QNBFS Daily Market Report May 08, 2016

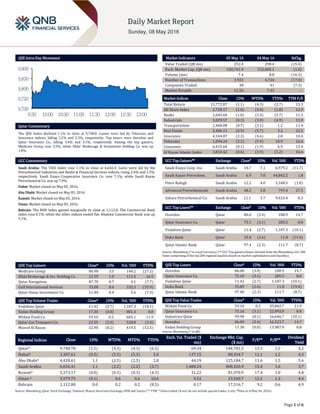

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.1% to close at 9,748.8. Losses were led by Telecoms and Insurance indices, falling 3.2% and 2.3%, respectively. Top losers were Ooredoo and Qatar Insurance Co., falling 3.4% and 3.1%, respectively. Among the top gainers, Medicare Group rose 3.5%, while Dlala' Brokerage & Investment Holding Co. was up 1.0%. GCC Commentary Saudi Arabia: The TASI Index rose 1.1% to close at 6,656.4. Gains were led by the Petrochemical Industries and Banks & Financial Services indices, rising 2.4% and 1.3%, respectively. Saudi Enaya Cooperative Insurance Co. rose 7.1%, while Saudi Kayan Petrochemical Co. was up 7.0%. Dubai: Market closed on May 05, 2016. Abu Dhabi: Market closed on May 05, 2016. Kuwait: Market closed on May 05, 2016. Oman: Market closed on May 05, 2016. Bahrain: The BHB Index gained marginally to close at 1,112.8. The Commercial Bank index rose 0.1%, while the other indices ended flat. Khaleeji Commercial Bank was up 5.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 86.90 3.5 144.2 (27.2) Dlala Brokerage & Inv. Holding Co. 21.55 1.0 111.5 16.5 Qatar Navigation 87.70 0.7 4.1 (7.7) Gulf International Services 33.00 0.6 332.3 (35.9) Qatar Oman Investment Co. 11.40 0.4 5.6 (7.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 11.42 (2.7) 1,187.3 (10.1) Ezdan Holding Group 17.30 (0.8) 801.4 8.8 Widam Food Co. 59.10 0.2 605.1 11.9 Qatar Gas Transport Co. 22.55 (2.0) 528.8 (3.4) Masraf Al Rayan 32.90 (0.2) 419.5 (12.5) Market Indicators 05 May 16 04 May 16 %Chg. Value Traded (QR mn) 252.4 298.4 (15.4) Exch. Market Cap. (QR mn) 526,761.9 532,085.1 (1.0) Volume (mn) 7.4 8.8 (16.3) Number of Transactions 3,923 4,726 (17.0) Companies Traded 38 41 (7.3) Market Breadth 11:26 7:33 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,772.87 (1.1) (4.3) (2.7) 13.3 All Share Index 2,728.17 (1.0) (4.0) (1.8) 12.9 Banks 2,645.60 (1.0) (3.4) (5.7) 11.2 Industrials 3,029.57 (0.3) (3.9) (4.9) 13.9 Transportation 2,460.08 (0.7) (3.1) 1.2 11.4 Real Estate 2,406.13 (0.9) (5.7) 3.2 22.2 Insurance 4,144.87 (2.3) (4.6) 2.8 10.4 Telecoms 1,094.24 (3.2) (5.9) 10.9 16.6 Consumer 6,415.66 (0.1) (1.9) 6.9 13.4 Al Rayan Islamic Index 3,810.42 (0.6) (3.9) (1.2) 16.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Enaya Coop. Ins. Saudi Arabia 14.7 7.1 6,979.2 (11.7) Saudi Kayan Petrochem. Saudi Arabia 6.9 7.0 44,842.2 1.8 Petro Rabigh Saudi Arabia 12.2 4.0 3,348.5 (1.0) Advanced Petrochemicals Saudi Arabia 48.2 3.8 797.4 27.5 Sahara Petrochemical Co. Saudi Arabia 11.1 3.7 9,423.4 8.3 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ooredoo Qatar 86.0 (3.4) 188.9 14.7 Qatar Insurance Co. Qatar 75.1 (3.1) 285.5 8.0 Vodafone Qatar Qatar 11.4 (2.7) 1,187.3 (10.1) Doha Bank Qatar 35.8 (2.6) 11.8 (19.4) Qatar Islamic Bank Qatar 97.4 (2.3) 111.7 (8.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ooredoo 86.00 (3.4) 188.9 14.7 Qatar Insurance Co. 75.10 (3.1) 285.5 8.0 Vodafone Qatar 11.42 (2.7) 1,187.3 (10.1) Doha Bank 35.85 (2.6) 11.8 (19.4) Qatar Islamic Bank 97.40 (2.3) 111.7 (8.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Widam Food Co. 59.10 0.2 35,842.7 11.9 Qatar Insurance Co. 75.10 (3.1) 22,092.0 8.0 Industries Qatar 99.90 (0.1) 16,646.7 (10.1) Ooredoo 86.00 (3.4) 16,523.7 14.7 Ezdan Holding Group 17.30 (0.8) 13,987.8 8.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,748.78 (1.1) (4.3) (4.3) (6.5) 69.34 144,701.5 13.3 1.5 4.2 Dubai# 3,307.61 (0.5) (5.3) (5.3) 5.0 137.15 88,324.7 11.1 1.2 4.3 Abu Dhabi# 4,428.61 1.1 (2.5) (2.5) 2.8 44.19 125,184.7 11.6 1.5 5.6 Saudi Arabia 6,656.41 1.1 (2.2) (2.2) (3.7) 1,488.24 408,426.9 15.4 1.6 3.7 Kuwait# 5,373.17 (0.0) (0.3) (0.3) (4.3) 31.22 81,970.9 17.4 1.0 4.8 Oman # 5,979.75 (0.1) 0.6 0.6 10.6 9.52 23,560.7 12.2 1.3 4.4 Bahrain 1,112.80 0.0 0.2 0.2 (8.5) 0.17 17,516.7 9.2 0.6 4.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, DFM and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; #Data as of May 04, 2016) 9,700 9,750 9,800 9,850 9,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 1.1% to close at 9,748.8. The Telecoms and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Ooredoo and Qatar Insurance Co. were the top losers, falling 3.4% and 3.1%, respectively. Among the top gainers, Medicare Group rose 3.5%, while Dlala' Brokerage & Investment Holding Co. was up 1.0%. Volume of shares traded on Thursday fell by 16.3% to 7.4mn from 8.8mn on Wednesday. Further, as compared to the 30-day moving average of 9.5mn, volume for the day was 21.8% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 16.1% and 10.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Qatar International Islamic Bank (QIIK) Moody’s Qatar IR A2 A2 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, IR – Issuer Rating) Earnings Releases Company Market Currency Revenue (mn) 1Q2016 % Change YoY Operating Profit (mn) 1Q2016 % Change YoY Net Profit (mn) 1Q2016 % Change YoY Bahrain Tourism Co. Bahrain BHD 1.8 5.7% – – 0.8 20.8% Takaful International Co. Bahrain BHD – – – – 0.1 -38.8% Bahrain Telecommunication Co. Bahrain BHD 90.9 -3.0% – – 9.6 -32.4% Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/05 US Department of Labor Initial Jobless Claims 30-April 274k 260k 257k 05/05 US Department of Labor Continuing Claims 23-April 2,121k 2,128k 2,129k 05/06 US Bureau of Labor Statistics Change in Nonfarm Payrolls April 160k 200k 208k 05/06 US Bureau of Labor Statistics Change in Private Payrolls April 171k 195k 184k 05/06 US Bureau of Labor Statistics Change in Manufact. Payrolls April 4k -5k -29k 05/06 EU Markit Markit Eurozone Retail PMI April 47.9 – 49.2 05/06 France Markit Markit France Retail PMI April 48.2 – 45.5 05/06 Germany Markit Markit Germany Construction PMI April 53.4 – 55.8 05/06 Germany Markit Markit Germany Retail PMI April 51.0 – 54.1 05/05 UK Markit Markit/CIPS UK Services PMI April 52.3 53.5 53.7 05/05 UK Markit Markit/CIPS UK Composite PMI April 51.9 53.2 53.6 05/05 China Caixin Caixin China PMI Services April 51.8 – 52.2 05/05 China Caixin Caixin China PMI Composite April 50.8 – 51.3 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting results No. of days remaining Status VFQS Vodafone Qatar 17-May-16 9 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 42.85% 46.74% (9,823,663.79) Qatari Institutions 24.89% 30.22% (13,466,216.39) Qatari 67.74% 76.96% (23,289,880.18) GCC Individuals 0.69% 0.51% 443,470.51 GCC Institutions 0.95% 0.87% 201,577.11 GCC 1.64% 1.38% 645,047.62 Non-Qatari Individuals 12.08% 10.08% 5,046,173.21 Non-Qatari Institutions 18.55% 11.58% 17,598,659.35 Non-Qatari 30.63% 21.66% 22,644,832.56

- 3. Page 3 of 6 News Qatar MERS terminates process of negotiation with Spinneys owners – Al Meera Consumer Goods Company (MERS) has decided to terminate the process of negotiation with Spinneys owners. (QSE) GHC signs contract with Saudi Aramco to maintain fleet of AW 139 helicopters – Gulf International Services (GISS) has announced that its subsidiary Gulf Helicopters Company (GHC) has signed a new contract with Saudi Aramco to perform heavy maintenance on its fleet of Agusta Westland (AW) 139 helicopters. GHC has so far undertaken over fifteen 4-year inspections on AW 139s and amassed a wealth of know-how and capabilities to carry out heavy inspections on the type. The Company’s maintenance capabilities also extend to the other types of helicopters operated, like AW 189, S 92, Bell 412, Bell 212, Bell 206 L3, and MD 902. (QSE) Moody’s affirms QIIK rating at ‘A2’ with a ‘stable’ outlook – Qatar International Islamic Bank (QIIK) has announced that leading international credit rating agency Moody’s has affirmed the bank’s rating at ‘A2’ with a ‘stable’ outlook. Moody’s affirmation comes shortly after Fitch’s affirmation of the bank’s rating at ‘A+’ with a ‘stable’ outlook and Capital Intelligence’s affirmation of the QIIB rating at ‘A-’ with a ‘positive’ outlook. QIIK said Moody’s action was based on “many considerations”, including the fact that the bank was among the oldest Islamic banks in Qatar and that it provides “distinguished” services, particularly in retail banking. The bank also maintains “good” liquidity position, “high quality” assets that exceed $11bn as well as a “strong capital and profitability”. Moody’s also highlighted the bank’s high-quality financing portfolio. It said QIIK’s bad debt ratio remained within the limit set for such non-performing debts within Qatar’s banking system and lower than the globally prevailing and prescribed ratios among banks within the same category. Moreover, Moody’s noted that the government support, when necessary, can help improve the rating, along with Qatar’s strong economy and the ongoing major infrastructure projects that support the economic growth in general. (Gulf-Times.com) QSE suspends trading of NLCS shares on May 08 – The Qatar Stock Exchange (QSE) suspended trading of National Leasing (NLCS) shares on May 08, 2016 due to its EGM being held on that day. (QSE) UAE-Qatar joint investment to rise – Federation of the UAE Chambers of Commerce and Industry Chairman & Abu Dhabi Chamber of Commerce and Industry Chairman Mohammed Thani Murshid Al Rumaithi has said that the bilateral trade between Qatar and the UAE will increase further in coming years due to the positive steps taken by both governments. Speaking on the occasion of the 2nd UAE-Qatar Business Forum 2016, which was held in Doha, Qatar, he said fraternal and historic ties between the UAE and Qatar are growing stronger due to the common denominators that organize the distinguished bilateral relations, thanks to the wise leadership of President His Highness Sheikh Khalifa Bin Zayed Al Nahyan and His Highness Sheikh Tamim Bin Hamad Al Thani, Emir of the State of Qatar, which made ties a lively role model in cooperation and in the economic integration field as part of the umbrella of the Cooperation Council for the Arab States of the Gulf. The trade exchange between the UAE and Qatar has amounted to QR26bn or $7bn in 2015. (GulfBase.com) Qatar may see sustained 3.6% average growth in 2016-2018 – According to the MENA (Middle East and North Africa) Economic Monitor Report - Spring 2016, Qatar may see a sustained 3.6% average growth during 2016-18 mainly powered by non- hydrocarbon sectors, even as its key medium-term risk is the persisting low global oil & gas prices as well as intensifying competition in the gas market. The report, which supplements the World Bank’s bi-annual MENA quarterly economic brief, stated the outlook for Qatar economic growth remains moderate, despite the slowdown in the hydrocarbon sector. The hydrocarbon sector has been going through stagnating production since 2012 (largely due to the self-imposed moratorium on additional production from the North Field), and from plummeting oil & gas prices since mid- 2014. However, non-hydrocarbon growth may be slower than in previous years due to a reduction in manufacturing growth as the push from the expansion of the fertilizers and petrochemicals sectors fades. Services (real estate, transport, communications, and business services) are projected to contribute the bulk of GDP growth over the forecast period, although these sectors would grow at a slower rate than in the past as population growth decelerates and fiscal spending is reined in. (Gulf-Times.com) Qatar could host Summer Olympics – The Head of world athletics, Sebastian Coe, refused to rule out the summer Olympics being held in Qatar. Coe said athletics aspired to being a global sport. He stated “We have consistently turned up to conferences to talk about globalization and using sport to impact and imprint on the lives of young people.” (Peninsula Qatar) 42% in Qatar read news online as smartphone penetration rises – According to a six-nation survey conducted by Northwestern University in Qatar (NU-Q), in partnership with Doha Film Institute (DFI), there are more people in Qatar, who get their news online than some countries in the Middle East. Qatar leads in reading news online daily (42%), followed by Saudi Arabia (39%). Daily newspaper readership in Qatar is 32% and 25% in the UAE. While internet penetration levels are up in the region, internet and smartphone penetration are significantly higher in the GCC than in other countries included in the survey. The UAE has the highest rate of internet penetration with most nationals saying they are being connected to the internet in 2016. Closely following are Qatar and Saudi Arabia, both at 93% internet penetration, followed by Lebanon (84%). (Peninsula Qatar) Energy rating for ACs soon – Starting July 2016, the General Electricity and Water Corporation (Kahramaa) will implement the Energy Star rating system to enhance power efficiency of air conditioners (ACs) in Qatar. The measure will be introduced as part of Kahramaa’s National Program for Conservation and Energy Efficiency (Tarsheed), in cooperation with the Ministry of Municipality and Environment. Energy Star is an international standard for energy-efficient consumer products originated in the US. It was created in 1992 by the Environmental Protection Agency and the Department of Energy. Since then, many Western countries have adopted the program. Devices carrying the Energy Star service mark generally use 20-30% less energy than required by federal standards. (Gulf-Times.com) Ministry issues 1,351 commercial registrations – The commercial registration and licenses department at the Ministry of Economy and Commerce (MEC) issued some 1,351 new commercial registrations last month. One-person companies topped the registrations with 494 licenses (53% of the total number issued), followed by companies with limited liability with 379 (41%), and solidarity companies with 56 (6%). The most commercial registrations in April were for contracting companies (27%), followed by building materials trade (12%), detergents (9%), eateries, fast foods, and vegetables and fruits (7%), groceries (5%), other companies and activities stood at 40%. Some 50% of the new registrations were issued for Al Rayyan Area, followed by Doha (38%), Wakrah (5%), and Umm Salal (4%). (Gulf- Times.com) MoI opens service office at SC headquarters – The Ministry of Interior (MoI) has opened a service office at the headquarters of

- 4. Page 4 of 6 the Supreme Committee for Delivery and Legacy (SC) to serve customers and facilitate their relevant transactions and procedures at the ministry. The services to be provided by the office include all services available at other service centers such as expatriates affairs services, criminal evidence and information service, traffic department services, and other services. Director of the Unified Services Department at Ministry of Interior Brig. Abdullah Ahmad al Ansari said this office will provide MoI’s services for employees and visitors to the office of the SC. (Qatar Tribune) ‘Doha Sooq’ to launch Qatar’s first online supermarket – Doha Bank’s award-winning e-commerce portal ‘Doha Sooq’ has partnered with leading supermarket chain Grand Mart to launch the first online supermarket in Qatar with free delivery facility. The move will see Grand Mart offer groceries and a wide variety of consumer products via Doha Sooq, providing customers across the country the opportunity to make everyday purchases from the convenience of their home and have them delivered right at their doorstep. (Peninsula Qatar) International US jobless claims rise; planned layoffs surge – The number of Americans filing for unemployment benefits rose more than expected last week, posting the biggest gain in more than a year, but the underlying trend continued to point to a strengthening labor market. Another report showed a 35% surge in planned layoffs by US-based employers last month. Most of the announced job cuts were concentrated in the energy sector, which is reeling from low oil prices that have hurt profits. The Labor Department said initial claims for state unemployment benefits increased 17,000 to a seasonally adjusted 274,000 for the week ended April30. Last week's increase was the largest since February of last year. (Reuters) Obama: New tax rule will fight corruption, help economy – The US President Barack Obama said a long-delayed rule requiring the financial industry to identify the real owners of companies will help fight corruption and tax evasion and boost the economy. His administration issued the Customer Due Diligence rule in the works since 2012 and proposed legislation meant to stop prevent criminals from using shell companies to evade taxes, launder money and finance terror. (Reuters) China central bank pledges policy fine-tuning, yuan flexibility – China's central bank said that it will fine tune policy in a pre- emptive and timely way, as the economy still faces downward pressure despite signs of steadying. The People's Bank of China, in its first-quarter monetary policy implementation report, said it will stick to its long-standing prudent stance and keep the yuan currency basically stable. The central bank said it would create "an appropriate monetary and financial environment for structural adjustments, transformation and upgrading", and take measures to ward off systemic financial risks. The central bank said downward pressure still exists on China's economy due to weak global economy and domestic structural adjustments, adding that it would closely watch changes in consumer prices. The central bank also pledged to let the market play a bigger role in determining the yuan exchange rate and improve the currency's two-way flexibility. Meanwhile, the International Monetary Fund's (IMF) deputy division Chief of Asia department, Roberto Guimaraes, said it could be time for China to tighten monetary policy rather than ease it further to avoid the risk of overheating in parts of the giant economy. He said that further Chinese interest rate cuts and stimulus could increase the chance of unhealthy debt growth (Reuters) China exports fall 1.8% in April, missing forecasts – According to the customs data, China's April exports disappointed analyst expectations, falling 1.8% YoY, while imports fell by 10.9%. The General Administration of Customs said that left the country with a trade surplus of $45.56bn for the month. Analysts polled by Reuters had expected exports to fall by 0.1%, and predicted imports would fall by 5.0%. (Reuters) India, Iran agree to clear $6.4bn in oil payments via European banks – India's Oil Minister Dharmendra Pradhan said the central banks of India and Iran have reached an arrangement to use European banks to process pending oil payments to Tehran, unlocking $6.4bn in stalled funds. Buyers of Iranian oil were prevented from using global banking channels to clear their transactions after sanctions were imposed on Iran in 2011 over its nuclear program. With the end of those sanctions in January, after an agreement to curb the program, Iran is finally gaining needed access to the funds. Iran hopes the money will revive its moribund economy and raise Iranian living standards as well as help to integrate the country into the global economic system. (Reuters) Brazil's inflation falls less than expected in April; plans inheritance tax to pay for exemptions – Government statistics agency IBGE said Brazil's 12-month inflation rate slowed less than expected in April as the government allowed medicine prices to rise, adding to signs that the central bank could wait longer before cutting interest rates to counter a deep recession. Consumer prices as measured by the benchmark IPCA index rose 9.28% in the 12 months through April, down from an increase of 9.39% in March but above forecasts for a 9.20% rate in a Reuters poll. Prices rose 0.61% in April from March, up from an increase of 0.43% in the previous month. Meanwhile, Embattled Brazilian President Dilma Rousseff submitted legislation to raise the tax on inheritance and donations in order to exempt more middle-class workers from income tax. The finance ministry said in a statement the bill would increase the income tax brackets by 5%, which would raise the take-home pay for more middle-class workers. The measure will cost the government 5bn reais in loss revenue per year, which the finance ministry said will be compensated by tax increases on inheritance, donations, image copyrights among other levies. (Reuters) Regional Saudi shake-up rolls on with big reshuffle of economic posts – Saudi Arabia's King Salman replaced his veteran Oil Minister and restructured some big Ministries in a major reshuffle apparently intended to support a wide-ranging economic reform program unveiled recently. The most eye-catching move was the creation of a new Energy, Industry and Natural Resources Ministry under Khaled al-Falih, Chairman of the state oil company Aramco. He replaces the 80-year-old Oil Minister Ali al-Naimi, in charge of energy policy at the world's biggest oil exporter since 1995. However, major changes were also made to the economic leadership, with Majed al-Qusaibi named head of the new Commerce and Investment Ministry, and Ahmed al-Kholifey made governor of the Saudi Arabian Monetary Agency (SAMA), the central bank. The changes, announced in a series of royal decrees, go far beyond Salman's previous reshuffles since he became King in January 2015, and also put the stamp of his son, Deputy Crown Prince Mohammed bin Salman, author of the Vision 2030 reform program, on the government. (Reuters) IATA: Mideast carriers see highest rise in passenger demand – According to the International Air Transport Association’s (IATA) latest report, Middle East carriers experienced a 12% YoY rise in international passenger demand in March 2016, which was the highest increase among regions. The association announced global passenger traffic results for March showing that demand (measured in revenue passenger kilometers, or RPKs) rose 5.3% on YoY basis. (Peninsula Qatar)

- 5. Page 5 of 6 GCC governments to raise $255bn-$390bn via bonds by 2020 – Mena market intelligence Marmore has said in its latest “GCC Sovereign Debt Forecast” Webinar that the GCC governments are expected to raise between $255bn and $390bn cumulatively through 2020 by issuance of local and international debts/bonds. A flurry of activity in fixed income space is expected to present investors with widespread opportunities in the region going forward. Persisting low oil prices has exerted tremendous pressure on government finances. The GCC countries between 2015 and 2016 are expected to post a fiscal deficit of $318bn. (Peninsula Qatar) Fitch: Saudi Bank resolution draft unlikely to change support – Fitch Ratings has said that Saudi Arabia’s Draft Law on the resolution of financial institutions, currently under review, is unlikely, at least in the foreseeable future, to change our view that there is an extremely high probability of the government supporting its banking system. The Saudi Arabian Monetary Agency (SAMA), which supervises the banks, has a strong tradition of supporting the banking sector and to date, no depositors or creditors of banks have lost money. The rating agency believes it will take time to implement a culture change, but that the enactment of a resolution framework will introduce more transparency. The Financial Stability Board’s (FSB) regional consultative group for the Middle East and North Africa (MENA), at a recent meeting in Riyadh, announced on April 25, 2016 that it had discussed regional approaches to bank resolution, too-big-to-fail issues, and bail-in. (Reuters) Saudi Aramco extends bid date for clean fuels project – According to sources, Saudi Aramco has extended the bidding deadline for a clean fuels project at its biggest oil refinery in Ras Tanura. The potential $2bn scheme to remove sulfur from refined products is part of a drive to meet stricter environmental standards. It has already had at least three bidding rounds. The deadline is now July 17, adding it had been extended from a May closing date because companies needed more time to prepare bids. (Reuters) Aramco raises oil pricing for Asia by most since April 2015 – Saudi Arabian Oil Company (Saudi Aramco) raised its pricing for June oil sales to Asia by the most since April 2015, a sign that the world’s biggest crude exporter expects demand to recover as the global market rebalances. Aramco increased its official selling price for Arab Light crude to Asia by $1.10 a barrel, 25 cents more than regional benchmarks Oman and Dubai. The Company was predicted to raise the grade by 65 cents a barrel. (Bloomberg) Saudi Enaya appoints advisor for capital reduction – Saudi Enaya Cooperative Insurance Company appointed Aljazira Capital as a financial advisor for a capital cut. The advisor will manage the company’s capital reduction transaction after obtaining the approval from the SAMA and the CMA. (Tadawul) Saudi Zain appoints new Chairman – Mobile Telecommunications Company Saudi Zain has appointed HH Prince Naif bin Sultan bin Mohammed bin Saud Al Kabeer as the Chairman of the board (Independent Member) and Mr. Bader bin Nasser Al Kharafi as the Vice Chairman of the board (Non-Executive-Member) for three years starting from April 26, 2016. (Tadawul) Al Alamiya gets temporary approval from SAMA – Al Alamiya for Cooperative Insurance Company has got a temporary approval from the Saudi Arabian Monetary Agency (SAMA) for the use of insurance products for six months starting from May 05, 2016. (Tadawul) SACO opens new store in Hail – Saudi Company for Hardware (SACO) has opened a new store in Hail on May 05, bringing the total number of SACO stores to 27 in Saudi Arabia. The store area is 5275 sq m and located in the unique place, Hail. The new store is expected to play a major role in increasing the turnover and profitability for the shareholders. The financial impact of this new opening store will start from 2Q2016. (Tadawul) SAICO announces renewal of license by SAMA – Saudi Arabian Cooperative Insurance Company (SAICO) has announced obtaining the Saudi Arabian Monetary Agency (SAMA) renewal for the company license to conduct insurance business in the Kingdom of Saudi Arabia for three years. (Tadawul) Halal tourism spending to reach $200bn by 2020 – According to Halal Travel 2016 report, Halal tourism numbers are expected to hit 150mn in traveler’s volume and collectively spend an estimated $200bn by 2020. Halal travelers highlight three core themes that span the key drivers of travel: cultural experiences, accommodation needs, and activity preferences. (GulfBase.com) DSI replaces CFO – Drake & Scull International (DSI) has replaced its Chief Financial Officer (CFO) after just eight months in the role. The company has also brought in the former Head of Arcadis’s Middle East operations to the new post of the Chief Operating Officer. (GulfBase.com) Abu Dhabi to delay building Fujairah LNG-import plant – According to sources, Abu Dhabi is indefinitely delaying construction of the first land-based facility for importing liquefied natural gas (LNG) into the UAE after it contracted a floating supply terminal. Emirates LNG is looking at other options for the planned onshore facility in Fujairah, including storing gas at the site, reloading it on ships for sale elsewhere and providing LNG as marine fuel. (GulfBase.com) NBO offers mortgages on Bausher Heights villas – National Bank of Oman (NBO) has announced that it has entered into an agreement to offer mortgages on 16 villas currently being built in the Bausher Heights development in Muscat. As per the mortgage lender agreement with developer Sayyid Hamed Al Busaidi, NBO will offer tailored loan packages for customers looking to secure a new residential unit in the integrated tourism development. NBO’s mortgage facilities are offered up to 80% of a property’s purchase value and for terms of up to 25 years. (GulfBase.com) Chinese refiner trades Oman crude oil futures on DME – Shandong Chambroad Petrochemicals Co has become the first independent Chinese refiner to trade Oman crude oil futures on the DME, the leading east of Suez energy exchange. The Chinese government allowed independent refiners to import crude oil for the first time earlier in 2016. So far 10 independent refiners have been granted approval by the Chinese authorities, with more expected to follow. Shandong Chambroad is expanding its international operations significantly and expects to become a regular trader of the DME Oman contract. The refiner will use DME Oman crude oil futures for risk management and physical procurement. DME will hold a roundtable for independent refiners in Shandong, China in mid- May to assist other local participants with the Exchange’s registration process. (GulfBase.com) KHCB net profit surges 70.7% YoY in 1Q2016 – Khaleeji Commercial Bank (KHCB) net profit surged 70.7% YoY in 1Q2016 to BHD2.85mn. The bank is continuously expanding its business to reach the gross assets of BHD 672.3mn, registering a growth of 2.8% YoY. Additionally, the gross fixed deposits from customers have increased by 1.7% YoY to reach BHD493.6mn. The financing assets have also shown a tremendous increase by 5.8% YoY to reach BHD410.1mn. The bank has maintained its profit ratio and strong financial positions with a liquid assets ratio reaching in an excess of 21.9% with a capital adequacy ratio of 17.8%. EPS for 1Q2016 was BHD2.92 fils as compared to BHD1.72 fils for 1Q2015. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (#Data as of May 04, 2016) Source: Bloomberg (#Market closed on May 06, 2016) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Apr-12 Apr-13 Apr-14 Apr-15 Apr-16 QSE Index S&P Pan Arab S&P GCC 1.1% (1.1%) (0.0%) 0.0% (0.1%) 1.1% (0.5%) (1.6%) (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait# Bahrain Oman# AbuDhabi# Dubai# Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,287.90 0.8 (0.4) 21.3 MSCI World Index 1,643.19 0.1 (1.7) (1.2) Silver/Ounce 17.47 0.7 (2.1) 26.1 DJ Industrial 17,740.63 0.5 (0.2) 1.8 Crude Oil (Brent)/Barrel(FM Future) 45.37 0.8 (5.7) 21.7 S&P 500 2,057.14 0.3 (0.4) 0.6 Crude Oil (WTI)/Barrel (FM Future) 44.66 0.8 (2.7) 20.6 NASDAQ 100 4,736.16 0.4 (0.8) (5.4) Natural Gas (Henry Hub)/MMBtu 1.84 (10.1) (3.5) (20.4) STOXX 600 331.67 (0.2) (3.0) (4.7) LPG Propane (Arab Gulf)/Ton# 48.50 0.0 (2.5) 26.4 DAX 9,869.95 0.3 (1.8) (3.8) LPG Butane (Arab Gulf)/Ton# 57.38 0.0 (1.1) 4.1 FTSE 100 6,125.70 (0.0) (3.0) (3.7) Euro 1.14 (0.0) (0.4) 5.0 CAC 40 4,301.24 (0.3) (3.0) (2.5) Yen 107.12 (0.1) 0.6 (10.9) Nikkei 16,106.72 (0.4) (1.8) (4.3) GBP 1.44 (0.4) (1.3) (2.1) MSCI EM 805.34 (0.5) (4.1) 1.4 CHF 1.03 (0.5) (1.4) 3.1 SHANGHAI SE Composite 2,913.25 (2.8) (1.3) (17.9) AUD 0.74 (1.3) (3.1) 1.1 HANG SENG 20,109.87 (1.6) (4.6) (8.4) USD Index 93.89 0.1 0.9 (4.8) BSE SENSEX 25,228.50 (0.1) (1.7) (3.9) RUB 66.17 0.4 2.2 (8.8) Bovespa 51,717.82 0.7 (5.6) 34.5 BRL 0.29 1.0 (2.0) 13.0 RTS 912.02 (0.5) (4.1) 20.5 110.2 88.4 88.0