Company final accounts

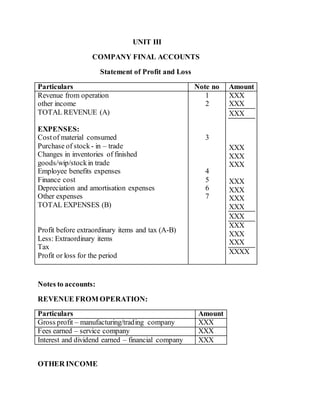

- 1. UNIT III COMPANY FINAL ACCOUNTS Statement of Profit and Loss Particulars Note no Amount Revenue from operation other income TOTAL REVENUE (A) EXPENSES: Costof material consumed Purchase of stock- in – trade Changes in inventories of finished goods/wip/stockin trade Employee benefits expenses Finance cost Depreciation and amortisation expenses Other expenses TOTAL EXPENSES (B) Profit before extraordinary items and tax (A-B) Less: Extraordinary items Tax Profit or loss for the period 1 2 3 4 5 6 7 XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXXX Notes to accounts: REVENUE FROM OPERATION: Particulars Amount Gross profit – manufacturing/trading company XXX Fees earned – service company XXX Interest and dividend earned – financial company XXX OTHER INCOME

- 2. Particulars Amount Sale of fixed asset XXX Interest earned on fixed asset XXX Interest on investment XXX Dividend earned XXX Commission received XXX Refund of income tax XXX Excess provision written off XXX Export subsidy and duty drawback XXX Miscellaneous income XXX COST OF MATERIAL CONSUMED Particulars Amount Opening stockof raw materials XXX Add: purchases,carriage inwards,other expenses incurred on purchase of material XXX XXX Less:purchase return XXX Less: Closing stockof raw materials XXX XXX PURCHASE OF STOCK- IN – TRADE Particulars Amount Goods purchased forreselling XXX CHANGES IN INVENTORIES OF FINISHED GOODS/WIP/STOCKIN TRADE Particulars Amount Opening stock XXX Less: closing stock XXX +/-

- 3. EMPLOYEE BENEFITSEXPENSES Particulars Amount Wages XXX Add: outstanding wages XXX Less: Prepaid expenses XXX XXX Salaries add o/s Bonus Leave encashment gratuity Medical expenses FINANCE COST Particulars Amount Interest on bank overdraft/ Discount on issue of debentures w/off XXX Interest of debentures/term loans XXX Interest on bonds/cashcredit XXX Interest on public deposit XXX DEPRECIATIONAND AMORTISATION EXPENSES Particulars Amount Depreciation on plant and machinery,building,loose tools XXX Furniture,computer,patent , goodwill,copy write,preliminary expenses XXX OTHER EXPENSES Particulars Amount Administrative expenses XXX Selling expenses XXX Carriage outwards XXX Telephone/stationary expenses XXX Electricity expenses XXX

- 4. Rent and rates paid XXX Sundry expenses XXX Commission paid XXX EXTRAORDINARYITEMS Particulars Amount Loss on account of fire XXX Loss on clamaties like earthquake,floods XXX Speculation loss or gain XXX Salaries or wages paid for previous period due to agreement with retrospective effect XXX FORM OF THE BALANCESHEET Particulars Note no Amount I.EQUITY AND LIABILITIES ( I ) sharesholders funds: Share capital Reserves & surplus Money received against sharewarrants (ii) Non Current liabilities: Long term borrowings Deferred tax labilities Other long term liabilities Long term provisions (iii) Current liabilities: Short term borrowings Trade payables Other current liabilities Short term provisions TOTAL 1 2 3 4 5 6 7 8 9 10 11 II.ASSETS (i) Non current assets: (a) Fixed assets: Tangible assets Intangible assets 12 13

- 5. Capital work in progress Intangible assets under development (b)Non current investments (c)Deferred tax assets(net) (d)Long term loans and advances (e) Other non current assets (ii) Current assets Current investment Inventories Trade receivables Cash and cash euivalents Short term loans and advances Othr current assets TOTAL 14 15 16 17 18 19 20 21 22 23 24 25 Notes to accounts Share capital Authorised capital XXX Issued capital Subscribed capital and paid up capital Less: calls in arrear Add: forfeited shares Reserves and surplus PARTICULARS AMT AMT General reserve (op) Add: Addition during the year XXXX XXXX XXXXX

- 6. SECURITIES PREMIUM LESS: Premium on redemption of pref shares XXXX Xxx xxxx Capital redemption reserve Xxxx Capital reserve Xxxxx Debenture redemption reserve Xxxxx Surplus i.e balance in statement of profit and loss Add: Profit for the year XXX Xxxx xxxx Less: Appropriations: Transfer to general reserve Final dividend Interim dividend Proposed dividend Corporate dividend tax@17% on interim dividend and proposed dividend Xxxx Xxx Xxx Xxxx xxxx (c) Money received against share warrants: Share warrants are the financial instruments which give the holder right to acquire equity shares. These are financial instruments which will be converted into equity shares at a later date at a predetermined price. Since these will be converted into equity shares, these are classified as shareholders' funds. II .Non-current liabilities Long term borrowings: Amount taken as loan by company is termed as borrowings. The borrowings are considered long term when the loan is repayable by the company after 12 months from the date of balance sheet or after the operating cycle period from the date of loan. Debentures, Bonds, Term loans from banks and other parties, Public deposits and other loans and advances are categorized as long term borrowings. These items are shown in the Notes to Accounts on Long term borrowings. Debentures bonds Term loan Public deposit Other loans and advances 5. Deferred tax liability Accounting income

- 7. Taxable income Income tax on the difference is termed as deferred tax 6. Other long term liability Premium payable on redemption on debentures/ pref shares 7. Long term provisions Provision on retirement benefits payable to employees who will retire after 12 months of the date of balance sheet Provision for warranty claims that relates to the period after 12 months of the date of the B/s 8. Short term borrowings Bank overdraft Cash credit Deposits Loan from other parties 9. Trade payables Sundry creditors Trade creditors Bills payable 10. Other current liabilities Outstanding expense Unpaid dividend Income received in advance Calls in advance Providend fund payable ESI payable VAT payable Central sales tax payable 11. Short term provision

- 8. Provision for tax Proposed dividend Provision for employee benefit Provision for expenses Asstes 12. Tangible asset Land and building Plant and machinery Vehicles Office euipments Furniture 13. Intangible asset Goodwill Brand/trademarks Computer software Mining rights copyrights Patents Formulae License ,franchise 14. Capital work in progress It means tangible asstes under construction 15. Intangible assets under development: It means intangible asstes like patents,intellectual rights 16.Non current investment Investment in property Invt in equity instruments Invt in pref shares Invt in govt or trust securities Invt in debentures or bonds Invt in mutual fund Invt in partnership firms

- 9. Managerial remuneration The companies act lays down a number of restrictions on managerial remuneration payable by a public company or a private company which is a subsidiary of a public company. The term managerial remuneration includes remuneration payable to the: a) managing director b) manager c) part time directors and d) whole time directors

- 10. The following statement showing the maximum remuneration payable to the different categories of managerial personnel: S.NO MANAGERIAL PERSONNEL MAXIMUM % ON NET PROFITS a Maximum remuneration to all the managerial personnel 11% b manager 5% c managing director or whole time director 5% d managing director or whole time director when there is more than one 10% e part time directors when the company is not having managing director, whole time director or manager 3% f part time directors when assisted by a managing director, whole time director or manager 1% Calculation of Managerial Remuneration Format for statement ofprofit for the purpose ofmanagerial remuneration PARTICULARS AMOUNT AMOUNT NET PROFITS(GIVEN) xxx Add: capital expenditure xxxx special depreciation xxxx Provision for income tax/taxation xxxx ex - gratia payment to employee xxxx XXX XXX Less: Capital profit on sale of asset xxxx profit on sale of investment xxxx XXX Net profit for managerial remuneration XXX 1. From the following particular, determine the maximum remuneration available to a full time director of a manufacturing company. The profit and loss account of the company showed a net profit of Rs.40,00,000 after taking into account the following items: a) Depreciation (incluing special depn of rs.40,000) rs.1,00,000

- 11. b) Provision for income tax rs.2,00,000 c) Donation to political parties rs.50,000 d) Ex – gratia payment to a worker Rs.10,000 e) Capital profit on sale of asstes rs.15,000 solution: Format for statement ofprofit for the purpose ofmanagerial remuneration PARTICULARS AMOUNT AMOUNT NET PROFITS(GIVEN) 40,00,000 Add: capital expenditure - special depreciation 40,000 Provision for income tax/taxation 2,00,000 ex - gratia payment to employee 10,000 2,50,000 42,50,000 Less: Capital profit on sale of asset 15,000 profit on sale of investment - 15,000 Net profit for managerial remuneration 42,35,000 Managing Director Or Whole Time Director 5% is permitted by law = 42,35,000x 5/100 = Rs.2,11,750 Comprehensive problem 1.Moon and Star Co. Ltd. Is a company with an authorized capital of 5,00,000 divided into 5,000 equity shares of Rs.100 each on 31.12.2013 of which 2,500 shares were fully called up. The following are the balances extracted from the ledger as on 31.12.2013 Trial balance of Moon & Star Co. Ltd Debit Rs. Credit Rs. Opening stock(P&L) 50,000 Sales (P&L) 3,25,000

- 12. Purchases ( P&L) 2,00,000 Discount received (P&L) 3150 Wages (P&L) 70,000 Profit & Loss A/c (B/s) 6220 Discount allowed (P&L) 4,200 Creditors(B/s) 35,200 Insurance(upto Reserves(B/s) 25,000 31.3.14) (P&L) 6,720 Loan from managing director (B/s) 15,700 Salaries (P&L) 18,500 Share capital (B/s) 2,50,000 Rent (P&L) 6,000 General expenses(P&L) 8,950 Printing (P&L) 2,400 Advertisements(P&L) 3,800 Bonus (P&L) 10,500 Debtors (B/s) 38,700 Plant (B/s) 1,80,500 Furniture(B/s) 17,100 Bank (B/s) 34,700 Bad debts (P&L) 3,200 Calls-in-arrears (B/s) 5,000 6,60,270 6,60,270 You are required to prepare Profit & Loss Account for the year ended 31.12.2013 and a balance sheet as on that date. The following further information is given: (a) Closing stockwas valued at Rs.1,91,500 (b)Depreciation on plant at 15% and on furniture at 10% should be provided (c)A tax provision of Rs. 8,000 is considered necessary (d)The directors declared an interim dividend on 15.8.13 for 6 months ending June 30, 2013@ 6%.

- 13. (e) provide corporatedividend tax @17%. SOLUTION: Statement of Profit and Loss ACCOUNT OF MOON AND STAR LTD Particulars Note no Amount Revenue from operation 1 3,25,000 other income 2 3,150 TOTAL REVENUE (A) 3,28,150 EXPENSES: Costof material consumed 3 58,500 Purchase of stock- in – trade NIL Changes in inventories of finished goods/wip/stockin trade NIL Employee benefits expenses 99,000 Finance cost 4 NIL Depreciation and amortisation expenses 5 28,785 Other expenses 6 33,590 TOTAL EXPENSES (B) 7 2,19,875 Profit before extraordinary items and tax (A-B) 1,08,275 Less: Extraordinary items NIL Tax 8,000 Profit or loss for the period 1,00,275 Balance sheet of moon and star Ltd as on 31.12.2013 Particulars Note no Amount I.EQUITY AND

- 14. LIABILITIES ( I ) shareholder’s funds: Share capital 1 2,45,000 Reserves & surplus 2 1,14,296 Money received against share warrants 3 (ii) Non-Current liabilities: Long term borrowings 4 15,700 Deferred tax liabilities 5 Other long term liabilities 6 Long term provisions 7 (iii) Current liabilities: Short term borrowings 8 Trade payables 9 35,200 Other current liabilities 10 17,199 Short term provisions 11 18,000 TOTAL 4,35,395 II.ASSETS (i) Non - current assets: (a) Fixed assets: Tangible assets 12 1,68,815 Intangible assets 13 Capital work in progress 14 Intangible assets under development 15 (b)Non-current investments 16 (c) Deferred tax assets(net) 17 (d)Long term loans and advances 18 (e) Other non-current assets 19 (ii) Current assets Current investment 20 Inventories (closing stock) 21 1,91,500 Trade receivables 22 38,700

- 15. Cash and cash euivalents(bank) 23 34,700 Short term loans and advances 24 1,680 Othr current assets 25 TOTAL 4,35,395 NOTES TO ACCOUNT REVENUE FROM OPERATION: Particulars Amount Gross profit/Sales – manufacturing/trading company 3,25,000 OTHER INCOME Particulars Amount Discount received 3,150 COST OF MATERIAL CONSUMED Particulars Amount Opening stockof raw materials 50,000 Add: purchase 2,00,000 2,50,000 Less: purchase return - Less: Closing stockof raw materials 1,91,500 58,500.00 EMPLOYEE BENEFITSEXPENSES Particulars Amount Wages 70,000 Salaries 18,500 Bonus 10,500

- 16. 99,000 DEPRECIATIONAND AMORTISATION EXPENSES Particulars Amount Depreciation on plant 15% on 180500 27,075 Furniture 10% on 17,100 1,710 28,785 OTHER EXPENSES Particulars Amount Discount allowed 4,200 Insurance less: Prepaid(6720x3/12) 6720 1,680 5,040 printing 2400 General expenses 8950 Rent 6,000 Advirtising 3800 bad debts 3200 33,590 Notes to account to balance sheet Share capital Authorised capital 5,000 eq shares of Rs.100 each 5,00,000 Issued capital,Subscribed capital up: 2,500 shares of Rs.100 each Less: calls in arrears 2,50,000 5,000

- 17. Paid up capital 2,45,000 Reserves and surplus PARTICULARS AMT AMT General reserve (op) 25,000 Add: Addition during the year - 25,000 Surplus i.e balance in statement of profit and loss 6,220 Add: Profit for the year 1,00,275 1,06,495 Less: Appropriations: Interim dividend (2,45,000x6%) 14,700 Corporate dividend tax@17% (14700x17%) 2,499 89,296 1,14,296 Long term borrowings Unsecured loan Loan from managing director 15,700 Trade payables Sundry creditors 35200 Short term provision Provision for tax 8,000 Other current liabilities Interim dividend payable 14,700 Dividend tax payable 2,499 Tangible assets Plant 1,80,500 1,53,425

- 18. Less: Depreciation 15% 27,075 Furniture 17,100 Less: Depreciation 10% 1,710 15390 1,68,815 Trade receivables: Debtors 38,700 Short term loans and advances Prepaid insurance 1,680 ANSWER: Rs. Gross profit c/d Net profit c/d Interim dividend Corporate dividend tax at 10% Balance carried forward to Balance sheet Balance sheet total 1,96,500 1,00,275 14,700 1,470 90,325 4,35,395 1.Amount realized from sale of goods is shown in the statement of profit and loss as Other income

- 19. Revenue from operation Any of the above None of the above 2. Gain on sale of fixed assets is shown in the statement of profit and loss as Other income Revenue from operation Any of the above None of the above 3. Dividend received by a financial company is shown in the statement of profit and loss as Other income Revenue from operation Any of the above None of the above 4. Raw materials purchased is shown in the statement of profit and loss Costof material consumed Purchase of stockin trade Changes in inventories None of these 5. Goodspurchased for reselling is shown in the statement of profit and loss as Costof material consumed Purchase of stock in trade Changes in inventories None of these 6. Payment of wages and salaries is shown in the statement of profit and loss under

- 20. Employee benefit expenses Other expenses Finance cost None of these 7. Payment of interest on debenture and bank overdraft is shown in statement of profit and loss under Employee benefit expenses Other expenses Finance cost None of these 8. Carriage outwards is shown in statement of profit and loss under Employee benefit expenses Other expenses Finance cost Depreciation and amortization expenses 9. Preliminary expenses written off is shown in statement of profit and loss under Employee benefit expenses Other expenses Finance cost Depreciationand amortization expenses 10. Which one of the following assets could be described as a current asset? Machinery to manufacture goods forresale Stock of goods forresale Buildings to house the machinery Land on which the buildings stand

- 21. 11. Retained Earnings is classified as which type of account? Asset Liability Expense Stockholders'equity 12. Wages is an example of? Capital expenses Indirect expenses Directexpenses All of before 13. Profit and loss account would not include? Salaries Drawings Rent received Carriage outwards 14. Current liabilities are those obligations which are to be satisfied within? 6 months 1 year 2 year Both A & B 15. All of the following are property, plant, and equipment except? Machinery Supplies Land Buildings 16. Debentures redeemable after 10 years of issue are shown as

- 22. Long term borrowings Short term borrowings Other current liabilities None of these 17. Bank overdraft is shown in the balance sheet of a company as Long term borrowings Short term borrowings Other current liabilities None of these 18. Dividend is paid on Authorized capital Issued capital Called up capital Paid up capital 19. Securities is shown in the balance sheet of a company as Share capital Reserves andsurplus Long term borrowings None of these 20. The assets that can be easily converted into cashwithin a short period, i.e., 1 year or less are known as Current assets Fixed assets Intangible assets Investments 21. Copyrights, Patents and Trademarks are, Current assets

- 23. Fixed assets Intangible assets Investments 22. In order to find out the value of the closing stockduring the end of the financial year we, do this by stocktaking deductthe costof goods sold from sales deductopening stockfrom the costof goods sold look in the stock account 23. Opening stock+ …………………+ Direct Expenses (Carriage on Raw material)-Closing Stock = ………………… Sales, Purchases Sales, Sales return Purchases, Costof goods produced Purchases, Costofgoods sold 24. What is deferred tax liability? Difference betweenaccounting income and taxable income 25. Maximum remuneration to all the managerial personnel 11% 5% 3% 1% 26. Maximum remuneration payable to the manager and managing director or whole time director 11% 5% 3% 1% 27. Maximum remuneration payable to the managing director or whole time director when there is more than one

- 24. 11% 10% 3% 1% 28. Maximum remuneration payable to the part time directors when the company is not having managing director, whole time director or manager 11% 10% 3% 1% 29. Maximum remuneration payable to the part time directors when assisted by a managing director, whole time director or manager 11% 10% 3% 1%

- 27. COMPANYFINAL ACCOUNTS The following balances have been extracted from the books of Rama Ltd., on 31st March 2018. Equity share capital (1,00,000 shares of ` 10 each) ` 10,00,000; Securities premium ` 2,00,000; Debentures ` 5,00,000; Creditors ` 2,00,000; Proposed dividend ` 50,000; Land and Building ` 9,00,000; Government Bonds ` 5,00,000; Capital Work-in-Progress (Buildings) ` 3,50,000 and Discount on issue of 12% Debentures ` 1,00,000; Cash at Bank ` 50,000; Furniture ` 60,000; Debtors ` 20,000. Debentures were issued on 1st April 2017 redeemable after 5 years, on 31st March 2021. Surplus, i.e., Balance in statement of profit and loss is before writing off Discount on issue of Debentures. Prepare the balance sheet of a company as per revised schedule VI. Give the format of statement of profit and loss as per Revised schedule VI. 2. A Ltd was registered with an authorized capital of Rs. 6,00,000 in equity shares of Rs 10 each. The following is its Trail Balance on 31 st March 2018 Trial Balance of ‘A’ Ltd Debit Balance Rs. Credit Balance Rs. Goodwill Cash Bank Purchase Preliminary Expenses Share capital 25,000 750 39,900 1,85,000 5,000 - - - - - - 4,00,000

- 28. 12 % debentures P&L A/c(Cr) Calls-in-arrears Premises Plant & Machinery Interim dividend Sales Stocks Furniture & fixtures Sundry debtors Wages General expenses Freight and carriage Salaries Director’s fees Bad debts Debenture interest paid Bill payable Sundry creditors General reserve Provision for bad debts - - 7,500 3,00,000 3,30,000 39,250 - 75,000 7,200 87,000 84,865 6,835 13,115 14,500 5,725 2,110 18,000 - - - - 12,46,750 3,00,000 26,250 - - - - 4,15,000 - - - - - - - - - - 37,000 40,000 25,000 3,500 12,46,750 Prepare Profit & Loss Account, Profit & Loss Appropriation A/c and Balance Sheet in proper form after making the following adjustments: (i)Depreciate plant and machinery by 15% (ii) Write off Rs.500 from preliminary expense (iii)Provide for 6 months interest on debentures (iv) Leave bad and doubtful debts provision at 5% on sundry debtors (v) Provide for income tax at 50% (iv) Stock on 31.3.2018 was Rs. 95,000. (vi) Provide for corporate dividend tax @10% ANSWER: Gross profit c/d 1,52,000 Provision for income tax 18,000 Net profit c/d 18,000 Interim dividend 39,250 Assume corporate dividend tax 3925 Balance carried forward to Balance sheet 1,075 Balance sheet total 8,35,500 Moon and Star Co. Ltd. Is a company with an authorized capital of 5,00,000 divided into 5,000 equity shares of Rs.100 each on 31.12.2003 of which 2,500 shares were

- 29. fully called up. The following are the balances extracted from the ledger as on 31.12.2003 Trial balance of Moon & Star Co. Ltd Debit Rs. Credit Rs. Opening stock Purchases Wages Discount allowed Insurance(upto 31.3.04) Salaries Rent General expenses Printing Advertisements Bonus Debtors Plant Furniture Bank Bad debts Calls-in-arrears 50,000 2,00,000 70,000 4,200 6,720 18,500 6,000 8,950 2,400 3,800 10,500 38,700 1,80,500 17,100 34,700 3,200 5,000 6,60,270 Sales Discount received Profit & Loss A/c Creditors Reserves Loan from managing director Share capital 3,25,000 3150 6220 35,200 25,000 15,700 2,50,000 6,60,270 You are required to prepare Profit & Loss Account for the year ended 31.12.2003 and a balance sheet as on that date. The following further information is given: (f) Closing stock was valued at Rs.1,91,500 (g) Depreciation on plant at 15% and on furniture at 10% should be provided (h) A tax provision of Rs. 8,000 is considered necessary (i) The directors declared an interim dividend on 15.8.03 for 6 months ending June 30, 2003@ 6%.Assume corporate dividend tax @10%. ANSWER: Rs. Gross profit c/d Net profit c/d Interim dividend Corporate dividend tax at 10% Balance carried forward to Balance sheet Balance sheet total 1,96,500 1,00,275 14,700 1,470 90,325 4,35,395