Held in Milan on 23-24 May, IAB Europe’s annual 2-day conference Interact 2018 featured a keynote speech by Randall Rothenberg, Chief Executive Officer IAB

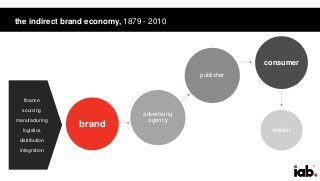

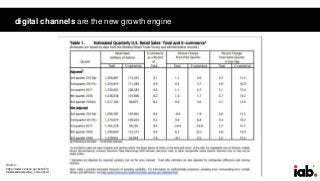

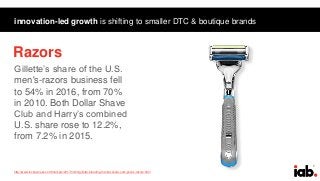

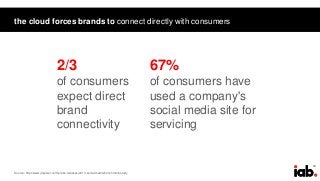

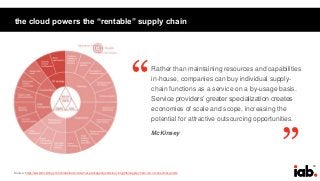

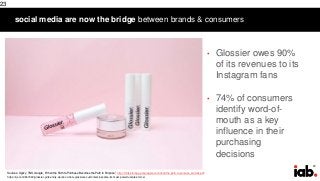

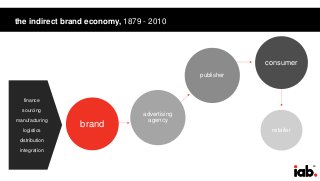

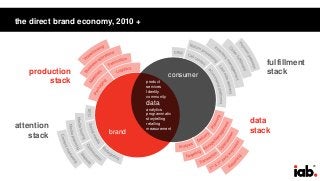

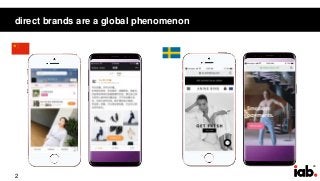

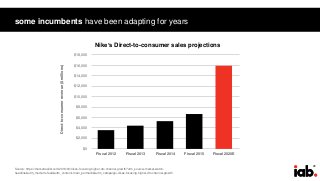

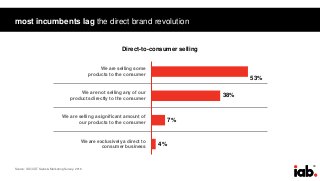

Across virtually all product and service categories and segments, the conventional source of differentiation and value is shifting from high-barrier-to-entry, capital-intensive, owned-and-operated supply chains, to low-barrier-to-entry, capital-flexible, leased and rented supply chains – and value extraction, historically managed through cumbersome, third-party processes, is now being accomplished via direct relationships between brands and consumers. CEO Randall Rothenberg details IAB’s groundbreaking research into the new world of Direct Brands – and their implications for media, advertising, and marketing.