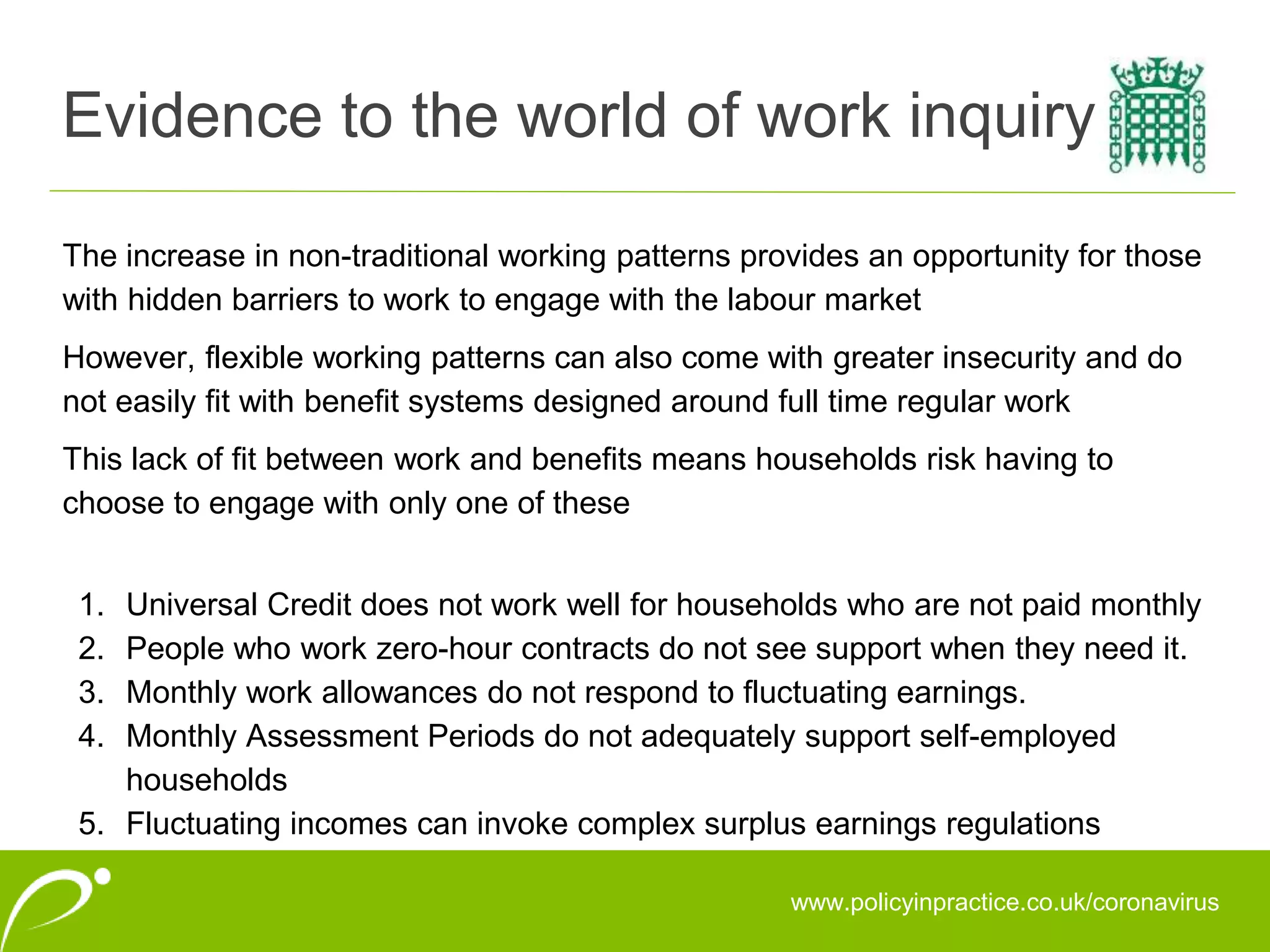

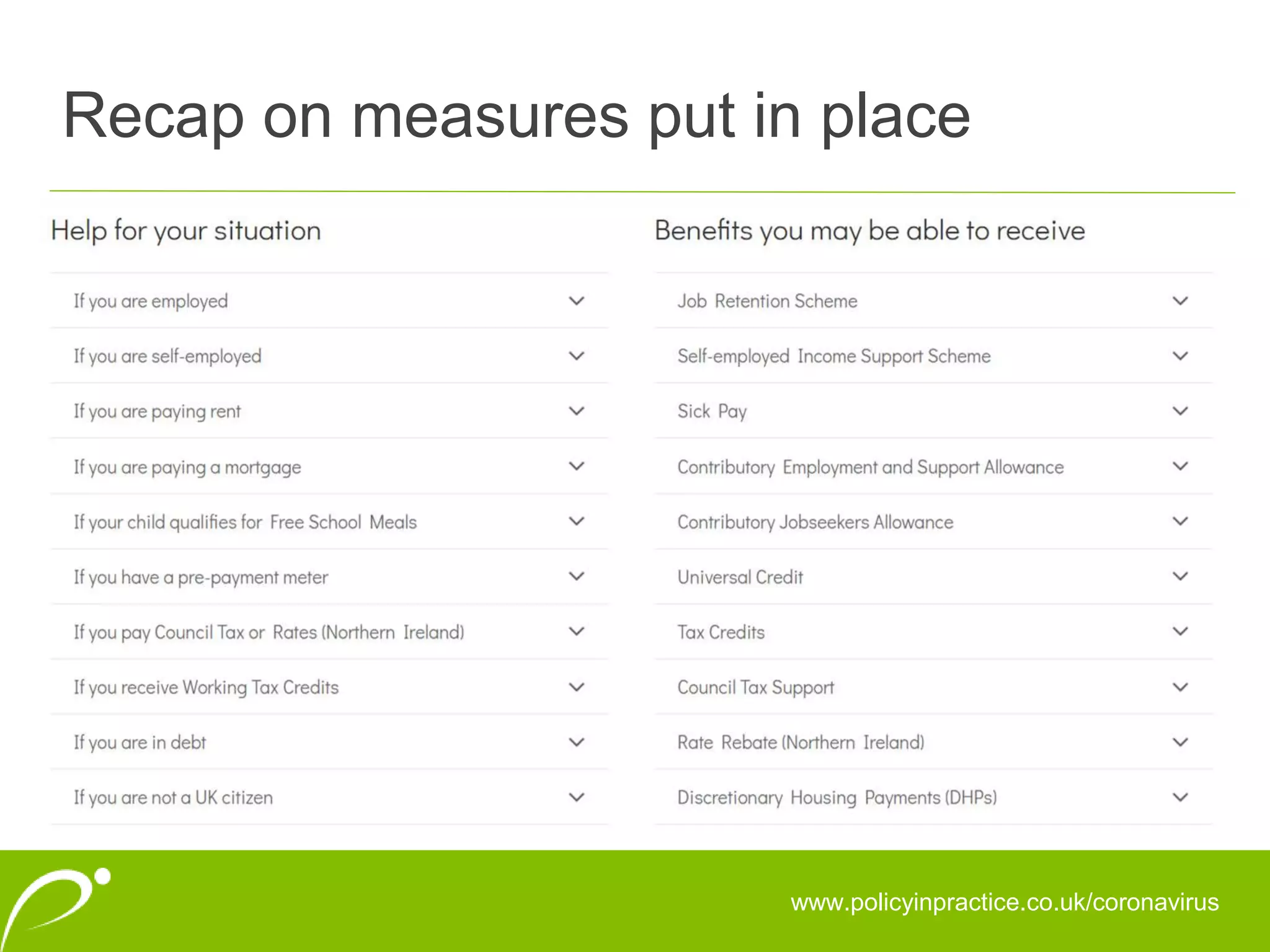

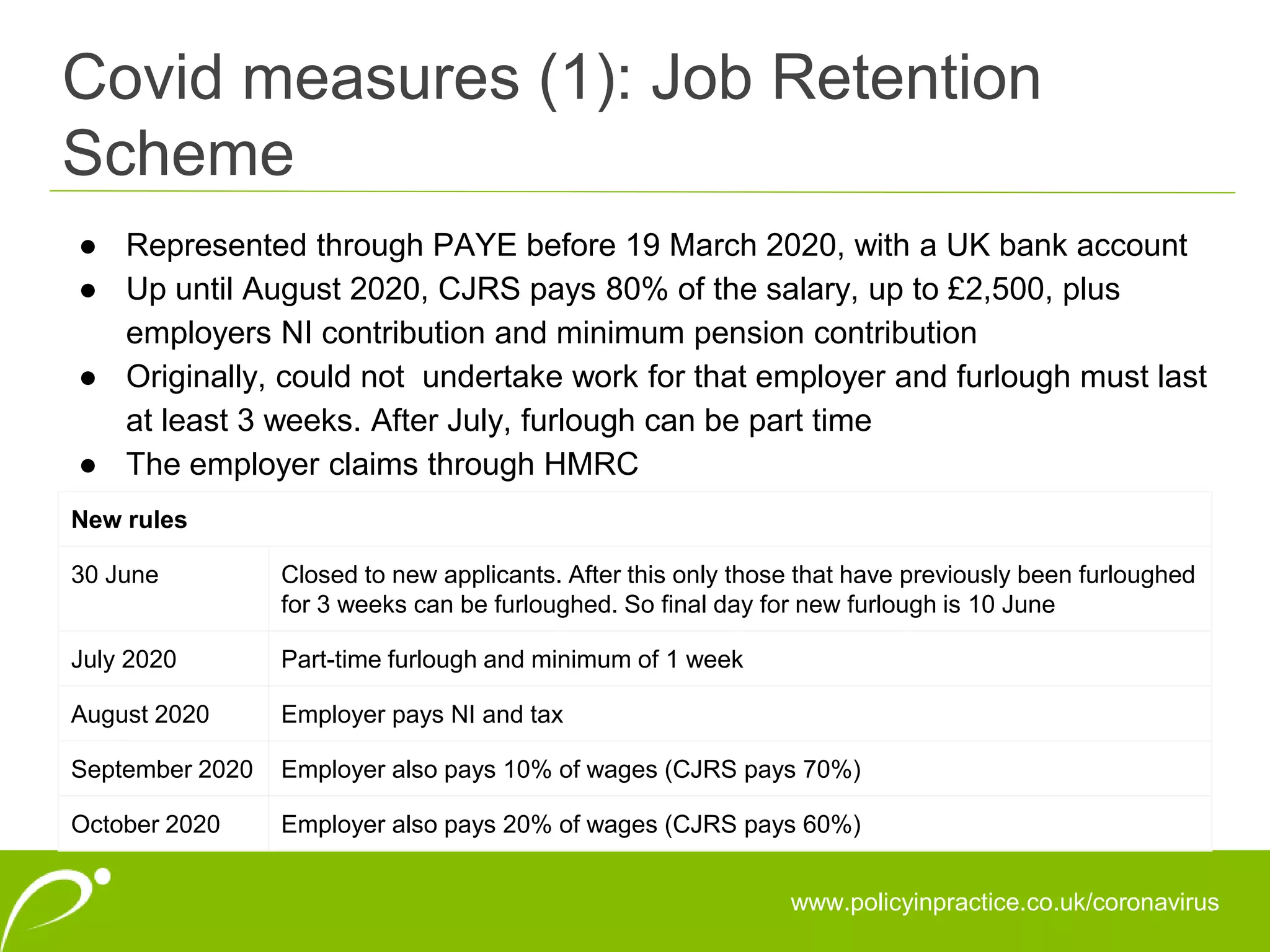

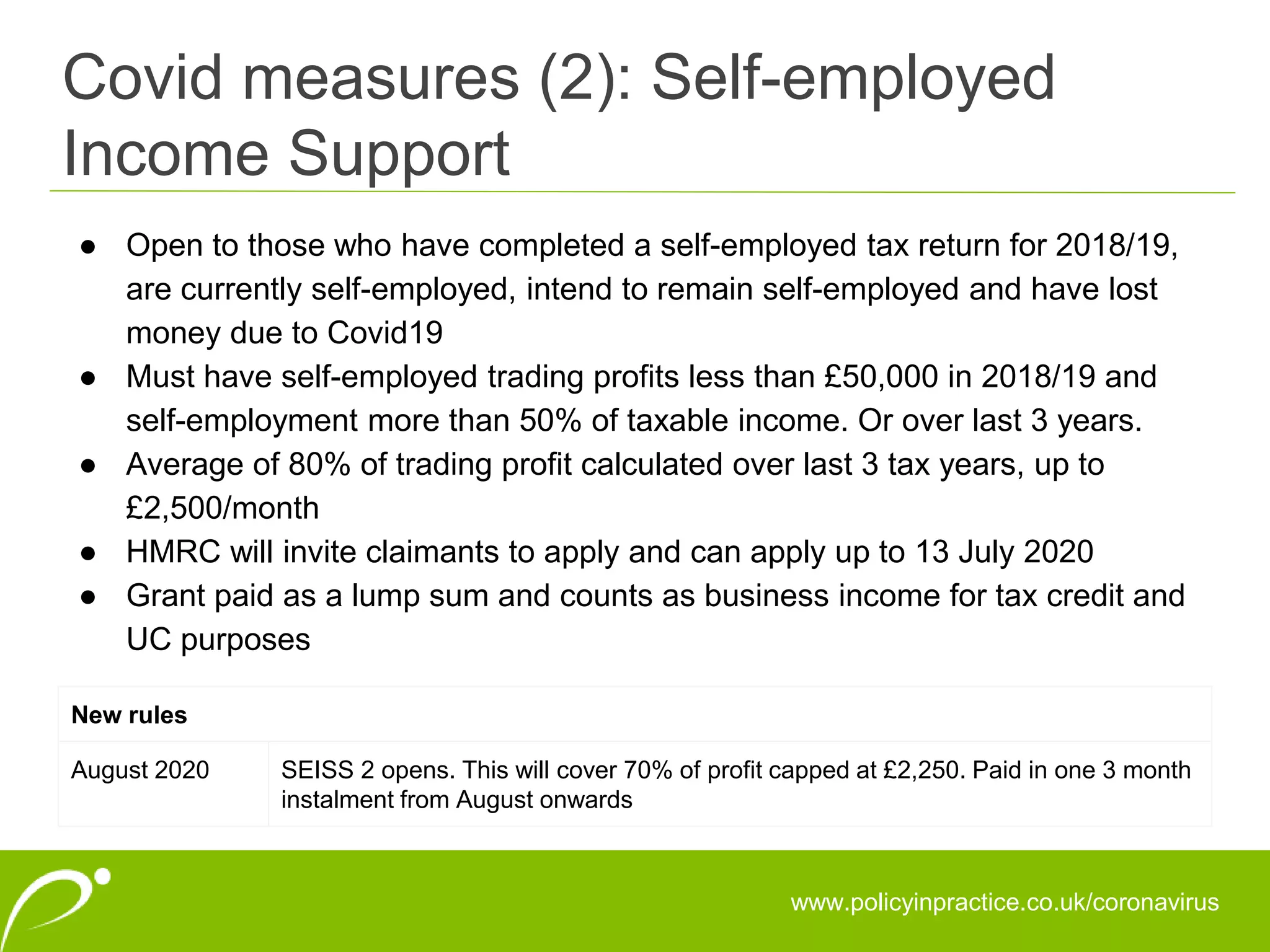

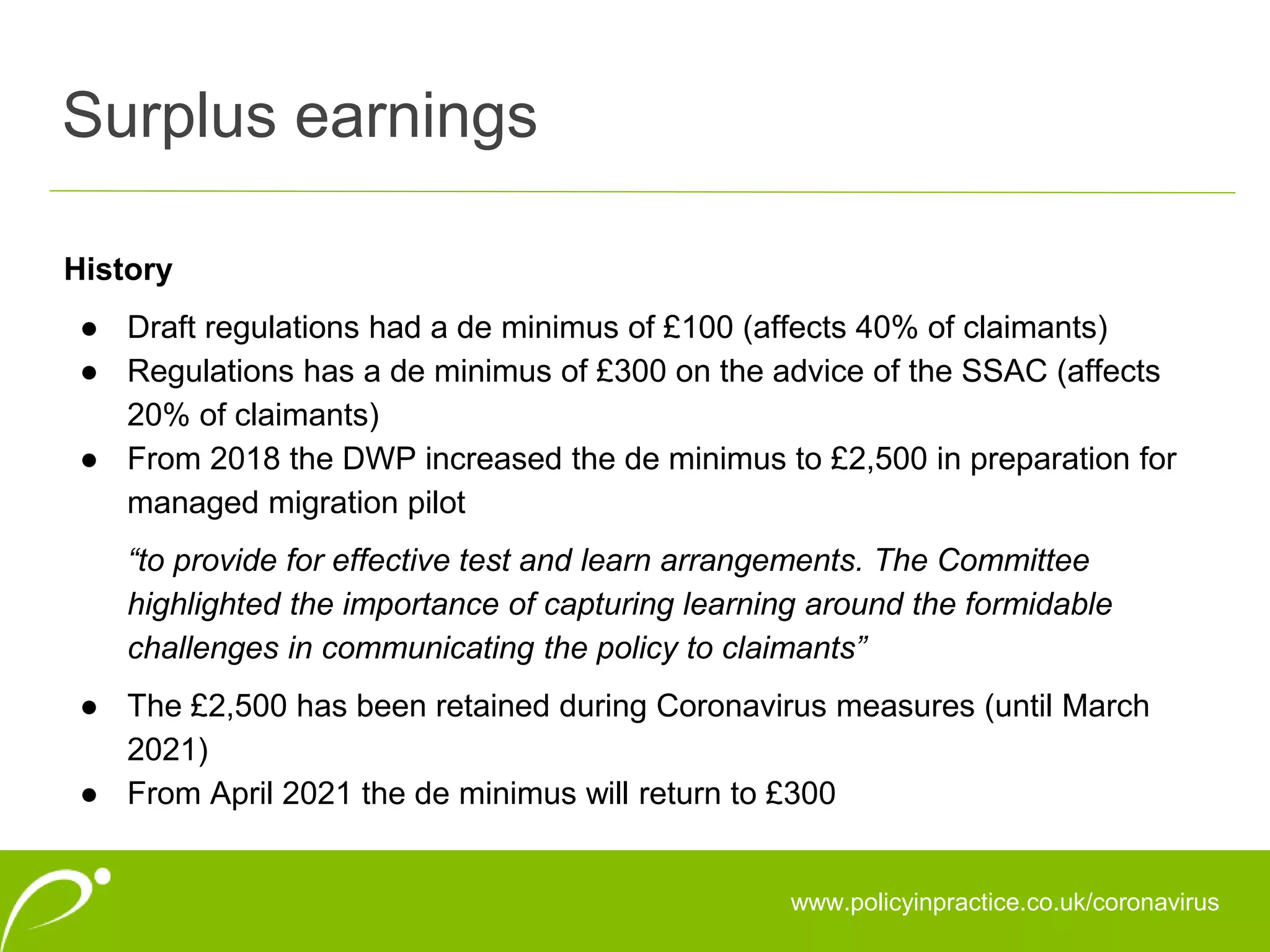

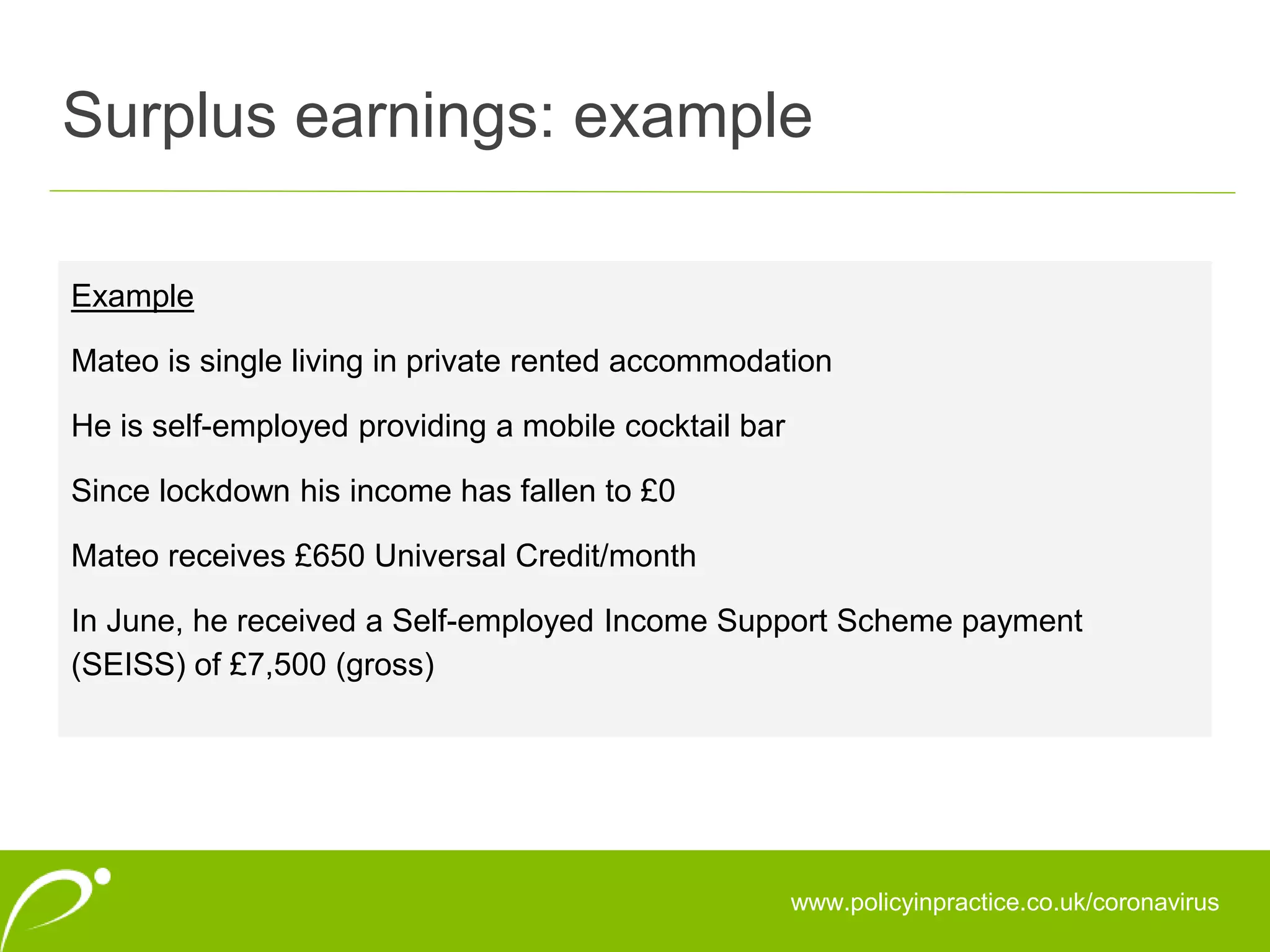

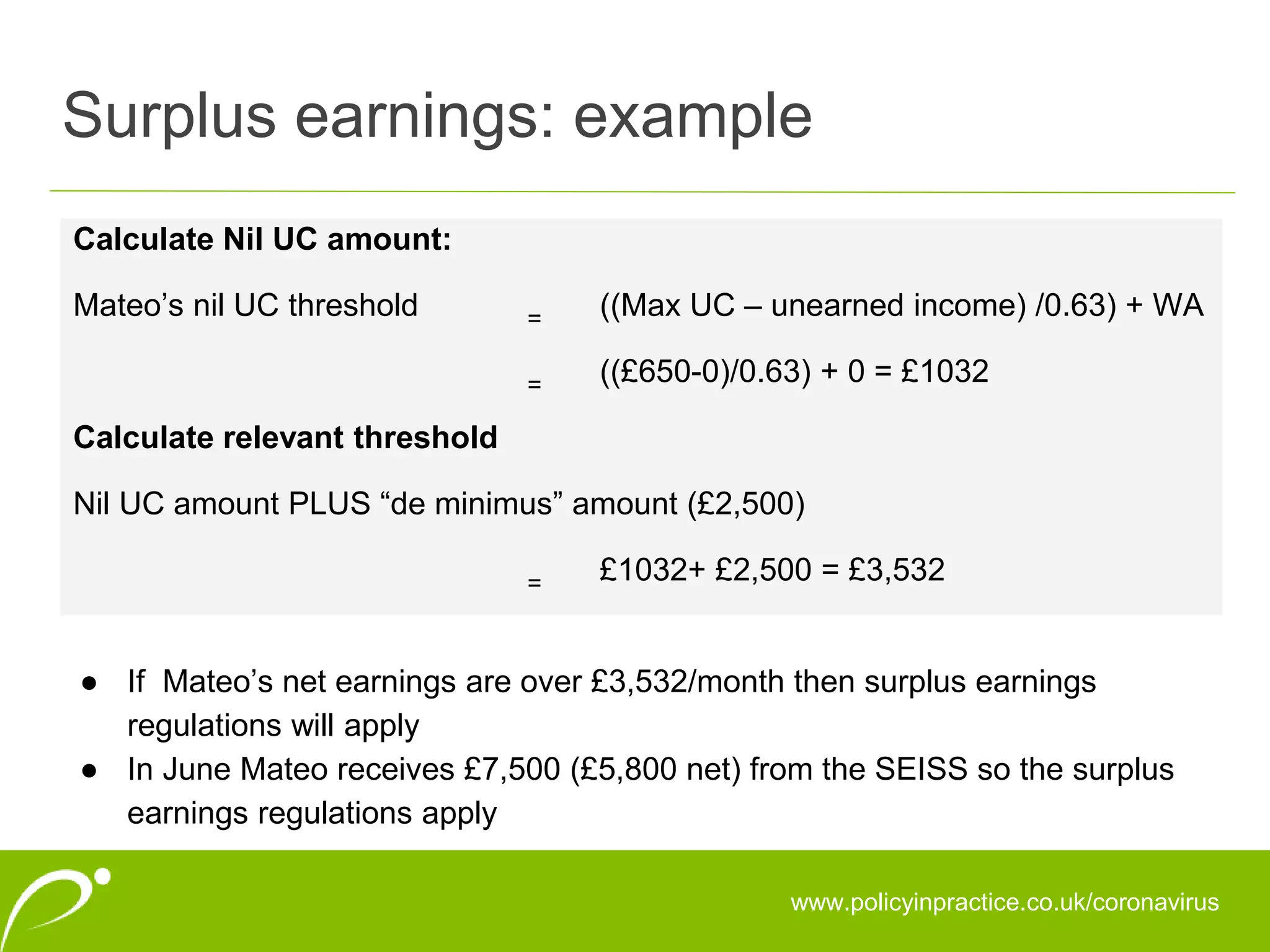

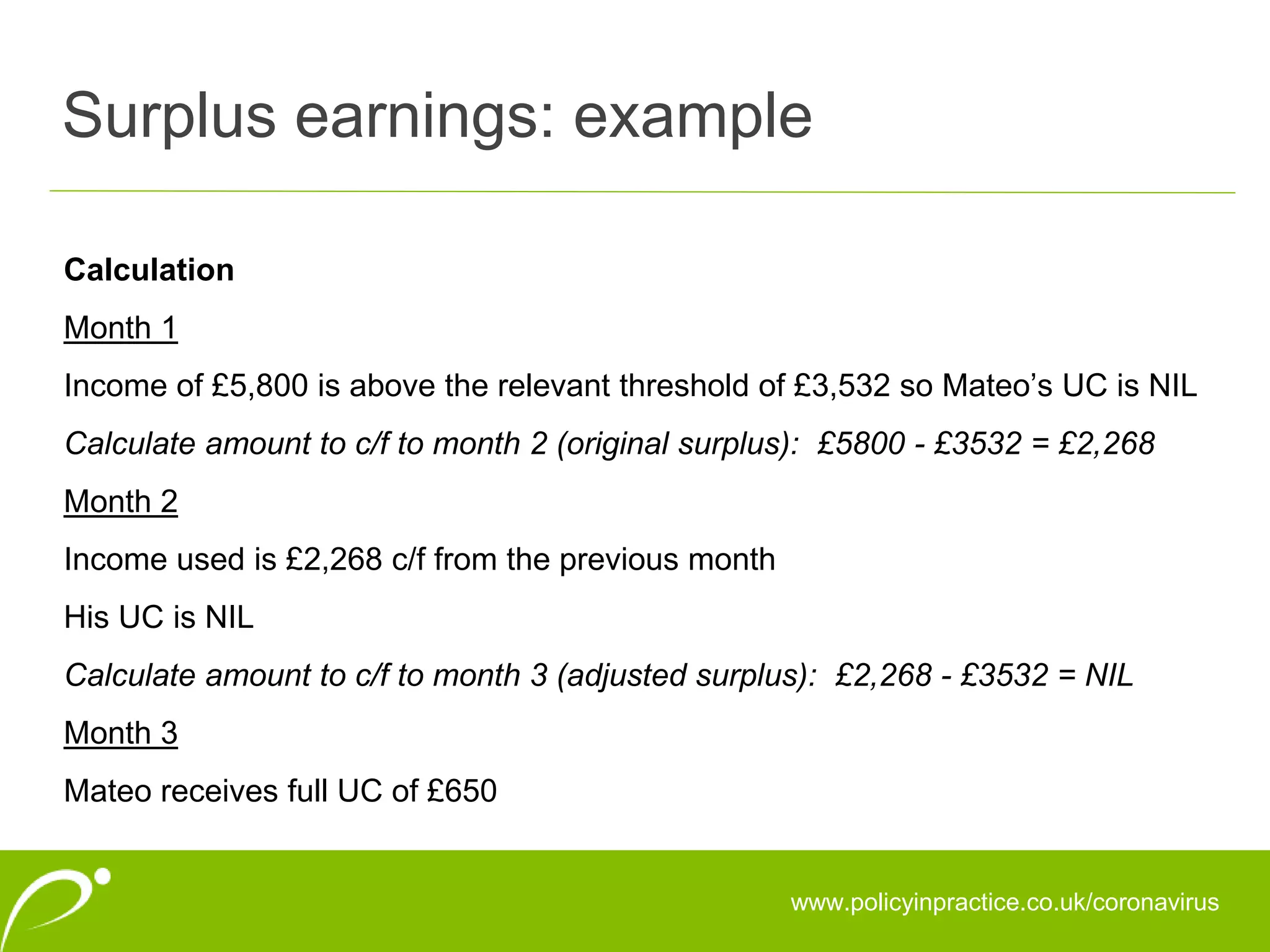

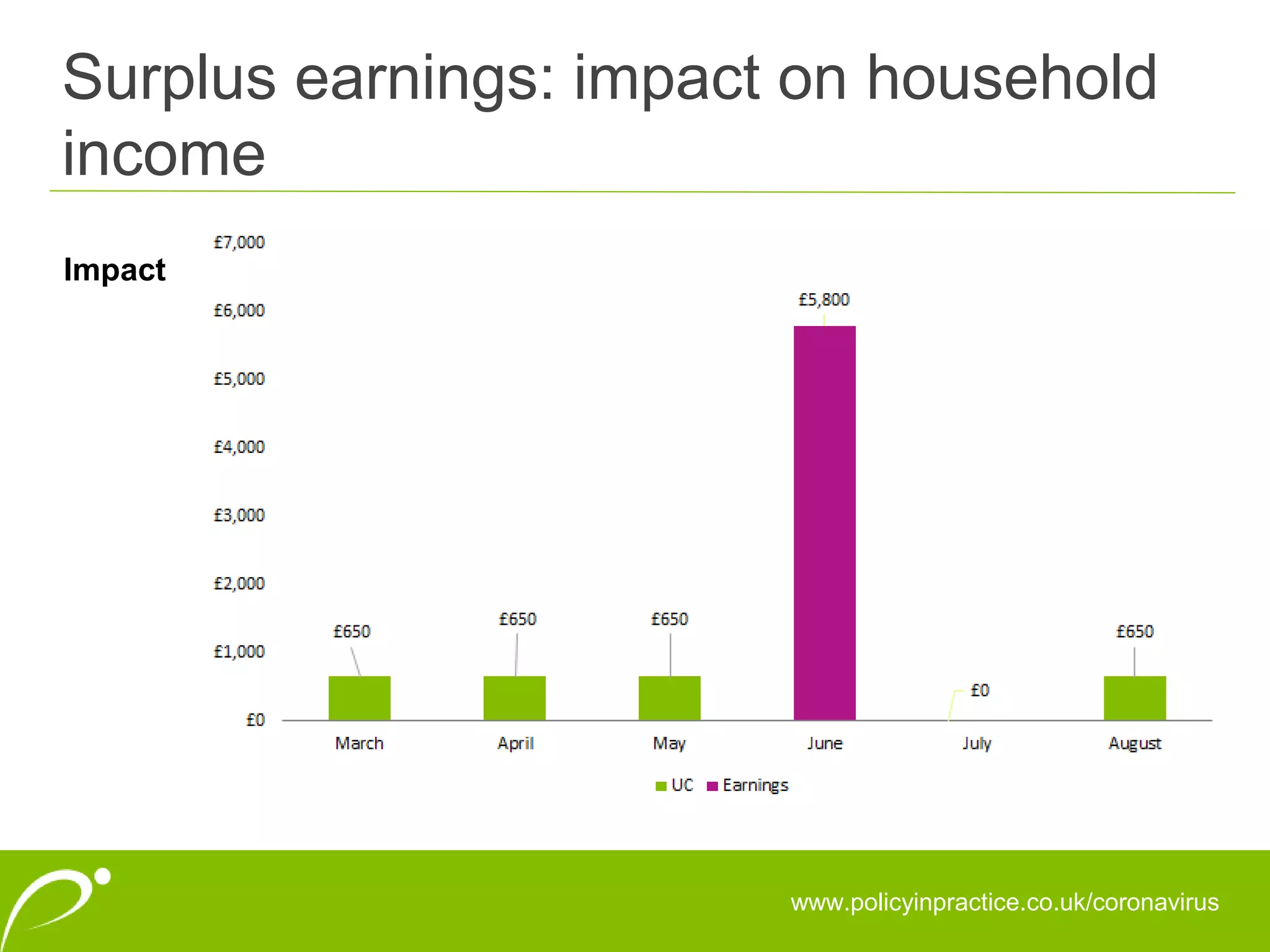

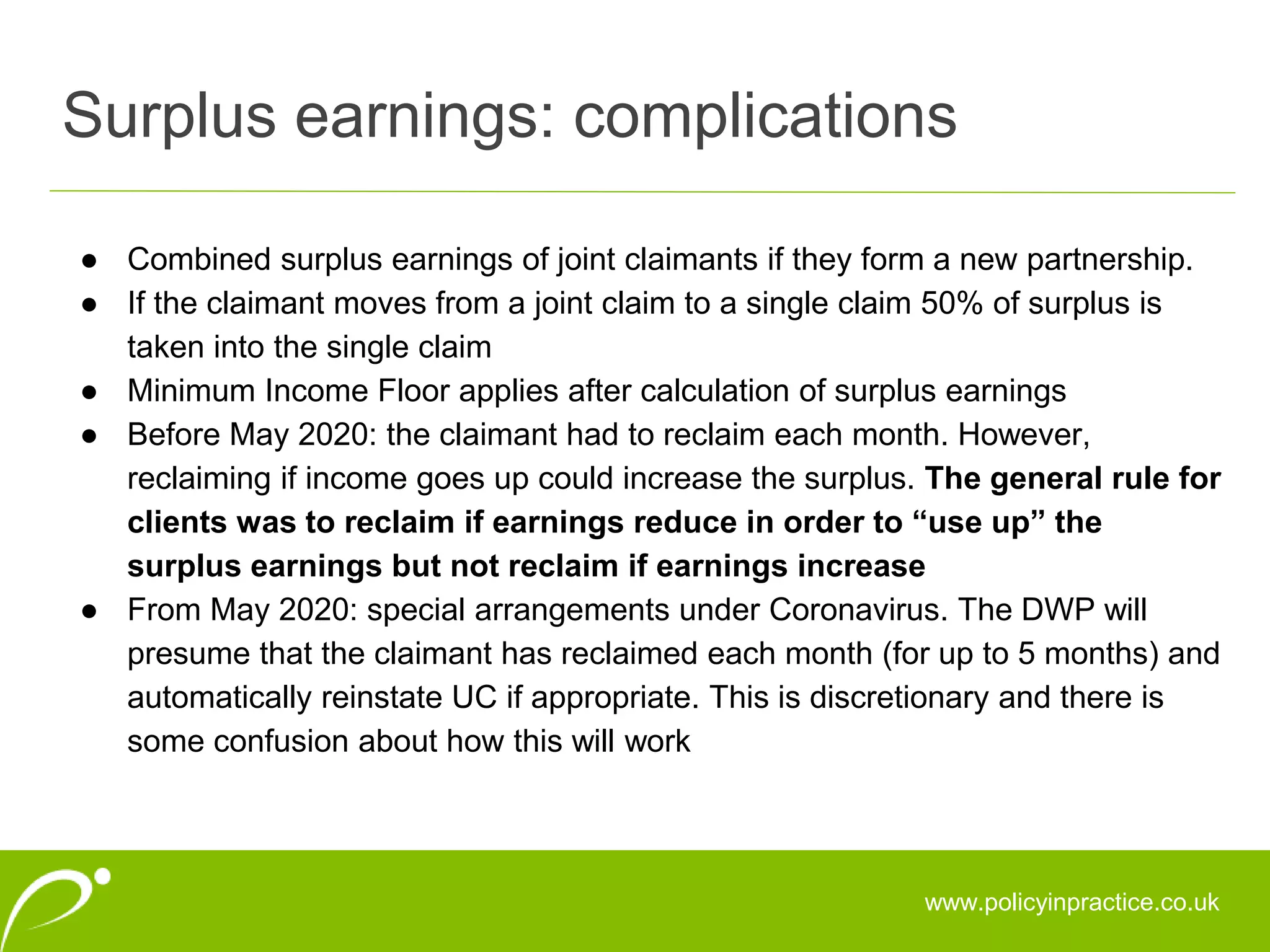

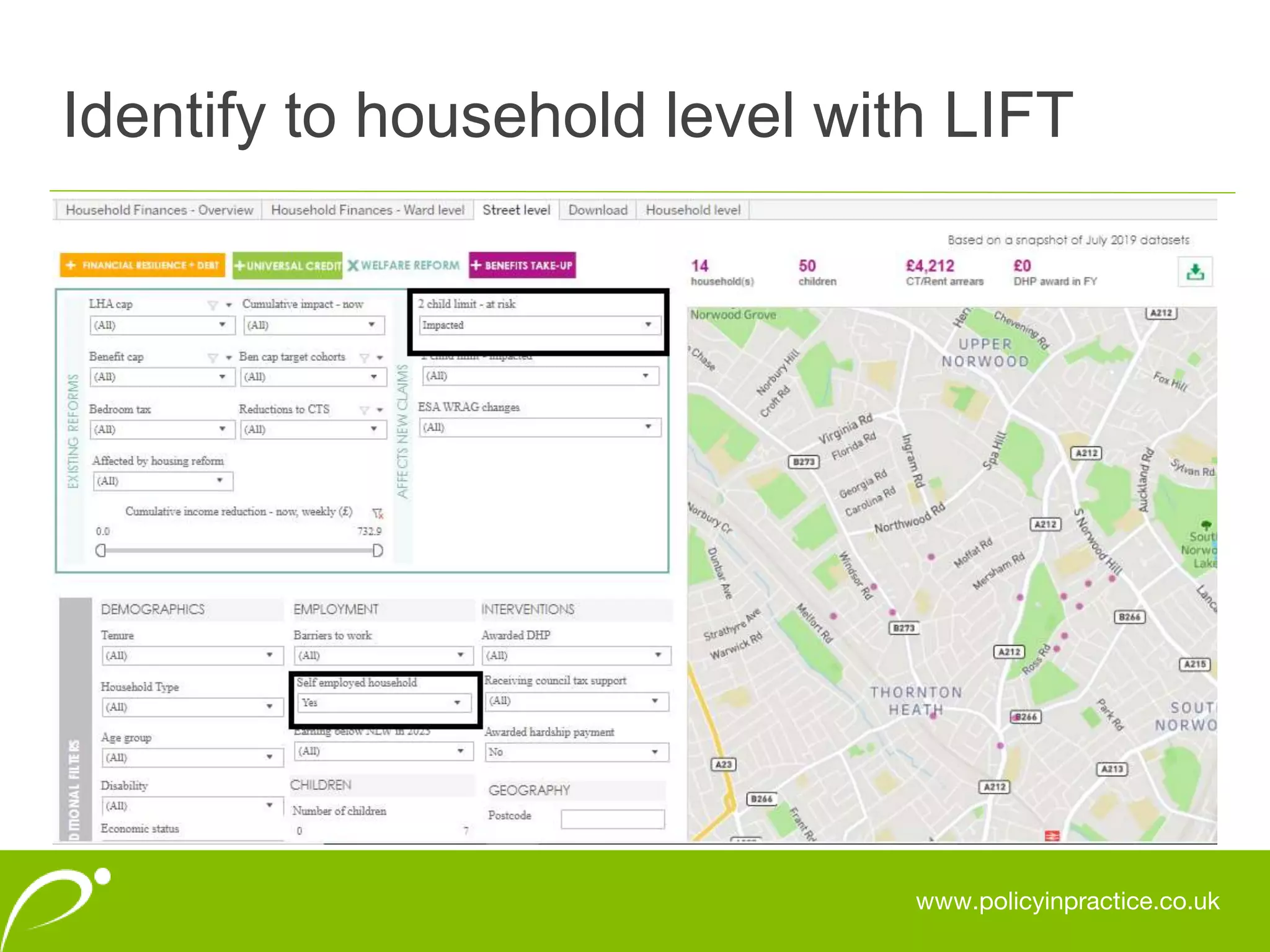

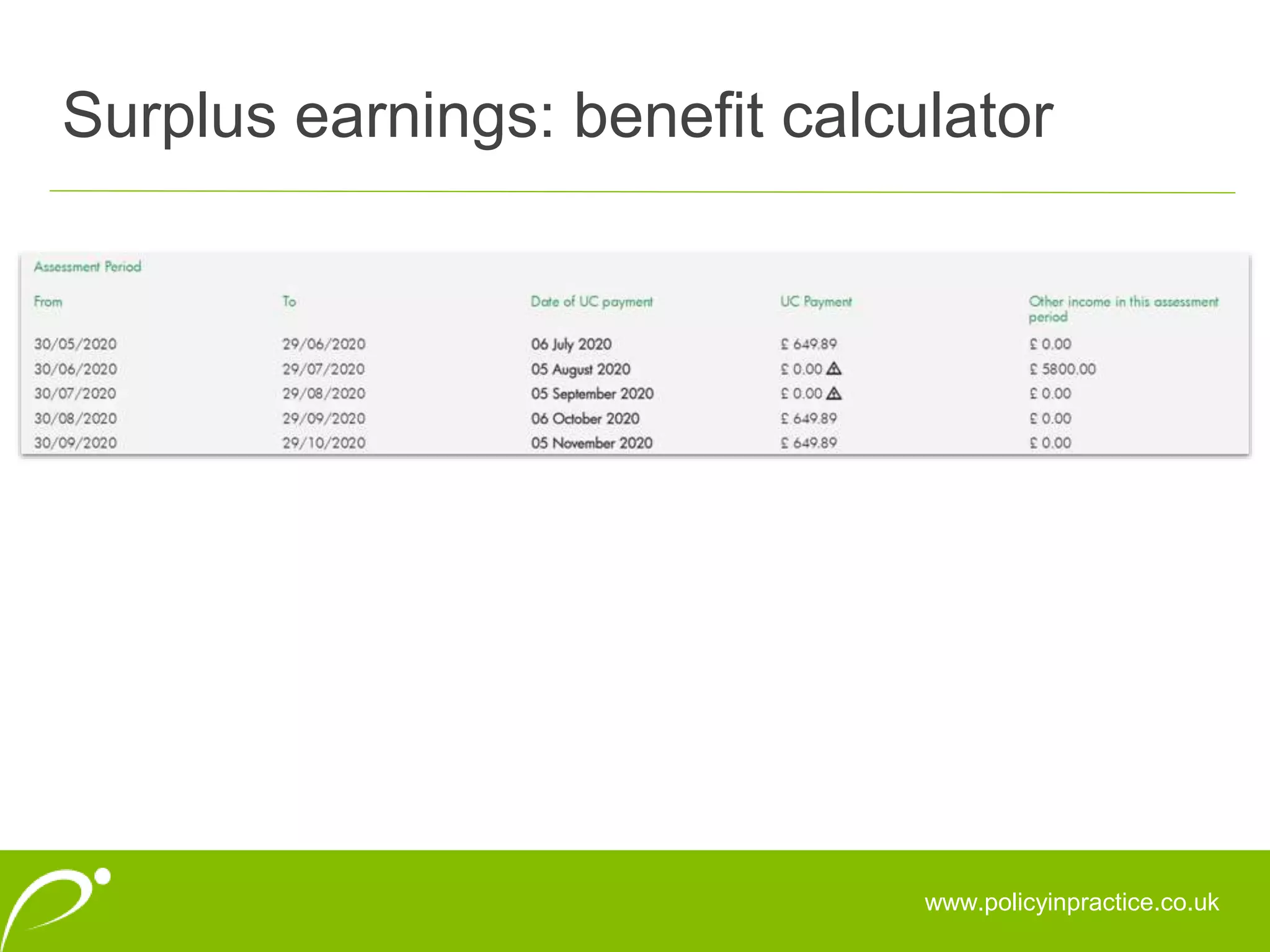

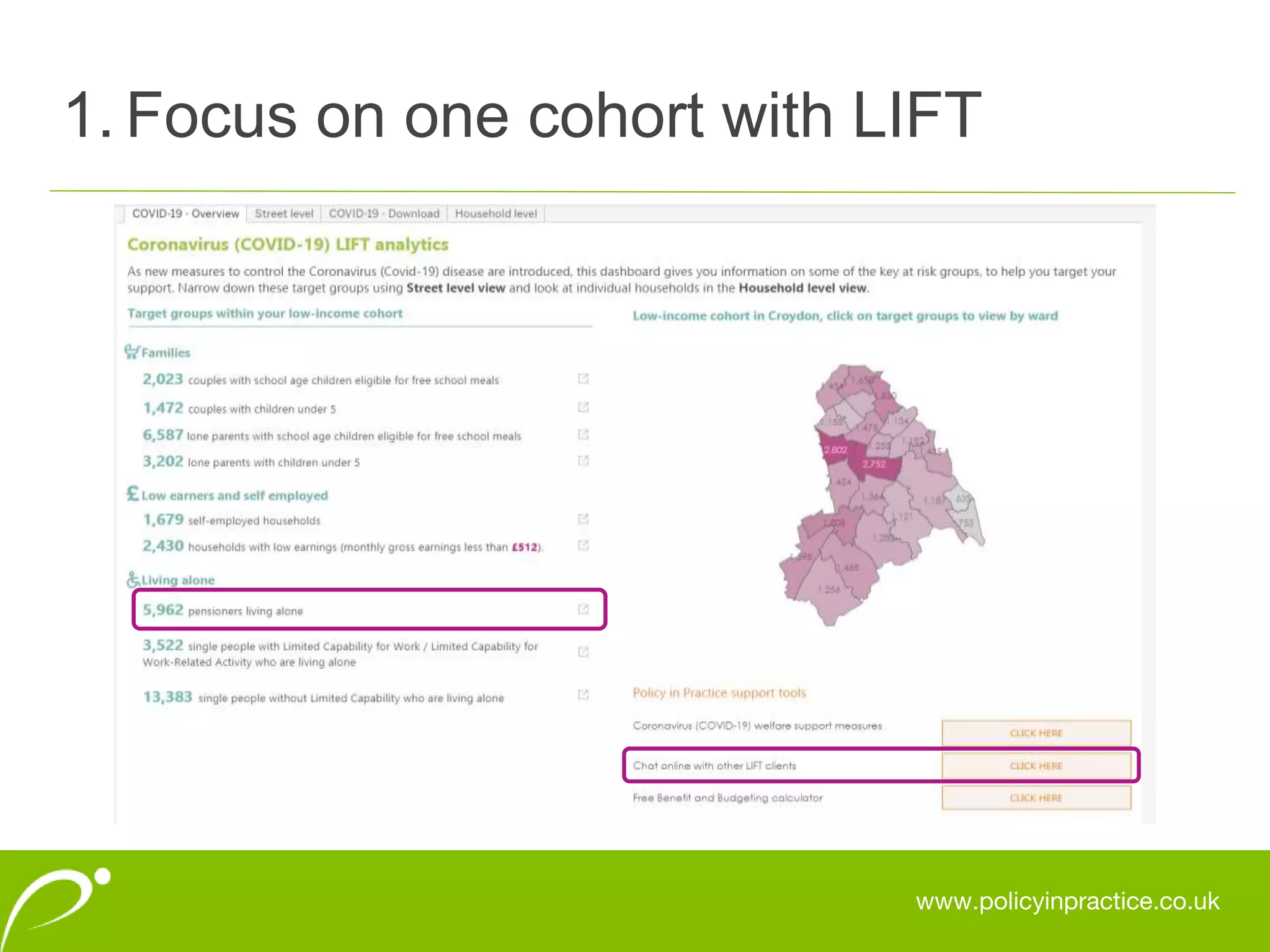

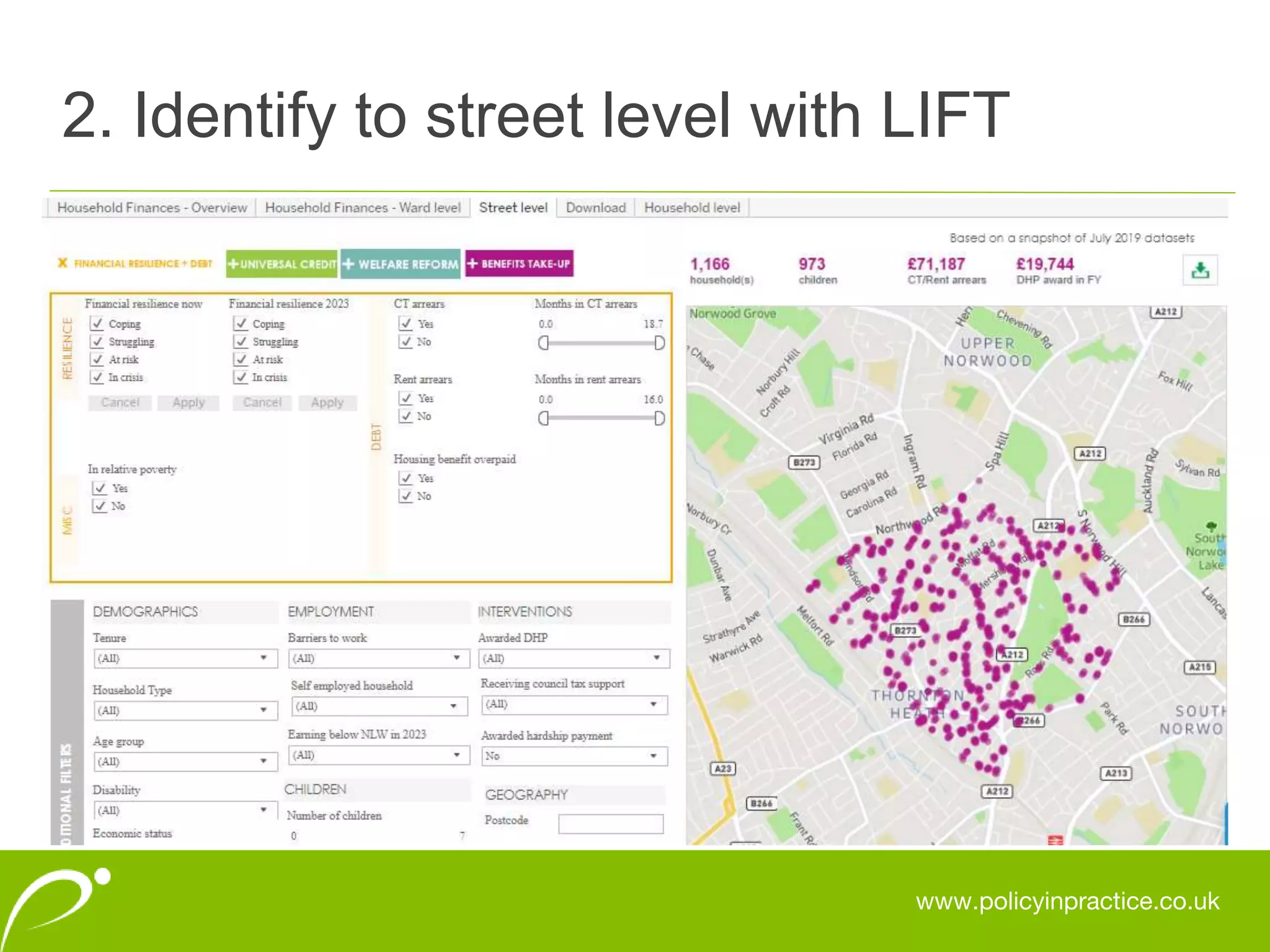

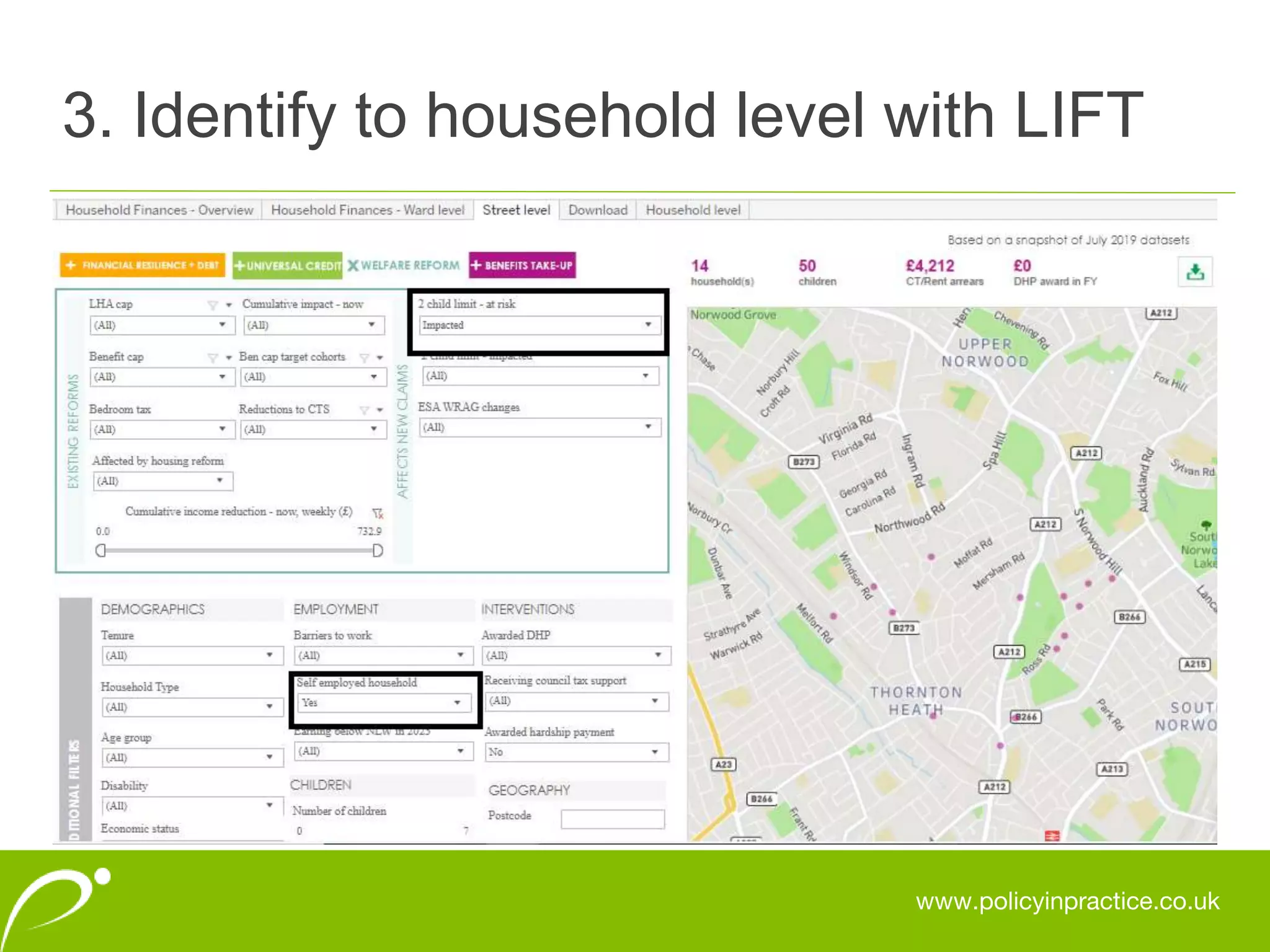

The document outlines a webinar discussing the complexities of surplus earnings and their implications for those receiving Universal Credit and SEISS due to irregular income, particularly in light of the COVID-19 pandemic. Key points include how surplus earnings regulations can affect claimants with fluctuating incomes, the challenges posed by non-traditional working patterns, and examples illustrating how these regulations apply in practice. The discussion also emphasizes the importance of support tools, such as benefit and budgeting calculators, to help advisors and clients navigate these complexities.