World Bank and International Monetary Fund

- 2. World Bank - Its impact on us Submitted to, Under Guidance, Prof.Dr.Anurag Trivedi Miss Manisha H.O.D. – Electrical Electrical Department Submitted By, Krishna K. Omer 0601EE131021 7th semester

- 3. Terminology How WB came into existence IMF and IBRD World Bank India and WB Nixon shock Economic collapse Conclusion

- 4. Currency war, also known as competitive devaluations, is a condition where countries seek to gain a trade advantage over other countries by causing the exchange rate of their currency. Fiat money : -Any money declared by a government to be legal tender. -Non-convertible. -Valueless money used as money because of government decree. A currency that uses a floating exchange rate is known as a floating currency.

- 5. An economic bubble is trade of asset at a price or price range that strongly deviates from the corresponding asset's intrinsic value. Price gouging is a term, when a seller spikes the prices of goods, services or commodities to a level much higher than is considered reasonable or fair. Usually this event occurs after a demand or supply shock

- 6. After the second world war (1939–45), representatives of 45 countries met in a resort, at Bretton woods, USA to come up with a system which can boost economy and rebuid economies shattered by war. As a result, Bretton Woods system was introduced formulating two bodies called : 1. International Bank for Reconstruction and Development (IBRD), 2. International Monetary Fund (IMF). System suggested that all currencies will be linked to the dollar, and the dollar linked to gold. [ All countries currency ---- Dollar ---- Gold ] - Bretton woods system

- 7. The IMF creates a stable climate for international trade by harmonising its members, and maintaining exchange stability. Also, It can provide temporary financial assistance to countries encountering financial difficulties. The IBRD, serves to improve the capacity of countries to trade by lending them loans. As time changed, now IBRD is globally known as World Bank.

- 8. The World Bank is an international financial institution that provides loans to developing countries. The World Bank's official goal is the reduction of poverty, the promotion of foreign investment and international trade. The first country to receive a World Bank loan was France. The loan was of 250 million US$, half the amount requested, and it came with strict conditions. Country who gets loan from WB has to return amount + interest, and has to fulfill a list of conditions. Jim Yong Kim, present president of WB.

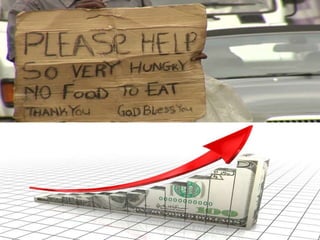

- 9. India is a developing or third world country with a fantastic poverty, that makes us fit for asking help from WB. Now if we get loan from WB, we have to repay, plus interest, plus conditions. Bigger the amount and longer the time, bigger the interest This interest would be paid by India, how ? -inflation -taxes -reduced salaries -unemployment n what not resulting in poverty means actually we individually are paying these interest With increase in poverty we are more prone to take more loans n this cycle goes on till we cry for help.

- 10. “Now if we get loan from WB, we have to repay, plus interest, plus conditions. Bigger the amt n longer the time, bigger the interest” while repaying, we have to convert INR to USD. If 1 USD = 67 INR, so interest gets *67, Ex : 1 million earlier, 67 millions now. Results in uncontrolled amplified poverty.

- 11. “USD dollar is accepted as international currency” Ex : - Ram, RGPV, BE, tomorrow xam, wants study material, has 11 10 Rs. notes (=110 Rs.) - shop, book available, book cost 100 Rs.,

- 12. -accepted money denomination of 100 Rs. - Ram ???

- 13. - outside shop, man, offers 1 100 Rs. In xchange of 10 10 Rs. Notes(=100 Rs.) + 10 Rs. Commission - since its urgent, deal is made, effectively he pays 110 Rs. For 100 Rs,

- 14. - Now compare : “ Ram = India, Shopkeeper = WB (accepts USD only), commission = exchange rates (USD vs INR)”

- 15. Because world use it : (why ?) - lot of countries (govts. & banks) hold reserves of the USD because it is perceived as the strongest and most reliable currency. So if India exports to Nigeria, instead of taking payment in Nigerian currency, we'd prefer to take payment in USD, because India may be unable to use Nigerian currency to import from other countries. But everyone would accept USD, so India will say pay us in USD. All countries trade in this way, so it makes more sense to mention all prices in USD and compare one's national currency with the USD. The Euro is the second largest reserve currency and so they've started comparing the INR with Euro too.

- 17. NIXON shock Countries settled their international accounts in dollars that could be converted to gold at a fixed exchange rate of $35 per ounce, which was redeemable by the U.S. government. Thus, the United States was committed to backing every dollar overseas with gold. Other currencies were fixed to the dollar, and the dollar was pegged to gold. The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, the most significant of which was the unilateral cancellation of the direct international convertibility of the United States dollar to gold. [ All countries currency ---- Dollar ---- Gold ] - (1944-1971) - Bretton woods system [ All countries currency ---- Dollar Gold ] -(1971-present) - Nixon shock (FIAT money system)

- 18. Today USD is well spread in market means it became popular, hence gets internationalise. Now, it has world class quality product, so it exports and we purchase, in return it accepts USD, and we pay so USD goes on increasing. Ex : In INDIA “made in china” is also popular, means we import China’s product and pay them as per they ask and make ourself weaker. But its obvious, made in china is cheaper, so why not we go with it. USD vs. INR is actually the status of two countries. ( Ex : 1 punch = 67 punches )

- 19. There is no precise definition of an economic collapse. The term has been used to describe a broad range of bad economic conditions, ranging from a severe, prolonged depression with high bankruptcy rates, high unemployment, hyperinflation, etc. The Great Recession was a period of general economic decline observed in world markets during the late 2000s and early 2010s. The scale and timing of the recession varied from country to country.

- 20. Kaushik Basu, the chief economist of the World Bank and former chief economic adviser of the Indian government, says corruption helped India avoid banking crisis that has damaged most other large economies in the last few years. He says wide use of "black money" - illegal cash, hidden from the tax authorities – results in answer against crisis in the banking sector. Ex : Let's say you like the look of a house that is for sale. You r purchasing it now - for argument's sake , cost 100 rupees. -The chances are the seller will tell you, he will only take, 50 rupees as a formal payment and demand the rest in cash. -That cash payment is what Indians refer to as "black money". -It means the seller can avoid tax bill. Buyers benefit too because the lower the declared value of the property, lower the property tax they have to pay. That's why when the crash came, the balance sheets of the big banks collapsed along with property prices. So when prices fell in India - and they did fall in 2008 and 2009 (Great Recession) most bank loans were still comfortably within the value of the property. That's why India managed to avoid the damage to economy.

- 21. Corruption : an unpleasant disease, it may have some positive side effects - encouraging your hair to grow, but you would still prefer not to have the illness. Bribe, instead of both bribe-givers and bribe-takers being held criminally responsible for their actions, only the bribe-taker should face sanctions. Use “Made in India” and produce in India so that no exchange rates may apply. Taking loan from World Bank is a negative gesture, reflects poverty, instead spread education, optimise your own system. Policies for enterpreneurs should be optimised with least paper work. Produce quality products. Co-relate yourself with the economics, either you are anyside of the table but you impact economy, claim it, let it not happen that our economy is in AUTO-PILOT mode .

- 23. Thank you….