 577,066.67 1,057,955.56 480,888.89 480,888.89 480,888.89 851,860.32 851,860.32 1,222,831.75 1,222,831.75 1,547,431.75 Monthly Cumulative Outflow (Before Retention) 1,442,666.67 2,019,733.33 3,077,688.89 3,558,577.78 4,039,466.67 4,520,355.56 5,372,215.87 6,224,076.19 7,446,907.94 8,669,739.68 10,217,171.43 Less Retention (10%, Limit 5%) (995,440.00) (144,266.67) (57,706.67) (105,795.56) (48,088.89) (48,088.89) (48,088.89) (85,186.03) (85,186.03) (122,283.17) (122,283.17) (128,466.03) Monthly Cumulative Outflow (After Retention) 1,298,400.00 1,962,026.67 2,971,893.33 3,510,488.89 3,991,377.78 4,472,266.67 5,287,029.84 6,138,890.16 7,324,624.76 8,547,456.51 10,088,705.40 Monthly Total Cash Outflow (After Retention) 18,047,760.00 1,298,400.00 519,360.00 952,160.00 432,800.00 432,800.00 432,800.00 766,674.29 766,674.29 1,100,548.57 1,100,548.57 1,418,965.71 Item Description Months % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 Construction Cost 1 Earthworks 1 4.3% 865,600.00 2 Foundation 3 8.7% 1,731,200.00 3 RC Framework 9 21.7% 4,328,000.00 4 Walls, Doors & Window Frame 7 13.0% 2,596,800.00 370,971.43 370,971.43 5 Roofing, Elec Wiring & Plumbing 7 13.0% 2,596,800.00 370,971.43 370,971.43 370,971.43 370,971.43 6 Internal & External Plastering 8 13.0% 2,596,800.00 324,600.00 324,600.00 324,600.00 324,600.00 324,600.00 324,600.00 324,600.00 7 Sewerage Works 5 4.3% 865,600.00 173,120.00 173,120.00 173,120.00 173,120.00 173,120.00 8 Drainage Works 6 4.3% 865,600.00 144,266.67 144,266.67 144,266.67 144,266.67 144,266.67 144,266.67 9 Roadworks 2 8.7% 1,731,200.00 865,600.00 10 Infrastructure Works 6 8.7% 1,731,200.00 288,533.33 288,533.33 288,533.33 288,533.33 288,533.33 288,533.33 TOTAL CONSTRUCTION COST 100.0% 19,908,800.00 Monthly Total Cash Outflow (Before Retention) 1,066,542.86 1,066,542.86 695,571.43 695,571.43 613,133.33 757,400.00 757,400.00 605,920.00 605,920.00 605,920.00 317,386.67 1,038,720.00 Monthly Cumulative Outflow (Before Retention) 11,283,714.29 12,350,257.14 13,045,828.57 13,741,400.00 14,354,533.33 15,111,933.33 15,869,333.33 16,475,253.33 17,081,173.33 17,687,093.33 18,004,480.00 19,043,200.00 Less Retention (10%, Limit 5%) (995,440.00) Monthly Cumulative Outflow (After Retention) 11,283,714.29 12,350,257.14 13,045,828.57 13,741,400.00 14,354,533.33 15,111,933.33 15,869,333.33 16,475,253.33 17,081,173.33 17,687,093.33 18,004,480.00 19,043,200.00 Monthly Total Cash Outflow (After Retention) 18,047,760.00 1,066,542.86 1,066,542.86 695,571.43 695,571.43 613,133.33 757,400.00 757,400.00 605,920.00 605,920.00 605,920.00 317,386.67 1,038,720.00 2013 Q1 Q2 Q3 Q4 2014 Q1 Q2 Q3 Q4

- 6. Cash Outflow 2015-2016 Item Description Months % Amount M1 M2 M3 M4 M5 M6 M7 M8 M9 M10 M11 M12 Construction Cost 1 Earthworks 1 4.3% 865,600.00 2 Foundation 3 8.7% 1,731,200.00 3 RC Framework 9 21.7% 4,328,000.00 4 Walls, Doors & Window Frame 7 13.0% 2,596,800.00 5 Roofing, Elec Wiring & Plumbing 7 13.0% 2,596,800.00 6 Internal & External Plastering 8 13.0% 2,596,800.00 7 Sewerage Works 5 4.3% 865,600.00 8 Drainage Works 6 4.3% 865,600.00 9 Roadworks 2 8.7% 1,731,200.00 865,600.00 10 Infrastructure Works 6 8.7% 1,731,200.00 TOTAL CONSTRUCTION COST 100.0% 19,908,800.00 Monthly Total Cash Outflow (Before Retention) 865,600.00 - - - - - - - - - - - Monthly Cumulative Outflow (Before Retention) 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 Less Retention (10%, Limit 5%) (995,440.00) 497,720.00 Monthly Cumulative Outflow (After Retention) 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 Monthly Total Cash Outflow (After Retention) 18,047,760.00 1,363,320.00 Item Description Months % Amount M1 M2 M3 M4 M5 M6 Construction Cost 1 Earthworks 1 4.3% 865,600.00 2 Foundation 3 8.7% 1,731,200.00 3 RC Framework 9 21.7% 4,328,000.00 4 Walls, Doors & Window Frame 7 13.0% 2,596,800.00 5 Roofing, Elec Wiring & Plumbing 7 13.0% 2,596,800.00 6 Internal & External Plastering 8 13.0% 2,596,800.00 7 Sewerage Works 5 4.3% 865,600.00 8 Drainage Works 6 4.3% 865,600.00 9 Roadworks 2 8.7% 1,731,200.00 10 Infrastructure Works 6 8.7% 1,731,200.00 TOTAL CONSTRUCTION COST 100.0% 19,908,800.00 Monthly Total Cash Outflow (Before Retention) - - - - - - Monthly Cumulative Outflow (Before Retention) 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 19,908,800.00 Less Retention (10%, Limit 5%) (995,440.00) 497,720.00 Monthly Cumulative Outflow (After Retention) 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 20,406,520.00 Monthly Total Cash Outflow (After Retention) 18,047,760.00 497,720.00 2015 Q1 Q2 Q3 Q1 Q2 2016 Q4

- 7. Quarter Yearly Cash Flow 2010-2012 Item Description Amount (RM) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 A CASH INFLOW 1 Bank Loan for Land Purchase 6,500,000.00 6,500,000.00 2 Sales Projection 55,068,750.00 Total Cash Inflow 61,568,750.00 6,500,000.00 - - - - - - - - - - - Cumulative Cash Inflow 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 6,500,000.00 Item Description Amount (RM) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 B CASH OUTFLOW 1 Land Cost 6,738,187.50 6,738,187.50 2 Construction Cost 19,908,800.00 3 Repayment of Land Loan 6,500,000.00 Administrative Cost 4 Professional Fees 1,791,792.00 5 Administrative Fees 1,101,375.00 6 Plan Fees 396,000.00 7 Contribution & Fees 398,176.00 8 Advertising & Marketing 550,687.50 9 Conversion Premium:- a) Commercial 125,400.00 b) Residential 513,000.00 c) Subdivision 297,000.00 d) Legal Fees 495,000.00 Financing Cost 10 Interest on Bridging Finance 2,389,056.00 11 Interest on Land Loan 2,925,000.00 12 Contigencies 995,440.00 Total Cash Outflow 45,124,914.00 6,738,187.50 - - - - - - - - - - - Cumulative Cash Outflow 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 6,738,187.50 2010 2011 2012 2010 2011 2012

- 8. QuarterYearly Cash Flow2013-2015 Item Description Amount (RM) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 A CASHINFLOW 1 Bank Loanfor LandPurchase 6,500,000.00 2 Sales Projection 55,068,750.00 13,314,400.00 9,212,390.00 11,194,865.00 5,110,380.00 11,194,865.00 2,016,740.00 3,025,110.00 TotalCash Inflow 61,568,750.00 13,314,400.00 - 9,212,390.00 11,194,865.00 5,110,380.00 11,194,865.00 2,016,740.00 3,025,110.00 - - Cumulative Cash Inflow 19,814,400.00 19,814,400.00 29,026,790.00 40,221,655.00 45,332,035.00 56,526,900.00 58,543,640.00 61,568,750.00 61,568,750.00 61,568,750.00 Item Description Amount (RM) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 B CASHOUTFLOW 1 LandCost 6,738,187.50 2 ConstructionCost 19,908,800.00 2,019,733.33 2,019,733.33 2,184,609.52 3,993,095.24 2,828,657.14 2,066,104.76 1,969,240.00 1,962,026.67 865,600.00 3 Repayment of LandLoan 6,500,000.00 6,500,000.00 Administrative Cost 4 Professional Fees 1,791,792.00 1,075,075.20 358,358.40 358,358.40 5 Administrative Fees 1,101,375.00 137,671.88 137,671.88 137,671.88 137,671.88 137,671.88 137,671.88 137,671.88 137,671.88 6 PlanFees 396,000.00 396,000.00 7 Contribution& Fees 398,176.00 398,176.00 8 Advertising& Marketing 550,687.50 68,835.94 68,835.94 68,835.94 68,835.94 68,835.94 68,835.94 68,835.94 68,835.94 9 ConversionPremium:- a)Commercial 125,400.00 125,400.00 b)Residential 513,000.00 513,000.00 c)Subdivision 297,000.00 297,000.00 d)Legal Fees 495,000.00 495,000.00 Financing Cost 10 Interest onBridgingFinance 2,389,056.00 298,632.00 298,632.00 298,632.00 298,632.00 298,632.00 298,632.00 298,632.00 298,632.00 11 Interest onLandLoan 2,925,000.00 365,625.00 365,625.00 365,625.00 365,625.00 365,625.00 365,625.00 365,625.00 365,625.00 12 Contigencies 995,440.00 124,430.00 124,430.00 124,430.00 124,430.00 124,430.00 124,430.00 124,430.00 124,430.00 TotalCash Outflow 45,124,914.00 5,650,322.35 3,014,928.15 3,179,804.34 4,988,290.05 4,182,210.36 3,061,299.57 2,964,434.81 9,457,221.48 1,888,215.40 - Cumulative Cash Outflow 12,388,509.85 15,403,437.99 18,583,242.33 23,571,532.38 27,753,742.73 30,815,042.31 33,779,477.12 43,236,698.60 45,124,914.00 45,124,914.00 2013 2014 2015 2015 2013 2014

- 9. 2.3 Net Present Value PV = 1/(1+i)^n Year Quarter Quarterly Inflow Quarterly Outflow Net Cash Flow PV Factor (12%) NPV Q1 6,500,000.00 (6,738,187.50) (238,187.50) 0.972 (231,533.83) Q2 - - - 0.945 - Q3 - - - 0.919 - Q4 - - - 0.893 - Q1 - - - 0.868 - Q2 - - - 0.844 - Q3 - - - 0.820 - Q4 - - - 0.797 - Q1 - - - 0.775 - Q2 - - - 0.753 - Q3 - - - 0.732 - Q4 - - - 0.712 - Q1 13,314,400.00 (5,650,322.35) 7,664,077.65 0.692 5,302,752.07 Q2 - (3,014,928.15) (3,014,928.15) 0.673 (2,027,747.56) Q3 9,212,390.00 (3,179,804.34) 6,032,585.66 0.654 3,943,990.97 Q4 11,194,865.00 (4,988,290.05) 6,206,574.95 0.636 3,944,390.59 Q1 5,110,380.00 (4,182,210.36) 928,169.64 0.618 573,390.86 Q2 11,194,865.00 (3,061,299.57) 8,133,565.43 0.601 4,884,272.24 Q3 2,016,740.00 (2,964,434.81) (947,694.81) 0.584 (553,200.92) Q4 3,025,110.00 (9,457,221.48) (6,432,111.48) 0.567 (3,649,752.79) Q1 - (1,888,215.40) (1,888,215.40) 0.552 (1,041,494.35) Q2 - - - 0.536 - Q3 - - - 0.521 - Q4 - - - 0.507 - Q1 - - - 0.492 - Q2 - (497,720.00) (497,720.00) 0.479 (238,269.22) Q3 - - - 0.465 - Q4 - - - 0.452 - 15,946,115.99 10,906,798.06Total 2010 2016 2015 2014 2013 2012 2011

- 10. 2.4 Build-then-sell Concept ‘Build- then- Sell’ concept in property market known as a project will only open for sales after the issuance of Certificate of Completion and Compliance (CCC). ‘Build- then Sell’ concept is the new concept introduced by the Government to the developers. However, developers have their own decision to choose whether to carry out ‘Build- then Sell’ or ‘Sell- then- Build’ because the cash flow faced by the developer could be different. There are two types of ‘Build- then- Sell’ which are 100% ‘Build- then- Sell’ with CCC and ‘Build- then- Sell’ 10:90 formula. The figure 5.1 shows the graph 100% ‘Build- then- Sell’ with CCC. Figure 5.1 Cash Flow of 100% ‘Build- then- Sell’ with CCC Based on the figure 5.1, the developer do not receive any payment from the purchasers to fund the construction costs or to repay the bridging loans secured by the developer from point A to point C which is during the construction stage. In this case, during the construction

- 11. stage the developer will face serious financial problems which is the negative cash flow. Thus, the developer has to borrow loans which is the short-term and long-term loan from the bank to cover current obligations by providing immediate cash flow due to the zero cash inflows during the construction stage. At point C, sales only can launched at this time where the project has been completed and issuance by the Certificate of Completion and Compliance (CCC) which allow the purchasers to buy the property first with the payment of 10% of selling price upon signing the sale and purchase agreement. However, the break-even point of cash inflow and outflow for the developer will not meet at this point yet because the net inflows may need longer time to move into profit account where the other 90% of the payment from each purchaser will be paid after3 months from the date of signing sales and purchase agreement with another 1 month extension. In additional, the developer has to ensure that all of the property or housing that has been constructed able to sell out as soon as possible so that they are able to pay the debt to bank to avoid the charge of interest. Once there are the property or housing weren’t sell out yet then the developer is consider loss of profits. The `Build- then- Sell’ with 10:90 formula is where the buyers only required to pay 10% of the total amount of the selling price to the stakeholder as proposed by the Housing Buyers Association (HBA). The 10% payment made by the buyers can be assumed as the booking fees for their selection of property or housing based on their favored. After that, the buyers will not require to make any payment during the construction stage until the issuance of Certificate of Completion and Compliance has been issued only the buyers required to pay the remaining 90% of the selling price of the property. Based on National House Buyer Association (HBA), developer who wanted to adopt this Build then Sell 10:90 formula will be exempted from paying Rm200, 000 deposit for a housing development license. The ‘Build- then –Sell’ concept could bring advantages to the buyers, bank and developer. The main advantage of `Build- then- Sell’ to the buyers is they can avoid from buying properties or houses that might be abandoned during the construction period and property or housing that could not complete at the time as promised and caused major delay problems. If this situation happened, it could decrease the reputation of the developer and the

- 12. the buyers will losses their trusts on the developer and avoid buying property or housing from the developer. Next, ‘Build- then- Sell’ concept able for the buyers to view the completed design and construction of the houses to make sure the final products are able to reach the satisfaction from the buyers. This is because the design before completion as advertisement might be different from the actual completion design. Buyers also able to examine the quality of the housing in term of finishing, specification and etc. and workmanship during construction the housing project. In financial aspect, buyers only required to pay after the issuance of Certificate of Completion and Compliance to the housing which could increase the confidence of the buyers on purchasing the property or housing. The advantage could be found between the developer and buyers where the developer has the ability to accommodate the specific property or housing that based on the demands and needs from the buyers. Before the completion or during the construction of a project, the buyers may want certain finishes, specifications and design to the property or housing so the developer can conduct a survey to conclude the decision and meet most of the buyer satisfaction which could highly increase the demand of the property or housing. After that, there are advantages for the developer from the government to encourage and helps in decrease financial burden of the developer to who implement the ‘Build- then- Sell’ concept. There are four types of incentives by government to the developer which are: The banking institution to be given tax exemption on interest income received from the rescuing contractor or developer. Developer be given a double deduction on interest paid and all direct costs incurred in obtaining loans. Contractor be given stamp duty exemption on all instruments executed for the purpose of transfer of land or house.

- 13. Loan agreements to finance the cost of revival and original house buyer in abandoned project be given stamp duty exemption on all instruments executed for the purpose of obtaining additional finance and the transfer of the house. Lastly, there are advantages for the bank because there are required of bank loan by developer to run or develop the property or housing based on ‘Build- then- Sell’ concept. This allow the bank to gain more interest profits when they released the high amount of loan to the developer. In conclusion, the cash flow of ‘Build- then Sell’ seen like not a good sight for the developer where the developer may faces a lot of financial issues and the developer may need a sufficient or high amount of capital to kick start a construction. However, the implement of `Build- then-Sell’ concept able to provide benefits to the developer, buyers, banker so it is highly recommend to implement the concept of ‘Build- then- Sell’ in a country.