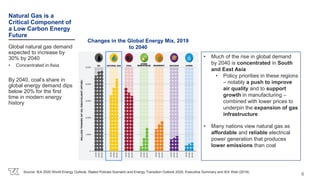

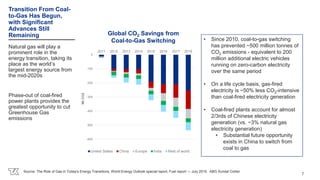

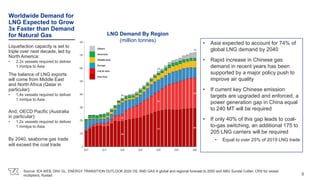

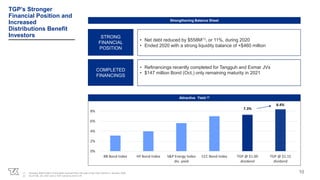

Teekay LNG Partners reported record-high 2020 results, with adjusted net income up 39% and total adjusted EBITDA up 11% from 2019. The company also announced a 15% increase to its common unit distribution commencing in Q1 2021. Teekay LNG's fleet has 97% of available days fixed for 2021 and 89% fixed for 2022, providing stable cash flow. Global demand for LNG is expected to grow substantially over the next decades, driven by Asia and the transition away from coal, supporting strong long-term LNG shipping dynamics.