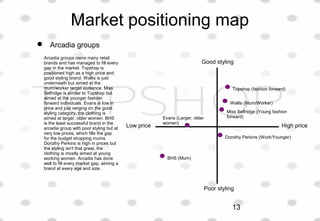

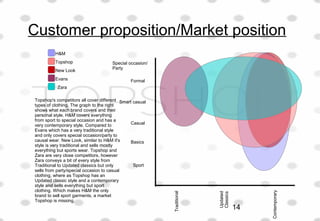

Topshop is a multinational retailer that started in 1964 in a basement in Sheffield, England. It has since expanded to over 400 stores globally. As part of the Arcadia Group, Topshop focuses on trendy clothing, accessories, beauty and footwear. The document discusses Topshop's history, brands under Arcadia Group, target demographics, marketing strategies, and objectives for further market research and strategic analysis.

![Product perceptual maps for Topshop products

FASHION

BASIC

LOW PRICES

Topshop sells products which are affordable to everyone, and products which are

bought occasionally because the price Is high but the clothing is more on trend. The

Unique collection in Topshop is expensive but the most fashionable collection as it has

been featured on catwalks. The basic collection is very simple but cheap. They're is

also fashionable and on trend products but at very cheap prices, for example; the

skater dress. Topshop also sells basic clothing but with added detail at high prices like

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

10

HIGH PRICES](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-10-320.jpg)

![Product perceptual maps for Topshop competitors

FASHION

BASIC

HIGH PRICES

FASHION

BASIC

LOW PRICES

HIGHPRICES

Zara

Zara's products are all very

similar in prices, however it does

have basic clothing at cheap

prices called the TRF collection.

It also has expensive clothing at

high prices.

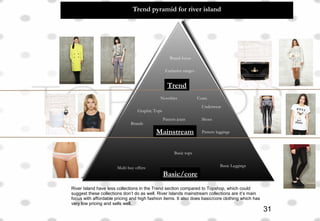

River Island

River Island is similar to

Zara as the pricing of River

Island products are in

similar price ranges, but it

does sell cheap basic

products like, leggings and

tank tops. As well as

expensive clothing which is

mostly made with

expensive materials.

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

11

LOW PRICES](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-11-320.jpg)

![Boston matrix

High

Low

Low High

Question Marks

Dogs

Stars

Cosmetics

Bags

Hats

Fashion denim

Shoes

Fashion jersey

Unique collection

Brands (Kate/Motel)

Novelties

Maternity

Petite

Tall

Underwear

Basics

Tank top

Kate Moss tee

Basic denim

Leather jackets

Fashion

dresses

Basic jersey

Leggings

accessories

Cash cows

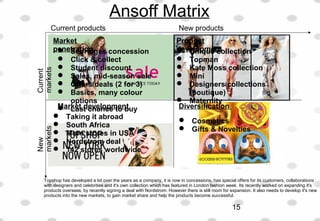

Topshops question marks are handbags, hats and cosmetics. Cosmetics has only recently been introduced into

Topshop, therefore customers are still testing the product. The stars in Topshop are the fashion items, Unique

collection and brands, customers want to keep up with the latest trends and this is the best place to get a unique item

which looks fashionable. The cash cows are mostly the basics which most of the public have one of, the products are

always very popular and Topshop can always rely on them to make sells. The Dogs are Novelties, Maternity, Petite

and tall, this could be due to lack of awareness of the collections and the amount being produced for each collection.

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

17](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-17-320.jpg)

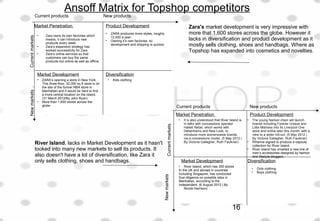

![Boston matrix for Topshop competitors

Question Marks Stars- strong

Cash cowsDogs

Dogs Cash cows

Question Marks Stars- strong

ZARA

• Handbags

• Jackets/coats

• Shirt

• Evening dresses

• Scarfs

• Trafaluc clothes range

• Jeans

• Shoes

• Skirts

• Basic tees

• Accessories

• Zara Kids

• Man

RIVER ISLAND

• Onesie

• Jackets and coats

• Evening dresses

• Handbags

• Fashion leggings

• Brands

(lashes of London)

• Male suits

• Male clothing

• Jeans

• Leggings

• Beachwear/Swimwear

• Fashion Dresses

• Basic tees

• Knitwear

• Boys

• Girls

HIGH

LOW

LOW

LOW

LOW HIGH

HIGH

(Zara., 2012. [digital image] [19 November 2012]. Available from:

www.zara.co.uk)

(River Island., 2012. [digital image] [19 November 2012]. Available

from: www.riverisland.com)

18](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-18-320.jpg)

![Financial chart for Topshop and it's two competitors

Topshop

River Island

(Top Shop/Top Man., 2002-2011. Top Shop/Top Man Limited. Key financials and employees. Fame report [online].)

(River Island., 2002-2011. River Island Limited. Key financials and employees. Fame report [online].)

Huge difference in turnover

19](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-19-320.jpg)

![Financial chart for Topshop and it's two competitors

Zara

These are the key financials results from 2002- 2011 for Topshop and it’s two competitors, Zara and River Island In 2002 Topshop turned

over 528,000, where as River Island turned over 377,641 and in 2003 Zara only turned over 67,789. Topshop bought in the most money out

of both it’s competitors in this year. Then in 2006 Topshop turned over 629,000, River Island Turned over 670,538 and Zara only turned over

155,325 which means River Island turned over the most amount of money in 2006 making it a close competitor with Topshop. In 2011

Topshop took the largest amount of money, with a turnover of 763,00 compared to Zara with 332,487 and River Island with 720,700. River

Island and Topshop are both in the 7 million mark but Topshop just took the lead by 42300. Topshop had a 100% profit margin from 2002-

2011 apart from in 2006 when it made a 69.95% profit margin . Compared to it’s two competitors this is extremely impressive. The highest

percentage Zara made was 5% in 2011 and River Islands highest percentage was 23.35 % in 2006. These findings show Topshop stands

strong compared to it’s competitors, although it had a slight down fall in 2006 where River Island came out on top, it’s managed to pick up

and come out with amazing figures.

(Zara., 2002-2011. Zara Limited. Key financials and employees. Fame report [online].)

20](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-20-320.jpg)

![Pen portrait

Sage

• Age – 22

• Single

• Interning

Sage is 22 and is currently interning at Glamour magazine in London. She want’s to

become a creative director of a high end fashion magazine in the near future. She

studied fashion at central Saint martins in London and came out with an impressive 2:1.

She supports herself financially as a part time waitress in an Italian restaurant near by,

she works there most nights and on the weekends. On her nights off she likes to

socialize with her friends in the local pubs and bars nearby with the occasional big night

out. She is currently sharing a flat with two of her close mates in Brick Lane.

Her main passion is fashion and music, she always makes time to go see gigs and

festivals. She spends a lot of her money on clothing, exhibitions, festivals, cd’s and

records. Her favourite brands are Guns and Roses and The White Stripes. Her fashion

style is very vintage and unique, she enjoys rummaging around for bargains in Vintage

fairs and shops but also shops a lot in High street stores like; Topshop, Urban outfitters

and Zara.

She watches what she eats but isn’t afraid to have the occasional binge here and there.

She’s career minded but wants to live a fun packed life whilst she’s young and single.

Maisie 28, Is currently in a stable job for HPR Lonon. After studying Public Relations

and communication at Southampton Solent University. She is very passionate about her

job and hopes to work her way up to the top in the company.

She lives with her boyfriend, who works in the film industry. They've been living with

each other for three years now but are not thinking about marriage and children just yet,

they are both very career minded.

Her job means she works with many celebrities which inquires her to keep up with the

latest fashion trends, to make a good impression. She happens to enjoy shopping and

loves the Unique collection in Topshop, her other favourite high street fashion retailers

are Zara and All Saints. Her style is very sophisticated and elegant with elements of

sparkle and glamour.

In her spare time she enjoys going for coffee with her friends and going to the cinema to

watch the latest films, she has done the partying life and now prefers a quiet night in

with her boyfriend.

She's very content and happy with her life and is excited for what the future may hold for

her.

Maisie

Age – 28

In a

relationship

Job in PR

(LookBook., 2012. [digital image] [19 November 2012]. Available from: www.lookbook.nu) 21](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-21-320.jpg)

![Pen portrait

Drew

•Age – 25

•Single

•Guitarist in a band

Drew 25, is a fun loving guy who is always up for a party. He has recently graduated from ACM in Guildford

studying music performance. He is currently working as a bar man supporting himself financially, whilst he

works on his band in his spare time. He aspires to be like the band Mumford and Sons.

He rents out a small house with his ex- university friends who also enjoy the same things as he does. He is

currently single but is in no hurry to settle down, enjoying the single life whilst he is young. He enjoys

traveling and has travelled most of the world already, his spontaneous attitude towards life takes him around

the world, trying out dangerous and exciting activities. He doesn’t believe he will ever get to old to bungee

jump. His other hobbies include socializing, jamming to music and skateboarding.

Image and brand conscious, Drew shops for branded clothes but also is appealed to the basic tees and

jeans at Topshop and Urban Outfitters. His style is very basic but still fashionable.

Abdou

Age – 22

Single

Works for an Architecture company

Abdou 22, is a very ambitious and career minded guy. After gradating at UWE bristol studying Architecture

he was offered a job from Broadway Malyan (an architecture company based in London), after

interning with them in the previous year. His job entitles him to explore different buildings as well as

designing them, so he takes many weekends away exploring city landmarks.

He currently still lives at home with his parents just outside of London, as he travels around a lot with his job,

he doesn't feel the need to move into his own place yet.

He takes care of himself and is very vein about what he looks like. He has two different styles for night and

day. In the day his style is very rustic and vintage, he looks around Topshop and Urban Outfitters for

his outfits. Yet in the night he likes to look smart, wearing chinos and a nice shirt, he shops around

the more expensive brands for his clubbing clothes.

In his spare time, he enjoys going clubbing and going to many music gigs. His career is his main priority in

his life right now and he wants to excel in his career before he settles down with a girlfriend and and

(LookBook., 2012. [digital image] [19 November 2012]. Available from: www.lookbook.nu)

22](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-22-320.jpg)

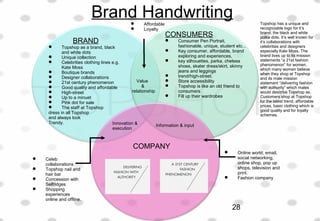

![Trend pyramid for topshop

Trend

Mainstream

Basic/core

Celeb collaborations

Made in Britain

Boutique

Unique

Underwear Make up

Wholesale Motel/Rare

Jewelry

Fashion/pattern Moto denim

Coats

Shoes

Hard/Novelties/gifts

Maternity

Pattern leggings

Mini - Kids

Basic leggingsFashion dresses

Skater dresses

Moto basic denim

Basic tees

Price

Risk

Topshop’s trend collections have a higher risk factor and are more expensive, there is very little of these

Collections in store and online. The mainstream collections are in the middle, affordable prices and enough

items which will sell, these item are aimed at fashion forward customers at affordable prices. The basic/core

collections have the biggest market share with very low prices and are guaranteed to sell.

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

30](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-30-320.jpg)

![Price architecture

Good- Entry

prices & offers

Best – Exit

price

Better –

Average prices

£1-18

£18-60

£60 -

200

• £15 – leggings

• £8 – T-shirt

• £3 – underwear

• £15 – skater dresses

• £20 – Dolly shoes

• Unique

• Celeb collaborations

• Made in Britain

• Designer shoes

• Leather jackets

• Boutique

• £30,45 -fashion jeans

• £25+ fashion shirt

• £18,25 – fashion leggings

• £25,30 - skirts

Topshops best collection is the Unique, designer brands and celebrity collaborations the prices are a little steep but quality and high fashion is

guaranteed. This is compared to the basic items like leggings which a priced cheaply but are low in fashion. The clothing which offers affordable pricing

and fashionable clothing is the ‘Better’ items, like the fashion leggings and shirts.

(Topshop.,2012.[digitalimage][13November2012].Availablefrom:www.topshop.com)

33](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-33-320.jpg)

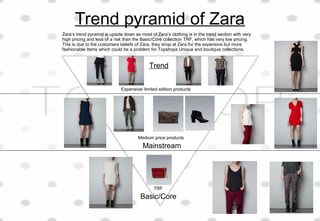

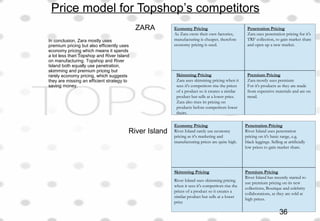

![Price Model

Premium Pricing

Penetration PricingEconomy Pricing

Skimming Pricing

Topshop uses premium pricing

for its more expensive lines like;

Unique and Boutique. Unique

uses more expensive materials

and is also shown on the

catwalks which makes it a more

valuable and unique item.

Topshop also uses

penetration pricing for the

basic ranges in Topshop,

Artificially low prices to

gain market share, opens

up a new market for

Topshop.

Topshop doesn’t use economy pricing as it’s

manufacturing and marketing prices are too

high to use this type of pricing.

As Topshop has a wide range of customers

who are loyal to the retail company, it is

financially able to increase it’s prices for its

products, however competitors like River

Island and Zara will soon pick up on this and

create similar products for cheaper prices, this

forces Topshop to lower its prices.

Low High

LowHigh

Quality

Quality

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

35](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-35-320.jpg)

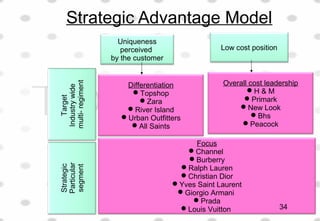

![Price Strategy used for a Topshop product

Low Price

High price

HighFashion

Lowfashion

£160

£65

£36

£29

£50

£20 Penetration pricing

Premium pricing

Skimming pricing

Topshop have created a variation of different styles of skater dresses, ranging from as low as £20 and as high as £160.Topshop uses

Penetration pricing on the basic styles of skater dresses selling them at cheap pricing to gain market share and open up a new market.

Skimming pricing is used for the skater dresses which are still quite simple but with added detail, so Topshop can put them at higher

prices as they know loyal customers of Topshop will buy them. Finally Premium pricing is used on the Unique and Boutique collections

as they are more expensive to make and they are designed by top designers.

(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

37](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-37-320.jpg)

![Demographic trends lifestyle and culture

The retail industry is changing dramatically. Retailers are changing their parallel

operating models to multichannel operating models, so customers have various

unique opportunities to shop from or find out information. The customer needs to

be able to interact with a retail brand, interacting with other channels and touch

points to create a unique shopping experience. Retailers need to consider many

factors when in the process of changing to a multichannel operating model.

Defining the store proposition, retailers must understand their customers

requirements and expectations of the brand. Review each channel and how they

create an overall proposition for the store and finally determine the role of the store

for the customers.

Retailers should also reset the store portfolio by identifying immediate cost

reductions and review the necessary size, formats and location of the store.

Finally realigning the operating model, retailers must understand the impact of

moving to a multichannel operating model and appropriately allocate costs.

Brands need to create a more efficient shopping experience for their customers due to

many social and economic factors;

Consumer spending has decreased due to high unemployment, rising petrol prices

and interest rate uncertainty

Rise in commodity prices and global demand

Technology is evolving fast

More competition

A more greener economy

The statements above suggests retailers are developing their technology in store and

online. Both Apple and Nordstrom are developing their technology in store and online to

create a more dynamic and efficient experience for their customers, this also puts them

in a stronger position with competitors.

“Deloitte predicts that in 2011 more than 25%7 of all tablet computers

will be bought by enterprises, and that figure is likely to rise in 2012

and beyond.”

Both these statements suggest retailers will need to invest more

money into technology to create a more unique experience for their

customers and to keep in competition with other retailers. Once one

retailer develops it's technology it will attract more customers to this

new exciting experience which will result in other retailers doing the

same thing.

Geddes,I. 2011 Changing the face of retail. Deloitte report [online]3, [viewed 17th november2012]

Available from: www.deloitte.com/assets/.../uk-cb-store-of-the-future-report.pdf

46](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-46-320.jpg)

![Political

•(Anon., 2009. Ethical clothing – UK. Mintel [Online], 1-2 [viewed 13 October 2012].)

Economics

•(Anon., 2009.Growth in emerging markets. The Global Fashion industry [Online], 1-5 [viewed 13 October 2012].)

•(Neilan, C., 2012. Dip in Eurozone's economies. [online], 1-3 [viewed 10 October 2012].)

•(Nelian, C., 2012. Emergency loan for Spanish banks. Drapers article [Online], 1-3 [viewed 10 October] 2012.)

•(Nelian, C., 2012. Bank of England's growth predictions. Drapers article [Online], 1-3 [Viewed 10 October 2012].)

•(Nelian, C., 2012. UK inflation. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Nelian, C., 2012. 2012- Year the UK will return to “full fitness”. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Anon., 2011. Consumers and the Economic Outlook quarterly update. [Online], 1-6 [viewed 10 October] 2012.)

•(Anon., 2010. Fashion: Impact of the recession – UK. Mintel [Online], 1-4 [viewed 10 October 2012].)

Social

•(Anon., 2012. Highlights of consumer online habits. [Online], 1-4 [viewed 10 October 2012].)

•(Faulkner, R. and V. Gallagher, 2012. [Online], 1-4 [Viewed 10 October 2012].)

•(Anon., 2012. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Knowels, J., 2012. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Perry, J., 2012. Drapers Article [Online], 1-8 [viewed 10 October 2012].)

Technology

•(Perry, J., 2012. Drapers article [online], 1-3 [viewed 10 October 2012].)

•(Stocker, K., 2012. All Saints campaign. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Faulkner, R., 2012. Click + Collect. Drapers Article [Online], 1-3 [viewed 10 October 2012].)

•(Stocker, K., 2012. Retails Week [online], 1-3 [viewed 10 October 2012].)

•(Holland, T., 2012. Retail Week [Online], 1-2 [viewed 10 October 2012].)

•(Gallagher, V., 2012. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Nodder, C., 2012. Drapers article [online], 1-2 [viewed 10 October 2012].)

•(Nielson, 2012. [Online], [viewed 10 October 2012].)

Strengths

•(Ryan, J.,2012. Topshop opening in Selfridges. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Bearne, S., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Goldfingle, G., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Faulkner, R., 2012. Topshop hires Burberry PR guru. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Anon., 2012. Hit or Miss. Drapers article [Online], 1-2 [viewed 12 October 2012].)

Weaknesses

•(Gallagher, V., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Wright, I., 2012. Hit or Miss. Drapers article, 1-2 [viewed 12 October 2012].)

Opportunity's

•(Neilan, C., 2012. [Online], 1-2 [viewed 12 October 2012].)

•(Nodder, C., 2012. [Online], 1-2 [viewed 12 October 2012].)

•(Anon., 2012. Topshop to debut eco capsule collection. Drapers article [Online], 1-2 [Viewed 12 October 2012].)

•(Gallagher, V., 2012. [Online], 1-2 [viewed 12 October 2012].)

Threats

•(Anon., 2011. Colloquy and Epsilon’s cross- cultural study. [Online], 1-2 [viewed 12 October 2012].)

•(Goldfingle, G., 2012. [online], 1-2 [viewed 12 October 2012].)

•(Faulkner, R., 2012. H&M opening in Mexico. [Online], 1-2 [viewed 12 October 2012].)

•(Gallagher, V., 2012. [Online], 1-2 [Viewed 12 October 2012].)

REFRENCES

51](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-51-320.jpg)

![Zara

Strength

•(Goldfingle, G., 2012. Drapers article [Online], 1-2 [viewed on 20 November 2012].)

•(Gallagher, V., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

Weaknesses

•(Qureshi, H., 2012. Guardian article [Online], 1-2 [viewed 20 November 2012].)

•(Fleming, O., 2012. Daily Mail [Online], 1-2 [viewed 20 November 2012].)

Opportunity's

•(Creevy, J., 2012. Drapers [Online], 1-2 [viewed 20 November 2012].)

Threats

•(Gallagher, V., 2012. Drapers [Online], 1-2 [viewed 20 November 2012].)

•(Berwin, L., 2008. Retail Week [Online], 1-2 [viewed 20 November 2012].)

River Island

Strength

•(Harrison, N., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(Anon., 2006. Retail Week [Online], 1-2 [viewed 20 November 2012].)

Weaknesses

•(Moran, G., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(MacDonald, G., 2012. Retail Week [Online], 1-2 [viewed 20 November 2012].)

Opportunity’s

•(Wright, I., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(Rushton, K.,2011. Retail Week [Online], 1-2 [viewed 20 November 2012].)

•Page 45 - (Geddes,I. 2011 Changing the face of retail. Deloitte report [online]3, [viewed 17th november2012] Available from:

www.deloitte.com/assets/.../uk-cb-store-of-the-future-report.pdf)

Perceptual map

•(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

• (Mason,N., 2011. Multi- channel Retailing. Exeecutive summary – UK, Mintel [Online], 1-8 [Viewed 10 November 2012], Available rom:

http://academic.mintel.com/display/600483/?highlight=true.)

Images

•(River Island., 2012. [digital image] [19 November 2012]. Available from: www.riverisland.com)

•(Zara., 2012. [digital image] [19 November 2012]. Available from: www.zara.co.uk)

•(LookBook., 2012. [digital image] [19 November 2012]. Available from: www.lookbook.nu)

Reports

•(Top Shop/Top Man., 2002-2011. Top Shop/Top Man Limited. Key financials and employees. Fame report [online].)

•(Zara., 2002-2011. Zara Limited. Key financials and employees. Fame report [online].)

•(River Island., 2002-2011. River Island Limited. Key financials and employees. Fame report [online].)

REFRENCES

52](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-52-320.jpg)

![Bibliography

53

Political

•(Anon., 2009. Ethical clothing – UK. Mintel [Online], 1-2 [viewed 13 October 2012].)

Economics

•(Anon., 2009.Growth in emerging markets. The Global Fashion industry [Online], 1-5 [viewed 13 October 2012].)

•(Neilan, C., 2012. Dip in Eurozone's economies. [online], 1-3 [viewed 10 October 2012].)

•(Nelian, C., 2012. Emergency loan for Spanish banks. Drapers article [Online], 1-3 [viewed 10 October] 2012.)

•(Nelian, C., 2012. Bank of England's growth predictions. Drapers article [Online], 1-3 [Viewed 10 October 2012].)

•(Nelian, C., 2012. UK inflation. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Nelian, C., 2012. 2012- Year the UK will return to “full fitness”. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Anon., 2011. Consumers and the Economic Outlook quarterly update. [Online], 1-6 [viewed 10 October] 2012.)

•(Anon., 2010. Fashion: Impact of the recession – UK. Mintel [Online], 1-4 [viewed 10 October 2012].)

Social

•(Anon., 2012. Highlights of consumer online habits. [Online], 1-4 [viewed 10 October 2012].)

•(Faulkner, R. and V. Gallagher, 2012. [Online], 1-4 [Viewed 10 October 2012].)

•(Anon., 2012. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Knowels, J., 2012. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Perry, J., 2012. Drapers Article [Online], 1-8 [viewed 10 October 2012].)

Technology

•(Perry, J., 2012. Drapers article [online], 1-3 [viewed 10 October 2012].)

•(Stocker, K., 2012. All Saints campaign. Drapers article [Online], 1-4 [viewed 10 October 2012].)

•(Faulkner, R., 2012. Click + Collect. Drapers Article [Online], 1-3 [viewed 10 October 2012].)

•(Stocker, K., 2012. Retails Week [online], 1-3 [viewed 10 October 2012].)

•(Holland, T., 2012. Retail Week [Online], 1-2 [viewed 10 October 2012].)

•(Gallagher, V., 2012. Drapers article [Online], 1-3 [viewed 10 October 2012].)

•(Nodder, C., 2012. Drapers article [online], 1-2 [viewed 10 October 2012].)

•(Nielson, 2012. [Online], [viewed 10 October 2012].)

Strengths

•(Ryan, J.,2012. Topshop opening in Selfridges. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Bearne, S., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Goldfingle, G., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Faulkner, R., 2012. Topshop hires Burberry PR guru. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Anon., 2012. Hit or Miss. Drapers article [Online], 1-2 [viewed 12 October 2012].)

Weaknesses

•(Gallagher, V., 2012. Drapers article [Online], 1 [viewed 12 October 2012].)

•(Wright, I., 2012. Hit or Miss. Drapers article, 1-2 [viewed 12 October 2012].)

Opportunity's

•(Neilan, C., 2012. [Online], 1-2 [viewed 12 October 2012].)

•(Nodder, C., 2012. [Online], 1-2 [viewed 12 October 2012].)

•(Anon., 2012. Topshop to debut eco capsule collection. Drapers article [Online], 1-2 [Viewed 12 October 2012].)

•(Gallagher, V., 2012. [Online], 1-2 [viewed 12 October 2012].)

Threats

•(Anon., 2011. Colloquy and Epsilon’s cross- cultural study. [Online], 1-2 [viewed 12 October 2012].)

•(Goldfingle, G., 2012. [online], 1-2 [viewed 12 October 2012].)

•(Faulkner, R., 2012. H&M opening in Mexico. [Online], 1-2 [viewed 12 October 2012].)

•(Gallagher, V., 2012. [Online], 1-2 [Viewed 12 October 2012].)](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-53-320.jpg)

![Bibliography

54

Zara

Strength

•(Goldfingle, G., 2012. Drapers article [Online], 1-2 [viewed on 20 November 2012].)

•(Gallagher, V., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

Weaknesses

•(Qureshi, H., 2012. Guardian article [Online], 1-2 [viewed 20 November 2012].)

•(Fleming, O., 2012. Daily Mail [Online], 1-2 [viewed 20 November 2012].)

Opportunity's

•(Creevy, J., 2012. Drapers [Online], 1-2 [viewed 20 November 2012].)

Threats

•(Gallagher, V., 2012. Drapers [Online], 1-2 [viewed 20 November 2012].)

•(Berwin, L., 2008. Retail Week [Online], 1-2 [viewed 20 November 2012].)

River Island

Strength

•(Harrison, N., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(Anon., 2006. Retail Week [Online], 1-2 [viewed 20 November 2012].)

Weaknesses

•(Moran, G., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(MacDonald, G., 2012. Retail Week [Online], 1-2 [viewed 20 November 2012].)

Opportunity’s

•(Wright, I., 2012. Drapers article [Online], 1-2 [viewed 20 November 2012].)

•(Rushton, K.,2011. Retail Week [Online], 1-2 [viewed 20 November 2012].)

•Page 45 - (Geddes,I. 2011 Changing the face of retail. Deloitte report [online]3, [viewed 17th november2012] Available from:

www.deloitte.com/assets/.../uk-cb-store-of-the-future-report.pdf)

Perceptual map

•(Topshop., 2012.[digital image] [13 November 2012]. Available from: www.topshop.com)

• (Mason,N., 2011. Multi- channel Retailing. Exeecutive summary – UK, Mintel [Online], 1-8 [Viewed 10 November 2012], Available rom:

http://academic.mintel.com/display/600483/?highlight=true.)

Images

•(River Island., 2012. [digital image] [19 November 2012]. Available from: www.riverisland.com)

•(Zara., 2012. [digital image] [19 November 2012]. Available from: www.zara.co.uk)

•(LookBook., 2012. [digital image] [19 November 2012]. Available from: www.lookbook.nu)

Reports

•(Top Shop/Top Man., 2002-2011. Top Shop/Top Man Limited. Key financials and employees. Fame report [online].)

•(Zara., 2002-2011. Zara Limited. Key financials and employees. Fame report [online].)

•(River Island., 2002-2011. River Island Limited. Key financials and employees. Fame report [online].)](https://image.slidesharecdn.com/completetopshoppresentation-140611115944-phpapp01/85/Complete-topshop-presentation-54-320.jpg)