Key diagrams a2_business_economics

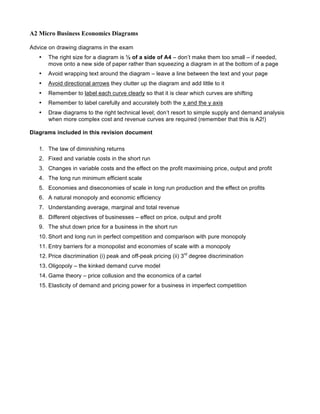

- 1. A2 Micro Business Economics Diagrams Advice on drawing diagrams in the exam • The right size for a diagram is ½ of a side of A4 – don’t make them too small – if needed, move onto a new side of paper rather than squeezing a diagram in at the bottom of a page • Avoid wrapping text around the diagram – leave a line between the text and your page • Avoid directional arrows they clutter up the diagram and add little to it • Remember to label each curve clearly so that it is clear which curves are shifting • Remember to label carefully and accurately both the x and the y axis • Draw diagrams to the right technical level; don’t resort to simple supply and demand analysis when more complex cost and revenue curves are required (remember that this is A2!) Diagrams included in this revision document 1. The law of diminishing returns 2. Fixed and variable costs in the short run 3. Changes in variable costs and the effect on the profit maximising price, output and profit 4. The long run minimum efficient scale 5. Economies and diseconomies of scale in long run production and the effect on profits 6. A natural monopoly and economic efficiency 7. Understanding average, marginal and total revenue 8. Different objectives of businesses – effect on price, output and profit 9. The shut down price for a business in the short run 10. Short and long run in perfect competition and comparison with pure monopoly 11. Entry barriers for a monopolist and economies of scale with a monopoly 12. Price discrimination (i) peak and off-peak pricing (ii) 3rd degree discrimination 13. Oligopoly – the kinked demand curve model 14. Game theory – price collusion and the economics of a cartel 15. Elasticity of demand and pricing power for a business in imperfect competition

- 2. Total Output (Q) Units of Labour Employed (L) (Q) Slope of the curve gives the marginal product of labour Diminishing returns are apparent here – total output is rising but at a decreasing rate I.e. the marginal product of labour is increasing The short run is a period of time where at least one factor of production is assumed to be in fixed supply i.e. it cannot be changed. In the short run, the law of diminishing returns states that as we add more units of a variable input (i.e. labour or raw materials) to fixed amounts of land and capital, the change in total output will at first rise and then fall. In many industries as a business expands in the long run, it is more likely to experience increasing returns leading to lower unit costs of production.

- 3. Fixed and variable costs in the short run Costs Output (Q) Total Fixed Cost Average Fixed Cost 10 £2000 £1000 20 Fixed costs (FC) are independent of output and must be paid out even if the production stops. Capital-intensive industries with a high ratio of fixed to variable costs offer scope for economies of scale. AFC = Fixed Costs (FC) / Output (Q). Costs Output (Q) Average Fixed Cost Marginal Cost (MC) Average Total Cost (AC) Average Variable Cost (AVC) • These are the “traditional” short run cost curves • Marginal cost cuts both AVC and ATC at the minimum point of each • Your diagrams need to be accurate so it is worth practising them as often as possible to improve your accuracy

- 4. Changes in variable costs and the effect on the profit maximising price; output and profit Costs Output (Q) AC1 MC1 AC2 Costs Output (Q) AC1 MC1 AC2 Higher variable costs – the effect on equilibrium prices and profits (ceteris paribus) AR MR AC1 AC2 P1 P2 Q1 Q2 Profit after cost rise Important: A rise in fixed costs has no effect on marginal cost – it simply causes an upward shift in the average cost curve. But a rise in variable cost causes a shift in both MC and AC

- 5. Long run minimum efficient scale of production (MES) Cost per unit in the long run LRAC MES Rising LRAC – Diseconomies of Scale (Decreasing Returns to Scale) In the long run, all factors of production are variable. How the output of a business responds to a change in factor inputs is called returns to scale. Economies of scale are the cost advantages exploited by expanding the scale of production in the long run. The effect is to reduce long run average costs over a range of output. The minimum efficient scale (MES) is the scale of production where internal economies of scale have been fully exploited. The MES corresponds to the lowest point on LRAC and is an output range over which a business achieves productive efficiency. The MES will differ from industry to industry as we can see from the diagram below. LRAC1 - Low MES – characteristic of a competitive market LRAC3 - High MES – characteristic of a natural monopoly LRAC2 MES2 Output (Q) Falling LRAC – Economies of Scale (Increasing Returns to Scale) Costs per unit in the long run (ATC) Output (Q) LRAC1 LRAC3 MES1 MES3

- 6. Economies and dis-economies of scale in long run and the effect on profits Deriving the long run average cost curve – the envelope of a series of short run average cost curves Lower costs allows a profit maximising firm to charge a lower price (P2) but make higher total profits because of the fall in AC per unit Costs Output (Q) SRAC1 SRAC3 AR (Demand) MR MC1 MC2 P1 P2 Q1 Q2 Profit at Price P1 Profit at Price P2 Costs Output (Q) SRAC1 SRAC2 SRAC3 Q1 Q2 Q3 AC1 AC2 AC3 LRAC

- 7. Natural monopoly and economic efficiency Demand (AR) Revenue Cost and Profit Output (Q) MR LRMC LRAC P1 AC1 Q1 Q2 P2 AC2 Profit at price P1 Loss at price P2 A natural monopoly – splitting infrastructure from the final delivery of services A natural monopoly occurs in an industry where LRAC falls over a wide range of output levels such that there may be room only for one supplier to fully exploit all of the internal economies of scale, reach the minimum efficient scale and therefore achieve productive efficiency. The major utilities such as gas, electricity and water are often put forward as examples of industries with strong "natural tendencies" towards being a natural monopoly in part because of the huge fixed costs of building and maintaining nationwide networks / infrastructures of cables and pipes. In fact we can make an important distinction between the supply and distribution of services such as gas and electricity and web services. Often a monopolistic firm is in charge of maintaining a network but a regulator will seek to inject competition into the market by allowing new firms to come in a use the existing network and compete for customer contracts in the delivery of services. Good examples include the liberalisation of postal services and also the decision by OFCOM to force British Telecom to open up its networks to household and business customers so that rival firms can compete for the market demand in telecommunication services.

- 8. Understanding average, marginal and total revenue Output (Q) Revenue Total Revenue (TR) Marginal Revenue (MR) Average Revenue (Demand) AR Total revenue is maximized when MR = 0 Price elasticity of demand = 1 at this output Ped >1 for a price fall along this length of AR Output (Q) AR (Demand) MR Q1 P1 Total revenue is maximised at price P1 where marginal revenue is zero A rise in price to P2 causes a reduction in total revenue P2 Q2 Total revenue at price P2 Average and marginal revenue

- 9. Different objectives of businesses – effect on price, output and profit Costs Output (Q) SRAC AR (Demand) MR MC Q1 P1 AC1 Profit Max at Price P1 P2 AC2 Q2 Revenue Max at Price P2 It is now widely accepted that modern businesses depart frequently from pure profit maximisation pricing strategies as part of competition within markets. The objectives and strategies of firms will vary with market conditions and with the aims of the different stakeholders that are part of the decision-making process in modern corporations. The normal profit maximising output is at Q1 (where marginal revenue = marginal cost) Total revenue is maximised at output Q2 where marginal revenue is zero. This gives a lower level of total profits, although supernormal profits are still being earned. If shareholders insist on the business achieving a normal rate of profit as a minimum then the managers of a business have the discretion to vary price anywhere above P3 At any output beyond Q3 (where average revenue and average cost intersect) losses are made (i.e. sub-normal profits). Be aware of the reasons for firms moving away from profit maximisation and also the effects of different price strategies on consumer and producer welfare and economic efficiency. Q3 P3

- 10. The shut down price for a business in the short run Costs, Revenues Output (Q) ATC MC = supply AVC P1 The Shut Down Price P2 Break-Even Price Q1 The shut down price for a business in the short run The theory of the firm assumes that a business needs to make at least normal profit in the long run to justify remaining in an industry but this is not a strict requirement in the short term. In the short run the firm will continue to produce as long as total revenue covers total variable costs or put another way, so long as price per unit > or equal to average variable cost (AR = AVC). The reason for this is as follows. A business’s fixed costs must be paid regardless of the level of output. If we make an assumption that these costs are sunk costs (i.e. they cannot be covered if the firm shuts down) then the loss per unit would be greater if the firm were to shut down, provided variable costs are covered. In the short run, the supply curve for a competitive firm is the marginal cost curve above average variable cost. P2

- 11. Short and long run in perfect competition Output (Q) Output (Q) Market Demand and Supply Individual Firm’s Costs and Revenues Price (P) Price (P) Market Demand Market Supply (MS) P1 Q1 AR1 = MR1 MC (Supply) AC P1 Q3 P2 P2 AR2 = MR2 Q2 MS2 P 2 Long run equilibrium output No barriers to entry and super normal profits encourage the entry of new firms shifting market supply & price downward until price falls back to P2. Normal profits are restored. Output (Q) Competitive Market Pure Monopoly Price (P) Price (P) Market Supply Market Demand Market Supply Monopoly Demand Q1 Q1 MR P comp P mon Q2

- 12. Entry barriers for a monopolist and monopoly with economies of scale LRAC = LRMC (Existing Monopolist) Monopoly Demand (AR) MR Q1 Revenue Cost and Profit Output (Q) P1 Pc Qc B A C AC = MC (Potential Entrant into the market) D Monopoly Supply with Scale Economies Output (Q) Competitive Market Pure Monopoly Price (P) Price (P) Market Supply Market Demand Competitive Supply (MC) Monopoly Demand Q1 Q1 MR P comp P mon Q2

- 13. Price discrimination (i) peak and off-peak pricing (ii) 3rd degree discrimination Supply (Marginal Cost) Off-Peak Demand Peak Demand MR Off-Peak MR Peak Price Off-Peak Price Peak Output Off-Peak Output Peak Price (P) and Costs Output Market A Market B MC=A C Quantit y Quantit y Pric e Pric e P a P b MR a MR b AR b AR a Profit from selling to market A – with a relatively elastic demand – and charging a lower price Demand in segment B of the market is relatively inelastic. A higher unit price is charged MC=A C Q b Q a

- 14. Oligopoly – the kinked demand curve model Assume we start out at P1 and Q1: Will a firm benefit from raising price above P1? Will it benefit from cutting price below P1? Raising price above P1 Demand is relatively elastic Firm loses market share and some total revenue Reducing price below P1 Demand is relatively inelastic Little gain in market share – other firms have followed suit Total revenue may still fall Costs Revenues Output (Q) P1 Q1 MR AR MC1 An oligopoly is a market dominated by a few producers, each of which has control over the market. It is an industry where there is a high level of market concentration. However, oligopoly is best defined by the conduct (or behaviour) of firms within a market rather than its market structure. The kinked demand curve model assumes that a business might face a dual demand curve for its product based on the likely reactions of other firms in the market to a change in its price or another variable. The common assumption is that firms in an oligopoly are looking to protect and maintain market share and that rival firms are unlikely to match another’s price increase but may match a price fall. I.e. rival firms within an oligopoly react asymmetrically to a change in the price of another firm. The kinked demand curve model therefore makes a prediction that a business might reach a stable profit-maximizing equilibrium at price P1 and output Q1 and have little incentive to alter prices. Even a shift in the marginal cost curve (MC1) in the diagram above might not be enough to change the profit maximizing equilibrium. The kinked demand curve model predicts periods of relative price stability under an oligopoly with businesses focusing on non-price competition as a means of reinforcing their market position and increasing their supernormal profits.

- 15. Game theory – price collusion and the economics of a cartel Individual Firm Industr yy Firms Output MC (industry) Deman d M R P(cartel ) M C A C Quot a Industr y Output P(cartel ) A C Collusion is a desire to achieve joint-profit maximization within a market or prevent price and revenue instability in an industry. Price fixing represents an attempt by suppliers to control supply and fix price at a level close to the level we would expect from a monopoly. To fix prices, the producers in the market must be able to exert control over market supply. In the diagram below a producer cartel is assumed to fix the cartel price at output Qm and price Pm. The distribution of the cartel output may be allocated on the basis of an output quota system or another process of negotiation. Although the cartel as a whole is maximizing profits, the individual firm’s output quota is unlikely to be at their profit maximizing point. For any one firm, within the cartel, expanding output and selling at a price that slightly undercuts the cartel price can achieve extra profits. Unfortunately if one firm does this, it is in each firm’s interests to do exactly the same. If all firms break the terms of their cartel agreement, the result will be an excess supply in the market and a sharp fall in the price. Under these circumstances, a cartel agreement might break down. Collusive behaviour is often predicted by game theory Game theory is concerned with predicting the outcome of games of strategy in which the participants (for example two or more businesses competing in a market) have incomplete information about the others' intentions. Collusive behaviour reduces some of the uncertainty that is characteristic of oligopolistic markets.

- 16. Elasticity of demand and pricing power for a business in imperfect competition Price and Costs Output (Q) SRAC AR (Monopoly) MR MC Q1 P1 AC1 Low Price Elasticity of Demand SRAC MR MC P1 AC1 Q2 Price and Costs Low Price Elasticity of Demand AR (Contestable market) The importance of price elasticity of demand in theory of the firm Price elasticity of demand is a concept that was introduced at AS level. Horizontal synopticity requires you to apply the concept in theory of the firm diagrams. A good example of when this can be done is on questions on contestable markets Highly contestable markets Baumol defined contestable markets as existing where “an entrant has access to all production techniques available to the incumbents, is not prohibited from wooing the incumbent’s customers, and entry decisions can be reversed without cost.” For a contestable market to exist there must be low barriers to entry and exit so that there is always the potential for new suppliers to come into a market to provide fresh competition to existing suppliers. For a perfectly contestable market, entry into and exit out of the market must be costless. When a market is contestable there are likely to be a large number of competing suppliers; the cross-price elasticity of demand will be high because of strong substitution effects when relative prices in a market change. Hence we can draw the average revenue curve to be price elastic. This reduces the potential for a business to charge a price that is well above the marginal cost of production. Profit margins are lower, output is higher and consumer welfare is great than it would be with a monopolist exploiting an inelastic demand curve (see left hand diagram).