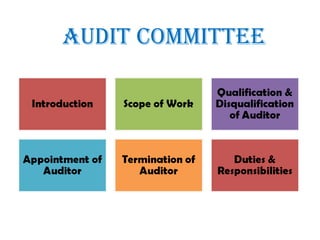

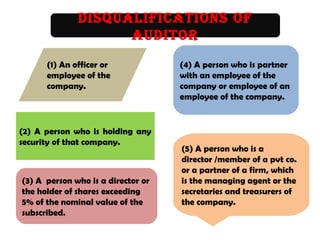

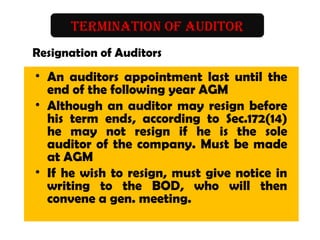

The document discusses the roles and responsibilities of auditors in Malaysia. It covers the legal framework for auditing, including the relevant governing bodies like the Malaysian Accounting Standards Board and Audit Oversight Board. It also outlines the scope of an audit, qualifications and appointments of auditors, reasons for termination, and duties and responsibilities of auditors to shareholders, the company, third parties, and in maintaining confidentiality.

![APPOINTMENT BY DIRECTORS

•To appoint the first auditor for the company

[Section 171(1) CA]

•To fill any casual vacancy in the office of an

auditor. Failing such as an appointment, the

surviving or continuing auditors, if any, may

act [Sec 171(3) CA]](https://image.slidesharecdn.com/auditcommittee-140614031809-phpapp01/85/Audit-committee-12-320.jpg)

![APPOINTMENT BY REGISTRAR

•Where an auditor of a company has been

removed from office, and the company has not

appointed another auditor [Sec 172(8) CA]

•To act on a written application of a member

where the directors of the company fail to

appoint an auditor [Sec 172(10) of the Act]](https://image.slidesharecdn.com/auditcommittee-140614031809-phpapp01/85/Audit-committee-13-320.jpg)

![• At the meeting, he may request for his explanation

to be read & may speak to defend himself.

• Sec 127(7) – When an auditor has been removed,

another auditor appointed at a gen meeting may

replace him.

• The appointment of new auditor must be made by

a resolution passed by a majority of not less than ¾

of the members of the company who are entitled to

vote (in person or by proxy).

• If the company does not appoint another auditor,

the Registrar of the Co is empowered to appoint for

the company. [Sec.172(8)]](https://image.slidesharecdn.com/auditcommittee-140614031809-phpapp01/85/Audit-committee-16-320.jpg)

![Duty to the trustee for Debentures

•The auditor is obliged by the provisions of the CA/by the

debenture/ trust deed to furnish the corporation with

specified report, certificates or documents.

•Within 7 days after furnishing, auditor is obliged to post

a copy of the report, cert / doc to every trustee for the

deb. holder. [sec 175(1)]

Law Society V KPMG Peat Marwick

Held : If a negligent breach of duty to a trustee causes

damage both to the trustee in his personal capacity and

to the trust property, the trustee can claim on both his

own and on the beneficiary’s account](https://image.slidesharecdn.com/auditcommittee-140614031809-phpapp01/85/Audit-committee-22-320.jpg)