Department of the Treasury—Internal Revenue Service (99)O.docx

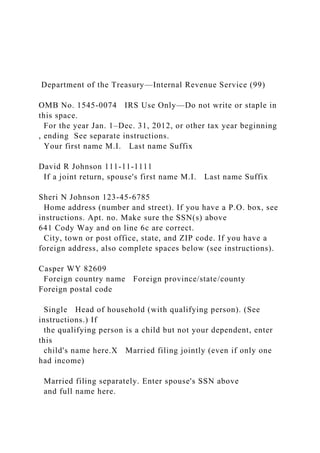

- 1. Department of the Treasury—Internal Revenue Service (99) OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. For the year Jan. 1–Dec. 31, 2012, or other tax year beginning , ending See separate instructions. Your first name M.I. Last name Suffix David R Johnson 111-11-1111 If a joint return, spouse's first name M.I. Last name Suffix Sheri N Johnson 123-45-6785 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Make sure the SSN(s) above 641 Cody Way and on line 6c are correct. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Casper WY 82609 Foreign country name Foreign province/state/county Foreign postal code Single Head of household (with qualifying person). (See instructions.) If the qualifying person is a child but not your dependent, enter this child's name here.X Married filing jointly (even if only one had income) Married filing separately. Enter spouse's SSN above and full name here.

- 2. Check only one First name Last name SSN box. First name Last name Qualifying widow(er) with dependent child X If someone can claim you as a dependent, check box 6a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .} 2X . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Dependent's social security number Dependent's relationship to you if child under age 17 2 qualifying for child tax credit First name Last name (see instructions) 0If more than four Kirby Johnson 123-45-6788 Daughter dependents, see Toby Johnson 123-45-6789 Son 1instructions and Vivian Olson 123-45-6786 Parent check here 5Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 3. . . . . . . . . . . . . . . . . . 38,000 interest. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500 interest. include on line 8a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,900 Ordinary dividends. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 700 Qualified dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 700 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70,724 If you did not get a W-2, see instructions. Capital gain or (loss). Attach Schedule D if required. If not required, check here -3,000 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 4. . . . . . . . . . . . . . . . IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taxable amount . . . . . . . . . Pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taxable amount . . . . . . . . . Enclose, but do Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896 not attach, any Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . payment. Also, Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . please use Social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Taxable amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Other income. List type and amount Jury Pay 420 Combine the amounts in the far right column for lines 7 through 21. This is your total income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111,240 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 5. . . . . . . . . . . . . . . . . Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Health savings account deduction. Attach Form 8889 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Moving expenses. Attach Form 3903 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Deductible part of self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,996 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,000 Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,800 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Alimony paid Recipient's SSN IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,000 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Domestic production activities deduction. Attach Form 8903 . .

- 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 23 through 31a and 32 through 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .22,796 Subtract line 36 from line 22. This is your . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88,444 Form (2012) HTA Form 1040 (2012) David R and Sheri N Johnson 111-11-1111 Page Amount from line 37 (adjusted gross income). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88,444 Check { were born before January 2, 1948, Blind. } if: was born before January 2, 1948, Blind. If your spouse itemizes on a separate return or you were a dual- status alien, check here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (from Schedule A) your (see left margin) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,833 • People who check any box on line 39a or 39b

- 7. who can be claimed as a dependent, see instructions. Subtract line 40 from line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73,611 Multiply $3,800 by the number on line 6d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,000 Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54,611 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,21 9 (see instructions). Attach Form 6251 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 44 and 45 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,219 • All others: Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 8. Single or Married filing separately, $5,950 Married filing jointly or Qualifying widow(er), $11,900 Head of household, $8,700 Credit for child and dependent care expenses. Attach Form 2441 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Education credits from Form 8863, line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tax is calculated from the Qualified Dividends and Capital Gain Tax Worksheet . Retirement savings contributions credit. Attach Form 8880 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Child tax credit. Attach Schedule 8812, if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Residential energy credits. Attach Form 5695 . . . . . . .

- 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 47 through 53. These are your . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,219 Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,687 Unreported social security and Medicare tax from Form: 4137 8919 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Household employment taxes from Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other taxes. Enter code(s) from instructions Add lines 55 through 60. This is your . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,906 Federal income tax withheld from Forms W-2 and 1099 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 10. 2012 estimated tax payments and amount applied from 2011 return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . If you have a qualifying child, attach Schedule EIC. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Nontaxable combat pay election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Additional child tax credit. Attach Schedule 8812 American opportunity credit from Form 8863, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Amount paid with request for extension to file . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Excess social security and tier 1 RRTA tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2439 8801 8885 Add lines 62, 63, 64a, and 65 through 71. These are your total payments . . . . . . . . . . . . . . . . . . . .

- 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Amount of line 73 you want refunded to you. If Form 8888 is attached, check here. . . . . . . Routing number Type: Checking Savings If e-filing, enter Routing & Account numbers on Form E-File Info. Direct deposit? See instructions. Account number Amount of line 73 you want . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 72 from line 61. For details on how to pay, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,90 6 Estimated tax penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Do you want to allow another person to discuss this return with the IRS (see instructions)? Complete below. Designee's name

- 12. Phone no. Personal identification number (PIN) Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Joint return? See instructions. Keep a copy for your records. Your signature Date Your occupation Daytime phone number Consulting Engineer Spouse's signature. If a joint return, must sign. Date Spouse's occupation Paralegal Print/Type preparer's name Preparer's signature Date Check if PTIN self-employed Firm's name Firm's EIN Firm's address Phone no.

- 13. Form (2012) OMB No. 1545-0074 Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. Name(s) shown on Form 1040 David R and Sheri N Johnson 111-11-1111 Do not include expenses reimbursed or paid by others. Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,197 Enter amount from Form 1040, line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .88,444 Multiply line 2 by 7.5% (.075) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,633 Subtract line 3 from line 1. If line 3 is more than line 1, enter - 0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,564 State and local Income taxes, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2,469 X General sales taxes

- 14. Real estate taxes (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,480 Personal property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other taxes. List type and amount Add lines 5 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,949 Home mortgage interest and points reported to you on Form 1098 3,520 Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address Name Address Your mortgage interest deduction may be limited (see instructions). TIN Points not reported to you on Form 1098. See instructions for special rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Mortgage insurance premiums (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Investment interest. Attach Form 4952 if required. (See

- 15. instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 10 through 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,520 Gifts by cash or check. If you made any gift of $250 or more, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,800 If you made a gift and got a benefit for it, see instructions. Other than by cash or check. If any gift of $250 or more, see instructions. You attach Form 8283 if over $500 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 16 through 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,800 Casualty or theft loss(es). Attach Form 4684. (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Unreimbursed employee expenses—job travel, union dues, job education, etc. Attach Form 2106 or 2106-EZ if required. (See instructions.)

- 16. $ See Attached Statement $ 1,340 1,340 Tax preparation fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other expenses—investment, safe deposit box, etc. List type and amount $ $ $ Add lines 21 through 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,340 Enter amount from Form 1040, line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .88,444 Multiply line 25 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,769 Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Other—from list in instructions. List type and amount $ $ Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,833 If you elect to itemize deductions even though they are less than your standard deduction, check here . . . . . . . . . . . . . . . .

- 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . HTA OMB No. 1545-0074 Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. Name of proprietor David R Johnson 111-11-1111 Principal business or profession, including product or service (see instructions) Engineer, Services to MIning Companies 541990 Business name. If no separate business name, leave blank. (see instr.) Business address (including suite or room no.) 641 Cody Way City, town or post office, state, and ZIP code Casper WY 82609 Accounting method: X Cash Accrual Other (specify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X If you started or acquired this business during 2012, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Did you make any payments in 2012 that would require you to

- 18. file Form(s) 1099? (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X If "Yes," did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117,620 Returns and allowances (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117,620 Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117,620 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117,620 Advertising . . . . . . . . . . . . . . . . . . .

- 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,400 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,200 Car and truck expenses (see Pension and profit-sharing plans instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,390 Rent or lease (see instructions): Commissions and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other business property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depreciation and section 179 expense deduction (not included in Part III) (see instructions) . . . . . . . . Supplies (not included in Part III) 3,200 Taxes and licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300 9,210 Travel, meals, and entertainment:

- 20. Employee benefit programs Travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,320 (other than on line 19). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Deductible meals and . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . entertainment (see instructions) 3,050 Interest: Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Mortgage (paid to banks, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other expenses (from line 48) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,280 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . before expenses for business use of home. Add lines 8 through 27a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,350 Tentative profit or (loss). Subtract line 28 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 21. . . . . . . . . . . . . . . . . . . . . . 77,270 Expenses for business use of your home. Attach . Do report such expenses elsewhere . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,546 Subtract line 30 from line 29. (If you checked the box on line 1, see instructions) Estates and trusts, enter on 70,724 If a loss, you go to line 32. If you have a loss, check the box that describes your investment in this activity (see instructions). If you checked 32a, enter the loss on both (or F and on (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on Some investment is not at risk. If you checked 32b, you attach . Your loss may be limited. HTA Schedule C (Form 1040) 2012 David R Johnson 111-11-1111 Page (see instructions) Method(s) used to value closing inventory: Cost Lower of cost or market Other (attach explanation) Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

- 22. If "Yes," attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Inventory at beginning of year. If different from last year's closing inventory, attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Purchases less cost of items withdrawn for personal use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cost of labor. Do not include any amounts paid to yourself . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Materials and supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 35 through 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 41 from line 40. Enter the result here and on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0

- 23. Complete this part if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. When did you place your vehicle in service for business purposes? (month, day, year) Of the total number of miles you drove your vehicle during 2012, enter the number of miles you used your vehicle for: Business Commuting (see instructions) Other Was your vehicle available for personal use during off-duty hours? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Do you (or your spouse) have another vehicle available for personal use? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Do you have evidence to support your deduction? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . If "Yes," is the evidence written? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . List below business expenses not included on lines 8–26 or line 30. Telephone/Internet 860 Trade Journals 240

- 24. Professional Dues 180 Enter here and on line 27a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,280 OMB No. 1545-0074 Department of the Treasury Internal Revenue Service Attachment Sequence No.(99) Name(s) shown on return David R and Sheri N Johnson 111-11-1111 Complete Form 8949 before completing line 1, 2, or 3. Proceeds (sales price) from Form(s) 8949, Part I, line 2, column (d) Cost or other basis from Form(s) 8949, Part I, line 2, column (e) Adjustments to gain or loss from

- 25. Form(s) 8949, Part I, line 2, column (g) Subtract column (e) from column (d) and combine the result with column (g) This form may be easier to complete if you round off cents to whole dollars. Short-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Short-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Short-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Short-term capital loss carryover. Enter the amount, if any, from line 8 of your in the instructions . . . . . . . . . . . . . . . . .

- 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Combine lines 1 through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Complete Form 8949 before completing line 8, 9, or 10. Proceeds (sales price) from Form(s) 8949, Part II, line 4, column (d) Cost or other basis from Form(s) 8949, Part II, line 4, column (e) Adjustments to gain or loss from Form(s) 8949, Part II, line 4, column (g) Subtract column (e) from column (d) and combine the result with column (g) This form may be easier to complete if you round off cents to whole dollars. Long-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . .

- 27. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Long-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Long-term totals from all Forms 8949 with checked in . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,900 -3,900 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 8824 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter Capital Gain Distributions on Dividends Worksheet. Capital gain distributions. See the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Long-term capital loss carryover. Enter the amount, if any, from line 13 of your in the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Combine lines 8 through 14 in column (h). Then go to Part III on the back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -3,900

- 28. HTA Schedule D (Form 1040) 2012 David R and Sheri N Johnson 111-11-1111 Page Combine lines 7 and 15 and enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -3,900 If line 16 is a , enter the amount from line 16 on Form 1040, line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a , skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is skip lines 17 through 21 below and enter -0- on Form 1040, line 13, or Form 1040NR, line 14. Then go to line 22. Are lines 15 and 16 gains? Go to line 18. Skip lines 18 through 21, and go to line 22. Enter the amount, if any, from line 7 of the in the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter the amount, if any, from line 18 of the in the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 29. Are lines 18 and 19 zero or blank? Complete the in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). complete lines 21 and 22 below. Complete the in the instructions. complete lines 21 and 22 below. If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the of: The loss on line 16 or . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( 3,000) ($3,000), or if married filing separately, ($1,500) When figuring which amount is smaller, treat both amounts as positive numbers. Do you have qualified dividends on Form 1040, line 9b, or Form 1040NR, line 10b? X Complete the in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Complete the rest of Form 1040 or Form 1040NR. Form 8949 (2012) Attachment Sequence No. Page Name(s) shown on return. (Name and SSN or taxpayer identification no. not required if shown on other side.)

- 30. David R and Sheri N Johnson 111-11-1111 Transactions involving capital assets you held more than one year are long term. For short-term transactions, see page 1. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. Long-term transactions reported on Form(s) 1099-B showing basis reported to the IRS Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS X Long-term transactions not reported to you on Form 1099-B If you enter an amount in column (g), escription of property (Example: 100 sh. XYZ Co.) Cost or other basis. enter a code in column (f). Date acquired Date sold or Proceeds See the below Subtract column (e) (Mo., day, yr.) disposed (sales price) and see Code(s) from instructions Amount of

- 31. adjustment from column (d) and (Mo., day, yr.) (see instructions) in the separate combine the result instructions with column (g) Cormorant Stock 3/7/2011 Worthless Worthless 3,900 -3,900 Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, (if above is checked), (if above is checked), or (if above is checked) 0 3,900 0 -3,900 If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See in the separate instructions for how to figure the amount of the adjustment. Form (2012) OMB No. 1545-0074 Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. Name(s) shown on return

- 32. David R and Sheri N Johnson 111-11-1111 If you are in the business of renting personal property, use or (see instructions). If you are an individual, report farm rental income or loss from on page 2, line 40. Did you make any payments in 2012 that would require you to file Form(s) 1099? (see instructions) Yes X No If "Yes," did you or will you file required Forms 1099? Yes No Physical address of each property (street, city, state, ZIP code) 4620 Cottonwood Lane Casper, WY Type of Property For each rental real estate property listed above, report the number of fair rental and personal use days. Check the box only if you meet the requirements to file as a qualified joint venture. See instructions. (from list below) 1 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Rents received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,600 Royalties received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 33. Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Auto and travel (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cleaning and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,200 Commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,100 Legal and other professional fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Management fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Mortgage interest paid to banks, etc. (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 34. . . . . . . . . . . . . . . 2,400 Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depreciation expense or depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,204 Other (list) Total expenses. Add lines 5 through 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,704 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896 Deductible rental real estate loss after limitation, if any, on (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) ) ) Total of all amounts reported on line 3 for all rental properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,600 Total of all amounts reported on line 4 for all royalty properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Total of all amounts reported on line 12 for all properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Total of all amounts reported on line 18 for all properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,204 Total of all amounts reported on line 20 for all properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,704

- 35. Add positive amounts shown on line 21. include any losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896 Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( 0 ) Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Form 1040, line 17, or Form 1040NR, line 18. Otherwise, include this amount in the total on line 41 on page 2 . . . . . . . . . . . . . 2,896 HTA OMB No. 1545-0074 Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. Name of person with income (as shown on Form 1040) Social security number of person David R Johnson with income 111-11-1111 To determine if you must file Schedule SE, see the instructions. Use this flowchart you must file Schedule SE. If unsure, see in the instructions.

- 36. Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval to be taxed on earnings from these sources, you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security or railroad retirement (tier 1) tax your net earnings from self-employment more than $110,100? Are you using one of the optional methods to figure your net earnings (see instructions)? Did you receive tips subject to social security or Medicare tax that you report to your employer? Did you report any wages on Form 8919, Uncollected Social Security and Medicare Tax on Wages?Did you receive church employee income (see instructions) reported on Form W-2 of $108.28 or more? Read above to see if you can use Short Schedule SE. Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code J1. Ministers and members of religious orders, see instructions for

- 37. types of income to report on this line. See instructions for other income to report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70,724 Combine lines 1a, 1b, and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70,724 Multiply line 3 by 92.35% (.9235). If less than $400, you do not owe self-employment tax; file this schedule unless you have an amount on line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65,314 If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. If the amount on line 4 is: $110,100 or less, multiply line 4 by 13.3% (.133). Enter the result here and on or More than $110,100, multiply line 4 by 2.9% (.029). Then, add $11,450.40 to the result. Enter the total here and on or . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,687 If the amount on line 5 is: $14,643.30 or less, multiply line 5 by 57.51% (.5751) More than $14,643.30, multiply line 5 by 50% (.50) and add $1,100 to the result. Enter the result here and on or

- 38. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,996 HTA Schedule SE (Form 1040) 2012 Attachment Sequence No. Page Name of person with income (as shown on Form 1040) Social security number of person David R Johnson with income 111-11-1111 If your only income subject to self-employment tax is , see instructions. Also see instructions for the definition of church employee income. If you are a minister, member of a religious order, or Christian Science practitioner you filed Form 4361, but you had $400 or more of net earnings from self-employment, check here and continue with Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. . Skip lines 1a and 1b if you use the farm optional method (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code J1.

- 39. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. Skip this line if you use the nonfarm optional method (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Combine lines 1a, 1b, and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 If line 3 is more than zero, multiply line 3 by 92.35% (.9235). Otherwise, enter amount from line 3 If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. If you elect one or both of the optional methods, enter the total of lines 15 and 17 here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Combine lines 4a and 4b. If less than $400, ; you do not owe self-employment tax. If less than $400 and you had enter -0- and continue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Enter your from Form W-2. See instructions for definition of church employee income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Multiply line 5a by 92.35% (.9235). If less than $100, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Add lines 4c and 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Maximum amount of combined wages and self-employment

- 40. earnings subject to social security tax or the 4.2% portion of the 5.65% railroad retirement (tier 1) tax for 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $110,100 or more, skip lines 8b through 10, and go to line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Unreported tips subject to social security tax (from Form 4137, line 10) Wages subject to social security tax (from Form 8919, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 8a, 8b, and 8c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Multiply the of line 6 or line 9 by 10.4% (.104) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Multiply line 6 by 2.9% (.029) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Add lines 10 and 11. Enter here and on or 0 Add the two following amounts. 59.6% (.596) of line 10. One-half of line 11. Enter the result here and on or

- 41. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 (see instructions) You may use this method if your gross farm income¹ was not more than $6,780, your net farm profits² were less than $4,894. Maximum income for optional methods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter the of: two-thirds (²/3) of gross farm income¹ (not less than zero) $4,520. Also include this amount on line 4b above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . You may use this method if your net nonfarm profits³ were less than $4,894 and also less than 72.189% of your gross nonfarm income, you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. You may use this method no more than five times. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Enter the of: two-thirds (²/3) of gross nonfarm income (not less than zero) the amount on line 16. Also include this amount on line 4b above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¹ From Sch. F, line 9, and Sch. K-1 (Form 1065), box 14, code B. ³ From Sch. C, line 31; Sch. C-EZ, line 3; Sch. K-1 (Form

- 42. 1065), box 14, code ² From Sch. F, line 34, and Sch. K-1 (Form 1065), box 14, code A; and Sch. K-1 (Form 1065-B), box 9, code J1. A—minus the amount you would have entered on line 1b had you not From Sch. C, line 7; Sch. C-EZ, line 1; Sch. K-1 (Form 1065), box 14, code used the optional method. C; and Sch. K-1 (Form 1065-B), box 9, code J2. Form OMB No. 1545-0172 Department of the Treasury Attachment Internal Revenue Service (99) Sequence No. Name(s) shown on return Business or activity to which this form relates Sheri N Johnson 2106: 01 123-45-6785 If you have more than one business or activity with Section 179, see 179 Summary. Maximum amount (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total cost of section 179 property placed in service (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Threshold cost of section 179 property before reduction in limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 43. Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Description of property Cost (business use only) Elected cost Listed property. Enter the amount from line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Tentative deduction. Enter the of line 5 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction from line 13 of your 2011 Form 4562. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 960 Carryover of disallowed deduction to 2013. Add lines 9 and 10, less line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0

- 44. include listed property. (See instructions.) Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Property subject to section 168(f)(1) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other depreciation (including ACRS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . include listed property. (See instructions.) MACRS deductions for assets placed in service in tax years beginning before 2012 . . . . . . . . . . . . . . . . . . . . . . . If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Month and Basis for depreciation Recovery period Classification of property year placed (business/investment use Convention Method in service only—see instructions) 3-year property 5-year property 5 HY 200DB 7-year property 10-year property

- 45. 15-year property 20-year property 25-year property 25 yrs. S/L Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L Nonresidential real 39 yrs. MM S/L property MM S/L Class life S/L 12-year 12 yrs. S/L 40-year 40 yrs. MM S/L (See instructions.) Listed property. Enter amount from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 960 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Form 4562 (2012) HTA Form OMB No. 1545-0172

- 46. Department of the Treasury Attachment Internal Revenue Service (99) Sequence No. Name(s) shown on return Business or activity to which this form relates David R Johnson Sch C: 01 - Engineer, Services to MIning Companies 111-11-1111 If you have more than one business or activity with Section 179, see 179 Summary. Maximum amount (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total cost of section 179 property placed in service (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Threshold cost of section 179 property before reduction in limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Description of property Cost (business use only) Elected cost Listed property. Enter the amount from line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 47. . . . . . . . . . . . . . . . . . . . Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Tentative deduction. Enter the of line 5 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction from line 13 of your 2011 Form 4562. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800 Carryover of disallowed deduction to 2013. Add lines 9 and 10, less line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 include listed property. (See instructions.) Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Property subject to section 168(f)(1) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other depreciation (including ACRS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 48. include listed property. (See instructions.) MACRS deductions for assets placed in service in tax years beginning before 2012 . . . . . . . . . . . . . . . . . . . . . . . If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Month and Basis for depreciation Recovery period Classification of property year placed (business/investment use Convention Method in service only—see instructions) 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 25 yrs. S/L Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L Nonresidential real 39 yrs. MM S/L property MM S/L Class life S/L 12-year 12 yrs. S/L 40-year 40 yrs. MM S/L (See instructions.) Listed property. Enter amount from line 28 . . . . . . .

- 49. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,410 Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,210 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Form 4562 (2012) HTA Form 4562 (2012) David R Johnson 111-11-1111 Page (Include automobiles, certain other vehicles, certain computers, and property used for entertainment, recreation, or amusement.) X If "Yes," is the evidence written? X Business/ investment use percentage Basis for depreciation (business/ investment

- 50. use only) Type of property Date placed Cost or other basis Recovery Method/ Depreciation Elected section 179 (list vehicles first) in service period Convention deduction cost Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ." Property used more than 50% in a qualified business use: Infiniti crossover SUV 2/4/2011 90.00% 41,000 29,700 5 200DB - HY 4,410 Property used 50% or less in a qualified business use: % S/L - % S/L - % S/L - Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,410 Add amounts in column (i), line 26. Enter here and on line 7, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

- 51. Total business/investment miles driven during Vehicle 1 Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6 the year ( include commuting miles) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,050 Total commuting miles driven during the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total other personal (noncommuting) miles driven . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,450 Total miles driven during the year. Add lines 30 through 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,500 Was the vehicle available for personal use during off-duty hours? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Was the vehicle used primarily by a more than 5% owner or related person? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Is another vehicle available for personal use? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who more than 5% owners or related persons (see instructions). Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting,

- 52. by your employees? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Do you treat all use of vehicles by employees as personal use? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Do you meet the requirements concerning qualified automobile demonstration use? (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X Amortization period or percentage Description of costs Date amortization Amortizable amount Code section begins Amortization of costs that begins during your 2012 tax year (see instructions): Amortization of costs that began before your 2012 tax year . . . . . . . . . . . . . . . . . . . . . . . . . .

- 53. . . . . . . . . Add amounts in column (f). See the instructions for where to report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Form 4562 (2012) Form OMB No. 1545-0172 Department of the Treasury Attachment Internal Revenue Service (99) Sequence No. Name(s) shown on return Business or activity to which this form relates David R Johnson Sch C: 01 (8829 #1) 111-11-1111 If you have more than one business or activity with Section 179, see 179 Summary. Maximum amount (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total cost of section 179 property placed in service (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Threshold cost of section 179 property before reduction in limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Dollar limitation for tax year. Subtract line 4 from line 1. If

- 54. zero or less, enter -0-. If married filing separately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Description of property Cost (business use only) Elected cost Listed property. Enter the amount from line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Tentative deduction. Enter the of line 5 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction from line 13 of your 2011 Form 4562. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction to 2013. Add lines 9 and 10, less line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 include listed property. (See instructions.) Special depreciation allowance for qualified property (other than listed property) placed in service

- 55. during the tax year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Property subject to section 168(f)(1) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other depreciation (including ACRS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . include listed property. (See instructions.) MACRS deductions for assets placed in service in tax years beginning before 2012 . . . . . . . . . . . . . . . . . . . . . . . 1,846 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Month and Basis for depreciation Recovery period Classification of property year placed (business/investment use Convention Method in service only—see instructions) 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 25 yrs. S/L Residential rental 27.5 yrs. MM S/L

- 56. property 27.5 yrs. MM S/L Nonresidential real 39 yrs. MM S/L property MM S/L Class life S/L 12-year 12 yrs. S/L 40-year 40 yrs. MM S/L (See instructions.) Listed property. Enter amount from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,846 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Form 4562 (2012) HTA Form OMB No. 1545-0172 Department of the Treasury Attachment Internal Revenue Service (99) Sequence No.

- 57. Name(s) shown on return Business or activity to which this form relates David R Johnson Sch E: 01 111-11-1111 If you have more than one business or activity with Section 179, see 179 Summary. Maximum amount (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total cost of section 179 property placed in service (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Threshold cost of section 179 property before reduction in limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Description of property Cost (business use only) Elected cost Listed property. Enter the amount from line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0

- 58. Tentative deduction. Enter the of line 5 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction from line 13 of your 2011 Form 4562. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Carryover of disallowed deduction to 2013. Add lines 9 and 10, less line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 include listed property. (See instructions.) Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Property subject to section 168(f)(1) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other depreciation (including ACRS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . include listed property. (See instructions.) MACRS deductions for assets placed in service in tax years beginning before 2012 . . . . . . . . . . . . . . . . . . . . . . . 18,204

- 59. If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Month and Basis for depreciation Recovery period Classification of property year placed (business/investment use Convention Method in service only—see instructions) 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 25 yrs. S/L Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L Nonresidential real 39 yrs. MM S/L property MM S/L Class life S/L 12-year 12 yrs. S/L 40-year 40 yrs. MM S/L (See instructions.) Listed property. Enter amount from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21.

- 60. Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,204 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Form 4562 (2012) HTA Form OMB No. 1545-1008 Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. Name(s) shown on return David R and Sheri N Johnson 111-11-1111 Enter prior losses on form where loss occurred, i.e. Sch E (1040) 'Ln 22 - Loss Limitations' or K-1 Input (For the definition of active participation, see in the instructions.) Activities with net income (enter the amount from Worksheet 1, column (a)) . . . . . . . . . . . . . . . . . . .

- 61. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896) Activities with net loss (enter the amount from Worksheet 1, column (b)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Prior years unallowed losses (enter the amount from Worksheet 1, column (c)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Combine lines 1a, 1b, and 1c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896) Commercial revitalization deductions from Worksheet 2, column (a) ( ) Prior year unallowed commercial revitalization deductions from Worksheet 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Add lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Enter prior losses on K-1 Input or 'Loss Limitations' worksheets Activities with net income (enter the amount from Worksheet 3, column (a)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Activities with net loss (enter the amount from Worksheet 3, column (b)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( )

- 62. Prior years unallowed losses (enter the amount from Worksheet 3, column (c)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( ) Combine lines 3a, 3b, and 3c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0) Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c, 2b, or 3c. Report the losses on the forms and schedules normally used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896) If line 4 is a loss and: Line 1d is a loss, go to Part II. Line 2c is a loss (and line 1d is zero or more), skip Part II and go to Part III. Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts II and III and go to line 15. Enter the of the loss on line 1d or the loss on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Enter $150,000. If married filing separately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

- 63. . . . . . . . . . . . . . . . . . 0 0 Enter the of line 5 or line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 If line 2c is a loss, go to Part III. Otherwise, go to line 15. Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions 0 Enter the loss from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Reduce line 12 by the amount on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Enter the of line 2c (treated as a positive amount), line 11, or line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Add the income, if any, on lines 1a and 3a and enter the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Add lines 10, 14, and 15. See instructions to find out how to report the losses on your tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Form (2012) HTA Form 8582 (2012) David R and Sheri N Johnson 111-11-1111

- 64. Page (See instructions.) Sch E: 2,896 2,896 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,896 0 0 (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 0 (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 0 (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 Form (2012) Form 8582 (2012) David R and Sheri N Johnson 111-11-1111 Page (See instructions.)

- 65. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 0 (See instructions.) Net loss plus prior year unallowed loss from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net income from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 1b from line 1a. If zero or less, enter -0- Net loss plus prior year unallowed loss from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net income from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 1b from line 1a. If zero or less, enter -0- Net loss plus prior year unallowed loss from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net income from form or schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .