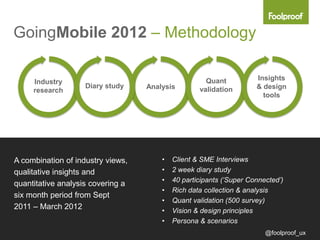

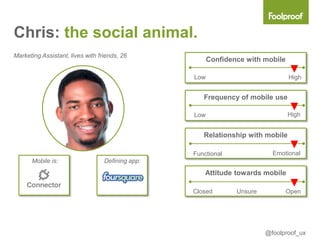

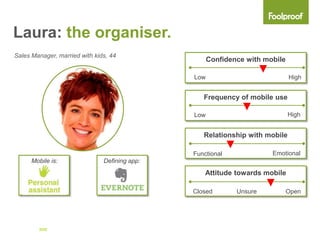

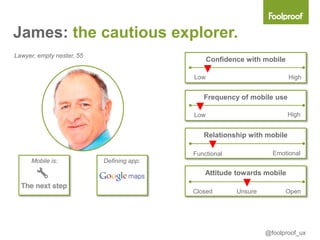

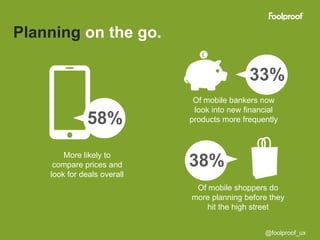

This document summarizes ethnographic research conducted with UK mobile consumers. It describes the methodology used, which included diary studies, interviews, surveys and analysis over a six month period. Key insights include identifying different types of mobile consumers ("personas") and emerging mobile behaviors around planning, sharing, gaming and blending the physical and digital. The document stresses that mobile expectations are high and rising, and that brands must commit to a long-term mobile experience vision to meet consumer needs and inspire new ways of interacting.