11 August Daily market report

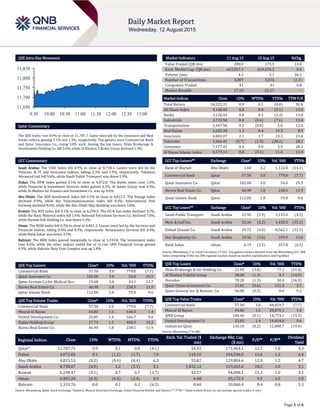

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.9% to close at 11,787.7. Gains were led by the Insurance and Real Estate indices, gaining 2.1% and 1.3%, respectively. Top gainers were Commercial Bank and Qatar Insurance Co., rising 3.0% each. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 3.0%, while Al Khaleej Takaful Group declined 1.3%. GCC Commentary Saudi Arabia: The TASI Index fell 0.9% to close at 8,758.1. Losses were led by the Telecom. & IT and Insurance indices, falling 2.3% and 1.9%, respectively. Takween Advanced Ind. fell 9.6%, while Saudi Public Transport was down 5.9%. Dubai: The DFM Index gained 0.1% to close at 4,072.8. The Banks index rose 1.0%, while Financial & Investment Services index gained 0.3%. Al Salam Group rose 4.3%, while Al-Madina for Finance and Investment Co. was up 4.0%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,815.5. The Energy index declined 0.9%, while the Telecommunication index fell 0.4%. International Fish Farming declined 8.6%, while the Abu Dhabi Ship Building was down 3.8%. Kuwait: The KSE Index fell 0.1% to close at 6,294.5. The Oil & Gas index declined 3.2%, while the Basic Material index fell 1.6%. National Petroleum Services Co. declined 7.8%, while Human Soft Holding Co. was down 6.3%. Oman: The MSM Index fell 0.3% to close at 6,401.2. Losses were led by the Services and Financial indices, falling 0.4% and 0.3%, respectively. Renaissance Services fell 4.4%, while Bank Sohar was down 3.5%. Bahrain: The BHB Index gained marginally to close at 1,333.8. The Investment index rose 0.6%, while the other indices ended flat or in red. GFH Financial Group gained 4.9%, while Bahrain Duty Free Complex was up 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Commercial Bank 57.50 3.0 779.0 (7.7) Qatar Insurance Co. 102.00 3.0 54.0 29.5 Qatar German Co for Medical Dev. 15.60 2.0 43.1 53.7 Barwa Real Estate Co. 46.90 1.8 238.5 11.9 Qatar Islamic Bank 112.00 1.8 59.8 9.6 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Commercial Bank 57.50 3.0 779.0 (7.7) Masraf Al Rayan 44.80 1.6 640.0 1.4 United Development Co. 25.85 1.4 566.7 9.6 Ezdan Holding Group 17.79 1.1 408.9 19.2 Barwa Real Estate Co. 46.90 1.8 238.5 11.9 Market Indicators 11 Aug 15 10 Aug 15 %Chg. Value Traded (QR mn) 200.0 175.5 14.0 Exch. Market Cap. (QR mn) 622,957.3 619,476.2 0.6 Volume (mn) 4.2 3.1 36.1 Number of Transactions 3,007 3,076 (2.2) Companies Traded 41 41 0.0 Market Breadth 27:10 22:15 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,322.31 0.9 0.1 (0.0) N/A All Share Index 3,148.40 0.8 0.0 (0.1) 13.0 Banks 3,126.43 0.8 0.3 (2.4) 13.8 Industrials 3,733.58 0.4 (0.6) (7.6) 13.0 Transportation 2,447.96 0.1 (0.8) 5.6 12.6 Real Estate 2,682.48 1.3 0.4 19.5 8.9 Insurance 4,882.07 2.1 1.7 23.3 23.0 Telecoms 1,066.42 (0.7) (1.9) (28.2) 28.1 Consumer 7,177.41 0.4 0.0 3.9 28.1 Al Rayan Islamic Index 4,579.14 0.8 (0.1) 11.6 13.4 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bank of Sharjah Abu Dhabi 1.60 3.2 1,122.0 (14.1) Commercial Bank Qatar 57.50 3.0 779.0 (7.7) Qatar Insurance Co. Qatar 102.00 3.0 54.0 29.5 Barwa Real Estate Co. Qatar 46.90 1.8 238.5 11.9 Qatar Islamic Bank Qatar 112.00 1.8 59.8 9.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Public Transport Saudi Arabia 22.92 (5.9) 3,143.0 (4.5) Med. & Gulf Ins. Saudi Arabia 32.46 (4.2) 1,450.5 (35.2) Etihad Etisalat Co. Saudi Arabia 29.72 (4.0) 8,562.1 (32.3) Dur Hospitality Co. Saudi Arabia 33.56 (3.6) 103.9 15.0 Bank Sohar Oman 0.19 (3.5) 357.8 (6.3) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv Holding Co. 22.95 (3.0) 77.1 (31.4) Al Khaleej Takaful Group 38.00 (1.3) 8.7 (14.0) Ooredoo 78.20 (1.3) 30.4 (36.9) Qatar Oman Investment Co. 15.81 (0.6) 121.5 2.7 Qatar General Ins. & Reinsur. Co. 56.00 (0.5) 0.0 9.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Commercial Bank 57.50 3.0 44,829.7 (7.7) Masraf Al Rayan 44.80 1.6 28,676.1 1.4 QNB Group 180.40 (0.1) 14,773.1 (15.3) United Development Co 25.85 1.4 14,654.8 9.6 Industries Qatar 136.10 (0.2) 12,088.7 (19.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,787.71 0.9 0.1 0.0 (4.1) 54.92 171,064.1 12.1 1.8 4.3 Dubai 4,072.82 0.1 (1.2) (1.7) 7.9 110.10 104,596.0 12.6 1.3 6.4 Abu Dhabi 4,815.53 (0.2) (0.4) (0.4) 6.3 55.82 129,804.6 12.0 1.5 4.7 Saudi Arabia 8,758.07 (0.9) 1.2 (3.7) 5.1 1,032.12 519,265.0 18.5 2.0 3.1 Kuwait 6,294.47 (0.1) 0.7 0.7 (3.7) 42.57 94,098.1 15.3 1.0 4.2 Oman 6,401.20 (0.3) (0.5) (2.4) 0.9 6.48 25,172.3 9.5 1.5 3.9 Bahrain 1,333.76 0.0 0.1 0.2 (6.5) 0.60 20,860.4 8.4 0.8 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,650 11,700 11,750 11,800 11,850 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.9% to close at 11,787.7. The Insurance and Real Estate indices led the gains. The index rose on the back of buying support from GCC shareholders despite selling pressure from Qatari and non-Qatari shareholders. Commercial Bank and Qatar Insurance Co. were the top gainers, rising 3.0% each. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 3.0%, while Al Khaleej Takaful Group declined 1.3%. Volume of shares traded on Tuesday rose by 36.1% to 4.2mn from 3.1mn on Monday. Further, as compared to the 30-day moving average of 4.1mn, volume for the day was 2.1% higher. Commercial Bank and Masraf Al Rayan were the most active stocks, contributing 18.6% and 15.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 2Q2015 % Change YoY Operating Profit (mn) 2Q2015 % Change YoY Net Profit (mn) 2Q2015 % Change YoY Renaissance Services* Oman OMR 117.9 0.5% – – -1.9 NA Zain Bahrain Bahrain BHD 17.5 -3.6% 1.2 -17.4% 1.1 -8.2% The Bahrain Shipping Repairing & Engineering (BASREC) Bahrain BHD 1.5 18.6% – – 0.3 -10.7% Banader Hotels Co. (BANADER) Bahrain BHD – – – – -0.1 NA Source: Company data, DFM, ADX, MSM (*1H2015 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/11 US Census Bureau Wholesale Inventories MoM June 0.90% 0.40% 0.60% 08/11 US Census Bureau Wholesale Trade Sales MoM June 0.10% 0.50% 0.20% 08/11 EU ZEW Zentrum fuer Europaeische ZEW Survey Expectations August 47.6 – 42.7 08/11 Germany Destatis Wholesale Price Index MoM July 0.10% – -0.20% 08/11 Germany Destatis Wholesale Price Index YoY July -0.50% – -0.50% 08/11 UK The British Retail Consortium BRC Sales Like-For-Like YoY July 1.20% 1.00% 1.80% 08/11 Italy ISTAT CPI FOI Index Ex Tobacco July 107.2 – 107.3 08/11 China National Bureau of Statistics New Yuan Loans CNY July 1,480.0B 750.0B 1,279.1B 08/11 China National Bureau of Statistics Aggregate Financing CNY July 718.8B 1,006.7B 1,858.1B 08/11 China The People's Bank of China Money Supply M0 YoY July 2.90% 3.10% 2.90% 08/11 China The People's Bank of China Money Supply M1 YoY July 6.60% 4.90% 4.30% 08/11 China The People's Bank of China Money Supply M2 YoY July 13.30% 11.70% 11.80% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 48.03% 50.86% (5,650,949.81) GCC 19.78% 7.39% 24,783,980.12 Non-Qatari 32.19% 41.76% (19,133,030.31)

- 3. Page 3 of 6 News Qatar QEWS to start QR10bn power and water project in Umm Al Houl – Qatar Electricity and Water Company (QEWS) General Manager Mr. Fahad Hamad Al Mohannadi has announced the launch of the construction of a major power and water project in Umm Al Houl. The station with a production capacity of 2520 megawatts (MW) of electricity and 136mn gallons of drinking water per day is expected to cost QR10bn. The construction is expected to start in October 2015. QEWS owns 60% of the project while other stakeholders include state-owned Qatar Petroleum and Qatar Foundation. The Umm Al Houl plant will be implemented in three phases. The first stage will process 40mn gallons of water per day in April 2017 while additional 20mn gallons of water will be processed in the second phase in May 2017. The Umm Al Houl will also witness the production of 1620 MW of electricity in July 2017. The project will be implemented fully by 2H2018. (QSE, Peninsula Qatar) Ashghal: Lane on Al Shamal Road to be closed for three months – The Public Works Authority (Ashghal) has announced closure of one lane in each direction of Al Shamal Road (near the Al Rayyan interchange) from August 13, 2015 midnight. Ashghal said the closure, which extends to about 300 meters and is scheduled to last three months, will not affect traffic as an alternative lane will be provided in each direction. This will be done to maintain the same number of lanes - three - as the existing road. The closure is being carried out to facilitate the construction of a bridge that will link Al Rayyan Road with Al Shamal Road. It will help reduce traffic congestions in the Rayyan area. (Gulf-Times.com) Kahramaa switching to smart meters by 2016 – According to sources, Qatar General Electricity & Water Corporation (Kahramaa) intends to replace conventional meters in the Doha area with smart meters by 2016. Smart meter installation provides real-time information on energy, water or natural gas consumption of a building. (Gulf-Times.com) QA wins two awards for flagship A380 and A350 aircraft – Qatar Airways (QA), crowned Airline of the Year at the Skytrax World Airline Awards 2015, has won two awards at the recent Australian Business Traveler Awards. The Doha-based carrier’s superjumbo A380 Lounge was named “Best Inflight Lounge” and the airline also won the “Best Economy Class” accolade for its A350 Economy Class cabin. Meanwhile, QA has deployed the world’s newest aircraft on the Doha-Dubai route during August 2015. Starting August 8, the airline is showcasing its state-of-the-art A350 on 28 of its Dubai Shuttle frequencies, up until September 1. (Bloomberg, Gulf-Times.com) International US productivity rebounds in 2Q2015, but trend still soft – The US non-farm productivity rebounded in 2Q2015, but a weak underlying trend suggested inflation could pick up more quickly than what economists have anticipated. The Labor Department said productivity increased at a 1.3% annual rate in the April-June period. But productivity, which measures hourly output per worker, rose only 0.3% YoY. In line with annual revisions to GDP published last week, the 1Q2015 productivity was revised to show it falling at a 1.1% rate instead of the previously reported 3.1% pace of decline. Productivity is one of the metrics the Federal Reserve is watching as it contemplates raising interest rates for the first time in nearly a decade. Meanwhile, the National Federation of Independent Business said its Small Business Optimism Index increased 1.3 points to 95.4 in July as owners anticipated solid sales and inventory growth, providing another boost to the economic outlook for 3Q2015. (Reuters) German investor confidence slid in August on global slowdown – German investor confidence unexpectedly fell, signaling concern that a global slowdown could weigh on Europe’s powerhouse economy. The ZEW Center for European Economic Research said its index of investor and analyst expectations, which aims to predict economic developments six months ahead, slid to 25 in August from 29.7 in July. The reading is the lowest since November 2014. ZEW President Clemens Fuest said that the German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances, a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined. (Bloomberg) Greece reaches bailout deal with creditors – Greece and its international lenders reached an €85bn bailout agreement on Tuesday after nailing down the terms of new loans needed to save the country from financial ruin. The deal, which came after 23 hours of talks that continued through the night, must still be adopted by Greece’s parliament and by Eurozone countries. The currency bloc’s finance ministers are expected to approve it on August 14, in time for Greece to make a crucial €3.2bn debt repayment that falls due next week. A Greek Finance Ministry official said the pact would be worth up to €85bn in fresh loans over three years. Greek banks would get €10bn immediately and would be recapitalized by 2015-end. The talks also agreed on final fiscal targets that should govern the bailout effort, aiming for a primary budget surplus, which excludes interest payments, from 2016. (Reuters) IMF: China’s new yuan midpoint mechanism a welcome step – The International Monetary Fund (IMF) has said that the move by China’s central bank on Tuesday to change the mechanism for setting the daily reference rate for the yuan “appears a welcome step” as it should allow market forces to have a greater role in determining the exchange rate. An IMF spokesperson said greater exchange rate flexibility is important for China as it strives to give market forces a decisive role in the economy and is rapidly integrating into global financial markets. The spokesperson added the announced change by China has no direct implications for the criteria used in determining the composition of the IMF’s SDR basket. Nevertheless, a more market-determined exchange rate would facilitate SDR operations in case the Renminbi were included in the currency basket going forward. (Reuters) Regional MENA records PE deals worth $2.7bn in 1H2015 – According to Al Masah Capital, the Middle East and North Africa (MENA) region recorded private equity (PE) activity worth $2.7bn and IPOs worth $915mn during 1H2015. The staggering figures come on the back of a steady economic outlook for the region, which is forecasted at 2.4% in 2015 for oil-exporting countries. Al Masah Capital stated that the region witnessed a total of 16 PE deals worth $2.67bn during 1H2015 as compared to 26 deals worth $128.7mn in 1H2014. Both Saudi Arabia and the UAE witnessed the largest number of deals in 1H2015, while Algeria led in terms of value. The UAE, Saudi Arabia, Lebanon and Egypt are expected to be frontrunners in PE activity during 2H2015. In terms of fund raising activities during the period, the MENA region undertook 16 IPOs worth $914.9mn. (Peninsula Qatar) OPEC raises 2015 oil demand outlook despite dull markets – The Organization of the Petroleum Exporting Countries (OPEC) revised upward its growth forecast for global oil demand in 2015 and maintained projected record levels of world consumption in 2016, despite turbulent market conditions spurred by financial instability in Greece and China. In its August monthly report, the

- 4. Page 4 of 6 OPEC said it was expecting world oil demand to grow by 1.38mn barrels per day – around 90,000 more than announced in its July estimates, following an increase in July. Earlier this year, OPEC slashed its prediction of non-OPEC supply for 2015, expecting lower prices to lead to a slowdown. (Gulf-Base.com) Tadawul announces beginning of first subscription period for AMTC – The Saudi Stock Exchange (Tadawul) announced that first subscription period and tradable rights trading for Alinma Tokio Marine Company (AMTC) has begun which starts from August 11 and ends on August 20. (Tadawul) Sipchem to shut down methanol plant for maintenance – Saudi International Petrochemical Company (Sipchem) will shut down its methanol plant for around four weeks for maintenance in 4Q2015. The company would upgrade major equipment at the plant. Sipchem said that there is enough inventory to limit the impact of this maintenance program. (GulfBase.com) SABB plans dollar-denominated bond issue – According to sources, Saudi British Bank (SABB) is planning to issue a dollar- denominated bond in international markets. The deal would happen by 3Q2015-end, subject to market conditions, and would look to refinance an existing $600mn bond which is set to mature in November 2015. The deal is likely to be arranged solely by HSBC, which has a 40% stake in SABB. (Reuters) Mansour Al Mosaid wins NPCC bidding – Saudi-based Mansour Al Mosaid has won bidding of Pakistan-based National Power Construction Company (NPCC) as privatization of national institutions continues. The company has bought NPCC with a bid of at least Pakistani Rupees (PKR) 2.49bn. Mosaid offered PKR1,420 per share. The Pakistan government had offered 80% of the company’s shares to potential buyers, while the remaining 12% are owned by the employees. (Bloomberg) Indian Prime Minister to visit UAE to enhance two-way trade – Indian Prime Minister Narendra Modi's two-day visit next week to the UAE promises to give a new impetus and focus to the thriving trade and investments between the two countries, besides paving the way for a spate of accords covering a wide range of topics. India-UAE trade, valued at $180mn per annum in the 1970s, is today around $60bn, making UAE India's third largest trading partner for the year 2014-15 after China and the US. The UAE is the second largest export destination of India with an amount of over $33bn for the year 2014-15, while for the UAE, India is the largest trading partner for the year 2014 with an amount of over $28bn (non-oil trade). There is an estimated $8bn UAE investment in India, of which around $3.01bn (January 2015) is in the form of FDI, while the remaining is portfolio investment. (GulfBase.com) NBAD to act as borrowing agent in UAE – National Bank of Abu Dhabi (NBAD) had won approval to act as the first securities lending and borrowing agent in the UAE, as part of reforms aimed at adding liquidity and efficiency to the market. NBAD will be able to borrow, and lend out, shares for use in market making activities. Lenders will be able to earn revenue from the use of their shares and NBAD as the borrower, will be obliged to return the securities to the lender at an agreed date, on demand. (Bloomberg) Amanat acquires 35% beneficial interest in Sukoon International Holding – Amanat Holdings through its affiliate has acquired 35% beneficial interest in Sukoon International Holding for a consideration of SR179.2mn. Sukoon is a Saudi Arabian healthcare company specializing in extended care and critical care medical services, with operations in Jeddah and expansion plans underway in Riyadh. (DFM) EIBank reports AED6.6mn net profit in 2Q2015 – Emirates Investment Bank (EIBank) reported a net profit of AED6.6mn in 2Q2015 as compared to AED15.77mn in 2Q2014. Operating income stood at AED22.98mn in 2Q2015 as compared to AED32.99mn in 2Q2014. The bank’s total assets stood at AED3.51bn as of June 30, 2015 as compared to AED3.50bn at the end of December 31, 2014. Net loans & advances reached AED639.59mn, while customer deposits stood at AED2.99bn. EPS amounted to AED9.43 in 2Q2015 versus AED22.53 in 2Q2014. (DFM) Egypt-based Lumiglass Industries plans product diversification – Egypt-based Lumiglass Industries is planning to diversify its product offering in the architectural Bullet Resistant Glass sector in line with rising industry demand amid rampant construction activities in the region. The company aims to ramp up its market presence across the GCC region, other Middle East countries, Asia and possible expansion into new markets across the African continent. Lumiglass Industries is a component of Glass LLC and a subsidiary of Dubai Investments. (DFM) Dubai Customs delivers 4.5mn transactions in 1H2015 – According to the statistics provided by Dubai Customs, Dubai Customs processed around 4.5mn transactions in 1H2015 as compared to 4.2mn transactions processed in 1H2014. The customs transactions for Dubai Customs customers comprise 19 main services provided through 23 inland, port and airport customs centers distributed across Dubai. There was a considerable increase in the total number of transactions for ‘Request for Guarantees/Deposits Claims and Refunds’ service from 488,334 transactions during 1H2014 to 628,455 during 1H2015. (GulfBase.com) Emirates NBD: Dubai’s non-oil growth slows as weak crude prices hit tourism – According to Emirates NBD, the growth in Dubai’s non-oil sector slowed in July 2015 to its lowest rate since March 2012, as the effect of the low oil price spilt over into reduced tourist activity in the Emirate. The Emirates NBD economic tracker, an informal indicator of growth, offered a headline reading of 53.8, down from 55.5 in June 2015. Any reading above 50.0 indicates that the economy is expanding. Tourism was especially badly hit, falling to 50.5 in July 2015, down from 55.3 in June 2015. Occupancy in Dubai’s hotels was down 15.4% in June 2015. Revenue per available room, a measure of hotel profits, fell 22.7% to AED373 per room, while the average daily room rate fell 8.6% to AED593. Part of the slowing growth is probably because of the plunge in oil prices, in which Brent crude fell from $100 per barrel in June 2014 to about $50 per barrel this week. (GulfBase.com) Egypt-based Beltone joins NASDAQ Dubai as market maker – Beltone Market Maker, a subsidiary of Egypt-based Beltone Financial, has joined NASDAQ Dubai to provide market-making services. Beltone Market Maker will initially focus on market making in equities as well as offer simultaneous bid and offer prices in selected securities listed on NASDAQ Dubai. (Reuters) Fujairah Cement Finance Manager steps down – Fujairah Cement Industries announced that Mr. V. Sreenivasa Murthy has quit as Finance Manager, effective July 31, 2015. Mr. B.T. Jacob has taken over as the Finance Manager from August 1. (ADX) Finance House reports AED66.2mn net profit in 1H2015 – Finance House reported a consolidated net profit of AED66.2mn in 1H2015, reflecting an increase of 8.2% YoY. The company said that net interest income and income from Islamic financing and investing assets grew by 46.7% YoY to reach AED93.4mn during 1H2015 on the back of a sustained growth in the lending book and targeted expansion of the fixed income portfolio, as compared to AED63.7mn 1H2014. Income from proprietary investment portfolio stood at AED70.3mn in 1H2015, indicating an increase of 5.4% YoY. Earnings per share (EPS) surged 21% to 23 fils per share in 1H2015 from 19 fils per share in 1H2014. (GulfBase.com) Etisalat’s Nigerian affiliate completes transfer of 555 telecom towers to HIS – Emirates Telecommunication Corporation’s

- 5. Page 5 of 6 (Etisalat) Nigerian affiliate has completed the transfer of 555 telecom towers to Africa's IHS, the second tranche of a sale and leaseback deal announced in 2014. The move is part of Etisalat's strategy to improve the quality of its network and to accelerate the roll-out of 2G, 3G and 4G coverage in Nigeria. Following the deal, HIS will own and manage over 15,500 installations in Nigeria and over 23,100 in Africa as a whole. Earlier, in August 2014, Etisalat Nigeria had signed a deal to sell 2,136 of its towers to privately- held IHS and lease them back as part of plans to expand its coverage in Africa's biggest economy. (GulfBase.com) Sembcorp Salalah clarifies on debt refinancing news – With reference to media news on Sembcorp Salalah refinancing, the company has clarified that in line with their Annual Report 2014, it is exploring refinancing of its senior loans under the prevailing market conditions. However, it is premature to conclude the viability and the details of refinancing at this stage. (MSM) MPC’s promoters sign three major agreements for 120 megawatt project – Musandam Power Company’s (MPC) promoters have signed three major agreements with financial institutions and government agencies for implementing the 120 megawatt project in Musandam governorate. MPC has inked a finance agreement with Bank Muscat, while it signed a power purchase agreement and natural gas sales pact with Oman Power and Water Procurement Company and Oman’s Ministry of Oil & Gas. MPC is developing a new dual fuel independent power plant (Musandam IPP) at Tibat in the Wilayat of Bukha in Musandam with a capacity of 120 megawatt. (TimesofOman) Omani insurance firms achieve 9% growth in gross premiums – Omani insurance companies’ gross direct premium grew by 9% to OMR246.44mn in 1H2015 from OMR226.89mn in 1H2014. The medical insurance sector witnessed the maximum growth of 32% at OMR63.07mn for 1H2015 from OMR47.96mn in 1H2014. Net direct premium also increased by 13% to OMR135.27mn in 1H2015 from OMR119.33mn in 1H2014. The maximum growth in net direct premium was witnessed in group life insurance (55%) and medical insurance (54%). (TimesofOman)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15 QSE Index S&P Pan Arab S&P GCC (0.9%) 0.9% (0.1%) 0.0% (0.3%) (0.2%) 0.1% (1.0%) 0.0% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,108.95 0.4 1.4 (6.4) MSCI World Index 1,749.63 (1.0) 0.1 2.3 Silver/Ounce 15.37 0.7 3.7 (2.1) DJ Industrial 17,402.84 (1.2) 0.2 (2.4) Crude Oil (Brent)/Barrel (FM Future) 49.18 (2.4) 1.2 (14.2) S&P 500 2,084.07 (1.0) 0.3 1.2 Crude Oil (WTI)/Barrel (FM Future) 43.08 (4.2) (1.8) (19.1) NASDAQ 100 5,036.79 (1.3) (0.1) 6.3 Natural Gas (Henry Hub)/MMBtu 2.84 (0.4) 1.4 (5.1) STOXX 600 393.61 (1.6) (0.3) 4.6 LPG Propane (Arab Gulf)/Ton 37.25 (2.0) 1.4 (24.0) DAX 11,293.65 (2.7) (1.2) 4.4 LPG Butane (Arab Gulf)/Ton 49.50 (1.0) 1.0 (21.1) FTSE 100 6,664.54 (1.2) (0.2) 1.4 Euro 1.10 0.2 0.7 (8.7) CAC 40 5,099.03 (1.9) (0.5) 8.7 Yen 125.13 0.4 0.7 4.5 Nikkei 20,720.75 (0.9) (0.7) 13.4 GBP 1.56 (0.1) 0.5 (0.0) MSCI EM 878.27 (1.1) (0.8) (8.2) CHF 1.01 (0.5) (0.4) 0.6 SHANGHAI SE Composite 3,927.91 (1.8) 3.0 19.2 AUD 0.73 (1.5) (1.5) (10.7) HANG SENG 24,498.21 (0.2) (0.4) 3.7 USD Index 97.29 0.1 (0.3) 7.8 BSE SENSEX 27,866.09 (1.8) (2.3) (0.5) RUB 64.27 2.1 0.4 5.8 Bovespa 49,072.34 (1.9) 1.2 (25.9) BRL 0.29 (1.1) 1.0 (23.7) RTS 830.33 (2.1) (0.3) 5.0 141.0 121.1 116.2