PROFORMA FOR GRADE 12 ACCOUNATNCY- Modified.pdf

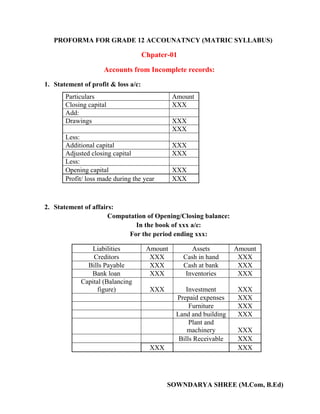

- 1. SOWNDARYA SHREE (M.Com, B.Ed) PROFORMA FOR GRADE 12 ACCOUNATNCY (MATRIC SYLLABUS) Chpater-01 Accounts from Incomplete records: 1. Statement of profit & loss a/c: 2. Statement of affairs: Computation of Opening/Closing balance: In the book of xxx a/c: For the period ending xxx: Liabilities Amount Assets Amount Creditors XXX Cash in hand XXX Bills Payable XXX Cash at bank XXX Bank loan XXX Inventories XXX Capital (Balancing figure) XXX Investment XXX Prepaid expenses XXX Furniture XXX Land and building XXX Plant and machinery XXX Bills Receivable XXX XXX XXX Particulars Amount Closing capital XXX Add: Drawings XXX XXX Less: Additional capital XXX Adjusted closing capital XXX Less: Opening capital XXX Profit/ loss made during the year XXX

- 2. SOWNDARYA SHREE (M.Com, B.Ed) 3. Total debtors a/c: Particulars Amount Particulars Amount To balance b/d (Opening) XXX By cash (Received) XXX To Bills receivable (Dishonor) XXX By discount allowed XXX To Credit sales (Balancing figure) XXX By Sales return XXX By Bills receivable (Received) XXX By balance c/d (Closing) XXX XXX XXX Total sales= Cash sales + Credit sales 4. Bills receivable a/c: Particulars Amount Particulars Amount To balance b/d (Opening) XXX By debtors a/c (Bills dishonor) XXX To sundry debtors (Balancing figure) XXX By balance c/d (Closing) XXX XXX XXX 5. Total creditors a/c: Particulars Amount Particulars Amount To cash (Paid) XXX By balance b/d (Opening) XXX To discount received a/c XXX By bank (Dishonor) XXX To purchase return a/c XXX By credit purchase (Balancing figure) XXX To balance c/d (Closing) XXX XXX XXX Total purchase = Cash purchase + Credit purchase

- 3. SOWNDARYA SHREE (M.Com, B.Ed) 6. Bills payable a/c: Particulars Amount Particulars Amount To cash (Bills paid) XXX By balance b/d (Opening) XXX To balance c/d (Closing) XXX By creditors (Bills accepted) XXX XXX XXX 7. Trading and proft loss account In the book of XXX a/c: For the period ending xxx Particulars Amount Amount Particulars Amount Amount To Opening stock Xxx By sales To purchases Cash xxx Cash xxx Credit xxx Credit xxx less: Less: xxx Sales return xxx xxx Purchase return xxx Xxx By closing stock xxx To Direct expenses Xxx To Gross profit c/d (Balancing figure) Xxx By Gross loss c/d (Balancing figure) xxx XXX XXX To Gross loss b/d Xxx By Gross profit b/d xxx To Rent paid Xxx By discount received xxx To salaries Xxx By commission received xxx To sundry expenses Xxx By Net loss c/d (Balancing figure) xxx To Net profit c/d (balancing figure) Xxx XXX XXX

- 4. SOWNDARYA SHREE (M.Com, B.Ed) Balance sheet In the book of xxx a/c: As on ***: Liabilities Amount Assets Amount Capital xxx Add: Net profit /Less: Net loss xxx Less: Drawings xxx XXX Cash in hand XXX Creditors XXX Cash at bank XXX Bills Payable XXX Inventories XXX Bank loan XXX Investment XXX Prepaid expenses XXX Furniture XXX Land and building XXX Plant and machinery XXX Bills Receivable XXX XXX XXX List of direct expenses: 1. Royalty 2. Octri Duty 3. Carriage inward 4. Freight inward 5. Import duty 6. Lightning etc… Notes: In case both the accounts of debtors and bills receivable is asked always your first account should be bills receivable and Vice vera for other two acounts.

- 5. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-02 Non profit organisations: 1. Receipts and payment account: Particulars Amount Particulars Amount To balance b/d Cash Bank Xxx Xxx By rent Xxx To subscription a/c Previous year Current year Subsequent year Xxx Xxx Xxx By telephone charges To life membership fee Xxx By interest on bank charges Xxx To Legacies Xxx By Insurance premium Xxx To Sale of an old newspaper Xxx By upkeep of ground Xxx To sale of investment Xxx By balance c/d Cash Bank Xxx Xxx XXX XXX Items to be excluded: i. Depreciation ii. Outstanding 2. Income and expenditure account: Expenditure Amount Income Amount To loss on sale of asset Xxx By subscription Xxx To salary Xxx By interest received Xxxx To Rent Xxx By entrance fees Xxx To Travelling expense Xxx By locker rent recived Xxx To printing & Stationery xxX To insurance of assets To Surplus (Balancing figure) Xxx By deficit (Balancing figure) Xxx Items to be excluded: 1. Opening and closing balance

- 6. SOWNDARYA SHREE (M.Com, B.Ed) 2. Purchase and sale of asset 3. Legacy 4. Life membership fees 3. Consumption of materials, medicines: Income and expenditure account: Expenditure Amount Income Amount To opening stock xxx Add: Purchases xxx Less: Closing stock xxx XXX By sale of …. xxx XXX Balance sheet: Liability Amount Assets Amount Closing stock XXX 4. Subscription account: Given year balance as per question *** Add: Pertaining to Current year *** Less: Previous and Subsequent year ***

- 7. SOWNDARYA SHREE (M.Com, B.Ed) Chapter- 03 Fundamentals of partnership accounting: 1. Format of fixed capital account method: (a) Partners capital account: Date Particulars A B Date Particulars A B By balance b/d xxx xxx To balance c/d xxx Xxx By cash/ bank a/c(fresh capital introduced) xxx xxx xxx Xxx xxx xxx (b) Partners current account: Date Particulars A B Date Particulars A B To balance b/d xxxxxx By balance b/d xxx xxx To drawings a/c xxxxxx By interest on capital a/c xxxXxx To interest on drawing a/c xxxxxx By salary a/c xxxXxx To P&L appropriation a/c(share of loss) xxxxxx By commission a/c xxxXxx To balance c/d ? ? By p&l appropriation a/c (share of profit) xxxXxx By balance c/d ? ? xxxxxx xxxXxx

- 8. SOWNDARYA SHREE (M.Com, B.Ed) 2. Fluctuating Capital Method: Date Particulars A B Date Particulars A B To balance b/d xxxxxx By balance b/d xxxxxx To drawings a/c xxxxxx By interest on capital a/c xxxxxx To interest on drawing a/c xxxxxx By salary a/c xxxxxx To P&L appropriation a/c(share of loss) xxxxxx By commission a/c xxxxxx To balance c/d ? ? By P&L appropriation a/c (share of profit) xxxxxx By balance c/d ? ? xxxxxx xxxxxx 3. Interest on capital = Amount of capital * Rate of interest* Average period. 4. Journal entry for Interest on capital: Date Particulars L.F Dr (Rs) Cr (Rs) Interest on capital A/c Dr. Xxx To Partners capital a/c (Being interest provided) Xxx Date Particulars L.F Dr (Rs) Cr (Rs) P&L appropriation a/c dr. Xxx To interest on capital a/c (Being IOC closed) Xxx

- 9. SOWNDARYA SHREE (M.Com, B.Ed) 5. Methods for computing IOD: • Direct method Interest on drawings = Amount of drawings x Rate of interest x Period of interest • Product method Interest on drawings = Sum of products x Rate of interest p.a x 1/12 Average period method Frequency of withdrawal Average period of months Time of withdrawal At the beginning At the middle At the end Monthly 6.5 6 5.5 Quarterly 7.5 6 4.5 Half-yearly 9 6 3 6. Managers commission a. Commission as a percentage of net profit before charging commission = Net profit before commission × % of commission/100 b. Commission as a percentage of net profit after charging commission = Net profit before commission X % of commission/ 100+ % of commission 7. Profit and loss appropriation: Particulars Rs. Particulars Rs. To Interest on partners capital a/c XXX By P&L a/c XXX To partners salary a/c XXX By Interest on drawing a/c XXX To partners commission a/c XXX To partners capital/ current a/c (profit) ?

- 10. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-04 Goodwill : 1. Average profit = Total profit / No. of years of purchase Goodwill = Average profit * No. of purchase of years 2. Weighted average profit = Total of weighted profits/Total of weights Goodwill = Weighted average profit * No. of year of purchase 3. Super profit = Average profit – Normal profit Normal profit = capital employed * normal rate of return If capital employed not given directly in question, apply as Capital employed = Current assets – Current liability 4. Total capitalized value of average profit = Average profit / Normal rate of return *100 Goodwill = Total capitalized value of average profit – Capital employed

- 11. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-05 Admission of partnership accounting: 1. Revaluation account: 2. Basic journal entries for adjustment for goodwill: Case I: For bringing the share of goodwill: Cash/ Bank a/c dr. To Goodwill a/c For transferring goodwill to the capital account of old partners in sacrificing ratio: Goodwill a/c dr. To old partners capital a/c By combining above entries single entry can be passed as: Cash/Bank a/c dr. To old partners capital a/c Case II: Goodwill brought in cash and withdrawn by old partner: A. Withdrawn by old partners: Old partners capital a/c dr. To cash a/c B. For the amount brought in for goodwill: Cash a/c dr. To Old partners capital a/c Particulars Amount Particulars Amount Decrease in the value of assets XXX Decrease in the value of liabilities XXX Increase in the value of liabilities XXX Increase in the value of assets XXX Gain on revaluation a/c (B/F) Loss on revaluation a/c (B/F) XXX XXX

- 12. SOWNDARYA SHREE (M.Com, B.Ed) 3. Partners capital account: Particulars A B C Particulars A B C To Profit and loss a/c xxx xxx By balance b/d xxx xxx By General reserve xxx xxx By Profit and loss a/c xxx xxx By Reserve fund a/c xxx xxx To balance c/d (Balancing figure) xxx xxx Xxx By Bank/Cash a/c xxx By Workman compensation fund xxx xxx By Investment fluctuation fund a/c xxx xxx xxx xxx Xxx xxx xxx xxx By balance b/d xxx xxx xxx HINT: 1. If Goodwill bought by New partner share with sacrificing ratio. 2. Sacrificing ratio = Old ratio – New ratio

- 13. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-06 Retirement and Death of partnership accounting: 1. Revaluation account: 2. Partners capital account: Particulars A B C Particulars A B C To Profit and loss a/c xxx Xxx By balance b/d xxx xxx By General reserve xxx xxx By Profit and loss a/c xxx xxx By Reserve fund a/c xxx xxx To balance c/d (Balancing figure) xxx Xxx Xxx By Bank/Cash a/c xxx By Workman compensation fund xxx xxx By Investment fluctuation fund a/c xxx xxx xxx Xxx Xxx xxx xxx xxx By balance b/d xxx xxx xxx Particulars Amount Particulars Amount Decrease in the value of assets XXX Decrease in the value of liabilities XXX Increase in the value of liabilities XXX Increase in the value of assets XXX Gain on revaluation a/c (B/F) Loss on revaluation a/c (B/F) XXX XXX

- 14. SOWNDARYA SHREE (M.Com, B.Ed) Hint: 1. If retiring partner goodwill is given share it with Gaining ratio 2. Gaining ratio = New ratio – Old ratio 3. Goodwill -> Dr & Cr 4. Journal entries: A. Paid immediately: Retiring partner a/c dr. To Cash/ Bank a/c B. Not paid immediately: Retiring partner a/c dr. To Partner Loan a/c C. Half paid immediately and rest later basis: Retiring partner a/c dr. To cash/ Bank a/c To Loan a/c Note: In case of Death mention the deceased partner as Executor.

- 15. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-07 Company accounts: Terms to know: 1. Share capital – A. Equity B. Preference 2. Face value - A. Par (Equal to face value) B. Discount (Less than face value) C. Premium (More than face value) 3. Subscription: A. Under subscription B. Over subscription 4. Calls in arrear 5. Calls in advance Common Entries: Date Particulars L.F Dr.(Rs) Cr. (Rs) Bank a/c dr. xxx To share application a/c xxx (Being application money received) Share application a/c dr. xxx To Share capital a/c xxx (Being application money paid) Share allotment a/c dr. xxx To Share capital a/c xxx (Being allotment money paid)

- 16. SOWNDARYA SHREE (M.Com, B.Ed) Bank a/c dr. xxx Entry for Forfeiture & Re-issue: Forfeiture entry: Bank a/c dr. Xxx To share forfeiture a/c Xxx To share capital a/c (Being nonpayment of money) Re- Issue entry Share forfeiture a/c dr. Xxx Share capital a/c dr. Xxx To Bank a/c Xxx (Being Shares are reissued) Forfeiture should be transferred to capital reserve (Final entry) To Share allotment a/c xxx (Being allotment money rcd) Share calls a/c dr. xxx To share capital a/c xxx (Being call money paid) Bank a/c dr. xxx To share calls a/c xxx (Being call money rcd)

- 17. SOWNDARYA SHREE (M.Com, B.Ed) Chapter-09 Ratios 1. Liquidity ratios 2. Profitability ratio 3. Solvency ratio 4. Turnover ratio A. Liquidity ratio-> Liquidity means capable of converting into cash and to meet out its short term financial obligation. It can also be called as short term solvency ratios. (i) Current ratio = Current assets/ Current liability (ii) Liquid ratio = Liquid assets/ Current liability Liquid assets = Current assets – (Stock+ Prepaid expenses) Liquid ratio can also be called as acid test ratio or quick ratio. B. Long term solvency ratio: It means the firm ability to meet its liabilities in long run. In order to repay its debts in long run. (i) Debt equity ratio = Long Term Debt/ Shareholders fund Long Term Debt: Debentures, long term loans & Borrowings. Shareholders fund: Share capital (equity and preference)+ Reserves and surplus. (ii) Proprietary ratio = Shareholders fund/ Total assets Shareholders fund = Share capital (equity and preference) & Reserves and surplus. Total assets = Current assets + Fixed assets (iii) Capital gearing ratio = Funds bearing fixed interest & fixed dividend/ Equity shareholders fund. Funds bearing fixed interest and fixed dividend: (Preference share capital, Debentures, Bonds & long term borrowings with fixed interest).

- 18. SOWNDARYA SHREE (M.Com, B.Ed) C. Turnover ratios/ Activity ratios/ Efficiency ratios: (i) Inventory turnover ratio: Cost of revenue from operations/ Average inventory. Cost of revenue from operations: A. Purchase of stock in trade + Change in inventories of finished goods +Direct expenses. B. Revenue from operations – Gross profit Average inventory: Opening stock + Closing stock/ 2 (ii) Trade receivables turnover ratios: Net credit sales/ Average trade receivables. (iii) Trade payable turnover ratios: Net credit purchase/ Average trade payable. (iv) Fixed assets turnover ratios: Revenue from operations/ Average fixed assets. D) Profitability ratios: 1. Gross profit ratio 2. Net profit ratio 3. Operating cost ratio 4. Operating profit ratio 5. Return on investment (ROI) (i) Gross profit ratio = Gross profit/ Revenue from operation *100 Gross profit = Revenue from operations- Cost of revenue from operations. Gross profit = Revenue from operation – Cost of revenue from operation. Cost of revenue from operation = Purchase of stock in trade + Change in inventories

- 19. SOWNDARYA SHREE (M.Com, B.Ed) (ii) Net profit ratio= Net profit/ Revenue from operation *100 Net profit = Revenue from operations- Cost of revenue from operation- Selling and distribution- Administartive expenses (iii) Operating cost ratio = Operating cost/ Revenue from operations*100 Operating cost = Cost of revenue from operations+ Operating expenses Operating expenses= Employee benefit expenses+ Depreciation + Other expenses related to office and administration, selling and distribution. (iv) Operating profit ratio= Operating profit/Revenue from operations*100 Operating profit= Revenue from operation- Operating cost OR Operating profit= Gross profit – Operating expenses (v) Return on capital = Net profit before tax and interest/ Capital employed *100 Capital employed = Share capital +Reserves and surplus + Long term borrowings.