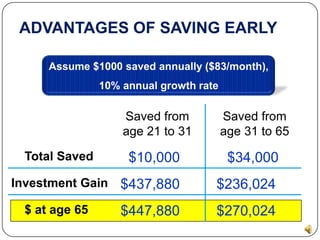

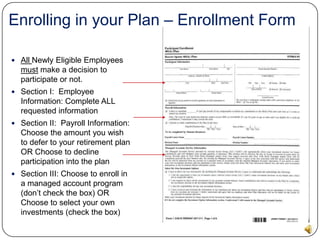

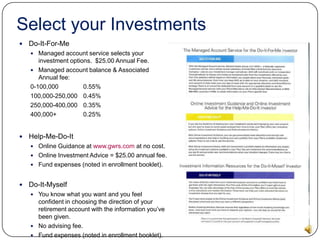

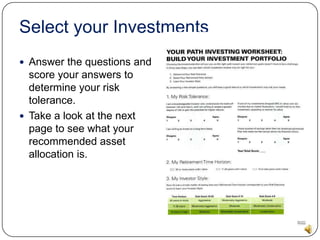

This document provides information about enrolling in a 401(k) retirement plan. It outlines the plan features including eligibility requirements, contribution limits, employer matching, and vesting schedules. It also describes how to enroll by completing enrollment forms, selecting investments, naming beneficiaries, and turning in paperwork. Additional sections discuss the benefits of saving in a 401k plan and accessing account information online.