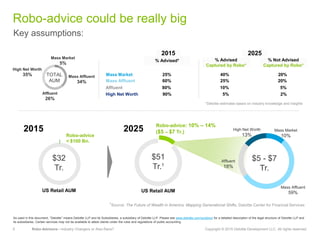

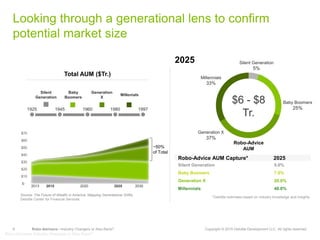

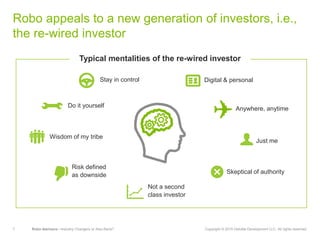

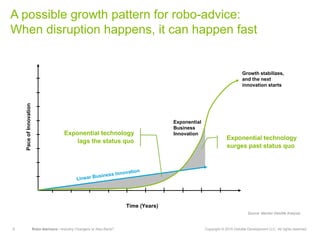

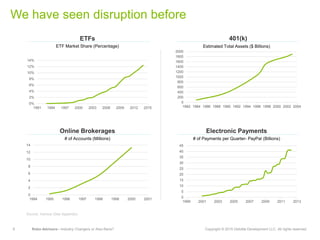

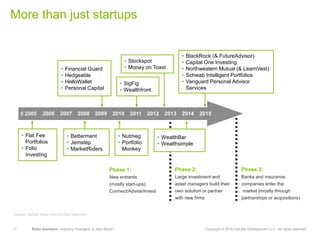

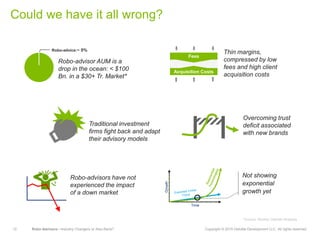

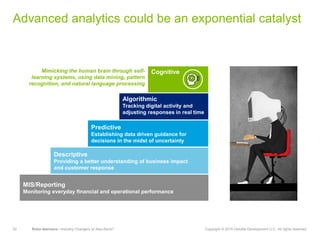

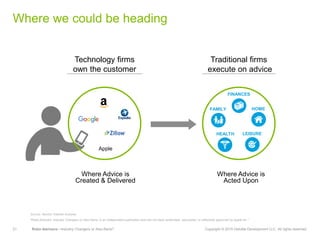

This document discusses the growth potential and business models of robo-advisors. It begins by asking how big and fast the robo-advisor industry can grow in the US, what business models may be successful, and where advice is headed in the future. It then examines the size and growth projections of the robo-advisor market, outlines different business models, and explores how advanced analytics could expand the scope of automated advice over time. The document concludes that while robo-advice has significant growth potential, many questions remain around which firms and models can succeed in this evolving space.