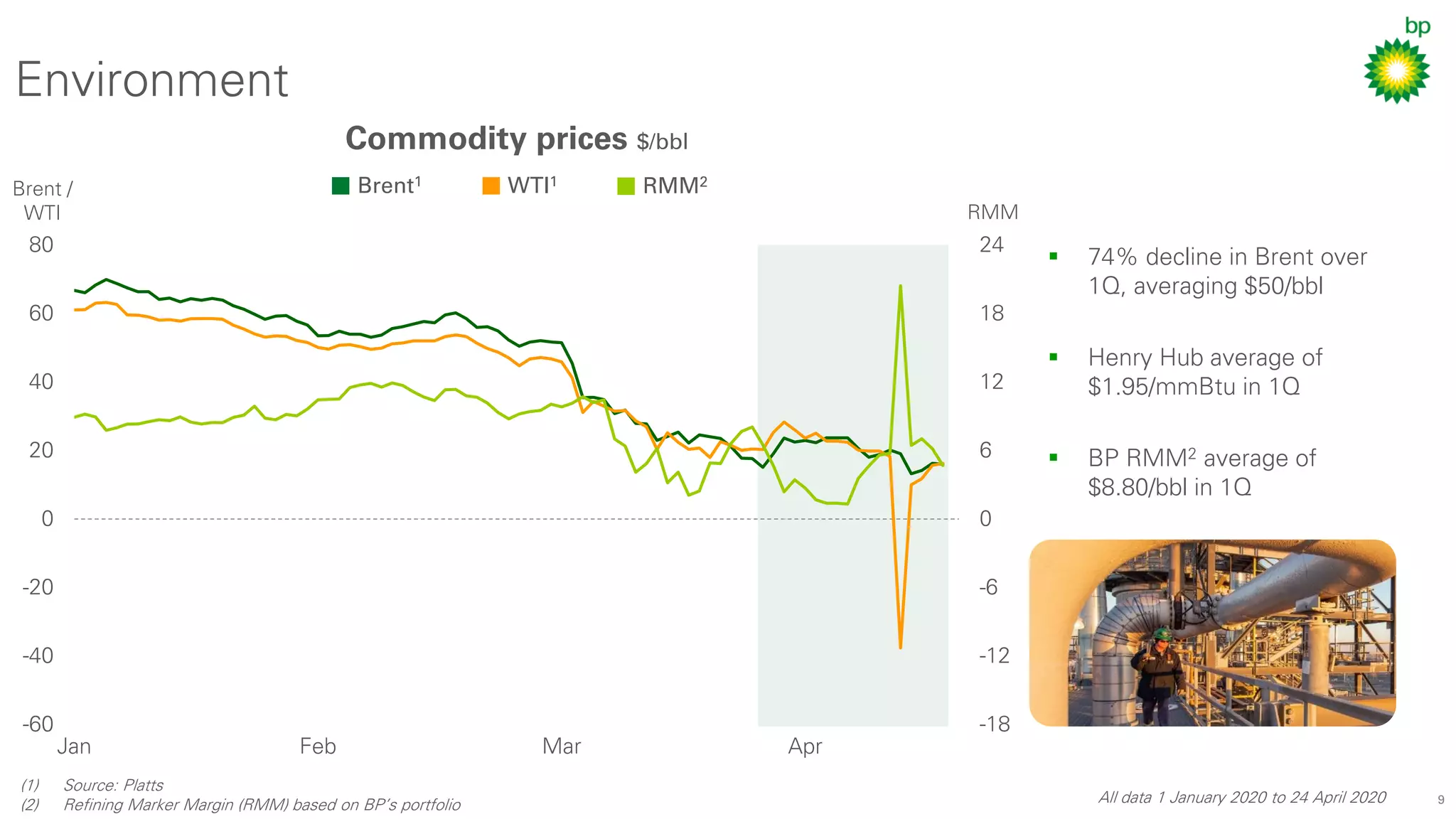

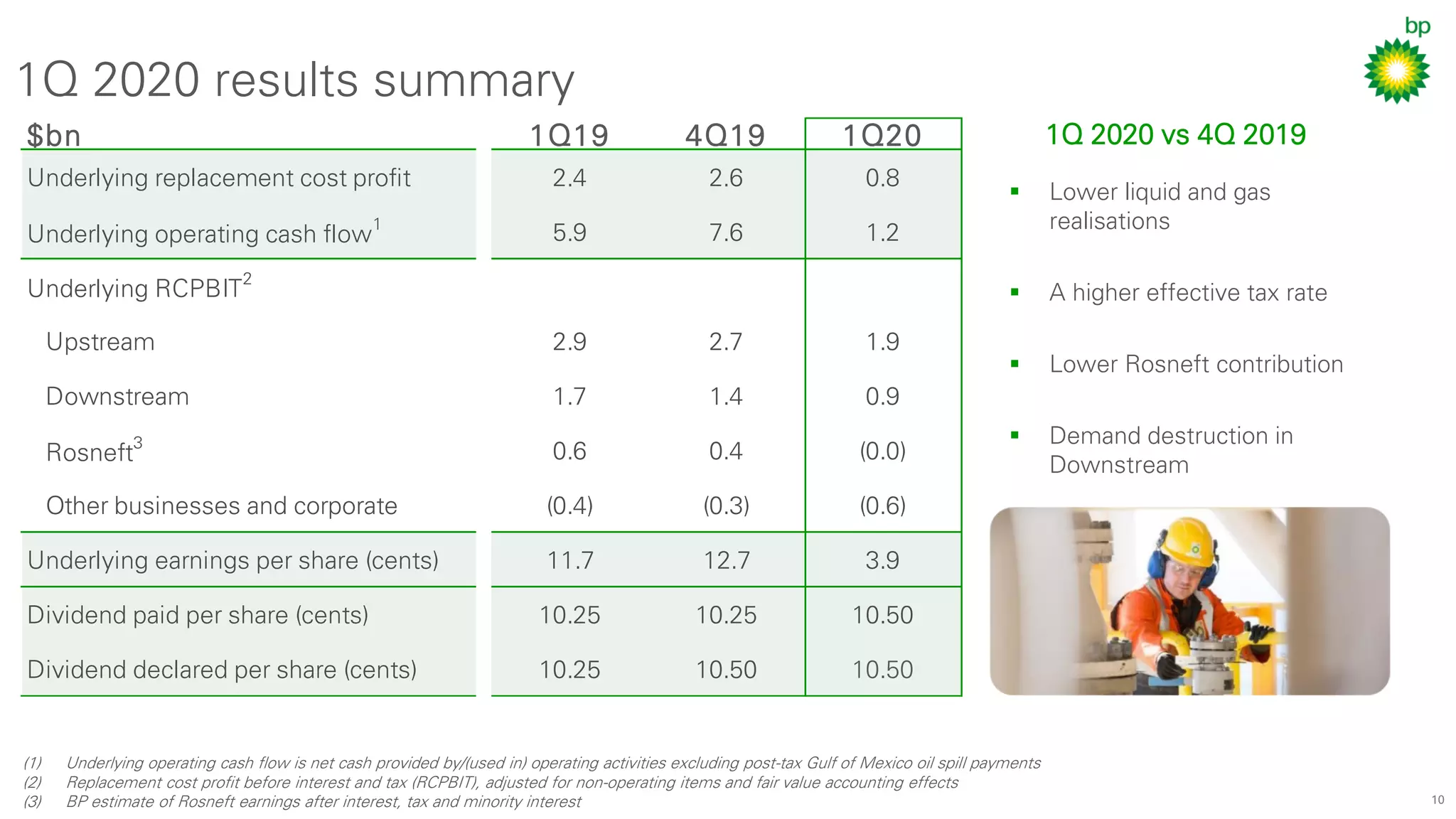

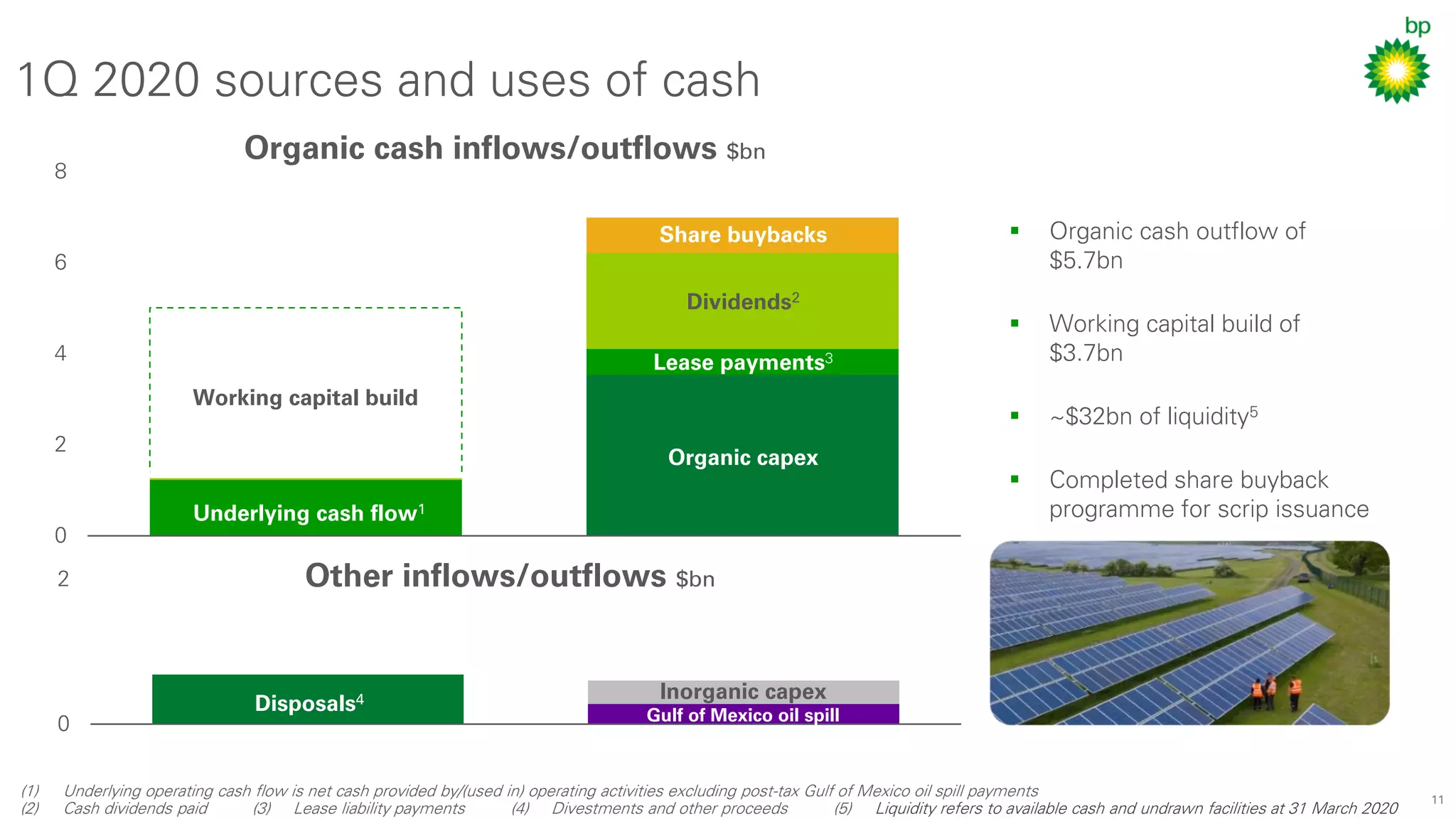

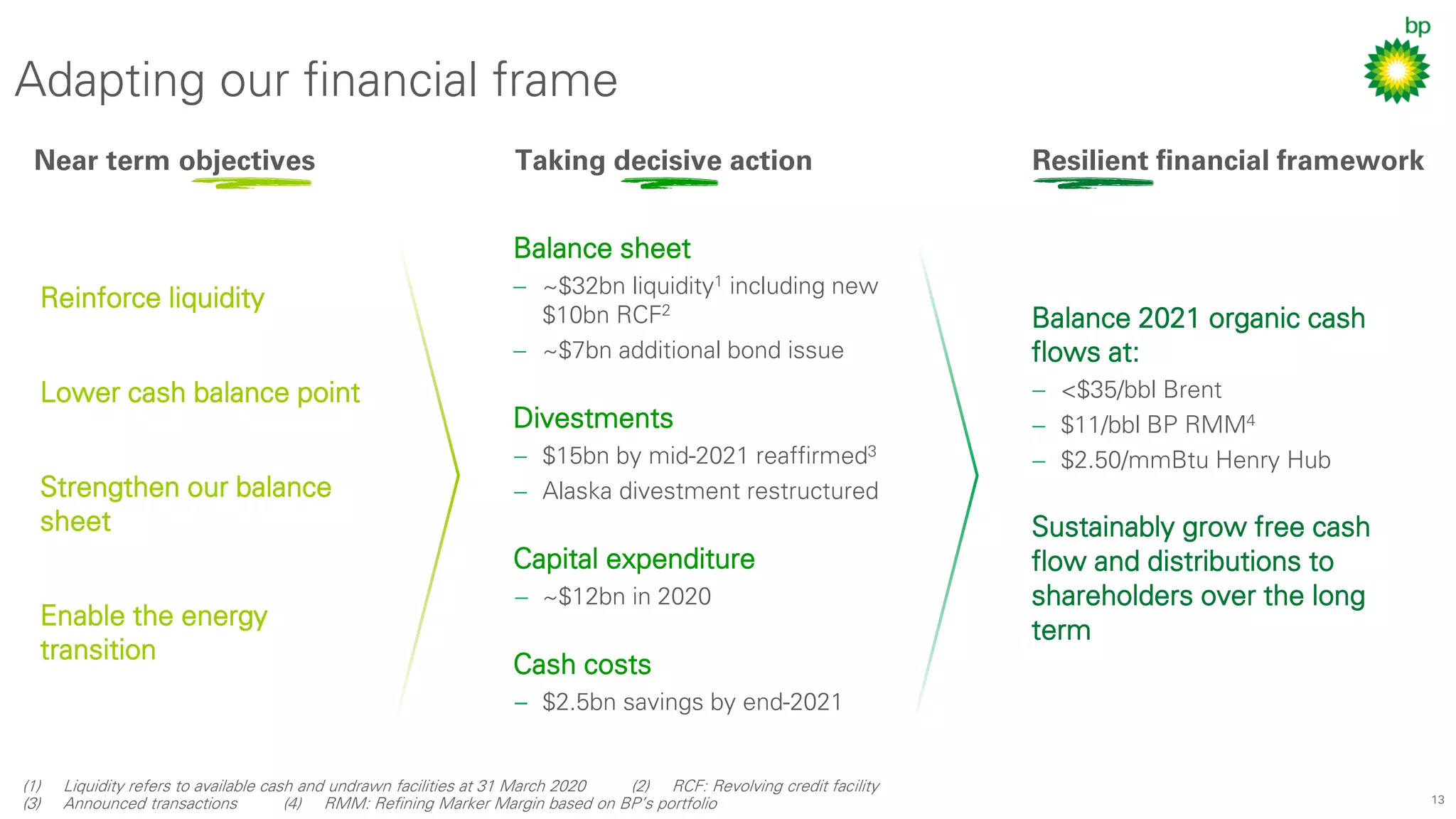

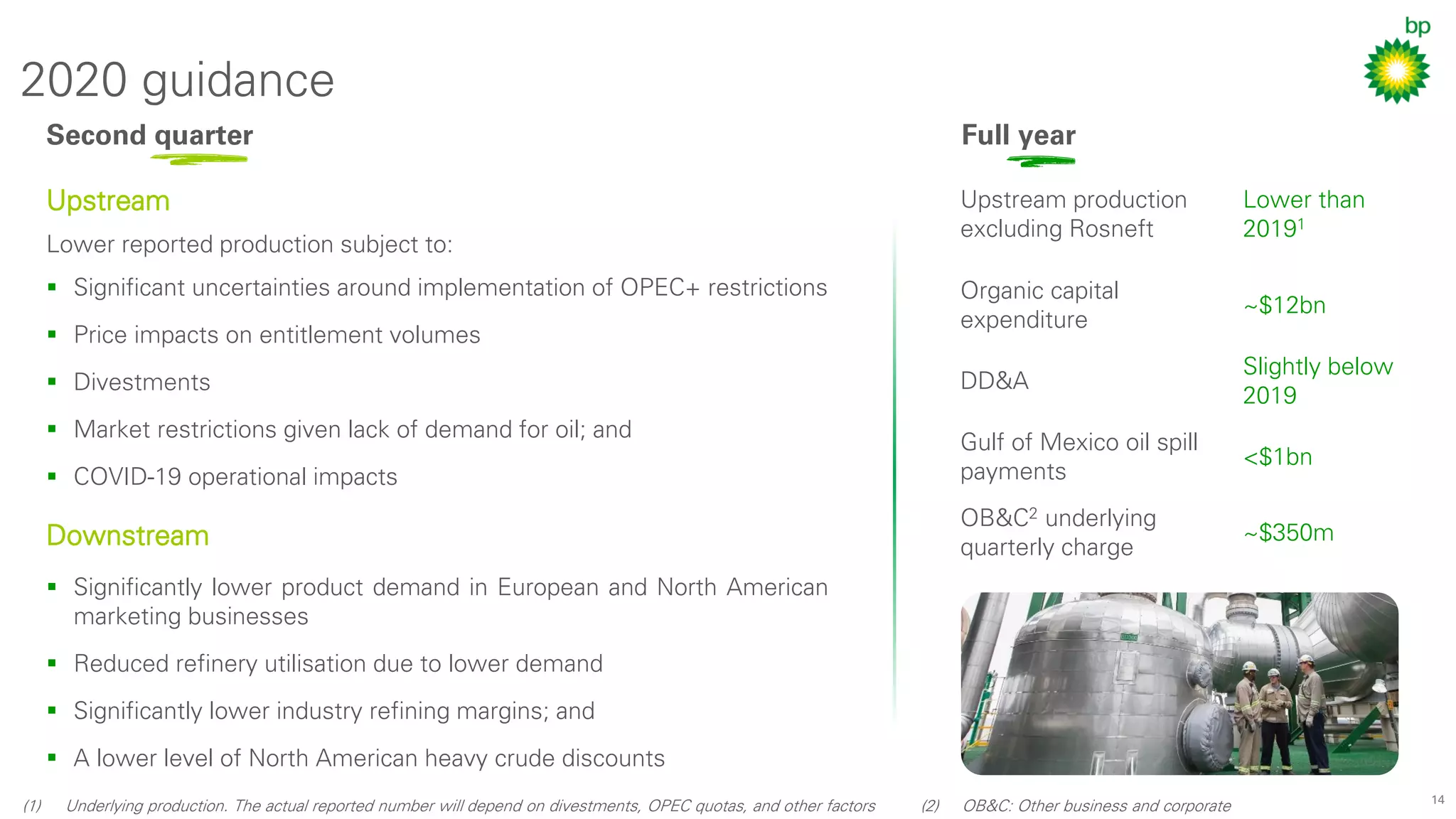

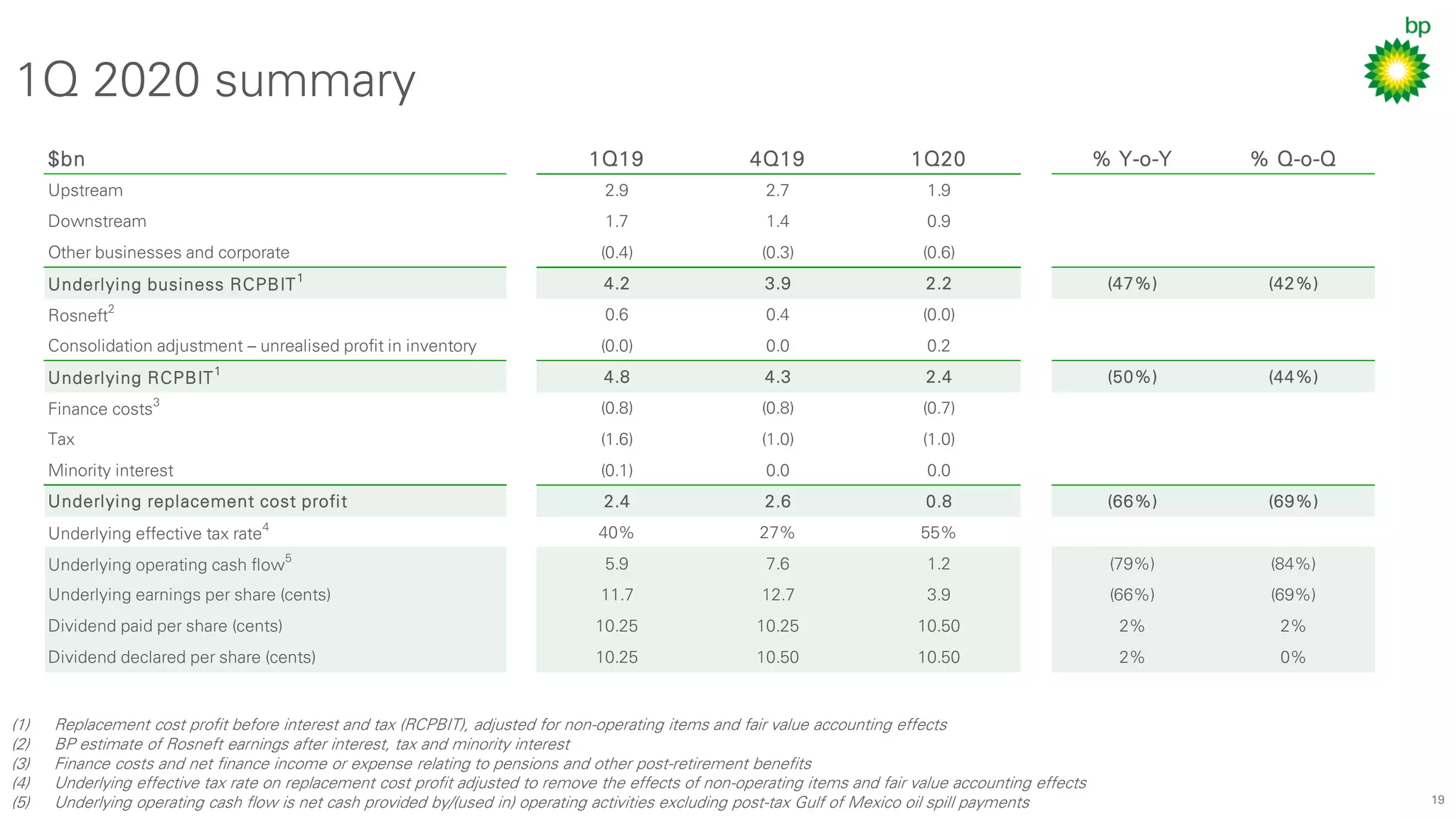

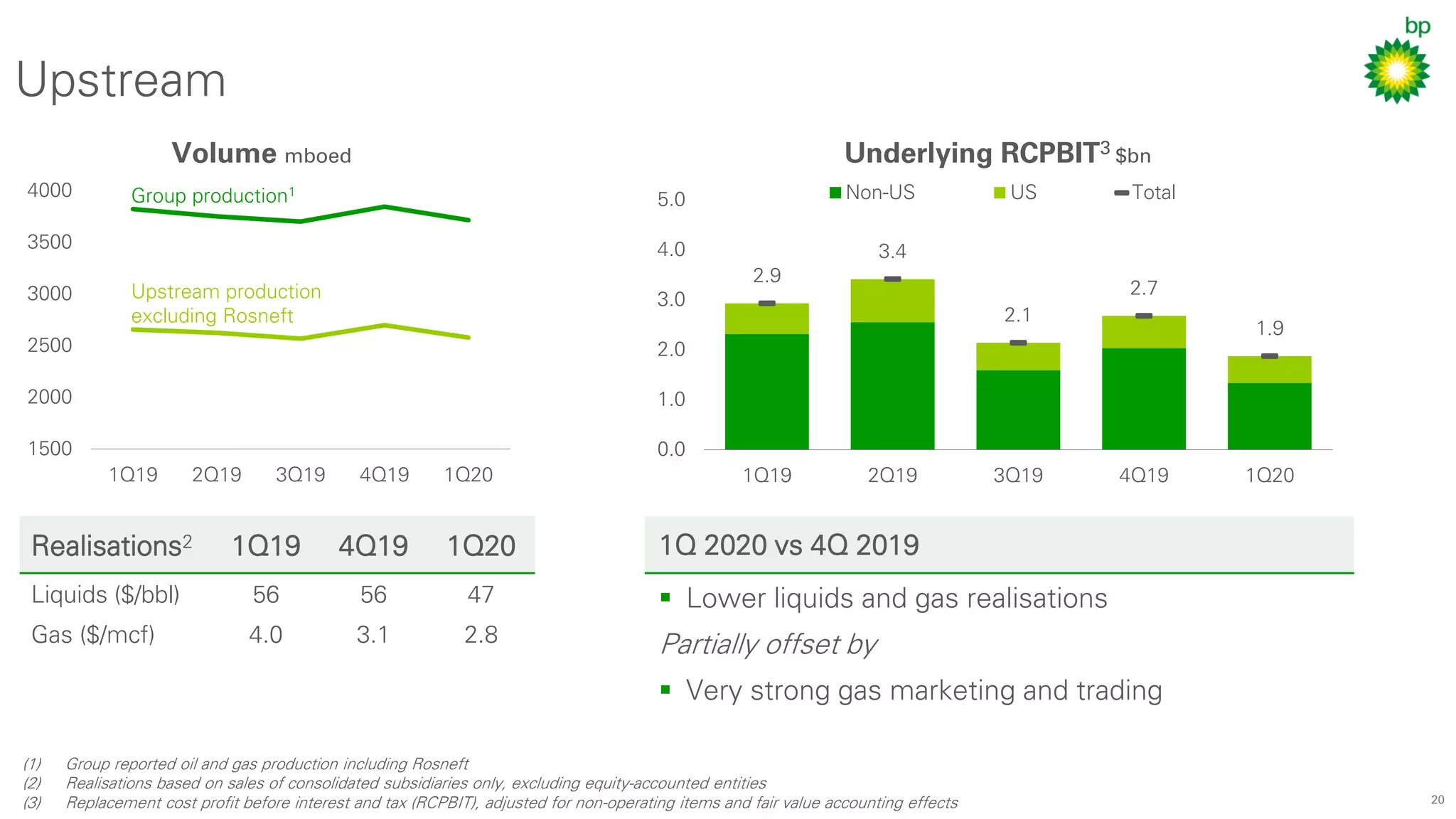

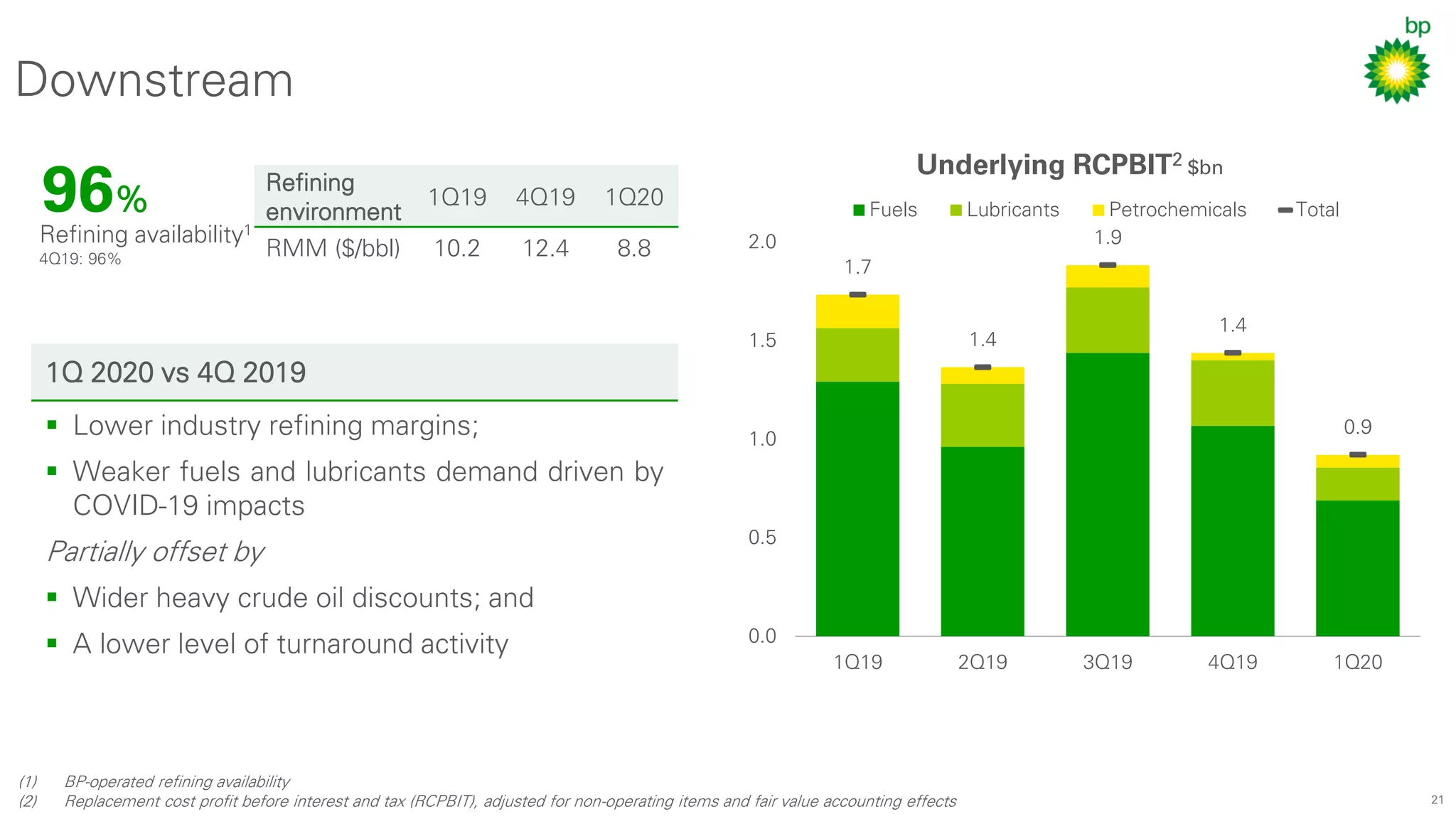

BP reported financial results for 1Q 2020 that showed a significant decline from 4Q 2019 due to lower oil and gas prices driven by the COVID-19 pandemic. Underlying replacement cost profit was $0.8 billion, down from $2.6 billion in 4Q 2019. BP took actions to strengthen its financial position including reducing capital expenditures and strengthening its $32 billion liquidity position. BP also reaffirmed its commitment to its long term strategic plan and financial framework to sustainably grow free cash flow and distributions to shareholders over the long term.