13 July Daily market report

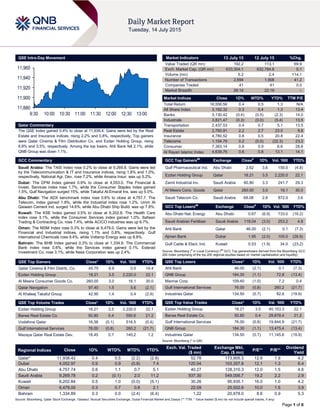

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 0.4% to close at 11,938.4. Gains were led by the Real Estate and Insurance indices, rising 2.2% and 0.8%, respectively. Top gainers were Qatar Cinema & Film Distribution Co. and Ezdan Holding Group, rising 8.9% and 3.5%, respectively. Among the top losers, Ahli Bank fell 2.1%, while QNB Group was down 1.1%. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 9,269.8. Gains were led by the Telecommunication & IT and Insurance indices, rising 1.8% and 1.0%, respectively. National Agr. Dev. rose 7.2%, while Amana Insur. was up 5.2%. Dubai: The DFM Index gained 0.9% to close at 4,053.0. The Financial & Invest. Services index rose 1.7%, while the Consumer Staples index gained 1.5%. Gulf Navigation surged 15%, while Takaful Al-Emarat Ins. was up 5.0%. Abu Dhabi: The ADX benchmark index rose 0.6% to close at 4,757.7. The Telecom. index gained 1.8%, while the Industrial index rose 1.2%. Umm Al Qaiwain Cement Ind. surged 14.6%, while Abu Dhabi Ship Build. was up 7.8%. Kuwait: The KSE Index gained 0.5% to close at 6,202.8. The Health Care index rose 3.1%, while the Consumer Services index gained 1.0%. Safwan Trading & Contracting Co. rose 7.4%, while ACICO industries was up 6.7%. Oman: The MSM Index rose 0.3% to close at 6,479.0. Gains were led by the Financial and Industrial indices, rising 1.1% and 0.8%, respectively. Gulf International Chemicals rose 9.4%, while Voltamp Energy was up 8.8%. Bahrain: The BHB Index gained 0.3% to close at 1,334.9. The Commercial Bank index rose 0.6%, while the Services index gained 0.1%. Esterad Investment Co. rose 3.1%, while Nass Corporation was up 2.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distrib. Co. 45.75 8.9 0.5 14.4 Ezdan Holding Group 18.21 3.5 2,220.0 22.1 Al Meera Consumer Goods Co. 260.00 3.0 16.1 30.0 Qatar Navigation 97.40 1.5 5.6 (2.1) Al Khaleej Takaful Group 42.90 1.4 0.4 (2.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 18.21 3.5 2,220.0 22.1 Barwa Real Estate Co. 50.80 0.4 590.6 21.2 Vodafone Qatar 16.38 (0.1) 516.5 (0.4) Gulf International Services 76.00 (0.8) 260.2 (21.7) Mazaya Qatar Real Estate Dev. 18.45 0.7 140.2 1.2 Market Indicators 13 July 15 12 July 15 %Chg. Value Traded (QR mn) 192.2 113.1 69.9 Exch. Market Cap. (QR mn) 633,304.1 632,784.6 0.1 Volume (mn) 5.2 2.4 114.1 Number of Transactions 2,694 1,908 41.2 Companies Traded 41 41 0.0 Market Breadth 26:14 22:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,556.56 0.4 0.5 1.3 N/A All Share Index 3,192.32 0.3 0.4 1.3 13.4 Banks 3,130.42 (0.4) (0.5) (2.3) 14.0 Industrials 3,821.47 (0.3) (0.0) (5.4) 13.5 Transportation 2,437.53 0.4 0.7 5.1 13.5 Real Estate 2,760.91 2.2 2.7 23.0 9.8 Insurance 4,780.52 0.8 0.5 20.8 22.4 Telecoms 1,154.79 0.2 (0.5) (22.3) 23.2 Consumer 7,363.14 0.8 0.9 6.6 28.6 Al Rayan Islamic Index 4,639.76 0.6 0.8 13.1 14.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Gulf Pharmaceutical Ind. Abu Dhabi 2.62 3.6 150.0 (4.8) Ezdan Holding Group Qatar 18.21 3.5 2,220.0 22.1 Zamil Industrial Inv. Saudi Arabia 60.80 3.3 241.7 29.3 Al Meera Cons. Goods Qatar 260.00 3.0 16.1 30.0 Saudi Telecom Co. Saudi Arabia 68.08 2.8 872.0 3.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Energy Abu Dhabi 0.67 (6.9) 733.0 (16.2) Saudi Arabian Fertilizer Saudi Arabia 118.04 (3.0) 253.2 4.8 Ahli Bank Qatar 46.00 (2.1) 0.1 (7.3) Ajman Bank Dubai 1.95 (2.0) 100.0 (26.9) Gulf Cable & Elect. Ind. Kuwait 0.53 (1.9) 34.0 (23.2) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ahli Bank 46.00 (2.1) 0.1 (7.3) QNB Group 184.30 (1.1) 72.8 (13.4) Mannai Corp. 109.40 (1.0) 7.2 0.4 Gulf International Services 76.00 (0.8) 260.2 (21.7) Industries Qatar 134.50 (0.7) 82.6 (19.9) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 18.21 3.5 40,153.3 22.1 Barwa Real Estate Co. 50.80 0.4 29,878.4 21.2 Gulf International Services 76.00 (0.8) 19,844.9 (21.7) QNB Group 184.30 (1.1) 13,475.4 (13.4) Industries Qatar 134.50 (0.7) 11,145.6 (19.9) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,938.42 0.4 0.5 (2.2) (2.8) 52.78 173,905.3 12.6 1.9 4.2 Dubai 4,052.97 0.9 0.9 (0.8) 7.4 120.04 103,357.8 12.1 1.3 6.4 Abu Dhabi 4,757.74 0.6 1.1 0.7 5.1 40.27 128,310.3 12.0 1.5 4.6 Saudi Arabia 9,269.78 0.2 (0.1) 2.0 11.2 937.30 549,006.7 19.2 2.2 2.9 Kuwait 6,202.84 0.5 1.0 (0.0) (5.1) 30.26 95,935.1 16.0 1.0 4.2 Oman 6,479.00 0.3 0.7 0.8 2.1 22.09 25,502.6 10.0 1.5 3.9 Bahrain 1,334.89 0.3 0.0 (2.4) (6.4) 1.22 20,878.0 8.6 0.9 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,880 11,900 11,920 11,940 11,960 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index gained 0.4% to close at 11,938.4. The Real Estate and Insurance indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Qatar Cinema & Film Distribution Co. and Ezdan Holding Group were the top gainers, rising 8.9% and 3.5%, respectively. Among the top losers, Ahli Bank fell 2.1%, while QNB Group was down 1.1%. Volume of shares traded on Monday rose by 114.1% to 5.2mn from 2.4mn on Sunday. However, as compared to the 30-day moving average of 6.6mn, volume for the day was 20.7% lower. Ezdan Holding Group and Barwa Real Estate Co. were the most active stocks, contributing 42.7% and 11.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 2Q2015 % Change YoY Operating Profit (mn) 2Q2015 % Change YoY Net Profit (mn) 2Q2015 % Change YoY Taiba Holding Co. (Taiba) Saudi Arabia SR – – 54.0 13.0% 57.0 -3.7% Saudia Dairy and Foodstuff Co. (SADAFCO) Saudi Arabia SR – – 62.2 62.6% 58.5 71.5% Aseer Trading, Tourism & Manufacturing Co. (Aseer) Saudi Arabia SR – – 102.6 -1.1% 64.9 0.8% Alahli Takaful Co. (ATC) Saudi Arabia SR 13.7 30.0% 0.0 NA 8.7 32.2% The National Shipping Co. of Saudi Arabia (Bahri) Saudi Arabia SR – – 411.9 245.3% 342.5 162.6% Nama Chemicals Co. (Nama Chemicals) Saudi Arabia SR – – -9.0 NA 6.5 NA The National Co. for Glass Industries (Zoujaj) Saudi Arabia SR – – 5.5 77.4% 16.6 17.7% Saudi Marketing Co. (Farm Superstores) Saudi Arabia SR – – 34.2 16.5% 32.8 12.7% Saudi Cement Co. (SCC) Saudi Arabia SR – – 258.0 -12.8% 254.0 -11.8% Saudi Industrial Services Co. (SISCO) Saudi Arabia SR – – 50.4 23.0% 25.2 16.1% Herfy Food Services Co. (Herfy Food) Saudi Arabia SR – – 49.3 -7.4% 46.3 -11.7% Saudi Company for Hardware (SACO) Saudi Arabia SR – – 38.4 -1.0% 35.9 -4.8% Advanced Petrochemical Co. (APC) Saudi Arabia SR – – 253.5 38.4% 243.2 31.7% Deyaar Development Dubai AED – – – – 85.8 37.5% Al Madina Investment Co.** Oman OMR 0.1 114.2% – – -0.6 NA Financial Services Co. (FSC)* Oman OMR 0.3 -44.0% – – 0.0 NA Oman International Development and Investment Co. (Ominvest)* Oman OMR 44.5 12.8% – – 10.5 11.7% National Detergent Co. Oman OMR 12.0 -5.3% – – 0.3 -37.2% Source: Company data, DFM, ADX, MSM (*IH2015 results,**1Q2015-16 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/13 China General Admin. of Cust. Exports YoY CNY June 2.10% 1.20% -2.80% 07/13 China General Admin. of Cust. Imports YoY CNY June -6.70% -16.20% -18.10% 07/13 China General Admin. of Cust. Trade Balance CNY June 284.20B 355.00B 366.80B 07/13 China National Bureau of Stat. Trade Balance June $46.54B $56.70B $59.49B 07/13 China National Bureau of Stat. Exports YoY June 2.80% 1.00% -2.50% 07/13 China National Bureau of Stat. Imports YoY June -6.10% -15.50% -17.60% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 50.53% 61.23% (20,553,420.45) GCC 11.31% 4.24% 13,564,820.26 Non-Qatari 38.15% 34.52% 6,988,600.19

- 3. Page 3 of 6 News Qatar MARK posts weak 2Q2015 bottom-line – Masraf Al Rayan (MARK) reported a net profit of QR487.6mn in 2Q2015 short of our expectation of QR528.3mn (BBG: QR510mn, Reuters: QR513mn), declining 4.5% QoQ (+ 3.4% YoY). The miss was due to higher than expected operating expenses. MARK reported opex of QR165.1mn vs. our estimate of QR129.0mn. On the other hand, net interest income & investment income (QR546.4mn) was in-line with our estimate of QR547.4mn (- 0.2% variation). The bank’s net interest income & investment income increased by 2.6% QoQ (+7.6% YoY) to QR546.4mn while net fees & commissions were flat QoQ (-27.8% YoY) at QR49.5mn in 2Q2015. Surprisingly, operating expenses surged by 36.8% QoQ and 39.1% YoY to QR165.1mn. Thus, MARK’s cost-to-income jumped to 26.2% vs. 19.7% in 1Q2015 (20.0% in 2Q2014). It should be mentioned that the YoY growth in the bottom-line was primarily driven by QR46.5mn, which is a partial gain from its sale of 50% stake in Seef Lusail Real Estate Development Co. Without this gain, net income would have dropped by 6.4% YoY. Net loans exhibited weakness, declining by 5.3% QoQ (+2.8% YTD) to QR59.5bn. Moreover, deposits followed suit and receded by 4.1% QoQ (down 6.7% YTD). Hence, the LDR remained flattish at 102% vs. 1Q2015 (93% in 2014). Mark’s capital adequacy ratio stood at 18.34%. Asset quality remained superior as the NPL ratio stood at 0.08%. (Company Financials, QNBFS Research) QIBK net income jumps YoY in 2Q2015 – Qatar Islamic Bank’s (QIBK) net income gained by 23.6% QoQ and 26.9% YoY to QR494.7mn in 2Q2015, beating our estimate of QR428.3mn and Reuters consensus estimate of 427.2mn. (Company Financials, QNBFS Research) QOIS to disclose financials on August 10 – Qatar Oman Investment Company (QOIS) will announce the financial reports for the period ending June 30, 2015 on August 10, 2015. (QSE) MCCS to announce financials on August 12 – Mannai Corporation (MCCS) will disclose the financial reports for the period ending June 30, 2015 on August 12, 2015. (QSE) Qatargas, ConocoPhillips sign Incident Assistance agreement – Qatargas and ConocoPhillips have signed an Incident Assistance agreement that will further enhance the Qatargas Response Management System. The agreement will facilitate Qatargas to improve technical expertise to respond effectively in an emergency. (QNA) Manateq awards $459m contract to build first economic zone – Manateq has awarded a $459mn contract for the development of Qatar’s first economic zone, which will focus on logistics and advanced technologies. A consortium formed by Spain's Sacyr and Qatari firm Urbacon Trading & Contracting (UCC) has been hired to design and construct QEZ-1 in Ras Bufontas. The Ras Bufontas project, near the new Hamad International Airport, will specialize in companies in the communications, infotech, energy, logistics, construction, transportation and other sectors. (Bloomberg) MDPS: Qatar gross income, savings drop in 1Q2015 – According to the statistics released by the Ministry of Development Planning & Statistics (MDPS), Qatar’s gross national income (GNI) fell 12% YoY and 3.5% QoQ to QR169.53bn in 1Q2015. The country’s gross national savings declined 23% YoY and 9% QoQ to QR94.49bn. The gross saving ratio to nominal GDP in 1Q2015 has been estimated at 54.6% compared to 61.1% in 1Q2014. The comparative figure for 4Q2014 was 56.6%. The MDPS said rising population and the price rise of consumer items in the country have led the household final consumption expenditure (HFCE) to increase 13% YoY to QR31.53bn in 1Q2015. It had risen 7% QoQ. The share of HFCE in the nominal GDP in 1Q2015 is estimated at 18.2%. The corresponding figures for 1Q2014 and 4Q2014 are 13.8% and 16.1% respectively. The increase in sovereign spending is in line with the rise in production of public goods and services to cater to the growing population. It led the government final consumption expenditure (GFCE) to expand 9% YoY and 5% QoQ to QR29bn in 1Q2015. The proportion of GFCE in nominal GDP during 1Q2015 has been estimated at 16.8%. The corresponding shares for 1Q2014 and 4Q2014 have been 13.2% and 15.1% respectively. The ministry said major investments in the construction sector, especially in the infrastructure-related projects, has resulted in the gross capital formation (GCF) to increase 18% YoY to QR61.09bn in 1Q2015. It registered a 10% QoQ jump. The GCF accounted for 41.8% of nominal GDP during 1Q2015 against 30.4% in 1Q2014. The corresponding share for 4Q2014 has been estimated at 35.9%. Qatar’s total exports (valued at free on board) plunged 35% YoY to QR94.05bn in 1Q2015 mainly due to lower shipments of mineral fuels, lubricants and related materials. Exports had fallen 19% QoQ. Exports constituted 54.4% of nominal GDP in 1Q2015 compared to 72.1% in 1Q2014. The corresponding share for 4Q2014 was 63.5%. Total imports (valued at cost insurance freight) showed a 9% YoY fall to QR53.82bn in 1Q2015 on lower intake of miscellaneous manufactured articles, transport and communication service. It had declined 4% QoQ. Imports accounted for 31.1% of nominal GDP in 1Q2015 against 29.5% in 1Q2014. Its share was 30.6% in 4Q2014. (Gulf- Times.com) New road to link Hamad Port and truck route – A new link road has been opened between Hamad Port and the Temporary Truck Route (TTR), also known as Route 55. According to the Public Works Authority (Ashghal), the new road will help ease the flow of heavy vehicles from the Hamad Port being developed on the southern side of Doha to Route 55 ahead of its full-scale commercial operations. The road, known as Mesaieed Road 1, is approximately 4 kilometers long and has two lanes in each direction, one of which is dedicated for heavy vehicles, similar to the existing Route 55. The road is considered a vital addition to the country's road network as it will form a free-flowing traffic route without entering Doha city, helping to alleviate congestion and manage the heavy vehicle movement better. (Gulf- Times.com) CBQK ties up with Credit Bureau Office for faster loans, credit cards – Commercial Bank (CBQK) has forged ties with the Credit Bureau Office making it the first bank in Qatar to use a live link to approve and process loans and credit card applications within minutes. CBQK CEO Abdulla Saleh al-Raisi said all CBQK customers will now enjoy “enhanced banking experience” and “the fastest approval times” for personal and vehicle loans, as well as credit cards in Qatar. (Gulf-Times.com) Beema net profit touches QR32mn in 1H2015 – Damaan Islamic Insurance Company (Beema) has reported a net profit of QR32mn for 1H2015. The company recorded a gross contribution of QR172mn and surplus of QR9mn from insurance operations in 1H2015, rising 21% and 14% YoY, respectively. (Peninsula Qatar) International US annual budget deficit drops on June budget surplus – The US Treasury Department has said that the budget deficit remained near its lowest level in seven years in June amidst a

- 4. Page 4 of 6 brightening economic outlook that has boosted revenues. The US reported a $52bn surplus in June, a month in which the government in recent decades has typically generated a surplus on account of corporate and individual taxes collected at month’s end. The monthly surplus brought the budget deficit over the past 12 months to $431bn, down nearly 20% YoY. It represents the second lowest 12-month deficit since August 2008. The budget picture has improved this year amidst higher revenues and better economic growth, even though federal spending has also ticked higher. Revenue for the 12-month period ended June is nearly 9% over the year-earlier level, while spending is up 4%. (WSJ) Greece secures rescue deal, Tsipras faces party revolt – Greece reached a rescue deal on Monday morning after a weekend of often-acrimonious negotiations among eurozone leaders and finance ministers. This gives the debt-stricken country a fighting chance to hold on to the euro as its currency. But its success depends on Greeks swallowing an even-tougher austerity plan than the one they rejected overwhelmingly in a referendum on July 5. The terms imposed by international lenders led by Germany, require Tsipras to pass legislation to cut pensions, increase value added tax, clamp down on collective bargaining agreements and put in place quasi- automatic spending constraints. In addition, he must set €50bn of public sector assets aside to be sold off under the supervision of foreign lenders and get the whole package through parliament by Wednesday. However, as a result of the deal, Tsipras faces a showdown with rebels in his own party furious at his capitulation to German demands for one of the most sweeping austerity packages ever demanded of a eurozone government. Left-wing rebels in the ruling Syriza party, and his junior coalition partner, the right-wing Independent Greeks party, indicated they would not tear up election pledges that brought them to power in January. (WSJ, Reuters) China June exports gain signal stabilizing economy – According to China’s Customs Department, overseas shipments rose 2.1% YoY in Yuan value. Exports rose for the first time in four months in June, providing fresh evidence that growth is stabilizing ahead of the gross domestic product data due this week. On the other hand, imports dropped 6.7%, narrowing from the fall of 18.1% previously reported in May, leaving a trade surplus of Yuan 284.2bn. Demand from the US continues to underpin China’s shipments, with exports to the world’s biggest economy climbing 12% YoY in June. The improvement in exports provides a cushion for an economy weighed by a slump in investment growth that is putting Premier Li Keqiang’s 2015 growth target of about 7% at risk. (Bloomberg) India inflation rises in June, reduces room for rate cuts – According to data released by the Statistics Ministry, India’s consumer prices rose 5.4% YoY in June after a 5.01% increase in May. The increase in inflation exceeded a 5.1% estimate, decreasing room for central bank Governor Raghuram Rajan to cut interest rates again to boost investment. Food prices rose 5.48% YoY in June after a 4.8% gain in May, led by a 22% surge in pulses. Food accounts for about 50% of India’s CPI basket. A reduction in one of Asia’s highest borrowing costs may help spur new investment from a one-year low. (Bloomberg) Singapore economy contracts QoQ, hit by shrinking manufacturing – Singapore’s Trade Ministry has reported that the GDP fell an annualized 4.6% in 2Q2015 from 1Q2015. The contraction in economy underscores the weakening outlook for Asian nations amidst sluggish global growth. Manufacturing shrank an annualized 14% in 2Q2015 from 1Q2015. Construction contracted 0.2%, while services fell 2.6% in the same period. Singapore’s economy expanded 1.7% in 2Q2015 on a YoY basis after growing a revised 2.8% in 1Q2015. According to data compiled by Bloomberg, the economy’s contraction is the worst since 3Q2012. A commodities slump, China’s slowdown and uneven recoveries in the US and Europe have damped exports that power many Asian economies. (Bloomberg) Regional GOIC: GCC food industries’ investments expanded to $24bn in 2014 – Gulf Organization for Industrial Consulting (GOIC) in its latest report ‘GCC Food Industries’ Directory 2015’ said that the number of factories operating in the GCC food industries sector increased from 1,606 in 2010 to 1,965 in 2014, reflecting a CAGR of 5.2%. Investments jumped from $13.69bn to $23.76bn over the same period, at a five-year CAGR of 14.8%, while the labor force increased from 159,613 workers to 238,825 workers, at a CAGR of 10.6%. GOIC Secretary General, Abdulaziz Bin Hamad Al-Ageel said that the sector represents approximately 12.1% of the total manufacturing industries, about 6.2% of the total investments and 15.6% of the total manufacturing labor force. (GulfBase.com) Saudi Total achieves ISO 14001 certification – Saudi Total has achieved the Environmental Management System certificate ISO 14001 for its plant in King Abdullah Economic City. The plant has been awarded this certificate on the basis of recommendations of the ISO International Commission in less than two years of startup. (GulfBase.com) UNIKAI raises GCC ownership limit – The Dubai Financial Market (DFM) announced that United Kaipara Dairies Company (UNIKAI) has raised the ownership limit of its stocks to GCC citizens to 49%, effective July 12, 2015. Asteco: Abu Dhabi residential market witnesses uptick – According to Asteco’s UAE Property Review report, apartment rental rates for prime buildings are on the increase in Abu Dhabi. The report highlighted average rise of 6% (1Q-2Q2015) and 4% (YoY) respectively for apartment rental rates and sales prices and said the new legislation is set to reinforce market credibility with prime supply to grow significantly from 2018. The majority of prime, high and mid-quality developments increased by 4-6% upon contract renewal, whereas new leases were on an average, 8% higher than what it was in 1Q2015. Abu Dhabi’s most popular prime developments, such as the Eastern Mangroves and St Regis Residences by TDIC, recorded rent renewal increases of 12% and 10% respectively, with long prospective tenant waiting lists, indicating the continued lack of prime quality supply in the capital. Sales prices for apartments and villas remained steady, continuing the trend of the last 12 months, although the YoY figures showed an average positive growth of 4% in apartment sales prices. (GulfBase.com) SCAD: Abu Dhabi inflation rises 1.2% QoQ in 2Q2015 – According to the Statistics Centre Abu Dhabi (SCAD), the average consumer prices in Abu Dhabi rose 1.2% QoQ in 2Q2015. The highest rises in 2Q2015 were observed in the restaurants and hotels group, which was up 3.0%. SCAD said in its report that average consumer prices rose 1.1% MoM in June 2015. The housing, water, electricity, gas, and other fuels category recorded a 2% increase during June, posting the largest rise, followed by food and beverages with a 1.2% gain. The growth in June 2015 pushed consumer prices up 1% for citizen households, 1.2% for non-citizen households and 1.1% for share households. (GulfBase.com) Boubyan Bank net profit surges 28% YoY in 1H2015 – Boubyan Bank reported a net profit of KD16mn in 1H2015 as compared to KD12.6mn in 1H2014, reflecting an increase of

- 5. Page 5 of 6 28% on a YoY basis. The bank’s total assets rose 19% to KD2.9bn and operating income climbed 12% to KD43.8mn. Customer deposits stood at KD2.3bn, showing an increase of 25% and the financing portfolio rose to KD2mn, up by 21%. EPS amounted to 7.78 fils in 1H2015 versus 6.1 fils in 1H2014. (GulfBase.com) Bank Sohar reports 14.12% YoY decrease in net profit in 2Q2015 – Bank Sohar reported a net profit of OMR13.87mn in 2Q2015, reflecting a decrease of 14.12% YoY. The bank’s operating income reached OMR34.3mn in 2Q2015 as compared to OMR35.27mn in 2Q2014. Total assets stood at OMR2.1bn at the end of June 30, 2014 as compared to OMR1.9bn at the end of June 30, 2014. Bank Sohar’s net loans & advances reached OMR1.58bn, showing an increase of 15.51% YoY, while its customer deposits stood at OMR1.57bn. (MSM) Orpic, Pörner sign deal for bitumen unit – Oman Daily Observer reported that Oman Oil Refineries and Petroleum Industries Company (Orpic) has signed a deal with Austria- based Pörner Group, a leading engineering contractor, to provide proprietary Biturox technology for a bitumen production unit planned in Sohar. The bitumen production unit will be a part of the multi-billion dollar Sohar Refinery Improvement Project (SRIP) and will enable Oman to produce bitumen in the sultanate for the first time. The country has completely depended on imports from Iran and the UAE for its bitumen requirements in order to carry out projects such as asphalting of roads, and various other infrastructure-related works. It further reported that Pörner Group said it will support the construction of a bitumen unit featuring a pair of reactors each with a capacity to produce 516 tons per day (tpd) of bitumen. In addition to supplying the license and basic engineering, the group will also undertake the detailed engineering, pilot testing and commissioning of the new Biturox unit. (Bloomberg)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 QSE Index S&P Pan Arab S&P GCC 0.2% 0.4% 0.5% 0.3% 0.3% 0.6% 0.9% (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,157.97 (0.5) (0.5) (2.3) MSCI World Index 1,758.69 0.9 0.9 2.9 Silver/Ounce 15.51 (0.5) (0.5) (1.2) DJ Industrial 17,977.68 1.2 1.2 0.9 Crude Oil (Brent)/Barrel (FM Future) 57.85 (1.5) (1.5) 0.9 S&P 500 2,099.60 1.1 1.1 2.0 Crude Oil (WTI)/Barrel (FM Future) 52.20 (1.0) (1.0) (2.0) NASDAQ 100 5,071.51 1.5 1.5 7.1 Natural Gas (Henry Hub)/MMBtu 2.88 4.8 4.8 (3.9) STOXX 600 396.46 1.0 1.0 5.4 LPG Propane (Arab Gulf)/Ton 41.00 (2.4) (2.4) (16.3) DAX 11,484.38 0.5 0.5 6.2 LPG Butane (Arab Gulf)/Ton 54.25 (1.4) (1.4) (13.5) FTSE 100 6,737.95 1.2 1.2 2.1 Euro 1.10 (1.4) (1.4) (9.1) CAC 40 4,998.10 0.9 0.9 6.5 Yen 123.43 0.5 0.5 3.0 Nikkei 20,089.77 1.1 1.1 11.5 GBP 1.55 (0.2) (0.2) (0.6) MSCI EM 943.01 1.1 1.1 (1.4) CHF 1.05 (1.2) (1.2) 4.6 SHANGHAI SE Composite 3,970.39 2.5 2.5 22.7 AUD 0.74 (0.5) (0.5) (9.4) HANG SENG 25,224.01 1.3 1.3 6.9 USD Index 96.86 0.9 0.9 7.3 BSE SENSEX 27,961.19 0.9 0.9 1.3 RUB 56.55 0.2 0.2 (6.9) Bovespa 53,119.47 2.4 2.4 (10.6) BRL 0.32 0.8 0.8 (15.4) RTS 915.47 1.1 1.1 15.8 143.4 122.4 116.6