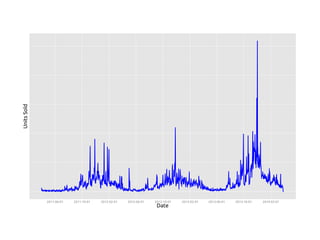

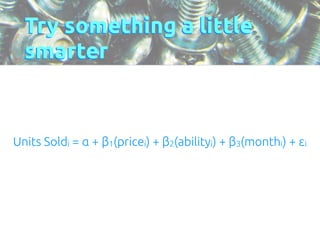

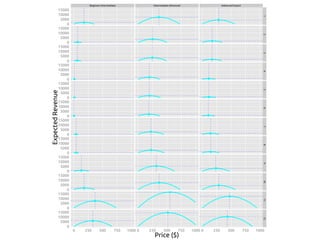

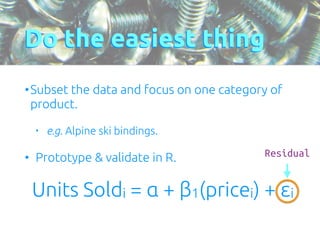

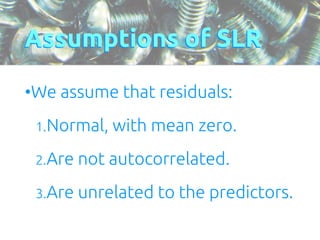

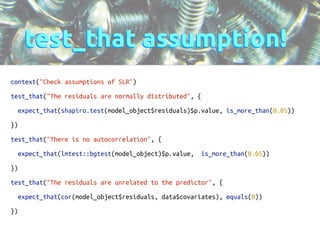

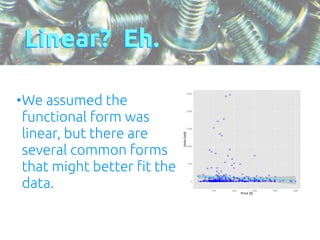

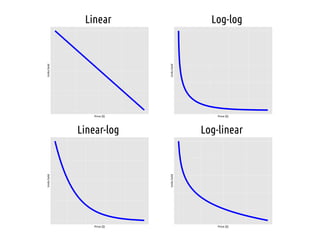

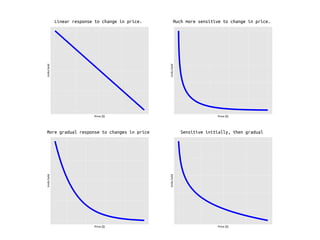

The document discusses the process of price optimization using data science techniques, emphasizing the importance of making sound assumptions and validating them through statistical testing. It outlines steps for harvesting big data, forecasting demand, and optimizing pricing while identifying potential issues with statistical assumptions related to linear regression models. The presentation concludes with a reminder to start with simple approaches and gradually build up complexity, reinforcing the necessity of testing assumptions in data analysis.

![Tests pass!

> test_file("./tests/test_slr.R")

Check assumptions of SLR : [1] "units_sold ~ price"

...

!](https://image.slidesharecdn.com/craftsmanship-140915105019-phpapp01/85/Assumptions-Check-yo-self-before-you-wreck-yourself-22-320.jpg)

![Psych.

> test_file("./tests/test_slr.R")

Check assumptions of SLR : [1] "units_sold ~ price"

1..

!!

1. Failure(@test_slr.R#12): The residuals are normally distributed

------------------------

shapiro.test(model_object$residuals)$p.value not more than 0.05. Difference: 0.05

!](https://image.slidesharecdn.com/craftsmanship-140915105019-phpapp01/85/Assumptions-Check-yo-self-before-you-wreck-yourself-23-320.jpg)

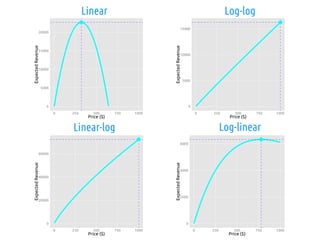

![# Automagically explore SLR with common functional forms

candidate_models = list(linear = 'units_sold ~ price',

loglog = 'log(units_sold + 1) ~ log(price + 1)',

linearlog = 'units_sold ~ log(price + 1)',

loglinear = 'log(units_sold + 1) ~ price')

!

run = function(candidate_models, input_data) {

forecasts = list()

test_input = data.frame(price = 0:1000)

!

# Forecast

for (model in candidate_models) {

test_environment = new.env()

!

# Generate the forecast

forecasts[[model]] = generate_forecast(model, input_data)

!

# Save off current value of things for testing

assign("model", forecasts[[model]], envir = test_environment)

assign("errors", forecasts[[model]]$residuals, envir = test_environment)

assign("covariate", input_data$price, envir = test_environment)

assign("label", model, envir = test_environment)

!

save(test_environment, file = 'env_to_test.Rda')

!

# Run assumption tests

test_file("./tests/test_slr.R")

!

#### OPTIMIZE PRICE!!! ####

opt_results = optimizer(forecasts[[model]], test_input)

!

# Multiply the predicted demand by the price for expected revenue

opt_results$expected_revenue = test_data$price * opt_results$predicted_units_sold

!

pdf(paste(model, “.pdf”, sep = ‘’))

plot_price(opt_results)

!

}

!

return(forecasts)

!

}](https://image.slidesharecdn.com/craftsmanship-140915105019-phpapp01/85/Assumptions-Check-yo-self-before-you-wreck-yourself-30-320.jpg)

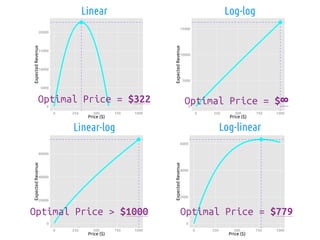

![rut roh…

> run(candidate_models, slr_data)

Check assumptions of SLR : [1] "units_sold ~ price"

1..

!!

1. Failure(@test_slr.R#12): The residuals are normally distributed ---------------------------------

shapiro.test(linear$residuals)$p.value not more than 0.05. Difference: 0.05

!

Check assumptions of SLR : [1] "log(units_sold + 1) ~ log(price + 1)"

1.2

!!

1. Failure(@test_slr.R#12): The residuals are normally distributed ---------------------------------

shapiro.test(linear$residuals)$p.value not more than 0.05. Difference: 0.05

!

2. Failure(@test_slr.R#24): The residuals are unrelated to the predictor ---------------------------

cor(test_environment$errors, test_environment$covariate) not equal to 0

Mean absolute difference: 0.05545615

!

Check assumptions of SLR : [1] "units_sold ~ log(price + 1)"

1.2

!!

1. Failure(@test_slr.R#12): The residuals are normally distributed ---------------------------------

shapiro.test(linear$residuals)$p.value not more than 0.05. Difference: 0.05

!

2. Failure(@test_slr.R#24): The residuals are unrelated to the predictor ---------------------------

cor(test_environment$errors, test_environment$covariate) not equal to 0

Mean absolute difference: 0.04201906

!

Check assumptions of SLR : [1] "log(units_sold + 1) ~ price"

1..

!!

1. Failure(@test_slr.R#12): The residuals are normally distributed ---------------------------------

shapiro.test(linear$residuals)$p.value not more than 0.05. Difference: 0.05](https://image.slidesharecdn.com/craftsmanship-140915105019-phpapp01/85/Assumptions-Check-yo-self-before-you-wreck-yourself-31-320.jpg)