New base special energy news 03 july 2016

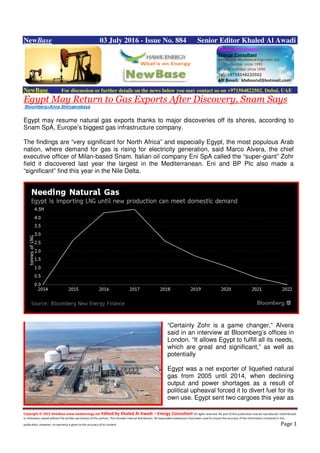

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 03 July 2016 - Issue No. 884 Senior Editor Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Egypt May Return to Gas Exports After Discovery, Snam Says Bloomberg+Anna Shiryaevskaya Egypt may resume natural gas exports thanks to major discoveries off its shores, according to Snam SpA, Europe’s biggest gas infrastructure company. The findings are “very significant for North Africa” and especially Egypt, the most populous Arab nation, where demand for gas is rising for electricity generation, said Marco Alvera, the chief executive officer of Milan-based Snam. Italian oil company Eni SpA called the “super-giant” Zohr field it discovered last year the largest in the Mediterranean. Eni and BP Plc also made a “significant” find this year in the Nile Delta. “Certainly Zohr is a game changer,” Alvera said in an interview at Bloomberg’s offices in London. “It allows Egypt to fulfill all its needs, which are great and significant,” as well as potentially Egypt was a net exporter of liquefied natural gas from 2005 until 2014, when declining output and power shortages as a result of political upheaval forced it to divert fuel for its own use. Egypt sent two cargoes this year as

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Royal Dutch Shell Plc, a buyer of the country’s LNG, said sporadic exports are possible after the 2014 notice of force majeure -- a provision protecting companies from liability for unfulfilled contracts. Egypt’s share in global LNG trade reached about 7 percent in 2006 with 10.5 million metric tons shipped, before declining each year since then, according to the International Group of LNG Importers. Snam’s unit GNL Italia owns and manages an LNG regasification terminal at La Spezia, the first LNG import plant to be built in Italy, and one of the country’s three such facilities. Egypt has said it would keep all the gas from its Zohr field, with production seen by the end of 2017. The discovery is deemed a super giant, which is a field that contains more than 850 billion cubic meters of natural gas, according to the Encyclopedia Britannica. That compares with a giant, with reserves of about 85 billion to 850 billion cubic meters. The country has already installed two floating storage and regasification units and has said it plans to add a third such facility to meet the growing demand for LNG imports. Egypt’s LNG import demand is likely to jump in this year before falling from 2018 until it becomes self-sufficient from 2022, Bloomberg New Energy Finance said this month.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Qatargas to supply 1.3mta of LNG to Pakistan for 20 years Gulf Tmes + Newbase Qatargas will supply 1.3mn tonnes per annum (mta) of liquefied natural gas (LNG) to Pakistan for 20 years, with provisions to raise the volume to 2.3mta. In this regard, Qatargas has entered into a long-term sale and purchase agreement (SPA) with Global Energy Infrastructure (GEIL). The LNG will be supplied from Qatargas 2, the world’s first fully integrated LNG value chain venture, with the first cargo slated to be delivered to Pakistan in 2018 by Qatargas-chartered Q-Flex vessels. “We are proud to support countries in their desire to enhance their energy security. This new agreement reinforces our confidence in Pakistan as an energy market and in its potential,” Qatargas chairman Saad Sherida al-Kaabi said. Qatar, as the world’s largest exporter of LNG, has been able to achieve its strategic objective to diversify its export base to include major gas markets, and to be a leader in the supply of a clean energy source that will help reduce greenhouse gas emissions and protect the environment, he said. “Qatargas is delighted to announce a 20-year deal with GEIL for the supply of LNG to Pakistan. I am particularly pleased to strengthen our relationship with Pakistan, which continues to grow as an important market in the LNG industry,” Qatargas chief executive Sheikh Khalid bin Khalifa al- Thani said. Qatargas 2, a joint venture between Qatar Petroleum, ExxonMobil and Total which started production in 2009, is committed to reliable supplies of clean, safe and highly efficient source of energy.`

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 India’s $13 Billion Pay Rise Seen Lifting Oil Demand on New Cars Bloomberg - Saket Sundria India’s $13 billion pay increase for federal employees will boost car and motorcycle purchases, increasing fuel use in a country with the world’s fastest oil demand growth. Prime Minister Narendra Modi’s cabinet this week decided to increase salaries for federal government employees resulting in a payout of roughly 849 billion rupees ($13 billion) for 4.7 million workers and 5.2 million pensioners in the year through March 2017. The move is seen as a boon for auto sales, which have been the driving force behind the country’s accelerating oil consumption. “There will be lot more activity,” S. Varadarajan, chairman of India’s second- largest oil marketing company Bharat Petroleum Corp., said in phone interview. “Two wheeler sales will go up, cars will go up. So automatically all these will lead to an increased usage of vehicles, which will ultimately reflect in higher demand.” India’s fuel demand grew 11 percent in the year ended March, the quickest pace in records going back to 2001. The country is expected to surpass Japan as the world’s third-largest oil user this year and will be the fastest-growing consumer through 2040, the International Energy Agency estimates. India is forecast to use 4.34 million barrels a day of oil this year, compared with 19.6 million in the U.S. and 11.7 million in China, the IEA said in its latest monthly market report. Auto Performance “This augurs well for the automotive sector, which is now hoping for a much better performance in the coming months as compared to the last three years,” said Sugato Sen, deputy director of the Society of Indian Automobile Manufacturers. Before factoring in the impact from pay increases, total oil product demand was already seen growing as much as 8 percent this fiscal year, according to BPCL’s Varadarajan. Gasoline demand was expected to expand as much as 12 percent and diesel as much as 6 percent this fiscal year, he said. “Definitely these companies will benefit,” said Sudeep Anand, an analyst at IDBI Capital Market Services Ltd, referring to BPCL, Indian Oil Corp., and Hindustan Petroleum Corp. “Once the economy picks, we will see some surge in demand.”

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Indonesia: BP to go ahead with $8 B. Tangguh LNG expansion Reuters + NewBase BP gained final investment approval to an $8 billion expansion of the Tangguh liquefied natural gas (LNG) project in Indonesia on Friday, clearing the way for a third train to start operations in 2020. BP is going forward with expansion of Tangguh despite announcing it would rein back on spending this year due to weak oil prices. It also approved investment on an Egyptian gas field last week. The investment will boost annual LNG production capacity at the Tangguh project in Indonesia's West Papua province by 50 percent to 11.4 million tonnes. Three-quarters of the gas from the new Train 3 will be supplied to Indonesian power utility Perusahaan Listrik Negara [PLNEG.UL], BP said. The rest will go to Japan's Kansai Electric Power Co. Officials at Indonesia's upstream energy regulator SKKMigas said the project was worth $8 billion, although BP declined to confirm that figure. "We are finalizing details with potential lenders and at this point I'm not able to disclose who they are," Christina Verchere, BP regional president Asia Pacific, told reporters. In May BP cut its budget for the project to $8-10 billion from $12 billion. "This final investment decision was made after confirmation with Tangguh production-sharing contractors and is based on commercial considerations," said Indonesian energy minister Sudirman Said. BP leads the Tangguh project with a 37.16 percent stake. Its partners include MI Berau, China National Offshore Oil Co and a venture between Mitsubishi Corp and Inpex. Friday's decision also sealed a $2.43-billion onshore building contract for a consortium led by Tripatra, part of Indonesia's Indika Energy Group, SKKMigas chief Amien Sunaryadi said. A $448-million offshore contract was awarded to the Indonesian unit of Saipem, he said. "(These) are the contractors who did the front end engineering designs, so we hope the (results) aren't too different from that," Sunaryadi said.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 China:Trouble in renewables spotted in idled wind farms Bloomberg/Beijing Trouble may be brewing in China’s renewable energy industry if idled wind farms are anything to go by. The nation’s clean-energy investment binge has made it the world leader in wind, accounting for about one in every three turbines currently installed, according to the Global Wind Energy Council. In turn, Xinjiang Goldwind Science & Technology Co., which makes the machines, has pushed past its western rivals such as Vestas Wind Systems A/S and General Electric Co. Yet even with double the wind capacity, China still produces less electricity from turbines when compared with the U.S. That’s because it’s installing lower-quality machines using less reliable breezes and doing so more quickly than the distribution grid can take in the flows. “The numbers are striking,” said Justin Wu, head of Asia-Pacific for London-based Bloomberg New Energy Finance. “They say China is building wind faster than it can be absorbed.” The chart above shows China’s wind turbine installations against those in the U.S., with the pace of construction accelerating since the two markets were neck-and-neck in 2009. From the end of 2006 to the end of 2015, China’s wind capacity surged 89-fold to 139.3 gigawatts, while the U.S. saw a sevenfold increase to 73.8 gigawatts, according to data from BNEF. Yet those machines aren’t as efficient in cranking out electricity as the ones in the U.S. In 2015, the U.S. slightly edged China in wind power production, generating 185.6 terrawatt- hours

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 compared with 185.1 terrawatt hours, BNEF research shows. In other words, the U.S. produced more with less. One issue under scrutiny is turbine efficiency -- a concern hinted at by foreign turbine makers trying to crack the Chinese market. Goldwind is now the world’s biggest turbine maker by shipments, while the market share in China for Vestas has declined from about 23 percent a decade ago to about 1 percent for the last two years, according to BNEF. “We see clear signs” of a shift from a focus on low costs to energy output and internal rate of return for turbines that can operate for 20 years, Vestas’s Chief Executive Officer, Anders Runevad, said in an interview with Bloomberg Television’s Tom MacKenzie in Beijing recently. Weaker Breezes Wind quality is also pegged as a culprit. Findings published earlier this year in the journal Nature Energyby a group of researchers from places such as Tsinghua University in Beijing and Harvard University in the U.S. showed that the quality of wind flow explained part of the difference in electricity output between the U.S. and China.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The researchers point to a myriad of other reasons for the shortcomings of turbines in China, ranging from lower turbine quality, grid connection problems and the failure of grid operators to transmit wind power to users because they prefer other types of energy sources such as coal. “Improvements in both technology choices and the policy environment are critical in addressing these challenges,” the authors of the report concluded. Curtailment Curse Analysts say “curtailment” is one of the biggest challenges. Curtailment occurs when wind generation is available but grid operators won’t accept the electricity. The reasons are complex, ranging from poor grid connections to a preference for coal-fired power, which is more predictable and reliable. “Some policy has run ahead of other policy,” BNEF’s Wu said. “Policy to incentivize to build is working great, but policy to actually get the grid to uptake is falling behind.” China is studying how to cut idle capacity in renewables over the next five to 10 years, Nur Bekri, head of the National Energy Administration, said in interview in Beijing on Wednesday. "If China can meet a goal of transmitting and distributing renewable energy in a reasonable way, then the idle-capacity issue will gradually be solved," Bekri said. Despite China’s boom in clean energy, coal-fired generation still accounts for more than 70 percent of the country’s power needs, according to the International Energy Agency. “Grids and local governments sometimes have to sacrifice the output from renewables to make room for coal,” said Frank Yu, principal consultant on China and North East Asia power at research consultancy Wood Mackenzie Ltd. “This unspoken coal-favoring protectionist measure is an important limiting factor to renewable outputs.”

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 UK: EnQuest reports encouraging results from Eagle exploration well in the Central North Sea.. Source: EnQuest EnQuest reports that the implementation of the Company's 2016 drilling programme in the Central North Sea has been excellent. Drilling of theScolty/Crathes development wells was completed ahead of schedule and under budget. The Scolty reservoir was on prognosis and the Crathes reservoir exceeded expectations, with a small reserves upgrade. In Q2 2016, EnQuest undertook the drilling of an Eagle exploration well on a 100% working interest basis. Eagle was acquired along with EnQuest’s other interests in theGreater Kittiwake Area (‘GKA’) in 2014. The Eagle exploration well was completed recently and confirmed as a discovery. Assessment of the results is underway and preliminary analysis indicates Fulmar oil bearing reservoir was encountered with a vertical thickness of 67ft and excellent reservoir properties. Additionally no oil water contact was encountered, representing potential upside volumes on the flank of the structure. The encouraging results of the initial analysis lead EnQuest to anticipate gross total recoverable reserves to be a similar size to those in the nearby Gadwall producing oil field. Gadwall is part of GKA and was successfully returned to production by EnQuest in H2 2015; it is estimated that total gross ultimate recovery from Gadwall will be approximately 6 MMstb. Further evaluation of the Eagle results is ongoing. Neil McCulloch, EnQuest’s President, North Sea said: 'Drilling performance in the Central North Sea this year has been excellent, both ahead of schedule and under budget; this builds on EnQuest’s outstanding North Sea drilling performance in 2015, also under budget. I am now also pleased to confirm that the initial results of the drilling of the nearby Eagle exploration well have confirmed a new discovery. Following last year’s production growth and unit operating cost reduction successes at GKA,

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S. Shale Drillers Bring Back Rigs as Oil Market Seen Stabilizing Bloomberg - David Wethe @davidwethe Shale drillers brought back the most oil rigs of any week this year as confidence in a stabilized market is prompting talk of expansion throughout 2016. Rigs targeting crude in the U.S. rose by 11 to 341, after 7 were dropped last week, Baker Hughes Inc. said on its website Friday. It’s the fourth time in the past five weeks that producers have added oil rigs. Explorers in the Permian Basin of West Texas, the nation’s busiest oil patch, again led the activity climb by adding 4 for a total of 154 oil rigs working in the region. "You’re seeing rig counts added in the right places, like the Permian," Luke Lemoine, an analyst at Capital One Southcoast in New Orleans, said in a phone interview. "There have been a lot of cuts in the industry, so a lot of wounds to heal. It’s understandable that the first steps would be small." Supply disruptions and falling U.S. output have helped cut a global surplus, with both the International Energy Agency and the Organization of Petroleum Exporting Countries forecasting that the market is heading toward balance as demand growth outpaces supply. A Balancing Market "With oil prices approaching $50 per barrel for WTI as supply and demand move into balance, operational visibility is beginning to improve," Patrick Schorn, president of operations at Schlumberger Ltd., told investors last week at the Wells Fargo West Coast Energy Conference in San Francisco. "The rig count is now expected to increase on land during the next two quarters."

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 West Texas Intermediate, the U.S. benchmark for crude, rose 1.4 percent to settle at $48.99 on the New York Mercantile Exchange. America’s oil drillers have been mostly idling rigs since October 2014 as the world’s largest crude suppliers battle for market share. U.S. crude output fell by 55,000 barrels a day to 8.62 million through June 24, Energy Information Administration data show. Production Slide To stem current production declines, Lemoine estimates explorers would need to run 530 to 610 oil rigs in the U.S. "It might not pop back as quickly as people expect," he said. "People want to be cautious." Natural gas rigs were trimmed by 1 to 89 this week, bringing the total for oil and gas up by 10 to 431, Baker Hughes data show.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Expanded Panama Canal reduces travel time for shipments of U.S. LNG to Asian markets..Source: U.S. EIA calculations based on IHS and other sources The newly expanded Panama Canal will be able to accommodate 90% of the world's current liquefied natural gas (LNG) tankers with LNG-carrying capacity up to 3.9 billion cubic feet (Bcf). Prior to the expansion, only 30 of the smallest LNG tankers (6% of the current global fleet) with capacities up to 0.7 Bcf could transit the canal. The expansion has significant implications for LNG trade, reducing travel time and transportation costs for LNG shipments from the U.S. Gulf Coast to key markets in Asia and providing additional access to previously regionalized LNG markets. The new locks in the canal provide access to a wider lane for vessels and are 180 feet across, compared with 109 feet in the original locks. Only the 45 largest LNG vessels, 4.5-Bcf to 5.7-Bcf capacity Q-Flex and Q-Max tankers used for exports from Qatar, will not be able to use the expanded canal. Transit through the Panama Canal will considerably reduce voyage time for LNG from the U.S Gulf Coast to markets in northern Asia. Four countries in northern Asia—Japan, South Korea, China, and Taiwan—collectively account for almost two-thirds of global LNG imports. A transit from the U.S. Gulf Coast through the Panama Canal to Japan will reduce voyage time to 20 days, compared to 34 days for voyages around the southern tip of Africa or 31 days if transiting through the Suez Canal. Voyage time to South Korea, China, and Taiwan will also be reduced by transiting through the Panama Canal. The wider Panama Canal will also considerably reduce travel time from the U.S. Gulf Coast to South America, declining from 20 days to 8-9 days to Chilean regasification terminals, and from 25 days to 5 days to prospective terminals in Colombia and Ecuador. For markets west of northern Asia, including India and Pakistan, transiting the Panama Canal will take longer than either transiting the Suez Canal or going around the southern tip of Africa. In addition to shortening transit times, using the Panama Canal will also reduce transportation costs. The Panama Canal Authority has introduced new toll structures for LNG vessels designed to encourage additional LNG traffic through the Canal, especially for round trips. Transit costs through the Panama Canal for an average 3.5 Bcf LNG carrier are estimated at $0.20 per million

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 British thermal units (MMBtu) for a round-trip voyage, representing about 9% to 12% of the round- trip voyage cost to countries in northern Asia. Based on IHS data, the round trip voyage cost for ships traveling from the U.S. Gulf Coast and transiting the Panama Canal to countries in northern Asia is estimated to be $0.30/MMBtu to $0.80/MMBtu lower than transiting through the Suez Canal and $0.20/MMBtu to $0.70/MMBtu lower than traveling around the southern tip of Africa. Transiting the Panama Canal offers reduction in transportation costs to northern Asian countries such as Japan, South Korea, Taiwan, and China and may offer some minimal cost reductions to countries in southeast Asia (Malaysia, Thailand, Indonesia, and Singapore), depending on transit time. U.S. LNG exports to India, Pakistan, and the Middle East are not expected to flow through the Panama Canal because alternative routes, either the Suez Canal or around the southern tip of Africa, have lower transportation costs. Currently, about 9.2 billion cubic feet per day (Bcf/d) of U.S. natural gas liquefaction capacity is either in operation or under construction in the United States. By 2020, the United States is set to become the world's third-largest LNG producer, after Australia and Qatar. More than 4.0 Bcf/d of U.S. liquefaction capacity has long-term (20 years) contracts with markets in Asia, of which 3.2 Bcf/d is contracted to Japan, South Korea, and Indonesia. An additional 2.9 Bcf/d of U.S. liquefaction capacity currently under construction has been contracted long- term to various countries. Flexibility in destination clauses allows these contracted volumes to be taken to any LNG market in the world. Assuming all contracted volumes transit the Panama Canal, EIA estimates that LNG traffic through the Canal could reach more than 550 vessels annually, or 1-2 vessels per day, by 2021.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase 03 July 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil jumps on pre-holiday buying, Brent up 4 percent on a week Reuters + NewBase Oil prices surged on Friday, and Brent crude posted its largest weekly gain since mid May, as investors positioned for the start of third quarter trading while a weaker dollar boosted prices of most commodities. The market shook off a closely-followed industry report that showed a fourth weekly rise in the last five in the number of U.S. oil rigs operating. According to oil services firm Baker Hughes, producers added 11 oil rigs this week, the biggest increase since December, signalling a near-two year rout in drilling may have ended. "Higher rigs indicate higher production, but we're still down by more than 300 rigs from a year ago, so no one's really too worried about it for now," said Phil Flynn, analyst at the Price Futures Group brokerage in Chicago. Brent crude futures settled up 64 cents, or 1.3 percent, at $50.35 a barrel. It was down 1 percent early in the session. U.S. crude's West Texas Intermediate (WTI) futures rose 66 cents, or 1.4 percent, to settle at $48.99. Investors also bought oil after cashing out in the previous session on the market's largest quarterly gain in seven years. Crude prices gained about 25 percent in the second quarter. Oil price special coverage

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Friday's rebound came as the dollar index fell 0.5 percent, making commodities denominated in the greenback more affordable for holders of the euro and other currencies. Brent's 4 percent rise since last Friday was the biggest in seven weeks, and was fed by a return of fund buying as the turmoil sparked by Britain's shock exit from the European Union receded. WTI gained nearly 3 percent on the week. Front-month volume in WTI was about three-quarters of Thursday's level, not typical for the eve of a long weekend. U.S. financial and commodity markets will be closed on Monday for the Independence Day holiday. "There is some pre-holiday market positioning for the second half that's going on," said David Thompson, executive vice-president at Washington-based commodities-focused broker Powerhouse. "People are also moving on from Brexit, accepting they have to deal with an 'organized divorce' with Britain." Even so, some were pessimistic of significant price gains in the second half. British bank Barclays, for instance, cut its price forecasts by $3 a barrel for both oil benchmarks, forecasting Brent at $44 and WTI at $43 for the remainder of 2016. "Markets have experienced only the tip of the iceberg in terms of the impact of the UK's 'leave' vote," Barclays analysts said in a note.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Opec output hits record high in June on Nigeria rebound Reuters + newbase Opec’s oil output has risen in June to its highest in recent history, a Reuters survey found yesterday, as Nigeria’s oil industry partially recovers from militant attacks and Iran and Gulf members boost supplies. Higher supply from major Middle East producers except Iraq underlines their focus on market share. Talks in April between producers on freezing output failed and have not been revived as a recovery in prices to $50 a barrel reduces the urgency to prop up the market. Supply from the Organization of the Petroleum Exporting Countries has risen to 32.82mn bpd this month, from a revised 32.57mn bpd in May, the survey based on shipping data and information from industry sources found. That June output figure would be less than the average demand Opec expects for its crude in the third quarter, suggesting demand could exceed supply in coming months if Opec does not pump more than current levels. “We could see a slight supply deficit - it depends on further development of unplanned outages,” said Carsten Fritsch, analyst at Commerbank in Frankfurt. Opec’s June output exceeds January’s 32.65mn bpd, when Indonesia’s return as an Opec member boosted production and output from the other 12 members was the highest in Reuters survey records, starting in 1997. Supply has surged since Opec abandoned in 2014 its historic role of cutting supply to prop up prices. The biggest increase in June of 150,000 bpd came from Nigeria, where output had fallen to its lowest in more than 20 years due to militant attacks on oil facilities, due to repairs and a lack of major new attacks since mid-June. Iran managed a further supply increase after the lifting of Western sanctions in January, sources in the survey said, although the pace of growth is slowing. Gulf producers Saudi Arabia and the UAE increased supply by 50,000 bpd each, the survey found. Saudi output edged up to 10.30mn bpd due to higher crude use in power plants to meet air-conditioning needs.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase Special Coverage News Agencies News Release 03 july 2016 The Oil World's Little Secret Bloomberg - Liam Denning Everything about oil is big: the money; the political stakes. Back in the day, even the hair on "Dallas" wasn't small. But in one crucial respect, small has become more fashionable. This year, spending on developing oil and gas fields is forecast to be $462 billion worldwide, its lowest since 2009, according to Rystad Energy, an energy consultancy. Given that $50 a barrel is seen as cause for celebration in 2016, this isn't terribly surprising. More interesting is how that spending breaks down by the size of the field it gets spent on. Between 2000 and 2014, spending on fields with more than 1 billion barrels of oil equivalent in reserves rose by 12.5 percent a year. But spending on fields in the next two tiers down increased by between 15 and 16 percent a year. Fields with reserves of just 30 million to 300 million barrels- equivalent took the lead on investment in 2013. What's more, Rystad expects them to bounce back more quickly, with spending rising by 12.5 percent a year between now and 2020, almost double the pace of investment for mega-fields. The trend is even more pronounced when you consider oil fields in isolation. Spending on gas has been skewed toward larger prospects in recent years because of the frenzied investment in liquefied natural gas projects (these only make sense when the reserves are huge, and they also cost billions to build).

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 As remarkable as the surge in spending on more modest fields is the fact that annual investment in 1 billion-barrel-plus fields essentially started to plateau as far back as 2008. If you look at the overall share of spending, the extent to which big plays have been edged out becomes clearer. There are some straightforward reasons for this trend. The most obvious is that it has become harder to find giant conventional oil fields, not just because of geology but also because of restricted access to promising regions such as Russia and swathes of the Middle East. There are still large discoveries to be had -- Hess and Exxon Mobil just raised their estimate of one off the coast of Guyana -- but they aren't as frequent as they used to be.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Instead, more money has migrated to shale fields. These are smaller individually, but collectively are tapping into a vast pool of potential resources trapped in tightly packed rock far beneath where conventional fields usually lie. They also happen, thus far, to be most readily available for development in the relatively benign political environment of the U.S. What links these trends? Finance. For investors, Big Oil has become less than beautiful, largely because it spent much of the past decade pouring billions of dollars into mega-projects that have generated poor returns. This was true even before oil prices crashed, but the added pressure has led to concerns about the oil majors being able to fund their dividends. Witness the cutbacks in their capital expenditure budgets and several mergers by oil-field services players such as Schlumberger and FMC Technologies as they try to reduce the costs of finding and developing bigger discoveries. Shale's shorter time horizons, with oil being generated months rather than years after the first dollar of investment goes in, have made it more attractive. Smaller oil companies selling investors a growth story rather than dividends have been the pioneers here, and they have been helped not merely by the prior boom in energy prices, but also by cheap finance. It is no accident that the surge in spending on smaller fields really took off in 2010 as junk-bond yields collapsed. Tighter finance and low oil prices have choked off spending for now. Still, despite many bankruptcies, U.S. exploration and production companies have proven adept at raising more money and swapping debt for equity, as well as cutting costs, in even these straitened times. And as oil prices rise in response to the pullback at the top of the industry, the minnows will have more resources to fund their insurgency. This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 03 July 2016 K. Al Awadi