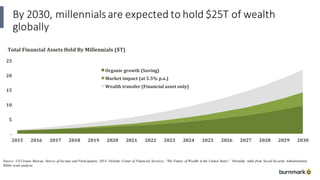

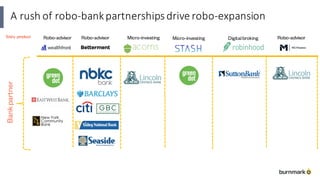

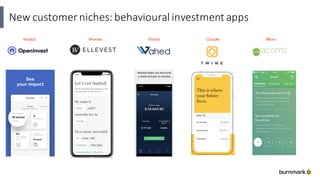

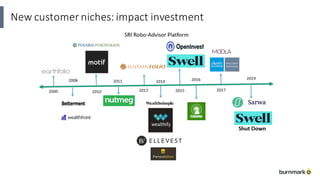

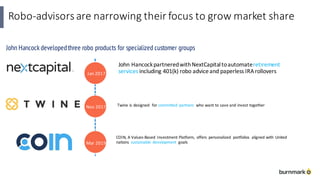

The robo-advisor market is growing rapidly but also changing and narrowing its focus. The number of robo-advisor users has tripled since 2017 and is expected to continue growing significantly by 2023. Robo-advisors are focusing on niche areas like retirement planning and socially responsible investing to attract more clients. By 2030, millennials will be the dominant generation of investors globally. Major financial institutions are partnering with robo-advisors or developing their own digital advice platforms to target millennial clients.