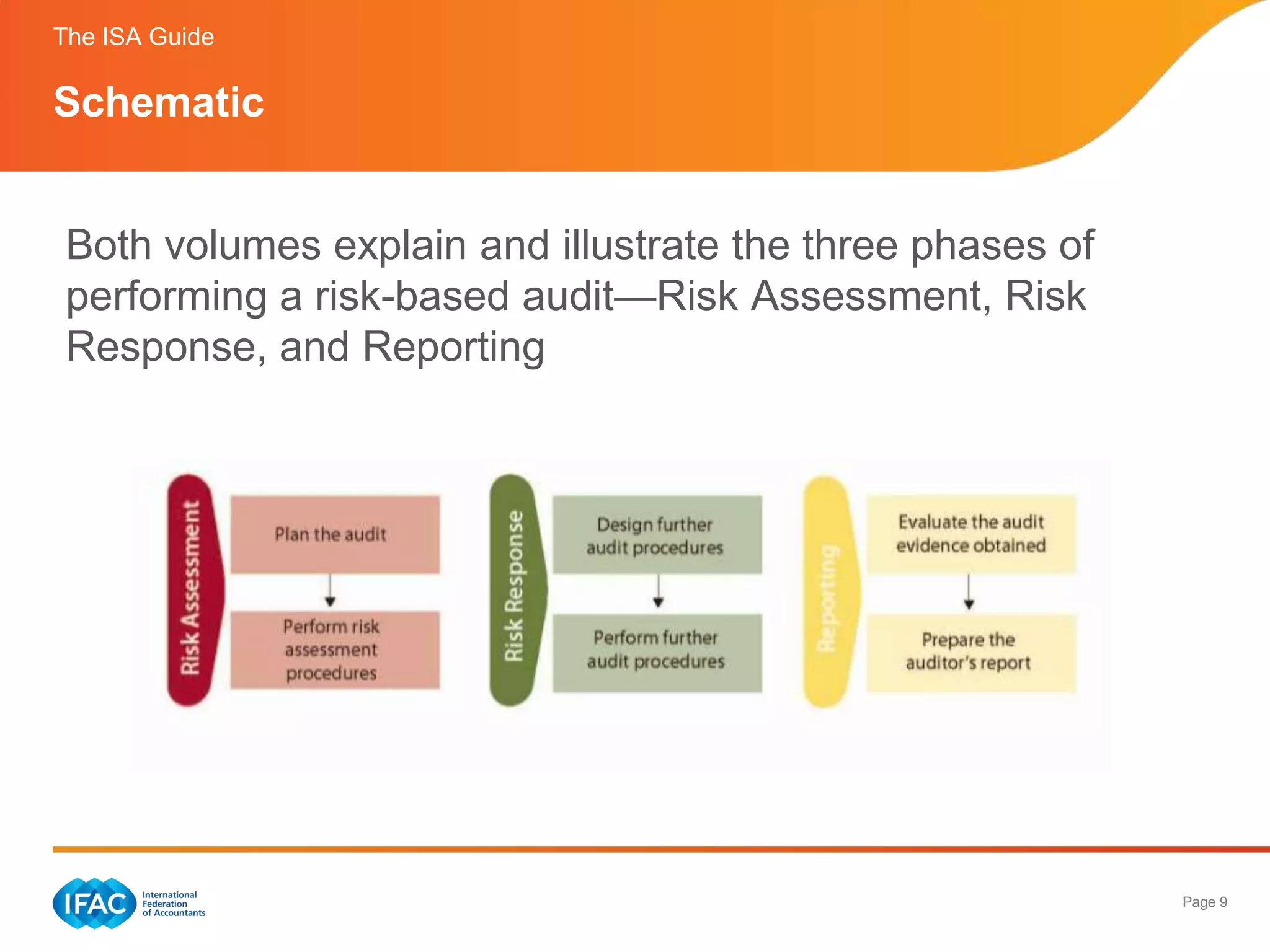

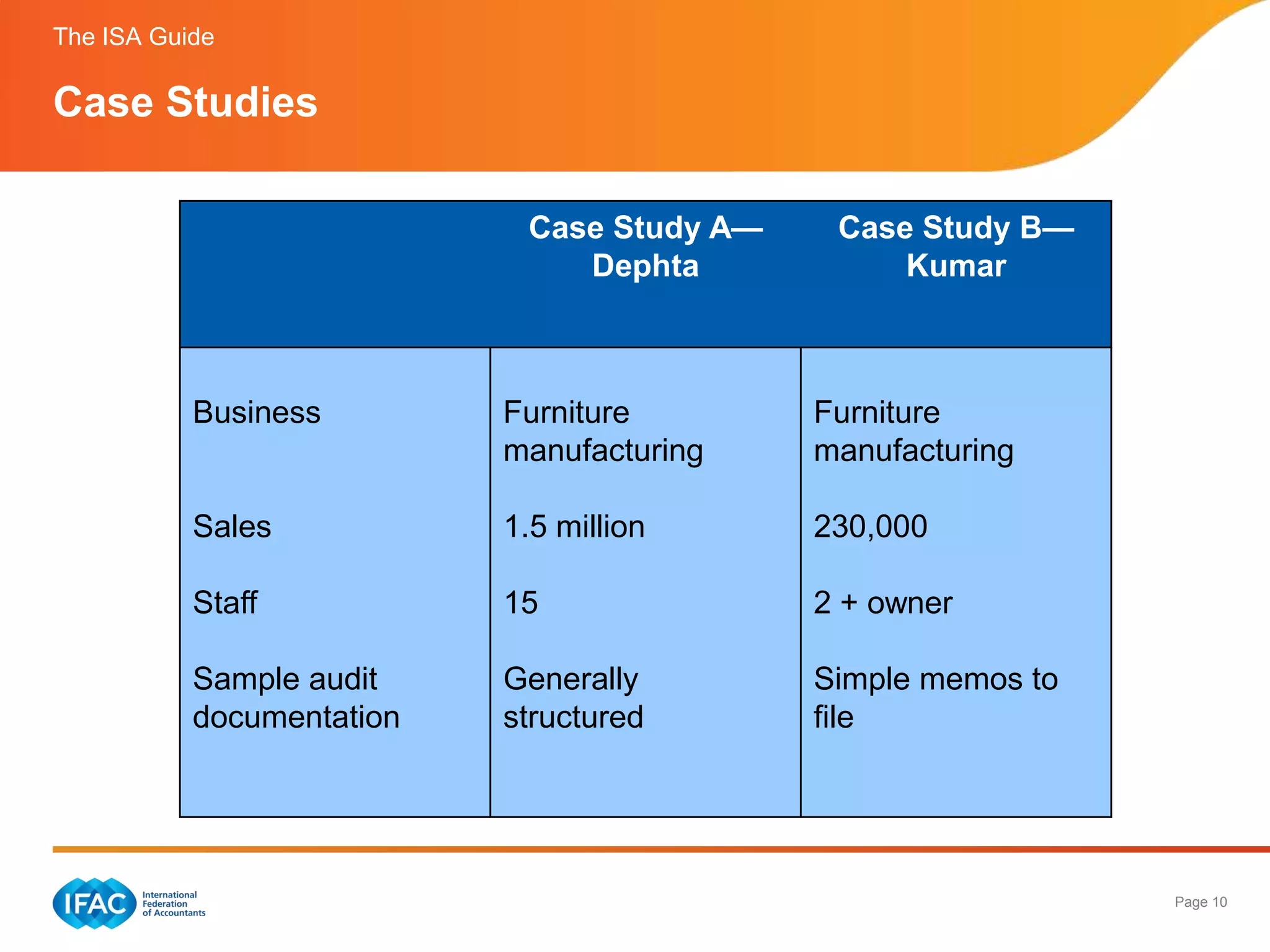

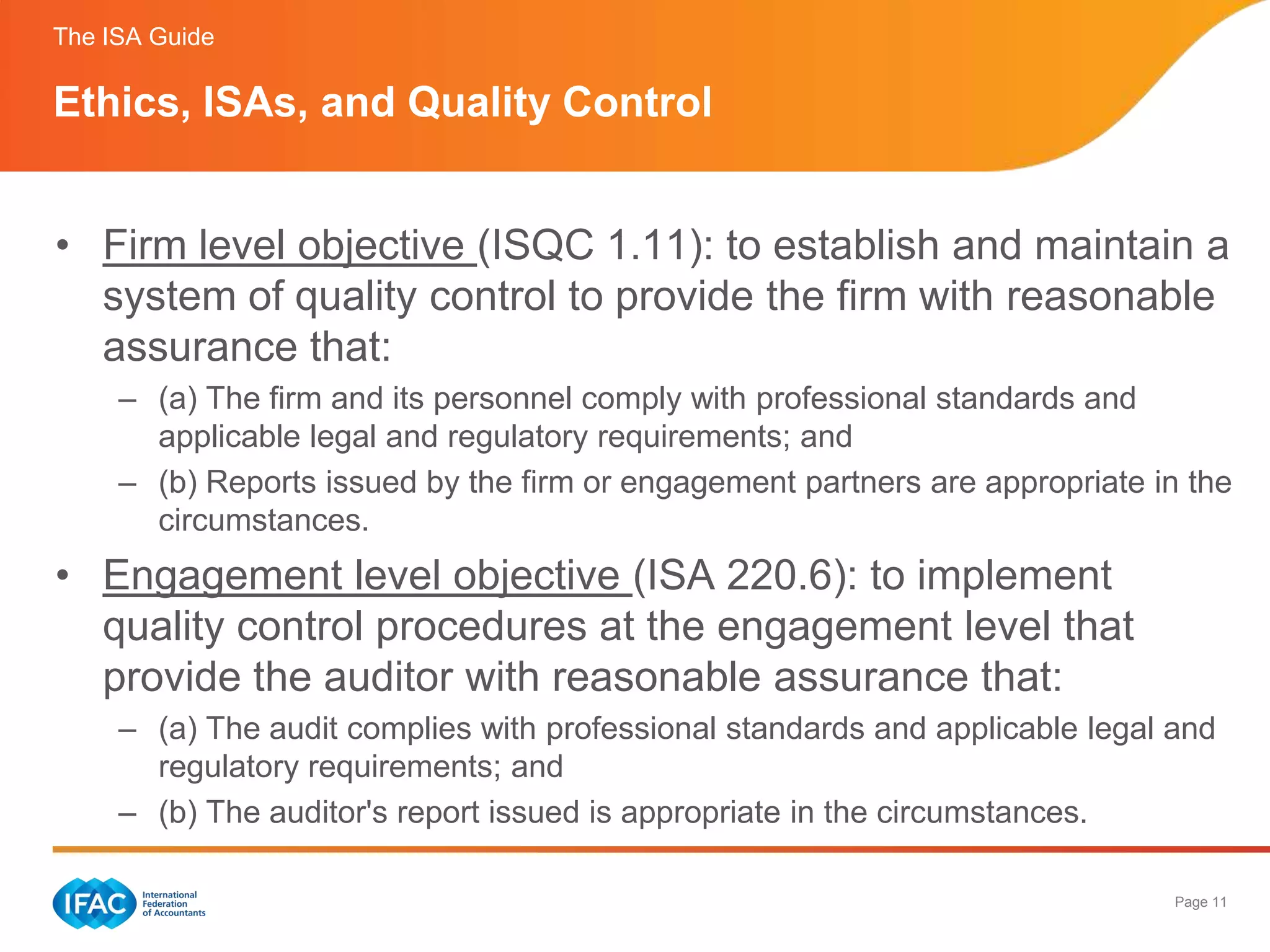

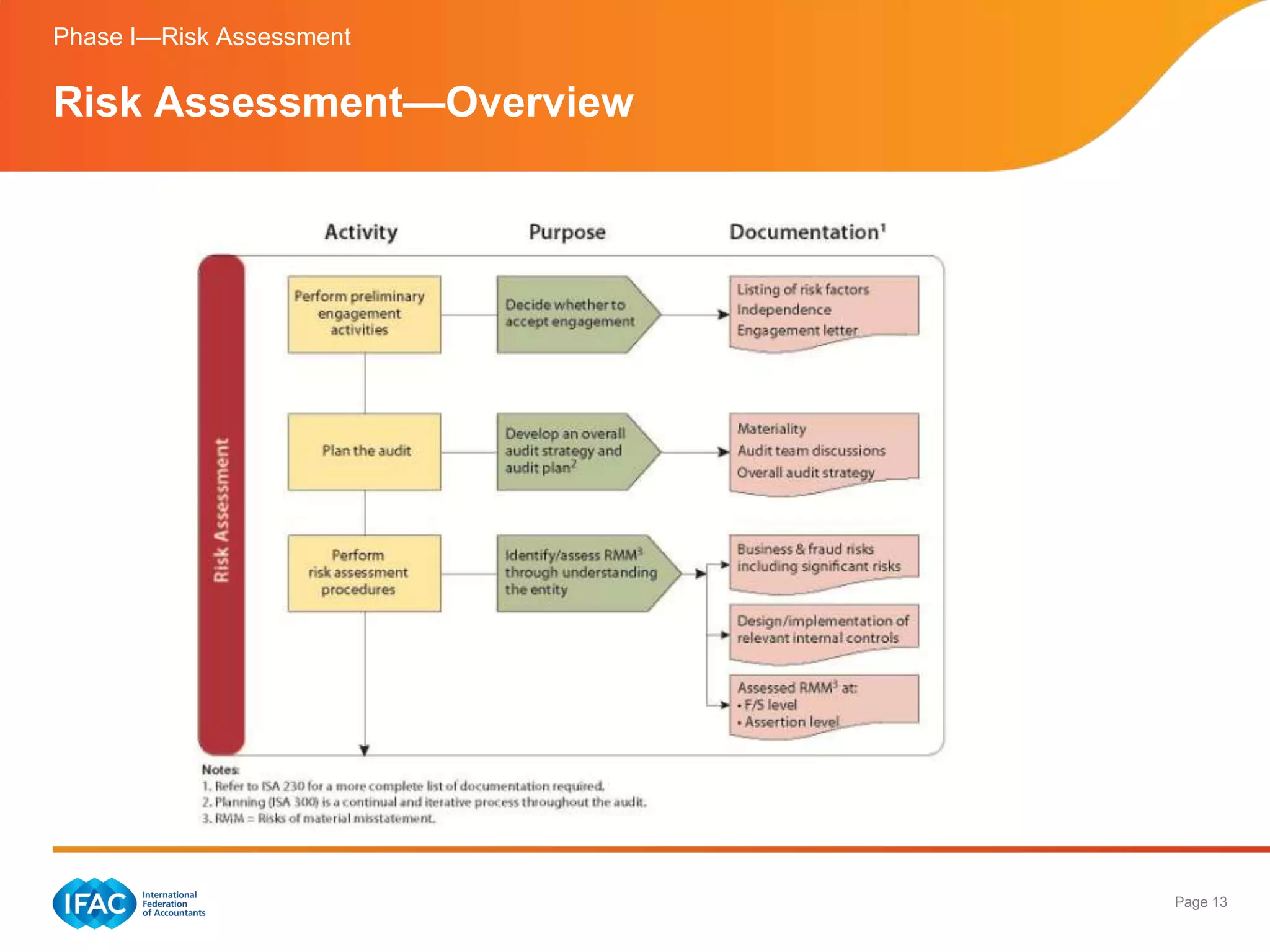

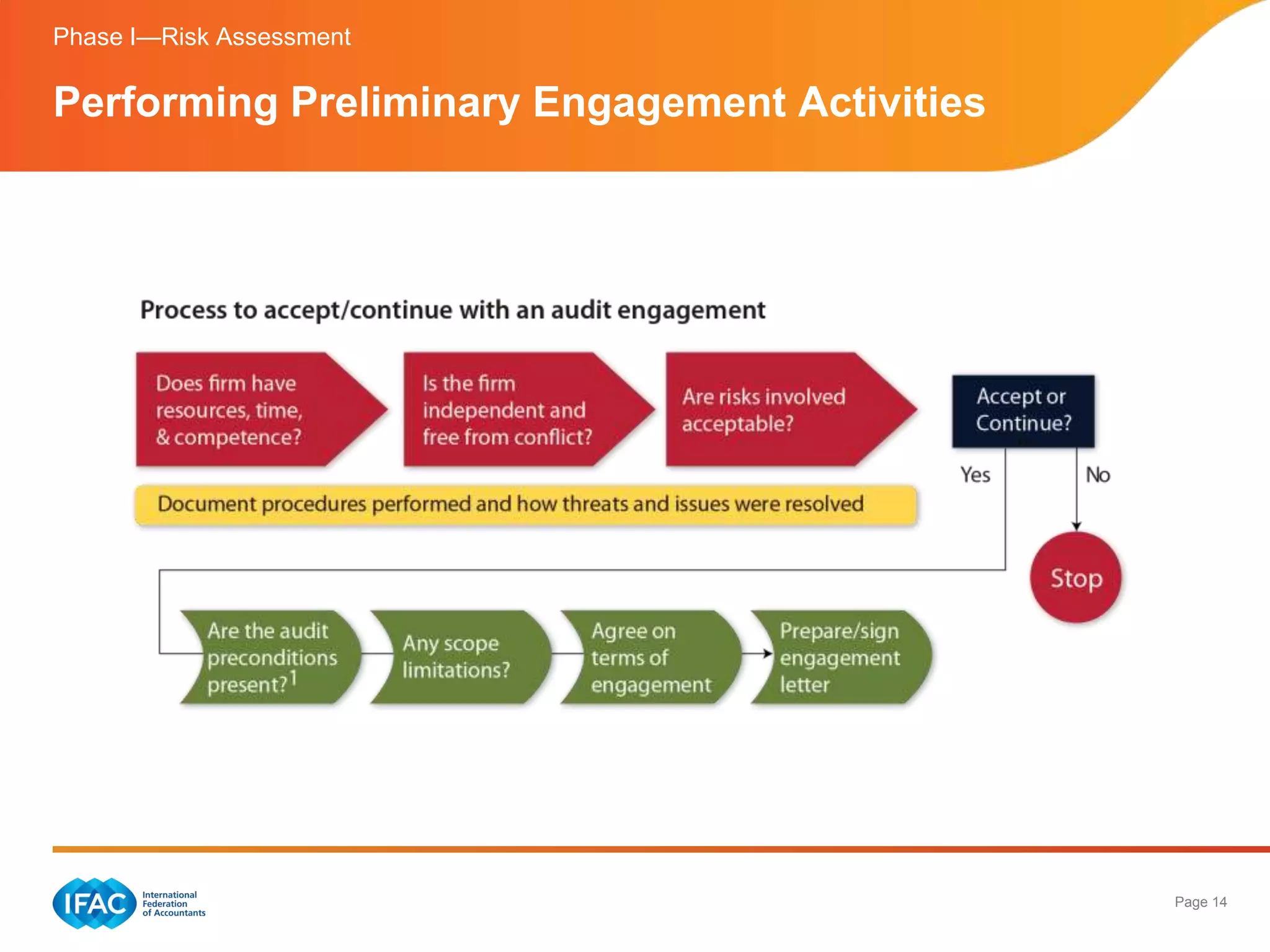

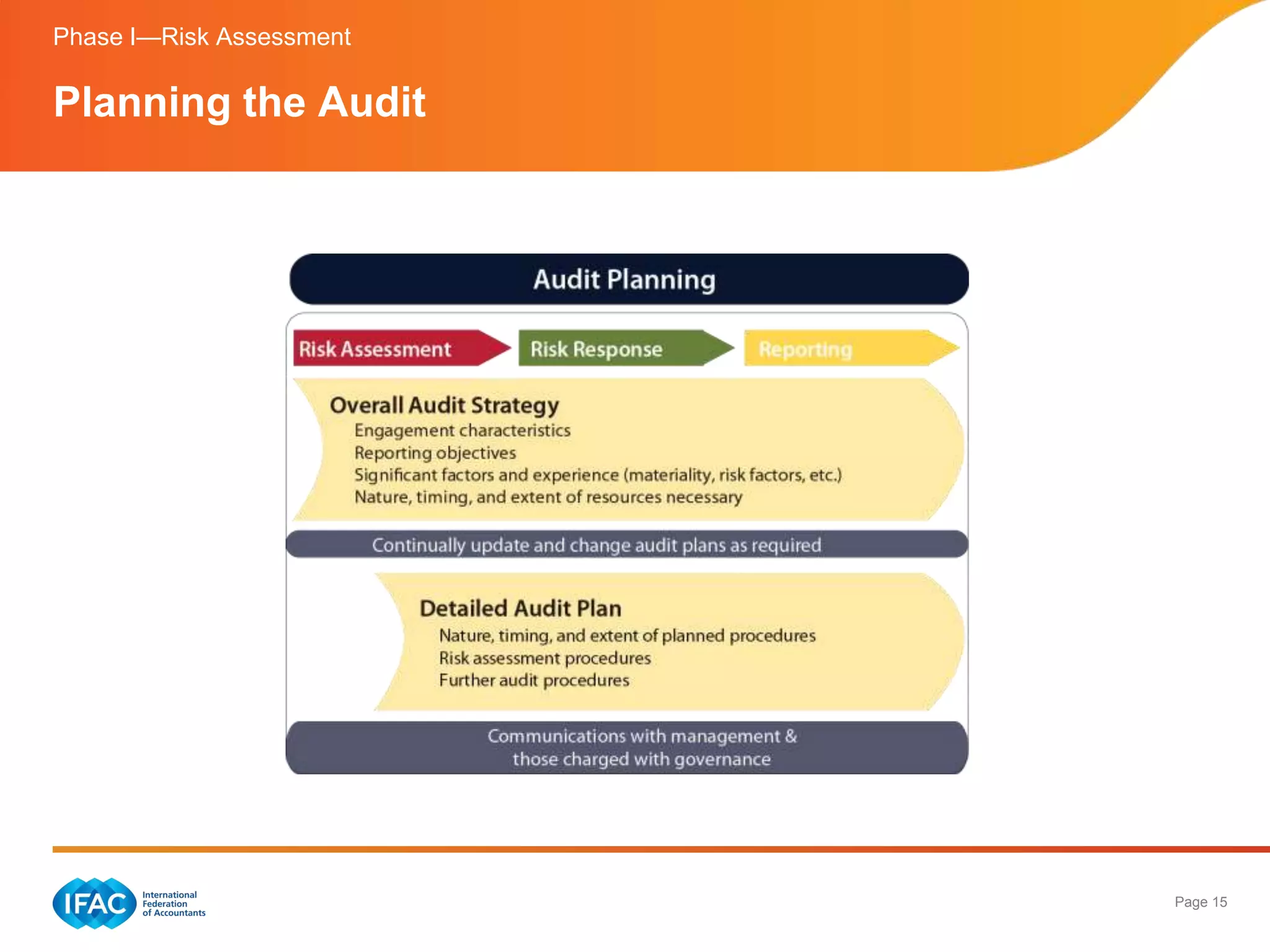

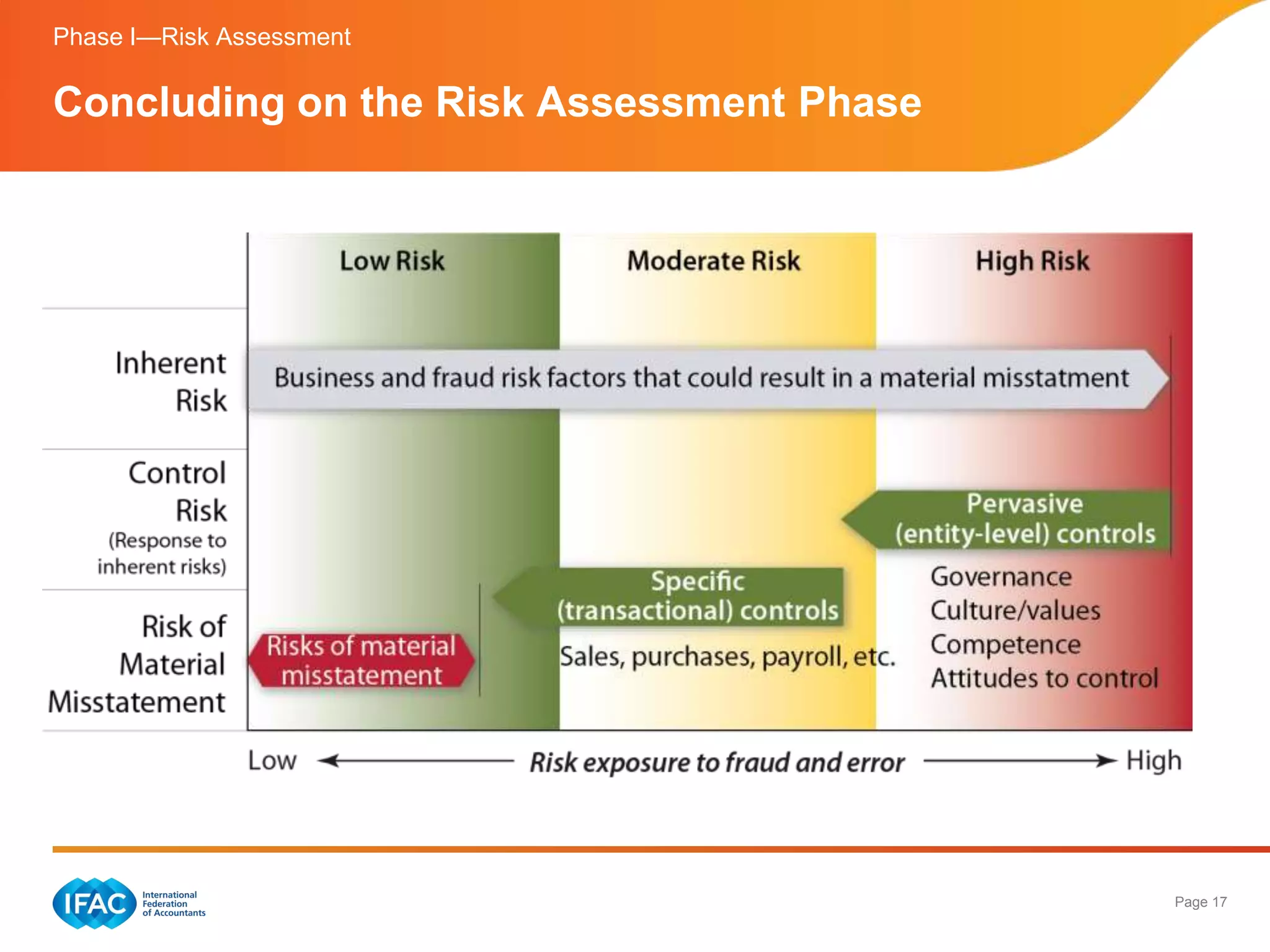

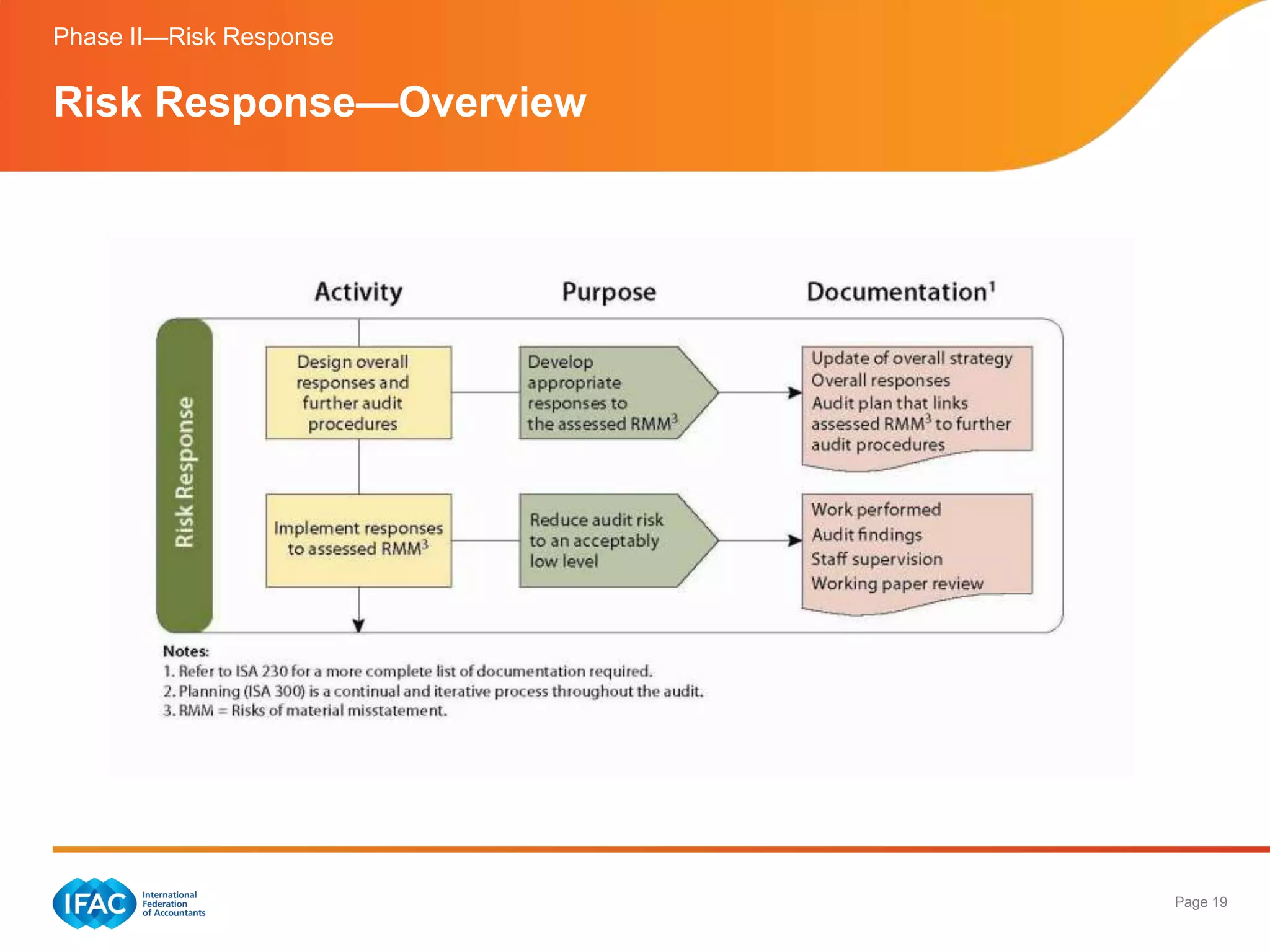

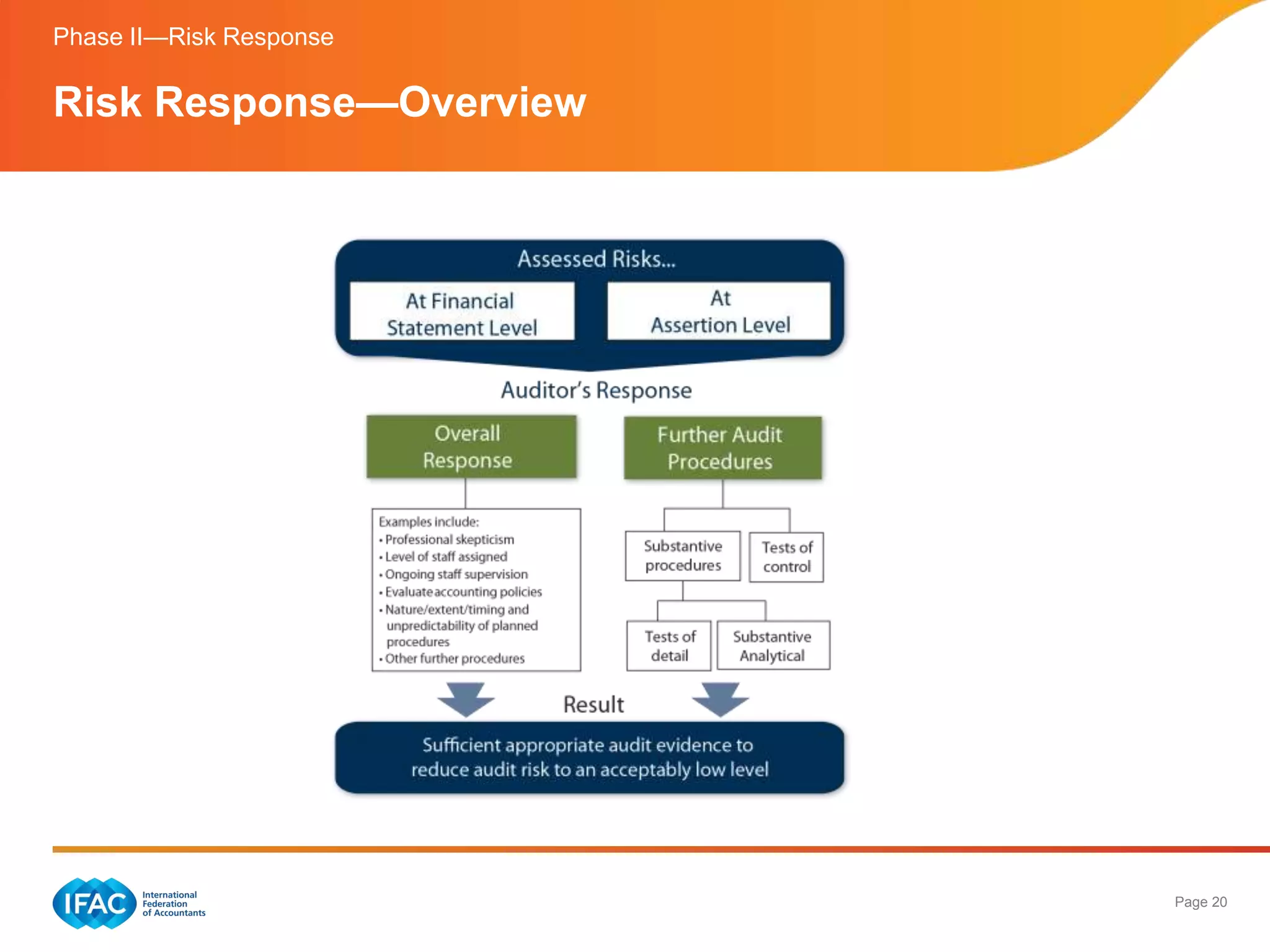

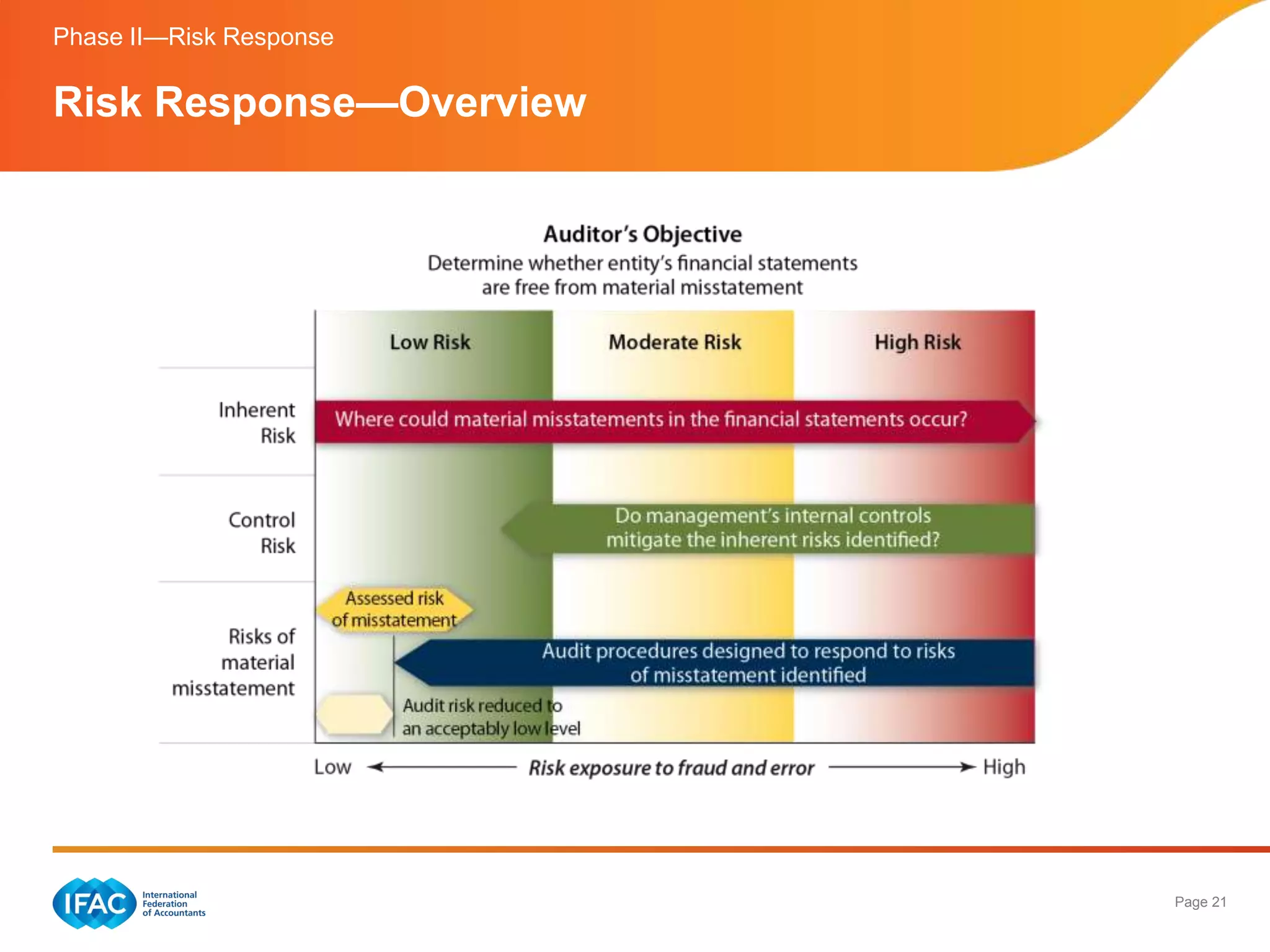

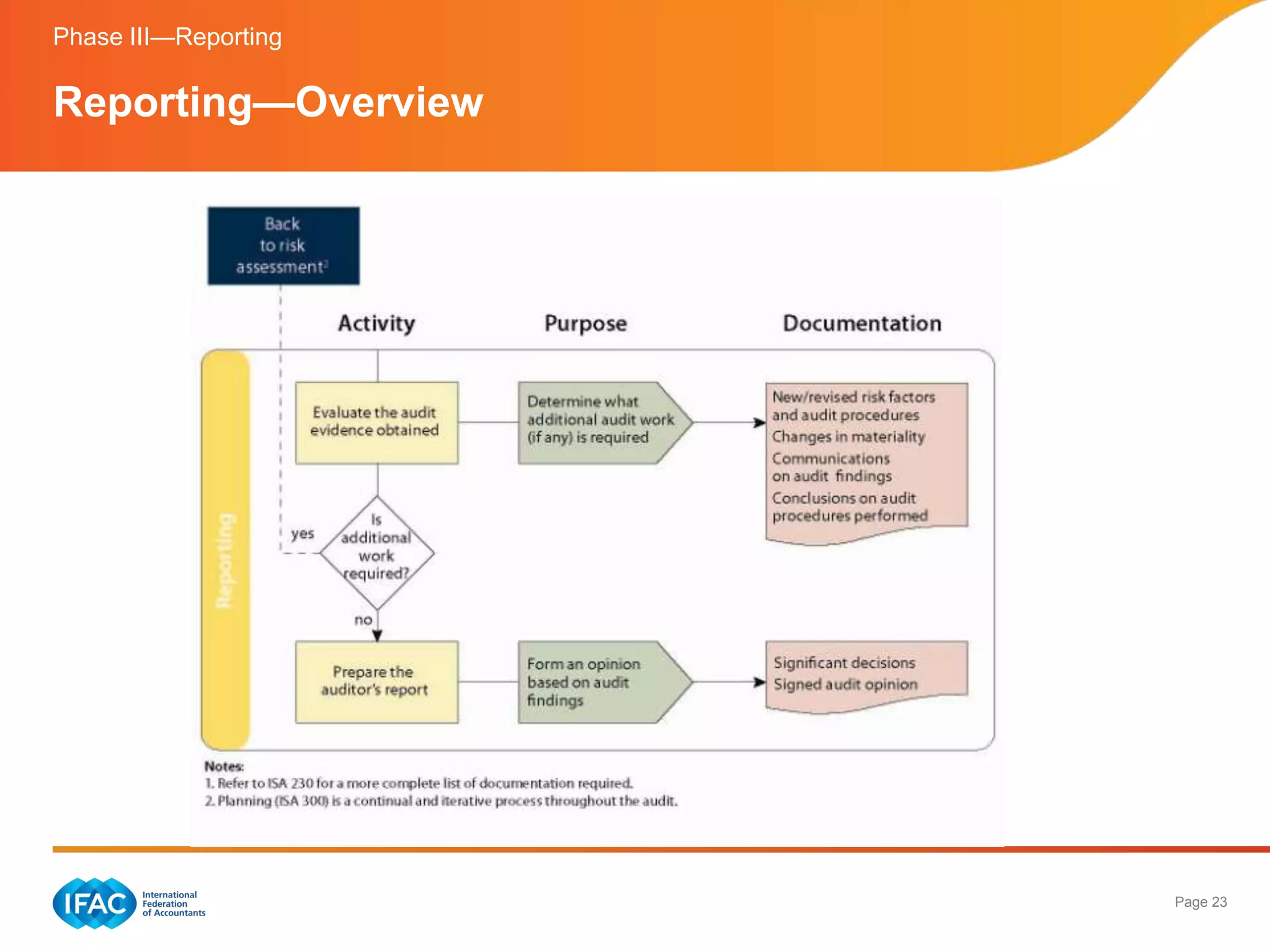

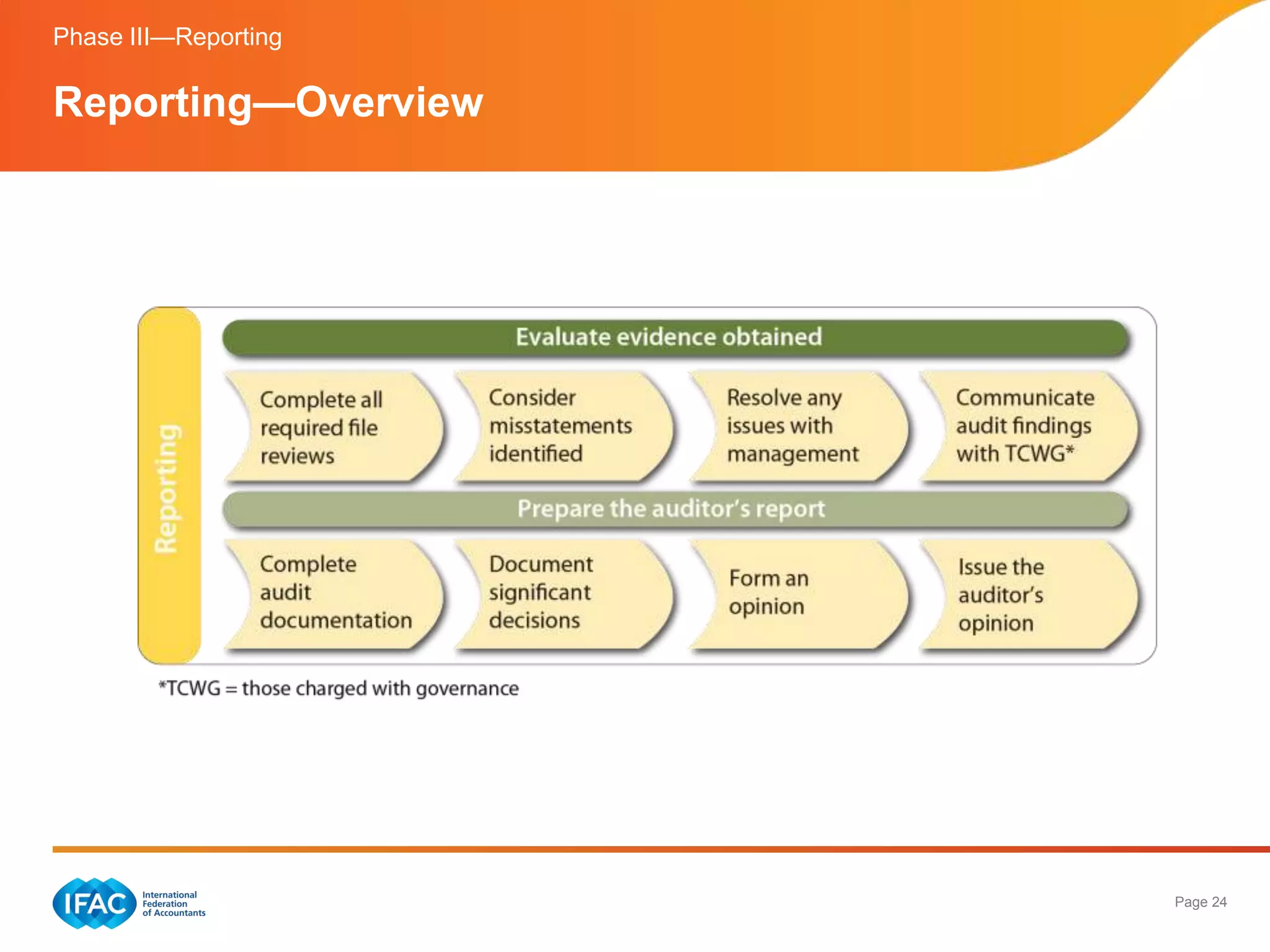

The document is a guide by the IFAC SMP Committee, aimed at providing practical support for implementing International Standards on Auditing (ISAs) in audits of small- and medium-sized entities (SMEs). It outlines the structure and content of the guide, highlights the importance of ethical standards and quality control, and details the phases of performing a risk-based audit. The guide also includes illustrative case studies and resources for further assistance in applying ISAs in SME audits.