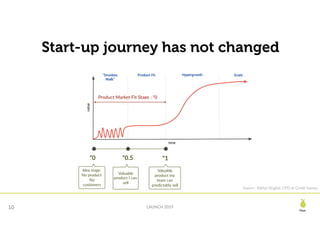

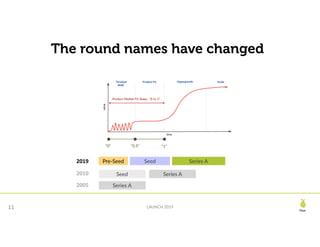

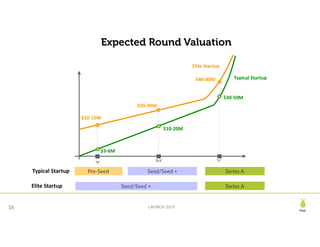

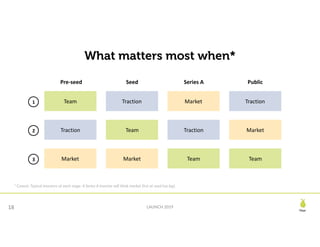

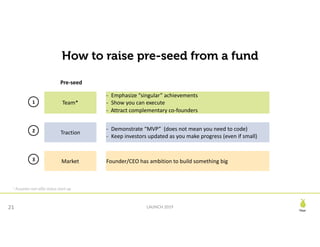

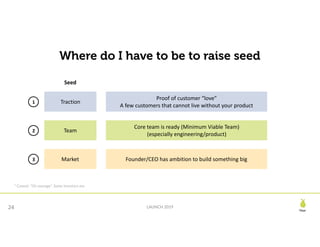

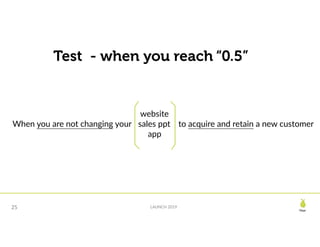

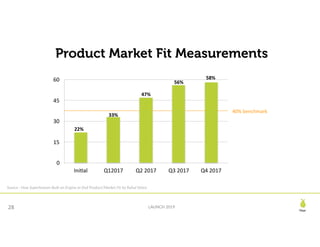

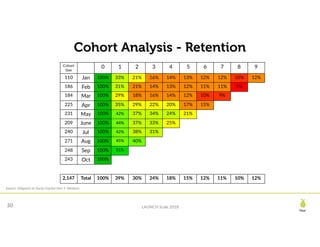

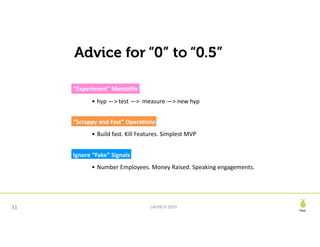

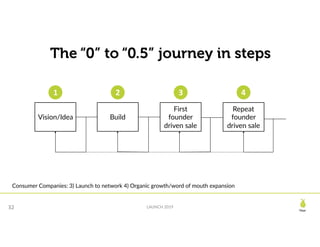

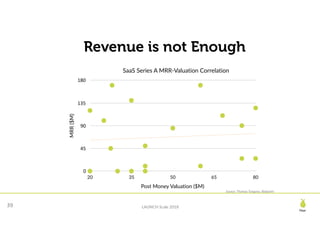

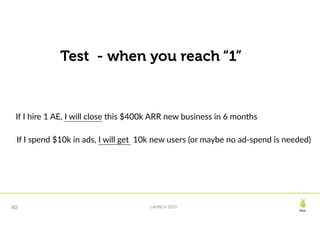

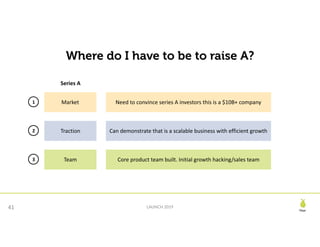

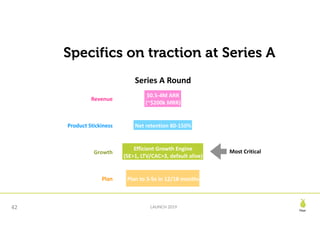

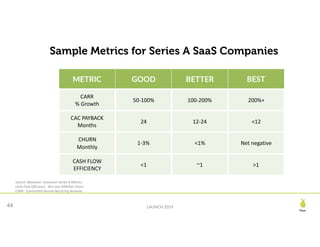

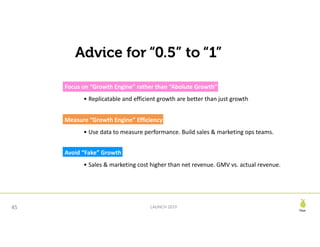

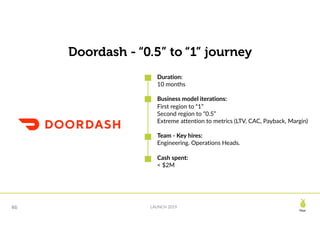

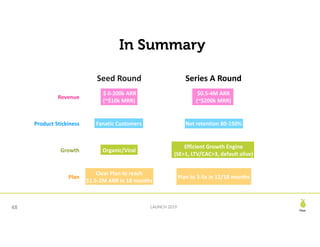

This document discusses key metrics and milestones for startups at different stages of funding. It notes that the seed stage now corresponds to what used to be called the Series A stage, with seed rounds averaging $2-4M. To raise a seed round, a startup needs proof of customer traction and a minimum viable team. For a Series A round, startups should demonstrate efficient growth through metrics like net retention rates above 80% and efficient customer acquisition costs. The document provides advice for navigating the stages from idea to product-market fit to scaling growth.

![Pear

LAUNCH 2019

Getting to a Series A is a ~3.5 year Journey

8

$5.6M Raised

Before Series A

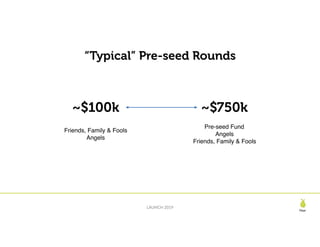

$250k-$750k

Pre-seed

$1-4M

[Seed Plus]

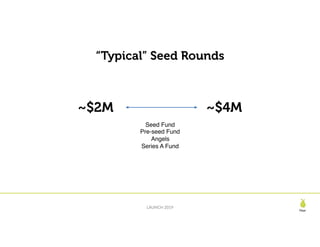

Pre-seed 2019 = Seed 2010 Seed 2019 = Series A 2010

Metrics in Seed round matter

$2-4M

Seed](https://image.slidesharecdn.com/launch2019octoberv2-191008221706/85/Seed-Financing-Landscape-Launch-2019-8-320.jpg)