BP held its 2011 Results and Strategy presentation on February 7, 2012. Bob Dudley, BP's Group Chief Executive, welcomed attendees and introduced Brian Gilvary as BP's new Chief Financial Officer and Iain Conn as Chief Executive of Refining & Marketing. Dudley noted safety guidelines for the venue and asked attendees to turn off phones. He then presented BP's cautionary statement regarding forward-looking projections in the presentation. Actual results could differ materially from expectations due to risks including future market conditions.

![BP 4Q11 Results and 2012 Strategy

Script and slides

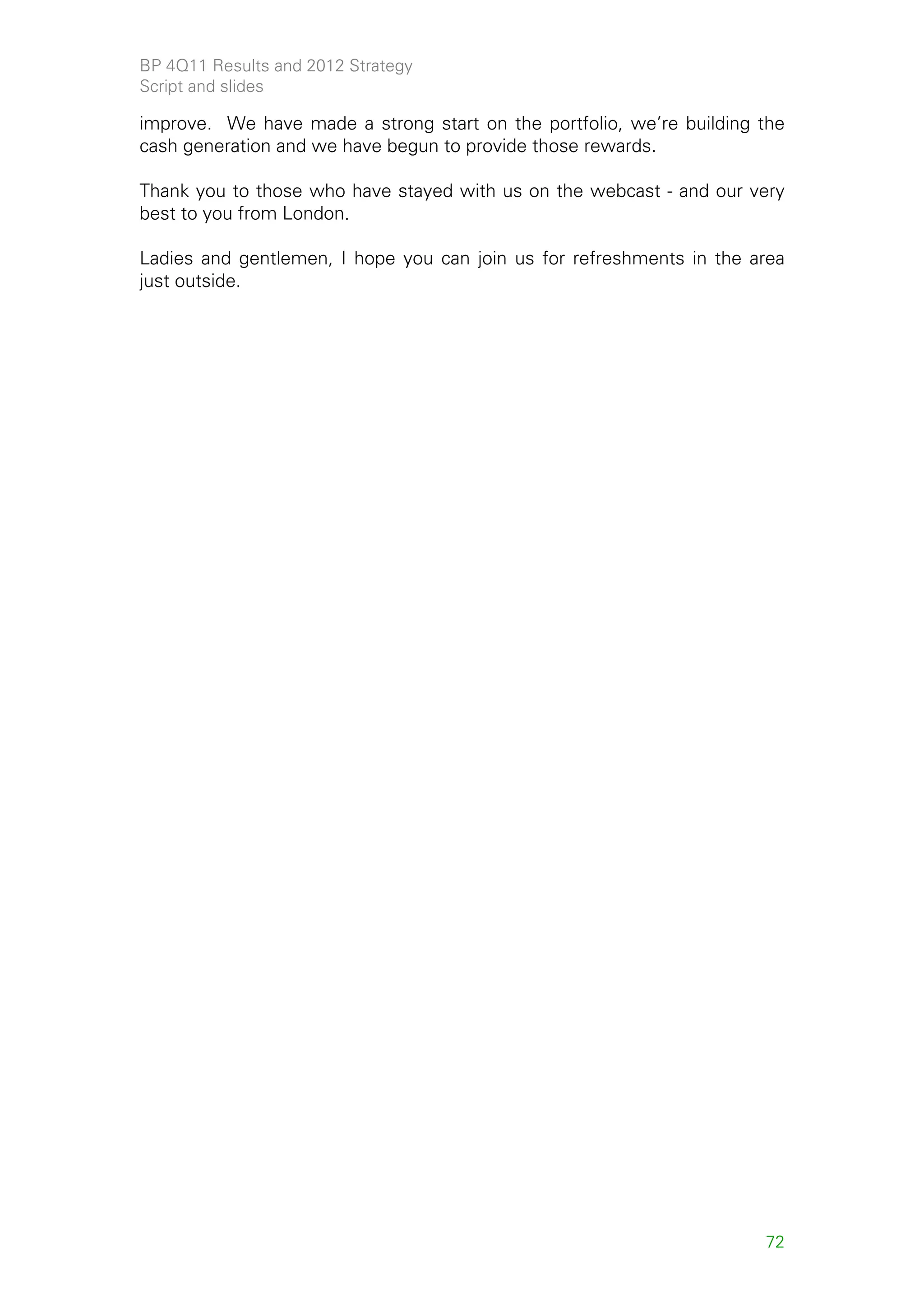

Robust pipeline for the longer term

Exploration Pre-FID Post-FID

• Australia • GoM(1): Kaskida, Thunder • Angola: Block 18 West, • Angola: Kizomba • Angola: LNG, Block 31

• Asia Horse Water Injection, Tiber, Block 31 South-East, Satellites Phase 2 PSVM, Clochas-Mavacola,

Moccasin, Freedom, Mad Pazflor Phase 2, Tulipa • GoM: Mad Dog CLOV

Deepwater • GoM(1)

Dog North • Brazil: Itaipu, Wahoo Phase 2 • GoM: Galapagos,

• North Africa

Na Kika Phase 3, Mars B

• South Atlantic

• Australia • Azerbaijan: Shah Deniz FFD(2) • Australia: Browse, • Australia: Western • Australia: North Rankin 2

• Egypt • Indonesia: Tangguh Western Flank B, Flank A • North Africa: In Salah

Gas Value expansion Persephone • Egypt: West Nile Southern Fields,

• India

Chains • India: D6 Satellites, NEC 25 • Trinidad: Field expansion, Delta In Amenas Compression

• Indonesia

Juniper

• Trinidad

• Egypt: East Nile Delta

Giant Fields • Azerbaijan • Azerbaijan: ACG expansion • North Sea: Greater Clair • North Sea: Clair • Azerbaijan: Chirag Oil

Conventional • North Sea • Iraq: Rumaila expansion • North Sea: Norway Ridge, Quad 204 • North Sea: Skarv, Devenick,

• Canada: Arctic Kinnoull

Unconventional • Alaska: heavy oil • Canada: Sunrise Phase 2, • Canada: Sunrise Phase 1

oil Pike, Terre de Grace

Unconventional • Jordan • Oman: Khazzan • Algeria: Bourarhat

gas (1) GoM: Gulf of Mexico

• US: Eagle Ford • Indonesia: Sanga Sanga

(2) FFD: Full Field Development

• Argentina: Neuquen coal bed methane

Start ups by end 2014 in bold

Excludes TNK-BP 43

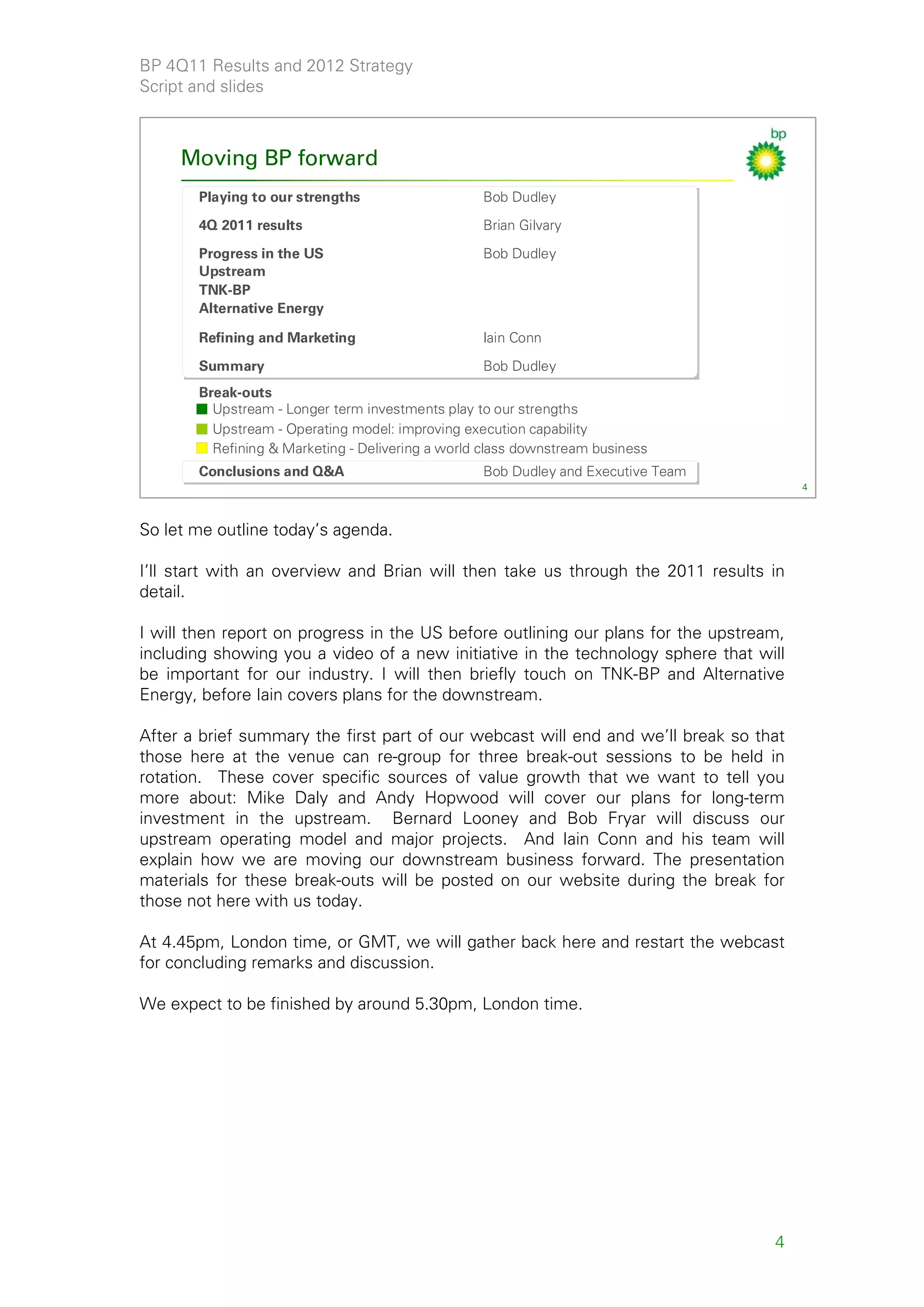

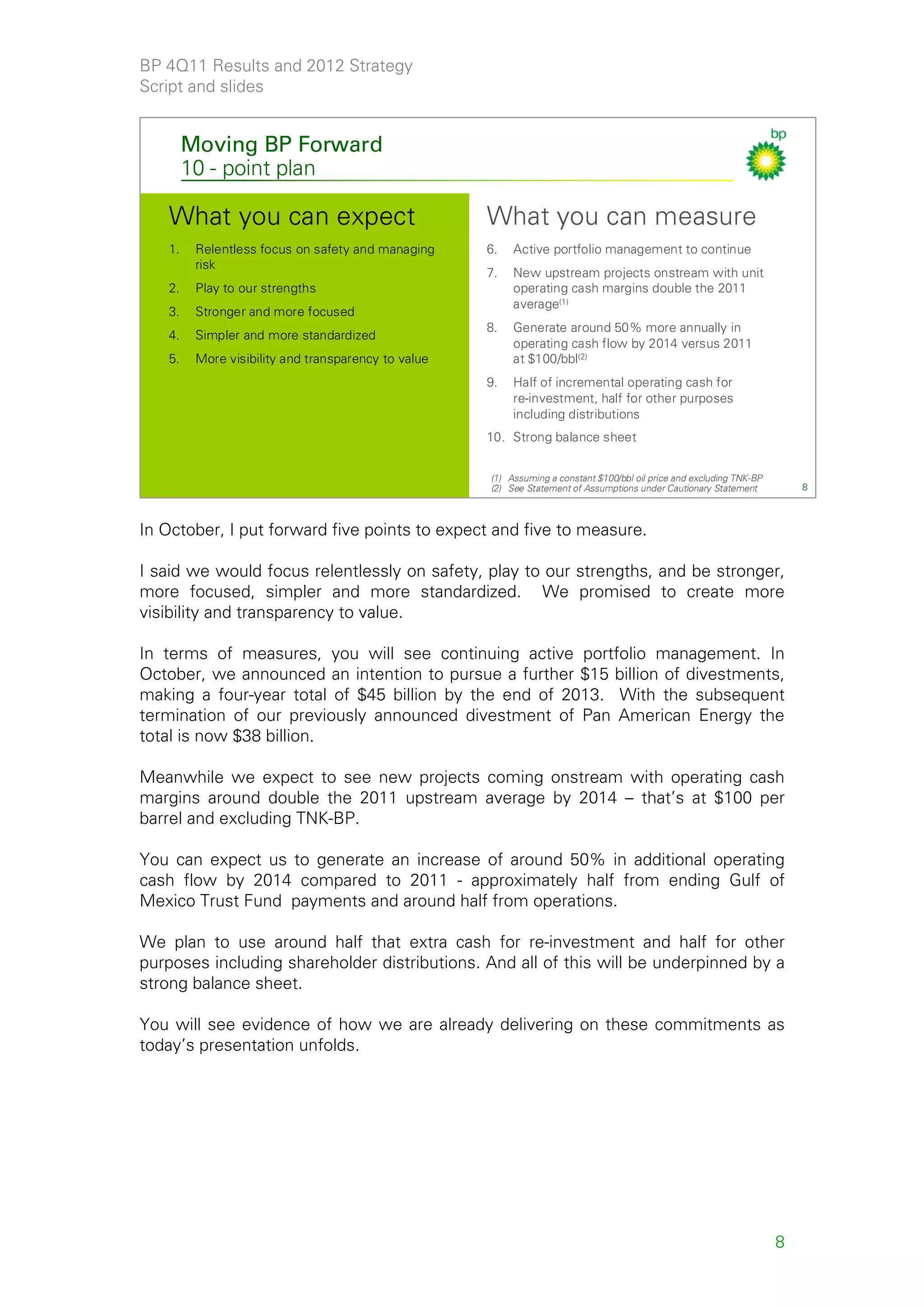

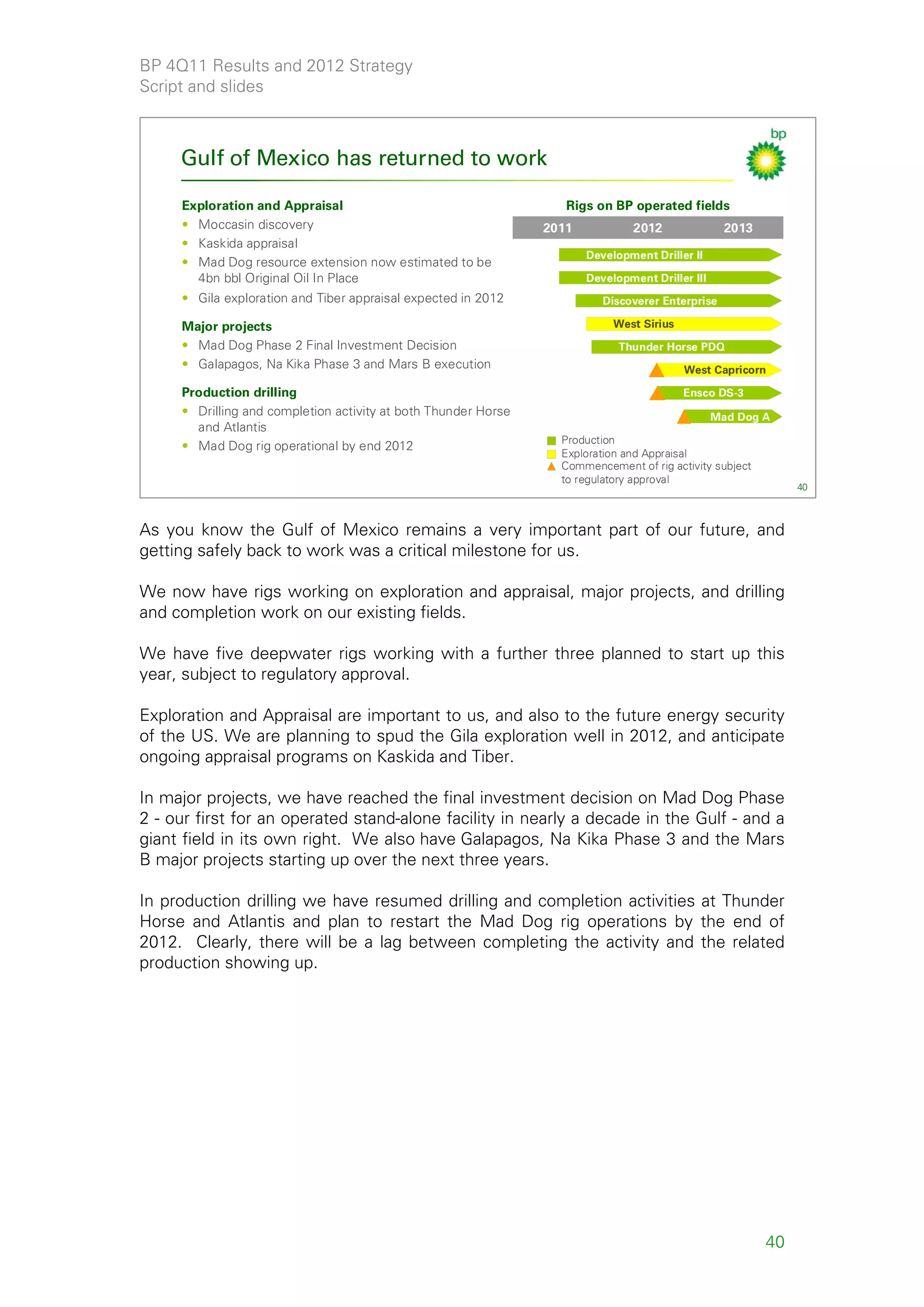

This shows the pipeline in more detail. You can see that we have some major

projects coming through behind the highlighted projects on the right side. These

projects will start up in the next three years. And there is a very strong inventory of

material exploration positions [on the left].

These are aligned with our strengths in deepwater, gas value chains and giant fields.

Deepwater will remain a core building block of our portfolio through the end of the

decade.

In the gas value chains we have world-scale projects in Azerbaijan, Tangguh in

Indonesia, in Egypt and Trinidad. We are appraising another in Oman.

In the area of giant fields we will have significant cash flow coming over decades

from our unconventional Canadian heavy oil projects and big unconventional gas

fields around the world.

43](https://image.slidesharecdn.com/bpfourthquarter2011resultspresentationslidesandscript-120914075044-phpapp01/75/P-4Q11-2012-Strategy-Presentation-43-2048.jpg)

![BP 4Q11 Results and 2012 Strategy

Script and slides

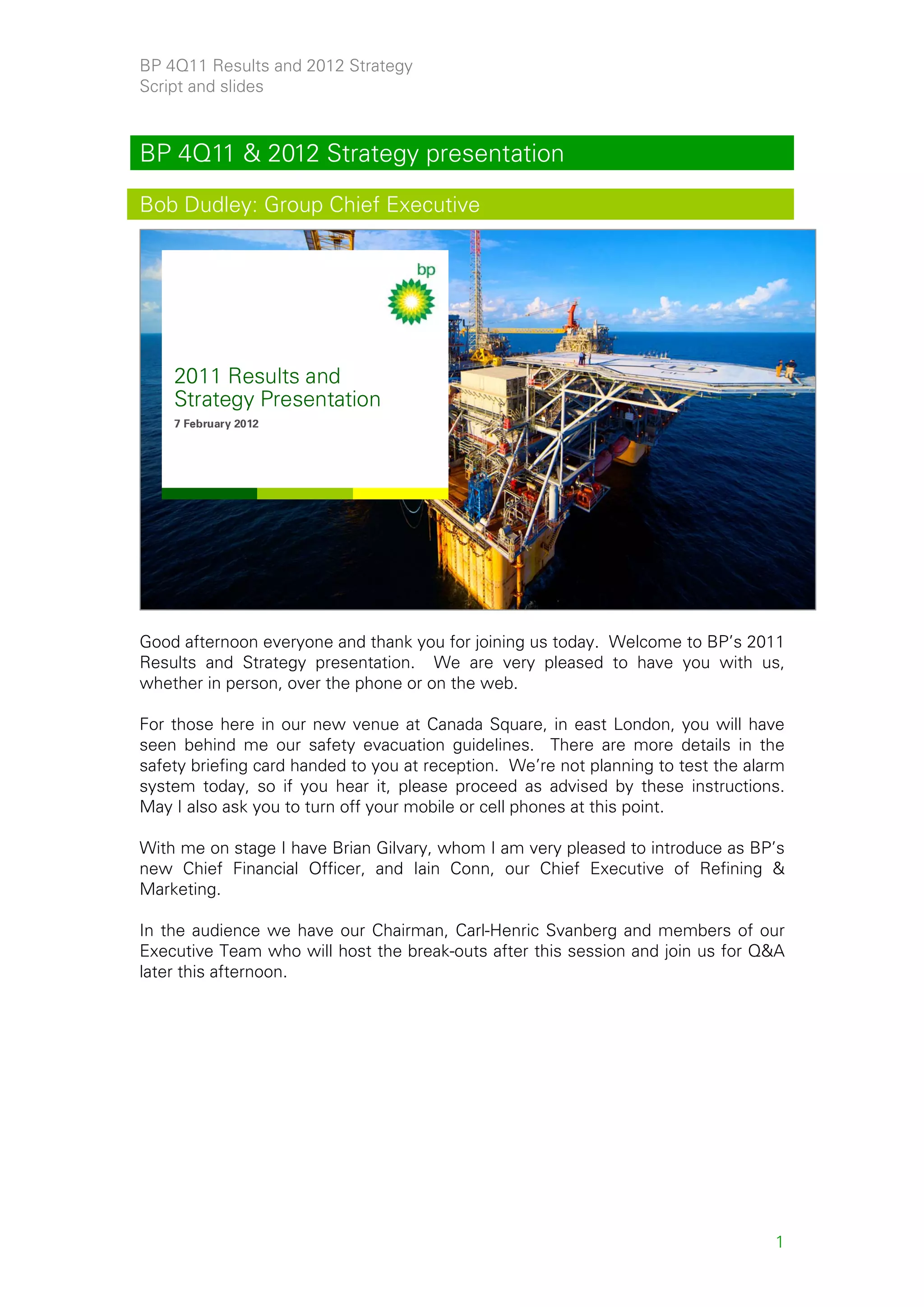

20KTM the next challenge in deepwater

Building 20KTM capability The next deepwater technical frontier: >15 thousand PSI

• BP is investing in technology to enable exploration,

development and production of reservoirs at

20 thousand PSI

• Successful development of 20KTM will enable us to:

- Develop deeper higher pressure resources in our

existing giant fields

- Explore for and produce new hydrocarbon resources in

global basins >15 thousand PSI

10-20 bn bbls resource potential

We will be developing four new 20KTM systems

Rig, riser and BOP Well designs and Subsea production Well intervention and

equipment completions system (SPS) containment

Stronger, larger and safer More real-time monitoring New High Integrity Pressure Apply lessons from Deepwater

design Protection System (HIPPS) Horizon

BOP = Blow Out Preventer

PSI = Pounds per square inch 45

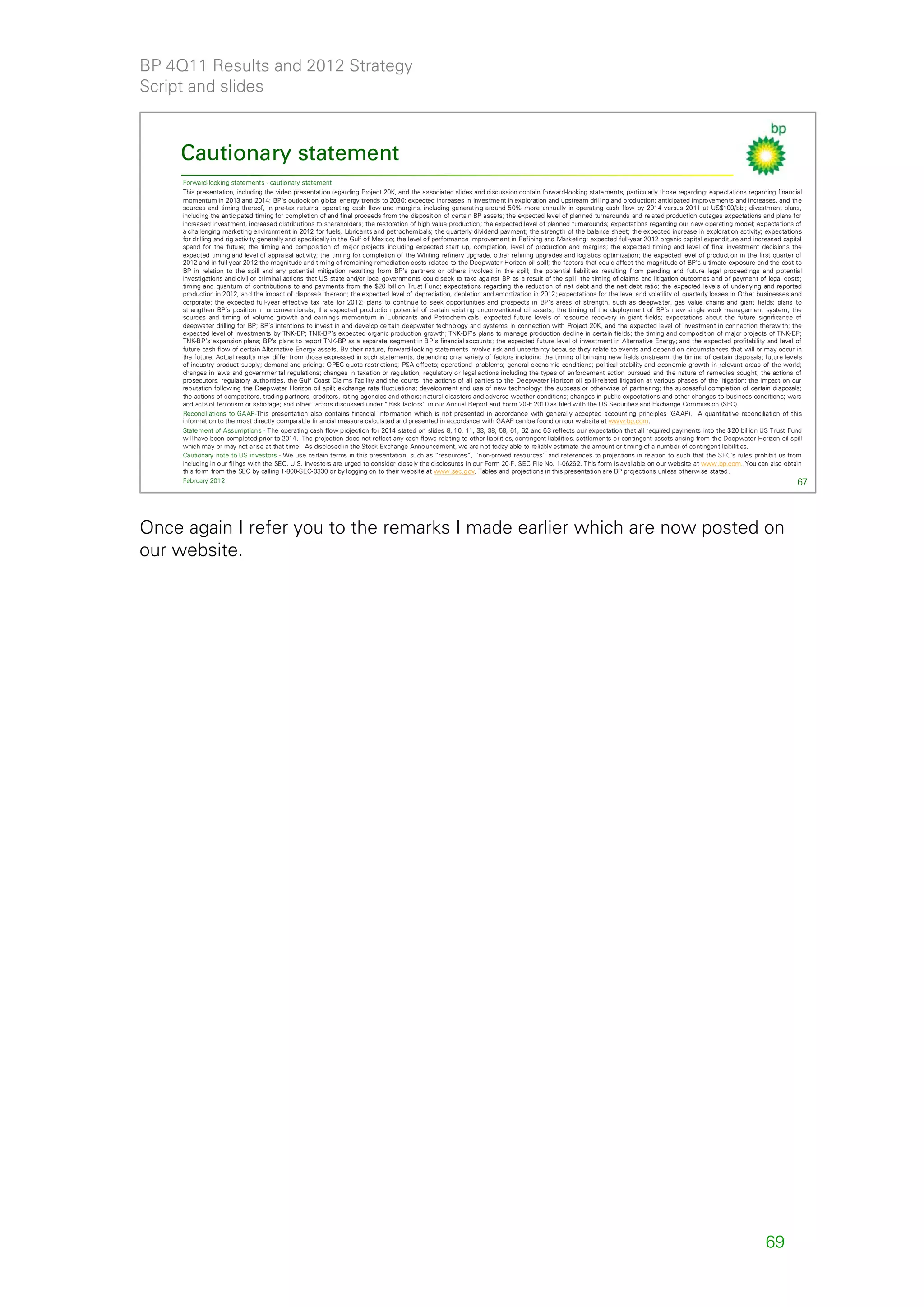

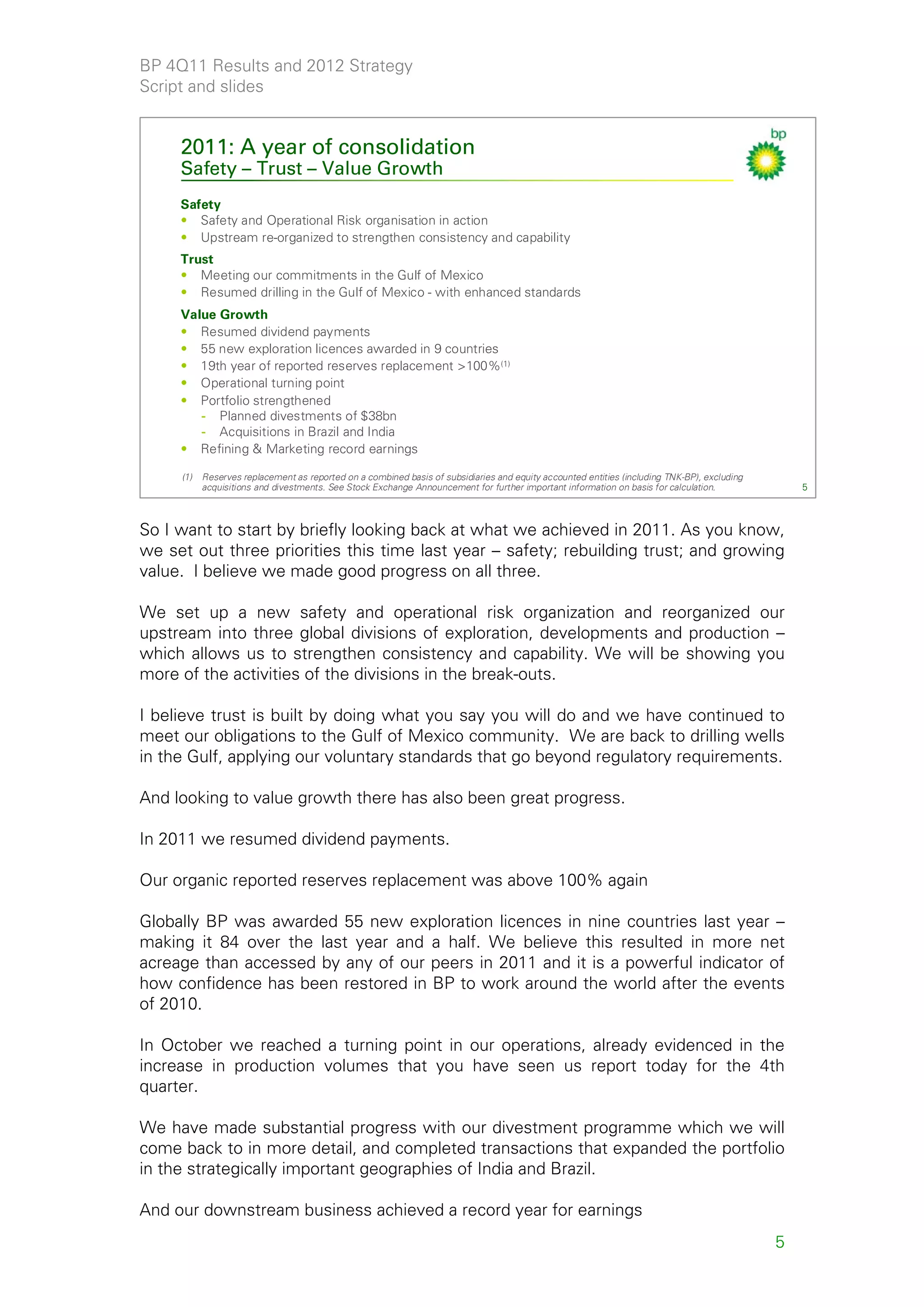

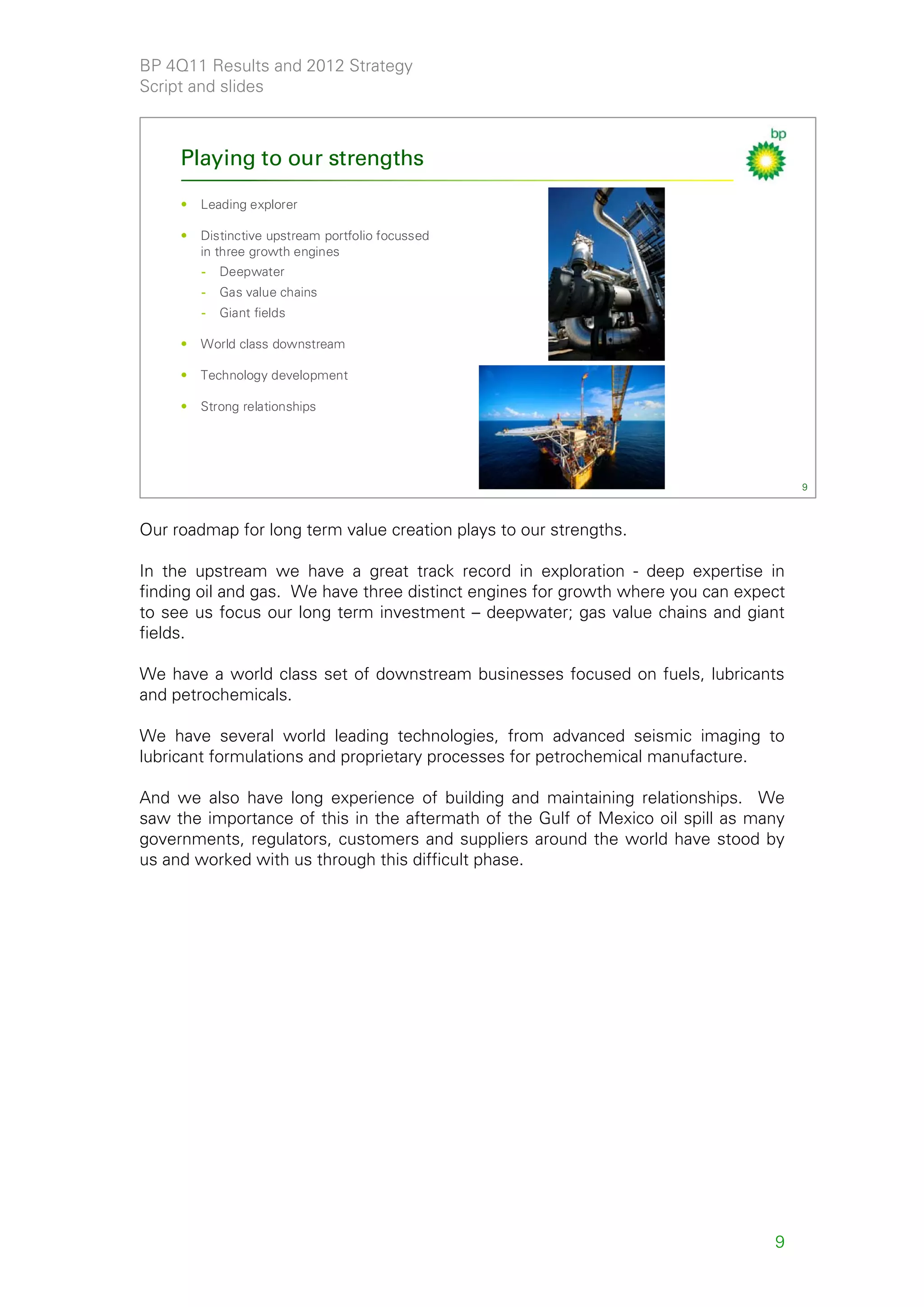

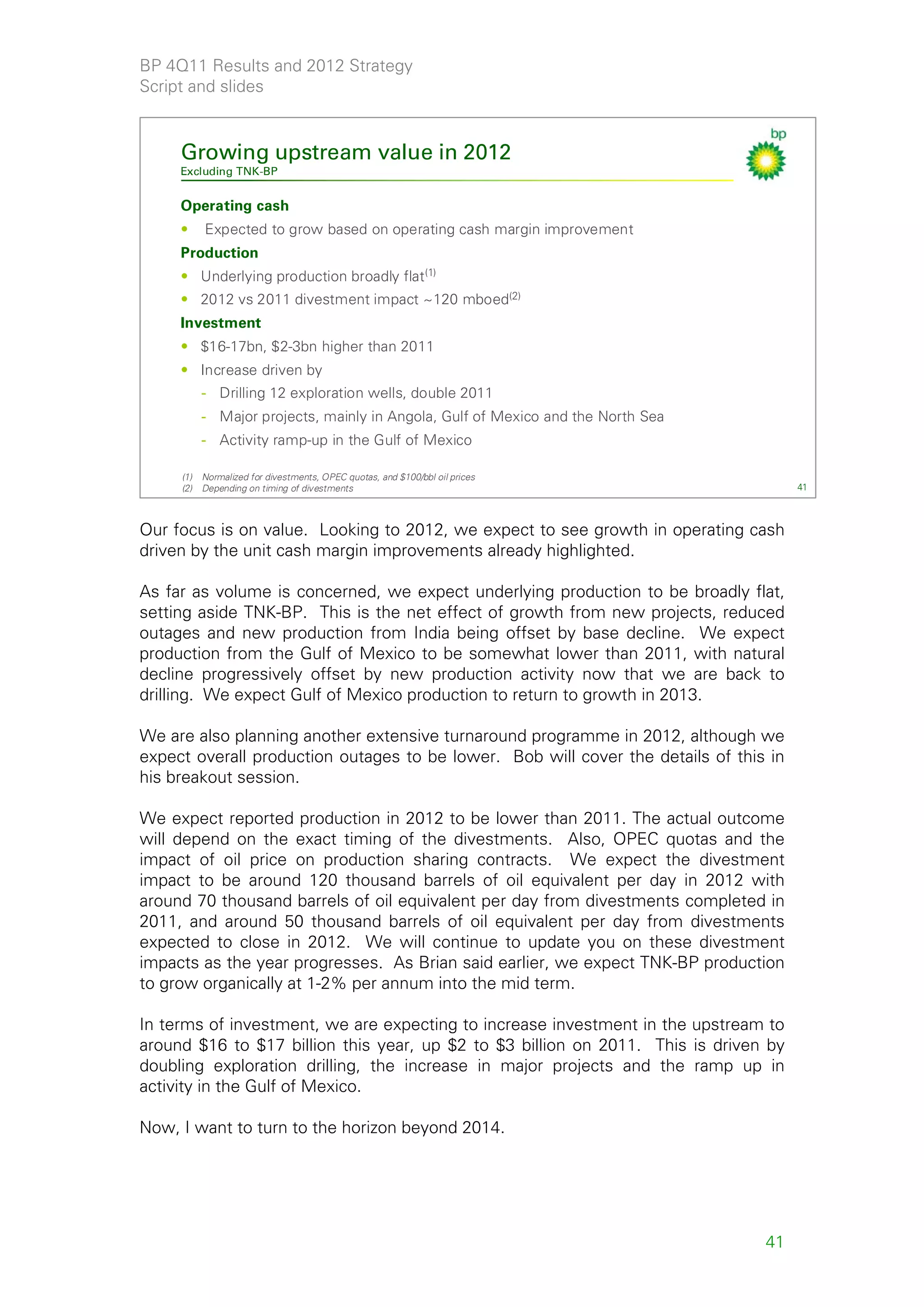

Earlier I mentioned the importance that technology plays in the world of energy. I

would like to make a departure from our usual format and show you something we

are very committed to and will be important for us in the years to come for safely

unlocking new deepwater resources.

Over the last few years we have had considerable success in exploring deeper plays

in some of our established basins - specifically the Paleogene of the Gulf of Mexico,

Tiber and Kaskida; the OlioMiocene of the Nile Delta, that is Raven and Satis; and

the PreFasila reservoirs of Shah Deniz in the Caspian.

Each of these plays has developable oil and gas today, but each also has a material

upside that sits beyond the industry’s current development capability due to high

reservoir pressures.

To address this undevelopable resource, today we are outlining a project to develop

a high pressure capability to drill, develop and produce resources beyond 15,000

pounds per square inch or 15kpsi - we call it Project 20K.

Let’s look at a short video that will give you some appreciation of the challenge and

the opportunity the project represents

[Play-out of Project 20K video]

You can see the challenge and the valuable opportunity this will unlock. We have

great people working on this and I believe it will not only open up some of BP's

existing resources, but perhaps a greater prize will be the new resources it will

unlock in exploration and development of resources.

We anticipate doing this both as BP and in partnership with NOC's. Much of the

technology will apply on and offshore and therefore be of help in the Middle East,

the Mediterranean, Russia and the Gulf of Mexico.

Like many advances in industry development of this capability will take some time.

We will keep you posted on our progress

45](https://image.slidesharecdn.com/bpfourthquarter2011resultspresentationslidesandscript-120914075044-phpapp01/75/P-4Q11-2012-Strategy-Presentation-45-2048.jpg)

![BP 4Q11 Results and 2012 Strategy

Script and slides

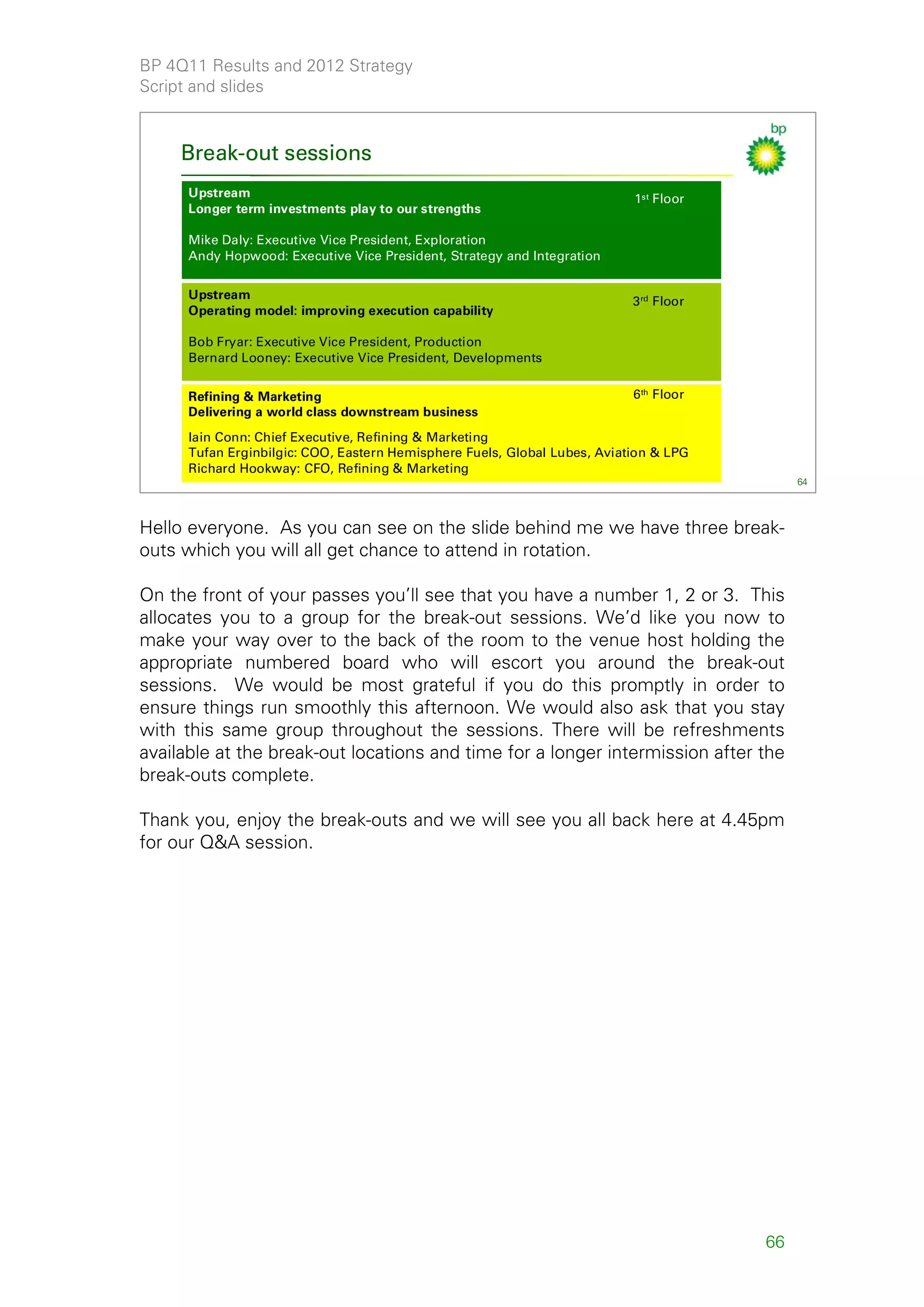

For those here in person, I will now hand over to our Head of Investor

Relations, Jess Mitchell, to explain the arrangements for the break-outs.

Thank you.

[Webcast ends]

65](https://image.slidesharecdn.com/bpfourthquarter2011resultspresentationslidesandscript-120914075044-phpapp01/75/P-4Q11-2012-Strategy-Presentation-65-2048.jpg)

![BP 4Q11 Results and 2012 Strategy

Script and slides

SECRET

2011 Results and

Strategy Presentation

2011 Results and

7 February 2012

Strategy Presentation

7 February 2012

65

[Picture for when attendees reconvene for wrap-up Q&A]

67](https://image.slidesharecdn.com/bpfourthquarter2011resultspresentationslidesandscript-120914075044-phpapp01/75/P-4Q11-2012-Strategy-Presentation-67-2048.jpg)