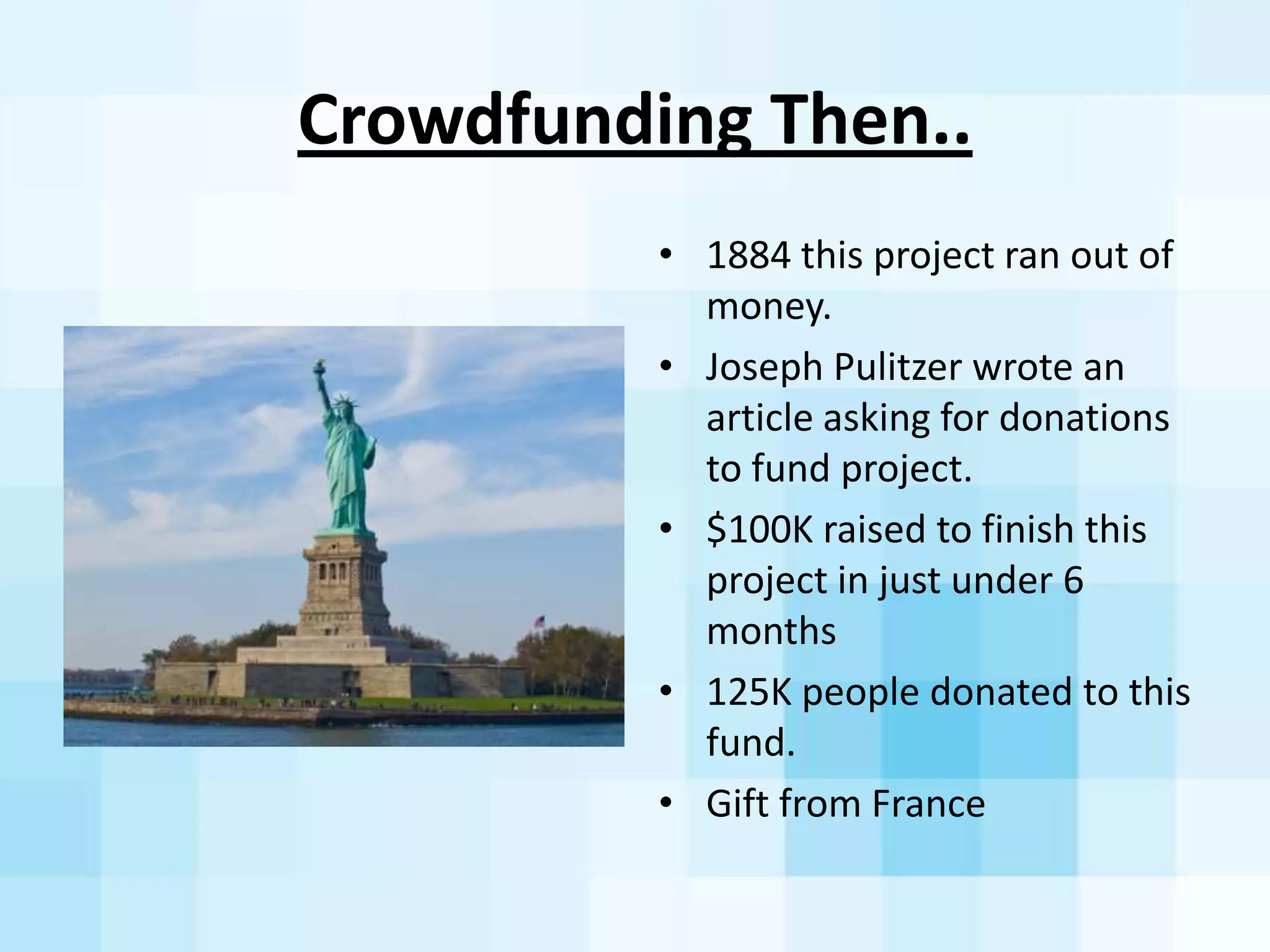

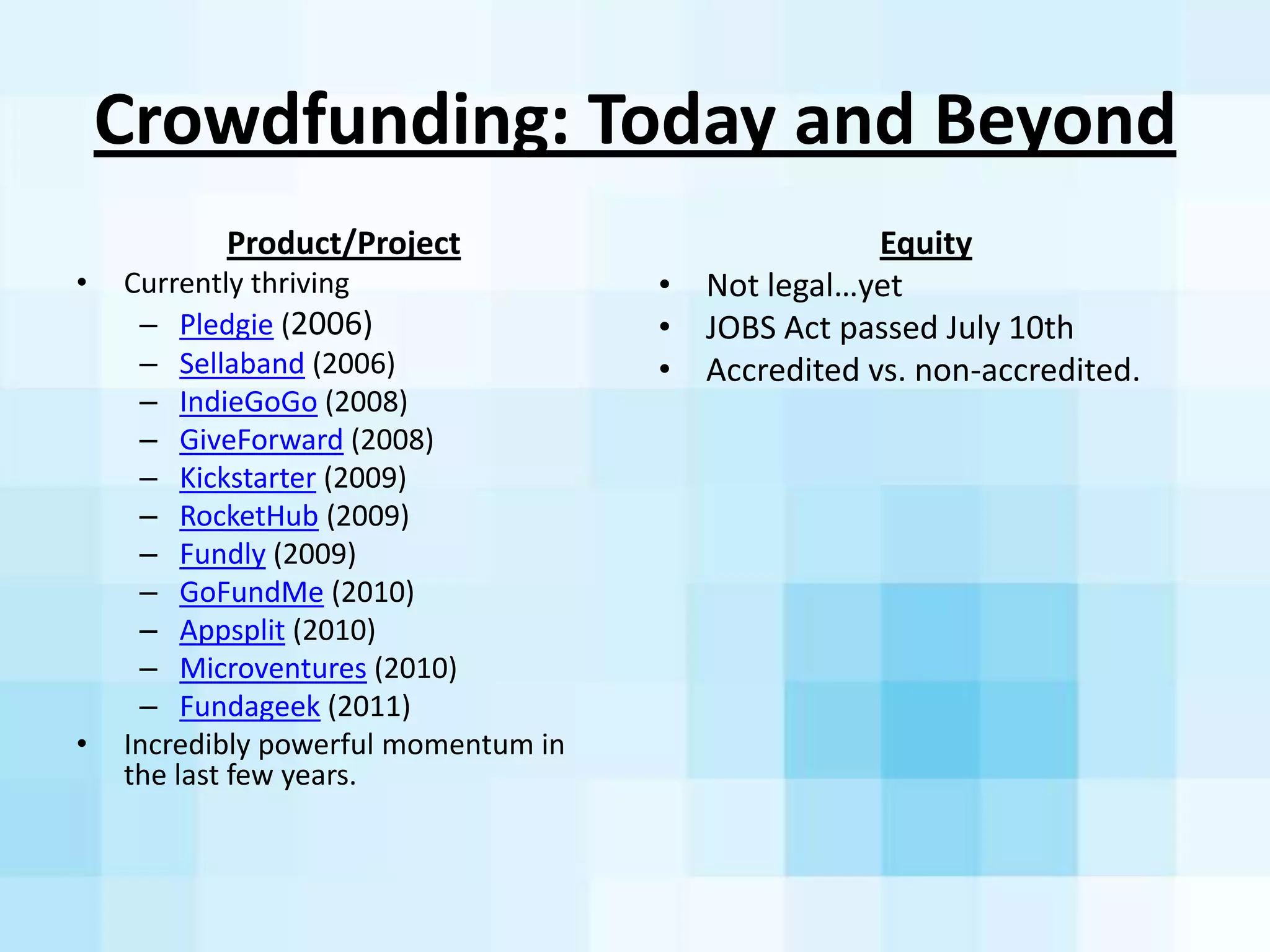

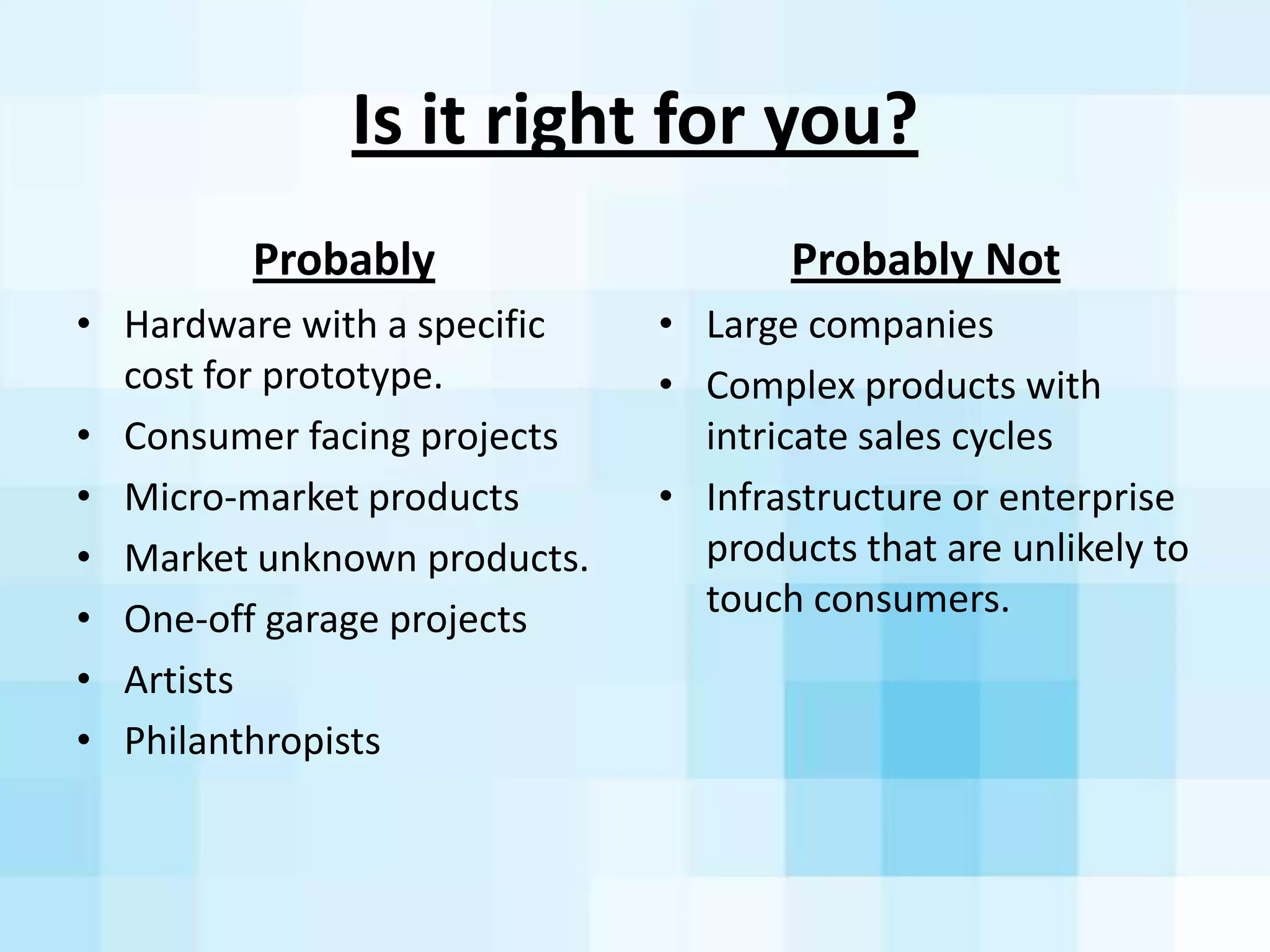

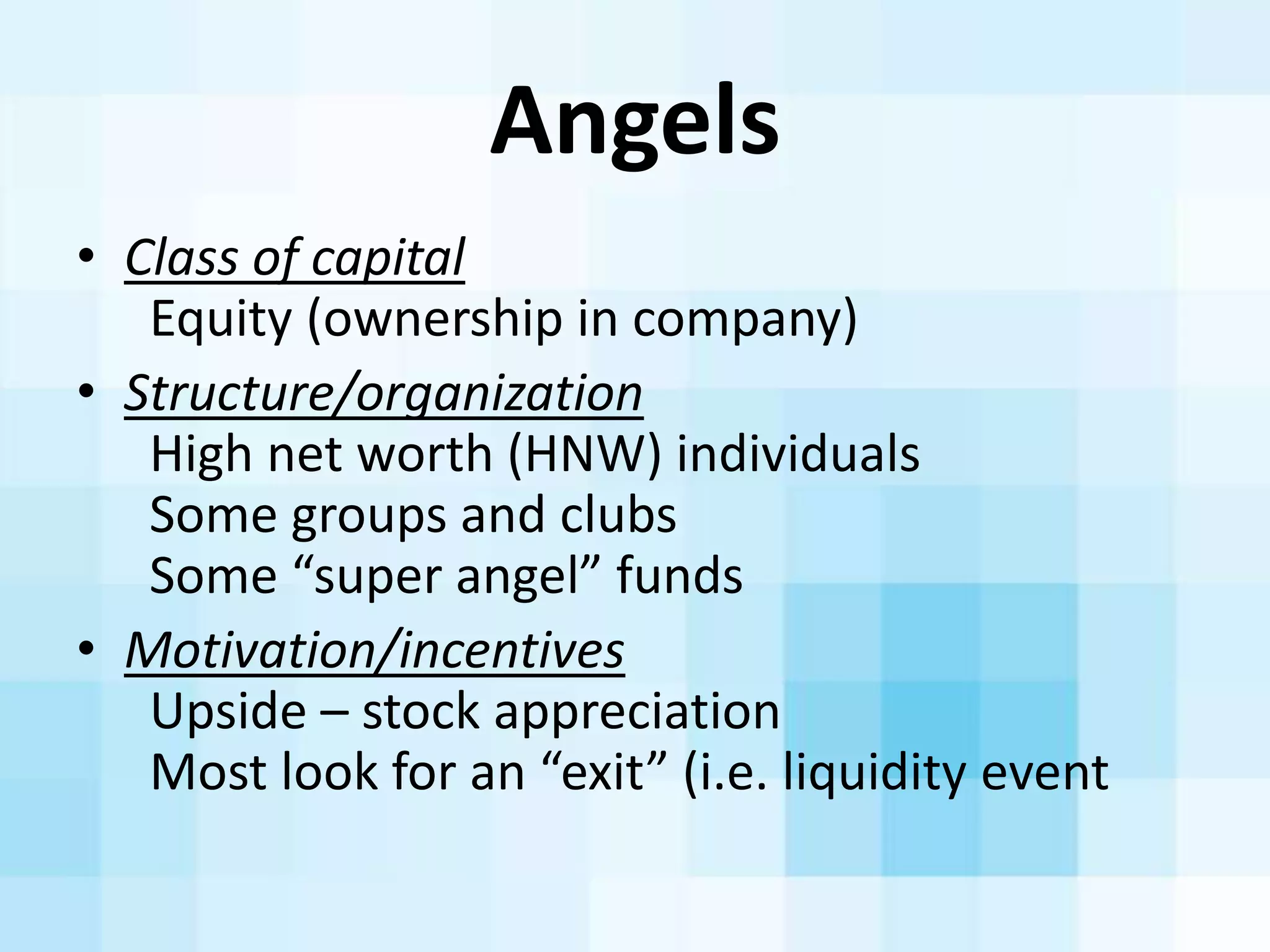

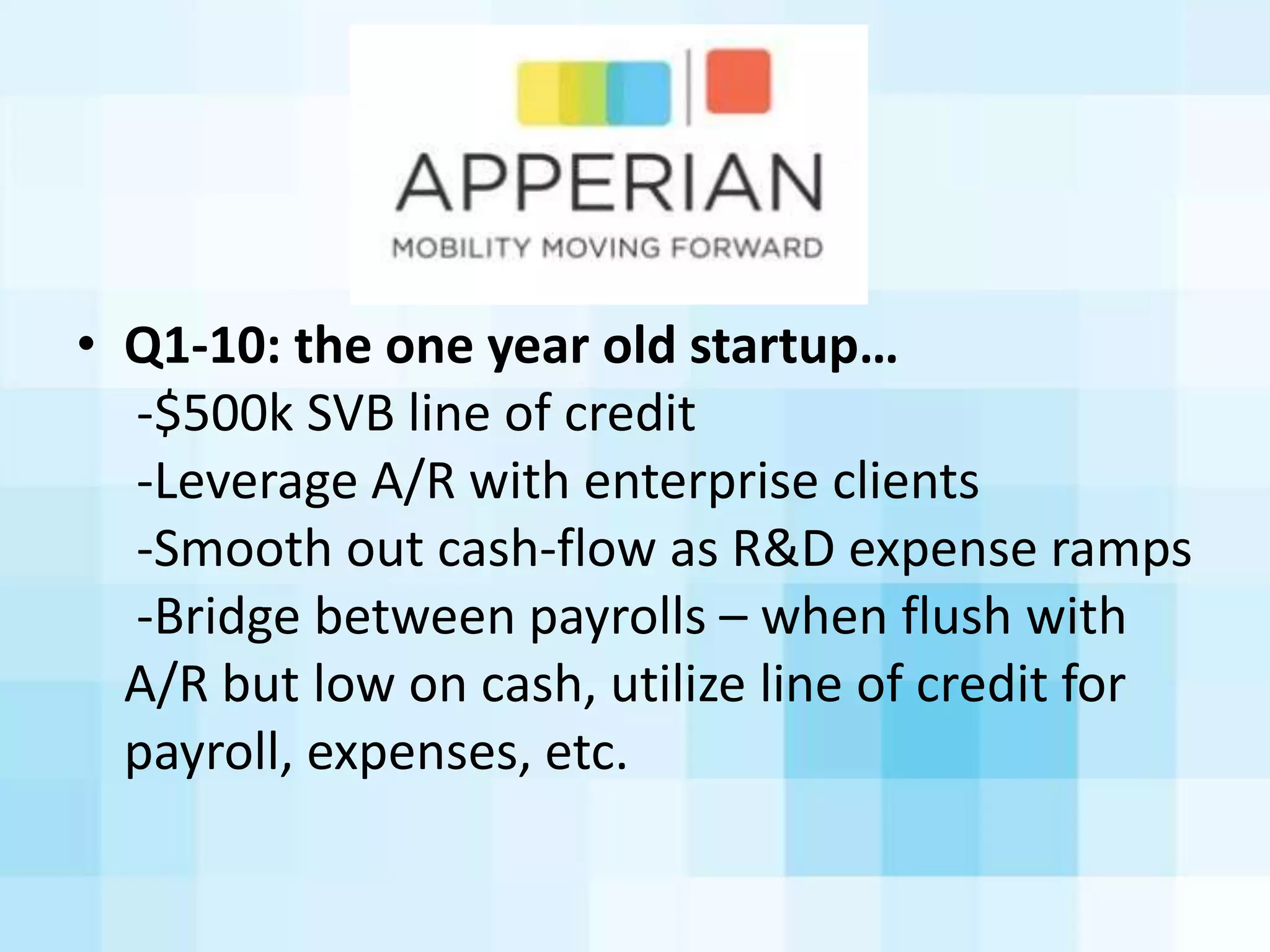

The document outlines financial fundamentals for startups seeking funding, including various financing sources such as crowdfunding, angel investors, and venture capital. It emphasizes the importance of understanding the risks and benefits associated with each funding type, including self-financing and the role of financial partners. Furthermore, it provides historical examples and case studies to illustrate successful fundraising strategies and market validation.