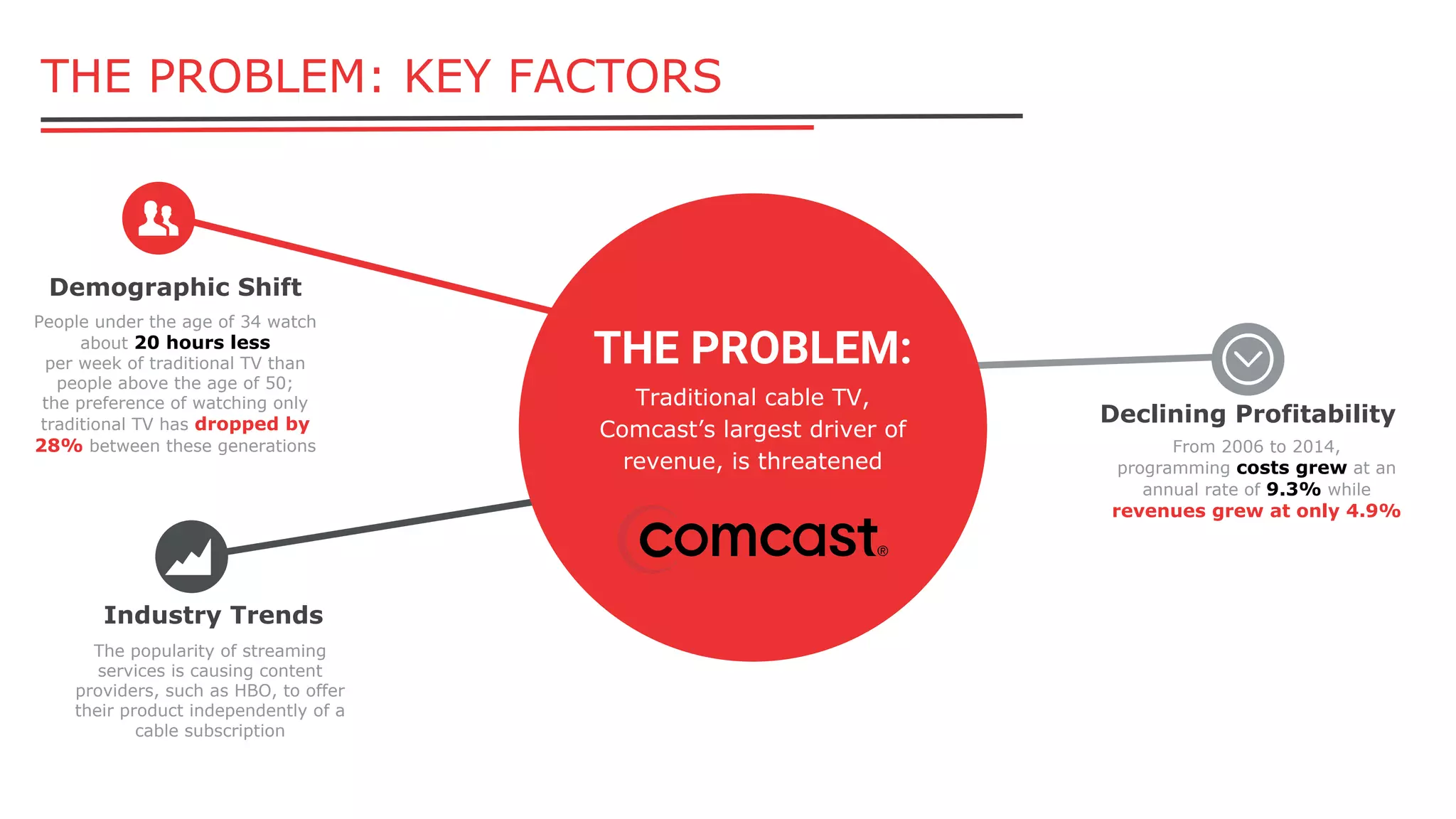

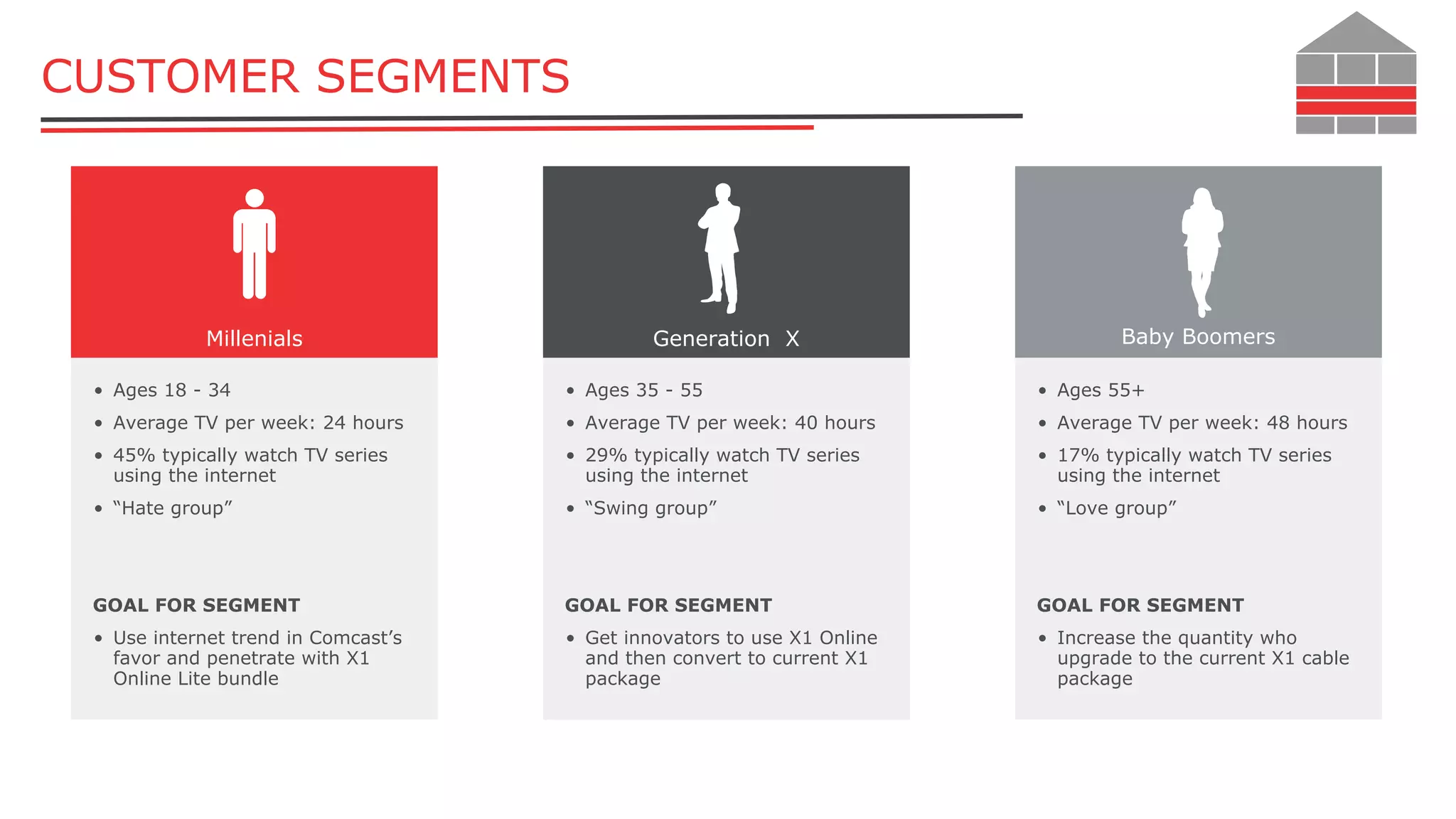

The strategic business plan proposes expanding Comcast's XFINITY X1 platform to address challenges from demographic shifts, industry trends, and declining profitability in traditional cable TV. The strategy involves:

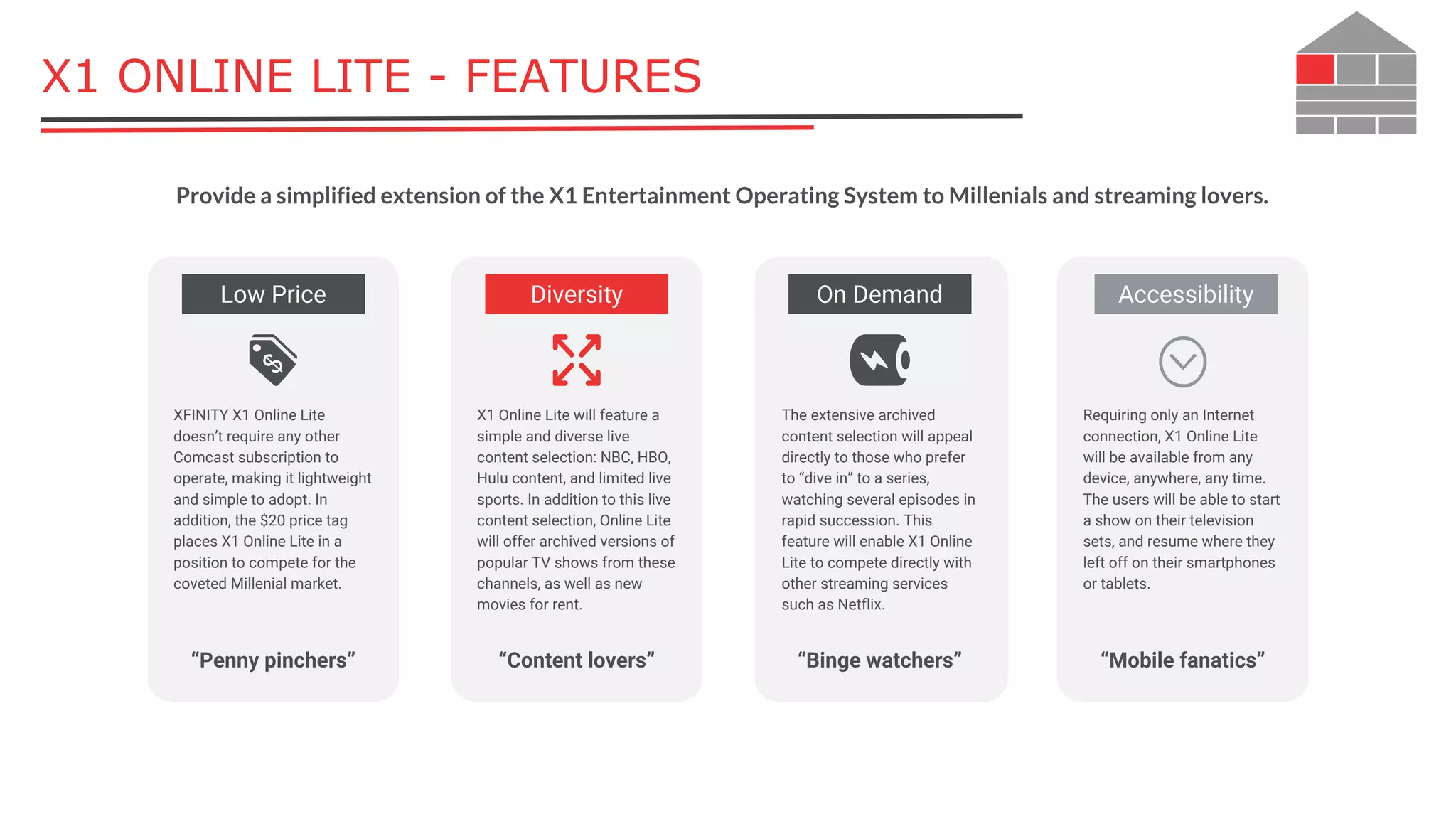

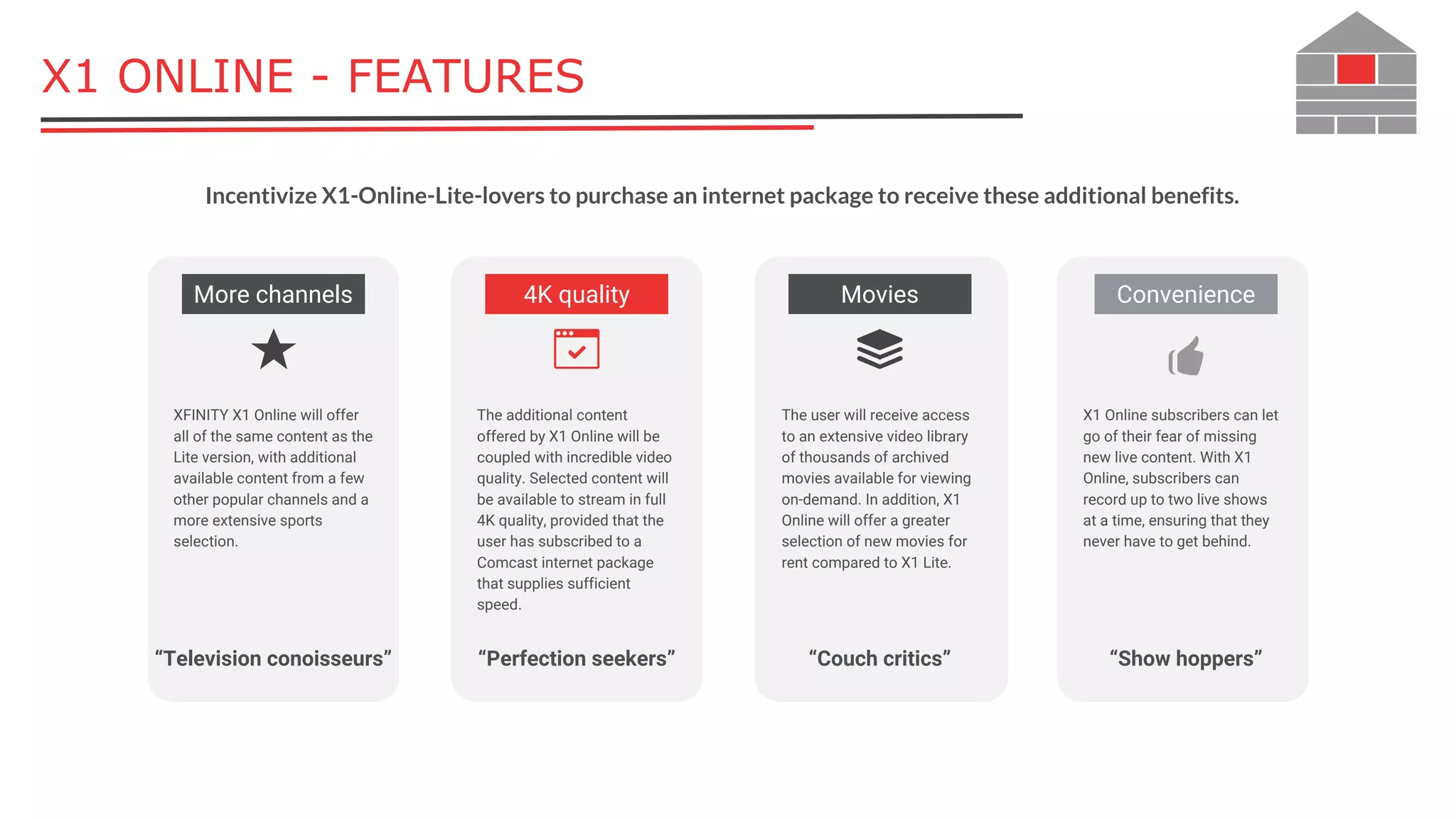

1) Developing X1 Online Lite, a $20/month streaming service targeting millennials, and X1 Online for Comcast internet subscribers, to capitalize on cord-cutting trends.

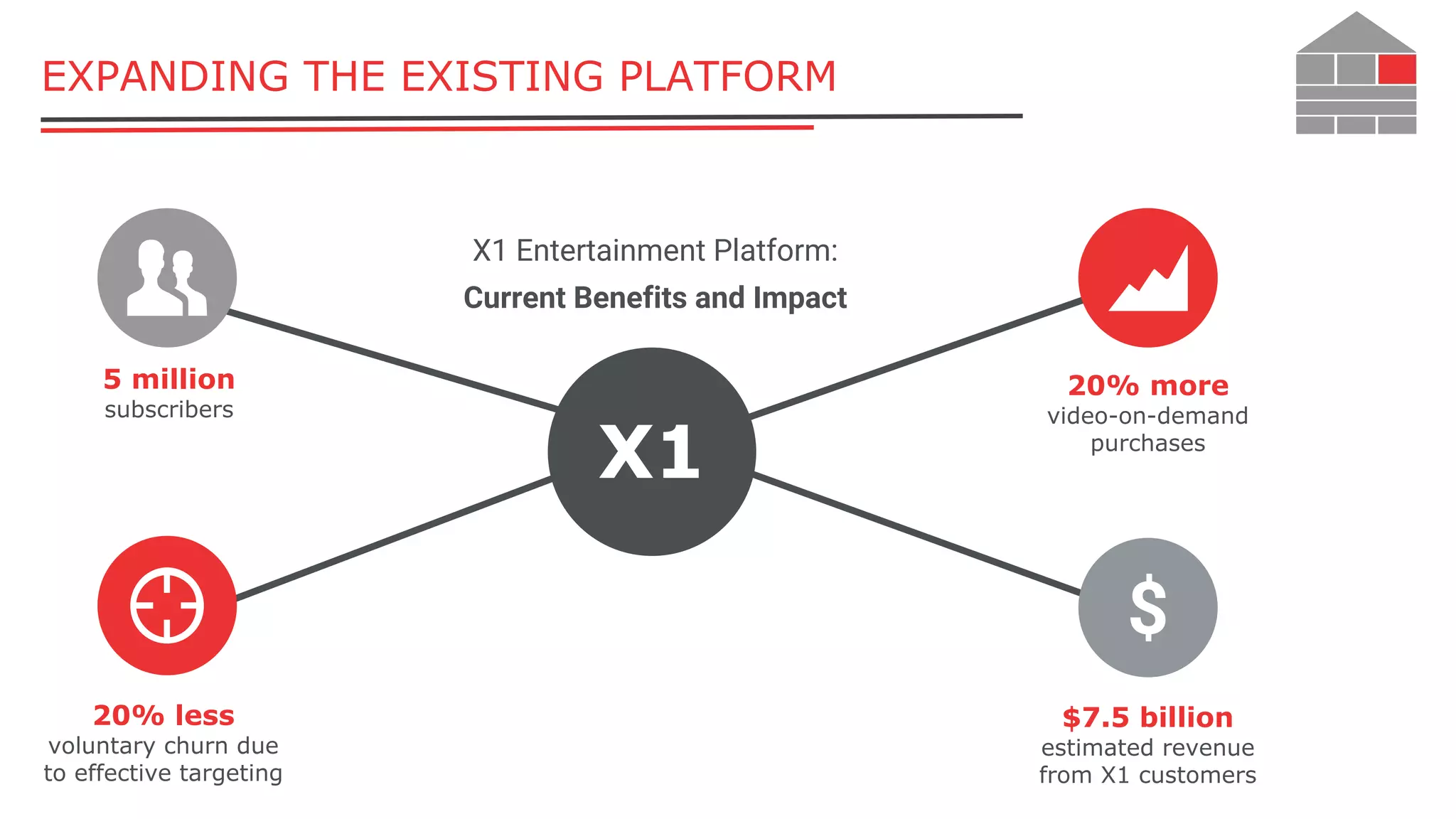

2) Continuing to expand the existing successful X1 platform among older customers through promotions, referrals, advertising, and support.

3) Targeting each approach towards specific customer segments - X1 Online Lite for millennials, X1 Online for Gen X, and expanding existing X1 for baby boomers