Finnacle Investments Monthly Report Highlights Key News and Analysis

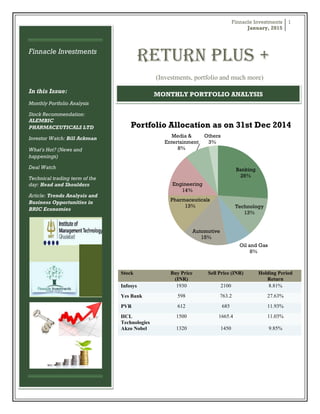

- 1. Finnacle Investments January, 2015 1 Finnacle Investments In this Issue: Monthly Portfolio Analysis Stock Recommendation: ALEMBIC PHARMACEUTICALS LTD Investor Watch: Bill Ackman What's Hot? (News and happenings) Deal Watch Technical trading term of the day: Head and Shoulders Article: Trends Analysis and Business Opportunities in BRIC Economies Return Plus + (Investments, portfolio and much more) Banking 26% Technology 13% Oil and Gas 8% Automotive 15% Pharmaceuticals 13% Engineering 14% Media & Entertainment 8% Others 3% Portfolio Allocation as on 31st Dec 2014 Stock Buy Price (INR) Sell Price (INR) Holding Period Return Infosys 1930 2100 8.81% Yes Bank 598 763.2 27.63% PVR 612 685 11.93% HCL Technologies 1500 1665.4 11.03% Akzo Nobel 1320 1450 9.85% MONTHLY PORTFOLIO ANALYSIS

- 2. Finnacle Investments January, 2015 2 Alembic Pharma is a leader in several sub-segments of anti-infective therapeutic segment. In the last two to three years the company has invested heavily in increasing revenue from chronic therapies and regulated markets, which are high margin businesses. The company continues to improve its year-on-year margins year after year with an EBITDA margin of 19% by the end of FY14. This is expected to grow by 100-125 bps annually and reach 23-24% over next 3-4 years owing to growing international generic business on account of: annual launches of 7-9 products in the US market including complex generics and many high value launches, market share improvement in existing products in US, ramp up in European generic portfolio where the company is expected to be the generic for a niche product. The company is expected to go live with its own front end in US in FY16 which will assist in gaining higher market share in the new launches and ramp up existing products that the company has launched through front end partners. Alembic Pharma has final ANDA (Abbreviated New Drug Application) approvals for 31 products out of which it has commercialized 25 products and is expected to launch some of the products once it has its own front end. Parameter Value(INR) 52-Week High 493.90 (12-Jan-2015) 52-Week Low 211.25 (27-Jan-2014) Current Market Price 477.85 (25-Jan-2015) STOCK RECOMMENDATION: ALEMBIC PHARMACEUTICALS LTD FUNDAMENTALS

- 3. Finnacle Investments January, 2015 3 Domestic formulation is expected to grow by 16-18% annually on account of around 25 new launches in specialty segment while international brands (ROW – 3% of sales) are expected to grow by 25-30% on account of low base and commercialization of products in new markets like South East Asia, CIS, brazil, East Africa where company has made filings over last 2 years. 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 Revenue EBITDA PAT 14,679 2,194 1,301 15,260 2,520 1,652 18,684 3,577 2,355 Revenue, EBITDA, PAT (in INR million) FY12 FY13 FY14 FINANCIAL SNAPSHOT

- 4. Finnacle Investments January, 2015 4 Founder, Pershing Square Capital Management Ackman got his start in the real estate business, where he worked for his father prior to starting Gotham. Bill Ackman is an activist investor. He buys the common stocks of public companies, and pushes for changes so that the market can realize the value of the companies. Ackman buys stocks trading at a discount, and sells when the companies reach their appraised value. His firm performed incredibly in 2014. In the first six months of the year, the flagship hedge fund returned 25% after fees. The portfolio includes new investment in Allergan, which drive performance. Ackman helped back Valeant Pharmaceuticals' hostile takeover of Allergan by taking a position in the target company before the effort was made public, benefiting from the surge in Allergan's stock. In 2014, Ackman has also seen his huge bet against Herbalife go his way as shares of the company fell. Ackman continues to be one of the most prominent activist investors, managing some $15 billion and working to raise billions of dollars more in permanent capital. INVESTOR WATCH: Bill Ackman Net Worth: US$1.69 billion (as on November 2014) Source of Wealth: Hedge funds, Self-Made Age: 48 Education: Bachelor of Arts / Science, Harvard University; Master of Business Administration, Harvard University Residence: New York

- 5. Finnacle Investments January, 2015 5 RBI’s surprise rate cut The Reserve Bank of India (RBI) surprised markets with a 25 basis point reduction in repo rates on Thursday, 15 Jan bringing it to 7.75% the Cash reserve ratio is however remains unchanged to 4%. The main reason for rate cut is to ease inflationary pressures and to achieve fiscal deficit target. This move of RBI will boost investor sentiments and will have positive impact on capital intensive industry like Auto and Auto Ancillary Sector, Real Estate and Infrastructure sector and Banking and NBFC sector. TCS ends RIL's 23-year run as most profitable firm Tata Consultancy Services (TCS) has overtaken Reliance Industries Ltd (RIL) to become the country's most profitable private company on a quarterly basis. RIL has been topping the profitability charts since 1992-93, when it went past Tata Steel in the rankings. TCS posted a profit of Rs 5328 crore for the quarter ended December where reliance profit dipped to Rs 5256 crore due to falling crude oil prices. Airtel, Idea, RComm & Vodafone may collectively bid Rs 74,000 crore for 900 Hz spectrum Airtel, Idea, RComm & Vodafone may collectively bid Rs 74,000 crore for spectrum as these companies are expected to prioritize 900 MHz airwave renewals over boosting their 3G . The operators are likely to factor in existing debt, incremental capex needs for data business and fallback cash reserves to acquire super-efficient 4G airwaves in the 700 MHz band in the near future spectrum holdings. Novartis AG and GlaxoSmithKline to create a global healthcare joint venture Novartis India is selling its OTC division to GlaxoSmithKline, Consumer Private Ltd, a consumer healthcare joint venture between Novartis AG and GSK, for a consideration of Rs 109.7 crore. The transfer of the business is subject to the receipt of all applicable legal and regulatory approvals, consents, permissions and sanctions as may be necessary from concerned authorities. Drop in the crude oil by 60% since Jan 2014 Crude oil prices have fallen down to its lowest level of five and a half years. This drop has been due to increase in the production of US shale oil and decrease in demand by Europe and Asia. As per the Goldman Sachs, WTI will be trading at $41 a barrel and Brent at $42 in three months and they also believe prices will stay lower for longer. In order to re-balance the global market the investment in shale has to be curtailed. Societal General has reduced their average WTI price to $51a barrel for this year and Brent will average around $55 a barrel. With the supply staying at its own place and the demand going weak, the oil prices will keep going down. What's Hot? (News and Happenings)

- 6. Finnacle Investments January, 2015 6 Apollo Health acquires Nova Specialty Hospital for Rs. 145 crore In a strategic move aimed at expansion, Apollo Health and Lifestyle, a wholly owned subsidiary of Apollo Hospitals Group has acquired Nova Specialty Hospital in a Rs. 145 crore deal. Nova is currently present in 8 cities including Mumbai, Jaipur and Kanpur. The existing Nova centers will function under the Apollo brand name. Apollo Hospital is looking for a business of Rs.500 crore in a span of 5 years in multi-specialty short stay/day surgery centers, while the combined network is expected to clock a turnover between Rs 115 crore - 125 crore for the year ending in Mar'15 and reach break even in the next 18-24 months. Reliance Capital all set to exit Yatra.com with a 12-fold gain by sale of its 16% stake Reliance Capital is all set to sell its 16% stake in the online travel portal Yatra.com for Rs 500 crore, a 12-times appreciation since investment of Rs. 40 crore in 2006. The move to exit Yatra.com cashes in on the booming e-commerce industry and is in sync with the Reliance Group's recently announced plans to focus on core business and encashing its minority investments. The company is in talks with 2-3 international investors and expects to close the deal in 4-6 weeks. Zomato buys Italian restaurant search guide, its fifth deal on the global front in recent months In what would be its fifth buy in the recent months, Zomato Media Private Limited has bought an Italian restaurant search guide, Cibando for an undisclosed amount. With this, the company has expanded its presence to 20 countries. The company appears to be on a global acquisition spree with plans to enter the US market through acquisition of market leaders and building global payment systems for the diners. Here's a look at Zomato's recent buys: Company Country Amount Gastronauci Poland Undisclosed Lunchtime.cz Czech Republic $2.2 million Obedovat.sk Slovakia $1 million MenuMania New Zealand Undisclosed American Tower Corporation to Pick up Majority Stake in Viom Networks American Tower Corporation is soon going to acquire 51% stake in Viom networks, the second largest tower company in India, in a deal that is estimated to be around $ 1 billion. In the first phase, Srei Infrastructure, which currently holds 18.5% stake would exit the venture while Tata's current stake of 55% would be trimmed down to 26-30% and would become a minority DEAL WATCH

- 7. Finnacle Investments January, 2015 7 shareholder along with Macquarie Fund, SBI, GIC, Oman Investment Fund and IDFC. The second phase of the deal involves merger of Viom with the Indian entity of the ATC which currently owns 12,000 towers in the country. The merged entity would be looking at a public offering through which Tatas would seek a complete exit. Viom owns around 42,000 towers in the country and counts Tata Teleservices as one of its major clients bringing in over 40% of the revenues. ATC recently acquired 4,800 communication towers from Bharti Airtel for $1.05 billion. Head and Shoulders pattern is basically identified when the security prices cover all of the following characteristics: 1. Price first falls to a trough and then make a rise 2. Price again fall below the former trough 3. It makes a rise again. 4. Finally, after this price falls again, but not as far as second trough. 5. Once the final trough, price heads upward towards the resistance level. INVESTOR DECISION: Investor takes a long position when price rises above the resistance of the neckline. First and third troughs are called as shoulder (as shown in figure) and second peak is the head. We also have inverse Head and Shoulders pattern. TECHNICAL TRADING TERM OF THE MONTH - HEAD AND SHOULDERS

- 8. Finnacle Investments January, 2015 8 Ageing World World is taking a transition in demographics. Population is getting older due to a combination of longer life expectancy especially in developed markets and decline in birth rates. Euro-monitor report reveals that in 2012, 577 million people were in the age category of 65+. This will rise to 775 million people in 2020 and will further rise to 35% in 2050 (keeping in mind current trends). Though the demographic shift is more prevalent in developed market- Western Europe’s median age population is 40, while the global median age is 30. Few emerging markets like India and China will have significant elderly consumers. Technology: Niche Opportunities One of the game changer points is rise in ownership of technology. Like in 2001, average spending on computers was US $ 22 in Western Europe and at US $17 in North America. Now, it has risen to US $ 77 in Western Europe and US $ 73 in North America. Technology aimed at formation of cleaning products that are less likely to use water and other fossil fuel. The innovations are likely to be game changer in home care. Income level In BRIC mega-cities, exponential economic growth, improvement in living standards and higher consumer spending will lead to intense competition and market saturation. The rising disposable income in second tier cities will lead to accessibility of Western brands. Though smaller in size, BRIC cities have projected to rise up 30-50% in next decades. Energy efficiency preference For energy exporters like Saudi Arabia, UAE; energy affordability and security was never been the major concern. However, these countries still suffer from impact on the environment from energy production. For emerging market economies diversification of energy mix has always been the cause of concern. These countries rely on fossils for the electricity production. Economic growth and population will raise the demand for energy in these EMEs. In all these 25 economies, aggregate population will expand by around 12.7% during 2014-30 and this will further rise by approximately 10% in 50s. Till 2030, population in these EMEs will reach up to 4.7 billion or 56% of world’s population in absolute terms. According to the report by “Energy Outlook 2035”, India and China alone will be responsible for the half of increase in energy demand by 2035.This will further rise till 2050. Trends Analysis and Business Opportunities in BRIC Economies (till 2050)

- 9. Finnacle Investments January, 2015 9 Working Women World scenario is changing in terms of employment. Female employment has grown to 66% in 2012 comparing to 58% in 1983 in UK. Thus, household chores will transform evenly. Similar is the case with the EMEs .Moreover, marriage rate is falling. For example in UK, marriage rate dropped to 5 in 1,000 to 7 people in 1000 over the last 30 years. This will further fall in coming 30 years. Single person household will show the growth of up to 47.1 million worldwide (2012-20 scenarios). Thus the scenario will rise further in coming years. The shift to nuclear families that started in west has started in EMEs. Thus, in 40s and 50s younger men has to manage the household work themselves. Thus, huge transformation in the trends in BRIC countries provides new opportunities to do businesses. JYOTI GUPTA PGDM 2014-16 IMT GHAZIABAD

- 10. Finnacle Investments January, 2015 10 Editorial Team Anshu Mishra Neha Kumar Jyoti Gupta