17 January Daily market report

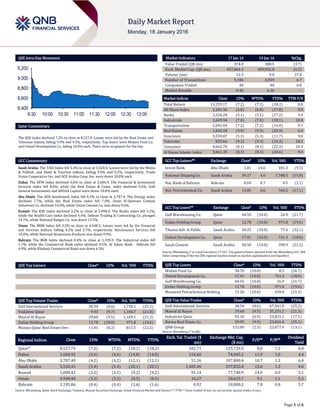

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 7.2% to close at 8,527.8. Losses were led by the Real Estate and Telecoms indices, falling 9.9% and 9.3%, respectively. Top losers were Widam Food Co. and United Development Co., falling 10.0% each. There were no gainers for the day. GCC Commentary Saudi Arabia: The TASI Index fell 5.4% to close at 5,520.4. Losses were led by the Media & Publish. and Hotel & Tourism indices, falling 9.9% and 9.2%, respectively. Trade Union Cooperative Ins. and ACE Arabia Coop. Ins. were down 10.0% each. Dubai: The DFM Index declined 4.6% to close at 2,684.9. The Financial & Investment Services index fell 8.6%, while the Real Estate & Const. index declined 5.6%. Gulf General Investments and SHUAA Capital were down 10.0% each. Abu Dhabi: The ADX benchmark index fell 4.2% to close at 3,787.4. The Energy index declined 7.7%, while the Real Estate index fell 7.0%. Umm Al-Qaiwain Cement Industries Co. declined 10.0%, while Union Cement Co. was down 9.6%. Kuwait: The KSE Index declined 3.2% to close at 5,098.4. The Banks index fell 5.2%, while the Health Care index declined 4.6%. Safwan Trading & Contracting Co. plunged 14.1%, while National Ranges Co. was down 13.5%. Oman: The MSM Index fell 3.2% to close at 4,948.5. Losses were led by the Financial and Services indices, falling 4.2% and 2.7%, respectively. Renaissance Services fell 10.0%, while National Aluminium Products was down 9.9%. Bahrain: The BHB Index declined 0.4% to close at 1,195.9. The Industrial index fell 1.1%, while the Commercial Bank index declined 0.5%. Al Salam Bank - Bahrain fell 6.9%, while Khaleeji Commercial Bank was down 6.3%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Gulf International Services 38.50 (8.6) 1,758.1 (25.2) Vodafone Qatar 9.93 (9.7) 1,184.7 (21.8) Masraf Al Rayan 29.60 (9.5) 1,169.1 (21.3) Ezdan Holding Group 12.78 (10.0) 971.8 (19.6) Mazaya Qatar Real Estate Dev. 11.01 (8.2) 815.5 (22.5) Market Indicators 17 Jan 16 14 Jan 16 %Chg. Value Traded (QR mn) 374.0 388.5 (3.7) Exch. Market Cap. (QR mn) 457,864.3 489,932.8 (6.5) Volume (mn) 12.3 9.0 37.0 Number of Transactions 5,186 4,859 6.7 Companies Traded 40 40 0.0 Market Breadth 0:40 4:36 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,255.17 (7.2) (7.2) (18.2) 8.8 All Share Index 2,281.36 (6.8) (6.8) (17.8) 9.0 Banks 2,324.28 (5.1) (5.1) (17.2) 9.4 Industrials 2,609.94 (7.0) (7.0) (18.1) 10.0 Transportation 2,041.69 (7.2) (7.2) (16.0) 9.7 Real Estate 1,845.58 (9.9) (9.9) (20.9) 6.0 Insurance 3,559.87 (5.3) (5.3) (11.7) 9.8 Telecoms 825.66 (9.3) (9.3) (16.3) 18.1 Consumer 4,662.76 (8.1) (8.1) (22.3) 10.3 Al Rayan Islamic Index 3,061.39 (8.3) (8.3) (20.6) 9.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Invest Bank Abu Dhabi 1.81 14.6 181.3 (9.5) National Shipping Co. Saudi Arabia 39.17 4.6 7,788.5 (15.8) Nat. Bank of Bahrain Bahrain 0.69 0.7 9.5 (2.1) Nat. Petrochemical Co. Saudi Arabia 13.85 0.6 760.2 (17.1) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Gulf Warehousing Co. Qatar 44.55 (10.0) 26.9 (21.7) Ezdan Holding Group Qatar 12.78 (10.0) 971.8 (19.6) Tihama Adv. & Public Saudi Arabia 20.25 (10.0) 77.6 (32.1) United Development Co. Qatar 17.01 (10.0) 741.3 (18.0) Saudi Cement Saudi Arabia 50.50 (10.0) 390.9 (22.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 38.70 (10.0) 8.5 (26.7) United Development Co. 17.01 (10.0) 741.3 (18.0) Gulf Warehousing Co. 44.55 (10.0) 26.9 (21.7) Ezdan Holding Group 12.78 (10.0) 971.8 (19.6) Mesaieed Petrochemical Holding 15.26 (10.0) 430.8 (21.3) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 38.50 (8.6) 67,341.8 (25.2) Masraf Al Rayan 29.60 (9.5) 35,251.2 (21.3) Industries Qatar 92.10 (6.9) 23,831.1 (17.1) Barwa Real Estate Co. 29.95 (9.9) 23,826.4 (25.1) QNB Group 152.00 (2.3) 23,077.0 (13.1) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,527.75 (7.2) (7.2) (18.2) (18.2) 102.71 125,729.5 8.8 1.3 6.0 Dubai 2,684.92 (4.6) (4.6) (14.8) (14.8) 124.60 74,045.2 11.0 1.0 4.4 Abu Dhabi 3,787.40 (4.2) (4.2) (12.1) (12.1) 51.26 107,800.4 10.7 1.3 6.0 Saudi Arabia 5,520.41 (5.4) (5.4) (20.1) (20.1) 1,405.46 337,832.0 12.6 1.3 4.6 Kuwait 5,098.42 (3.2) (3.2) (9.2) (9.2) 91.14 77,748.9 14.0 0.9 5.1 Oman 4,948.48 (3.2) (3.2) (8.5) (8.5) 16.27 20,625.7 9.1 1.1 5.3 Bahrain 1,195.86 (0.4) (0.4) (1.6) (1.6) 0.92 18,800.2 7.8 0.8 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,400 8,600 8,800 9,000 9,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 7.2% to close at 8,527.8. The Real Estate and Telecoms indices led the losses. The index fell on the back of selling pressure from non-Qatari and GCC shareholders despite buying support from Qatari shareholders. Widam Food Co. and United Development Co. were the top losers, falling 10.0% each. There were no gainers for the day. Volume of shares traded on Sunday rose by 37.0% to 12.3mn from 9.0mn on Thursday. Further, as compared to the 30-day moving average of 5.6mn, volume for the day was 119.8% higher. Gulf International Services and Vodafone Qatar were the most active stocks, contributing 14.3% and 9.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2015 % Change YoY Operating Profit (mn) 4Q2015 % Change YoY Net Profit (mn) 4Q2015 % Change YoY City Cement Co. Saudi Arabia SR – – 62.5 26.2% 59.9 26.7% Almarai Co. Saudi Arabia SR – – 572.5 9.3% 483.7 13.0% Najran Cement Co. Saudi Arabia SR – – 67.8 -8.9% 53.7 -16.0% Bishah Agricultural Development Saudi Arabia SR – – -0.6 NA -0.5 NA The Agricultural Development Co. Saudi Arabia SR – – 47.1 56.8% 34.4 71.7% Yanbu Cement Co. Saudi Arabia SR – – 212.0 6.5% 209.0 8.3% Saudi Cement Co. Saudi Arabia SR – – 185.0 -35.5% 180.0 -32.8% Tourism Enterprise Co. Saudi Arabia SR – – -3.0 NA -2.4 NA Ash-Sharqiyah Development Co. Saudi Arabia SR – – 0.6 NA 0.8 258.3% Advanced Petrochemical Co. (APC) Saudi Arabia SR – – 148.1 -31.6% 146.1 -27.0% Al-Jouf Agricultural Development Saudi Arabia SR – – 16.8 -54.6% 19.7 -46.9% The National Shipping Co. (Bahri) Saudi Arabia SR – – 595.5 202.4% 566.9 359.3% Saudi Basic Industries Corporation Saudi Arabia SR – – 4,360.0 -41.1% 3,080.0 -29.4% Oman Fisheries Co.* Oman OMR 19.4 7.4% – – 0.0 NA Salalah Mills* Oman OMR 68.3 1.0% – – 5.5 -0.9% Al Maha Ceramic Oman OMR 9.8 -9.2% – – 2.4 -11.2% Source: Company data, DFM, ADX, MSM (*9M-FY2015-16 results) Earnings Calendar Tickers Company Name Date of reporting 4Q2015 results No. of days remaining Status MARK Masraf Al Rayan 18-Jan-16 0 Due QIBK Qatar Islamic Bank 19-Jan-16 1 Due GWCS Gulf Warehousing Company 20-Jan-16 2 Due KCBK Al Khalij Commercial Bank 20-Jan-16 2 Due QNCD Qatar National Cement Company 20-Jan-16 2 Due NLCS National Leasing (Alijarah) 21-Jan-16 3 Due DHBK Doha Bank 24-Jan-16 6 Due QOIS Qatar & Oman Investment 24-Jan-16 6 Due QIGD Qatari Investors Group 25-Jan-16 7 Due VFQS Vodafone Qatar 26-Jan-16 8 Due MRDS Mazaya Qatar 26-Jan-16 8 Due IHGS Islamic Holding Group 27-Jan-16 9 Due QIIK Qatar International Islamic Bank 27-Jan-16 9 Due CBQK Commercial Bank of Qatar 27-Jan-16 9 Due QISI Qatar Islamic Insurance 27-Jan-16 9 Due DOHI Doha Insurance 31-Jan-16 13 Due QGRI Qatar General Insurance & Reinsurance 10-Feb-16 23 Due ORDS Ooredoo 1-Mar-16 43 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 58.11% 51.62% 24,242,370.71 Qatari Institutions 19.87% 15.50% 16,332,818.19 Qatari 77.98% 67.12% 40,575,188.90 GCC Individuals 1.44% 3.43% (7,453,959.93) GCC Institutions 2.04% 3.85% (6,786,749.65) GCC 3.48% 7.28% (14,240,709.58) Non-Qatari Individuals 12.78% 17.23% (16,639,402.03) Non-Qatari Institutions 5.77% 8.37% (9,695,077.29) Non-Qatari 18.55% 25.60% (26,334,479.32)

- 3. Page 3 of 6 News Qatar BRES signs QR572mn financing agreement – Barwa Real Estate Company (BRES) has signed a QR572mn Shari’ah-compliant financing agreement. The credit facility, with a five-year term, will be used to refinance an existing Islamic financial liability of BRES. The deal is in line with the group’s strategy to refinance its liabilities in order to strengthen its overall financial position. (QSE) Two lawsuits filed against ERES – Ezdan Holding Group (ERES) has announced that two lawsuits have been filed against the company. The first lawsuit bearing the number 003 981 for the year 2015 was filed by Qatari Investors Group (QIGD) in the First Instance Civil Court - Circuit (2) against ERES and its subsidiaries for not owning 20.1% of QIGD’s capital. ERES was notified about this case on December 23, 2015. The session is set to take place on February 2, 2016. The second lawsuit was submitted by Abdullah Bin Nasser Bin Abdullah Al Missned, a businessman and a shareholders in ERES. ERES was notified early January. The session is set to take place on February 14, 2016. (QSE) QGRI BoD meeting on February 10 – Qatar General Insurance & Reinsurance Company (QGRI) has announced that its board of directors (BoD) will meet on February 10, 2016 to discuss its financial results ending December 31, 2015. (QSE) ORDS BoD meeting on March 1 – Ooredoo (ORDS) has announced that its board of directors (BoD) will meet on March 1, 2016 to discuss its financial results ending December 31, 2015. (QSE) New ORDS system to speed up installation – Ooredoo (ORDS) has launched a special Field Force Automation (FFA) system, which will make the process of installation faster and easier for customers across Qatar. The new Field Force Automation (FFA) system allows the customer’s details to be uploaded to a special mobile app, along with GPS co-ordinates for the address, as soon as an installation date is booked. This enables technicians to immediately know the order details, location and appointment time for new installations, and find the location via GPS. The FFA app will also send customers an automatic SMS with the appointment time, following on from the standard appointment date SMS they get when they make a booking, so that they know when to expect the technicians, saving time and making the process smooth and efficient. The FFA solution enables ORDS’s installation team to track & monitor the whole process from start to finish, ensuring that all necessary equipment is available at the warehouse, the appointment is logged with ORDS, and any problems or need for repeat visits are recorded to enable a faster follow-up. (Gulf-Times.com) Injaz Qatar: Qatar start-ups to gain from public, private sectors’ support – Injaz Qatar Executive Director Emad al-Khaja has said that entrepreneurs and start-ups in Qatar stand to gain from the “ample support” provided by the government and the private sector. He said HH the Emir Sheikh Tamim bin Hamad al-Thani has addressed the issues of diversification, small and medium enterprises (SMEs) growth, and entrepreneurship by encouraging everyone to take advantage of the support provided by the government and private sector. While many start-ups in Qatar receive ample support from the government and the private sector, the level of commitment from incubatees remains one of the critical factors, which could make or break budding entrepreneurs. (Gulf-Times.com) WDAM opens sales outlet in Muaither suburb – Widam Food Company (WDAM) has opened a sales outlet in Muaither suburb. The outlet on Umm Dome Street in Muaither is WDAM’s 18th sales point opened as part of the company’s expansion plans for 2016. (Peninsula Qatar) Al Khalaf: Private sector can play major role in food security program – International Projects Development Company Chairman Ahmed Hussain Al Khalaf has said that Qatar’s emerging private sector can play a proactive role in realizing the country’s ambitious food safety program, provided the government extends support by leasing out land at attractive rates and offering subsidies to import material required for developing infrastructure and logistics. Launched in 2008, Qatar’s national food security program was aimed at ensuring the country’s food security. Al Khalaf said the private sector, which contributes over half of the country’s total GDP, can play a better role in supporting the country’s initiative. (Peninsula Qatar) International Banks losing share in corporate currency business – According to a recent survey small and medium-sized British companies are increasingly looking outside banks for foreign exchange in search of better rates and services. Research Company East & Partners' survey of more than 2,200 UK firms with annual revenues of up to £100mn showed roughly 10% use at least one of the dozens of brokerages specializing in payments in and out of foreign currencies. It listed the top six brokers in the space by market share as Western Union, Monex, CMC, American Express, Alpari and UKForex. The survey showed that more than 8% of those that trade in the more sophisticated currency options market also use brokers instead of banks. By offering companies currency at much tighter "spreads" between buy and sell prices than the rates banks give each other and their biggest clients, the brokers have been instrumental in making forex trading as a whole more competitive. (Reuters) German exports to Iran expected to double after sanctions lifted – Economy Minister Sigmar Gabriel said German industry expects a steep rise in exports to Iran following the lifting of international sanctions, and he would seek to drum up trade on visit Tehran in early May 2016. Iran ended years of economic isolation when world powers lifted the crippling sanctions against the Islamic Republic in return for Tehran complying with a deal to curb its nuclear ambitions. (Reuters) China launches new AIIB development bank as power balance shifts – Chinese President Xi Jinping launched a new international development bank seen as a rival to the US-led World Bank, as Beijing seeks to change the unwritten rules of global development finance. Despite opposition from Washington, US allies including Australia, Britain, German, Italy, the Philippines and South Korea have agreed to join the Asian Infrastructure Investment Bank (AIIB) in recognition of China's growing economic clout. Premier Li Keqiang said in order for Asia to continue to be the most dynamic region for global growth, it needs to invest in infrastructure and connectivity. The AIIB is expected to lend $10- $15bn a year for the first five or six years and will start operations in the 2Q2016. (Reuters) China to clean-up 'zombie' companies by 2020 – Official Xinhua News Agency has reported that China's top state-owned asset administrator has vowed to clean-up the country's so-called "zombie" industrial companies by 2020. State-owned Assets Supervision and Administration Commission (SASAC) Chairman Zhang Yi told a central and local enterprise work conference that the agency will "basically" resolve the problem of unproductive "zombie" firms over the next three years. The central government in September 2015 rolled out the most ambitious reform program in two decades to resolve the problems at its hugely inefficient public sector companies, encouraging the greater use of "mixed ownership" while promoting more mergers to create globally- competitive conglomerates. (Reuters)

- 4. Page 4 of 6 Regional NADEC BoD recommends 10% capital increase, SR38.5mn cash dividend for 2015 – National Agriculture Development Company’s (NADEC) board of directors (BoD) has proposed a capital increase through bonus share distribution. The increase in capital to SR847mn from SR770m will be made through capitalizing SR77mn from retained earnings. The company’s objective behind the capital increase is to support its expansion and financial leverage. Meanwhile, NADEC BoD has recommended the distribution of 5% cash dividend (SR0.5 per share) amounting to SR38.5mn for 2015. The eligibility of bonus shares and dividends is limited to the shareholders, who are registered in the shareholder’s registrar at the Securities Depository Center (Tadawul) at the close of trading on the extraordinary general assembly day, which will be decided later by the company. (Tadawul) SHADCO CEO & MD steps down – Ash-Sharqiyah Development Company (SHADCO) board of director (BoD) has accepted the resignation of the company’s Managing Director (MD) and Chief Executive Officer (CEO) Mohammed bin Ahmed Al Rahma, effective January 16, 2016. The board also decided to appoint General of Administrative & Financial Affairs Director Ayman Bin Zareaa Al Sheikh to the post of CEO, effective the same day. (Tadawul) Al Alamiya announces developments regarding use of rights issue proceeds – Al Alamiya for Cooperative Insurance Company has announced developments regarding the use of 2015 rights issue proceeds. The total proceeds from the capital increase amounted to SR200mn, while the net proceeds amounted to SR190.86mn, after deducting direct and indirect costs of SR9.14mn. An amount of SR20mn has been added to the statutory deposit to align the deposit with the capital increase. The company has invested SR120mn in short-to-medium term deposits and SR50.85mn in medium-to-long term bonds. (Tadawul) Saudi Hollandi Bank reports SR451.3mn net profit in 4Q2015 – Saudi Hollandi Bank reported a net profit of SR451.32mn in 4Q2015 as compared to SR461.88mn in 4Q2014, representing a decrease of 2.29% YoY. The bank’s total assets stood at SR108.07bn at the end of December 31, 2015 as compared to SR96.62bn in the year-ago period. Loans & advances portfolio reached SR76.14bn, while customer deposits stood at SR88.83bn. (Tadawul) Wafa Insurance CEO: KSA insurance market to grow further – Saudi Indian Company for Cooperative Insurance (Wafa Insurance) CEO Abdulrahman A. Al Sahli has said that the Kingdom’s insurance market has good potential for further gains due to its low insurance penetration levels. (GulfBase.com) Alpha1Estates: Makkah, Madinah real estate index up 7% in 2015 – Alpha1Estates International has said that its real estate index for Makkah and Madinah rose by 7% in 2015, its lowest rise in five years, in a year of immense change for the Kingdom, with the death of King Abdullah and King Salman bin Abdulaziz Al-Saud’s ascension to the throne. (GulfBase.com) FALCOM conducts rebalancing process of funds – FALCOM Financial Services has conducted rebalancing process on the components of the FALCOM Petrochemical ETF basket and FALCOM Saudi Equity ETF basket on January 17, 2016. (Tadawul) RAKBANK to cut up to 250 jobs as part of review – National Bank of Ras Al Khaimah (RAKBANK) will cut up to 250 jobs as part of a review of the lender’s organizational structure. UAE banks have been adjusting staffing levels in recent weeks, as they react to deteriorating market conditions and tighter liquidity caused by lower oil prices. RAKBANK revisited the organization structure of select departments and made changes where necessary to improve synergy and efficiency across the bank. (Reuters) Ajman Bank BoD meeting on January 20 – Ajman Bank’s board of directors (BoD) will hold a meeting on January 20, 2016 to discuss and approve a proposal to increase the bank’s capital. (DFM) Marka expands sports retail footprint – Marka has announced the opening of two new retail outlets operated by its dedicated sports retail division, Marka Sports. The launch of a new Cheeky Monkeys outlet and Nike store form part of the company’s growth strategy focused on expanding its network of high-profile global brands and home-grown retail concepts. (DFM) HSBC plans new Mideast headquarters – HSBC Holdings has confirmed its plans to start building a new Middle East (Mideast) headquarters near the world’s tallest tower in Dubai as the lender aims to combine staff from three other locations in the city. Gulf Resources Development & Investment (GRDI) will construct the tower and sell it to HSBC Bank Middle East Limited for about AED920mn upon completion in 2017. Meanwhile, sources said HSBC is reviewing its operations in Lebanon and may exit the Middle Eastern country as the bank focuses on more profitable markets. In the Middle East, HSBC operates in the UAE, Egypt, Qatar, Oman, Bahrain, Kuwait, Lebanon, and Algeria. In Saudi Arabia, the bank holds a 40% stake in Saudi British Bank and a 49% share in HSBC Saudi Arabia. (Bloomberg) Emaar Properties to launch sales of Harbour Views – Emaar Properties is starting off 2016 with the local and international sales launch of the ‘Harbour Views’ residences in the Island District, a hub in Dubai Creek Harbour. A two-tower development with a three-level podium, Harbour Views will be one of the tallest residential projects in the Island District and is defined by its central unmatched location within the area and its unparalleled views. (GulfBase.com) Manazel Real Estate establishes new unit for retail areas – Manazel Real Estate has announced the creation of a new subsidiary called Manazel Malls to take operational and managerial control of Capital Mall and all retail areas in Al Reef Community and Al Reef 2 in Abu Dhabi in addition to future retail projects. The new unit will be responsible for all of Manazel’s retail operations, as well as driving operational efficiencies and improve performance across this line of business. Manazel Malls also strategically provides Manazel with the potential to manage retail assets on behalf of third parties within the UAE and across the wider region, and presents it with the opportunity to potentially seek a listing for this business. (ADX) Watania appoints CEO – National Takaful Company (Watania) board of directors (BoD) has appointed Gautam Datta as the Chief Executive Officer (CEO) of the company. (ADX) NBAD among top three in S&P/Hawkamah Index – National Bank of Abu Dhabi (NBAD) has ranked among the top three organizations on the S&P/ Hawkamah ESG Pan Arab Index for the fourth consecutive year. This reflects NBAD’s strong environmental, social and corporate governance practices and robust standing among publicly-traded MENA region companies. NBAD has been among the top 10 on the index since it was established, improving its position from eighth in 2010 to sixth in 2011, and among the top three since 2012. (GulfBase.com) KFH 2015 Sukuk volume traded outpaces $4.4bn – Kuwait Finance House (KFH) Acting Chief Treasury Abdulwahab Essa Al-Roshood has said that KFH volume traded in the Sukuk market outpaced $4.4bn for the year 2015, an increase of 46% YoY as compared to 2014. He indicated that such volume is yet another outstanding achievement of KFH, a primary dealer and a global Sukuk market maker. (GulfBase.com)

- 5. Page 5 of 6 NBK: Kuwait inflation edges up to 3.3% YoY in 2015 – According to a report by National Bank of Kuwait (NBK), Kuwait’s annual headline inflation is on track to average close to 3.3% in 2015, slightly higher than the annual average of 3% in 2014. Inflation in consumer prices came in marginally lower in November 2015, easing from 3.2% YoY in October to 3.1% YoY, as inflation in most components was either unchanged or remained steady. As per the report, Core inflation (which excludes food inflation) also eased slightly, from 2.9% YoY to 2.8% during the same period. Meanwhile, inflation in local food prices remained unchanged at 4.3% YoY in November 2015; global food prices declined. (GulfBase.com) MOG: Oman’s crude oil output grows 4% to 358mn barrels in 2015 – According to the monthly report released by the Ministry of Oil & Gas (MOG), Oman’s total crude oil and condensates output in 2015 edged up by roughly 4% to a total of 358.10mn barrels, indicating an average daily production of 981,090 barrels. In 2014, Oman’s output had stood at 344.37mn barrels or 943,500 barrels per day. Sultanate’s total crude oil exports in 2015 amounted to 308.13mn barrels, a daily average of 844,207 barrels. The statistics indicated that China remained the biggest importer of Omani oil in 2015, accounting for 7.1% of the total. Moreover, the figures revealed that the price of the Omani oil on an average in the past year stood at $56.45 per barrel as compared to an average price of $103.23 per barrel in 2014. As per the report, Oman’s total output of crude oil in December 2015 alone stood at 31.21mn barrels, a daily rate of 1,006,905 barrels, up by 1.12% as compared to November 2015. (Bloomberg) NCSI: Oman inflation rate shows marginal growth – According to the latest data released by the National Centre for Statistics and Information (NCSI), Oman’s consumer price index (CPI)-based inflation registered a 0.33% MoM upswing in December 2015 from November 2015, while on YoY basis the inflation marked a decline of 0.14%. Average inflation for 2015 rose 0.06% as compared to 2014. Food & non-alcoholic beverages group (with a weightage of nearly 24% in the CPI basket), saw an average price drop of 0.81% in 2015 as compared to 2014. Clothing & footwear and transport groups were also down by 0.92% and 0.05%, respectively, on YoY basis in 2015. In contrast, the housing, electricity, water and fuels group marked a rise of 0.43%, while the health segment posted a price rise of 3.42% in 2015 on a YoY basis. (GulfBase.com) Oman Observer: Omran eyes investment in $1.3bn waterfront project – Oman Observer reported that Oman Tourism Development Company (Omran) is in advanced stages of negotiations with a number of private sector players for investment in its OMR500mn Port Sultan Qaboos Waterfront Project. A new company is being set up to develop the project, with 51% owned by Omran, while the remaining 49% taken up by pension and investment funds, together with private sector investors. The huge waterfront destination will be developed over four phases, with construction of the Phase I beginning in mid- 2016 and completion set for 2020. (GulfBase.com) Oman plans to build new industrial estates in Oman – Oman is planning to build three new industrial estates, one each in Thumrait, Al Mudhaibi and Shinas in a move to diversify the country’s economy and create employment opportunities for the youth. Public Establishment for Industrial Estate (PEIE) CEO Hilal bin Hamad Al Hassan said the work is currently underway, in coordination with various government agencies, especially the Ministry of Housing (MoH), to complete the allocation of land for PEIE. Besides, Marmul and Qarn Al Alam are currently being studied, in collaboration with the Ministry of Oil & Gas and Petroleum Development Oman, to set up industrial estates. He added that that PEIE has proposed certain locations to the MoH in the wilayats of Al Suwaiq and Al Musana'ah, besides requests to extend some of the existing estates like Raysut, Nizwa and Sumail. (GulfBase.com) BCFC closes $125mn five-year term loan facility – Bahrain Commercial Facilities Company (BCFC) has successfully closed a $125mn five-year term loan facility. Ahli United Bank, Arab Banking Corporation, and Gulf International Bank acted as the mandated lead arrangers and book runners (MLABs) for the facility. The MLABs were joined by Arab Bank and National Bank of Bahrain as arrangers. The company intends to use the proceeds for refinancing and general corporate purposes. (Bahrain Bourse) Ibdar Bank exits from four real estate investments for $21.67mn – Bahrain’s Ibdar Bank has announced the successful exit from four Bahrain-based real estate investments for a total value of $21.67mn. The first two exits consist of the sale of two 11-storey buildings acquired by the bank for a total consideration of $12.07mn. The first is a 64-apartment fully furnished building located in Manama and the other consists of 38-fully furnished apartments in Busaiteen. The other two exits consist of the sale of the bank’s affiliate company’s 11-storey and 10-storey properties located in the popular Juffair area. The properties consist of 83 fully furnished apartments in total and supporting convenience, leisure and parking facilities, which were sold for a total consideration of $9.6mn. (GulfBase.com) BBK plans capital increase – BBK has made a clarification regarding the news article published in Al Ayam Newspaper. The bank said that it is planning to increase its capital by about BHD100mn to reach BHD430mn. This will be decided by the shareholders during the extraordinary general meeting, which will be held on January 28, 2016. Moreover, the bank has clarified that it is in the process of setting up an investment company in the UK and not as stated in the news article that the bank is working on an acquisition. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 QSE Index S&P Pan Arab S&P GCC (5.4%) (7.2%) (3.2%) (0.4%) (3.2%) (4.2%) (4.6%) (8.0%) (6.0%) (4.0%) (2.0%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,088.88 1.0 (1.4) 2.6 MSCI World Index 1,521.00 (1.8) (2.6) (8.5) Silver/Ounce 13.93 0.9 (0.1) 0.5 DJ Industrial 15,988.08 (2.4) (2.2) (8.2) Crude Oil (Brent)/Barrel (FM Future) 28.94 (6.7) (13.7) (22.4) S&P 500 1,880.33 (2.2) (2.2) (8.0) Crude Oil (WTI)/Barrel (FM Future) 29.42 (5.7) (11.3) (20.6) NASDAQ 100 4,488.42 (2.7) (3.3) (10.4) Natural Gas (Henry Hub)/MMBtu 2.18 (0.5) (11.7) (5.7) STOXX 600 329.84 (2.0) (2.8) (9.1) LPG Propane (Arab Gulf)/Ton 30.25 (7.3) (12.3) (22.7) DAX 9,545.27 (1.7) (2.5) (10.8) LPG Butane (Arab Gulf)/Ton 43.50 (4.4) (14.7) (24.3) FTSE 100 5,804.10 (2.9) (3.5) (9.9) Euro 1.09 0.5 (0.1) 0.5 CAC 40 4,210.16 (1.6) (2.3) (8.5) Yen 116.98 (0.9) (0.2) (2.7) Nikkei 17,147.11 0.6 (2.3) (6.9) GBP 1.43 (1.1) (1.8) (3.2) MSCI EM 709.19 (1.9) (4.2) (10.7) CHF 1.00 0.4 (0.7) 0.1 SHANGHAI SE Composite 2,900.97 (3.3) (8.7) (19.1) AUD 0.69 (1.7) (1.3) (5.8) HANG SENG 19,520.77 (1.7) (5.0) (11.5) USD Index 98.96 (0.1) 0.4 0.3 BSE SENSEX 24,455.04 (2.0) (3.3) (8.7) RUB 77.70 2.2 4.0 7.1 Bovespa 38,569.13 (3.5) (5.3) (13.1) BRL 0.25 (1.2) (0.6) (2.2) RTS 652.98 (5.8) (11.4) (13.7) 98.4 88.1 87.9