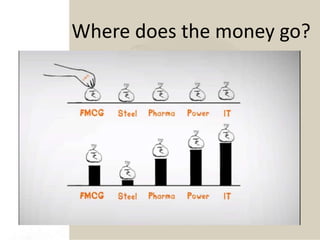

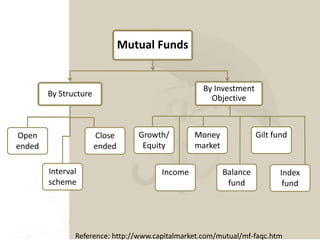

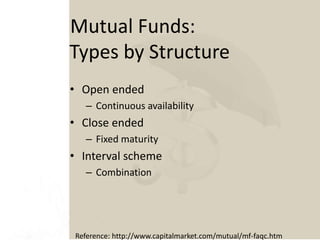

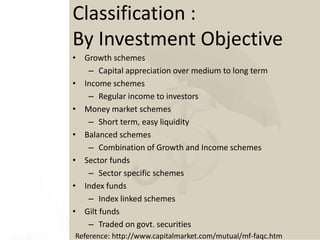

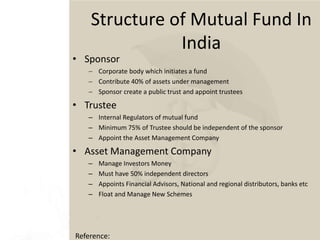

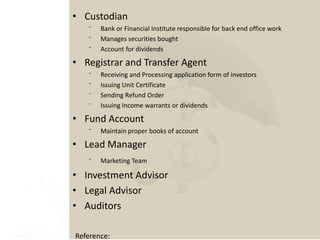

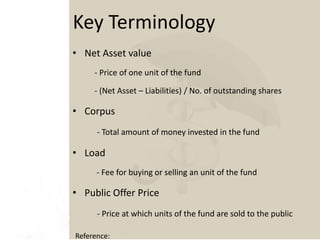

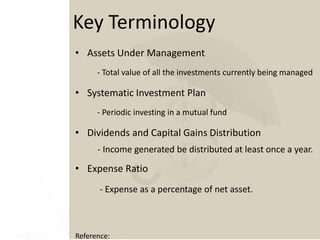

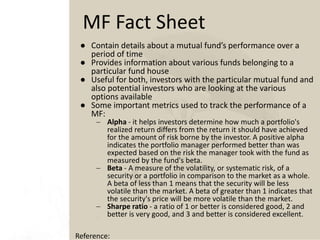

The document provides a comprehensive overview of mutual funds, including their structure, types, and key features such as professional management and diversification. It details the roles of various parties involved in mutual funds, such as sponsors, trustees, and asset management companies, and explains important terminology like net asset value and systematic investment plan. Additionally, performance metrics such as alpha, beta, and Sharpe ratio are highlighted to assess mutual fund performance.