Tutorial 9 Solutions.docx

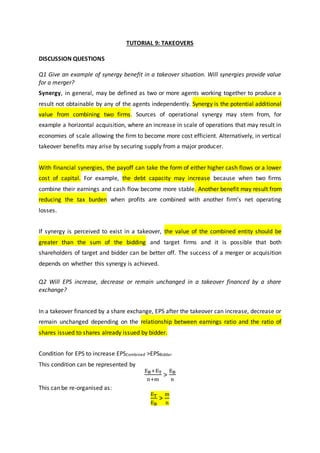

- 1. TUTORIAL 9: TAKEOVERS DISCUSSION QUESTIONS Q1 Give an example of synergy benefit in a takeover situation. Will synergies provide value for a merger? Synergy, in general, may be defined as two or more agents working together to produce a result not obtainable by any of the agents independently. Synergy is the potential additional value from combining two firms. Sources of operational synergy may stem from, for example a horizontal acquisition, where an increase in scale of operations that may result in economies of scale allowing the firm to become more cost efficient. Alternatively, in vertical takeover benefits may arise by securing supply from a major producer. With financial synergies, the payoff can take the form of either higher cash flows or a lower cost of capital. For example, the debt capacity may increase because when two firms combine their earnings and cash flow become more stable. Another benefit may result from reducing the tax burden when profits are combined with another firm’s net operating losses. If synergy is perceived to exist in a takeover, the value of the combined entity should be greater than the sum of the bidding and target firms and it is possible that both shareholders of target and bidder can be better off. The success of a merger or acquisition depends on whether this synergy is achieved. Q2 Will EPS increase, decrease or remain unchanged in a takeover financed by a share exchange? In a takeover financed by a share exchange, EPS after the takeover can increase, decrease or remain unchanged depending on the relationship between earnings ratio and the ratio of shares issued to shares already issued by bidder. Condition for EPS to increase EPSCombined >EPSBidder This condition can be represented by EB+ET n+m > EB n This can be re-organised as: ET EB > m n

- 2. m: number of shares offered to issue to target shareholders n: number of shares of bidder For EPS to remain unchanged, the condition is: ET EB = m n For EPS to decrease, ET EB < m n This condition is applicable under zero sum game (no synergy) and non-zero sum game (synergies exist). If synergies exist, after the takeover, earnings of target company will be increased by the annual effect of synergy. PROBLEMS Q1 BHP Billiton Takeover of WMC 2005 a) Determine the value of the merged firm (assume Rf = 5% and Rm – Rf = 7%). Assume that the Independent’s valuation of the target represents its intrinsic value. VC = VB + VT + VSynergy – ConsT (Cash) Value of Bidder VB = = Share price * Outstanding Shares = 17.85 (3,113.82m) = $55,581.687m Value of Target Using Independent export valuation of target as Value ‘as is’ = number of shares x value per share (mid-point of independent expert’s valuation) = 1,222.93m x $7.50 = $9,171.975m Value ‘as is’ Value of gains/ synergy Once only saving of $120m Ongoing cost saving of $115 pa Since these gains are linked with the target, the relevant cost of equity is that for WMC re = 5% + 1.7 (7%) = 16.9% Value of gains/ synergy = 120 + (115/ .169) = $800.473m Total offer price = $9.6b VC = $55,581.687m + 9,171.975m + $800.473m – 9,600m = $55,954.135m

- 3. b) Identify the target shareholders gain/ loss Target shareholders gain/ loss (Premium) = 𝐶𝑜𝑛𝑠𝑇 − 𝑉𝑇 =$9,600m – 9,171.975m = $428.025m c) Identify the acquiring companies gain/ loss 𝐵𝑖𝑑𝑑𝑒𝑟𝑠 𝐺𝑎𝑖𝑛 = 𝑆𝑦𝑛𝑒𝑟𝑔𝑖𝑒𝑠 − 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 = $800.437m – 428.025m = $372.448m Note that I have not factored the change of capital structure to the valuation. Recall, that finance theory argues a separation of the investing and financing decisions. This means that the capital investment decision is independent of the financing decision. d) Re-calculate answers to parts a) –c), if BHP had offered shares instead Assume share exchange (cash equivalent) in given in the form: 𝐸𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑅𝑎𝑡𝑖𝑜 = 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑇 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝐵 = 7.85 17.85 = 0.44 This means BHP would issue 44 shares in BHP for every 100 shares held in WMC. Calculate the number of shares issued by BHP 𝑚 = 7.85 17.85 (1,222.93) = 538 𝑠ℎ𝑎𝑟𝑒𝑠 𝑎𝑝𝑝𝑟𝑜𝑥 Using formula Share price of merged firm 𝑃𝐶 = 𝑉𝐶 𝑛 + 𝑚 = 𝑉𝐵 + 𝑉𝑇 + 𝑉𝑆𝑦𝑛𝑒𝑟𝑔𝑦 − 𝐶𝑜𝑛𝑠𝑇 (𝐶𝑎𝑠ℎ) 𝑛 + 𝑚 𝑃𝐶 = 55,581.687 + 9,171.975 + 800.473 − 0 3,113.82 + 538 = 65,554.135 3,651.9092 = $17.95 𝑝𝑠 Consideration for target, ConsT = 17.95 (538) = $9,657.1m Target shareholders gain/ loss: 9,657.1 – 9,171.975 = $485.128m Acquirers gain/loss = 800.473 – 485.128 = $315.345m e) Are BHP shareholders better off issuing cash or a share exchange? Shareholders of the acquiring company are worse off since part of the premium is not shared with the acquiring shareholders. We can say that: If Vsyn > 0 then premium paid to target shareholders is greater for share exchange than for a cash offer (since under a share exchange they receive part of the gain that bidder shareholders would receive under a cash offer- this is because in a share exchange they also become shareholders of the bidder).

- 4. If Vsyn = 0 then premium paid to target shareholders is greater for a cash offer than for a share exchange (since under a share exchange they receive part of the loss that bidder shareholders receive under a cash offer). f) Identify the exchange offer that is fair to both shareholders of target and acquiring firm. An exchange offer in the proportion of the fair value in shares of both the target and acquiring company. 𝐹𝑎𝑖𝑟 𝑒𝑥𝑐ℎ𝑎𝑛𝑔𝑒 = 𝐹𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡𝑎𝑟𝑔𝑒𝑡 𝑠ℎ𝑎𝑟𝑒𝑠 𝐹𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑏𝑖𝑑𝑑𝑒𝑟 𝑠ℎ𝑎𝑟𝑒𝑠 = $7.50 $17.85 = 42 𝑠ℎ𝑎𝑟𝑒𝑠 𝑖𝑛 𝐵𝐻𝑃 𝑓𝑜𝑟 𝑒𝑣𝑒𝑟𝑦 100 𝑠ℎ𝑎𝑟𝑒𝑠 ℎ𝑒𝑙𝑑 𝑖𝑛 𝑊𝑀𝐶’s This means that shareholders of Target are getting a better deal (44 shares) than a ‘fair exchange’. Exchange offer: lấy share price (WMC) following BHP’s offer Fair exchange: lấy share price prior to BHP’s offer g) Determine the P/E ratio that should be used to value the merger under the exchange offer (part (g)) that is consistent with your answer for part (d). From (d) 𝑉𝐶 = 55,581.687 (𝐵𝐻𝑃) + 9,171.975 (𝑊𝑀𝐶)+ 800.473 (𝑆𝑦𝑛𝑒𝑟𝑔𝑦) = $65,554𝑚 𝑃𝐶 = 65,554 3,651.9092 = $17.95𝑝𝑠 From (g) 𝐸𝑃𝑆𝐶 = 4,939.8 (𝐵𝐻𝑃) + 1,326.9 (𝑊𝑀𝐶)+ 115 (𝑆𝑎𝑣𝑖𝑛𝑔𝑠) 3,113.82 (𝐵𝐻𝑃) + 538 (𝑛𝑒𝑤 𝑠ℎ𝑎𝑟𝑒𝑠) = $1.75 Therefore $1.75 𝑥 𝑃 𝐸 ⁄ = $17.95 𝑃 𝐸 ⁄ = 17.95 1.75 = 𝟏𝟎.𝟑 Consistent with lecture, the P/E ratio for the combined entity can be verified using a weighted average P/E’s of the bidder and target in proportion of profit contribution as follows: 𝑃/𝐸𝐶 = 𝑃/𝐸𝐵 ( 𝐸𝐵 𝐸𝐵 + 𝐸𝑇 + 𝐸𝑆𝑌𝑁 ) + 𝑃/𝐸𝑇 ( 𝐸𝑇 + 𝐸𝑆𝑌𝑁 𝐸𝐵 + 𝐸𝑇 + 𝐸𝑆𝑌𝑁 ) 𝑃/𝐸𝐵 = 17.85 1.59 (𝑖.𝑒. 4939.8 3113.82 ) = 11.23

- 5. 𝑃/𝐸𝑇 = 7.50 (1,326.9 1,222.93 ⁄ ) = 6.91 Therefore 𝑃/𝐸𝐶 = 11.23( 4939.8 4939.8 + 1326.9 + 115 ) + 6.91 ( 1326.9 + 115 4939.8 + 1326.9 + 115 ) = 10.3