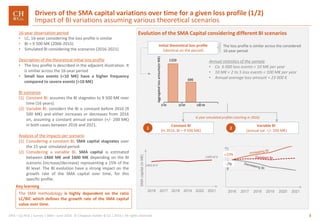

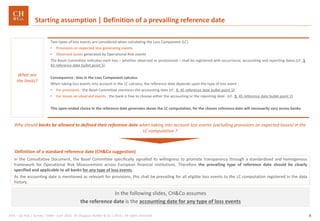

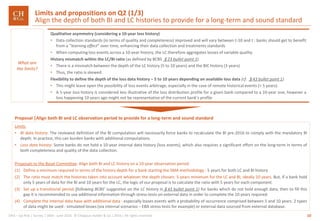

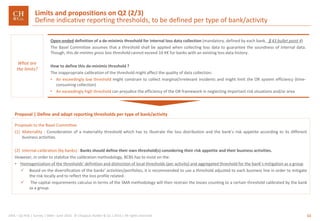

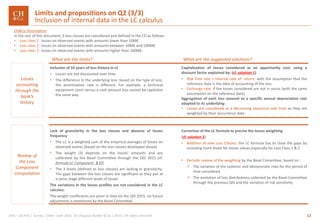

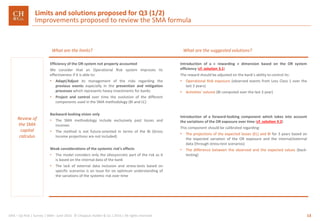

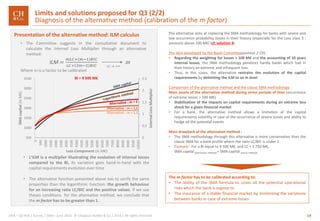

The document discusses the Standardised Measurement Approach (SMA) for operational risk capital requirements proposed by the Basel Committee. It analyzes key aspects of the SMA methodology and proposes alternatives. Specifically, it identifies limits around the inclusion of loss data, qualitative asymmetry in loss histories, and flexibility in defining loss history depth. It proposes aligning both business indicator and loss component histories to a minimum 10-year period. It also discusses limits around the undefined de-minimis threshold for loss data collection and proposes calibrating it based on materiality and banks' risk appetites.

![22GRA – Op Risk | Survey | SMA– June 2016 © Chappuis Halder & Co.| 2016 | All rights reserved

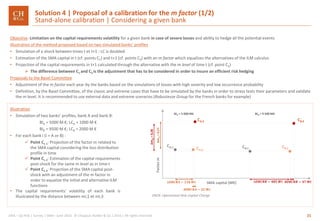

Detailed solution 4 | Proposal of a calibration for the m factor (2/2)

Global calibration | Considering banks across the European financial market

Objective: Homogenization of the m factor adjustments for similar banks by reducing the capital requirements’ variations in case of an extreme shock.

This proposal constitutes an extension of the previous one, once the m factor is calibrated by each bank

Proposals to the Basel Committee

• Simulation of severe shocks and scenarios of all the banks’ profiles collected by the Basel Committee

• Classification of the banks regarding their SMA capital sensitivity regarding the occurrence of an extreme loss (distance between points C1 and C3)

• Average interval [minf ; msup] for each bank group based on the variations observed to limit the clouds’ distortion

• Each bank in a given group, will calibrate its m factor too compute its capital requirements, depending on the interval allowed by the Committee

Factorm

SMA capital (M€)

A given bank class before shock

𝒎𝒊𝒏𝒇; 𝒎 𝒔𝒖𝒑

Interval allowed for m factors

After shock

Methodology

Based on the previous scenario, we suggest a 3-step methodology:

• Step 1 | Clustering of the banks according to their stress sensitivity

Our proposal is based on the classification of banks per group considering

their SMA capital sensitivity for a similar scenario (LC is doubled in this

case). This means that – in our proposal – the Committee would analyse, for

each bank, the distance between m factor before and after shock. The

greater the distance, the higher the sensitivity, and vice versa.

• Step 2 | Analysis of the scatterplots (pre- and post-stress)

For each group, the Basel Committee will project:

A cloud of points C1 for each bank of a given group

A cloud of points C3 for each bank of a given group

• Step 3 | Definition of the m factor and associated confidence interval

The Committee calibrates the m factor and defines an optimum interval

(maximum and minimum value of the m factor for a given group of banks).

Each bank from the same group will have to respect the interval and

provide their data to calculate the m factor, so that the Committee can

ensure they stick to the required confidence interval.

Illustration](https://image.slidesharecdn.com/june2016-commentsandsuggestions-reviewoftheorsma-160616120818/85/CH-CO_SMA-review_Op-Risk-comments-and-suggestions-22-320.jpg)