QSE Intra-Day Movement

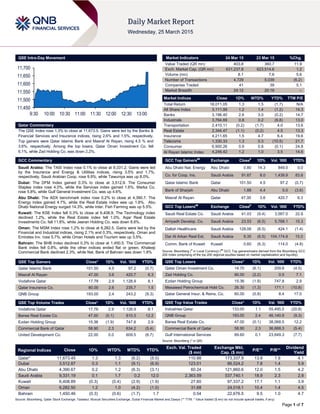

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.3% to close at 11,673.5. Gains were led by the Banks & Financial Services and Insurance indices, rising 2.6% and 1.5%, respectively. Top gainers were Qatar Islamic Bank and Masraf Al Rayan, rising 4.5 % and 3.6%, respectively. Among the top losers, Qatar Oman Investment Co. fell 6.1%, while Zad Holding Co. was down 2.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 9,331.2. Gains were led by the Insurance and Energy & Utilities indices, rising 3.5% and 1.7%, respectively. Saudi Arabian Coop. rose 9.9%, while Tawuniya was up 8.0%. Dubai: The DFM Index gained 0.3% to close at 3,512.9. The Consumer Staples index rose 4.0%, while the Services index gained 1.6%. Marka Co. rose 5.8%, while Gulf General Investment Co. was up 4.6%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,390.7. The Energy index gained 4.7%, while the Real Estate index was up 1.8%. Abu Dhabi National Energy surged 14.3%, while Inter. Fish Farming was up 5.5%. Kuwait: The KSE Index fell 0.3% to close at 6,408.9. The Technology index declined 1.2%, while the Real Estate index fell 1.0%. Aqar Real Estate Investments Co. fell 11.8%, while Jeeran Holding Co. was down 8.6%. Oman: The MSM Index rose 1.2% to close at 6,282.5. Gains were led by the Financial and Industrial indices, rising 2.1% and 0.3%, respectively. Oman and Emirates Inv. rose 5.7%, while Oman Hotels and Tourism was up 3.5%. Bahrain: The BHB Index declined 0.3% to close at 1,450.5. The Commercial Bank index fell 0.8%, while the other indices ended flat or green. Khaleeji Commercial Bank declined 2.3%, while Nat. Bank of Bahrain was down 1.8% QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Islamic Bank 101.50 4.5 97.2 (0.7) Masraf Al Rayan 47.00 3.6 420.7 6.3 Vodafone Qatar 17.78 2.9 1,128.9 8.1 Qatar Insurance Co. 80.00 2.6 235.7 1.5 QNB Group 193.00 2.4 243.2 (9.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 17.78 2.9 1,128.9 8.1 Barwa Real Estate Co. 47.00 (0.1) 810.3 12.2 Ezdan Holding Group 15.36 (1.9) 747.8 2.9 Commercial Bank of Qatar 58.90 2.3 634.2 (5.4) United Development Co. 22.00 0.0 609.5 (6.7) Market Indicators 24 Mar 15 23 Mar 15 %Chg. Value Traded (QR mn) 403.8 360.7 11.9 Exch. Market Cap. (QR mn) 631,237.8 623,514.6 1.2 Volume (mn) 8.1 7.6 5.6 Number of Transactions 4,729 5,039 (6.2) Companies Traded 41 39 5.1 Market Breadth 24:12 20:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,011.05 1.3 1.5 (1.7) N/A All Share Index 3,111.99 1.2 1.4 (1.2) 14.3 Banks 3,196.40 2.6 3.0 (0.2) 14.7 Industrials 3,764.69 0.8 0.2 (6.8) 13.0 Transportation 2,410.11 (0.2) (1.7) 4.0 13.6 Real Estate 2,344.47 (1.1) (0.2) 4.5 13.3 Insurance 4,211.65 1.5 4.7 6.4 19.6 Telecoms 1,330.33 1.3 0.3 (10.5) 21.7 Consumer 6,900.26 0.9 0.8 (0.1) 24.8 Al Rayan Islamic Index 4,246.42 1.2 1.0 3.5 14.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Energy Abu Dhabi 0.80 14.3 849.0 0.0 Co. for Coop. Ins. Saudi Arabia 91.67 8.0 1,439.9 83.6 Qatar Islamic Bank Qatar 101.50 4.5 97.2 (0.7) Bank of Sharjah Abu Dhabi 1.88 4.4 5.0 (3.6) Masraf Al Rayan Qatar 47.00 3.6 420.7 6.3 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Real Estate Co. Saudi Arabia 41.03 (9.4) 3,567.0 22.8 Arriyadh Develop. Co. Saudi Arabia 23.53 (6.5) 5,768.1 15.3 Dallah Healthcare Saudi Arabia 128.06 (6.5) 424.1 (1.4) Dar Al Arkan Real Est. Saudi Arabia 9.35 (6.5) 104,174.8 15.0 Comm. Bank of Kuwait Kuwait 0.60 (6.3) 114.0 (4.8) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Oman Investment Co. 14.70 (6.1) 209.8 (4.5) Zad Holding Co. 90.00 (2.2) 0.5 7.1 Ezdan Holding Group 15.36 (1.9) 747.8 2.9 Mesaieed Petrochemical Hold Co. 26.30 (1.3) 171.1 (10.8) Qatar General Insur. & Reins. Co. 60.00 (0.8) 8.4 17.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 133.00 1.1 55,495.5 (20.8) QNB Group 193.00 2.4 46,140.9 (9.3) Barwa Real Estate Co. 47.00 (0.1) 38,068.5 12.2 Commercial Bank of Qatar 58.90 2.3 36,668.3 (5.4) Gulf International Services 89.60 0.1 23,649.3 (7.7) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,673.45 1.3 1.3 (6.2) (5.0) 110.88 173,337.9 13.8 1.9 4.1 Dubai 3,512.87 0.3 1.1 (9.1) (6.9) 123.01 86,524.2 7.8 1.4 5.9 Abu Dhabi 4,390.67 0.2 1.2 (6.3) (3.1) 60.24 121,860.6 12.0 1.5 4.2 Saudi Arabia 9,331.19 0.1 1.7 0.2 12.0 2,363.59 537,740.1 18.9 2.3 2.8 Kuwait 6,408.89 (0.3) (0.4) (2.9) (1.9) 27.60 97,337.2 17.1 1.1 3.9 Oman 6,282.50 1.2 1.0 (4.2) (1.0) 31.68 24,018.1 10.4 1.4 4.5 Bahrain 1,450.46 (0.3) (0.6) (1.7) 1.7 0.54 22,676.5 9.5 1.0 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,450 11,500 11,550 11,600 11,650 11,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 1.3% to close at 11,673.5. The Banks & Financial Services and Insurance indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar Islamic Bank and Masraf Al Rayan were the top gainers, rising 4.5% and 3.6%, respectively. Among the top losers, Qatar Oman Investment Co. fell 6.1%, while Zad Holding Co. was down 2.2%. Volume of shares traded on Tuesday rose by 5.6% to 8.1mn from 7.6mn on Monday. However, as compared to the 30-day moving average of 12.2mn, volume for the day was 34.0% lower. Vodafone Qatar and Barwa Real Estate Co. were the most active stocks, contributing 14.0% and 10.0% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Gulf General Investment Co. (GGICO)* Dubai AED 1,375.06 -19.6% 0.0 NA 94.3 33.4% Source: Company data, DFM, ADX, MSM (*FY2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/24 US Bureau of Labor Stat. CPI MoM February 0.20% 0.20% -0.70% 03/24 US Bureau of Labor Stat. CPI Ex Food and Energy MoM February 0.20% 0.10% 0.20% 03/24 US Bureau of Labor Stat. CPI YoY February 0.00% -0.10% -0.10% 03/24 US Markit US Manufacturing PMI March 55.3 54.6 55.1 03/24 US Census Bureau New Home Sales February 539K 464K 500K 03/24 US Census Bureau New Home Sales MoM February 7.80% -3.50% 4.40% 03/24 US Richmond Fed Richmond Fed Manufact. Index March -8.0 3.0 0.0 03/24 EU Markit Eurozone Manufacturing PMI March 51.9 51.5 51.0 03/24 EU Markit Eurozone Services PMI March 54.3 53.9 53.7 03/24 EU Markit Eurozone Composite PMI March 54.1 53.6 53.3 03/24 France Markit France Manufacturing PMI March 48.2 48.5 47.6 03/24 France Markit France Services PMI March 52.8 52.5 53.4 03/24 France Markit France Composite PMI March 51.7 51.9 52.2 03/24 Germany Markit BME Germany Manufacturing PMI March 52.4 51.5 51.1 03/24 Germany Markit Germany Services PMI March 55.3 55.0 54.7 03/24 Germany Markit BME Germany Composite PMI March 55.3 54.1 53.8 03/24 UK ONS CPI MoM February 0.30% 0.30% -0.90% 03/24 UK ONS CPI YoY February 0.00% 0.10% 0.30% 03/24 UK ONS CPI Core YoY February 1.20% 1.30% 1.40% 03/24 UK ONS Retail Price Index February 256.7 256.6 255.4 03/24 UK ONS RPI MoM February 0.50% 0.40% -0.80% 03/24 UK ONS RPI YoY February 1.00% 0.90% 1.10% 03/24 Italy ISTAT Hourly Wages MoM February 0.00% – 0.70% 03/24 Italy ISTAT Hourly Wages YoY February 1.00% – 1.10% 03/24 China Markit HSBC China Manufacturing PMI March 49.2 50.5 50.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 47.97% 53.05% (20,529,313.32) Non-Qatari 52.04% 46.95% 20,529,313.32

- 3. Page 3 of 7 News Qatar Qatar to amend classification of GCC citizens invested in QE listed companies starting from tomorrow – Qatar Central Depository Securities will be amending the foreign ownership percentages for the citizens of the Gulf Cooperation Council (GCC) and treating them as local shareholders as of Thursday, 26th of March, 2015, based on the provisions of Law No. (9) for the year 2014. (QCSD) GWCS to disclose 1Q2015 results on April 23 – Gulf Warehousing Company (GWCS) has announced that its 1Q2015 financial results will be disclosed on April 23, 2015. (QSE) QSE suspends trading of ERES shares on March 25 – The Qatar Stock Exchange (QSE) has announced a suspension of trading in the shares of Ezdan Holding Group (ERES) on March 25, 2015 due to the company’s AGM and EGM being held on that day. (QSE) QGMD announces agenda for AGM on April 8 – Qatari German Company for Medical Devices (QGMD) has invited its shareholders to attend the annual general assembly meeting (AGM), which will be held on April 8, 2015. Shareholders at the AGM will discuss and approve the company's financial statements for the year ended December 31, 2014. The AGM will also dissolve the board and elect new board members for a period of three years. In case the required quorum is not met, a second meeting will be held on April 14, 2015. (QSE) Kahramaa: Qatar to build world’s largest water reservoirs – The Qatar General Electricity & Water Corporation (Kahramaa) said that Qatar is building the world’s largest water reservoirs to stock the precious resource for emergency, with a total capacity of 160mn imperial gallons. The 18 existing reservoirs in Doha are being demolished for reconstruction. Once completed, they will be the world’s largest concrete-based potable water reservoirs. Kahramaa said around 2mn cubic meters of cement will be used for building these reservoirs, along with covering 600 kilometers of pipelines. Between 2015 and 2018, three reservoir pumping stations will be built in Mekeines, Zikrit and Hazm Abal Jihh, with a total capacity of 18mn imperial gallons. Further, the company said that 40 kilometers of transmission pipelines will be installed during this period. (Peninsula Qatar) QPMC cement silos to be operational by 2015-end – Qatar Primary Materials Company’s (QPMC) upcoming cement storage and conveying plant (silos) in Mesaieed will be completed by the end of 2015. The facility has been designed to discharge 1.8mn tons of cement per year into 12 silos (circular structures for storing bulk materials) with a total storage capacity of 60,000 cubic meters. Once operational, the plant will be able to load 1,000 tons of cement per hour in trucks, which will significantly reduce the truck loading time to around 90 seconds per truck. (Peninsula Qatar) Egis wins Um Alhoul Economic Zone contract – Egis, an international group offering engineering, project structuring and operations services, has been awarded contracts for design and construction supervision for the Um Alhoul Economic Zone. This strategic project is part of the Qatar National Vision 2030. The first two zones, Ras Bufontas and Al Karaana, will be located south of Doha airport, while the third, Um Alhoul (QEZ 3), will be located in the port city of Al Waqrah, south of Doha. Manateq (Economic Zones Company) awarded the construction management of this third zone to Egis. (Peninsula Qatar) DECC: UK’s energy dynamics to benefit Qatar – Qatar is set to benefit from the change in dynamics of energy consumption in the United Kingdom (UK). Britain uses coal, gas and nuclear power plants to generate electricity. According to the Department of Energy & Climate Change (DECC), UK is looking at reducing the usage of coal for electricity generation in a bid to move toward clean energy, while its nuclear power plants will complete their work lifecycle by 2020, leaving gas as the major source for electricity generation. This change in energy consumption dynamics is likely to boost the demand for gas to generate electricity. Qatar will be the biggest beneficiary of rising demand as the UK imports 90% of its LNG from Qatar. The UK is expected to invest around £100bn in its electricity systems in next 10 years. (Peninsula Qatar) International US consumer inflation firming; new home sales at seven- year high; manufacturing expands – Consumer prices in the US rebounded in February as gasoline prices rose for the first time since June 2014, and there were also signs of an uptick in underlying inflation pressures, keeping the Federal Reserve on course to raise interest rates in 2015. The Labor Department said its Consumer Price Index (CPI) increased 0.2% in February after dropping 0.7% in January, ending three straight months of declines in the index. In the 12 months through February, the CPI was unchanged after slipping 0.1% in January, as the impact of an earlier plunge in global crude oil prices lingers. Fed officials have long viewed the energy-driven weakness in prices as transitory and economists said February's firmer readings were in line with policymakers' projections that inflation will move back to the central bank's 2% target. In a separate report, the Commerce Department said new home sales jumped 7.8% to a seasonally adjusted annual rate of 539,000 units in February, the highest level since February 2008. Meanwhile, Markit said its US Manufacturing Flash Purchasing Managers' Index rose to a five-month high of 55.3 in March from a reading of 55.1 in February. (Reuters) ONS: First time no inflation in Britain in February – According to official figures, British inflation vanished in February, hitting zero for the first time on record. The Office for National Statistics (ONS) said the annual rate of consumer price inflation dropped to 0% from 0.3% in January, pushing away a rate rise by the Bank of England firmly off the table for now. The decline was bigger than economists had expected and marked the first time there has been no growth in consumer prices since comparable records began in 1989. The Sterling Pound weakened slightly against the dollar after the data. Economists said that inflation was likely to dip below zero in April – though they stressed that Britain was at much less risk of entrenched deflation than the Eurozone. (Reuters) Flash PMI shows Eurozone’s economic recovery gathers momentum – According to surveys of purchasing managers, Eurozone’s modest economic recovery has gathered further momentum in March, with Germany leading the fastest increase in the private sector activity since May 2011. The surveys add to other signs that the Eurozone economy is finally emerging from a long period of near stagnation, aided by lower oil prices, a weakening euro and increasing confidence following the European Central Bank’s launch of a new stimulus program. Data firm Markit said its composite purchasing managers index — a measure of activity in the manufacturing and services sectors — rose to 46-month high of 54.1 in March from 53.3 in February. The surveys indicated the pickup in activity is likely to be sustained, with new orders rising at the fastest pace in four

- 4. Page 4 of 7 years. In response, businesses hired new workers at the fastest rate since August 2011, although it is likely take many months to return unemployment to pre-crisis levels from the 11.2% rate recorded in January 2015. (WSJ) Eurozone bailout fund to analyze €1.2bn refund to Greece – The Eurozone officials said its bailout fund will discuss the possibility of returning to Greece €1.2bn in bank recapitalization funds. If the board of directors of the European Financial Stability Facility (EFSF) approves the transfer, it would be a welcome shot in the arm for the Greek government, which is quickly running out of cash. According to sources, Athens will be out of money by April 20. Greece believes it should get the €1.2bn back because it says it paid this amount from a cash reserve of its own bank stabilization fund, the Hellenic Financial Stability Facility (HFSF), to recapitalize Greek banks. The recapitalization was done in cash under the previous government of Antonis Samaras even though the HFSF still held €10.9bn in EFSF bonds it could use for the purpose. (Reuters) Chinese flash HSBC PMI contracts to 11-month low in March – According to a private survey, activity in China's factory sector dipped to a 11-month low in March 2015 as new orders shrank, signaling persistent weakness in the economy. The poor reading added to signs that the economy has lost momentum despite two interest rate cuts since November 2014, a reduction in the amount of money banks must keep in reserve and repeated attempts by the central bank to reduce financing costs. The flash HSBC-Markit Purchasing Managers' Index dipped to 49.2 in March on a monthly basis. Reuters had forecast 50.6, slightly weaker than February's final PMI of 50.7. Some analysts expect the 1Q2015 economic growth to dip below the government's new full-year target of 7% – widely seen as the level needed to keep employment steady, fueling calls for more policy easing to support growth. (Reuters) Brazilian central bank not to extend forex intervention program – Brazil's central bank announced that it will not extend its foreign currency (forex) intervention program past March 31, 2015 as a combination of political problems at home and fears of higher US interest rates push the Brazilian real toward its lowest levels in a decade. However, the bank will roll over all swaps expiring after May 1. The real has been one of the worst performing currencies in March losing 10% against the dollar. While all emerging market currencies have suffered from fears of higher US interest rates, a number of domestic problems have further weighed on the real. Among those issues are Brazil's growing current account deficit, a massive corruption scandal at state-run oil company Petrobras and uncertainty about the approval of austerity measures proposed by President Dilma Rousseff. Uncertainty about the central bank's strategy to intervene in the foreign exchange market had also added to the long list of problems weighing on the real. (Reuters) Regional iGTB: Mideast banks’ share of global transaction banking revenues to rise 25% – According to a survey conducted by iGTB, Middle East (Mideast) banks are set to increase their share of global transaction banking revenues by at least 25%. The survey of 18 Middle East banks revealed that 93% of the survey’s 48 participants, who were senior-level bankers from across the region, believe Mideast banks will catch a larger portion of the global transaction banking market (worth $509bn) by 2025, with 62% anticipating a growth of 25% or greater, and 34% expecting the region’s share to increase by at least 50%. (GulfBase.com) Ma’aden subsidiary shuts down ammonia plant – Saudi Arabian Mining Company’s (Ma’aden) subsidiary, Ma’aden Phosphate Company has shut down its ammonia plant in Ras Al-Khair city after halting operations of a cooling facility to carry out unscheduled technical repairs. The closure started on March 23, 2015 and will continue for around 10 days. The shutdown will have no impact on the company’s ability to meet its obligations toward its customers. (Tadawul) Dallah Healthcare updates on Bagedo Hospital deal – Dallah Healthcare Holding Company has received a letter from Bagedo Trading Holding Company and Mohamed Ahmed Erfan & Sons Holding Company, the sellers of Bagedo & Dr. Erfan General Hospital Company (Bagedo Hospital), expressing their intention not to extend the long stop date. This will result in the SPA, except for certain provisions, cease to have effect on March 31, 2015. Earlier, Dallah Healthcare signed a sale & purchase (SPA) agreement with the sellers, to purchase the entire shares of Bagedo Hospital. The completion of the transaction was conditional on meeting all the agreed conditions by no later than March 31, 2015 (long stop date). (Tadawul) Jadwa Investment, APICORP buy majority stake in SMI – Jadwa Investment announced that Jadwa Mechanical Opportunities Fund, along with the Arab Petroleum Investments Corporation (APICORP) has acquired a majority stake in Saudi Mechanical Industries (SMI). SMI is a Saudi engineering company engaged in manufacturing a variety of products with a focus on fluid flow and control equipment. (GulfBase.com) Saudi cabinet approves land tax plan – Saudi Arabian cabinet has approved a proposal to tax undeveloped land in urban areas - a policy that could shake up investment incentives in the Kingdom and help to resolve a housing shortage. The decision aims to change that pattern by pushing more land out into the market, where it can be developed. However, the cabinet gave no details of the likely size of the tax, how it would be implemented, or a timetable for introducing it. (Reuters) UAE's Shah Gas project to achieve full capacity by 2Q2015 – Al Hosn Gas CEO Saif Ahmed al Ghafli said that the Shah Gas project, which began operations in 2015 in the UAE, will achieve full production in 2Q2015. Al Hosn Gas is the Shah Gas development joint venture in which the Abu Dhabi National Oil Company (ADNOC) holds a 60% stake and US-based Occidental Petroleum holds 40% stake. The project is expected to process around 1bn cubic feet per day (bcf/d) of sour gas into 0.5 bcf/d of usable gas. (Reuters) UAE central bank expands Islamic banks' access to its funds – The Central Bank of the UAE said it was making it easier for Islamic banks to access its special lending facility by expanding the range of collateral they can use. Islamic banks, which account for roughly a quarter of banking assets in the UAE, will be allowed to use Shari’ah-compliant securities other than central bank-issued Islamic certificates of deposit to borrow overnight from the central bank's Collateralised Murabaha Facility, from April 1, 2015. The eligible collateral will range from Sukuk issued by foreign governments, which must have a minimum long-term credit rating of A, to the UAE corporate entities and even some Sukuk which are rated below investment grade or do not have ratings, at the central bank's discretion. (Reuters) Emaar seeks shareholders’ nod to distribute 15% cash dividend – Emaar Properties has invited its shareholders to discuss the board of directors’ proposal to distribute 15% cash dividend of the share capital i.e. 15 fils per share for FY2014. Shareholders will also approve reducing the board’s strength from 11 to 10 board members. (DFM)

- 5. Page 5 of 7 ARIG OGM approves 5% cash dividend – Arab Insurance Group’s (ARIG) ordinary general assembly meeting (OGM) has approved the distribution of cash dividend equivalent to 5% of the capital i.e. $0.05 per share, totaling $9.9mn. Shareholders registered at the end of the trading day on March 23, 2015 (settlement date March 25, 2015) are eligible to receive dividend. Meanwhile, shareholders also gave their go-ahead for retaining $4.15mn of profits. (DFM) Arabtec Construction wins AED1.04bn contract from Saudi Aramco – Arabtec Construction, a Saudi-based subsidiary of Arabtec Holding, has won an AED1, 040mn worth contract from Saudi Arabian Oil Company (Saudi Aramco). The 28-month-long project entails the design, construction, completion and maintenance of 380 villas. The overall plot area of the project is 454,500 square meters (sqm), while the total build-up area is 166,200 sqm. (DFM) Arabtec seeks shareholders’ nod for 5% bonus shares – Arabtec Holding has invited its shareholders to consider and approve the board of directors’ recommendation regarding the distribution of dividend by way of bonus shares equivalent to 5% of the capital, totaling 219,765,000 shares, for the year ended December 31, 2014. (DFM) Emirates sets IPT for $913mn 10-year Sukuk – Emirates, the Dubai-based airline, has set the initial price thoughts (IPT) for a $913mn Sukuk issue that will be guaranteed by Britain's export credit agency and may price the issue as early as March 25, 2015. The IPT for the senior unsecured ten-year Sukuk issue is set at around 100 basis points over midswaps. Emirates will use the funds to partly pre-fund the acquisition of four new Airbus A380-800 aircraft, which are expected to be delivered in 2015. Emirates has picked Citigroup, HSBC, JP Morgan and National Bank of Abu Dhabi as the joint structuring agents, with Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD and Standard Chartered also acting as joint lead managers. (GulfBase.com) Dubai Customs: Dubai foreign trade reaches AED1.33tn in 2014 – According to Dubai Customs, Dubai’s foreign trade grew 0.15% to reach AED1.33tn in 2014 from AED1.329tn in 2013. Imports accounted for AED845bn in 2014, while exports and re- exports were valued at AED114bn and AED372bn, respectively. Direct trade accounted for AED818.8bn of total foreign trade value, while free zones contributed AED488.7bn and the customs warehouses accounted for AED23.8bn. As per the data, phones were the largest significant traded commodity, rising 9% to reach AED178bn, computers grew 9% to AED53bn while the trade of personal-use and transportation vehicles rose 30% to AED68bn. (GulfBase.com) NBF issues AED500mn Tier 1 capital – National Bank of Fujairah (NBF) has successfully issued a second tranche of additional Tier 1 capital worth AED500mn. The transaction was oversubscribed by investors ranging from insurance companies to government entities and was executed in partnership with Rasmala Investment Bank Limited. The issue was structured to comply with Basel III norms, and the funds raised will be used to support the bank's ongoing growth plans. Funds raised will improve the bank’s Tier 1 capital adequacy ratio to 15.9%, up from 14.6% in 2014. (ADX) Aabar to raise up to €2bn via UniCredit exchangeable bonds – Abu Dhabi's Aabar Investments, which owns just over 5% of Italian bank UniCredit, said it would sell two tranches of bonds exchangeable into shares of UniCredit, worth €750mn each, with an option to increase that amount by a further €250mn per tranche. At the same time, it would repurchase a previous 2016 bond exchangeable into shares of the German car maker, Daimler. Aabar said the proceeds of the offering would be used for general corporate purposes, including the repurchase of the Daimler bonds. (Reuters) Aldar completes sale of all 281 land plots at Al Merief – Aldar Properties has successfully completed the sale of all 281 land plots at Al Merief. Aldar’s first development in 2015 was fully sold in an off-market sales process, generating over AED600mn of revenues. The plots are located at Khalifa City, Abu Dhabi and were purchased by Emirati buyers with downpayment terms of between 50-100%. (GulfBase.com) CSB: Kuwait trade surplus shrinks 44% in 4Q2014 – According to data released by the Central Statistical Bureau (CSB), Kuwait's foreign trade surplus narrowed 44% YoY to KD3.33bn 4Q2014. Exports decreased to KD5.67bn in 4Q2014 from KD8.03bn recorded in 4Q2013. (GulfBase.com) Sembcorp Salalah AGM approves 4.2% cash dividend – Sembcorp Salalah Power & Water Company’s annual general meeting (AGM) has approved a proposed cash dividend of 4.2% of the share capital, i.e. 42 baizas per share. Shareholders registered with the Muscat Clearing & Depository Company as of April 1, 2015 will be eligible for dividend. (MSM) DIDIC wins Salalah 2 IPP contract – Dhofar International Development & Investment Holding Company (DIDIC) has won a contract for the development of the Salalah 2 Independent Power Project (IPP). DIDIC won the award as part of a consortium comprising Japan’s Mitsui & Co. Ltd and the International Company for Water and Power Projects (ACWA Power). This investment is part of DIDIC’s new strategic diversified investment plan and the management anticipates that this strategic investment will be of substantial benefit to the company. (MSM) PSC AGM approves 30% cash dividend – Port Services Corporation’s (PSC) ordinary annual general meeting (AGM) has approved the distribution of cash dividend equivalent to 30% of the share capital i.e. 30 baizas per share to the shareholders on the day of the AGM for the financial year ended December 31, 2014. (MSM) Bank Muscat, Oman Air launch joint promotion – Bank Muscat and Oman Air have launched a joint promotion offering 35% discount on Oman Air tickets booked through the call center and retail outlets of the airline with Bank Muscat credit cards. (GulfBase.com) A’saffa Foods AGM approves 18% cash dividend – A’saffa Foods’ ordinary annual general meeting (AGM) has approved the board of directors’ recommendation to pay a cash dividend of 18% of the paid-up capital for the year 2014. (MSM) Omantel shareholders approve OMR50mn Sukuk issue – Oman Telecommunications’ (Omantel) shareholders have approved the issuance of Islamic bonds, or Sukuk worth OMR50mn. (GulfBase.com) AOFS AGM approves 25% dividend for 2014 – Al Omaniya Financial Services Company’s (AOFS) annual general meeting (AGM) has approved a dividend of 25% for the year ended 2014, comprising 15% cash, 2% stock dividend and 8% compulsorily convertible unsecured bonus stock bonds. (GulfBase.com) Sunset Pacific to acquire participating stake in Oman oil block – Sunset Pacific Petroleum Limited, a Canadian oil & gas firm, has entered into a non-binding letter of intent (LOI) to acquire a 56.25% participating interest in an unspecified, existing exploration & production sharing agreement for an onshore oil block in Oman, with the current block holder owning

- 6. Page 6 of 7 an 18.75% participating interest and the Sultanate of Oman owning the remaining 25% interest in the property. Under the terms of the exploration & sharing agreement, the Oman government will carry the exploration phase, while Sunset Pacific will be the operator of the block. Pursuant to the terms of the LOI, Sunset Pacific will pay the current block holder $0.1mn within 30 days after signing the LOI. A finder’s fee may be payable with respect to this transaction. The parties are now working to finalize the necessary formal agreements as soon as practicable. (GulfBase.com) BisB shareholders gives go-ahead to form a SPV – Bahrain Islamic Bank’s (BisB) shareholders have approved the issuance of 9,396,735 shares with a nominal value of 100 fils each which, amounting BHD0.94mn to establish a special purpose vehicle (SPV). The SPV will administer the shares granted to staff according to the new incentive scheme amended in accordance with the Central Bank of Bahrain (CBB). Shareholders also approved the board’s recommendation to transfer BHD0.93mn to the legal reserve, and not to distribute any dividend to shareholders for 2014. (GulfBase.com) Al Baraka shareholders approve cash, stock dividend – Al Baraka Banking Group’s shareholders have approved cash dividend of 3% (3 cents per share) and one bonus share for every 50 fully paid up shares. The cash dividend payout amounts to $32.82mn and the bonus issue amounts to $21.88mn. The issued and paid up share capital of the bank has been increased from $1.09bn to $1.12bn by transferring $21.88mn to the share capital and the issue of bonus shares. Shareholders also approved the transfer of 10% of the net income amounting to $15.17mn to the statutory reserve. (GulfBase.com)

- 7. Contacts Saugata Sarkar Ahmed Al-Khoudary Sahbi Kasraoui Head of Research Head of Sales Trading – Institutional Manager – HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6548 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 QSE Index S&P Pan Arab S&P GCC 0.1% 1.3% (0.3%) (0.3%) 1.2% 0.2% 0.3% (0.6%) 0.0% 0.6% 1.2% 1.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,193.33 0.3 0.9 0.7 MSCI World Index 1,772.41 (0.3) (0.1) 3.7 Silver/Ounce 16.97 (0.1) 1.3 8.1 DJ Industrial 18,011.14 (0.6) (0.6) 1.1 Crude Oil (Brent)/Barrel (FM Future) 55.11 (1.4) (0.4) (3.9) S&P 500 2,091.50 (0.6) (0.8) 1.6 Crude Oil (WTI)/Barrel (FM Future) 47.51 0.1 3.9 (10.8) NASDAQ 100 4,994.73 (0.3) (0.6) 5.5 Natural Gas (Henry Hub)/MMBtu 2.78 3.4 (1.6) (7.3) STOXX 600 402.49 0.2 0.3 6.0 LPG Propane (Arab Gulf)/Ton 51.50 1.0 2.7 5.1 DAX 12,005.69 0.8 0.4 10.0 LPG Butane (Arab Gulf)/Ton 57.50 0.2 1.3 (8.4) FTSE 100 7,019.68 (0.8) (0.8) 2.0 Euro 1.09 (0.2) 1.0 (9.7) CAC 40 5,088.28 0.6 0.7 7.5 Yen 119.76 0.0 (0.2) (0.0) Nikkei 19,713.45 (0.1) 1.0 12.8 GBP 1.49 (0.7) (0.7) (4.7) MSCI EM 978.25 0.3 0.9 2.3 CHF 1.04 0.8 1.7 3.8 SHANGHAI SE Composite 3,691.41 0.3 2.1 14.2 AUD 0.79 (0.0) 1.3 (3.6) HANG SENG 24,399.60 (0.4) 0.1 3.3 USD Index 97.19 0.2 (0.7) 7.7 BSE SENSEX 28,161.72 (0.5) (0.6) 3.7 RUB 57.73 (1.7) (2.6) (4.9) Bovespa 51,506.07 0.2 2.0 (12.8) BRL 0.32 (0.2) 2.9 (15.6) RTS 167.7 136.2 124.9