Gst council 40th meet summary

•

1 like•278 views

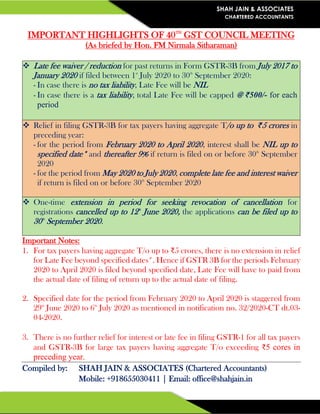

Important highlights of 40th GST council meet, as highlighted by Hon. Finance Minister Nirmala Sitharaman. Please note the measures will be in force only after issue of relevant notifications.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

CBDT extends Form 16 issue date to July 10; ITR filing due date may also get ...

CBDT extends Form 16 issue date to July 10; ITR filing due date may also get ...

CBDT extends the due date for filing of TDS statement in Form 24Q to 30th Jun...

CBDT extends the due date for filing of TDS statement in Form 24Q to 30th Jun...

MISSED INCOMETAX RETURN FILLING DUE DATE, NOW WHAT????

MISSED INCOMETAX RETURN FILLING DUE DATE, NOW WHAT????

Similar to Gst council 40th meet summary

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?Manish Anil Gupta & Co. - A CA firm in Delhi, India

Similar to Gst council 40th meet summary (20)

Summary of Recent Notifications & Circulars in GST

Summary of Recent Notifications & Circulars in GST

Corporate Compliance Tracker _ July 2020 _ CS Lalit Rajput

Corporate Compliance Tracker _ July 2020 _ CS Lalit Rajput

Economic and Tax Measures for Revival against COVID-19

Economic and Tax Measures for Revival against COVID-19

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

#Comprehensive Guide on TDS Under GST# By SN Panigrahi

#Comprehensive Guide on TDS Under GST# By SN Panigrahi

Important highlights of direct and indirect tax updates by finance minister o...

Important highlights of direct and indirect tax updates by finance minister o...

More from Priyank Shah

More from Priyank Shah (6)

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Recently uploaded

Russian Call Girls Service Gomti Nagar \ 9548273370 Indian Call Girls Service...

Russian Call Girls Service Gomti Nagar \ 9548273370 Indian Call Girls Service...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top BoutiqueSkyLaw Professional Corporation

Recently uploaded (20)

Russian Call Girls Service Gomti Nagar \ 9548273370 Indian Call Girls Service...

Russian Call Girls Service Gomti Nagar \ 9548273370 Indian Call Girls Service...

589308994-interpretation-of-statutes-notes-law-college.pdf

589308994-interpretation-of-statutes-notes-law-college.pdf

Ricky French: Championing Truth and Change in Midlothian

Ricky French: Championing Truth and Change in Midlothian

PPT- Voluntary Liquidation (Under section 59).pptx

PPT- Voluntary Liquidation (Under section 59).pptx

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Gst council 40th meet summary

- 1. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS IMPORTANT HIGHLIGHTS OF 40TH GST COUNCIL MEETING (As briefed by Hon. FM Nirmala Sitharaman) Late fee waiver / reduction for past returns in Form GSTR-3B from July 2017 to January 2020 if filed between 1st July 2020 to 30th September 2020: - In case there is no tax liability, Late Fee will be NIL - In case there is a tax liability, total Late Fee will be capped @ ₹500/- for each period Relief in filing GSTR-3B for tax payers having aggregate T/o up to ₹5 crores in preceding year: - for the period from February 2020 to April 2020, interest shall be NIL up to specified date* and thereafter 9% if return is filed on or before 30th September 2020 - for the period from May 2020 to July 2020, complete late fee and interest waiver if return is filed on or before 30th September 2020 One-time extension in period for seeking revocation of cancellation for registrations cancelled up to 12th June 2020, the applications can be filed up to 30th September 2020. Important Notes: 1. For tax payers having aggregate T/o up to ₹5 crores, there is no extension in relief for Late Fee beyond specified dates*. Hence if GSTR 3B for the periods February 2020 to April 2020 is filed beyond specified date, Late Fee will have to paid from the actual date of filing of return up to the actual date of filing. 2. Specified date for the period from February 2020 to April 2020 is staggered from 29th June 2020 to 6th July 2020 as mentioned in notification no. 32/2020-CT dt.03- 04-2020. 3. There is no further relief for interest or late fee in filing GSTR-1 for all tax payers and GSTR-3B for large tax payers having aggregate T/o exceeding ₹5 cores in preceding year. Compiled by: SHAH JAIN & ASSOCIATES (Chartered Accountants) Mobile: +918655030411 | Email: office@shahjain.in