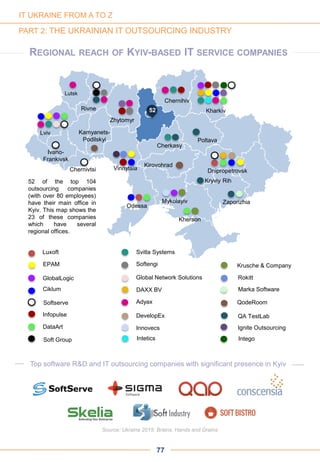

The document outlines a comprehensive report on Ukraine's IT outsourcing and software R&D industry, highlighting its growth and potential within the European tech landscape as of 2015. It covers various aspects of the Ukrainian IT ecosystem, including industry analysis, client testimonials, case studies, legal frameworks, and public policies, emphasizing the significant impact of technology on the nation's economy and society. The report is freely accessible and aims to promote awareness around Ukraine's vibrant innovation scene while encouraging ongoing updates and contributions from the tech community.

![The Technology Nation program aims to educate more than 120,000 people using fundamental

programming courses from world's leading technical universities in a two-year term (2016-2018). English

language won't be an issue since most of these courses will be available in Ukrainian (for instance

Ukrainian online-education platform Prometheus is already translating the Harvard Computer Science

courses).

The course is structured as a series of online and offline lessons. The offline part is necessary to minimize

the dropout rate. Participants will come to 80 hubs across Ukraine and work in groups with a teacher. The

government has agreed to give us access to over 1,000 teachers to conduct English classes. Participation

in the program is absolutely free, with classes expected to start on March 1, 2016.

In the immediate future we also plan to launch online courses on the Internet-of-Things, Big Data and a

range of other specialized courses. Let these projects become a contribution to transform Ukraine into a

technology nation.

– What have been the key challenges that your organization has faced?

The initiative, launched in spring 2014, went through a team overhaul and reemerged this year with a new

team of five, who have already accomplished a lot. A wide network of volunteers is also supporting us.

We also have a clear vision of what needs to be done. Right now we are gathering three essential

component groups : IT specialists who are ready to teach as volunteers ; companies to provide donations,

facilities and screens; and highly motivated candidates to launch study groups. However, our

biggest challenge remains ensuring continuous financial support for scaling the initiative and hiring

additional people next year.

– What is the budget of the foundation?

We do not have a budget, but rather a target for attracting investments. Last year we raised $100,000, most

of which came from Torben Majgaard, founder and CEO of Ciklum. Everything we raise, we reinvest in our

activity. Our target for next year [2016] is to raise $1 million.

– What guarantees of transparent use of the funds does BrainBasket offer to its sponsors?

We are a public organization with serious and responsible people on the Supervisory Board, including well-

known and respected businessmen, politicians and professionals. Each of us cares a lot about our

reputation both within and beyond Ukraine. In addition, we follow the reporting standards for NGO-type of

organizations rigorously. Currently, we are incorporated as an NGO in Ukraine and plan to apply for the

same status in the US next year.

(December 2015)

PART 1: THE UKRAINIAN IT ECOSYSTEM

24

IT UKRAINE FROM A TO Z](https://image.slidesharecdn.com/uahightech-160523073809/85/Ua-hightech-24-320.jpg)

![An interview with Eugene Vyborov, CEO at Webinerds

– What are the most common concerns that you hear from CEOs and entrepreneurs about working

with remote teams?

I’ll start with intellectual property. Many people in the startup industry have heard a ton of horror stories

related to startups basically closing because they've chosen a bad partner for product development and the

partner has either stolen the intellectual property or just decided to reuse it with a competitor. Or they've

disclosed some vital information regarding the startup — maybe accidentally, maybe not — and that

essentially killed the business.

– With all the horror stories floating around about working with remote teams, how can US

companies keep themselves safe?

Most importantly, they need to very carefully look at the agreements they're signing; and these agreements

should be signed with US entities, because when they’re not then they’re very hard to actually enforce. For

example, if they sign an agreement with some freelancer from India or Ukraine — an NDA, for example —

and then the freelancer breaks the NDA, there's effectively nothing they can do to protect themselves.

– Why is it especially critical for startups to have all their ducks in a row, so to speak, when working

with remote teams? Why is thorough paperwork especially important for startups?

Because on the next due diligence — when the startup is trying to raise money - they'll definitely be checked

for the proper legal documents, and all relationships are going to be scrutinized by potential investors. And if

the investors find a problem in an agreement that was signed with a particular partner or contractor -

something that threatens the company or violates intellectual property - there's a very high likelihood that the

startup is not going to raise the money because of that.

– We know that investors are always concerned about legal issues and paperwork. What are some

of the other hold-ups with venture capitalists when it comes to startups who are working with

remote teams?

Venture capitalists don’t tend to like working with remote teams because they [venture capitalists] have

preferred stock options. So in the event of bankruptcy, they can sell the team to someone else and get at

least partially compensated. When part of the team is external, not in the US, then it reduces the startup's

value because there are fewer assets. A lower valuation is bad news for investors.

– With all the challenges of working with remote teams, including potential challenges with venture

capital, why is it still desirable for startups to work on a team extension basis?

First, I should say that the core team needs to be on-site. Remote resources only help with development;

the main expertise has to be with the core team. But team extensions can be a really big boost.

The challenges of working with remote

teams for startups

54

IT UKRAINE FROM A TO Z

PART 2: THE UKRAINIAN IT OUTSOURCING INDUSTRY](https://image.slidesharecdn.com/uahightech-160523073809/85/Ua-hightech-54-320.jpg)

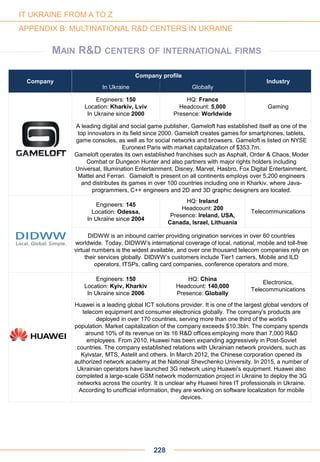

![So today we are pursuing two priority directions: first, to create more jobs for highly-educated, highly

intelligent workers – which usually drives higher salaries/incomes, improved working conditions and higher

ecological awareness along with a commensurate rise in innovation, foreign capital input and investment.

Second, to bring more R&D to transform the country into a tech hub in which great companies can grow

from scratch, rising from the idea stage to full fruition. The recent acquisition of several Ukrainian tech

companies by international firms is clear confirmation that R&D activities can and do flourish in this country.

In September 2015, Ukrainian president Petro Poroshenko (right) with Dmytro Shymkiv (middle) held a

Skype conference with Bill Gates. (Photo credits: Presidential Administration)

– Which are the most important concrete measures taken by the government with regards in the

field of IT since the Maidan revolution? Have they already had some effect in real life?

Technology was a key component of the Maidan revolution [in late 2013-early 2014]. Cloud computing and

social networking actually enabled important connections at the time, allowing people to share the

revolution's ideas and news around the nation, even as many IT professionals were themselves on the

barricades.

After Maidan, many initiatives were set in motion. First, we managed to launch 3G in the country through a

tender in early 2015. This has brought 11 billion hryvnias6 into state coffers, while citizens in more than 380

cities can already benefit from fully operational 3G networks. Several e-government services have been

launched, including the ProZorro7 and the iGov.org.ua8 projects.

6. Nearly 279 million euros at that time.

7. Originally an initiative from Maidan volunteers, this online public procurement platform received decisive support

from Dmytro Shymkiv in 2014. It aims to "make public spending transparent and effective and prevent corruption

through public monitoring and a wider range of suppliers." https://youtu.be/OTfMUcFr1WY http://uadn.net/?p=33043

8. The iGov.gov.ua portal gathers the services of more than 60 ministries and agencies.

165

IT UKRAINE FROM A TO Z

PART 7: PUBLIC POLICIES](https://image.slidesharecdn.com/uahightech-160523073809/85/Ua-hightech-165-320.jpg)