QNBFS Daily Market Report October 01, 2017

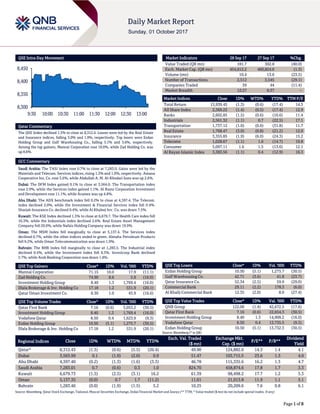

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.3% to close at 8,312.4. Losses were led by the Real Estate and Insurance indices, falling 3.0% and 1.9%, respectively. Top losers were Ezdan Holding Group and Gulf Warehousing Co., falling 5.1% and 3.6%, respectively. Among the top gainers, Mannai Corporation rose 10.0%, while Zad Holding Co. was up 8.6%. GCC Commentary Saudi Arabia: The TASI Index rose 0.7% to close at 7,283.0. Gains were led by the Materials and Telecom. Services indices, rising 1.3% and 1.0%, respectively. Amana Cooperative Ins. Co. rose 3.6%, while Abdullah A. M. Al-Khodari Sons was up 2.6%. Dubai: The DFM Index gained 0.1% to close at 3,564.0. The Transportation index rose 2.9%, while the Services index gained 1.1%. Al Ramz Corporation Investment and Development rose 11.1%, while Aramex was up 4.8%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,397.4. The Telecom. index declined 2.0%, while the Investment & Financial Services index fell 0.4%. Sharjah Insurance Co. declined 9.4%, while Al Khaleej Inv. Co. was down 7.5%. Kuwait: The KSE Index declined 1.3% to close at 6,679.7. The Health Care index fell 10.3%, while the Industrials index declined 2.6%. Real Estate Asset Management Company fell 20.0%, while Nafais Holding Company was down 19.9%. Oman: The MSM Index fell marginally to close at 5,137.4. The Services index declined 0.7%, while the other indices ended in green. Almaha Petroleum Products fell 9.2%, while Oman Telecommunication was down 1.9%. Bahrain: The BHB Index fell marginally to close at 1,283.5. The Industrial index declined 0.4%, while the Investment index fell 0.3%. Investcorp Bank declined 5.7%, while Arab Banking Corporation was down 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 71.15 10.0 17.9 (11.1) Zad Holding Co. 74.90 8.6 5.9 (16.0) Investment Holding Group 8.40 1.3 1,769.4 (16.0) Dlala Brokerage & Inv. Holding Co 17.18 1.2 531.9 (20.1) Qatar Oman Investment Co. 8.30 1.0 43.9 (16.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 7.16 (0.6) 3,053.2 (30.5) Investment Holding Group 8.40 1.3 1,769.4 (16.0) Vodafone Qatar 8.50 0.4 1,623.9 (9.3) Ezdan Holding Group 10.50 (5.1) 1,275.7 (30.5) Dlala Brokerage & Inv. Holding Co 17.18 1.2 531.9 (20.1) Market Indicators 28 Sep 17 27 Sep 17 %Chg. Value Traded (QR mn) 181.7 302.8 (40.0) Exch. Market Cap. (QR mn) 454,612.2 460,824.0 (1.3) Volume (mn) 10.4 13.6 (23.5) Number of Transactions 2,512 3,545 (29.1) Companies Traded 39 44 (11.4) Market Breadth 12:27 6:37 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,939.45 (1.3) (0.6) (17.4) 14.3 All Share Index 2,369.22 (1.4) (0.5) (17.4) 12.9 Banks 2,602.85 (1.5) (0.6) (10.6) 11.4 Industrials 2,561.32 (1.1) 0.7 (22.5) 17.1 Transportation 1,737.12 (1.0) (0.6) (31.8) 11.7 Real Estate 1,768.47 (3.0) (0.8) (21.2) 12.0 Insurance 3,355.85 (1.9) (6.0) (24.3) 15.2 Telecoms 1,028.67 (1.1) 1.6 (14.7) 19.8 Consumer 5,097.11 1.6 1.5 (13.6) 12.1 Al Rayan Islamic Index 3,383.56 (1.1) 0.4 (12.9) 16.3 QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 10.50 (5.1) 1,275.7 (30.5) Gulf Warehousing Co. 42.71 (3.6) 41.8 (23.7) Qatar Insurance Co. 52.34 (2.5) 59.9 (29.0) Commercial Bank 29.11 (2.2) 178.3 (6.0) Al Khalij Commercial Bank 12.35 (2.0) 8.0 (27.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 122.00 (1.4) 42,672.5 (17.6) Qatar First Bank 7.16 (0.6) 22,654.3 (30.5) Investment Holding Group 8.40 1.3 14,909.2 (16.0) Vodafone Qatar 8.50 0.4 13,735.5 (9.3) Ezdan Holding Group 10.50 (5.1) 13,732.3 (30.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,312.43 (1.3) (0.6) (5.5) (20.4) 49.90 124,882.0 14.3 1.4 4.1 Dubai 3,563.99 0.1 (1.9) (2.0) 0.9 51.47 103,715.5 23.6 1.3 4.0 Abu Dhabi 4,397.40 (0.2) (1.3) (1.6) (3.3) 46.78 115,335.6 16.2 1.3 4.7 Saudi Arabia 7,283.01 0.7 (0.6) 0.3 1.0 824.70 458,874.6 17.8 1.7 3.3 Kuwait 6,679.73 (1.3) (2.5) (3.1) 16.2 61.39 98,498.2 17.7 1.2 5.3 Oman 5,137.35 (0.0) 0.7 1.7 (11.2) 11.61 21,013.8 11.9 1.1 5.1 Bahrain 1,283.46 (0.0) (1.9) (1.5) 5.2 10.25 20,209.6 7.6 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,300 8,350 8,400 8,450 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 1.3% to close at 8,312.4. The Real Estate and Insurance indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari and GCC shareholders. Ezdan Holding Group and Gulf Warehousing Co. were the top losers, falling 5.1% and 3.6%, respectively. Among the top gainers, Mannai Corporation rose 10.0%, while Zad Holding Co. was up 8.6%. Volume of shares traded on Thursday fell by 23.5% to 10.4mn from 13.6mn on Wednesday. However, as compared to the 30-day moving average of 9.5mn, volume for the day was 10.1% higher. Qatar First Bank and Investment Holding Group were the most active stocks, contributing 29.3% and 17.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change First Abu Dhabi Bank Rating and Investment Abu Dhabi IR A+ A+ – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IR – Issuer Rating, SR – Support Rating, LC – Local Currency) Earnings Releases Company Market Currency Revenue (mn) 2Q2017 % Change YoY Operating Profit (mn) 2Q2017 % Change YoY Net Profit (mn) 2Q2017 % Change YoY Sahara Hospitality# Oman OMR 9.5 2.1% – – 1.8 -3.7% Source: Company data, DFM, ADX, MSM, TASI, BHB. # Financial Results for 9 months ended August 31, 2017. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/28 US Department of Labor Initial Jobless Claims 23-September 272k 270k 260k 09/28 US Department of Labor Continuing Claims 16-September 1,934k 1,993k 1,979k 09/29 UK GfK NOP (UK) GfK Consumer Confidence September -9 -11 -10 09/29 UK Bank of England Mortgage Approvals August 66.6k 67.3k 68.5k 09/29 UK UK Office for National Statistics GDP QoQ 2Q2017 0.3% 0.3% 0.3% 09/29 UK UK Office for National Statistics GDP YoY 2Q2017 1.5% 1.7% 1.7% 09/28 EU European Commission Economic Confidence September 113.0 112.0 111.9 09/28 EU European Commission Industrial Confidence September 6.6 5.2 5.0 09/28 EU European Commission Services Confidence September 15.3 15.0 15.1 09/28 EU European Commission Consumer Confidence September -1.2 -1.2 -1.2 09/29 EU Eurostat CPI Estimate YoY September 1.5% 1.6% 1.5% 09/29 EU Eurostat CPI Core YoY September 1.1% 1.2% 1.2% 09/28 Germany GfK AG GfK Consumer Confidence October 10.8 11.0 10.9 09/28 Germany German Federal Statistical Office CPI MoM September 0.1% 0.1% 0.1% 09/28 Germany German Federal Statistical Office CPI YoY September 1.8% 1.8% 1.8% 09/29 France INSEE CPI MoM September -0.1% -0.2% 0.5% 09/29 France INSEE CPI YoY September 1.0% 1.0% 0.9% 09/29 France INSEE PPI MoM August 0.4% – 0.1% 09/29 France INSEE PPI YoY August 2.0% – 1.6% 09/29 France INSEE Consumer Spending MoM August -0.3% 0.2% 0.6% 09/29 France INSEE Consumer Spending YoY August 1.2% 1.7% 2.1% 09/29 Japan Ministry of Internal Affairs & Communication Jobless Rate August 2.8% 2.8% 2.8% 09/29 Japan METI Industrial Production MoM August 2.1% 1.8% -0.8% 09/29 Japan METI Industrial Production YoY August 5.4% 5.2% 4.7% 09/30 China China Federation of Logistics Manufacturing PMI September 52.4 51.6 51.7 09/30 China China Federation of Logistics Non-manufacturing PMI September 55.4 – 53.4 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 49.52% 36.67% 23,342,959.69 Qatari Institutions 29.57% 15.04% 26,393,520.20 Qatari 79.09% 51.71% 49,736,479.89 GCC Individuals 0.82% 0.96% (262,742.49) GCC Institutions 1.44% 0.53% 1,659,028.27 GCC 2.26% 1.49% 1,396,285.78 Non-Qatari Individuals 9.93% 10.24% (557,923.32) Non-Qatari Institutions 8.72% 36.56% (50,574,842.35) Non-Qatari 18.65% 46.80% (51,132,765.67)

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 3Q2017 results No. of days remaining Status MCGS Medicare Group 10-Oct-17 9 Due QNBK QNB Group 11-Oct-17 10 Due MARK Masraf Al Rayan 16-Oct-17 15 Due DBIS Dlala Brokerage & Investment Holding Company 17-Oct-17 16 Due CBQK Commercial Bank 17-Oct-17 16 Due ABQK Ahli Bank 18-Oct-17 17 Due QIBK Qatar Islamic Bank 18-Oct-17 17 Due DHBK Doha Bank 23-Oct-17 22 Due KCBK Al Khaliji Commercial Bank 24-Oct-17 23 Due UDCD United Development Company 25-Oct-17 24 Due AKHI Al Khaleej Takaful Group 26-Oct-17 25 Due SIIS Salam International Investment Limited 29-Oct-17 28 Due Source: QSE News Qatar MCGS to disclose its third quarter financial statements on October 10 – Medicare group (MCGS) announced it would disclose its third quarter financial statements for the period ending September 30, 2017, on October 10, 2017. (QSE) QIBK to disclose its third quarter financial statements on October 18 – Qatar Islamic Bank (QIBK) announced it would disclose its third quarter financial statements for the period ending September 30, 2017, on October 18, 2017. (QSE) QSE Index, QSE Al Rayan Islamic Index and QSE All share constituents will rebalance October 1 – Al Meera Consumer Goods Company, Qatar First Bank and Mazaya Qatar will join QSE Index. Aamal Company and Qatar Insurance Company will be removed from the index. Qatar Islamic Insurance Company will join QSE Al Rayan Islamic Index. Ahli Bank will be removed from QSE All share Index and QSE Banks and Financial Services Index. (QSE) Qatar's non-oil exports exceed pre-siege level – The total value of Qatar's non-oil exports in August 2017 reached QR1.796bn compared to QR1.328bn in July, recording an increase of 35.2% and to QR1.493bn in August 2016 recording an increase of 20.3%, according to the monthly report of the Qatar Chamber on the foreign trade of the private sector. The report, which was prepared, based on certificates of origin issued by Qatar Chamber's Research & Studies Department and Member Affairs Department, pointed out that 2819 certificates of origin were issued during the same month. The report noted that Qatar's non-oil exports during August were distributed to about 58 countries compared to 59 last month. (Peninsula Qatar) Industrial production index rises by 0.8% – The index of industrial production rose by 0.8% in July 2017 to 104.1 points, compared to the previous month (June 2017); however, decreased by 2.4% compared to the corresponding month in 2016, QNA reported. The industrial production index, released by the Ministry of Development Planning and Statistics, consists of three main components including mining with a relative importance of 83.6%, manufacturing with a relative importance of 15.2%, electricity with a relative importance of 0.7%, and water with a relative importance of 0.5%. In the manufacturing sector, a rise of 4.5% was recorded in July 2017 from the previous month, as a result of higher production in seven groups including the beverage industry by 16.5%, the base metals industry by 12.6%, the food industry by 9.8%, the cement industry and other non-metallic mineral products by 6.1%, the refined petroleum products industry by 5.3%, the chemicals and chemical products industry by 3.4%, the rubber and plastics products industry by 2.8%, while there was a decline in production, in one group which is printing and copying of recorded media by 7.8%. (Peninsula Qatar) Qatar sees 10% increase in real estate activities – The real estate activities increased 10% last week compared to the previous week, giving a clear indication of firmness of the sector and strong economy of the country, said the Ministry of Justice in a report released. The value of real estate transactions also went up over QR247mn last week from over QR224mn previous week. A total of 1,916 real estate activities including property registrations, authentications and other associated services were recorded during September 17 to 21, 2017 at the services centers of the Ministry and the Real Estate Registration and Authentication System, known as SAK. The activities include 1,474 authentications and 442 property registrations. (Peninsula Qatar) Siege boosts home-based goods production – Encouraged by host of public initiatives towards supporting SMEs and other private sector businesses, the home-based micro-enterprises, including those run by female entrepreneurs, are ramping-up their scale of production to play a major role in Qatar’s efforts towards achieving self-sufficiency and economic diversification. The ongoing siege against Qatar is the major driving force that has prompted the small businesses, especially the women entrepreneurs, to come forward and contribute to the local economy in a big way to express solidarity and silent protest against the illegal blockade. The economic activities they were engaged with as part of their hobbies have now become profession. (Peninsula Qatar) Petrol, diesel to cost more in October – Fuel will cost more in Qatar next month, prices released by Qatar Petroleum (QP) indicate. Fuel prices in Qatar will go up 10 Dirhams a liter for petrol and 5 Dirhams a liter for Diesel from October. QP said the price of 95-octane super gasoline (petrol) will be QR1.70 a liter in October compared with QR1.60 for this month. The price of premium petrol (91-octane) will go up to QR1.60 a liter against

- 4. Page 4 of 8 QR1.50 now. Diesel will be priced QR1.55 a liter next month instead of QR1.50 now. Fuel prices in Qatar were allowed to fluctuate in response to changes in the global market from May 1 last year. (Gulf-Times.com) Qatar leads the world in government spending on projects – Qatar has ranked first globally in government spending on projects and in terms of tax impact on business incentives, among other rankings that incentivize international investment, according to Abdulbasit Al Ajji, Director (Business Development and Investment Promotion) at the Ministry of Economy & Commerce. He was making a presentation at a roundtable hosted in honor of HE the Minister of Economy and Commerce Sheikh Ahmed Bin Jassim Al Thani by the US-Qatar Business Council (USQBC) and the US Chamber of Commerce in New York. Abdulbasit Al Ajji’s, presentation emphasized on Qatar’s economic strengths when stacked against the international community. In his remarks, Sheikh Ahmed focused on the strength of the Qatari economy in the face of current events. Further, he discussed the openness of the Qatari economy, especially as it pertains to international businesses. Sheikh Ahmed commended the work of the US-Qatar Business Council in promoting bilateral business relations between the US and Qatar. (Gulf-Times.com) Qatari and Omani companies, sign ferry transport agreement – Qatari company Trans Oceans signed an agreement with Omani maritime transport company Naseera to facilitate the movement of ferries transporting goods, equipment, cars and tourists from the Sultanate of Oman to Qatar and vice versa. The agreement assumes importance as it will boost the trade between the two countries. Companies from Qatar and Oman are looking to increase business activities. Large numbers of Omani companies, including several small and mid-sized enterprises (SMEs), are negotiating with local businesses and investors to establish partnerships aiming to set up factories and production units in Qatar. (Peninsula Qatar) Galfar Al Misnad listed among top contributors to GCC infrastructure growth – Doha-based Galfar Al Misnad Engineering & Contracting was selected as a finalist in the Contractor of the Year award. The unprecedented growth of the infrastructure sector across the GCC over the past six decades has been one of the most significant achievements of the region in modern times. Guided by the ambitious national visions set by the leadership of each GCC state, the world has witnessed the transformation of the region from humble beginnings into a vibrant, modern and forward-looking market, where key cities have grown to become an important global business and trading hubs. (Peninsula Qatar) Al Baker: Qatar Airways to see pre-blockade traffic volumes by year-end – Qatar Airways, which has triggered expansion plans following the illegal blockade on the country by four Arab nations, is hopeful of seeing its traffic volumes at pre-blockade levels by the end of the current financial year, according to Group’s Chief Executive, Akbar Al Baker. “We have lost 10% of our passenger network and that much of our revenue generation due to the blockade,” Al Baker said at a media event at the Boeing production facility at Everett, Washington recently. Asked how the blockade had impacted the national airline, Al Baker said, “Let me be very honest…yes, we are affected. However, we have triggered our expansion plans immediately, which we initially delayed due to the aircraft delivery issues. And now with this blockade, we have capacity that has been released and now we have already started our expansion.” Qatar Airways recently said it has a host of exciting new destinations planned for the remainder of this year and 2018, including Canberra (Australia), Chiang Mai (Thailand) and Mombasa (Kenya). (Gulf-Times.com) Qatar Airways widens portfolio with stake in Italy’s Meridiana – Qatar Airways said it had acquired a 49% stake in AQA Holding, the new parent company of Italy’s Meridiana, adding to its growing portfolio of investments in foreign airlines. Previous sole owner Alisarda retains 51%, Qatar Airways said. The Sardinia-based Meridiana is Italy’s second largest carrier behind Alitalia, which is partly owned by Abu Dhabi’s Etihad Airways. Alitalia filed for administration earlier this year. The value of the Meridiana acquisition was not given, and the deal was finalized after protracted negotiations that formally started more than a year ago. (Gulf-Times.com) The First Investor Qatar acquires new asset in Paris – The First Investor (TFI) Qatar, a subsidiary of Barwa Bank, completed its acquisition of a commercial asset in Paris. The new acquisition complements TFI’s European Fund having a diversified and high-yield income, the Qatari closed shareholding investment banking firm said. The acquisition consists of a freehold commercial office building in Pantin, a dynamic banlieue (suburb) just on the boundaries of Paris and the next centre of art and culture. High-grade tenants on long lease basis occupy the property. The asset structure is a Shari’ah-compliant and tax efficient. In addition, the building has multiple of accesses to the Central Paris area, and well-connected through metro and train stations, which are walking distances from the building. (Gulf-Times.com) Al Rayan Poultry plans largest farm – Qatari owned Dar Al Rayan Investment Company announced the first of its kind initiative that will revolutionize the poultry sector and boost local production of poultry products in the country. Committing to significant investments in excess of QR1.6bn, Al Rayan Poultry, a subsidiary of Dar Al Rayan Investment Company, plans to introduce the largest exclusive integrated poultry farm in the country. “Through Dar Al Rayan Investment Company, we aim to contribute and be a part of vision 2030 by undertaking strategic projects that will support Qatar’s food security program,” Dar Al Rayan Investment Company’s Chairman, Sheikh Suhaim Bin Khaled Al Thani said. (Peninsula Qatar) International QNB Group: Low inflation worries continue to challenge Fed tightening – As structural factors continue to keep inflation below its 2% target, the Federal Reserve is expected to hike the rates three times between now and the end of 2018, according to QNB Group. The US Federal Open Market Committee (FOMC) surprised markets two weeks ago when it maintained its projection for another rate hike in 2017 and three additional hikes in 2018. In contrast, the market was predicting just one more hike over both the remainder of 2017 and all of 2018. The discrepancy between the Fed and the market rests on diverging views of inflation, which has been on a downward trend for

- 5. Page 5 of 8 most of 2017. The Fed believes weak inflation is temporary and will to rebound to its 2% target in 2018. On the other hand, market sceptics view subdued inflation more as a product of long-term structural trends which are unlikely to be so quickly overcome. “We expect the Fed to hike three times between now and the end of 2018 as structural factors continue to keep inflation below target while the temporary factors currently suppressing inflation unwind”, QNB Group noted in its weekly ‘economic commentary. (Peninsula Qatar) US economy accelerates in second quarter; hurricanes expected to slow growth – The US economy expanded a bit faster than previously estimated in the second quarter, recording its quickest rate of growth in more than two years, but the momentum likely slowed in the third quarter due to the impact of Hurricanes Harvey and Irma. Gross domestic product increased at a 3.1% annual rate in the April-June period, the Commerce Department noted in its third estimate. The upward revision from the 3.0% rate of growth reported last month reflected a rise in inventory investment. (Reuters) US jobless claims increase more than expected – The number of Americans filing for unemployment benefits rose more than expected last week, reflecting the lingering effects of Hurricanes Harvey and Irma. Initial claims for state unemployment benefits increased 12,000 to a seasonally adjusted 272,000 for the week ended September 23, according to the Labor Department. Data for the prior week was revised to show 1,000 more applications received than previously reported. A Labor Department official said Harvey and Irma affected claims for Texas, Florida, Georgia, Puerto Rico and the Virgin Islands. Unadjusted claims for Florida increased by 8,160 last week, while filings in Texas fell by 8,218. Unadjusted claims for Georgia rose by 3,157 last week. Economists polled by Reuters had forecast claims rising to 270,000 in the latest week. The storms have impacted the claims data in recent weeks and are expected to cut into job growth this month. Still, the labor market remains strong. (Reuters) CBI: UK’s economy cools in three months to September – Growth across Britain’s private sector cooled slightly in the three months to September, according to an industry survey, although companies were mostly upbeat about their prospects for the next three months. The Confederation of British Industry’s (CBI) monthly indicator of output for manufacturers, retailers and services companies slipped to +11, down from +14 for the three months to August. The expansion eased in factories and fizzled out in business and professional services firms, the CBI noted. Distribution was the only sector to experience faster growth, following a strong performance from retailers. Despite the mixed readings, overall output expectations for the next three months edged up to +18, up two points from August. The CBI survey is unlikely to sway Bank of England rate-setters who have said interest rates are likely to rise soon, as long as the economy continues growing and prices keep rising. (Reuters) Eurozone’s inflation miss supports case for ECB caution – Eurozone’s inflation undershot expectations in September, Eurostat data showed, highlighting that price growth remained week and supporting the European Central Bank’s (ECB) case for only gradual removal of stimulus. Inflation in the 19- member currency bloc held steady at 1.5% this month, missing expectations for 1.6% and trending well below the ECB’s target of almost 2%. With inflation heading lower in the coming months, likely bottoming out below 1% early next year, the ECB is in a difficult spot: strong economic growth would warrant policy tightening but weak consumer prices call for continued stimulus. The likely compromise is a small reduction in asset buys from next year, accompanied by a pledge to keep monetary policy easy for even longer. (Reuters) Jobless drop, retail sales fall paint mixed picture of German economy – Germany’s jobless rate fell to a new record low in September and the number of unemployed people fell far more than expected but retail sales disappointed, sending mixed signals about the state of Europe’s largest economy. The unemployment rate dropped to 5.6%, the lowest level since reunification in 1990, after 5.7% in August, data from the Federal Labor Office showed. Economists polled by Reuters had expected it to hold steady. The jobless total fell by 23,000 to 2.506mn in seasonally adjusted terms. That compared with the consensus forecast in a Reuters poll for a fall of 5,000 and was a steeper drop than that projected by even the most optimistic economist, who had expected a fall of 15,000. (Reuters) Japan's inflation, labor demand and factory output signal solid economic recovery – Japan’s core inflation accelerated in August, industrial output rose more than expected and demand for labor remained at its strongest in over 40 years in a further sign of solid momentum in the world’s third-largest economy. The flurry of data should bolster optimism about the outlook for growth, though Prime Minister Shinzo Abe’s decision to call a snap election has raised some uncertainty over economic policy. There was also some uneasiness about monetary policy after a summary of the Bank of Japan’s most recent meeting showed one board member wanted an expansion of stimulus as consumer prices remain distant from the central bank’s 2% inflation target. (Reuters) China's factories grow at the fastest pace in over five years as prices rise – China’s manufacturing activity grew at the fastest pace since 2012 in September as factories cranked up output to take advantage of strong demand and high prices, easing worries of a slowdown before a key political meeting next month. Production, total new orders and output prices all improved to the highest level in at least a year, while a pick-up in a reading for the construction sector indicated a building boom is undiminished. The official Purchasing Managers’ Index (PMI) rose to 52.4 in September, from 51.7 in August and well above the 50-point mark that separates growth from contraction on a monthly basis. It marked the 14th straight month of expansion for China’s massive manufacturing industry and the highest reading since April 2012. Analysts surveyed by Reuters had forecasted the reading would ease slightly. (Reuters) Regional FTSE Russell denies Saudi Arabia’s entry to EM list – Saudi Arabia to be assessed in March; Kuwait added to the same list Bloomberg Dubai Index provider FTSE Russell refrained from adding Saudi Arabia to its index of emerging market countries amid its September country classification annual review. Kuwait was added to the list. FTSE Russell said Saudi Arabia

- 6. Page 6 of 8 will soon meet criteria to be promoted from unclassified status to a secondary emerging market. Saudi Arabia will be assessed again in March. Capital markets regulators and the stock exchanges in both countries have introduced infrastructure reforms in attempts to attract local and international investors. In Saudi Arabia, the improvements are part of a broad program to diversify the country’s economy away from oil, its main export, and ahead of the sale of shares in state-controlled oil company Saudi Arabian Oil Co. Achieving emerging market status could trigger increase in passive inflows from funds tracking Tadawul benchmark around the world. (Gulf- Times.com) OPEC oil output edges higher in September as Iraq, Libya pump more – OPEC oil output has risen in September by 50,000 barrels per day (bpd), a Reuters survey found, as Iraqi exports increased and production edged higher in Libya, one of the producers exempt from a supply-cutting deal. OPEC’s adherence to its pledged supply curbs slipped to 86% from August’s 89%. Top exporter Saudi Arabia continued to shoulder a larger portion of OPEC’s total cut by pumping below its target. (Reuters) MENA’s Competitiveness Index improves – The MENA region improves its average performance this year, suggesting that measures to diversify economies away from gas and oil are starting to meet with success, although much needs to be done to lift the region’s overall competitiveness, the latest ‘Global Competitiveness Index 2017-2018 edition’ report by The World Economic Forum revealed. (GulfBase.com) Saudi Arabia’s retail market to top $142bn in 2021 – Saudi Arabia Vision 2030 will drive the Kingdom’s retail market to record-high of $142bn by 2021. Due to an increasingly globally- minded and brand-savvy local population and tourists, the Kingdom is the GCC’s fastest-growing retail market, growing 28% to reach $142bn by 2021, according to Alpen Capital. As a result, research firm AT Kearney said that the Kingdom has the third-highest retail potential among emerging markets in Europe, the Middle East, and Africa. (GulfBase.com) Saudi Arabia to widen foreign investment access again in 2017 – Capital Market Authority’s (CMA) Chairman, Mohammed Abdullah Elkuwaiz said that Saudi Arabia plans to further open up its stock market to foreign investors later this year as it seeks to become an international capital markets hub. Qualified foreign institutions (QFIs) were allowed to begin investing directly in Saudi Arabia’s stocks in 2015 and qualification requirements were eased late last year. Elkuwaiz said, “We are likely to follow up with a version three (of the QFI program) and maybe a version four shortly thereafter by continuing to deregulate foreign investor access. Our expectation is we continue the same cycle. Thereabouts every year we would expect a re-release.” (Reuters) Saudi Arabia’s August foreign reserves at lowest since early 2011 – Saudi Arabia's foreign reserves fell in August to their lowest level since April 2011, according to the Saudi Arabian Monetary Agency (SAMA), drawn down to cover a budget deficit caused by low oil prices. SAMA's net foreign assets shrank by $6.9bn from their level in July to $480.0bn. The assets dropped 13.4% from a year earlier; they peaked at $737bn in August 2014. The vast majority of the foreign assets are believed to be denominated in US Dollars. Foreign securities holdings dropped only slightly in August, edging down by $264mn from the previous month to $332.6bn, while foreign bank deposits shrank $6.2bn to $89.2bn. Foreign assets dropped in August despite the government's issue of $3.5bn of local currency Islamic bonds during the month to cover part of its deficit, sign that pressure on its finances remains heavy. (Reuters) Saudi Arabia pays SR525bn of private sector bills – Saudi Arabia paid the majority of SR525bn worth of invoices from the private sector received within 60 days of receipt, as the Kingdom seeks to settle its dues that have caused mayhem for contractors. The Kingdom's ministry of finance said that total of 345,000 invoices relating to work for 450 government entities were paid up to the middle of September as part of the 2017 fiscal year. Ninety-eight percent of all invoices representing 92% of total dues were paid within 45 days. Only 2% of the number of invoices took longer than 60 days to pay. The Kingdom began tightening its purse strings in 2016 to help bring down the fiscal deficit which reached record SR367bn in 2015 because of plunging oil prices. Saudi Arabia expects to narrow its budget this year to SR198bn this year, which is 7.7% of GDP (in fixed prices) and down by 33% YoY from SR297bn in 2016. (GulfBase.com) Saudi Aramco to finish first shale gas project soon – Saudi Arabia’s Aramco is expected to finish building facilities soon in the north of the Kingdom that will allow it to produce shale gas for the first time, industry sources said. The project, known as System A, involves gas processing facilities, wellheads and pipelines in Turaif which will feed the Waad Al Shamal phosphate mining project in the region. (GulfBase.com) Windfall to cascade through insurance, retail and auto sectors in KSA – Saudi Arabia is set to reap economic windfall as millions of women are allowed to drive in the Kingdom for the first time, in a move that is expected to spur spending across a range of sectors. Retailers, insurers and car hire companies are among the potential winners from the decision, while employers will be able to overcome one of the main barriers to boosting female participation in the workplace. Investors inside and outside the Kingdom are assessing the likely impact of the momentous move on the Kingdom’s $650bn economy. (GulfBase.com) Tadawul announces the listing Musharaka Capital Company’s Musharaka REIT – Saudi Arabia’s Stock Exchange (Tadawul) announced the listing and trading units of Musharaka Capital Company’s Real Estate Investment Traded Fund named ‘Musharaka REIT’ as of October 1, 2017. (Tadawul) UAE tops Government Spending index – The Ministry of Finance announced that the UAE was ranked first in the ‘Efficiency of Government Spending’ index, a sub-criteria of the World Competitiveness Report 2017, issued by the World Economic Forum (Davos) in Switzerland, having ranked second for three previous years. Since 2010, the UAE has achieved high rankings among the top 10 countries in the ‘Efficiency of Government Spending’ index, where the country rose from the 7th position globally, to 3rd in 2013, and then maintained the status of 2nd worldwide in 2014, 2015 and 2016 to now first in 2017. (GulfBase.com)

- 7. Page 7 of 8 UAE’s consumer electronics sales to fall marginally this year – The consumer electronics industry in the UAE is expected to fall by 0.23% to AED11.95bn, compared to AED11.97bn last year. Ahmad Bakr, research analyst at Euromonitor International Middle East, said that despite the decrease, sales are still better than last year. Revenues are down due to decreases in average selling price. Bakr said, “Volume is expected to register 1.8% growth but it is lower than last year. Volume for this year is expected to be 12.65mn compared to 12.4mn units last year. The reason is due to the overall slowdown in consumer electronics market. Small appliances are witnessing a negative growth.” (GulfBase.com) FTA: UAE is all set to implement tax system – All is set for the planned Excise Tax which goes into effect at the beginning of October 2017. This was announced in Dubai by the Federal Tax Authority (FTA). The new tax will be imposed on carbonated drinks by 50%, tobacco products by 100% and energy drinks by 100%. The tax affects specific ‘Excise’ goods that are produced in the UAE, imported into it or stockpiled in the Emirates, as well as excise goods released from designated zone. (GulfBase.com) GGICO signs debt restructuring with creditors – Dubai-based Gulf General Investment Company (GGICO) announced that it has completed $584mn debt restructuring after obtaining agreement from the majority of its creditors. GGICO’s Chairman, Abdalla Juma Al Sari believes this is a win-win deal both for GGICO and the creditors. Al Sari said, “Driven by market conditions, we have obtained enough time until 2023 to dispose of our non-core assets in an organized and structured manner and to retire the debts. Subsequently, the company will focus on its core assets with very low leverage.” (GulfBase.com) Drake & Scull International wins approval for capital reduction – Drake & Scull International (DSI) won regulatory approval to reduce its share capital by 75% and also to list 500mn new shares. The reduction of DSI’s share capital from AED2.28bn to AED571mn will be effective from October 2, 2017. This announcement comes close on the heels of the shareholders' approval for its capital restructuring program at the second General Assembly meeting in September. (GulfBase.com) Emirates NBD issues $156.3mn bond, ANZ is lead manager – Dubai’s Emirates NBD raised $156.3mn bond with Australia and New Zealand Banking Group (ANZ) as sole lead manager. The senior unsecured Australian bond has 10-year maturity and 4.85% annual coupon. The paper is expected to be rated ‘A3’ by Moody’s and ‘A+’ by Fitch. (GulfBase.com) Arab Trade Financing agrees deals worth $387mn – The directors of the Arab Trade Financing Program (ATFP) reviewed the funding activity during 2Q2017 and approved 118 requests for the funding of trade deals valued at $387mn. The total size of funding that it agreed to provide to its national agencies in all the Arab countries reached $521mn in 1H2017. (GulfBase.com) Kuwait expects to seal new deals to supply oil to Chinese buyers – Kuwait expects to seal new deals to supply Chinese buyers with crude amid healthy demand for its exports in Asia. The country also plans to export new light crude grade by January, as well as spending $120bn over the next five years on expanding both its upstream and downstream businesses, according to Kuwait Petroleum Corporation’s Deputy Managing Director Marketing, Waleed Al-Bader. (Reuters) Bank Muscat joins with Majid Al Futtaim for Mall of Oman project – Bank Muscat and Majid Al Futtaim Properties signed a term finance agreement for the Mall of Oman project. Anticipated to open in 2020, the Mall of Oman will be the largest shopping mall in the Sultanate. Bank Muscat is offering exclusive financing facility for development of the Mall of Oman project. (GulfBase.com) UGH listed after acquiring UGB listed shares – Bahrain Bourse announced the listing of United Gulf Holding Company (UGH) post reorganization of the activities of United Gulf Bank (UGB) as approved by the Central Bank of Bahrain, under which UGH acquired 100% the listed shares of UGB. An agreement was signed between Bahrain Bourse and UGH to list the shares of the restructured entity on Bahrain Bourse as of September 28, 2017. (GulfBase.com)

- 8. Contacts Saugata Sarkar, CFA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 QSE Index S&P Pan Arab S&P GCC 0.7% (1.3%) (1.3%) (0.0%) (0.0%) (0.2%) 0.1% (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,280.15 (0.6) (1.3) 11.1 MSCI World Index 2,000.55 0.4 0.3 14.2 Silver/Ounce 16.65 (1.2) (2.0) 4.6 DJ Industrial 22,405.09 0.1 0.2 13.4 Crude Oil (Brent)/Barrel (FM Future) 57.54 0.2 1.2 1.3 S&P 500 2,519.36 0.4 0.7 12.5 Crude Oil (WTI)/Barrel (FM Future) 51.67 0.2 2.0 (3.8) NASDAQ 100 6,495.96 0.7 1.1 20.7 Natural Gas (Henry Hub)/MMBtu 2.89 (1.2) (2.0) (21.6) STOXX 600 388.16 0.6 0.1 20.2 LPG Propane (Arab Gulf)/Ton 91.75 (2.1) (1.7) 27.2 DAX 12,828.86 1.1 0.7 25.0 LPG Butane (Arab Gulf)/Ton 102.00 (1.3) (1.0) (12.7) FTSE 100 7,372.76 0.4 (0.2) 12.0 Euro 1.18 0.2 (1.1) 12.3 CAC 40 5,329.81 0.8 (0.3) 22.7 Yen 112.51 0.2 0.5 (3.8) Nikkei 20,356.28 (0.2) (0.2) 10.3 GBP 1.34 (0.3) (0.8) 8.6 MSCI EM 1,081.72 0.9 (1.9) 25.5 CHF 1.03 0.2 0.1 5.2 SHANGHAI SE Composite 3,348.94 0.5 (0.9) 12.9 AUD 0.78 (0.3) (1.6) 8.7 HANG SENG 27,554.30 0.5 (1.2) 24.3 USD Index 93.08 (0.0) 1.0 (8.9) BSE SENSEX 31,283.72 0.1 (2.7) 22.2 RUB 57.55 (0.6) 0.1 (6.5) Bovespa 74,293.51 1.6 (2.6) 26.7 BRL 0.32 0.6 (1.2) 2.9 RTS 1,136.75 1.0 1.2 (1.4) 93.3 92.9 85.6