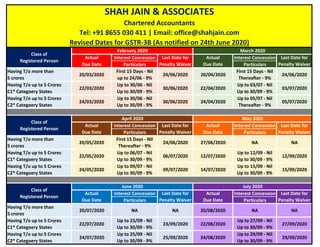

Revised GSTR-3B Dates as notified on 24.06.2020

- 1. Interest Concession Interest Concession Particulars Particulars Having T/o more than 5 crores 20/03/2020 First 15 Days - Nil up to 24/06 - 9% 24/06/2020 20/04/2020 First 15 Days - Nil Thereafter - 9% 24/06/2020 Having T/o up to 5 Crores C1* Categoery States 22/03/2020 Up to 30/06 - Nil Up to 30/09 - 9% 30/06/2020 22/04/2020 Up to 03/07 - Nil Up to 30/09 - 9% 03/07/2020 Having T/o up to 5 Crores C2* Categoery States 24/03/2020 Up to 30/06 - Nil Up to 30/09 - 9% 30/06/2020 24/04/2020 Up to 05/07 - Nil Thereafter - 9% 05/07/2020 Interest Concession Interest Concession Particulars Particulars Having T/o more than 5 crores 20/05/2020 First 15 Days - Nil Thereafter - 9% 24/06/2020 27/06/2020 NA NA Having T/o up to 5 Crores C1* Categoery States 22/05/2020 Up to 06/07 - Nil Up to 30/09 - 9% 06/07/2020 12/07/2020 Up to 12/09 - Nil Up to 30/09 - 9% 12/09/2020 Having T/o up to 5 Crores C2* Categoery States 24/05/2020 Up to 09/07 - Nil Up to 30/09 - 9% 09/07/2020 14/07/2020 Up to 15/09 - Nil Up to 30/09 - 9% 15/09/2020 Interest Concession Interest Concession Particulars Particulars Having T/o more than 5 crores 20/07/2020 NA NA 20/08/2020 NA NA Having T/o up to 5 Crores C1* Categoery States 22/07/2020 Up to 23/09 - Nil Up to 30/09 - 9% 23/09/2020 22/08/2020 Up to 27/09 - Nil Up to 30/09 - 9% 27/09/2020 Having T/o up to 5 Crores C2* Categoery States 24/07/2020 Up to 25/09 - Nil Up to 30/09 - 9% 25/09/2020 24/08/2020 Up to 29/09 - Nil Up to 30/09 - 9% 29/09/2020 March 2020 Actual Due Date Last Date for Penalty Waiver Last Date for Penalty Waiver Class of Registered Person May 2020 July 2020 Actual Due Date Last Date for Penalty Waiver Last Date for Penalty Waiver Actual Due Date Last Date for Penalty Waiver April 2020 Actual Due Date SHAH JAIN & ASSOCIATES Chartered Accountants Tel: +91 8655 030 411 | Email: office@shahjain.com Revised Dates for GSTR-3B (As notified on 24th June 2020) Class of Registered Person June 2020 Actual Due Date Last Date for Penalty Waiver Class of Registered Person Actual Due Date February 2020

- 2. March 2020 SHAH JAIN & ASSOCIATES Chartered Accountants Tel: +91 8655 030 411 | Email: office@shahjain.com Revised Dates for GSTR-3B (As notified on 24th June 2020) Class of Registered Person February 2020NOTES: 5. For tax payers having turnover up to Rs. 5 Crore, classification of C1 & C2 category states is as follows: 5. This due dates are not applicable to the union territor of Jammu & Kashmir & Ladakh. C1 - Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep C2 - Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi 6. For the limits, turnover of previous Financial Year is to be considered, i.e. for February & March 2020, T/o of FY 2018-19 will be considered and for periods on and after April 2020, T/o of FY 2019-20 will be considered. 2. However, the condition for penalty waiver still remains. If the GSTR-3B is not filed within specified date, then penalty will be levied at applicable rates from the original due date. 3. There is no penalty waiver or interest concession for the month of May 2020, June 2020 & July 2020 for tax payers having T/o more than 5 Crores. 4. Due date of filing GSTR-3B for the month of August 2020, is extended up to 1st of October 2020 for C1* category states & 3rd of October 2020 for C2* category states. 1. Interest will be levied @18% after the sepecified dates for concessional rate. The condition of filing GSTR-3B before specified date has been given off, so even if the returns are filed later, interest will have to be paid @ Nil, 9% & 18% respectively as per the mentioned dates.