Manner of opting for QRMP

•

0 likes•177 views

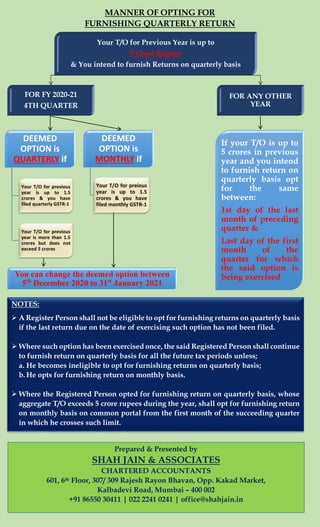

The CBIC has notified procedure and conditions for opting to furnish returns under Quarter Return Monthly Payment Scheme. We have provided a simple flow chart detailing the same.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (17)

Similar to Manner of opting for QRMP

Implications and Procedures for NRI Selling Property in India and Remittance ...

Implications and Procedures for NRI Selling Property in India and Remittance ...DVSResearchFoundatio

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?Manish Anil Gupta & Co. - A CA firm in Delhi, India

Similar to Manner of opting for QRMP (20)

Implications and Procedures for NRI Selling Property in India and Remittance ...

Implications and Procedures for NRI Selling Property in India and Remittance ...

Filing dates extended for providing relief to taxpayers in view of covid

Filing dates extended for providing relief to taxpayers in view of covid

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

More from Priyank Shah

More from Priyank Shah (12)

Notified Late Fee waiver for period from July 2017 to January 2020

Notified Late Fee waiver for period from July 2017 to January 2020

Notifications & Circulars - GST - 9th & 10th June 2020

Notifications & Circulars - GST - 9th & 10th June 2020

Summary of Recent Notifications & Circulars in GST

Summary of Recent Notifications & Circulars in GST

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Recently uploaded

Recently uploaded (20)

Bad Spaniel's Consumer Survey on the Use of Disclaimers

Bad Spaniel's Consumer Survey on the Use of Disclaimers

posts-harmful-to-secular-structure-of-the-country-539103-1.pdf

posts-harmful-to-secular-structure-of-the-country-539103-1.pdf

From Scratch to Strong: Introduction to Drafting of Criminal Cases and Applic...

From Scratch to Strong: Introduction to Drafting of Criminal Cases and Applic...

Streamline Legal Operations: A Guide to Paralegal Services

Streamline Legal Operations: A Guide to Paralegal Services

File Taxes Online Simple Steps for Efficient Filing.pdf

File Taxes Online Simple Steps for Efficient Filing.pdf

December 8 2020 Hearing Transcript from Bankruptcy Adversary Proceeding

December 8 2020 Hearing Transcript from Bankruptcy Adversary Proceeding

TTD - PPT on social stock exchange.pptx Presentation

TTD - PPT on social stock exchange.pptx Presentation

How Can an Attorney Help With My Car Accident Claim?

How Can an Attorney Help With My Car Accident Claim?

Essential Components of an Effective HIPAA Safeguard Program

Essential Components of an Effective HIPAA Safeguard Program

Manner of opting for QRMP

- 1. Your T/O for Previous Year is up to 5 Crore Rupees & You intend to furnish Returns on quarterly basis FOR FY 2020-21 4TH QUARTER FOR ANY OTHER YEAR DEEMED OPTION is QUARTERLY if Your T/O for previous year is up to 1.5 crores & you have filed quarterly GSTR-1 Your T/O for previous year is more than 1.5 crores but does not exceed 5 crores DEEMED OPTION is MONTHLY if Your T/O for preious year is up to 1.5 crores & you have filed monthly GSTR-1 You can change the deemed option between 5th December 2020 to 31st Jaunary 2021 If your T/O is up to 5 crores in previous year and you intend to furnish return on quarterly basis opt for the same between: 1st day of the last month of preceding quarter & Last day of the first month of the quarter for which the said option is being exercised MANNER OF OPTING FOR FURNISHING QUARTERLY RETURN he crosses such limit.NOTES: A Register Person shall not be eligible to opt for furnishing returns on quarterly basis if the last return due on the date of exercising such option has not been filed. Where such option has been exercised once, the said Registered Person shall continue to furnish return on quarterly basis for all the future tax periods unless; a. He becomes ineligible to opt for furnishing returns on quarterly basis; b. He opts for furnishing return on monthly basis. Where the Registered Person opted for furnishing return on quarterly basis, whose aggregate T/O exceeds 5 crore rupees during the year, shall opt for furnishing return on monthly basis on common portal from the first month of the succeeding quarter in which he crosses such limit. Prepared & Presented by SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS 601, 6th Floor, 307/ 309 Rajesh Rayon Bhavan, Opp. Kakad Market, Kalbadevi Road, Mumbai – 400 002 +91 86550 30411 | 022 2241 0241 | office@shahjain.in