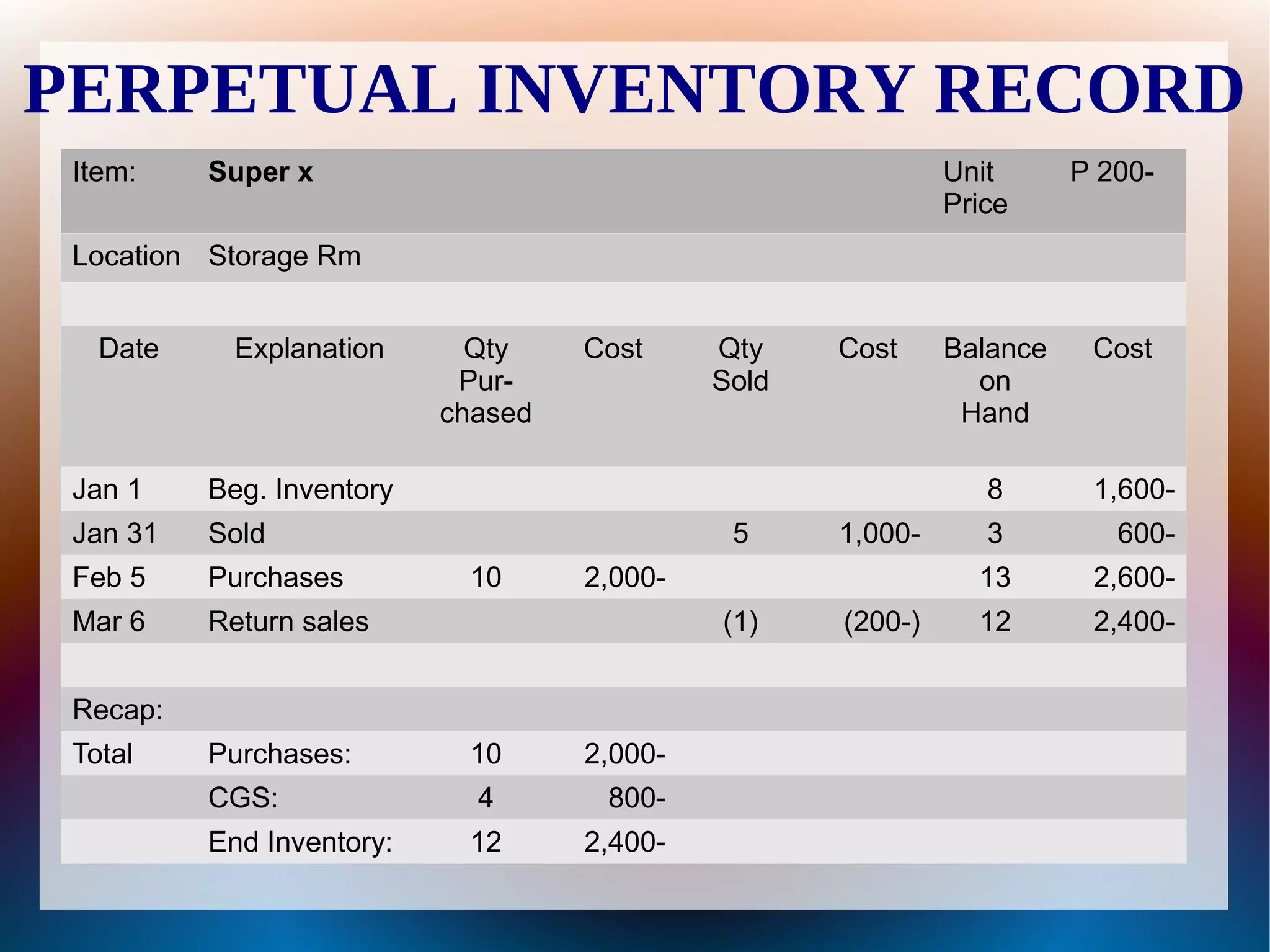

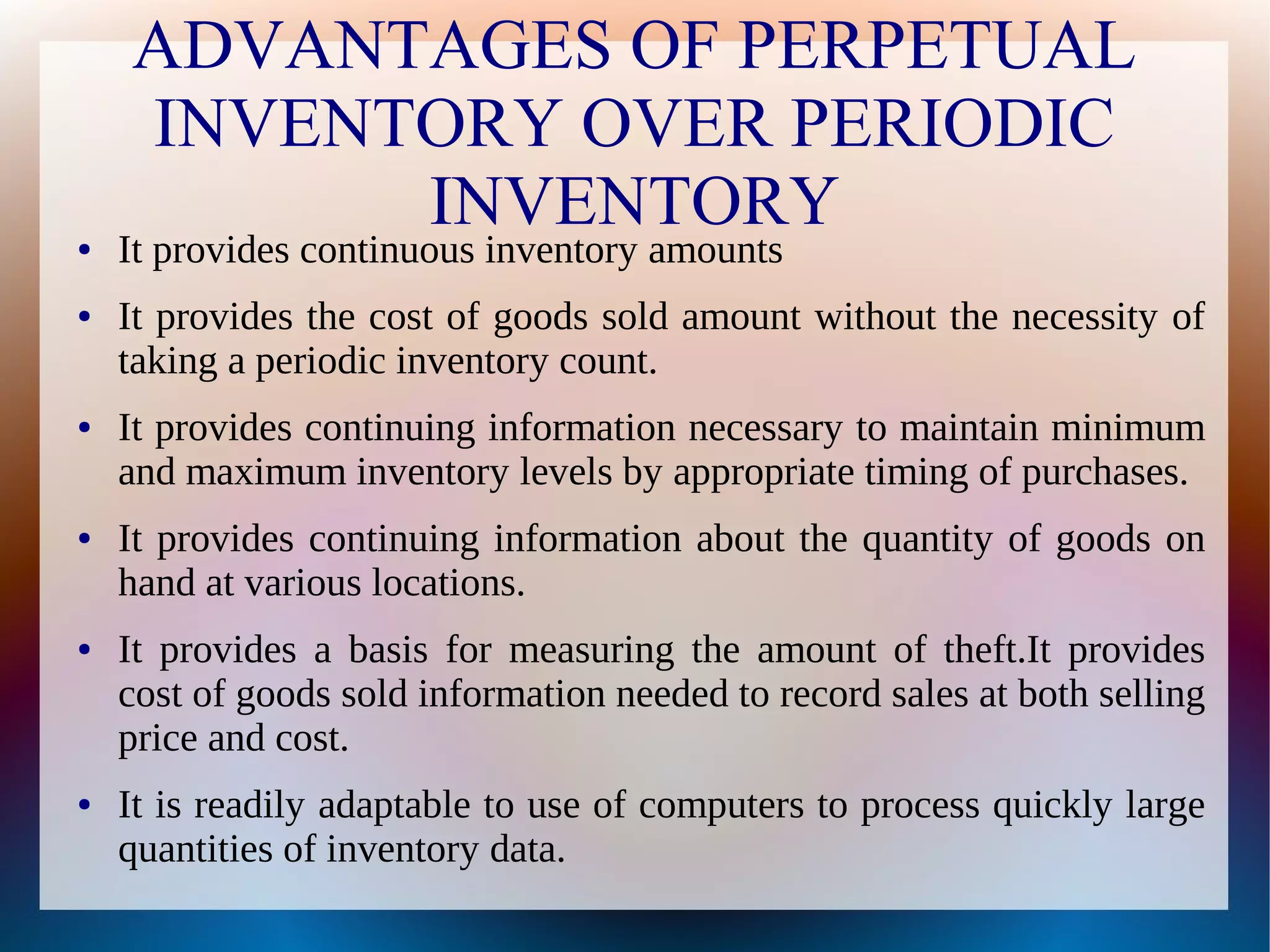

The document compares periodic and perpetual inventory systems. A periodic system only counts inventory at the end of a period, while a perpetual system continuously updates inventory records. The periodic system requires a physical count and has less control, while the perpetual system has ongoing costs but provides continuous, accurate inventory and cost of goods sold information needed for management decisions. Overall, the perpetual system is preferred as it avoids inventory counts and provides more timely data.