21 May Daily market report

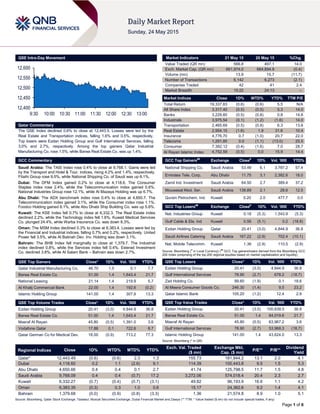

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.6% to close at 12,443.5. Losses were led by the Real Estate and Transportation indices, falling 1.6% and 0.5%, respectively. Top losers were Ezdan Holding Group and Gulf International Services, falling 3.0% and 2.7%, respectively. Among the top gainers Qatar Industrial Manufacturing Co. rose 1.5%, while Barwa Real Estate Co. was up 1.4%. GCC Commentary Saudi Arabia: The TASI Index rose 0.4% to close at 9,768.1. Gains were led by the Transport and Hotel & Tour. indices, rising 4.2% and 1.4%, respectively. Fitaihi Group rose 9.5%, while National Shipping Co. of Saudi was up 6.1%. Dubai: The DFM Index gained 0.2% to close at 4,118.6. The Consumer Staples index rose 2.4%, while the Telecommunication index gained 0.6%. National Industries Group rose 12.1%, while Al Mazaya Holding was up 6.7%. Abu Dhabi: The ADX benchmark index rose 0.4% to close at 4,650.7. The Telecommunication index gained 3.1%, while the Consumer index rose 1.1%. Foodco Holding gained 8.1%, while Abu Dhabi Ship Building Co. was up 5.6%. Kuwait: The KSE Index fell 0.7% to close at 6,332.3. The Real Estate index declined 2.2%, while the Technology index fell 1.6%. Kuwait Medical Services Co. plunged 24.4%, while Warba Insurance Co. was down 8.3%. Oman: The MSM Index declined 0.3% to close at 6,383.4. Losses were led by the Financial and Industrial indices, falling 0.7% and 0.2%, respectively. United Power fell 3.5%, while Al Batinah Dev. Inv. Holding was down 3.1%. Bahrain: The BHB Index fell marginally to close at 1,379.7. The Industrial index declined 0.8%, while the Services index fell 0.4%. Esterad Investment Co. declined 3.8%, while Al Salam Bank – Bahrain was down 2.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Industrial Manufacturing Co. 46.70 1.5 0.1 7.7 Barwa Real Estate Co. 51.00 1.4 1,643.4 21.7 National Leasing 21.14 1.4 219.9 5.7 Al Khalij Commercial Bank 22.00 1.4 192.6 (0.2) Islamic Holding Group 141.00 1.4 307.9 13.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 20.41 (3.0) 4,844.9 36.8 Barwa Real Estate Co. 51.00 1.4 1,643.4 21.7 Masraf Al Rayan 45.80 (0.5) 1,391.0 3.6 Vodafone Qatar 17.88 0.1 722.6 8.7 Qatar German Co for Medical Dev. 18.00 (0.9) 713.2 77.3 Market Indicators 21 May 15 20 May 15 %Chg. Value Traded (QR mn) 566.8 497.1 14.0 Exch. Market Cap. (QR mn) 661,974.0 664,894.9 (0.4) Volume (mn) 13.9 15.7 (11.7) Number of Transactions 6,142 6,273 (2.1) Companies Traded 42 41 2.4 Market Breadth 15:22 24:13 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,337.83 (0.6) (0.6) 5.5 N/A All Share Index 3,317.40 (0.5) (0.5) 5.3 14.0 Banks 3,229.60 (0.5) (0.8) 0.8 14.6 Industrials 3,975.54 (0.1) (1.2) (1.6) 14.0 Transportation 2,465.69 (0.5) (0.8) 6.3 13.6 Real Estate 2,954.15 (1.6) 1.9 31.6 10.4 Insurance 4,776.70 0.7 (1.0) 20.7 22.0 Telecoms 1,291.85 0.0 (1.1) (13.0) 25.5 Consumer 7,392.12 (0.4) (1.6) 7.0 28.7 Al Rayan Islamic Index 4,752.59 (0.5) 0.0 15.9 14.4 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% National Shipping Co. Saudi Arabia 53.49 6.1 3,787.2 57.4 Emirates Tele. Corp. Abu Dhabi 11.75 3.1 2,382.6 18.0 Zamil Ind. Investment Saudi Arabia 64.50 2.7 389.4 37.2 Mouwasat Med. Ser. Saudi Arabia 138.89 2.1 28.6 12.5 Qurain Petrochem. Ind. Kuwait 0.20 2.0 477.7 0.0 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Industries Group Kuwait 0.18 (5.3) 1,543.9 (5.3) Gulf Cable & Ele. Ind Kuwait 0.56 (5.1) 0.2 (18.8) Ezdan Holding Group Qatar 20.41 (3.0) 4,844.9 36.8 Saudi Airlines Catering Saudi Arabia 167.22 (2.9) 702.4 (10.1) Nat. Mobile Telecomm. Kuwait 1.36 (2.9) 110.5 (2.9) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 20.41 (3.0) 4,844.9 36.8 Gulf International Services 78.90 (2.7) 678.2 (18.7) Zad Holding Co. 99.60 (1.9) 0.1 18.6 Al Meera Consumer Goods Co. 246.30 (1.4) 9.5 23.2 Qatar Islamic Bank 105.20 (1.2) 12.4 2.9 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 20.41 (3.0) 100,838.5 36.8 Barwa Real Estate Co. 51.00 1.4 84,019.6 21.7 Masraf Al Rayan 45.80 (0.5) 63,967.2 3.6 Gulf International Services 78.90 (2.7) 53,968.3 (18.7) Islamic Holding Group 141.00 1.4 43,624.0 13.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,443.49 (0.6) (0.6) 2.3 1.3 155.73 181,844.2 13.1 2.0 4.1 Dubai 4,118.60 0.2 1.1 (2.6) 9.1 114.39 100,443.8 9.5 1.5 5.3 Abu Dhabi 4,650.66 0.4 0.4 0.1 2.7 41.74 125,798.5 11.7 1.5 4.8 Saudi Arabia 9,768.09 0.4 0.4 (0.7) 17.2 3,272.06 574,018.4 20.4 2.3 2.7 Kuwait 6,332.27 (0.7) (0.4) (0.7) (3.1) 49.82 96,193.9 16.6 1.1 4.2 Oman 6,383.35 (0.3) 0.3 1.0 0.6 15.17 24,362.6 9.2 1.4 4.1 Bahrain 1,379.68 (0.0) (0.9) (0.8) (3.3) 1.36 21,574.8 8.9 1.0 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,400 12,450 12,500 12,550 12,600 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.6% to close at 12,443.5. The Real Estate and Transportation indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Ezdan Holding Group and Gulf International Services were the top losers, falling 3.0% and 2.7%, respectively. Among the top gainers Qatar Industrial Manufacturing Co. rose 1.5%, while Barwa Real Estate Co. was up 1.4%. Volume of shares traded on Thursday fell by 11.7% to 13.9mn from 15.7mn on Wednesday. However, as compared to the 30- day moving average of 12.3mn, volume for the day was 13.0% higher. Ezdan Holding Group and Barwa Real Estate Co. were the most active stocks, contributing 34.9% and 11.8% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 1Q2015 % Change YoY Operating Profit (mn) 1Q2015 % Change YoY Net Profit (mn) 1Q2015 % Change YoY International Financial Advisors (IFA) Dubai KD 4.6 -14.1% – – -3.1 – Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/21 US Markit Markit US Manufacturing PMI May 53.8 54.5 54.1 05/21 US Bloomberg Bloomberg Consumer Comfort 17-May 42.4 – 43.5 05/21 US Bloomberg Bloomberg Economic Expectations May 44.0 – 50.0 05/22 US Bureau of Labor Stat. CPI MoM April 0.10% 0.10% 0.20% 05/22 US Bureau of Labor Stat. CPI YoY April -0.20% -0.20% -0.10% 05/21 EU Markit Markit Eurozone Manufacturing PMI May 52.3 51.8 52.0 05/21 EU Markit Markit Eurozone Services PMI May 53.3 53.9 54.1 05/21 EU Markit Markit Eurozone Composite PMI May 53.4 53.9 53.9 05/21 EU European Central Bank ECB Current Account SA March 18.6B 26.0B 27.3B 05/21 EU European Central Bank Current Account NSA March 24.9B – 14.7B 05/21 EU European Commission Consumer Confidence Maych -5.5 -4.8 -4.6 05/21 France Markit Markit France Manufacturing PMI May 49.3 48.5 48.0 05/21 France Markit Markit France Services PMI May 51.6 51.9 51.4 05/21 France Markit Markit France Composite PMI May 51.0 51.0 50.6 05/22 France INSEE Business Confidence May 97.0 97.0 96.0 05/22 France INSEE Manufacturing Confidence May 103.0 101.0 102.0 05/22 France INSEE Production Outlook Indicator May -1.0 – 2.0 05/21 Germany Markit BME Germany Manufacturing PMI May 51.4 52.0 52.1 05/21 Germany Markit Markit Germany Services PMI May 52.9 53.9 54 05/22 Germany Destatis Private Consumption QoQ 1Q2015 0.60% 0.60% 0.70% 05/22 Germany Destatis Government Spending QoQ 1Q2015 0.70% 0.20% 0.30% 05/22 Germany Destatis Capital Investment QoQ 1Q2015 1.50% 0.80% 0.80% 05/22 Germany Destatis Exports QoQ 1Q2015 0.80% 0.50% 1.00% 05/22 Germany Destatis Imports QoQ 1Q2015 1.50% 1.60% 1.90% 05/21 UK CBI CBI Trends Total Orders May -5.0 3.0 1.0 05/21 UK CBI CBI Trends Selling Prices May 2.0 – -3.0 05/22 UK ONS Public Finances (PSNCR) Apr -4.0B – 21.6B 05/22 Italy ISTAT Industrial Orders MoM March -0.30% 0.70% 0.80% 05/22 Italy ISTAT Industrial Sales MoM March 1.30% – 0.40% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 57.99% 71.04% (73,987,558.95) GCC 3.47% 4.87% (7,936,801.91) Non-Qatari 38.54% 24.09% 81,924,360.86

- 3. Page 3 of 6 News Qatar Online system to assess work of state contractors soon – Qatar is developing a unified online system to continuously assess the performance of contractors doing government projects worth QR40mn and above. The system is being developed for a contractors’ grading panel at the Central Tenders Committee of the Ministry of Finance. The proposed online evaluation system will be unified for all government departments and agencies, including the ministries that award state projects to contractors. (Peninsula Qatar) SAK Holding launches initiative to boost real estate sector – SAK Holding Group has announced that its subsidiary SAK Partnerships Company will join hands with investors and land owners as part of a key initiative named "Partner with us", which is aimed at developing Qatar's real estate sector. SAK Holding Group Chairman Sheikh Thani bin Abdulla Al-Thani said that SAK is ready to share in building and developing all kinds of first-rate land and property in the country to help investors meet their objectives and get attractive returns, as well as increase the readiness of Qatar’s real estate sector. He stated that besides landlords and property owners, “Partner with us” is also open to real estate investors, owners of ailing projects, and other prospective partners. SAK Partnerships Company General Manager, Adel Hassan M Saeed said that there are currently six projects in the residential and hotel sector under the “Partner with us” initiative. (Gulf-Times.com) Medical Commission to soon open new unit at Mesaimeer – The Medical Commission will soon open a new unit at Mesaimeer area for workers. The new unit, which could receive 500 visitors a day, is part of the cooperation between the Medical Commission Department and Qatar Red Crescent. (Gulf-Times.com) Jumbo Electronics plans major expansion – Video Home & Jumbo Electronics is expecting to reach a turnover of QR1bn by 2016 as compared to QR65mn turnover recorded in 2000. Thereafter the company seeks to achieve a constant compound annual growth rate (CAGR) of around 10% till 2020. The company’s expansion plans include opening new showrooms exclusively for LG’s high-end range of products as well as a second showroom of the group’s subsidiary company, Spark Lifestyle Electronics, at an upcoming mall. Jumbo Electronics also plans to set up a full-fledged facility management division and build major IT hardware & software solutions as well as management solutions. The company also plans to add three more satellite service centers with an outlet for spare parts distribution in Al Furjan neighborhood shopping complexes at Um Al Saneem, Rawdat Al Gadeem and Rawdat Al Hamama, issuing 10,000 new Jumbo Digits Loyalty Cards and expanding the MEP division. Moreover, Jumbo Electronics has also commenced a real estate division and has an investment budget of around QR500mn for the next few years in real estate development, buying, leasing and sales. (Gulf-Times.com) QA seeks more Doha-Manila flights – Qatar and Philippines are set to hold bilateral air talks on May 27 and 28 in Doha, after Qatar Airways (QA) requested for 13 additional weekly flights to the NinoyAquino International Airport in Manila from Doha’s Hamad International Airport. Once granted, the request would boost the services of the Qatari airline to 21 Doha-Manila flights a week, the highest frequency of flights offered by any Middle Eastern airline to the Philippine capital. (Bloomberg) International US core inflation inches toward Fed’s goal – The cost of living in US, excluding what households pay for food and fuel, climbed more than forecasted in April, indicating inflation is gravitating toward the Federal Reserve’s goal. The Labor Department report showed that the core consumer-price index rose 0.3% MoM, the biggest gain since January 2013 and reflecting broad-based increases. Prices rose 1.8% YoY, the same as in March 2015. Including food and fuel, the gauge was up a more moderate 0.1% as prices fell at grocery stores and gas stations. Costs may continue to firm as fuel expenses rebound, apartment rents climb and healthcare services become more expensive. Such price pressures should help Fed policy makers gain confidence in their forecast that inflation will move toward a 2% goal as they consider their first interest-rate rise since 2006. (Bloomberg) German business confidence declines as Greece uncertainty remains – German business confidence fell for the first time in seven months in May, signaling caution over the growth outlook for Europe’s largest economy. The Ifo institute’s business climate index dropped to 108.5 from 108.6 in April. Ifo’s measure of current conditions climbed to 114.3 in May from a revised 114 in April. A gauge of expectations fell to 103 from 103.4. The Bundesbank has predicted that German expansion will continue in the coming months as record-low unemployment supports consumer spending. At the same time, risks remain, notably from uncertainty over Greece, where the government might run out of cash and precipitate a regional crisis that could hurt German businesses. (Bloomberg) China-backed AIIB expects to be operational by 2015-end – The China-backed Asia Infrastructure Investment Bank (AIIB) said that it expects to be operational by the end of 2015. China is likely to hold a 25-30% stake in the new investment bank, while India will be the second-biggest shareholder. Overall, Asian countries are expected to own between 72-75% of the bank, while European and other nations will own the rest. A total of 57 countries have joined AIIB as its prospective founding members, throwing together countries as diverse as Iran, Israel, Britain and Laos. The US and Japan have stayed out of the institution, which is seen as a rival to the US-dominated World Bank and Japan-led Asian Development Bank, citing concerns about transparency and governance. (Reuters) Brazil sheds job in April, announces spending freeze – Brazil unexpectedly lost jobs in April for the first time on record as the economy heads toward the deepest recession in 25 years. The report published by the Labor Ministry showed that the economy shed 97,828 formal job posts. Meanwhile, the government has announced freezing $22.6bn in spending from the 2015 budget and said it would raise taxes on profits at banks, brokerages and credit-card processors to 20% from 15% as it steps up efforts to shrink a widening budget gap. President Dilma Rousseff is trying to rein in the largest budget gap in 16 years that threatens Brazil’s investment grade. (Bloomberg) South Africa warns of higher rate as inflation risks rise – South Africa’s central bank gave its strongest indication yet that it will raise interest rates in coming months as higher energy costs and a weaker rand threaten the inflation target. While the Monetary Policy Committee agreed to keep the benchmark repurchase rate unchanged at 5.75% on May 21, two of the six members favored an increase of 25 basis points. The central bank Governor, Lesetja Kganyago informed that the policy makers have kept borrowing costs unchanged since July 2014 to help support the economy that has been hit by strikes and power cuts. Inflation risks are rising, though, with the rand likely to come under more pressure as the US Federal Reserve

- 4. Page 4 of 6 tightens monetary policy and South Africa’s state-owned power utility pushes to raise tariffs. Inflation quickened to 4.5% in April from 4% in March, remaining within the bank’s 3-6% target band for the eighth month. (Bloomberg) Regional Gartner: MENA to spend $11.97bn on IT products and services in 2015 – According to Gartner, governments in the Middle East and North Africa (MENA) will spend $11.97bn on IT products and services in 2015, reflecting an increase of 0.4% YoY. This forecast includes spending on internal services, software, IT services, data center, devices and telecom services. Telecom services, which include fixed and mobile telecom services, will be the largest overall spending category throughout the forecasted period within the government sector. It is expected to be $5.2bn in 2015, led by growth in mobile network services. The software segment includes enterprise resource planning (ERP), supply chain management (SCM), customer relationship management (CRM), enterprise application software, infrastructure software and vertical specific software. Software spending will grow 6.7% YoY to reach $1.2bn in 2015. The software spending will be led by growth in the ERP, SCM, CRM and enterprise application software which includes office suites & content, communications and collaboration amongst others. (GulfBase.com) ATMC secures SAMA temporary approval for insurance products – Alinma Tokio Marine Company (ATMC) has obtained the Saudi Arabian Monetary Agency’s (SAMA) temporary approval for use of insurance products for six months starting from May 21, 2015. (Tadawul) Al Alamiya obtains SAMA final approval for insurance product – Al Alamiya for Cooperative Insurance Company has obtained the Saudi Arabian Monetary Agency’s (SAMA) final approval for Medical Malpractice Insurance product. (Tadawul) SAMA: Saudi Arabian mutual fund industry maintains largest position in MENA – According to a report released by the Saudi Arabian Monetary Agency (SAMA), Saudi Arabia’s mutual fund industry has maintained the largest position in Middle East North Africa (MENA) region in terms of asset under management. The industry has shown a remarkable growth of assets under management over the past couple of years. But the number of subscribers reduced to 242,802 subscribers by 1Q2015-end, the lowest in 10 years, showing a decrease of 5.3% on a YoY basis. As per the report, the reason for the decline is direct access to the traders and investors for trading in local as well as in international stocks and commodities. However, mutual funds offer a number of advantages to investors in comparison to equity investments e.g. diversification, portfolios under professional management, lower entry level, economies of scale and minimization of losses. (GulfBase.com) Bonki Rushdi Tojikiston signs deal with ICD – Bonki Rushdi Tojikiston has signed an advisory services agreement with the Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of the Islamic Development Bank Group (IDB) in order to process and support its conversion to full Shari’ah-compliant operations. The agreement is designed to develop an advisory process to effectively deliver full conversion by also identifying challenges and addressing impediments. The ICD will dedicate seven key teams across the full conversion process in areas of project management, Shari’ah-compliance, treasury, accounting, human resources, information technology, marketing and legal framework. (GulfBase.com) Borouge Phase III expansion to reach full capacity by 2016 – UAE-based petrochemical firm Borouge said that the third phase of expansion, which is set to raise its annual production capacity to 4.5mn tons of polyolefins, would be fully operational by 2016. The company said that its average production is expected to be 3.5mn tons in 2015. Borouge owned by Abu Dhabi National Oil Company and Borealis, an arm of Austria’s OMV, is also expanding its compounds-manufacturing plant in Shanghai, which makes products for the automotive industry. (GulfBase.com) Amlak to resume trading on DFM on June 2 – Amlak Finance’s board of directors has endorsed June 2, 2015 as the date for the company’s shares to restart trading on the Dubai Financial Market (DFM), subsequent to receiving approval from the relevant regulatory authorities. The company has elected Ali Ibrahim Mohamed as Board Chairman and Essamuddin Hussain Galadari as Vice Chairman, while Arif Abdulla Alharmi has been appointed as Managing Director. (DFM) Amanat buys stake in Al Noor Hospitals – Amanat Holdings has purchased a stake in the UAE’s Al Noor Hospitals Group from Deutsche Bank for AED250mn. The stake, reaching to 4.8mn shares or 4.14% was executed through an off-market transaction. Al Noor is a FTSE 250-listed company on the London Stock Exchange (LSE) and provides primary, secondary and tertiary care services through its portfolio of UAE-wide hospitals and medical centers in the UAE. (DFM) TAQA looking to raise $3.5bn five-year loan – According to sources, Abu Dhabi National Energy Company (TAQA) is looking to raise a $3.5bn five-year loan as it seeks to consolidate its existing debts into one facility with a lower rate of interest. The sources said that TAQA is looking for a facility of five years duration and is working with Bank of Tokyo-Mitsubishi and National Bank of Abu Dhabi for the same. As per the sources, among the existing debts which TAQA could refinance using the new facility is a $2.bn loan which is set to mature in December 2015, while it has a $1bn bond which it could also set aside cash for ahead of its maturity in October 2016. (GulfBase.com) ADCO awards $334mn contract to develop Mender field – Abu Dhabi Company for Onshore Petroleum Operations (ADCO) has awarded the engineering, procurement & construction (EPC) contract worth $334mn for the development of the Mender field to China Petroleum Engineering & Construction Corporation (CPECC). The Mender field project, with a production capacity of about 20,000 barrels per day (bpd), will boost ADCO’s daily crude production from 1.6mn bpd to 1.8mn bpd by 2017. The contract covers the construction of gathering stations, pipelines and power transmission lines, as well as sewage systems. (GulfBase.com) JAG approves KD20mn special dividend – Jazeera Airways Group’s (JAG) annual general meeting (AGM) has approved the cash distribution of KD20mn as special dividend for 2014. Additionally, JAG’s BoD has recommended the distribution of an additional KD30mn in cash in 2015, subject to shareholders’ approval, in the form of shareholder pay outs as part of a share buyback scheme targeted to readjust the company’s capital in line with the size of its current operations. (GulfBase.com) ABK to acquire 98.5% stake in PBE for $150mn – Al Ahli Bank of Kuwait (ABK) will pay $150mn cash for a 98.5% stake in Piraeus Bank's Egyptian unit. The purchase, struck at 1.5-times Piraeus Bank Egypt's (PBE) book value at the end of 2014, still requires regulatory approval in Egypt, Greece and Kuwait, as well as approval from the Hellenic Financial Stability Fund. In addition, ABK will also acquire at par value loans worth $26mn

- 5. Page 5 of 6 from Piraeus Bank, which are related to its Egyptian operations. This acquisition will allow ABK to expand beyond highly competitive domestic markets and increase its profitability. (Reuters) NBO to bid for UFC – National Bank of Oman (NBO) has confirmed its interest to participate in a merger and acquisition bidding process with United Finance Company (UFC). Sohar Power’s technical problems to affect earnings – Sohar Power Company said that its water desalination plant, which had faced some operational issues in early April 2015, will be brought back to full capacity by June 20, 2015. The repair activities for resolving the problem have been started. The company said that it faced two technical problems – one due to bursting of a sea water pipeline belonging to Orpic refinery on May 3, 2015 and the other one due to operational issues at Sohar power and water desalination plant on April 2, 2015. The financial impact related to these operational issues is expected to vary between OMR0.7mn and OMR1.4mn, depending on the outcome of actions undertaken by the company to mitigate such impact. (MSM) Raeco proposes four solar power projects – Rural Areas Electricity Company (Raeco) has proposed four solar power projects as pilot ventures in a move to efficiently utilize renewable energy, which will reduce use of fossil fuels. These four pilot projects are planned in Ibri (2,000 kilowatt), Sharqiya (2,000 kilowatt), Mudhaibi (2,000 kilowatt) and Dhofar (500 kilowatt). The project will help prove the feasibility of wind technology for Oman and address energy sustainability issues. (GulfBase.com) Salalah LPG plant likely to start production in 2019 – Salalah LPG Extraction Project, which is to extract all propane, butane and condensate associated with the natural gas pipeline from Salalah area, is likely to start actual production run in 2019. The project is the result of Oman Gas Company’s (OGC) efforts to find ways to optimize the added value of the gas chain. (GulfBase.com) ORPIC borrows OMR350mn from local, Gulf banks – Oman Oil Refineries & Petroleum Industries Company (ORPIC) has secured a OMR350mn ten-year loan from local and regional banks, part of which will be used to fund expansion projects. The syndicated loan was arranged by Bank Muscat, while the consortium included Bank Dhofar, National Bank of Oman, Bank Sohar, the local operation of QNB Group and other banks. Orpic CFO Nazar Al-Lawati said that the company will use the funds to ‘meet general corporate requirements as well as for certain current projects. (MSM) ABC finances OBALC purchase of aircrafts – Gulf Daily News (GDN) reported that Bahrain-based Arab Banking Corporation (ABC) has provided a financing facility to Oman Brunei Aviation Leasing Company (OBALC). The facility is for the purchase of two new B737-900ER aircraft leased to Oman Air. (GulfBase.com)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 QSE Index S&P Pan Arab S&P GCC 0.4% (0.6%) (0.7%) (0.0%) (0.3%) 0.4% 0.2% (0.9%) (0.6%) (0.3%) 0.0% 0.3% 0.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,206.34 (0.3) (1.4) 1.8 MSCI World Index 1,810.84 0.4 0.2 5.9 Silver/Ounce 17.16 0.2 (1.9) 9.3 DJ Industrial 18,285.74 0.0 0.1 2.6 Crude Oil (Brent)/Barrel (FM Future) 66.54 2.3 (0.4) 16.1 S&P 500 2,130.82 0.2 0.4 3.5 Crude Oil (WTI)/Barrel (FM Future) 60.72 3.0 1.7 14.0 NASDAQ 100 5,090.79 0.4 0.8 7.5 Natural Gas (Henry Hub)/MMBtu 2.93 (1.8) (0.9) (2.1) STOXX 600 407.87 0.7 0.2 9.5 LPG Propane (Arab Gulf)/Ton 44.25 (1.7) (7.6) (9.7) DAX 11,864.59 0.4 0.9 10.8 LPG Butane (Arab Gulf)/Ton 58.25 (0.9) 0.6 (11.1) FTSE 100 7,013.47 0.9 0.2 7.5 Euro 1.11 0.2 (3.0) (8.2) CAC 40 5,146.70 0.6 0.4 10.8 Yen 121.04 (0.3) 1.5 1.1 Nikkei 20,202.87 0.2 1.0 14.2 GBP 1.57 0.8 (0.4) 0.5 MSCI EM 1,032.70 (0.3) (1.0) 8.0 CHF 1.07 0.0 (2.2) 6.1 SHANGHAI SE Composite 4,529.42 2.0 5.3 40.3 AUD 0.79 0.3 (1.7) (3.4) HANG SENG 27,523.72 (0.2) (1.1) 16.6 USD Index 95.26 (0.2) 2.3 5.5 BSE SENSEX 27,809.35 0.2 1.5 0.7 RUB 49.98 0.4 0.9 (17.7) Bovespa 55,112.05 0.2 (5.3) (3.9) BRL 0.33 (1.2) (1.4) (12.8) RTS 1,047.47 1.5 (2.5) 32.5 178.8 143.6 130.0