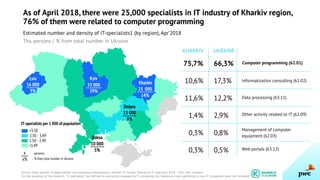

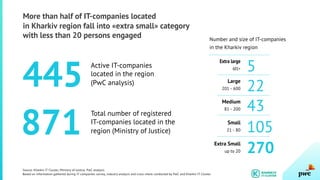

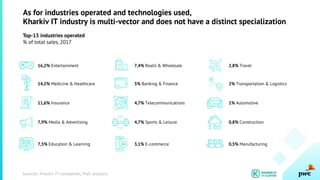

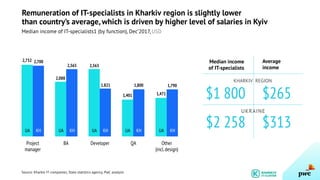

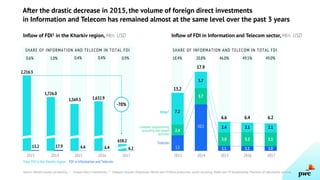

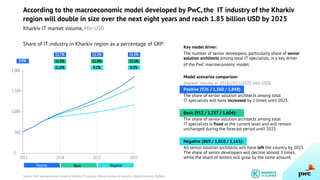

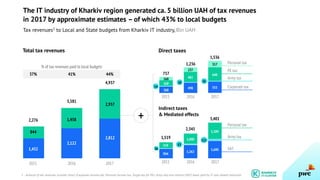

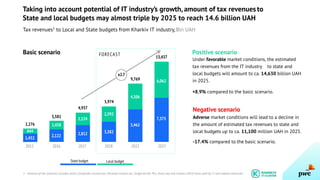

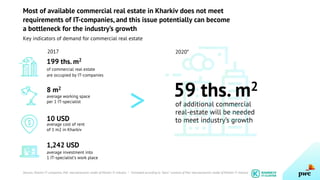

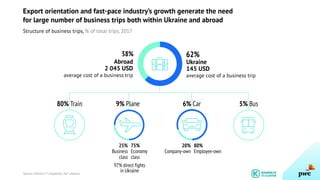

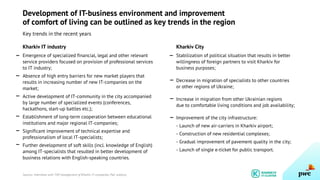

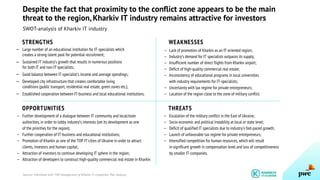

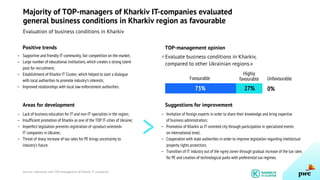

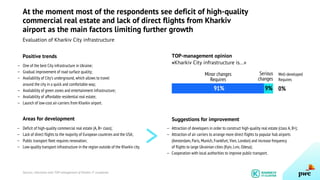

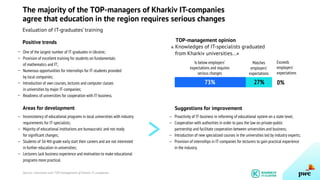

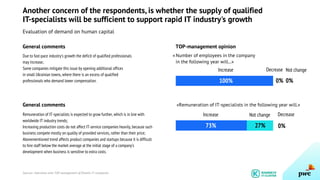

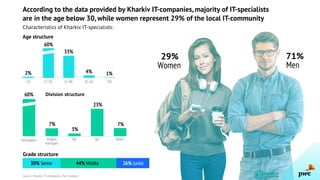

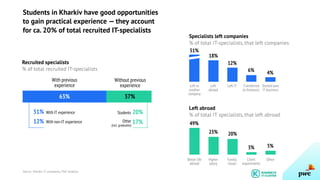

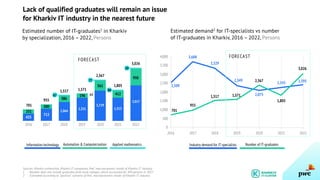

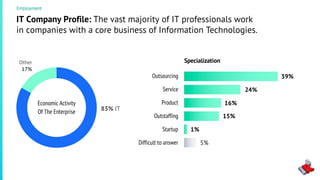

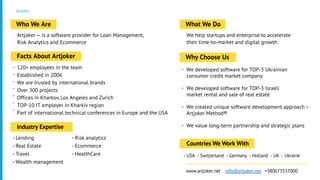

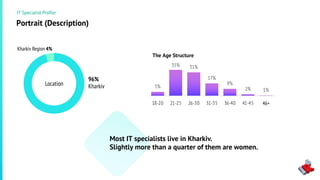

This report by PwC analyzes the performance and future potential of the Kharkiv IT industry, focusing on macroeconomic modeling and the impact of taxation on local budgets. It highlights the industry's reliance on export markets, particularly the United States, and outlines the region's talent pool and diversity in IT specializations. The document combines data from local IT companies and expert interviews to assess growth forecasts and regional strengths, emphasizing the need for further investment in technological innovations.