Japfa Ltd (SGX: UD2)

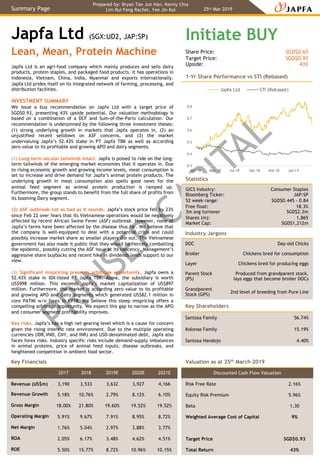

- 1. PRINSEP CAPITAL Japfa Ltd (SGX:UD2, JAP:SP) Lean, Mean, Protein Machine Initiate BUY Share Price: Target Price: Upside: SGD$0.65 SGD$0.93 43% Statistics GICS Industry: Bloomberg Ticker: 52 week range: Free float: 3m avg turnover Shares (m): Market Cap: Consumer Staples JAP:SP SGD$0.445 - 0.84 18.3% SGD$2.2m 1,865 SGD$1,212m Japfa Ltd is an agri-food company which mainly produces and sells dairy products, protein staples, and packaged food products. It has operations in Indonesia, Vietnam, China, India, Myanmar and exports internationally. Japfa Ltd prides itself on its integrated network of farming, processing, and distribution facilities. INVESTMENT SUMMARY We issue a buy recommendation on Japfa Ltd with a target price of SGD$0.93, presenting 43% upside potential. Our valuation methodology is based on a combination of a DCF and Sum-of-the-Parts calculation. Our recommendation is underpinned by the following three investment theses: (1) strong underlying growth in markets that Japfa operates in, (2) an unjustified recent selldown on ASF concerns, and (3) the market undervaluing Japfa’s 52.43% stake in PT Japfa TBK as well as according zero value to its profitable and growing APO and dairy segments. (1) Long term secular tailwinds intact. Japfa is poised to ride on the long- term tailwinds of the emerging market economies that it operates in. Due to rising economic growth and growing income levels, meat consumption is set to increase and drive demand for Japfa’s animal protein products. The underlying growth in meat consumption also spells good news for the animal feed segment as animal protein production is ramped up. Furthermore, the group stands to benefit from the full share of profits from its booming Dairy segment. (2) ASF outbreak not as bad as it sounds. Japfa’s stock price fell by 23% since Feb 22 over fears that its Vietnamese operations would be negatively affected by recent African Swine Fever (ASF) outbreak. However, none of Japfa’s farms have been affected by the disease thus far. We believe that the company is well-equipped to deal with a potential crisis and could possibly increase market share as smaller players die out. The Vietnamese government has also made it public that they would be fiercely combatting the epidemic, possibly cutting the ASF issue at its nascency. Management’s aggressive share buybacks and recent hike in dividends lends support to our view. (3) Significant mispricing presents arbitrage opportunity. Japfa owns a 52.43% stake in IDX-listed PT Japfa TBK. Alone, the subsidiary is worth US$998 million. This exceeds Japfa’s market capitalization of US$897 million. Furthermore, the market is according zero value to its profitable and growing APO and dairy segments which generated US$82.1 million in core PATMI w/o forex in FY18. We believe this steep mispricing offers a compelling arbitrage opportunity. We expect this gap to narrow as the APO and consumer segment profitability improves. Key risks. Japfa’s has a high net gearing level which is a cause for concern given the rising interest rate environment. Due to the multiple operating currencies (IDR,VND, CNY, and INR) and USD-denominated debt, Japfa also faces forex risks. Industry specific risks include demand-supply imbalances in animal proteins, price of animal feed inputs, disease outbreaks, and heightened competition in ambient food sector. 25th Mar 2019 Valuation as at 25th March 2019 Discounted Cash Flow Valuation Risk Free Rate 2.16% Equity Risk Premium 5.96% Beta 1.30 Weighted Average Cost of Capital 9% Target Price SGD$0.93 Total Return 43% 0.3 0.4 0.5 0.6 0.7 0.8 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Japfa Ltd STI (Rebased) Industry Jargons DOC Day-old Chicks Broiler Chickens bred for consumption Layer Chickens bred for producing eggs Parent Stock (PS) Produced from grandparent stock, lays eggs that become broiler DOCs Grandparent Stock (GPS) 2nd level of breeding from Pure Line 1-Yr Share Performance vs STI (Rebased) Key Financials 2017 2018 2019E 2020E 2021E Revenue (US$m) 3,190 3,533 3,632 3,927 4,166 Revenue Growth 5.18% 10.76% 2.79% 8.12% 6.10% Gross Margin 18.00% 21.80% 19.60% 19.52% 19.52% Operating Margin 5.91% 9.67% 7.91% 8.95% 8.72% Net Margin 1.76% 5.04% 2.97% 3.88% 3.77% ROA 2.05% 6.17% 3.48% 4.62% 4.51% ROE 5.50% 15.77% 8.72% 10.96% 10.15% Summary Page Key Shareholders Santosa Family 56.74% Kolonas Family 15.19% Santosa Handojo 4.40% Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 2. PRINSEP CAPITAL 0 10 20 30 40 50 China Indonesia Malaysia Thailand Vietnam Beef and Veal Pork Poultry PT Japfa TBK, 66% Animal Protein Other, 17% Dairy, 11% Consumer Goods, 6% Business Description Japfa is a leading pan-Asian industrial agri-food company headquartered in Singapore. Founded in 1975, it was privately-owned till its IPO on the Singapore Exchange in 2014. It is vertically integrated across the entire farming and food production value chain, from animal feed production and breeding to commercial farming and food processing. The company operates in high-growth emerging Asian markets, with production and distribution facilities in Indonesia, China, India, Vietnam and Myanmar and over 34,000 employees. Geographic and Business Segments Japfa serves 3 end-markets: animal feed, animal protein (poultry, swine, beef, aquaculture, dairy) and consumer foods (frozen, ambient). Of its 4 reportable business segments, most revenue originates from Animal Protein Indonesia (66%) which manages feed, poultry, beef and aquaculture operations under subsidiary PT Japfa Comfeed TBK. Succeeding it is Animal Protein Other (17%) comprising feed, poultry and swine operations in Vietnam, Myanmar and India; Dairy (11%) which produces raw milk for downstream consumers and in-house Greenfields brand in China and Indonesia respectively; and Consumer Goods (6%) in Indonesia and Vietnam which sells protein-based ready-to-eat frozen and chilled products under 5 brands such as So Good and So Yumm. Indonesia (74%) is Japfa’s largest geographical market, followed by Vietnam (9.5%) and China (9.5%). Core Products: Feed and Poultry Animal feed is recognized as a core strength and stable profitability pillar of Japfa, with feed conversion ratios of its Comfeed and Benefeed brands among the best in its core market of Indonesia. Poultry (including feed) is the largest of its animal proteins at 59.5% of total revenue in FY17. The company has over 9,000 contract farms and owns multiple facilities across all parts of the value chain. Japfa’s emphasis on quality and biosecurity is a strong success factor. It owns an animal vaccine company and has JVs with genetic companies Aviagen and Hypor to produce genetically superior breeding stock. Resultingly, it enjoys high production yields across its products with milk yields of 39kg/day and DOC production over 20%. Market Strategy Japfa’s key goal is to strengthen its 3 key business pillars of poultry, swine and dairy to provide quality yet affordable products for the masses. Its industrialization approach to farming and food production allows successful replication and standardization of its industrialized and scalable businesses across the region, enabling efficient expansion into key growth markets such as China and India. Japfa aims to mitigate market challenges by enhancing operational efficiency and profitability to counter price fluctuations, for example by extending its leadership position in milk yields to mitigate lower ASP of raw milk in China. Its diversification strategy across 5 animal proteins and 5 countries cushions it from cyclical fluctuations due to the harvest seasonality, macroeconomic factors affecting purchasing power and government policies, ensuring long-term resilience. Further, Japfa places emphasis on nurturing growth-oriented relationships with stakeholder groups through close relationships with poultry farmers and customers, community CSR like ‘Japfa 4 Kids’ and ethical and fair business practices. Japfa also reaffirms its aim to make strategic investments in selected markets to capture the rise in consumer demand. In 2018, it acquired the remaining interest in the consistently- profitable dairy business ‘AustAsia’ and opened new markets in Sumatra, Central Java and East Java areas to expand its Indonesian stronghold. Corporate Governance Japfa is composed of 6 holding companies in Singapore and main subsidiary PT Japfa Comfeed TBK in Indonesia. Its Board of Directors have 7 members and 3 committees: Audit (AC), Nominating (NC) and Remuneration (RC). There are 3 independent members (42.9%) and 1 female member (14.3%), which may raise some questions about the independence of current BOD members. To mitigate this, NC is comprised entirely of Independent members, while AC and RC have an independent majority. Of the 8 members of the group’s key management team, the 6 members overseeing the group’s product lines have been with the company for decades. We believe such a tenured and experienced team in livestock and agri-business can set a strong strategic direction for Japfa’s future growth. Japfa also has a whistleblowing avenue “Japfalert” for any employee, supplier or business associate and whistleblowers are protected from sanctions. In terms of shareholder structure, there are 1.86 billion outstanding shares of only one share class, with majority owned by company insiders. Shareholders have voting rights and Directors are re-elected annually. Strategy Sales by Operating Segments Sales by Geographic Segments Asia Animal Protein Consumption (kg per capita) Source: Japfa Annual Report 2018 Source: Bloomberg Source: Company Data Source: Food and Beverage Asia-Pacific FTSE Report Feb 2019 Others, 1.3% Indonesia, 74.2% Vietnam, 9.5% China, 9.5% India, 2.8% Source: Japfa Annual Report 2017 Company Background Industrialization approach to farming and food production Operational efficiency through productivity and production yield gains Diversification across 5 proteins, 5 countries Growth-oriented relationships with stakeholder groups 3 key pillars: poultry, swine, dairy Strategic investments in selected markets 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 3. PRINSEP CAPITAL Industry Overview Japfa operates in 2 agri-business subsectors, animal protein and consumer goods, in emerging Asia. Growth in these sectors is forecasted to be strong: of the 45% growth in the global animal protein market from 2015-2025, 60% originates from emerging Asia. Meat and poultry sales in Asia grew 5.5% in 2018 to USD$254.6bn while dairy sales grew 6.1% in 2018 to USD$118.6bn, with forecasted CAGRs of 11.2% and 10.8% respectively from 2018-2022 . Asia-Pacific’s processed meat market also has a forecasted 7.2% CAGR from 2018-2023. Higher per-capita incomes, growing regional Muslim population and preference for convenience present strong underlying drivers. Moreover, headwinds such as disease outbreaks and macroeconomic factors are likely to have minimal impact on growth due to their short-term nature. Industry Drivers and Trends Rising per-capita income. Rapid economic growth across Asia has increased per-capita incomes, with the middle-class to grow by 88% from 2017-21. This has skewed diet preferences towards pricier meat products, raising per-capita consumption of animal protein. Compounded by high population growth, the market for animal protein is likely to expand. Growing Muslim Population. The USD$632bn global Halal food market is expected to grow at a 6.1% CAGR from 2018-24 with much of it concentrated in Southeast Asia due to its large Muslim population. Hence, demand for poultry is expected to rise. Japfa’s Halal certification ensures that it is well-positioned to capture this growth. Preference for Convenience. Emancipation of women has led to more dual-income households which seek convenient food solutions, while the increased adoption of formal retail in emerging markets has grown demand for consumer packaged foods. Coupled with the shift towards high-protein diets, demand for processed meat ready-to-eat products is likely to rise. Competitive Positioning Japfa is a market leader in multiple protein segments in Asia and the 2nd largest poultry producer in Indonesia. As it derives most of its revenue from poultry, we have focused on the USD$254.6b Asian meat and poultry market, specifically that of emerging Asia. The industry is characterized by moderate barriers to entry; high capex is needed for new entrants to compete on a large scale with large industry players which are strongly vertically integrated, though opportunities in niche and high-value areas do exist. Competitive rivalry is also high due to the presence of many players and low ability to differentiate products. Additionally, buyer power is high as the many meat producers allow the biggest buyers, strong businesses like supermarkets, to choose freely between them based on price and quality. Supplier power is low due to the large number of suppliers and the fact that large industry players often own or have established partnerships with their suppliers. Finally, meat alternatives like plant-based protein pose little threat considering current diet trends towards animal protein. Core poultry business ahead of its competitors. Japfa Comfeed, its Indonesian poultry subsidiary, enjoys higher margins and returns than its peers; for instance, its 14.4% EBITDA margin is higher than its closest competitor, PT Chareon’s 9.0%. Japfa commands the second-highest market share in poultry feed (19%) and DOC (24%), while its main competitors are PT Charoen Pokphand Indonesia TBK (31% and 41%) and PT Malindo Feedmill TBK (8% and 7%). Together, their combined market share is 58% and 72% respectively, resulting in an oligopolistic market and high market power. As rising costs make further industry consolidation likely, this provides room for Japfa to expand; in fact, it gained market share in 1H18 with 18% YoY revenue growth compared to the industry’s 5%. Moreover, Japfa is the most diversified among its competitors, reducing the impact of cyclical fluctuations in the poultry industry. Its other businesses also fare well; its swine business ranks highly in cost-efficiency in the industry while in China, it has the highest milk yields in the industry. Key competencies aid growth. Japfa has competencies in scale, standardization, technology and animal health. Its ability to manage, replicate and standardize mega-scale farming operations across 5 countries lets it reap economies of scale and remain a low-cost producer, mitigating macroeconomic risks. Its strong technological slant and prioritization of biosecurity cements its product quality and brand value as a top consumer choice, lowering buyer power. Strong standing with suppliers and customers. Japfa has close broiler farm partnerships with small farmers with limited capital in Indonesia, protecting these farmers from macroeconomic risks and ensuring a sustainable supply source for its businesses. Additionally, Japfa’s partnership with conglomerate Cargill to produce premium chicken products reinforces its branding, ensuring it remains a top choice of supermarkets and grocers. Porter’s 5 Forces Meat and Poultry Sales in Asia, 2015-2022 Dairy Sales in Asia, % SWOT Industry Overview Bargaining Power of Customers Intensity of Competitive Rivalry Bargaining Power of Suppliers Threat of Substitutes Barriers to Entry Strengths Weaknesses Opportunities Threats 0 2 4 6 8 10 12 14 16 0 100 200 300 400 500 600 700 800 900 2015 2016 2017 2018 2019F 2020F 2021F 2022F YoYgrowth(%) Sales(USDbn) Sales % YoY growth Source: Fitch Solutions Industry Forecast 0 2 4 6 8 10 12 14 0 100 200 300 400 500 600 2015 2016 2017 2018 2019F 2020F 2021F 2022F YoYgrowth(%) Sales(USDbn) Sales % YoY growth Source: Fitch Solutions Industry Forecast Core competencies in scale, standardization, technology and animal health Concentration risk in Indonesia Macroeconomic uncertaintyDiet shifts towards meat High production yields across its products High net gearing Diversification across 5 countries and 5 protein staples Changes in government regulationsGrowing Halal food market and regional Muslim population Higher demand for protein-rich, ready-to-eat foods Demand-supply imbalances High competition in consumer foods 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 4. PRINSEP CAPITAL 9.09 0 20 40 60 80 100 120 UkraineBelarus New ZealandAustraliaCanada United StatesEU-28Russia India Brazil ArgentinaMexico Japan South KoreaTaiw an China 2017 World Per Capita Milk Consumption (Kg) Japfa Markets YoY GDP Growth (2019-2023) Correlation: GDP & Meat Consumption (2018) Long-Term Secular Tailwinds Intact Japfa’s pan-Asian operations enable it to have a total addressable market in excess of 3 billion people, which is over 40% of the world’s population. Furthermore, Japfa’s markets consist of emerging markets in Asia, where economic growth is set to outpace the world for the coming years. With rising incomes and populations to drive growth in its geographic markets, Japfa is well positioned to ride on the long-term secular tailwinds. As income levels rise, people in developing nations would eventually shift away from a grain-based diet to meat, which is of a higher nutritional value. To support this claim, an analysis of countries’ GDP growth and meat consumption was conducted and the results displayed a positive correlation with R2 of +0.63. Hence, animal protein consumption is expected to rise together with income levels in these developing economies. This is a boon for Japfa as its markets currently have a low GDP per capita and this presents robust upside potential for animal protein sales. Sustaining the Feeder of Emerging Asia: PT Japfa TBK Japfa’s Indonesian operation is helmed by a majority-owned subsidiary, PT Japfa TBK. In Indonesia, consumption of animal proteins have been increasing at a CAGR of 10.7% from 2013 – 2017. With Indonesia’s GDP per capita and meat consumption per capita substantially below world averages, there is considerable upside potential in this market. Since over 70% of FY18 revenue comes from the Indonesian segment alone, PT Japfa TBK’s animal protein operations stand to benefit from this growing trend of affluence. PT Japfa TBK’s animal feed business consisting of poultry and aquaculture feed has long been a pillar of profitability for Japfa. Examining PT Japfa TBK’s operations, we observe that the animal feed segment yields the most stable operating margins with an 4-Yr average operating margin of over 11%. Feed margins’ relative stability to that of other segments can be attributed to Japfa’s ability to incrementally pass any price fluctuations of non-perishable inputs like soy beans and corn onto downstream members of the value chain. In FY18, PT Japfa TBK enjoyed an increase in sales volume for poultry feed even with an increasing DOC shortage in Indonesia. This growth is expected to persist in the long-term as the secular trend of rising animal protein production continues to drive feed demand. Pigs and Troughs: Vietnam to lead APO Segment Growth Japfa’s Vietnamese businesses make up 93.4% of FY18 APO segment operating profit. Emerging from a lackluster FY17 due to a Chinese import ban on pork, the Vietnamese operations swung back to profitability on the backdrop of rising sales for poultry feed and a strong recovery of ASPs for swine fattening. We expect swine ASPs to remain stable moving forward in anticipation of a swine stock shortage given the recent ASF outbreak. Currently, pork is the most popular meat in Vietnam, making up 75% of all meats consumed. Additionally, poultry consumption has been rising at higher rates than pork. In the long-term, Vietnam’s pork and poultry consumption is forecasted to continue to outperform OECD averages, with a 10-Yr CAGR of 2.14% and 2.79% respectively. Japfa is well-poised to capture value from the rising consumption of meat with its well-established swine and poultry farming operations in Vietnam. Its animal feed operations would also be boosted by increased production of swine and poultry. Milking the Right Opportunities: Dairy The dairy segment is outlined by the group to be a salient future growth driver. The group’s upstream operations include supplying of premium raw milk while downstream operations are fronted by the sale of premium pasteurised fresh milk brand Greenfields. The segment’s Chinese operations propels its revenue and profitability. For the past 4 fiscal years, revenue has been rising at a 12.6% CAGR while operating profit margins have been hovering at over 21%. This can be associated to rising demand for dairy products and stellar milk yields of over 39kg/head/day. Japfa’s dairy segment is set to ride on the tailwinds of growing Chinese dairy consumption, which lags behind countries in the West and Asia. In FY18, the group completed the acquisition of the remaining stake of their dairy business in China and Indonesia held by Black River Funds. This would enable Japfa to increase their exposure to a rapidly growing profitable business and to strengthen its position in downstream markets. 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% India Indonesia Vietnam Myanmar China World 2019E 2020E 2021E 2022E 2023E Source: IMF Source: OECD, IMF 0 20 40 60 80 100 120 0 10000 20000 30000 40000 50000 60000 70000 R2 = +0.63 MeatConsumption/Capita(kg) GDP/Capita (USD$) USA Australia New ZealandEU Japan Vietnam Malaysia China World Philippines Thailand Indonesia India Vietnam Meat Consumption Growth (2017-2027) China Dairy Consumption (,000s Tons) Source: OECD 39,000 40,000 41,000 42,000 43,000 44,000 45,000 46,000 47,000 48,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 Source: OECD Investment Thesis #1 1.62% 2.14% 2.79% 0.23% 0.03% 0.40% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% Beef Pork Poultry Vietnam OECD 1.27% CAGR Sample Developed World Average: 62.82Kg Source: OECD 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 5. PRINSEP CAPITAL 11.09% 12.48% 11.90% 9.50% 10.98% 0% 2% 4% 6% 8% 10% 12% 14% 2014 2015 2016 2017 2018 ASF Outbreak Not As Bad As It Sounds Since Vietnam reported its first case of African Swine Fever (ASF) on 19th Feb 2019, Japfa’s stock price has tumbled by 23% from a high of $0.84 to $0.65. Upon conducting analysis of the effect of ASF on Japfa’s operations, we opine that the scale of the selldown is unjustified due to the fact that none of Japfa’s swine stock had been infected by the ASF and that Vietnam only accounts for 9-13% of the group’s total revenues. ASF is a fatal animal disease affecting pigs and wild boars, with mortality rates close to 100%. ASF recently surfaced in Asia on August 2018, with China reporting its first outbreaks of ASF in Liaoning Province. The disease subsequently spread throughout the country and this poses inherent contagion risks for countries surrounding China. To contain these risks, China has culled over 900,000 swine stocks. With the virus entering Vietnam, swine stocks in Japfa-operated farms risk contracting the virus. However, it must be noted that since Feb 2019, all 79 cases of ASF involving over 6,000 pigs in Vietnam occurred in rural households. In such small-scale rearing operations, biosecurity levels are low and few precautions are put in place to safeguard against a disease outbreak. In the ASF cases reported, all affected swine stocks were culled. Japfa is well-equipped to deal with a pandemic Since there is no known effective vaccine for ASF, prevention is imperative. Japfa takes an industrialised approach to farming and places utmost emphasis on stringent operating procedures that would ensure high levels of biosecurity. These include isolation facilities to prevent a full stock- wipeout and rigorous disinfection protocols for farm personnel. Its vertically integrated operations also allow for traceability of inputs such as animal feed to further reduce transmission risks. These measures put Japfa in good standing to weather an ASF epidemic. Thus far, none of Japfa’s farms have been affected by the disease. Seizing opportunities in the chaos Industrialised farms currently only make up 47% of Vietnam’s pork production market. However, as operations of smaller and less advanced backyard farms take a hit from this epidemic, industrialised farms are poised to capitalise on this opportune moment to accumulate market share. This scenario has played out before in Russia during the 2007 ASF outbreak, where large industrialised swine farms were better able to weather out the storm compared to backyard farms and doubled pork production over a decade. This allowed industrialised farms like Miratorg in Russia to increase production while smaller farms died away. With its consistent investments to improve biosecurity standards and with disease- control protocols put in place, Japfa is well-positioned to capture market share in Vietnam for its swine business. Consumer sentiment to improve after positive government measures The Vietnamese government is taking the ASF issue seriously and PM Nguyen Xuan Phuc has vowed to take drastic measures to combat the epidemic. PM Phuc ordered localities to ban the transport, trade, slaughtering and consumption of illegally imported pig products and those without clear origins. Japfa has indicated that it would be willing to fully adhere to new government policies to further contain the disease. Furthermore, Vietnam’s Ministry of Agriculture and Rural Development is urging the public not to boycott pork products as ASF only affects pigs and cannot be transmitted to humans. This might clarify doubts about consumption of pork and improve consumer sentiment. As wary and more informed consumers switch to producers with high safety standards and lucid traceability, Japfa is in good standing to be a beneficiary of the demand shift to more reputable pork producers. Recent management actions affirm our view that ASF concerns are overblown Japfa has been engaging in share-buyback activities since 4th March 2019 at a price range of SGD$0.645 - SGD$0.71. The total buyback value thus far is SGD$1.619m, which already exceeds last year’s total buyback value of SGD$1.602m. Furthermore, as a sign of confidence in the near term outlook, management has also declared a special dividend of 1.0 Singapore cent on top of the final dividend of 1.0 Singapore cent for FY18 (vs 0.5 Singapore cent for FY17). As such, total dividends declared is at an all time high since Japfa’s IPO in Aug 2014. These actions by management affirm our view that the ASF concerns are overblown. Vietnam Government ASF Reaction Plan 1 Farm owners to send blood samples of suspected swine affected by ASF to the World Organisation for Animal Health for analysis 2 Slaughter and dispose of infected pigs within 24h of receipt of ASF positive results 3 In areas of outbreak, slaughter and dispose of pigs displaying clinical symptoms like fever within 48h of outbreak without having to wait for results 4 For affected industrialised farms, apart from disposing of infected pigs, biosecurity measures are to be applied to remaining stocks and samples must be taken periodically for monitoring of disease. 5 Terminate entire farm if risk of contagion is high 6 Treatment of infected and potentially infected pigs not permitted 7 Farm sanitisation must be carried out once a day for first week of outbreak and 3 times a week for the next 2-3 weeks Russia’s Pork Production (million tons) 1.6 3.2 1 1.5 2 2.5 3 3.5 2007 2009 2011 2013 2015 2017 Source: Bloomberg Source: Ministry of Agriculture and Rural Development, Vietnam Vietnam Share of Japfa Revenue (%) ASF Cases in Northern Vietnam Source: Company Data Investment Thesis #2 ASF Outbreak in Russia China Outbreaks The cases of ASF are restricted to rural backyard farms in Northern Vietnam, possibly due to the area’s vicinity to the Chinese border. Thus far, none of Japfa’s farms have been affected Vietnamese Outbreaks Source: Pig Progress 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 6. PRINSEP CAPITAL Japfa trading below equity stake in PT Japfa TBK Japfa’s Group Structure Share Price History Comparison since Japfa’s IPO Animal Protein Peer Comparison Significant Mispricing Presents Arbitrage Opportunity PT Japfa Comfeed Indonesia TBK (“PT Japfa TBK”), together with its subsidiaries, engages in animal feed, DOC, commercial farm, consumer products, aquaculture, cattle, trading, and other businesses in Indonesia, rest of Asia, Europe, and the United States. The company was founded in 1971 and is headquartered in Jakarta, Indonesia. PT Japfa TBK is listed in the Indonesia Stock Exchange (IDX) and is a 52.43%-owned subsidiary of Japfa Ltd. Japfa’s share price detached from economic reality Since Japfa’s IPO in Aug 2014, PT Japfa TBK has been a significant contributor to Japfa’s topline and bottomline. In FY18, PT Japfa TBK contributed 67% and 51% to Japfa’s revenue and core PATMI w/o forex respectively. In addition, the IDX-listed PT Japfa TBK and the SGX-listed Japfa traded closely since the listing of the latter, but begun to diverge in 3Q17. The gap between the pair further widened during the recent selldown of Japfa due to the ASF concerns. Since Feb 21, Japfa’s share price is down 21% while PT Japfa TBK’s share price is only down by 4.3% during the same period. In our view, markets seem to have become distracted with the weak APO and consumer segments, and forgotten about the economic relationship between Japfa and PT Japfa TBK. Market value of 52.43% stake in PT Japfa TBK exceeds Japfa’s own market capitalization At IDR2,200 per share, PT Japfa TBK’s market cap stands at US$1,861 million, which means that the market value of Japfa’s 52.43% stake in IDX- listed PT Japfa TBK is worth US$976 million. On the other hand, at S$0.65 per share, Japfa’s market cap is only US$897 million. Therefore, the residual market cap excluding the PT Japfa TBK stake is a negative US$79 million. This means that the market is pricing in an 8% discount to the value of Japfa’s 52.43% stake in PT Japfa TBK as well as according zero value to Japfa’s profitable and growing APO and Dairy segment which contributed US$81.2m in core PATMI w/o forex in FY18. It is worth noting that the APO and Dairy segment accounted for nearly half (49%) of Japfa’s FY18 core PATMI w/o forex. Hence, we believe that Japfa is significantly mispriced and presents an interesting arbitrage opportunity. PT Japfa TBK trading at a discount against peers despite superior operational metrics PT Japfa TBK’s profitability margins and efficiency ratios are the highest amongst its Indonesian animal protein peer group. However, despite its superior gross, EBITDA, EBIT, and net income margins, PT Japfa is also trading at a significant discount compared to its peers from a P/E, EV/EBITDA, EV/EBIT, and perspective. As such, we believe that there is room for further upside in the equity value of Japfa’s 52.43% stake in PT Japfa TBK and that additional re-rating of its stock price could serve as a stock price catalyst for Japfa itself. We also expect this valuation mispricing to narrow once worries over the ASF outbreak and consumer segment losses ameliorates. A key risk in this thesis is a substantial deterioration in the market value of PT Japfa TBK due to negative internal and/or external factors. However, we believe that it is unlikely given PT Japfa TBK’s long operating track record and positive industry tailwinds. Japfa Ltd Austasia Investment Holdings Pte Ltd PT Japfa Comfeed Indonesia TBK Others Jupiter Foods Pte Ltd Dairy Animal Protein Consumer Food 100% 52.43% 100% 100% Source: Japfa 0.2 0.6 1 1.4 1.8 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 Japfa Ltd PT Japfa TBK (Rebased) Source: Yahoo Finance Details Value (USDm) PT Japfa TBK market cap 1,861 Value of 52.43% stake in PT Japfa TBK 976 Japfa market cap 897 Japfa market cap excl. PT Japfa TBK (101) % discount 8% FY18 Core PATMI w/o Forex excl. PT Japfa TBK & consumer food segment 81.2 Source: Japfa, Capital IQ Investment Thesis #3 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 7. PRINSEP CAPITAL Robust Revenue and Operating Profit Performance Japfa’s revenues have been growing at a CAGR of 3.69% for the past five years. The group saw FY18 revenue increase by 10.76% year-on-year to US$3,533m. This strong growth is driven mainly by higher feed sales volume and higher ASPs in Indonesia and a strong recovery of swine prices in Vietnam. Full ownership of its Dairy segment also allowed Japfa to recognize 100% of Dairy segment contributions in FY18. Operating profit increased to US$341.8m, which represented a 81.2% year- on-year increase. The US$152.5m increase was mainly due to PT Japfa TBK’s strong growth in EBIT, propelled by strong ASPs for broilers and DOCs. The APO segment also contributed to rising EBIT levels with a strong recovery in swine prices allowing the APO segment to turn a profit in FY18, compared with an operating loss of US$26.9 million in FY17. Moving forward, we expect revenues to rise further, on the back of strong tailwinds from rising consumption of animal protein in Japfa’s geographical markets. Our forward estimates for EBIT accounts for a slight dip in FY19 mainly due to stabilising poultry ASPs in Indonesia, higher expenditure on biosecurity in Vietnam and rising marketing expenses for the consumer goods segment. Thereafter, we expect operating margins to stabilise at around 8% over the next few years. Gearing Becoming Less of a Concern Japfa’s gearing spiked in FY18 due to borrowing of US$109m for purchasing of working capital. Japfa also took on an acquisition loan of US$252.8m for the acquisition of the remaining interest in its Dairy segment, as well as for additional interest in PT Japfa TBK. As a result, ending D/E was 1.09x. The increase in leverage is mitigated by an accompanied rise in interest coverage ratio to 2.93 from 2.80 in FY17. The increase in debt in FY18 was mainly due to acquisition activities. Moving forward, we expect Japfa’s debt levels to taper off as gearing approaches its historical peak. We also expect the interest coverage ratio to improve over the years with rising operating profits. Cash Conversion Cycle Improving Over the past 4 fiscal years, Japfa had a days inventory outstanding average of 190 days. Although seemingly a large figure, inventory figures are mainly dominated by non-perishables like cornmeal and soybeans for raw materials and animal feed as finished goods. For the case of Japfa, management controls inventory levels to hedge against the risk of commodity price fluctuations. Days sales outstanding was also relatively stable historically with an average of 37 days. This demonstrates good relations with its customers by maintaining consistent credit terms. To manage credit risks, management also ensures that customer concentration risks are minimised: In FY17, the top 3 customers only made up 9.66% of total receivables. Over the years, the days payable outstanding has been increasing. The days payable outstanding figure in FY18 was 134 days. This demonstrates suppliers’ confidence in Japfa’s credit rating. Overall, the cash conversion cycle has been falling, providing Japfa with increased liquidity. DuPont Analysis Japfa’s net profit margins increased from 1.76% in FY17 to 5.04% in FY17. On a strong recovery from FY17, ROE and ROA were also uplifted by rising earnings. Moving forward, we expect net profit margins to normalise due to FY18 being an exceptional year for Japfa. As debt levels taper off, equity multiplier is also expected to modestly decrease. With a relatively stable total asset turnover, future growth in ROE would be driven by rising net margins on higher share contribution from the dairy segment. 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2017 2018 2019F 2020F 2021F Thousands Revenue EBIT EBIT Margins 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 - 0.20 0.40 0.60 0.80 1.00 1.20 2017 2018 2019F 2020F 2021F D/E EBIT/Interest Expense Japfa’s Revenue and Operating Profit Financial Analysis Source: Company Data, Team Estimates D/E Ratio and Interest Coverage Ratio Source: Company Data, Team Estimates Cash Conversion Cycle Source: Company Data, Team Estimates DuPont Analysis 2017 2018 2019F 2020F 2021F Net Margin (%) 1.76% 5.04% 2.97% 3.88% 3.77% Total Asset Turnover 1.16 1.22 1.17 1.19 1.20 Equity Multiplier 2.68 2.56 2.51 2.37 2.25 ROA 2.05% 6.17% 3.48% 4.62% 4.51% ROE 5.50% 15.77% 8.72% 10.96% 10.15% -200 -150 -100 -50 0 50 100 150 200 250 300 2015 2016 2017 2018 DSI DSO DPO CCC Days 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 8. PRINSEP CAPITAL Our take on Japfa Ltd We issue a BUY recommendation on Japfa Ltd with a target price of SGD$0.93, representing a 43% upside from the closing price of SGD$0.65 per share of March 25th, 2019. Our target price was derived using a Discounted Cash Flow (DCF) model with a target price of SGD$0.93 as our primary valuation method. We have also used an SOTP valuation as a sense check for our primary valuation. Nevertheless, we obtained a similar target price of SGD$0.98 representing an upside of 51.4%. Our base case expects a slight year-on-year dip in revenue growth to 3% in FY19E for PT Japfa TBK’s Animal Feed segment due to reduced demand for poultry feed as a result of industry-wide culling of poultry stock to curb oversupply of poultry and maintain price stability. We foresee the APO segment to be moderately impacted by ASF fears, with lower demand for pork leading to a 5% fall in revenue in FY19E from FY18. We expect margins to contract due to heightened biosecurity measures in response to ASF. However, we do not expect ASF concerns to persist for more than a year. Hence, revenue and margins are set to normalise at the end of FY19E. The Dairy segment is expected to be the future growth driver for Japfa’s profitability. We attach a conservative revenue growth rate of 9%. This places the overall segment revenue growth rate at a steep discount to the growth of the Japfa Chinese Dairy operations but at a slight premium over the growth of the Indonesian Dairy business. As the Dairy segment continues to increase marketing expenses to improve the competitive positioning of its Greenfields brand, we forecast a slight dip in operating margins moving forward. We do not expect a quick turnaround in Japfa’s consumer goods segment. As such, we attach no revenue growth for the next five years and an operating margin of negative 10%, which is at a discount to historical performance. Estimating the risk-adjusted discount rate We applied a WACC of 9.00% to discount the projected firm FCF. The cost of debt was computed using Japfa's FY18 interest expense on FY18’s average total debt. The computation of cost of equity is based on the Capital Asset Pricing Model using the following inputs: a) risk-free rate equals 10-year Singapore Government bond rate of 2.16% b) Singapore's mature market equity risk premium of 5.96% c) comparables raw beta re- levered using Japfa’s current capital structure resulting in a Japfa-Beta of 1.34 d) weighted average country risk premium of 3.0% using revenue contribution by geography as weights. Optimistic views on terminal growth In the computation of the terminal growth rate, we used a positive terminal growth rate of 2.75% which was a conservative blend of the projected world inflation rate (3%-4%) and forecasted global GDP growth rate (3%-4%). We assume a mature stage terminal growth rate for Japfa. At this stage, the company’s growth is minimal as more of the company’s resources are diverted to defending its existing market share from emerging competitors within the industry. DCF analysis presents an undervalued share price Our DCF analysis reveals an undervalued share price. To assess the spread of our DCF valuation, we evaluated the sensitivity of our result using a sensitivity table that varied WACC and the terminal growth rate. The most conservative scenario indicates a upside of 7.6%. The most optimistic scenario results in an upside of 90.8%. These results reinforce our positive view of the severe undervaluation of Japfa by the market. WACC Assumptions Financial Statement Forecast Source: IMF Valuation 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% 3.54% 3.56% 3.58% 3.60% 3.62% 3.64% 3.66% 3.68% 3.70% 3.72% 2019E 2020E 2021E 2022E 2023E GDP Inflation Rate Source: Team Estimates Source: Team Estimates Terminal Growth Rate Assumptions Target Price Sensitivity Analysis WACC Terminal Growth Rate 0.93 2.25% 2.50% 2.75% 3.00% 3.25% 8.50% 0.95 1.02 1.08 1.16 1.24 8.75% 0.88 0.94 1.00 1.07 1.14 9.00% 0.82 0.87 0.93 0.99 1.06 9.25% 0.76 0.81 0.86 0.91 0.98 9.50% 0.70 0.75 0.79 0.85 0.90 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 9. PRINSEP CAPITAL Summary Statistics Minimum $ 0.34 Maximum $ 1.42 Mean $ 0.94 Skewness 0.0067 Kurtosis 0.0114 Median $ 0.94 Standard Deviation $ 0.14 Mean -2SD $ 0.66 Mean -1SD $ 0.80 Mean +1SD $ 1.07 Mean +2SD $ 1.21 SOTP valuation offers further support We value Japfa on a sum-of-the-parts (SOTP) analysis based on valuation of its business segments of: 1) PT Japfa TBK; 2) Dairy; 3) APO and 4) Consumer Goods. Our target price after incorporating a 10% holding company discount is SGD0.98 which implies an upside of 51.4% and a 11.7x FY19E P/E, a 41% discount to the peer average of 19.8x. Japfa is currently trading at 9.6x P/E and we believe this valuation gap should narrow when market concerns over ASF affecting Japfa's APO segment ease. The risk of an ASF outbreak would be easily mitigated with Japfa’s high biosecurity standards and widely diversified revenue streams. Overview of SOTP methodology PT Japfa TBK: We took into account Japfa's 52.43% stake in PT Japfa TBK and PT Japfa TBK’s current market capitalization in the IDX to determine the market value of the segment. APO: We value the APO segment at 10.5x P/E based on PT Japfa TBK's blended forward 12M P/E. This is because the APO segment also utilises a similar business model as PT Japfa TBK. Dairy: We value the Dairy segment at 7x P/E. This is based on the Dairy segment's 5 year expected CAGR of 7%, and an assumed PEG ratio of 1. Consumer food: We do not ascribe any valuation for the consumer business because of uncertainty regarding the profitability of this segment. The segment had EBIT losses in FY17 and FY18 despite small positive EBIT contributions in FY14-16. Hence, we are uncertain if a turnaround is on the horizon. The decline in profitability in FY17 and FY18 was primarily due to higher cost of major raw materials and heightened competition in Indonesia’s ambient food sector. A further increase in advertising and promotion activities is expected to worsen their margins. Furthermore, to sensitise the valuation, we used 2x of PT Japfa TBK’s 52- week volatility range (±34.6%) to determine the bull and bear cases. Blue-grey sky scenarios We performed a scenario analysis on the primary variables of the model in order to derive the bull and bear scenario cases. In order for us to change our recommendation to a SELL, Japfa’s APO segment has to be severely hit by the ASF with a 100% wipeout of their swine stocks. This translates to a 40% revenue cut and USD$42m operating loss for the APO segment. In addition, the Dairy segment’s operating margin would have to contract due to increasing competition in the market. Furthermore, revenues of PT Japfa’s DOC and animal feed sector would have to take a hit from the culling of livestock to maintain price stability in the poultry market. Given Japfa’s high biosecurity measures as well as their historical strong dairy segment growth, we see no foreseeable event that may deteriorate Japfa’s share price. Monte Carlo Simulation We further tested the spread of our valuation by varying the terminal growth rate and WACC assumptions using a Monte Carlo simulation of 10,000 trials. After running the simulation, we observed a 87.5% probability of finding a target price above 20% upside (SGD$0.78 per share), and only a 0.1% probability of a downgrade to a SELL, defined as a target price below 20% downside . Football Field Analysis To conclude our valuation, we conducted a football field analysis providing a sense-check to our various valuation methods. Our analysis revealed that our DCF-based target price of SGD$0.93 intersects the ranges of other valuation methods, namely the team’s SOTP valuation, scenario-based valuations as well as street estimates. The target price of SGD$0.93 is well above the 52 week high of SGD$0.84. Monte Carlo Simulation Football Field Analysis Valuation Source: Team Estimates 0 100 200 300 400 500 600 700 800 900 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $1.15 $1.20 $1.25 No.ofoccurrences/10,000 $0.93$0.65 Sum-of-the-parts Valuation Source: Team Estimates Source: Team Estimates $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Scenario Analysis Source: Team Estimates $1.14 $0.93 $0.60 t 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 10. PRINSEP CAPITAL 0 2000 4000 6000 8000 10000 12000 14000 2014 2015 2016 2017 2018 2019F 2020F 2021F Production Consumption Indonesian Corn Market (‘000 tonnes) Broiler Production in Indonesia Raw Milk Price in China (Rmb/kg) Source: PT Data Consult, 2018 Key Investment Risks (1) Demand-Supply Imbalances in Animal Proteins Oversupply of poultry, swine or milk may hurt prices and squeeze profits. Poultry – Moderate Risk: Its Indonesian poultry business suffered from an oversupply of DOCs from 2014-17, when excess imports of GPS saw ASP for broiler and DOC drop below production cost. Prices have since stabilized from government supply controls in 2017, such as egg culling programs and a lower GPS import quota. Average FY18 broiler and DOC price grew 16.3% YoY and 31.9% YoY to Rp19,624/kg and Rp5,526.7/chick, far above 2015 prices of Rp17,000/kg and Rp4,000/chick. However, these high prices are unlikely to stay as GPS import quotas were re-raised in 2018 and 2019F, although oversupply is also unlikely due to greater government oversight and ample chicken consumption growth. Swine – Moderate Risk: Japfa’s swine business in Vietnam was affected by lower ASPs due to China’s import restrictions. Reduced demand in Vietnam led to a low price environment from 4Q2016 till now. However, Japfa’s high cost efficiency well-positions it to navigate these headwinds. Dairy – Low Risk: Market glut in China due to low domestic consumption and high import competition has caused raw milk prices to tumble. Despite this, Japfa’s dairy business in China has seen consistent profitability and it holds the leadership position in milk yields, thus risk seems low. (2) Fluctuating Prices of Animal Feed Inputs As chicken feed largely comprises corn (50%) and soybean meal (15-20%), Japfa’s feed profitability is vulnerable to price fluctuations in corn and soybean. Corn is mainly sourced domestically as the government’s self- sufficiency program restricts corn imports. However, resulting corn shortages have caused prices to rise to Rp6,000/kg, above the Rp4,000 reference ceiling price. While the government has temporarily raised import quotas, uncertainty remains as to whether it will continue its unsuccessful program. However, prices on imported soybean are likely to stay low due to macroeconomic factors like the U.S.-China trade war and an appreciating Rupiah, benefitting Japfa. Moreover, Japfa’s core Indonesian animal feed business has high pricing power. It is able to pass on higher input costs in their feed selling prices, thus enjoying stable operating margins even in periods of downturn and Rupiah volatility. It is viewed as a stable pillar of profitability, making risks low. (3) Disease Outbreaks Disease outbreaks reduce both demand and supply of livestock, having a material effect on Japfa’s businesses. Avian influenza in the rainy season routinely depresses livebird prices in Indonesia. The recent outbreak of fatal African Swine Fever in Vietnam has also sparked fears that Japfa’s swine stocks might be affected and culled, on top of falling consumer demand for pork. However, factors in Investment Thesis #2 have helped to mitigate this risk. Therefore, we expect this risk to be moderate. (4) Heightened Competition in Ambient Food Sector Aggressive price competition by rivals threatens Japfa’s dominant position in ambient foods. Lower ASP of ambient food products and investment in advertising and promotion to maintain market share has resulted in growing operating losses. However, Japfa’s “So Good” and “So Nice” brands have been gaining market share. In the long-term, shifting consumption preference in emerging economies from wet markets to chilled and frozen distribution channels and higher consumption of healthy and convenience food products represents high growth potential for the Consumer Foods segment. Thus, while risk is high in the short-term, it is expected to fall. (5) High Net Gearing Japfa’s net gearing ratio rose to 0.9x in FY18 on the back of increased loans taken to acquire the remaining stake of their Dairy segment. This high net gearing level would increase Japfa’s earnings sensitivity towards interest rate hikes. However, the US Federal Reserve decided on 20th March 2019 to hold interest rates steady, signaling no further hikes in 2019. This would alleviates concerns of higher financing costs. Nonetheless, Japfa has a proven track record in maintaining a high level of borrowing at fixed rates. With this debt structure, the company estimated that a 1% increase in interest rates would only cause profit before income tax to fall by 1.68% in FY16 and 3.26% in FY17. Thus, with proper gearing risk management, we classify leverage risks to be low moving forward. (6) Foreign Exchange Risks Japfa operates in 5 different countries and hence exposes itself to high foreign exchange risks. Japfa’s main functional currency is the Indonesian Rupiah, with over 70% of revenues coming from Indonesia. Hence, over the years, FX losses worsened whenever there was a depreciation of the Rupiah. If volatility in the Rupiah persists, this would present a high risk for Japfa. 11,000 11,500 12,000 12,500 13,000 13,500 14,000 14,500 15,000 -25% -20% -15% -10% -5% 0% 5% 2014 2015 2016 2017 2018 FX Losses/Gains as % of Profit before Tax USD/IDR Effect of FX on Profit vs USD/IDR Rates Source: Company Data, Bloomberg -5 0 5 10 15 20 400 600 800 1000 1200 1400 1600 1800 2000 2013 2014 2015 2016 2017 Broiler production (Mt) % y-o-y 5.02 4.39 3.95 3.67 3.49 0 1 2 3 4 5 6 2014 2015 2016 2017 2018 Source: DBS HK Source: Fitch Solutions 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 11. PRINSEP CAPITAL Group StructureAppendix 1 Source: Japfa Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 12. PRINSEP CAPITAL Top ShareholdersAppendix 2 Rank Name No. of Shares % Shares Worth (SGD$) 1 SANTOSA FAMILY 1,055,082,615 56.7393 675,252,873 2 KOLONAS FAMILY 282,527,085 15.1935 180,817,334 3 SANTOSA HANDOJO 81,736,300 4.3955 52,311,232 4 TAN YONG NANG 46,810,691 2.5173 29,958,842 5 TAN YONG NANG FAMILY 30,000,000 1.6133 19,200,000 6 FIL Investment Management (Singapore) Ltd. 22,793,794 1.2258 14,588,028 7 Japfa Ltd. 16,420,700 0.8831 10,509,248 8 Dimensional Fund Advisors LP 9,852,100 0.5298 6,305,344 9 Nikko Asset Management Asia Ltd. 5,887,600 0.3166 3,768,064 10 Segall Bryant & Hamill LLC 4,572,480 0.2459 2,926,387 11 TIAA-CREF Investment Management LLC 3,328,700 0.179 2,130,368 12 MONTEIRO KEVIN JOHN 3,044,300 0.1637 1,948,352 13 BlackRock Fund Advisors 2,726,600 0.1466 1,745,024 14 Mellon Investments Corp. 2,502,700 0.1346 1,601,728 15 Amundi Singapore Ltd. 2,052,500 0.1104 1,313,600 16 Lazard Asset Management LLC 1,921,200 0.1033 1,229,568 17 Samsung Asset Management (Hong Kong) Ltd. 1,746,800 0.0939 1,117,952 18 Sydbank A/S (Investment Management) 1,687,300 0.0907 1,079,872 19 GOH GEOK KHIM 1,500,000 0.0807 960,000 20 DJE Kapital AG 1,472,700 0.0792 942,528 Source: ShareInvestor Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 13. PRINSEP CAPITAL Key Management TeamAppendix 3 Designation Name Information Executive Deputy Chairman Handojo Santosa § Mr. Santosa joined the Group in 1986 as a manager in the edible oil division at Nilam in Surabaya § 1989 to 1997, he served as Vice-President Director of subsidiary PT Japfa Comfeed Indonesia TBK Executive Director and Chief Executive Officer Tan Yong Nang § Mr. Tan joined the Group in 2007 as an assistant to the Chief Executive Officer and Chief Operating Officer of Corporate Services § 2011, he served as Chief Operating Officer of the Group. Executive Director and Chief Financial Officer Kevin John Monteiro § Mr. Monteiro’s key roles are to develop a balanced capital structure and to source adequate funding for the Group and to ensure the integrity of financial data for proper record keeping and accurate reporting. Head of Poultry Bambang Budi Hendarto § 1978, Mr. Hendarto joined the Group as a Nutrition Manager in the Production Planning Control Department. § 1981, He became a Vice Director (Deputy Director) of PT Comfeed Indonesia § He was promoted several times and was appointed the Vice-President Director of PT Japfa in 1997. Head of Dairy Edgar Dowse Collins § Mr. Collins is the Head of Dairy of our Group. He is responsible for the day-today operations of the Group's Dairy Division and is in charge of formulating, developing and implementing both strategic and long- term business plans for the Group's Dairy operations. Deputy Chief Operating Officer Operational 1, Poultry Business Antonius Harwanto § Mr. Harwanto is Deputy Chief Operating Officer, Operational 1, Poultry Business, Indonesia, and he is responsible for setting up the vision, mission and strategies to further grow the Group’s poultry business in Indonesia. Head of Legal and Compliance Christina Chua Sook Ping § Ms. Chua oversees all legal, compliance and secretarial functions of the Group's operations. She joined the Group in 2010. § Ms. Chua has more than 20 years of experience in legal practice. Head of Human Resources Jasper Tan Kai Loon § Mr. Tan is the Head of Human Resource is in charge of all human resource matters in the Group and responsible for human resource management, policy governance and administration. § He joined the Group in 2012. Source: Japfa Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 14. PRINSEP CAPITAL SWOT AnalysisAppendix 4 Strengths Weaknesses Opportunities Threats Core competencies in scale, standardization, technology and animal health Concentration risk in Indonesia Macroeconomic uncertaintyDiet shifts towards meat High production yields across its products High net gearing Diversification across 5 countries and 5 protein staples Changes in government regulationsGrowing Halal food market and regional Muslim population Higher demand for protein-rich, ready-to-eat foods Demand-supply imbalances High competition in consumer foods Strengths Description Core competencies in scale, standardization, technology, animal health (1) Scale: Ability to manage mega-scale farming operations of over 34,000 employees across 5 countries enables Japfa to enjoy economies of scale and an established network (2) Technology: Advanced feed technology and JVs with leading genetics companies Aviagen and Hyper for superior breeds and genetics, combined with best farm management practices, enables production of high quality animal proteins that are valued by customers (3) Animal Health: Best in class bio-security with stringent operating procedures and in-house vaccine production firm PT Vaksindo ensure high produce standards that are valued by customers and also protect livestock levels (4) Standardization and Replication: Replication of best practices and infrastructure design across 5 protein groups and 5 countries enables rapid and large-scale expansion and also provides a strong foundation for Japfa’s diversification strategy High production yields across its products Japfa holds leading upstream market positions in multiple protein staples across regions as of FY17: (1) China: Milk yield 37kg/day (No. 1) (2) Indonesia: Poultry feed production capacity 24%, DOC production 29% (No. 2) (3) Myanmar: Poultry feed production capacity 31%, DOC production 21% (No. 2) (4) Vietnam: DOC production 20% (No. 3) Diversification across 5 countries and 5 protein staples Mitigates cyclical fluctuations due to harvests and festivals, macroeconomic factors that affect prices, and government policies Weaknesses Description Concentration Risk in Indonesia Japfa generates 74% of revenue from its Indonesian operations, hence there is a risk that a single sudden catastrophic event such as a tsunami will have a huge detrimental impact on its business High net gearing Japfa’s net gearing ratio rose to 0.9x in FY18 on the back of increased loans taken to acquire the remaining stake of their Dairy segment, increasing Japfa’s earnings sensitivity towards interest rate hikes. However, percentage increase in interest rates would only cause profit before income tax to fall by 1.68% in FY16 and 3.26% in FY17. With proper management, this weakness can be reduced. Opportunities Description Diet shifts towards meat Rising affluence in emerging Asian markets has caused diet preferences to shift in favor of meat. Together with rapid population growth, the meat and poultry market is expected to grow exponentially in the future, with total meat and poultry sales in Asia having a forecasted CAGR of 11.2% from 2018-22. Growing Halal food market The $632bn global Halal food market is expected to grow at a 6.1% CAGR from 2018-24 with much of it concentrated in Southeast Asia due to its large Muslim population. Japfa already has Halal certification on its poultry sales and brand recognition as a Halal food producer, thus it is poised to take advantage of this key growth market. Higher demand for protein-rich, ready- to-eat foods Emancipation of women has led to more dual-income households which seek convenient food solutions, while the increased adoption of formal retail in emerging markets has grown demand for consumer packaged foods. Coupled with the shift towards high-protein diets, demand for processed meat ready-to- eat products is likely to rise. Threats Description Macroeconomic Uncertainty Factors such as political instability, U.S.-China Trade War and Rupiah depreciation/appreciation can potentially impact Japfa’s businesses by affecting the prices of its raw materials and products. Changes in government regulation Government regulations may impact Japfa’s business. For example, its restrictions on corn imports caused corn prices to rise exponentially. Japfa experienced rising feed costs and thus higher cost of production, hurting its profitability. Demand-supply imbalances in animal proteins Oversupply of poultry, swine or milk may hurt prices and squeeze profits. For instance, China’s import restrictions on pork from Vietnam caused oversupply of pork and prices of pork to fall, hurting Japfa’s profits on its Vietnamese business. High competition in consumer ambient foods Aggressive price competition by rivals threatens Japfa’s dominant position in ambient foods. Lower ASP of ambient food products and investment in advertising and promotion to maintain market share has resulted in growing operating losses. However, Japfa’s “So Good” and “So Nice” brands have been gaining market share. In the long-term, shifting consumption preference in emerging economies from wet markets to chilled and frozen distribution channels and higher consumption of healthy and convenience food products represents high growth potential for the Consumer Foods segment. Thus, while risk is high in the short-term, it is expected to fall. Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 15. PRINSEP CAPITAL Corporate Social ResponsibilityAppendix 5 Source: Japfa Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 16. PRINSEP CAPITAL Timeline of Key Events since IPOAppendix 6 Japfa’s historical share price since IPO No. Date Event 1 15 Aug 2014 Japfa debuts on the SGX, closed at S$0.845 (+5.6%) compared to IPO price of S$0.80. 2 27 Feb 2015 Japfa’s 4Q14 Net Loss Up 282% to US$13.9 million due to weak performance in Indonesia’s animal protein business 3 29 Feb 2016 Japfa’s FY15 earnings beat street expectations. Significant improvement in profitability was due to PT Japfa TBK’s poultry business turning around in 2H15, on the back of a better pricing environment for DOC and broilers 4 01 Nov 2016 Weakness in Vietnam swine due to China’s import ban. Japfa has swine-farming operations in Vietnam. 5 27 Jul 2017 2Q17 results below expectations due to depressed swine price in Vietnam. Decline in the Group’s profitability was largely due to a substantial loss in Vietnam where ASPs for swine continued to slide to levels well below operating costs. 6 02 May 2018 1Q18 reported strong recovery in earnings driven by better Indonesian poultry and Vietnam swine ASPs. 7 30 Jul 2018 2Q18 reported strong contributions from PT Japfa TBK arising from higher sales volume and margins across all poultry businesses. APO returns to profitability as a result of the rebalancing of the demand-supply dynamics in the Vietnam swine market 8 19 Feb 2019 First confirmed case of ASF in Vietnam. Japfa shares plunged 22.6% on worries of contagion. 9 28 Feb 2019 Japfa posts 80-fold increase in FY18 earnings to US$100.4m on record revenue. Indonesian poultry recorded higher feed sales volume and higher ASPs - Vietnam operations registered sharp turnaround in profitability. Full ownership of Dairy segment enables Japfa to recognise 100% contribution in FY2018. 0.2 0.4 0.6 0.8 1 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 1 9 2 8 7 6 3 4 5 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 17. PRINSEP CAPITAL Share buyback HistoryAppendix 7 Company Buyback Chart Source: ShareInvestor Company Buyback Transactions Date of Announcement Date of Effective Change Bought [‘000] Price (SGD) Estimated Transaction Value [SGD‘000] 15 Mar 2019 15 Mar 2019 319 0.645-0.655 207 14 Mar 2019 14 Mar 2019 600 0.665-0.67 400 12 Mar 2019 12 Mar 2019 100 0.7 70 08 Mar 2019 08 Mar 2019 130 0.695-0.7 91 07 Mar 2019 07 Mar 2019 450 0.7-0.715 318 06 Mar 2019 06 Mar 2019 450 0.71-0.715 321 04 Mar 2019 04 Mar 2019 300 0.705-0.71 212 16 Oct 2018 16 Oct 2018 100 0.61 61 11 Oct 2018 11 Oct 2018 50 0.59 30 08 Oct 2018 08 Oct 2018 500 0.61-0.625 309 05 Oct 2018 05 Oct 2018 98 0.63-0.635 62 04 Oct 2018 04 Oct 2018 48 0.635 30 24 Sep 2018 24 Sep 2018 300 0.615-0.625 186 20 Sep 2018 20 Sep 2018 79 0.625 50 18 Sep 2018 18 Sep 2018 50 0.62 31 07 Mar 2018 07 Mar 2018 345 0.445 157 05 Mar 2018 05 Mar 2018 300 0.448-0.455 135 02 Mar 2018 02 Mar 2018 576 0.4313-0.45 254 02 Feb 2018 01 Feb 2018 586 0.495-0.52 297 Source: ShareInvestor Key Observations: 1. Share price rallied strongly subsequent to share repurchases +50% +30% B Company Buyback Conducted Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 18. PRINSEP CAPITAL Analysis of Company Buyback for Last 3 Calendar YearsAppendix 8 Source: ShareInvestor Q1 (Jan to Mar) Q2 (Apr to Jun) Q3 (Jul to Sep) Q4 (Oct to Dec) Total [SGD’000] 2019 1,619 1,619 2018 843 267 492 1,602 2017 684 5,264 706 6,854 Breakdown by Transaction Value Breakdown by Transaction Volume Breakdown by Number of Trades Q1 (Jan to Mar) Q2 (Apr to Jun) Q3 (Jul to Sep) Q4 (Oct to Dec) Total [’000] 2019 2,349 2,349 2018 1,807 429 796 3,032 2017 868 8,825 1,421 11,114 Source: ShareInvestor Q1 (Jan to Mar) Q2 (Apr to Jun) Q3 (Jul to Sep) Q4 (Oct to Dec) Total 2019 7 7 2018 4 3 5 12 2017 2 8 3 13 Source: ShareInvestor Key Observations: 1. 1Q19 transaction value already exceeded FY18 transaction value 2. 1Q19 transaction volume represented 77% FY18 transaction volume Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 19. PRINSEP CAPITAL Income StatementAppendix 9 USD$m FY17 FY18 FY19E FY20E FY21E Revenue 3190 3533 3647 3927 4166 Cost of sales -2616 -2763 -2935 -3160 -3353 Gross profit 574 770 712 766 813 Marketing and distribution costs -137 -144 -147 -144 -156 Administrative expenses -248 -284 -277 -271 -294 EBIT (Operating Income) 189 342 287 351 363 Finance Costs -67 -83 -98 -104 -110 Interest income 4 4 3 6 6 Other gains 11 24 0 0 0 Gain on disposal of asset held for sale 0 0 0 0 0 Other losses -12 0 0 0 0 Foreign exchange adjustments losses, net 5 -33 -33 -33 -33 Decrease in fair value of biological assets -22 -12 -12 -12 -12 Share of loss from equity-accounted joint ventures PBT (Profit before income tax) 108 244 148 208 215 Income tax expense -51 -65 -40 -56 -58 PAT (Profit, net of income tax) 56 178 108 152 157 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 20. PRINSEP CAPITAL Balance SheetAppendix 10 USD$m FY17 FY18 FY19E FY20E FY21E ASSETS Non-current assets Property, plant and equipment 1011 1010 1101 1175 1258 Investment properties 5 5 5 5 5 Intangible assets 10 12 12 12 12 Investments in subsidiaries 0 0 0 0 0 Investments in joint ventures 6 6 6 6 6 Biological assets, non-current 351 365 365 393 417 Deferred tax assets 24 24 24 24 24 Other receivables, non-current 15 15 7 7 8 Other financial assets, non-current 19 30 30 30 30 Other assets, non-current 65 82 82 82 82 Total non-current assets 1507 1549 1632 1734 1842 Current assets Inventories 671 817 778 837 888 Biological assets, current 76 83 78 84 90 Trade and other receivables, current 179 194 192 207 219 Other financial assets, current 1 2 2 2 2 Other assets, current 75 75 75 75 75 Cash and cash equivalents 230 164 344 351 364 Cash pledged for bank facilities 4 4 4 4 4 Total current assets 1236 1340 1473 1561 1643 Total assets 2743 2889 3104 3295 3485 EQUITY AND LIABILITIES Equity attributable to owners of the parent Share capital 941 981 981 981 981 Treasury shares -5 -6 -6 -6 -6 Retained earnings 385 482 590 742 899 Other reserves -460 -451 -451 -451 -451 Translation reserve -168 -226 -226 -226 -226 Equity, attributable to owners of the parent 694 779 887 1040 1197 Non-controlling interests 329 351 351 351 351 Put options reserve Total equity 1023 1130 1238 1391 1548 Non-current liabilities Put option financial liabilities Provisions 106 85 85 85 85 Deferred tax liabilities 4 3 3 3 3 Trade and other payables, non-current 1 0 1 1 1 Loan and borrowings, non-current 635 778 778 778 778 Other liabilities, non-current 4 3 3 3 3 Total non-current liabilities 749 869 870 870 870 Current liabilities 0 0 0 0 0 Income tax payable 20 37 37 37 37 Trade and other payables, current 623 389 495 533 566 Loan and borrowings, current 319 449 449 449 449 Other liabilities, current 9 14 14 14 14 Total current liabilities 971 890 996 1034 1067 Total liabilities 1720 1759 1866 1904 1937 Total equity and liabilities 2743 2889 3104 3295 3485 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 21. PRINSEP CAPITAL Cash Flow StatementAppendix 11 USD$m FY17 FY18 FY19E FY20E FY21E Cash flows from operating activities Profit before income tax 108 244 148 208 215 Adjustments for: - - - - - Amortisation of intangible assets 2 2 - - - Amortisation of land use rights 0 1 - - - Depreciation of property, plant and equipment 95 104 103 109 116 Depreciation of investment properties 1 - - - - Fair value loss on financial assets - - - - - Fair value loss on derivative financial instruments 5 (16) - - - Fair value loss on biological assets 22 12 - - - Gain on disposal of other financial assets - - - - - Gain on disposal of property, plant and equipment and investment properties (2) 0 - - - Gain on disposal of asset held for sale - - - - - Fair value gain on call option assets - - - - - Gain on buy back of bonds payable - - - - - Increase in provision for retirement benefits 16 18 - - - Interest income (4) (4) (3) (6) (6) Interest expense 67 83 98 104 110 Gain on disposal of a subsidiary - - - - - Share options granted by a subsidiary 0 0 - - - Value of employee services received pursuant to performance share plan 0 1 - - - Value of employee services received pursuant to performance share plan by subsidiary 0 0 - - - Share of loss from equity-accounted joint ventures 0 (0) - - - Write-off of property, plant and equipment 0 1 - - - Net effect of exchange rate changes (5) 1 - - - Operating cash flows before changes in working capital 307 446 346 416 435 - - - - - Changes in Working Capital: - - - - - Inventories (59) (96) 40 (60) (51) Biological assets (45) (40) 5 (34) (29) Trade and other receivables (30) (14) 10 (15) (13) Other assets (8) 8 - - - Trade and other payables 67 33 107 38 33 Provisions (12) (13) - - - Other liabilities 1 4 - - - Net cash flows from operations before tax 221 328 509 345 374 Income taxes paid (80) (72) (40) (56) (58) Net cash flows from operating activities 140 256 469 289 316 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 22. PRINSEP CAPITAL Cash flows used in investing activities - - - - - Acquisition of subsidiaries - (2) - - - Additional investment in joint ventures (2) - - - - Purchase of property, plant and equipment (Note 23B) (212) (221) (194) (183) (199) Proceeds from disposal of property, plant and equipment 3 6 - - - Proceeds from disposal of investment properties 8 - - - - Proceeds from disposal of investment in other financial assets - - - - - Proceeds from disposal of assets held for sale - - - - - Proceeds from disposal of subsidiary, net of cash disposed of (Note 18) - - - - - Purchase of investment properties - (0) - - - Purchase of financial assets (5) (0) - - - Purchase of biological assets (27) (16) - - - Purchase of intangible assets (3) (3) - - - Purchase of land use rights (3) (2) - - - Interest income received 4 4 3 6 6 Net cash flows used in investing activities (237) (235) (191) (177) (193) - - - - - Cash flows (used in)/from financing activities - - - - - Dividends paid by subsidiary to non-controlling interests (25) (42) - - - Dividends paid to equity holders of the Company (13) (7) - - - Proceeds from issuance of shares - - - - - Proceeds from issue of bonds 320 - - - - Issue of new chares by combining entities under resturcturing exercise - - - - - Proceeds from issue of new shares by a subsidiary to non-controlling interests 8 - - - - Proceeds from disposal of shares in subsidiary to non-controlling interests without change in control - - - - - Acquisition of non-controlling interests without change in control - - - - - Transaction cost paid for acquisition of non-controlling interests (1) (223) - - - Decrease in cash restricted in use 1 0 - - - Purchase of treasury shares by the Company (5) (1) - - - Purchase of treasury shares by subsidiary (0) - - - - Buy back of bonds payable - - - - - Repayment of bonds payable (315) - - - - Net movements in shareholders' loans - - - - - Increase in new bank loans - 276 - - - Increase/(decrease) in working capital loans 96 (5) - - - Interest expense paid (67) (83) (98) (104) (110) Net cash flows (used in)/from financing activities (1) (84) (98) (104) (110) - - - - - Net (decrease)/increase in cash and cash equivalents (98) (63) 180 8 13 Effect of exchange rate changes on cash and cash equivalents (3) (4) - - - Cash and cash equivalents, beginning balance 331 230 164 344 351 Cash and cash equivalents, ending balance 230 164 344 351 364 Cash Flow Statement (continued)Appendix 11 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 23. PRINSEP CAPITAL Peer ComparablesAppendix 12 Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 24. PRINSEP CAPITAL Risk AssessmentAppendix 13 Probability LowMediumHigh Low Medium High Impact Demand-supply imbalances in animal proteins Disease outbreaks Strong competition in ambient food Fluctuating prices of animal feed inputs FX RisksHigh net gearing Appendix 25th Mar 2019 Prepared by: Bryan Tan Jun Han, Kenny Chia Lim Rui Feng Rachel, Yee Jin Koi

- 25. PRINSEP CAPITAL Metric Units Formula Application Cows & Dairy Milk production Milk yield l/qty Milk production/Dairy Cows Measure of production efficiency. Higher yield generally means less inputs per production unit. Milk premium dollars Milk product revenue/(Milk Products Sold * Average Milk Price) Milk price received by farm compared to other farms. Premium >1 is desirable and premium <1 is undesirable Total dairy cows qty Number of dairy cows Herd size comparison Intensity of Livestock Production Livestock Density qty/ ha Dairy cows / Non-Cash Crop Area Measures land use intensity for dairy cows Labor Intensity hours/ ha Annual hours worked / farm area Indirect measure of technology, useful for comparing farm productivity. Feed Mix Fodder area ha/ ha Fodder area/ grass area Measures reliance of fodder in feeding strategy; can be used to infer land use footprints Grass area ha/ ha Maize area/ grass area Measures maize dependence in feeding strategy; can be used to infer land use footprints Chicken Feed Conversion Ratio (FCR) - Feed given / Animal weight gain Measures efficiency with which the bodies of livestock convert animal feed into the desired output, i.e. the efficiency of a feeding strategy. Lower FCRs are preferred. Stock to use Ratio (S/U) - Carryover stock / % of total use of the commodity Measures supply and demand interrelationships of commodities. When S/U goes down, prices go up. It is useful for measuring prices of agriculture commodities such as wheat, which are heavily used in chicken feed Day-old chick mortality % Day-old chicks alive / total day-old chicks Measures quality and is highly related to the price of the chicks that broiler farms must pay to the hatchery Average Selling Price (ASP) Dollars Net sales / number of products sold Average price of a product or commodity sold across channels or markets Swine Feed Conversion Ratio (FCR) - Feed given / Animal weight gain Measures efficiency with which the bodies of livestock convert animal feed into the desired output, i.e. the efficiency of a feeding strategy. Lower FCRs are preferred. Wean-to-finish productivity % % of pigs sold to primary market / % of pigs weaned or placed Measures pig sales and thus the demand for pigs Industry MetricsAppendix 14 Appendix 25th Mar 2019

- 26. PRINSEP CAPITAL Source: BioNinja Feed Conversion RatioAppendix 15 Appendix 25th Mar 2019

- 27. PRINSEP CAPITAL Broiler Production Industry StructureAppendix 16 Source: McKay, 2008 Swine Production Industry StructureAppendix 17 Source: Department of Agriculture and Fisheries Appendix 25th Mar 2019