Effect of liquidity management on profitability of Indian banks

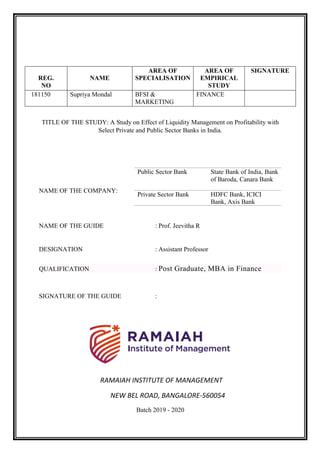

- 1. REG. NO NAME AREA OF SPECIALISATION AREA OF EMPIRICAL STUDY SIGNATURE 181150 Supriya Mondal BFSI & MARKETING FINANCE TITLE OF THE STUDY: A Study on Effect of Liquidity Management on Profitability with Select Private and Public Sector Banks in India. NAME OF THE COMPANY: NAME OF THE GUIDE : Prof. Jeevitha R DESIGNATION : Assistant Professor QUALIFICATION : Post Graduate, MBA in Finance SIGNATURE OF THE GUIDE : RAMAIAH INSTITUTE OF MANAGEMENT NEW BEL ROAD, BANGALORE-560054 Batch 2019 - 2020 Public Sector Bank State Bank of India, Bank of Baroda, Canara Bank Private Sector Bank HDFC Bank, ICICI Bank, Axis Bank

- 2. Brief introduction of the background subject: This study empirically examines the relation between liquidity and profitability, as measured by financial ratio on a sample of private and public sector banks in India. The trade-off between liquidity and profitability has been a burning issue in the corporate world. Theoretically, both liquidity and profitability are affected by the working capital decisions of any company. Excess of investment in working capital may result in low profitability and lower investment may result in poor liquidity. Therefore, the management needs to trade-off between liquidity and profitability to maximize shareholders’ wealth. Every organization, whether profit-oriented or not, irrespective of size and nature of business, requires necessary amount of working capital. Working capital is the most crucial factor for maintaining liquidity, survival, solvency and profitability of business. It is observed that if a firm wants to take a bigger risk for mammoth profits, it minimizes the dimension of its working capital in relation to the revenues it generates. If it intends to improve its liquidity, that in turn raises the level of its working capital. Nonetheless, this technique might tend to reduce the sales volume and consequently, it would affect the profitability. Thus, a company needs to have a striking balance between liquidity and profitability. In order to maintain high profitability levels, companies might need to forfeit their solvency by maintaining relatively low levels of current assets. As soon as the companies start doing so, their profitability would improve as less amount of money is fastened up to the idle current assets and their solvency would be in danger. Therefore, excessive levels of current assets may have a negative effect on the firm’s profitability, whereas a low level of current assets may lead to lower level of liquidity and stock outs, resulting in difficulties in maintaining smooth operations. In today’s developing and competitive world, the banking sector has emerged as a key player that contributes to the growth of economy, development of financial sector and more importantly, creation of employment in the country. Banks are the fulcrum of financial system of any economy and they play an important role in contributing to a country’s economic development. The major role of banks is to collect money from the public in the form of deposits and then along with its own funds to serve the demands of the customers quickly, paying interest for the deposits and to meet out the expenses to carry out its activities. For this purpose, banks maintain adequate liquidity and earn profits from their activities. Profit is the main reason for the continued existence of every commercial organization and profitability depicts the relationship of the absolute amount of profit with various other factors. In any case, compared to other business concerns, banks in general have to pay much more attention for balancing profitability and liquidity. Liquidity is required to meet the prompt demands of customers and profitability is required to meet the expenses of banks. But both the terms are contradictory in nature. If banks maintain more liquidity, their profitability decreases, and if they increase their profitability, they will have to reduce their liquidity. Liquidity of bank refers to reserves of cash, securities, bank’s ability to convert an asset into cash, and unused bank lines of credit. Liquidity must be adequate to meet all maturing unsecured debt obligations due within a one-year time horizon. Despite different approaches that can be used to analyse bank’s liquidity, the following are the key ratios that can be used to examine bank’s liquidity: Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) and whether they could be converted quickly to cover redemptions. On the other hand, profitability of the bank determines its ability to increase capital (through retained earnings), support the future growth of assets, absorb loan losses and provide return to investors. The key financial ratios that are used in assessing the profitability of a bank

- 3. include: Return on Assets (ROA), Return on Equity (ROE) and Return on Investment (ROI ). Keeping this in mind, banks have to do a balancing act between liquidity and profitability. Review of Previous literature: 1. The research paper on “The Effect of Liquidity Management on Profitability: A Comparative Analysis of Public and Private Sector Banks in India” by Birajit Mohanty and Shweta Mehrotra - This paper makes an attempt to study the effect of liquidity management on the profitability of public and private sector banks in India. For this purpose, 27 public sector banks and 20 private sector banks have been considered for the periods 2011-12 and 2015-16. Cash-Deposit Ratio (CDR), Credit- Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) have been used as independent variables to denote the liquidity management of the banks, while Return on Assets (ROA) and Return on Equity (ROE) have been used as proxy variables for the profitability of the banks. It is found that there is a significant negative effect of CDR and IDR on ROA. However, in the case of ROE, it is found that there is no significant relationship between banks’ profitability and liquidity taking all the variables into consideration, irrespective of the type or form of commercial banks in India. This leads to the conclusion that the commercial banks can focus on increasing their profitability without affecting their liquidity and vice versa. 2. The research paper on “A Study on Liquidity Position of Public Sector Banks in India after Liberalisation” by Dr.M.Krishnaveni, N. Umamaheswari - Introduction of reforms in the banking sector has changed the face of Indian banking industry. The globalization of operations and implementation of new technologies have led to increase in resource productivity, increasing level of deposits, credit and profitability. The objective of the study is to know the growth of the performance of Indian banks and to analyses the liquidity position of public sector banks after liberalization. In this study all the public sector banks were selected such as a19 Nationalised banks, 5 SBI Associates and SBI. We have chosen the liquidity ratios to analyse the liquidity position of the public sector banks. The statistical tools also used in this study such as standard deviation, co-efficient of variation, compound annual growth rate and two way ANOVA. Through this study we found that the overall liquidity position of Nationalized banks and SBI Associates are comparatively better than SBI. 3. The research paper on “A Comparative Study on the Performance of Selected Public Sector and Private Sector Banks in India ” by Cheenu Goel and Chitwan Bhutani Rekhi - Efficiency and profitability of the banking sector in India has assumed primal importance due to intense competition, greater customer demands and changing banking reforms. Since competition cannot be observed directly, various indirect measures in the form of simple indicators or complex models have been devised and used both in theory and in practice. This study attempts to measure the relative performance of Indian banks. For this study, we have used public sector banks and private sector banks. We know that in the service sector, it is difficult to quantify the output because it is intangible. Hence different proxy indicators are used for measuring productivity of banking sector. Segmentation of the banking sector in India was done on bank assets size. Overall, the analysis supports the conclusion that new banks are

- 4. more efficient that old ones. The public sector banks are not as profitable as other sectors are. It means that efficiency and profitability are interrelated. The key to increase performance depends upon ROA, ROE and NIM. 4. The research paper on “Trade-Off between Liquidity and Profitability: A Comparative Study between State Banks and Private Banks in Sri Lanka ” by A.Nishanthini and J.Meerajancy - Banks are the one of the most popular financial institution and those banks contribute the economic development and growth of economic. The banks play a crucial role in the competitive environment. Nowadays various types of human society wants to invest in banks and to earn more interest and obtain the other additional facilities such as leasing, loan, pawing and mortgage. An efficient and effective liquidity management provides an enjoyable profitability and leads to survival. There the purpose arises on the study is to find out the effect of liquidity on banks and also compare the banking organization that which bank play a better role, and also give suggestion based on the findings. The present study is initiated on liquidity and profitability trade –off with the samples of State Banks and private Banks in Sri Lanka over period of 2008-2012. All samples are licensed commercial banks. Current ratio (CR) and Quick ratio (QR) were used to measure liquidity as well as Net Profit margin (NP), Return on Assets (ROA) and Return on Equity (ROE) were used to measure the dependent variable as Profitability. The Statistical tests were used to find out the effects of liquidity and Profitability these are: descriptive statistics, correlation and regression analysis. The study found that insignificant correlation between liquidity and profitability both State Banks and Private Banks. And regression shows the negative impact of liquidity on profitability in selected Banks in Sri Lanka. 5. The research paper on “Efficiency and Profitability of Public and Private Sector Banks in India: Data Envelopment Analysis Approach” by Ravi Inder Singh and Simran Kaur - This paper examines the inter-bank relative efficiency of public and private sector commercial banks in India. This study includes analysis of slacks which remain to be explored for getting a clear picture about the causes of inefficiency. Though the issue is important, no recent study, to the best of our knowledge, has addressed it. Data Envelopment Analysis (DEA) approach has been used to examine the efficiency level achieved and to identify the slacks. The results reveal that private (Indian) sector banks are relatively more efficient compared to public sector banks. It was found that State Bank of Hyderabad, Bank of Maharashtra, Central Bank of India, United Bank of India, Dhanlaxmi Bank and ING Vysya could not achieve 100% efficiency even in a single year, whereas the Federal Bank, HDFC Bank, Kotak Mahindra Bank, Nainital Bank and Yes Bank Ltd., all private sector banks, achieved full efficiency in all the ten years. The strategies suggested in this study to the comparatively less efficient banks would help them not only in improving their efficiency, but also in lowering the cost of their products for the overall benefit of their customers. Efficiency is also found to be directly affecting the profitability of banks.

- 5. 6. The research paper on “Financial Analysis of Public and Private Sector Banks of India: A Comparative Study of Punjab National Bank and HDFC Bank” by Dr. Mohd Taqi and Maj. S.M. Mustafa - Banking sector occupies an important role in the economic development of a nation. It is one of the fastest growing sectors in India as it is featured by a large network of bank branches, serving many kinds of financial services to its customer. Bank plays an important role to mobilize savings of general public, remittance of money and other general banking services. The performance of a bank may be evaluated for several reasons depending upon various objectives. Profit is the main motive for the continued existence of every commercial organization and profitability depicts the relationship between the absolute amounts of profit with various other factors. As compared to other business concerns, banks in general have to pay much more attention for balancing profitability and liquidity. Liquidity is required to meet the prompt demands of customers whereas profitability is required to meet the expenses of banks. Hence, the present research is an effort to measure and compare the financial performance of Punjab National Bank and HDFC Bank as both the banks are big giants in public and private sector respectively. The study focused on the growth and performance analysis of both the banks for a period of ten years, i.e. from 2006-07 to 2015-16. Quantitative analysis has been undertaken by looking at various financial ratios like management efficiency, liquidity and profitability which are the reliable indicators of a bank performance. It is found that PNB is more financially sound than HDFC Bank but in context of deposits and expenditure HDFC bank has better managing efficiency than PNB. 7. The research paper on “PERFORMANCE EVALUATION OF PUBLIC SECTOR AND PRIVATE SECTOR BANKS – A COMPARATIVE STUDY ” by Mrs. N. VIJAYALAKSHMI and Dr. G. KARUNANITHI - Banking sector occupies an important role in the economic developmentof a nation. It is one of the fastest growing sectors in India as it is featured by a large network of bank branches, serving many kinds of financial services to its customer. Bank plays an important role to mobilize savings of general public, remittance of money and other general banking services. The performance of a bank may be evaluated for several reasons depending upon various objectives. Profit is the main motive for the continued existence of every commercial organization and profitability depicts the relationship between the absolute amounts of profit with various other factors. As compared to other business concerns, banks in general have to pay much more attention for balancing profitability and liquidity. Liquidity is required to meet the prompt demands of customers whereas profitability is required to meet the expenses of banks. Hence, the present research is an effort to measure and compare the financial performance of Punjab National Bank and HDFC Bank as both the banks are big giants in public and private sector respectively. The study focused on the growth and performance analysis of both the banks for a period of ten years, i.e. from 2006-07 to 2015-16. Quantitative analysis has been undertaken by looking at various financial ratios like management efficiency, liquidity and profitability which are the reliable indicators of a bank performance. It is found that PNB is more financially sound than HDFC Bank but in context of deposits and expenditure HDFC bank has better managing efficiency than PNB.

- 6. 8. The research paper on “Performance Evaluation of Public Sector, Private Sector and Multistate Cooperative Banks in India-A Study” by Ashish M Joshi and K. G. Sankaranaryanan - The banking industry in India as a whole is making significant contributions for the development of the economy and helping to achieve sustainable growth. The banks are helping the economy in terms of effective capital formation, effective lending and contributing to the development of the nation, thus banks need to be more closely watched. In India banks are one of the healthiest performers in the world banking industry seeing tremendous competitiveness, growth, efficiency, profitability and soundness, especially in the recent years. The main goal of banks today is to ensure stability and make sure that they are internally sound and sensible. Hence, it is important to measure soundness across various banks in the country and identify the weaker sections of the banking sector, devise appropriate strategies and policies to lift these sections and eventually create an environment that leads banks to be sound and results in stability. The CAMEL model in banking sector is widely used all over the world to ascertain the performance of the banks operating in various sectors. In the present study an attempt is made to evaluate relative performance of banks in India using CAMEL approach. In the present study while the comparing the performance of three categories of banks in various sectors it is observed that among the banks in public sector Bank of Baroda was considered to be better, whereas among private sector banks ICICI banks was better and in multistate cooperative banks the Punjab Maharashtra cooperative bank was better on certain parameters of camel model. 9. The research paper on “Performance Evaluation of Public Sector, Private Sector and Multistate Cooperative Banks in India-A Study” by Kajal Chaudhary and Monika Sharma - The economic reforms in India started in early nineties, but their outcome is visible now. Major changes took place in the functioning of Banks in India only after liberalization, globalisation and privatisation. It has become very mandatory to study and to make a comparative analysis of services of Public sector Banks and Private Sector banks. Increased competition, new information technologies and thereby declining processing costs, the erosion of product and geographic boundaries, and less restrictive governmental regulations have all played a major role for Public Sector Banks in India to forcefully compete with Private and Foreign Banks. this paper an attempt to analyze how efficiently Public and Private sector banks have been managing NPA. We have used statistical tools for projection of trend. 10. The research paper on “Profitability of Public Sector Banks in India : A Study of Determinants” by Prashanta Athma, K.P.Venugopala Rao and Farha Ibrahim - The “Profitability of Public Sector Banks in India: A Study of Determinants” examines the factors influencing the financial performance of 26 Indian Public Sector Banks post global financial crises. The Random Effect Model on the balanced panel data for the period 2012-2017 was performed to determine the impact of the macroeconomic and bank specific factors based on the CAMELS framework. The bank specific factors that influence the profitability of the Public Sector Banks in India are Total Investments to Total Assets, Operating Profit to Total Assets and Provisions on Loans whereas the effect of macroeconomic factors on the banks profitability were insignificant.

- 7. 11. The research paper on “A STUDY ON LIQUIDITY AND PROFITABILITY OF INDIAN PRIVATE SECTOR BANKS” by DR. V. R. NEDUNCHEZHIAN and MS. K. PREMALATHA - The study aims to know about the relationship between liquidity and profitability of the Indian private sector banks.5out of the 20 new private sector banks and new private sector banks involved in the study. The study was descriptive in nature and it was adopted to collect secondary data for the study. The selected financial reports of the ten private selected banks are studied for the relevant liquidity and profitability were determined by the use of the time series analysis and regression on profitability ratio. The result provides that there is no significant relationship between ROA with cash and bank balances to total liabilities. In the liquidity measures, here also there is no statistical significant relationship between ROE with loans and advances to total assets, and cash and bank advances to total liabilities. 12. The research paper on “Management Efficiency and Profitability Of Selected Indian Public And Private Sector Banks” by J.Kumar and Dr. R. Thamilselvan - Commercial banks play a vital role in the development of the industry and trade. They are performing not only the curator of the country but also resource of country. The present study aims at identify Management Efficiency and Profitability of selected Indian public and private sector banks. The study considered a sample of top ten Banks (7 public sector banks and 3 private sector banks) for the period from 1, April 2005 to March 31, 2016. The study is based on the secondary data, procured and extracted from financial statements of the selected banks. The collected data has analysed using various financial ratios and statistical tools like Geometric Mean Standard deviation and Compounded Annual Growth Rate have been accomplished .Indian banking will brace for new challenges for entry of new types of lenders intensifies competition while high bad loan. I t is found that in management efficiency IDBI bank has top rank followed by AXIS bank and ICICI bank it shows that better ability of the banks. Punjab National Bank has last position followed by Canara Bank and State Bank of India. In terms of profitability HDFC bank has top position followed by Canara Bank Punjab National Bank. Industrial Development of India bank has last position due to under utilization of assets followed by Bank of India and Canara Bank 13. The research paper on “Management Efficiency and Profitability Of Selected Indian Public And Private Sector Banks” by M.Sukanya - CAMEL model analysis is an important tool to analyse the banks’ and financial institutions’ performance and to suggest the necessary measures for its improvement where it is required. In the present study, Indian banks-five public and five private sector banks based on its total assets have been considered. This study is taken up for the five year period from 2012-17. The present study analyses the financial performance of the select banks. Five parameters of CAMEL-Capital Adequacy, Asset Quality, Management Efficiency, Earnings Ability and Liquidity are considered to rank the banks on its performance. The study found that Kotak Mahindra has performed better and ranked first among all the banks and Punjab National bank ranked the least position. Among all, private sector banks have outperformed compared to public sector banks. The top five positions are of private sector banks and Bank of Baroda being public sector bank ranked top third with HDFC bank. 14. The research paper on “Analysis of Financial Performance of Selected Commercial Banks in India” by Palamalai Srinivasan and John Britto - The present study attempts to evaluate the financial performance of selected Indian commercial banks for the period from 2012/13 to 2016/17. The study comprises 16 commercial banks, 11 representing public sector and 5 from private sector, and the financial performance of these banks are analysed using the financial ratios. The study shows that the financial performance of private sector banks is relatively better than the public sector banks throughout the study period. Besides, the study examines the impact of liquidity, solvency and efficiency on the profitability of the selected Indian

- 8. commercial banks by employing the panel data estimations, viz. the Fixed Effect and Random Effect models. The empirical results from the panel data estimations revealed that the liquidity ratio and solvency ratio, and the turnover ratio and solvency ratio are found to have positive and significant impact on the profitability of selected public sector and private sector banks, respectively, bearing testimony to the fact that profitability is a function of those ratios. 15. The research paper on “An analysis of profitability position of private bank in India” by Amit Kumar Singh - Profit is a measure of success of business and the means of its survival and growth. Profitability is the ability of a business to earn profit for its owners. The objective of this study was overall profitability analysis of different private sector banks in India based on the performance of profitability ratio like interest spread, net profit margin, return on long term funds, return on net worth, return on assets & adjusted cash margin. Profitability is a measure of efficiency and control it indicates the efficiency or effectiveness with which the operations of the business are carried on. Profitability ratios provide different useful insights into the financial health and performance of a company. A business that is not profitable cannot survive. Conversely, a business that is highly profitable has the ability to reward its owners with a large return on their investment. Increasing profitability is one of the most important tasks of the business managers. Managers constantly look for ways to change the business to improve profitability. These potential changes can be analysed with a support of income statement and balance sheet. Statement of the problem: The study is undertaken to analyse the relationship between liquidity management and bank’s profitability and also to the impact of liquidity management on profitability between select public sector and private sector banks in India for the period of last 5 years (2014 to 2019). Objectives of the study • To analyse the relationship between liquidity management and profitability of public and private sector banks in India • To understand the liquidity-profitability trade-off between public and private sector banks in India • To examine the effect of liquidity management on bank’s profitability of select public and private sector banks in India Scope of the study Period: 5 years data (2014 to 2019) Industry: Banking Companies: 1) Public Sector Bank: State Bank of India, Bank of Baroda, Canara Bank 2) Private Sector Bank: HDFC Bank, ICICI Bank, Axis Bank

- 9. Hypothesis Based on the above objectives, the following hypothesis are framed: H0: There is no significant relationship between the liquidity management and profitability with public and private sector banks in India H1: There is a significant relationship between the liquidity management and profitability with public and private sector banks in India Methodology Types of Research: Descriptive Research Sampling Plan: 3 Public sector banks & 3 private sector banks Sources of data: Secondary data Tools use Ratio analysis, T-test, Correlation Financial Ratios use: For Liquidity: Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) For profitability: Return on Assets (ROA), Return on Equity (ROE) and Return on Investment ( ROI ) Plain of analysis: Excel is used Limitation: The study is done to analyse liquidity management on profitability on select public and Private sector banks in India. There are 27 public sector bank and 21 private sector banks In India. But the present study covers only 6 banks (3 public sector and 3 Private sector). Only last 5 years data (2014 to 2019) are considered for the study because of the time constrain. Also, there are only 6 key financial ratios (3 for liquidity and 3 for profitability) are considered for the study. They are Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) for examine the liquidity, on the other hand Return on Assets (ROA), Return on Equity (ROE) and Return on Investment (ROI) for examine the profitability.

- 10. Bibliography: • Mohanty, B., & Mehrotra, S. (2018). The Effect of Liquidity Management on Profitability: A Comparative Analysis of Public and Private Sector Banks in India. IUP Journal of Bank Management, 17(1). • Bhatia, A., Mahajan, P., & Chander, S. (2012). Determinants of profitability of private sector banks in India. Indian Journal of Accounting, 42(2), 39-51. • Goel, C., & Rekhi, C. B. (2013). A comparative study on the performance of selected public sector and private sector banks in india. Journal of business management & Social sciences research, 2(7), 46-56. • Nishanthini, A., & Meerajancy, J. Trade-Off between Liquidity and Profitability: A Comparative Study between State Banks and Private Banks in Sri Lanka. • Singh, R. I., & Kaur, S. (2016). Efficiency and Profitability of Public and Private Sector Banks in India: Data Envelopment Analysis Approach. IUP Journal of Bank Management, 15(1). • Taqi, M., & Mustafa, M. S. (2018). Financial Analysis of Public and Private Sector Banks of India: A Comparative Study of Punjab National Bank and HDFC Bank. International Academic Journal of Business Management, 5(1), 26-47. • Chaudhary, K., & Sharma, M. (2011). Performance of Indian public sector banks and private sector banks: A comparative study. International journal of innovation, management and technology, 2(3), 249. • Bodla, B. S., & Verma, R. (2006). Determinants of profitability of banks in India: A multivariate analysis. Journal of Services Research, 6(2), 75-89. • NEDUNCHEZHIAN, D. V., & PREMALATHA, M. K. (2015). A STUDY ON LIQUIDITY AND PROFITABILITY OF INDIAN PRIVATE SECTOR BANKS. International Journal of Marketing, Financial Services and Management Research, 4(4). • Kumar, J., & Selvan, T. (2019). Management Efficiency and Profitability of Selected Indian Public and Private Sector Banks. International Journal of Knowledge-Based Organizations (IJKBO), 9(1), 26-35. • Palamalai, S., & Britto, J. (2017). Analysis of Financial Performance of Selected Commercial Banks in India. Srinivasan, Palamalai and Britto, John (2017),“Analysis of Financial Performance of Selected Commercial Banks in India”, Theoretical Economics Letters, 7(7), 2134-2151. • Singh, A. K. (2015). An analysis of profitability position of private banks in India. International Journal of Scientific and Research Publications, 5(5), 1-11. • www.sbi.co.in • www.bankofbaroda.com • www.canarabank.com • www.hdfc.com • www.icici.com • www.axisbank.com • www.economictimes.com • www.rbi.com