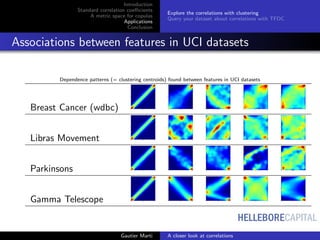

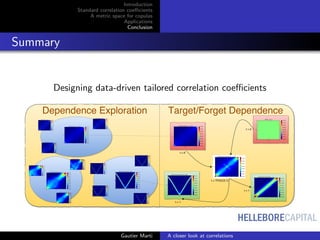

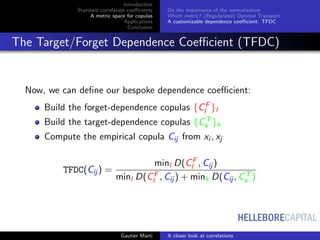

The document discusses standard correlation coefficients, including Pearson and Spearman metrics, and emphasizes the significance of normalization in correlation analysis. It introduces a customizable dependence coefficient known as the Target/Forgot Dependence Coefficient (TFDC) which enhances correlation exploration through applications like clustering. Additionally, it examines various copula methods and their applications in analyzing dependencies between variables.

![HELLEBORECAPITAL

Introduction

Standard correlation coefficients

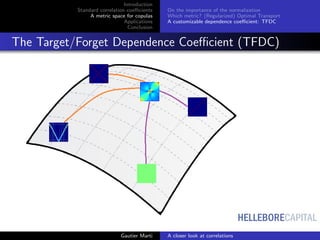

A metric space for copulas

Applications

Conclusion

What is correlation?

E[Xi Xj ] − E[Xi ]E[Xj ]

(E[X2

i ] − E[Xi ]2)(E[X2

j ] − E[Xj ]2)

∈ [−1, 1]

N

k=1(xik

− xi )(xjk

− xj )

N

k=1(xik

− xi )2 N

k=1(xjk

− xj )2

∈ [−1, 1]

import numpy as np

np.corrcoef(x_i,x_j)

Gautier Marti A closer look at correlations](https://image.slidesharecdn.com/mlmeetups4e3slides-161105203113/85/A-closer-look-at-correlations-3-320.jpg)

![HELLEBORECAPITAL

Introduction

Standard correlation coefficients

A metric space for copulas

Applications

Conclusion

On the importance of the normalization

Which metric? (Regularized) Optimal Transport

A customizable dependence coefficient: TFDC

From ranks to empirical copula

Sklar’s Theorem [3]

For (Xi , Xj ) having continuous marginal cdfs FXi

, FXj

, its joint cumulative

distribution F is uniquely expressed as

F(Xi , Xj ) = C(FXi

(Xi ), FXj

(Xj )),

where C is known as the copula of (Xi , Xj ).

Gautier Marti A closer look at correlations](https://image.slidesharecdn.com/mlmeetups4e3slides-161105203113/85/A-closer-look-at-correlations-23-320.jpg)

![HELLEBORECAPITAL

Introduction

Standard correlation coefficients

A metric space for copulas

Applications

Conclusion

On the importance of the normalization

Which metric? (Regularized) Optimal Transport

A customizable dependence coefficient: TFDC

Minimum, Independence, Maximum copulas

Fr´echet–Hoeffding copula bounds

For any copula C : [0, 1]2

→ [0, 1] and any (u, v) ∈ [0, 1]2

the following

bounds hold:

W(u, v) ≤ C(u, v) ≤ M(u, v),

where W is the copula for counter-monotonic random variables, and M

is the copula for co-monotonic random variables.

0 0.5 1

ui

0

0.5

1

uj

w(ui,uj)

0.000

0.002

0.004

0.006

0.008

0.010

0.012

0.014

0.016

0.018

0.020

0 0.5 1

ui

0

0.5

1

uj

W(ui,uj)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 0.5 1

ui

0

0.5

1

uj

π(ui,uj)

0.00036

0.00037

0.00038

0.00039

0.00040

0.00041

0.00042

0.00043

0.00044

0 0.5 1

ui

0

0.5

1

uj Π(ui,uj)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 0.5 1

ui

0

0.5

1

uj

m(ui,uj)

0.000

0.002

0.004

0.006

0.008

0.010

0.012

0.014

0.016

0.018

0.020

0 0.5 1

ui

0

0.5

1

uj

M(ui,uj)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

Gautier Marti A closer look at correlations](https://image.slidesharecdn.com/mlmeetups4e3slides-161105203113/85/A-closer-look-at-correlations-24-320.jpg)

![HELLEBORECAPITAL

Introduction

Standard correlation coefficients

A metric space for copulas

Applications

Conclusion

On the importance of the normalization

Which metric? (Regularized) Optimal Transport

A customizable dependence coefficient: TFDC

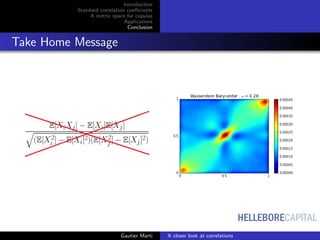

Which metric? (Regularized) Optimal Transport

Its geometry has good properties in general [1], and for copulas [2].

0 0.5 1

0

0.5

1

0.0000

0.0015

0.0030

0.0045

0.0060

0.0075

0.0090

0.0105

0.0120

0 0.5 1

0

0.5

1

0.0000

0.0015

0.0030

0.0045

0.0060

0.0075

0.0090

0.0105

0.0120

0 0.5 1

0

0.5

1

0.0000

0.0015

0.0030

0.0045

0.0060

0.0075

0.0090

0.0105

0.0120

0 0.5 1

0

0.5

1

0.0000

0.0015

0.0030

0.0045

0.0060

0.0075

0.0090

0.0105

0.0120

0 0.5 1

0

0.5

1 Bregman barycenter copula

0.0000

0.0008

0.0016

0.0024

0.0032

0.0040

0.0048

0.0056

0 0.5 1

0

0.5

1 Wasserstein barycenter copula

0.0000

0.0004

0.0008

0.0012

0.0016

0.0020

0.0024

0.0028

0.0032

Gautier Marti A closer look at correlations](https://image.slidesharecdn.com/mlmeetups4e3slides-161105203113/85/A-closer-look-at-correlations-29-320.jpg)

![HELLEBORECAPITAL

Introduction

Standard correlation coefficients

A metric space for copulas

Applications

Conclusion

On the importance of the normalization

Which metric? (Regularized) Optimal Transport

A customizable dependence coefficient: TFDC

TFDC Power

0.00.20.40.60.81.0

xvals

power.cor[typ,]

xvals

power.cor[typ,]

0.00.20.40.60.81.0

xvals

power.cor[typ,]

xvals

power.cor[typ,]

cor

dCor

MIC

ACE

MMD

CMMD

RDC

TFDC

0.00.20.40.60.81.0

xvals

power.cor[typ,]

xvals

power.cor[typ,]

0 20 40 60 80 100

0.00.20.40.60.81.0

xvals

power.cor[typ,]

0 20 40 60 80 100

xvals

power.cor[typ,]

Noise Level

Power

Figure: Power of several dependence coefficients as a function of the

noise level in eight different scenarios. Insets show the noise-free form of

each association pattern. The coefficient power was estimated via 500

simulations with sample size 500 each.

Gautier Marti A closer look at correlations](https://image.slidesharecdn.com/mlmeetups4e3slides-161105203113/85/A-closer-look-at-correlations-37-320.jpg)