1) The document discusses how monetary policy performance is affected by fiscal policy and whether monetary policy should depend on the fiscal policy regime.

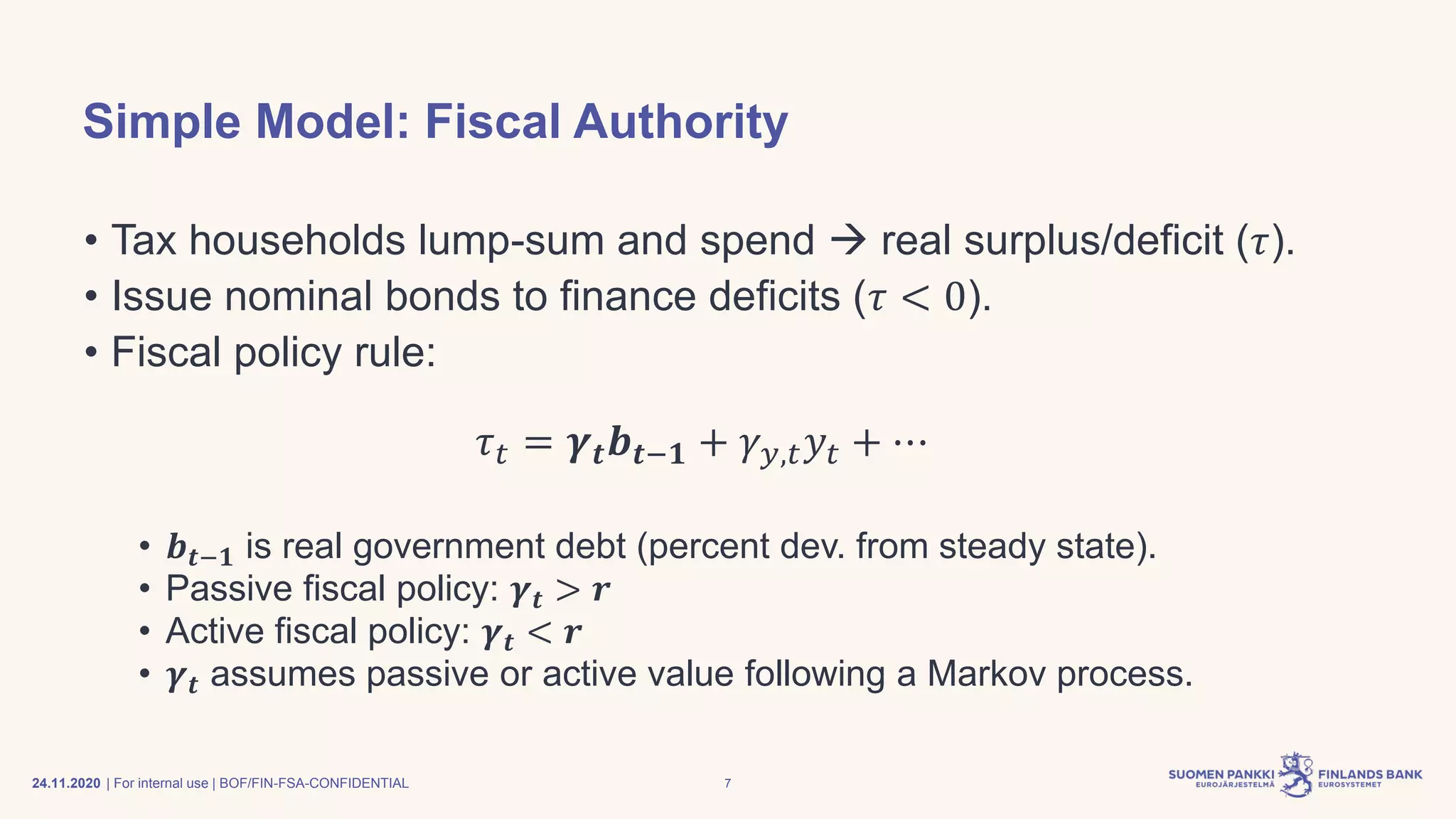

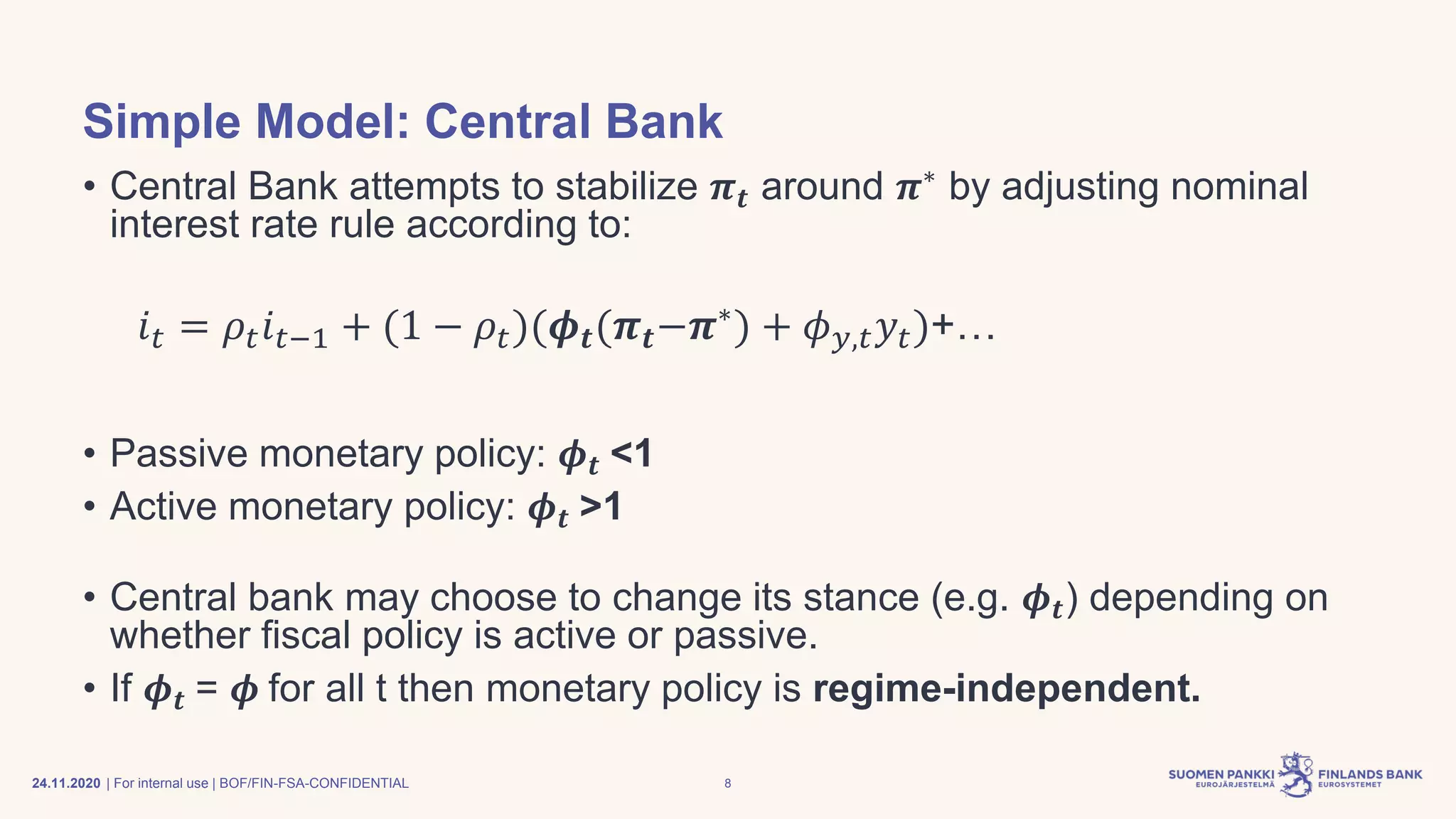

2) It finds that monetary policy should be active when fiscal policy is passive to ensure determinacy and stability, while an interest rate peg may be needed if fiscal policy is consistently active.

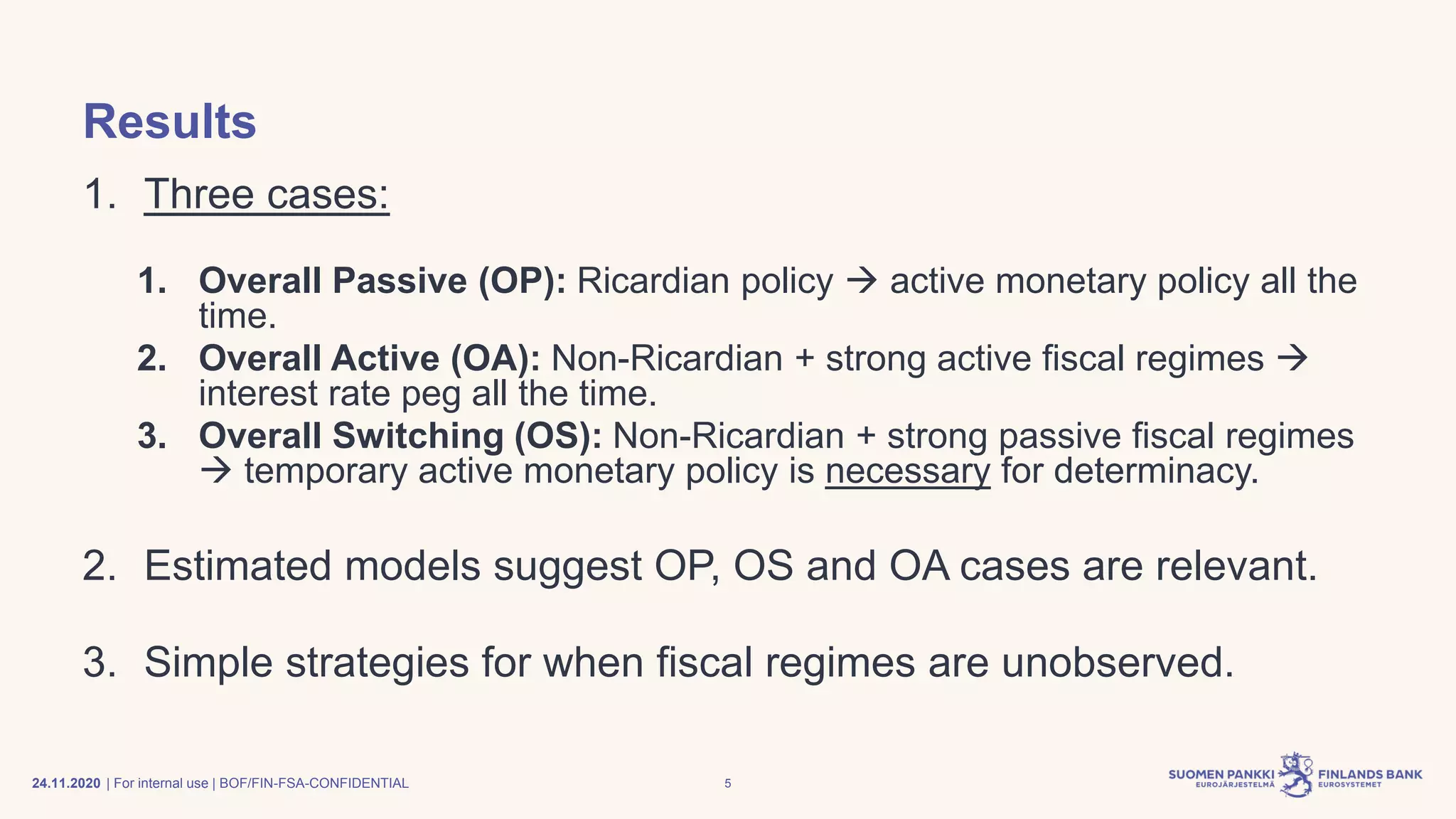

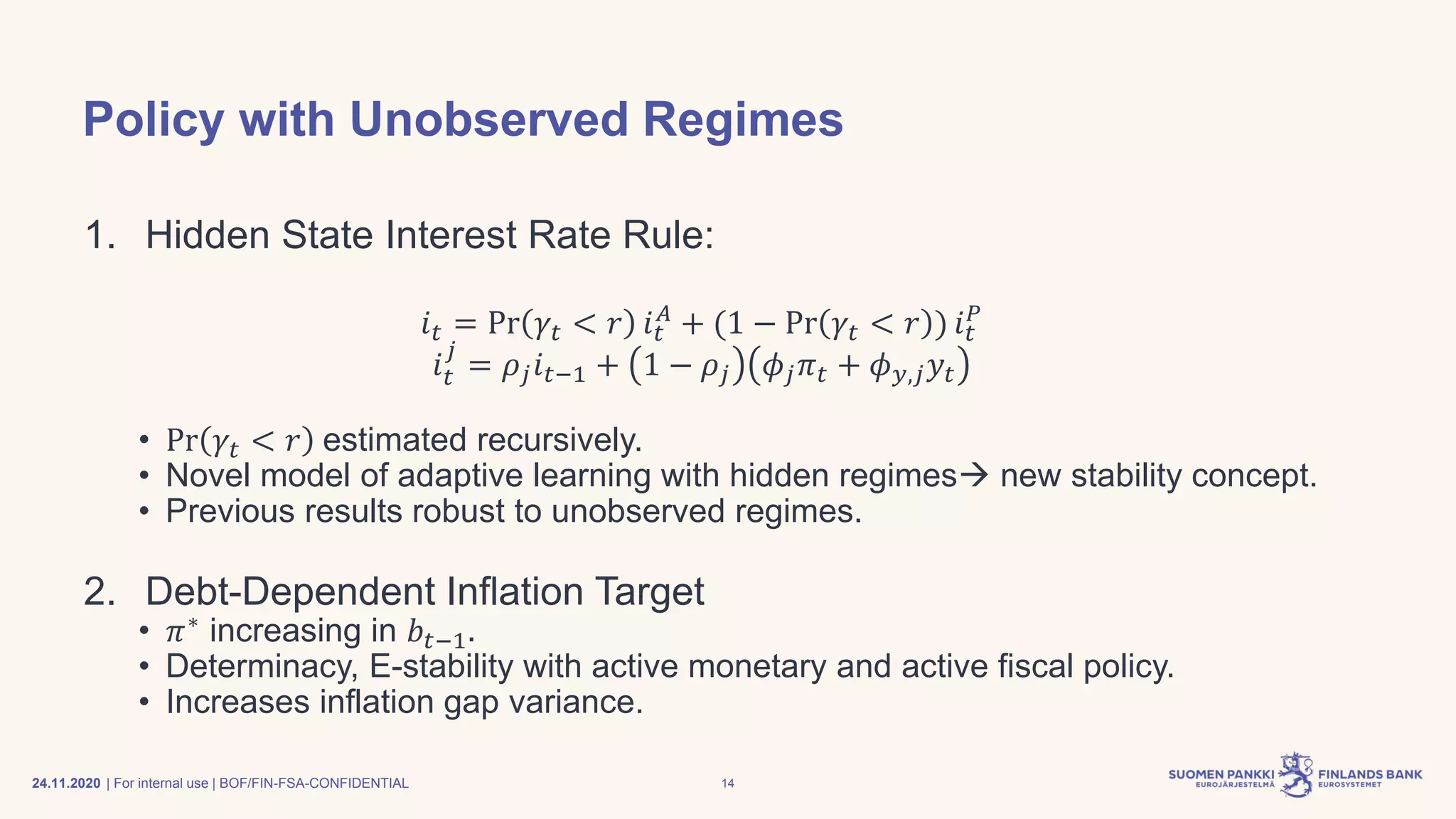

3) The research considers different cases where fiscal policy could be overall passive, active, or switching between regimes, and finds regime-dependent monetary policy is sometimes necessary to minimize inflation variability.