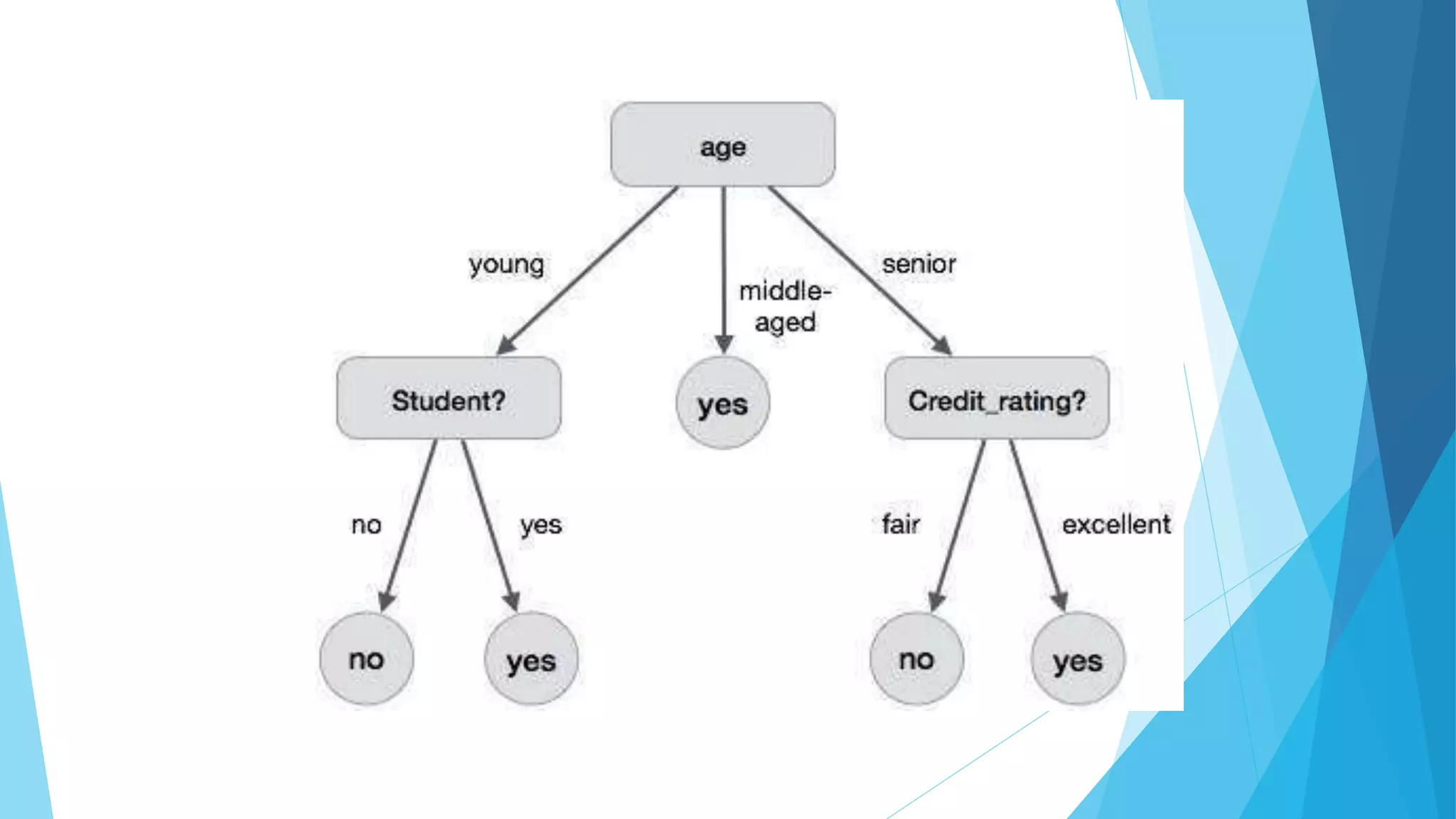

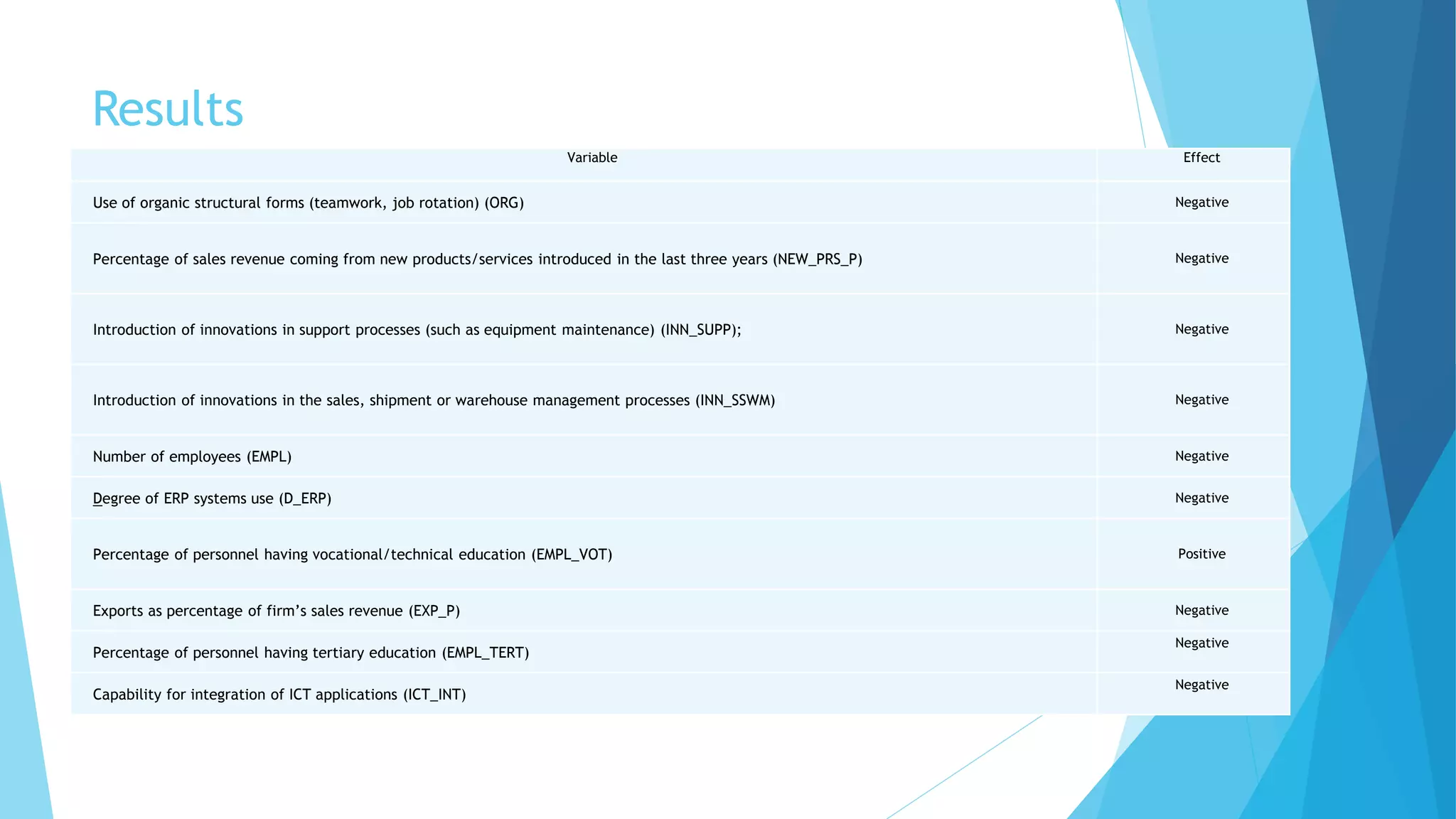

The document discusses the integration of artificial intelligence (AI) and policy analytics in public sector decision-making, particularly to address economic crises. It presents a methodology that leverages existing data from taxation and statistical agencies to identify firm characteristics that influence resilience to economic downturns. A practical application of this methodology on Greek firms during the 2009-2014 economic crisis illustrates its potential impact on policy design.