This document appears to be a strategic marketing report for Liverpool Football Club. It includes a situational analysis covering a PESTLE analysis, industry analysis using Porter's 5 Forces and a forecast, market analysis of domestic and global markets, competitor analysis, financial analysis, customer analysis, and an internal analysis. It also includes sections on objectives and strategy, tactics, and references. The overall goal is to develop a 5-year strategic marketing plan to give the club strategic direction and competitive advantage by clarifying its mission, vision, and value proposition.

![14

Launch of City Square in 2010 (Manchester City , [no date])

Arsenal

Qualif ied f or Champions League f or 16th

consecutiv e y ear, securing additional

broadcasting rights

Commercial rev enue increase helped by shirt

and stadium sponsorship f rom Emirates

New lucrativ e kit supplier deal f rom Puma in

2014 of £150m will increase commercial

rev enues going f orward (Mintel, 2014)

Chelsea

Receiv ed €20m less in broadcasting in

2012/13 than in 2011/12 af ter winning

Champions League

New commercial deals with Delta and

Gazprom, plus shirt sponsorship renewal

with Samsung

Won UEFA Cup in 2012/13

Tottenham Hotspur

Only made it into the Champions League once, in 2010/11.

It can be v ery benef icial f inancially to participate in the

Champions League as v iewership f igures are as high as 4

billion globally (Heineken, 2013)

New 5 y ear deal with Under Armour worth £10m per

season

Dual shirt sponsorship agreement

Match day rev enue decreased –limited by stadium capacity

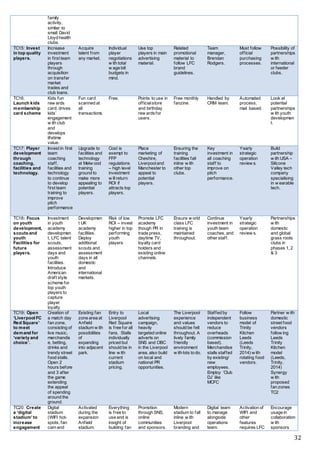

1.5.5 Total wages as a percentage of revenue over 5 years

Real Madrid, Bayern Munich and Manchester

United benefit from economies of scale, enabling

them to sustain financially healthy low wage bills.

(Fig. 10)

Manchester City has invested, on average, 95% of

their total revenue on wages over the past 5 years

(Fig.12). Although they have since been penalised

by UEFA for breaching FFP rules (Herbert, 2014),

the investment in players contributed to doubling

their broadcasting revenue and increasing their

commercial revenue by 800% over a 5 year

period, resulting in lower wage bills effective from

2011/12.

Investment in the team manager and players is

core to the success of the team and the overall business success (MMU, 2014). According to Deloitte

(2014b), six of the seven clubs that finished at the top of the Premier League in 2012/13 had above

average wage bills at £89m.

1.5.6 Revenue per ticket sold (RPTS)

Close rivals Chelsea lead the way on average RPTS, over the seasons 2008/09 – 2012/13, with a figure of

£1,724. (Fig. 11)

This could be a result of the affluent area around the

stadium, as well as the multiple hospitality package

offerings, the Michelin Star restaurants and hotel facilities

on-site (Chelsea, [no date] a).

Manchester City boast the lowest season ticket of the

Premier League (Deloitte, 2014), which likely contributes

to their low average RPTS.

However, it is noted that this figure is increasing year on

year (Fig. 10) potentially due to a rise in fan pride, glory

seekers and wealthy international visitors, and the

introduction of ‘City Square’ in 2010 (Manchester City,

[no date]a).

LFC’s RPTS is reasonable, however, there is “scope for

improvement “(MMU, 2014).

Figure10

Figure11](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-14-320.jpg)

![21

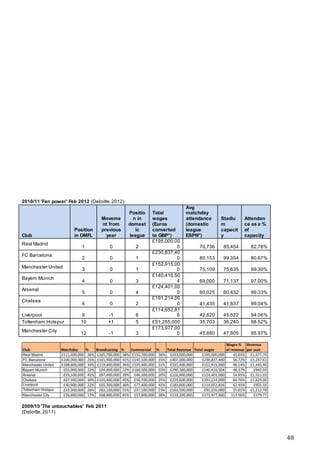

1.7 - Internal analysis

1.7.1 Dynamic Capabilities Value chain: Brand Heritage and Community of Fans

Supporting Activities

Owner:Fenway Sports Group (FSG) took ov er the club in October 2010 and hav e ‘…a prov en track record in sports marketing, asset maximization, stadium regeneration, contra branding f ertilization, strategic management and

inv estment, and international business dev elopment’ (MMU, 2014:23). The takeov er helped LFC negotiate higher v alued sponsorships, howev er, on-pitch perf ormance has not been as successf ul (MMU, 2014). FSG is based in

North America and also owns Major League Baseball team Boston Red Sox, Fenway Sports Management (FSM) and New England Sports Network (NESN), amongst other companies (MMU, 2014). This could prov ide additional

exposure and sponsorship opportunities f or LFC.

HQ & Management:Managing Director Ian Ay re brought all commercial aspects of the organisation in-house to enable LFC to hav e more control ov er its prof itability . LFC saw commercial rev enue up 85% ov er 2007-2012 af ter

this change was implemented (MMU, 2014). A new of f ice has been opened in London ‘to realise commercial potential’ (Joy , 2014), and Billy Hogan was hired as the Chief Commercial Director in 2012 to boost the v alue of the

brand (Joseph, 2012).

Newly appointed Chief Media Of f icer, Matthew Baxter, has been employ ed in an ef f ort to boost reach of digital content to ov erseas f ans (Joseph, 2013a).

Managementand support (Football Team): Brendan Rodgers manages the f irst team, along with 19 other staf f who support the team, comprising of assistant coaches, analy sts, phy siotherapists and consultants to name a

f ew (Liv erpool FC, [no date]a). Brendan Rogers joined the club in 2012, and has since signed 24 play ers f or LFC – many of those signed hav e been y oung play ers inv ested in f or the f uture, howev er, Sav age (2014) believ es that 20

of the signings don’t meet the mark. LFC also hav e ov er 40 play ers signed to their Under 21s and Under 18s squads through the ‘Academy ’, which current captain Gerrard joined when he was nine y ears old (BBC Sport, 2015),

prov ing the Academy has a history of success. They also hav e a successf ul women’s team – Liv erpool Ladies FC (ITV News, 2014).

Corporate Social Responsibility:LFC were awarded the ‘Community Mark’ in 2009 f or their inv estment in local and ov erseas communities, with a f ocus on ‘…education, health, social inclusion, phy sical activ ity and charity

support…’ (MMU, 2014:20). Although their community work benef its ev ery one, most initiatives aid y ounger people in the community by partnering with local schools.

Brand and Marketing:LFC has a strong brand, rich with heritage (Rogers, 2013), with the brand being v alued at £279m in 2014 and ranked 8th

highest f ootball brand in the world (Brand Finance, 2014). The LFC brand is

reportedly the 5th

most inf luential sports brand in licensing (Crookes, 2013). Brand Finance CEO, believ es that brand v alue can be lev eraged to grow rev enue (Brand Finance, 2014). The LFC brand is ‘…about inclusiv eness,

society , community and respect’ (MMU, 2014:22), resonating with f ans internationally . LFC works with its partners to create ‘…innov ativ e and measurable marketing programmes that consistently meet and surpass their business

objectiv es’ (Liv erpool FC, [no date]b).

Primary Activities

Players & Team:LFC

currently employ 3 of the top

100 f ootball play ers in the

world (Sedghi and Arnett,

2014), this could result in

increased brand attractiv eness

and improv e on-pitch

perf ormance, leading to

rev enue growth. Howev er,

long-serv ing captain Stev en

Gerrard is due to depart the

club at the end of the (Smith,

2015) and the team will need

to be strengthened (Brand

Finance, 2014). Wage bills are

also v ery high considering lack

of top play ers (Sav age, 2014).

The f irst team tour

international markets ahead of

the f ootball season (MMU,

2014) to grow interest.

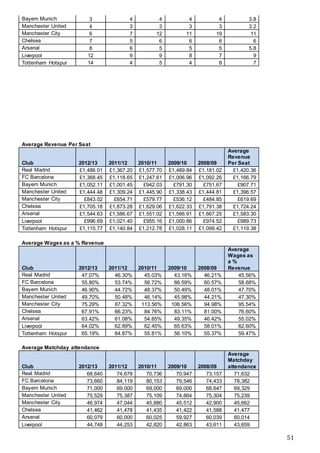

Stadium & Facilities:Stadium capacity is

currently 45,522 with plans to expand to

58,000 (Menezes, 2014), as stadium capacity

utilisation rate is so high. As well as of f ering

v arious hospitality packages, conf erence

f acilities, stadium and museum tours (MMU,

2014), and prov iding additional f acilities f or

f amilies (Family Park & Family Zone), LFC are

committed to improv ing f an experience by

making changes based on f an f eedback

(Liv erpool FC, [no date]c). It is also used f or

hosting ev ents like tribute acts and Christmas

parties. (Liv erpool FC, [no date]d). The Anf ield

Stadium has receiv ed the highest percentage

of ‘excellent’ ratings on TripAdv isor, compared

to competitors (see appendix 3). LFC of f er f ree

Wi-Fi access to the f ans in the 12,000-seater

Centenary Stand, howev er, they hav e no

plans to roll this out to the rest of the stadium

(Rey nolds, 2013). LFC can collect data on the

f ans who use the Wi-Fi (Joseph, 2013b)

Stores & Merchandise:

LFC hav e a wide range of

branded and licensed

merchandise (MMU, 2014).

Branded merchandise can

be purchased at 8 of f icial

club stores throughout the

UK, Northern Ireland,

Republic of Ireland and

Malay sia, with concessions

in Indonesia (Liv erpool FC

Store, [no date]), online, and

through other partnered

retailers. Replica kits and

f ootball accessories, such

as f ootball boots, make up

the bulk of the sales (MMU,

2014). LFC also plan to

open of f icial stores in

Thailand and Indonesia

(Liv erpool FC, 2014).

Subscriptions (Membership &

TV/Web/Mobile):LFC of f er

competitiv ely priced junior, light, f ull and

international membership (MMU, 2014;

see appendix 1 f or price comparison with

competitors). They are also v ery

accessible, hav ing a TV channel av ailable

on pay -TV packages in the UK, and LFC

TV Go (an on-demand serv ice av ailable

digitally ) f or both UK and international

f ans, which generate ov er £5m annually

(MMU, 2014). LFC are the most activ e

sports brand on social media (MMU,

2014), creating localised pages to

increase engagement and loy alty

ov erseas (Joseph, 2013c; Joseph, 2013a)

and also hav e a dedicated online f an area

on their website – ‘theKOP’, increasing

f ans opportunities to interact f urther

(Liv erpool FC, [no date]e). There are also

multiple mobile apps av ailable to

download (Liv erpool FC, [no date]f ),

adding to f an experience.

On-pitch

Performance:

Broadcasting rev enue

increases with on-pitch

success (MMU, 2014).

In the 2012/13 season,

broadcasting rev enues

accounted f or 31% of

total rev enue at

£63.9m, approximately

£40m less than close

riv als Chelsea and

Manchester City

(Deloitte, 2014), On-

pitch success can also

be linked to an increase

in sales of

merchandise,

subscriptions and

match day tickets,

whilst enabling LFC to

negotiate bigger

sponsorship deals.

Sponsorship, Partnerships &

Franchises:LFC hav e 3 main

sponsors, 14 global partners and 4

regional marketing partners (in

Thailand, Malay sia, Singapore and

India). The partnerships are committed

to putting f an rewards and engagement

f irst (Liv erpool FC, [no date]b).

LFC of f er a co-branded rewards credit

card (MBNA, [no date]), which allows

LFC to collect data on f ans. LFC of f er

coaching to play ers all ov er the world

through their Soccer School and

International Football Academy

programmes (MMU, 2014). This driv es

f an recruitment and engagement

through brand exposure internationally .

Figure 16: Porter's (1980) Value Chain adapted by Atkinson (2010)

CompetitiveAdvantage](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-21-320.jpg)

![27

It is recommended that LFC increase engagement and interaction opportunities in these countries by

growing physical store presence, supporting international fan zones and continuation of overseas pre-

season tours, introduction of loyalty rewards and localised partnerships.

LFC may not currently have the capabilities in-house to exploit these markets to their full potential and

should look to recruit people or out-source local agencies with experience dealing in these markets in order

to meet fans wants and needs.

Strategic Choice 2 (ST2): Option 4; Expand commercial revenue income opportunities

LFC are in a poor position financially (Section 1.8) yet there are a significant number of opportunities

available to them to expand their commercial revenue stream, both in emerging and existing markets,

where fans exist in their millions (1.6). LFC can implement activities to increase brand loyalty and

preferability by building a stronger presence internationally, for example through regional sponsorships.

However, there is a risk of over-commercialising the brand.

Strategic Choice 3 (ST5): Invest in international fan acquirement (Phase 2, 3, 4A, 4B)

There are opportunities to attract potential fans in emerging markets that have an increasing interest in the

Premier League, specifically, the USA, Australia and South Africa, where LFC fan bases are growing

(Section 1.3).

There are also opportunities to acquire fans in countries that have shown high interest in football generally.

The four key market segments identified as the best targets for LFC are segments 2, 3, 4A and 4B (Section

2.6) with a primary focus year one on USA and Australia.

It will be beneficial for LFC to build further brand awareness in these markets to meet this demand.

However, as these markets are still in their infancy, high acquisition rates cannot be guaranteed.

Strategic Choice 4 (ST4): Option 14; Invest in, develop and restructure first team

Figure 7 shows the correlation between on-pitch success and club revenues. As the two are intrinsically

linked, LFC should place a strong focus on improving the first team through player investment, team

restructure and youth development.

LFC’s long-serving history of success means the club has the capabilities to support the strategy, however,

due to their poor financial status, there must be extreme care and consideration in terms of player

investment - taking into account wages as a percentage of revenue to ensure FFP guidelines are met.

It is recommended to also consider investing in players who are successful both on-pitch and off, in order to

strengthen commercial marketing messages through leveraging popular players’ personalities.

This strategy will also raise the likelihood of securing places in the European competitions, increasing

brand awareness and generating more broadcasting revenue.

Strategic Choice 5 (ST5): Option 16; Expand match day revenue income opportunities

Match day revenues currently account for the lowest proportion of LFC’s income (Section 1.5). As the

stadium expansion is now underway, it is the perfect time to instigate changes to the stadium that will

increase average revenue per ticket sold.

Close competitors Manchester City increased their match day revenues by nearly 60% from 2010 (Section

1.5). Contributing to this was the introduction of ‘City Square’ where fans are encouraged to attend pre and

post-match entertainment, as well as a bar and café (Manchester City, [no date]).

Although LFC may not have the land to replicate this, they can make changes within the stadium to

increase match day experience, such as trendy street food vendors (which reduces paid staff costs and

enables LFC to charge rent for the hiring of concession stalls), introduction of new technology to the

stadium and entertainment, encouraging fan attendance and engagement. There is a risk of alienating

traditional fans with this strategy.](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-27-320.jpg)

![36

Abell, D. F. and Hammond J.S. (1979) Strategic Marketing Planning: Problems and Analytical

approaches. Englewood Cliffs, NJ: Prentice-Hall. Cited by: Wilson, R.M.S and Gilligan, C. (2005)

Strategic Marketing Management: Planning, Implementation & Control. 3rd

Ed., Oxford: Butterworth-

Heinemann

Adamson. G., Jones. W. & Tapp. A (2005) ‘From CRM to FRM: Applying CRM in the football industry.’

Journal of Database Marketing & Customer Strategy Management. Vol. 13, no. 2, pp.156-172

Allianz Arena (no date) General information about the Allianz Arena [Online] [Accessed on 6th

January

2015] https://www.allianz-arena.de/en/fakten/allgemeine-informationen/

Andrew, J. (2014). ‘Liverpool fans to continue protest over high ticket prices despite owner John Henry

making contact’ The Daily Mail [Online] [Accessed 15 December

2014]http://www.dailymail.co.uk/sport/football/article-2859189/Liverpool-fans-continue-protest-high-

ticket-prices-despite-owner-John-Henry-making-contact.html.

Arsenal ([no date]a) The real capacity of Emirates stadium [Online] [Accessed on 6th

January 2015]

http://www.arsenal.com/155/unhoused-import-pages/latest-stadium-news/the-real-capacity-of-emirates-

stadium

Arsenal ([no date]b) Arsenal memberships 2014/15 [Online] [Accessed on 6th

January 2015]

https://www.eticketing.co.uk/arsenal/memberships.aspx?findmembership=1

Arsenal (2011) Info for members and TV Online subscribers [Online] [Accessed on 6th

January 2015]

http://www.arsenal.com/news/news-archive/info-for-members-and-tv-online-subscribers

Atkinson, D. (2010) Dynamic Capabilities Lecture. Manchester; Manchester Metropolitan University

Banyan. A (2010). Kick-off Frenzy: Asia and English Premier League. Available:

http://www.economist.com/blogs/banyan/2010/08/asia_and_english_premier_league . [online] [Accessed

22nd January 2015].

Barca TV (no date) Barca TV [Online] [Accessed on 6th

January 2015]

http://barcatv.fcbarcelona.com/shows

Bascombe, C. (2014). ‘Liverpool FC news: Anfield stadium construction begins with £115m interest-free

loan from FSG.’ The Telegraph [Online] [Accessed on 11th January 2015]

http://www.telegraph.co.uk/sport/football/teams/liverpool/11273448/Liverpool-FC-news-Anfield-stadium-

construction-begins-with-115m-interest-free-loan-from-FSG.html. [Online] [Accessed 11th Dec 2014].

BBC (2009) Premier League giants target India. [Online] [Accessed 18th

January 2015]

http://news.bbc.co.uk/1/hi/business/8083210.stm

BBC (2014a) UK retail sales rose by 0.8% in October as prices fell. [Accessed on 10th

January 2015]

http://www.bbc.co.uk/news/business-30125972

BBC (2015a) UK interest rates held at 0.5% by Bank of England [Online] [Accessed on 10th

January

2015] http://www.bbc.co.uk/news/business-30726535

BBC (2012a). Premier League rights sold to BT and BSkyB for £3bn. Available:

http://www.bbc.co.uk/news/business-18430036. [online] [Accessed 12th December 2014].

BBC (2014b). Price of Football: Tickers increases outstrips cost of living. Available:

http://www.bbc.co.uk/sport/0/football/29614980. [online] [Accessed 28th November 2014].

BBC News (2014b) ‘Liverpool signs airline Garuda as training kit partner.’ BBC News. [Online] 27th

January. [Accessed on 5th

January 2015] http://www.bbc.co.uk/news/25909401

BBC Sport (2014b) Real Madrid reveal £330m design for new Bernabeu stadium. [Online] [Accessed on

6th

January 2015] http://www.bbc.co.uk/sport/0/football/25978150](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-36-320.jpg)

![37

BBC Sport (2015) Steven Gerrard: Liverpool captain to leave at end of season. [Online] [Accessed on

20h

January 2015] http://www.bbc.co.uk/sport/0/football/30653547

BBC Sport. (2014c). ‘Liverpool under UEFA Financial Fair Play investigation.’ BBC News [Online]

[Accessed 15 December 2014] http://www.bbc.co.uk/sport/0/football/29356406.

BBC Sport. (2014a). Liverpool: Anfield protest against prices during Hull City game. [Online] [Accessed

on 7th

January 2015] http://www.bbc.co.uk/sport/0/football/29775393

Bingham, C. (2014) Customer Loyalty Is Dead. Long Live Engagement! Forbes [Online] [Accessed on

20h

January 2015] http://www.forbes.com/sites/oracle/2014/03/28/customer-loyalty-is-dead-long-live-

engagement/

Bland, B. (2013). Indonesia Football: English clubs pitch for fans as local league falls apart |

Beyondbrics. Available: http://blogs.ft.com/beyond-brics/2013/01/29/indonesia-bad-for-local-football-

teams-lucrative-for-uk-ones/ [online] [Accessed 18th November 2014].

Brand Finance (2014) BrandFinance® Football 50 2014 [Online] [Accessed on 10th

November

2014]http://www.brandfinance.com/knowledge_centre/reports/brandfinance-football-50-2014

Brassington, F. and Petitt, S. (2006), Principles of Marketing. 4th

Ed., Harlow: Financial Times Prentice

Hall.

Campbell, P. (2014). Manchester City top global pay table with average salaries of £5.3m a year.

[Online] [Accessed 22nd Jan 2015] http://www.theguardian.com/football/blog/2014/apr/15/manchester-

city-global-pay-table-chelsea-barcelona-real-madrid

Chelsea FC ([no date]a) On-site facilities. [Online] [Accessed 6th

January 2015]

http://events.chelseafc.com/on-site-facilities/

Chelsea FC ([no date]b) True Blue membership 2014/15 [Online] [Accessed on 6th

January 2015]

http://kr.chelseafc.com/membership

Chelsea FC ([no date]c) Videos [Online] [Accessed on 6th

January 2015]

http://www.chelseafc.com/videos/chelsea-tv-on-demand.html

Crookes, D (2014) Manchester United beat Liverpool to be names the most influential football club brand

in the world [Online] [Accessed 14th

January 2015] http://www.independent.co.uk/sport/football/news-

and-comment/manchester-united-beat-liverpool-to-be-named-the-most-influential-football-club-brand-in-

the-world-8932011.html

Crookes, D. (2013) ‘Manchester United beat Liverpool to be named the most influential football club

brand in the world.’ The Independent [Online] 11th

November [Accessed 19th

January 2015]

http://www.independent.co.uk/sport/football/news-and-comment/manchester-united-beat-liverpool-to-be-

named-the-most-influential-football-club-brand-in-the-world-8932011.html

Daily Mail. (2011). Manchester United tie up £40m shirt sponsor deal... for their training kit!. Available:

http://www.dailymail.co.uk/sport/football/article-2028801/DHL-spend-10m-year-sponsor-Manchester-

Uniteds-training-kit.html. [online] [Accessed 23rd December 2014].

Davies, P (2014) Spectator Sports – UK – April 2014 [Online] [Accessed December 20th

2014]

http://store.mintel.com/spectator-sports-uk-april-2014

Davies, P. (2014). Digital Trends Winter - UK - December 2014 – Executive Summary. [Accessed on 1st

January 2015] http://store.mintel.com/digital-trends-winter-uk-december-2014

Deloitte (2010) Spanish masters: Football Money League [Online] [Accessed 16th

November 2014]

https://www.deloitte.com/assets/Dcom-Ecuador/Local%20Assets/Documents/Estudios/100412-

ec_DeloitteFML2010.pdf](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-37-320.jpg)

![38

Deloitte (2011) The untouchables: Football Money League [Online] [Accessed 16th

November 2014]

http://www.deloitte.com/assets/Dcom-

Chile/Local%20Assets/Documents/Nuevos/cl(es)_FML2011_140211.pdf

Deloitte (2012) Fan power: Football Money League [Online] [Accessed 16th

November 2014]

http://www.deloitte.com/assets/Dcom-

Sweden/Local%20Assets/Documents/FootballMoneyLeague%202012-uk-sbg-dfml-2012-final120209.pdf

Deloitte (2013) Captains of industry: Football Money League [Online] [Accessed 16th

November 2014]

http://www.deloitte.com/assets/Dcom-

Azerbaijan/Local%20Assets/Documents/footballmoneyleague2013.pdf

Deloitte (2014a) All to play for: Football Money League [Online] [Accessed 16th

November 2014]

http://www2.deloitte.com/content/dam/Deloitte/uk/Documents/sports-business-group/deloitte-uk-deloitte-

football-money-league-2014.pdf

Deloitte (2014b) Annual Review of Football Finance 2014 infographic [Online] [Accessed 16th

December

2014] http://www.deloitte.co.uk/aem/arff-2014-infographic.cfm

Deloitte. (2014). Annual Review of Football Finance 2014. [Online] [Accessed: 13th Jan 2015.]

http://www2.deloitte.com/uk/en/pages/sports-business-group/articles/annual-review-of-football-

finance.html

Dibb, S. Simkin, L. Pride, W. Ferrell, OC (2006) Marketing Concepts and strategies. 5th

edition. Boston:

Charles Hartford

DiBella M.F. (2013). Statistically Ranking the World's Top 20 Football Leagues. [Online] [Accessed 24th

December 2014] http://bleacherreport.com/articles/1458287-ranking-the-top-20-world-football-leagues-

statistically.

ESPN (no date) Football points table. [Online] [Accessed on 20th December 2014]

http://www.espn.co.uk/football/sport/tournament/points.html?event=28;season=2011%2F12

ESPN FC ([no date]a) Real Madrid statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/real-madrid/86/statistics/performance

ESPN FC ([no date]b) Barcelona statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/barcelona/83/statistics/performance

ESPN FC ([no date]c) Bayern Munich statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/bayern-munich/132/statistics/performance

ESPN FC ([no date]d) Manchester United statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/manchester-united/360/statistics/performance

ESPN FC ([no date]e) Manchester City statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/manchester-city/382/statistics/performance

ESPN FC ([no date]f) Chelsea statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/chelsea/363/statistics/performance

ESPN FC ([no date]g) Arsenal statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/arsenal/359/statistics/performance

ESPN FC ([no date]h) Liverpool statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/liverpool/364/index

ESPN FC ([no date]i) Tottenham Hotspur statistics. [Online] [Accessed on 20th December 2014]

http://www.espnfc.com/club/tottenham-hotspur/367/statistics/performance](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-38-320.jpg)

![39

FAME (2014a) 10 year financial data (2004 – 2013), Chelsea Football Club Limited (01965149). [Online]

[Accessed on 7th November 2014] https://fame-bvdinfo-com.ezproxy.mmu.ac.uk/version-

2015115/Report.serv?_CID=130&context=1G7M9GN4BXWOQV3

FAME (2014b) 10 year financial data (2004 – 2013), Manchester City Limited (02989498). [Online]

[Accessed on 7th November 2014] https://fame-bvdinfo-com.ezproxy.mmu.ac.uk/version-

2015115/Report.serv?_CID=437&context=1G7M9GN4BXWOQV3

FAME (2014c) 10 year financial data (2004 – 2013), The Liverpool Football Club And Athletic Grounds

Limited (00035668). [Online] [Accessed on 7th November 2014] https://fame-bvdinfo-

com.ezproxy.mmu.ac.uk/version-2015115/Report.serv?_CID=287&context=1G7M9GN4BXWOQV3

FAME (2014d) 10 year financial data (2004 – 2013), Tottenham Hotspur Limited (01706358). [Online]

[Accessed on 7th November 2014] https://fame-bvdinfo-com.ezproxy.mmu.ac.uk/version-

2015115/Report.serv?_CID=512&context=1G7M9GN4BXWOQV3

FC Barcelona ([no date]a) Camp Nou. [Online] [Accessed on 6th

January 2015]

http://www.fcbarcelona.com/club/facilites-and-services/camp_nou

FC Barcelona ([no date]b) 2015 membership card renewal [Online] [Accessed on 6th

January 2015]

http://www.fcbarcelona.com/members/detail/card/2015-membership-card-renewal

FC Barcelona ([no date]c) Memòria Anual del FC Barcelona [Online] [Accessed 20th December 2014]

http://www.fcbarcelona.cat/club/premsa/detall/fitxa/memoria-anual-del-fc-

barcelona?_ga=1.126307976.402642577.1419427072

FC Bayern (2013) Bayern post landmark €400m plus turnover [Online] [Accessed 20th

December 2014]

http://www.fcbayern.de/en/news/news/2013/agm-2013-new-record-figures-400-million.php

FC Bayern (no date) My FCB.TV subscription [Online] [Accessed on 6th

January 2015]

https://www.fcbayern.de/en/registration/?service=FCBTV&returnUrl=http%3A///en

FC Bayern Forum (no date) How do I become a member of the club? [Online] [Accessed on 6th

January

2015] http://www.bayernforum.com/general-bayern-f13/how-do-i-become-a-member-of-the-club-

t6987.html

Financial Fair Play (2014) Financial Fair Play Explained [Online] [Accessed: 24th

January 2015]

http://www.financialfairplay.co.uk/financial-fair-play-explained.php

Financial Times. (2014).Currencies. [Online] [Accessed on 6h

December 2014]

http://markets.ft.com/research/Markets/Currencies

Foy, T., (2015) Building a global social network: A Case study on LFC. Southampton FC: Melbourne

Gibson, O. (2012) ‘Premier League TV rights set to top £5bn for first time.’ The Guardian [Online] 12th

November [Accessed 10th

December 2014] http://www.theguardian.com/football/2012/nov/12/premier-

league-tv-rights-5-bn

Gilligan. C. and Wilson, R. (2013) Strategic Marketing Management: Planning, implementation and

control. 3rd

Ed. New York: Routledge

Hall, R. (2014) ‘Juventus: Serie A alternative club guide’ The Guardian. [Online] 22nd

July [Accessed 10th

December 2014] http://www.theguardian.com/football/the-gentleman-ultra/2014/jul/22/juventus-serie-a-

alternative-club-guide-fans-trezeguet

Heineken (2013) HEINEKEN renews UEFA Champions League sponsorship. [Online] [Accessed 16th

December 2014] http://www.heineken.co.uk/article.php?article=1234567880

Herbert, I. (2014) ‘Manchester City fined £49m for breaching Uefa's financial fair play rules - and will see

their Champions League squad reduced.’ The Independent. [Online] 16th

May [Accessed on 5th

January](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-39-320.jpg)

![40

2015] http://www.independent.co.uk/sport/football/premier-league/manchester-city-fined-49m-for-

breaching-uefas-financial-fair-play-rules-9388532.html

Hill, C. W. L. (1988), ‘Differentiation Versus Low Cost or Differentiation and Low Cost: A Contingency

Framework.’ Academy of Management Review, Vol. 13, no. 3, pp. 401-412.

Hunter, A. (2013) ‘La Liga seeks collective TV rights deal to close gap on Premier League.’ The

Guardian [Online] 11th

April [Accessed 20th

December 2014]

http://www.theguardian.com/football/2013/apr/11/la-liga-television-rights-premier-league

IMF -International Monetary Fund (2014). WORLD ECONOMIC OUTLOOK (WEO) UPDATE An Uneven

Global Recovery Continues. [Online] [Accessed on 20h

January 2015]

http://www.imf.org/external/pubs/ft/weo/2014/update/02/

Inman, P (2014) Starting Salaries stagnant across the UK and wages may fall. [Online] [Accessed on

10th

January 2015] http://www.theguardian.com/money/2014/aug/11/salaries-stagnent-cipd-survey-uk-

inflation-wages

ITV News (2014) ‘Liverpool ladies hoping success will continue’. ITV News [Online] 16th

October

[Accessed on 10th

January 2015] http://www.itv.com/news/granada/update/2014-10-16/liverpool-ladies-

look-for-success-in-europe/

Joseph, S. (2012) Liverpool names chief commercial director. Marketing Week [Online] [Accessed on

15th

January 2015] http://www.marketingweek.com/2012/05/25/liverpool-names-chief-commercial-

director/

Joseph, S. (2013a) Liverpool FC names digital media chief. Marketing Week [Online] [Accessed on 15th

January 2015] http://www.marketingweek.com/2013/02/05/liverpool-fc-names-digital-media-chief/

Joseph, S. (2013b) Football clubs offset match-day revenues dip with real-time marketing. Marketing

Week [Online] [Accessed on 15th

January 2015] http://www.marketingweek.com/2013/07/05/football-

clubs-offset-match-day-revenues-dip-with-real-time-marketing/

Joseph, S. (2013c) Liverpool eyes fan boost through social content push. Marketing Week [Online]

[Accessed on 5th

January 2015] http://www.marketingweek.com/2013/01/25/liverpool-eyes-fan-boost-

through-social-content-push/

Joseph, S. (2014) Man Utd leads rush from football clubs for regional sponsorships. Marketing Week

[Online] [Accessed on 16th

November 2014] http://www.marketingweek.com/2014/08/21/man-utd-leads-

rush-from-football-clubs-for-regional-sponsorships/

Joy, S. (2014a) Appeal of Man U brand grows with sponsors despite on-pitch woes. Marketing Week

[Online] [Accessed on 16th

November 2014] http://www.marketingweek.com/2014/09/10/appeal-of-man-

u-brand-grows-with-sponsors-despite-on-pitch-woes/

Joy, S. (2014b) Liverpool FC moves to London to ‘realise commercial potential’. Marketing Week

[Online] [Accessed on 16th

November 2014] http://www.marketingweek.com/2014/10/10/liverpool-fc-

moves-to-london-to-realise-commercial-potential/

Kent, D. (2014). ‘Liverpool claim they have a worldwide fan base 580m people... just as well they are

looking to increase Anfield's capacity.’ The Daily Mail. [Online] [Accessed on 11th January 2015]

http://www.dailymail.co.uk/sport/football/article-2792400/liverpool-claim-worldwide-fan-base-580m-

people-just-looking-increase-anfield-s-capacity.html. [Online] [Accessed 12th January 2015].

Kohli A.K., Jaworski B.J. (1990) “ Market Orientation: The Construct, Research Propositions, and

Managerial Implications”, Journal or Marketing, 54 (April, 1990) pp.1-18.

Liverpool FC ([no date]a) Team. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/team](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-40-320.jpg)

![41

Liverpool FC ([no date]b) Corporate Charter. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/corporate/charter

Liverpool FC ([no date]c) Fan experience. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/fans/fan-experience

Liverpool FC ([no date]d) Events at Anfield. [Online] [Accessed on 15th

January 2015]

http://events.liverpoolfc.com/events-at-anfield

Liverpool FC ([no date]e) The Kop. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/fans/thekop/how-it-works

Liverpool FC ([no date]f) Apps and Games. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/fans/apps-and-games/uk

Liverpool FC ([no date]g) Benefits [Online] [Accessed on 6th

January 2015]

http://www.liverpoolfc.com/membership/benefits-prices

Liverpool FC ([no date]h) LFCTV Go [Online] [Accessed on 6th

January 2015]

http://www.liverpoolfc.com/video

Liverpool FC (2014) Reds open new store in Malaysia. [Online] [Accessed on 15th

January 2015]

http://www.liverpoolfc.com/news/latest-news/171572-reds-open-new-store-in-malaysia

Liverpool FC Store ([no date]) Store finder. [Online] [Accessed on 15th

January 2015]

http://store.liverpoolfc.com/stores/finder/

Manchester City ([no date]a) About City Square. [Online] [Accessed on 5th

January 2015]

http://www.mcfc.co.uk/Fans/City-Square/About-City-Square/About-City-Square

Manchester City ([no date]b) Be a Cityzen [Online] [Accessed on 6th

January 2015]

http://beacityzen.mcfc.co.uk

Manchester City ([no date]c) CityTV [Online] [Accessed on 6th

January 2015] http://www.mcfc.co.uk/citytv

Manchester United ([no date]a) Company information [Online] [Accessed on 6th

January 2015]

http://ir.manutd.com/company-information/history.aspx

Manchester United ([no date]b) Official membership [Online] [Accessed n 6th

January 2015]

http://www.manutd.com/en/Official-Membership/New-Prices.aspx

Manchester United ([no date]c) MUTV HD [Online] [Accessed on 6th

January 2015]

http://www.manutd.com/en/MUTV-New/MUTV-FaqsNew.aspx

Manchester United (2014) Manchester United. [Online] [Accessed 10th

December 2014]

http://ir.manutd.com/~/media/Files/M/Manutd-

IR/About%20Manchester%20United/manu_presentation.pdf

Markham, C. (2014). ‘Liverpool financial results: Reds post £50m loss, but insist club is moving in right

direction.’ [Online] [Accessed 15 December 2014] http://www.independent.co.uk/sport/football/premier-

league/liverpool-financial-results-reds-post-50m-loss-but-insist-club-is-moving-in-right-direction-

9167721.html.

MBNA (no date) The official Liverpool FC rewards credit card. [Online] [Accessed on 5th

January 2015]

https://apply.mbna.co.uk/UKNeoCCapp/entry?sc=1OASLFCIGC0041L&mc=OAGLFC005DP

McLaren D., (2013). ‘Liverpool FC’s Winning online presence’ The UK Sports Network [Online]

[Accessed 15th December 2014] http://www.theuksportsnetwork.com/liverpool-fcs-winning-online-

presence. [Online] [Accessed 22nd December 2014].](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-41-320.jpg)

![42

McNulty, P. (2013) Which is the Premier League's biggest club? BBC Sport [Online] [Accessed on 5th

January 2015] http://www.bbc.co.uk/sport/0/football/20974695

Menezes, J.D. (2014) ‘Liverpool's stadium development plans approved as Anfield expansion gets the

green light.’ The Independent. [Online] 23rd

September

http://www.independent.co.uk/sport/football/news-and-comment/liverpools-anfield-development-plans-

approved-as-anfield-expansion-gets-the-green-light-9750977.html

Miller, A. (2014). Manchester United and Real Madrid continue to top replica shirt sales charts by selling

an average of 1.5 million each year. Available: http://www.dailymail.co.uk/sport/football/article-

2738568/Manchester-United-Real-Madrid-continue-replica-shirt-sales-charts-selling-average-1-5m-

year.html. [online] [Accessed 18th November 2014].

Mintel (2014) Football – UK – November 2014 [Online] [Accessed: 25th

Jan 2015]

http://reports.mintel.com/display/679670/

MMU (2014) ‘Liverpool Football Club Level 6 Strategic Marketing Case Study’ MMU Business School

Mullock, S. (2015). Premier League set for TV revolution with EVERY GAME available for streaming

under £4billion new deal. [Online] [Accessed: 13th Jan 2015]

http://www.mirror.co.uk/sport/football/news/premier-league-set-tv-revolution-4956046

Neville, G., (2013) Football needs to act now. The game is sleepwalking towards a crisis over

agents[Online] [Accessed 25th

January 2015] http://www.dailymail.co.uk/sport/football/article-

2279744/Football-sleepwalking-crisis-agents-It-act-Gary-Neville.html

O’donell. K (2013) My football club made me miserable, so I started supporting another team. [Online]

[Accessed 6th

January 2015] http://www.theguardian.com/football/when-saturday-comes-

blog/2013/mar/14/football-club-miserable-support-another-team

Oanda (no date) Currency converter [Online] [Accessed on 5th

January 2015]

http://www.oanda.com/currency/converter/

ON S (2013). Table A38 - Income and source of income by age of household reference person, 2013

(Excel sheet 46Kb). [Online] [Accessed: 22nd Jan 2015.]

http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0CCMQFjAA&url=http%3A

%2F%2Fwww.ons.gov.uk%2Fons%2Frel%2Ffamily-spending%2Ffamily-spending%2F2014-

edition%2Frft-a38-final-

2013.xls&ei=2qDGVIT5BoaW7AaavoG4Bw&usg=AFQjCNGDbyfzO5uUY1TqlDLKwNs6E5rOfQ&sig2=7r

WLZge1aNxFl6V1fqgKWA&bvm=bv.84349003,d.ZGU

Padmanabhan, L (2014) TTIP: The EU-US trade deal explained [Online] [Accessed on 10th

January

2015] http://www.bbc.co.uk/news/uk-politics-30493297

Pearce, J (2014) Exclusive – 580 million reasons why Liverpool FC Chief Bill Hogan is excited about

Red’s future. [Online] [Accessed 19th

January 2015]

http://www.liverpoolecho.co.uk/sport/football/football-news/exclusive---580-million-reasons-7922473

Platini, M (2014) Financial Fair Play: All you need to know about how it works [Accessed on 1st January

2015] http://www.bbc.co.uk/sport/0/football/29361839

Porter, M.E. (1980) Competitive Strategy. Free Press; New York. Cited by: Wilson, R.M.S and Gilligan,

C. (2005) Strategic Marketing Management: Planning, Implementation & Control. 3rd

Ed., Oxford:

Butterworth-Heinemann

Powell, M (2012) Marketing planning Manchester Metropolotan University, 15, 22/10/12 Lecture 5 Brand

Management

Premier League (no date) About the Premier League. [Online] [Accessed 16th

December 2014]

http://www.premierleague.com/en-gb/about/the-worlds-most-watched-league.html](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-42-320.jpg)

![43

Premier League Survey. (2012) Premier League Fan Survey – Research and Insight Season 2011/12. .

[Online] [Accessed on 14th October 2014] http://fansurvey.premierleague.com

Premier League. (2013x). 2013 Asia Cup Trophy Line Up Announced. Available:

http://www.premierleague.com/en-gb/news/news/2012-13/mar/2013-barclays-asia-trophy-

announced.html. [online] [Accessed 22nd January 2015].

Real Madrid ([no date]a) International Madridistas [Online] [Accessed on 6th

January 2015]

http://www.realmadrid.com/en/fans/madridistas/international

Real Madrid ([no date]b) Realmadrid TV [Online] [Accessed on 6th

January 2015]

http://www.realmadrid.com/en/fans/real-madrid-tv

Real Madrid (2014) Real Madrid 2013-14 Annual Report. [Online] [Accessed on 15th

December 2014]

http://www.realmadrid.com/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blo

btable=MungoBlobs&blobwhere=1203349468675&ssbinary=true

Repucom (2014a) World Football - full report [Online] [Accessed on 17th October 2014]

http://repucom.net/media/world-football

Repucom. (2014b). European Football Kit Supplier Report Online. Available:

http://repucom.net/reports/european-football-kit-supplier-report-2014. [online] [Accessed 19th November

2014].

Reynolds, C. (2014) ‘Chelsea announce plans that could lead to Stamford Bridge expansion.’ The

Independent [Online] 18th

June [Accessed on 6th

January 2015]

http://www.independent.co.uk/sport/football/premier-league/chelsea-announce-plans-that-could-lead-to-

stamford-bridge-expansion-9545508.html

Reynolds, J. (2013) Liverpool FC's Wi-Fi woes show football clubs are still struggling with unproven

technology. The Drum [Online] [Accessed on 6th

January 2015]

http://www.thedrum.com/opinion/2013/10/18/liverpool-fcs-wi-fi-woes-show-football-clubs-are-still-

struggling-unproven

Ritson, M. (2014) There’s only one Man Utd but several Manchester Cities. Marketing Week [Online]

[Accessed on 10th

January 2015] http://www.marketingweek.com/2014/08/20/theres-only-one-man-utd-

but-several-manchester-cities/

Rogers, P. (2013) England's greatest club – Infographic. Liverpool Football Club [Online] [Accessed on

15th

January 2015] http://www.liverpoolfc.com/news/latest-news/151404-england-s-greatest-club-

infographic

Savage, R. (2013). Robbie Savage reveals footballers' tricks to engineer a transfer. [Online] [Accessed

16th

Jan 2015] http://www.bbc.co.uk/sport/0/football/23703265

Savage, R. (2014) Liverpool signings by Brendan Rodgers - hits or misses? BBC Sport [Online]

[Accessed on 15th

January 2015] http://www.bbc.co.uk/sport/0/football/30516598

Sedghi, A. and Arnett, G. (2014) ‘The world's best footballers in 2014: by nationality, leagues and clubs.’

The Guardian. [Online] 24th

December [Accessed on 10th

January 2015]

http://www.theguardian.com/football/datablog/2014/dec/24/the-worlds-best-footballers-in-2014-by-

nationality-leagues-and-clubs

Smith, A (2013) Wealthy foreign investors in Premier League Clubs want more value for their buck

[Online] [Accessed 7th

January 2015] http://www.telegraph.co.uk/sport/football/teams/cardiff-

city/10540074/Wealthy-foreign-investors-in-Premier-League-clubs-want-more-value-for-their-buck.html

Smith, B. (2013) Steven Gerrard: Liverpool captain set for LA Galaxy move. BBC Sport [Online]

[Accessed on 15th

January 2015] http://www.bbc.co.uk/sport/0/football/30700069](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-43-320.jpg)

![44

Stewart, H (2015) Interest rate delay and living standard rise good news for George Osborne. [Online]

[Accessed on 20h

January 2015] http://www.theguardian.com/business/2015/jan/21/interest-rate-living-

standard-george-osborne-economics

Tapp. A. & Clowes., J (2002) ‘From “Carefree Casuals” to “Proffessional Wanderers”: Segmentation

possibilities for football supporters.’ European Journal of Marketing. Vol. 36. Issue 11/12

Taylor, D. (2011). Manchester City bank record £400m sponsorship deal with Etihad Airways. Available:

http://www.theguardian.com/football/2011/jul/08/manchester-city-deal-etihad-airways. [online] [Accessed

28th November 2014].

The Economist. (2011). Little Red Card: China and Hong Kong football industries. Available:

http://www.economist.com/node/21541716. [online] [Accessed 22nd January 2015].

The Guardian (2014) ‘Liverpool to be investigated by Uefa over alleged breach of FFP rules.’ The

Guardian. [Online] 25th

September [Accessed on 10th

January 2015]

http://www.theguardian.com/football/2014/sep/25/liverpool-investigated-ffp-uefa-monaco

The Guardian (2014a) Online shopping on mobiles overtakes desktop for first time. [Accessed on 10th

December 2014] http://www.theguardian.com/business/2014/sep/02/online-shopping-mobiles-overtakes-

desktop

Tottenham Hotspur ([no date]a) History of White Hart Lane [Online] [Accessed on 6th

January 2015]

http://www.tottenhamhotspur.com/the-stadium/history/

Tottenham Hotspur ([no date]b) Join the club [Online] [Accessed on 6th

January 2015]

http://www.tottenhamhotspur.com/uploadedFiles/Shared_Assets/Documents/Membership/Adult-

Membership-Graphic.pdf

Tottenham Hotspur ([no date]c) Spurs TV. [Online] [Accessed on 6th

January 2015]

http://www.tottenhamhotspur.com/spurs-tv/ipb-broadcasters/

TripAdvisor ([no date]a) Bernabeu stadium (Estadio Santiago Bernabeu). [Online] [Accessed on 8th

January 2015] http://www.tripadvisor.co.uk/Attraction_Review-g187514-d796251-Reviews-

Bernabeu_Stadium_Estadio_Santiago_Bernabeu-Madrid.html

TripAdvisor ([no date]b) Camp Nou. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g187497-d271009-Reviews-Camp_Nou-

Barcelona_Catalonia.html

TripAdvisor ([no date]c) Allianz Arena. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g187309-d594437-Reviews-Allianz_Arena-

Munich_Upper_Bavaria_Bavaria.html

TripAdvisor ([no date]d) Old Trafford. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g1020874-d2263052-Reviews-Old_Trafford-

Trafford_Greater_Manchester_England.html

TripAdvisor ([no date]e) Etihad stadium. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g187069-d4302956-Reviews-Etihad_Stadium-

Manchester_Greater_Manchester_England.html

TripAdvisor ([no date]f) Stamford Bridge stadium. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g186338-d6426418-Reviews-Stamford_Bridge_Stadium-

London_England.html

TripAdvisor ([no date]g) Emirates stadium. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g186338-d1056442-Reviews-Emirates_Stadium-

London_England.html](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-44-320.jpg)

![45

TripAdvisor ([no date]h) Anfield stadium. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g186337-d999329-Reviews-Anfield_Stadium-

Liverpool_Merseyside_England.html

TripAdvisor ([no date]i) White Hart Lane. [Online] [Accessed on 8th

January 2015]

http://www.tripadvisor.co.uk/Attraction_Review-g186338-d6426421-Reviews-White_Hart_Lane-

London_England.html

UEFA. (2010). FFP Regulations. [Online] [Accessed 13th

January 2015]

http://www.uefa.com/MultimediaFiles/Download/Tech/uefaorg/General/01/50/09/12/1500912_DOWNLO

AD.pdf.

Walmsley, D (2014) Football – UK – November 2014 [Online] [Accessed: 25th

Jan 2015]

http://reports.mintel.com/display/679670/

White, D. (2011) ‘Manchester City plan for bigger stadium.’ The Telegraph [Online] 22nd

October

[Accessed on 6th

January 2015] http://www.telegraph.co.uk/sport/football/teams/manchester-

city/8843970/Manchester-City-plan-for-bigger-stadium.html

Wilson, B. (2009). Premier League Giants Target India. Available:

http://news.bbc.co.uk/1/hi/business/8083210.stm. [online] [Accessed 22nd January 2015].

Wilson, R.M.S and Gilligan, C. (2005) Strategic Marketing Management: Planning, Implementation &

Control. 3rd

Ed., Oxford: Butterworth-Heinemann

World Bank. (2014a). World Population Figures. Available:

http://data.worldbank.org/indicator/SP.POP.TOTL. [online] [Accessed 15th December 2014].

World Bank. (2014b). 5 Year GDP Figures. Available:

http://data.worldbank.org/indicator/NY.GDP.MKTP.CD. [online] [Accessed 15th December 2014].

World Bank. (2014c). UK Data Analysis. Available: http://data.worldbank.org/country/united-kingdom.

[online] [Accessed 15th December 2014].

World Bank. (2014d). Worldwide GDP per Capita. Available:

http://data.worldbank.org/indicator/NY.GDP.PCAP.CD. [online] [Accessed 20th January 2015].

Zolfagharifard, Z (2015) Global warming believers are like a hysterical ‘cult’: MIT scientist compares

‘climate alarmists’ to religious fanatics [Accessed on 1st January 2015]

http://www.dailymail.co.uk/sciencetech/article-2922553/Global-warming-believers-like-hysterical-cult-

MIT-scientist-compares-climate-alarmists-religious-fanatics.html](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-45-320.jpg)

![52

Tottenham Hotspur 36,029 36,026 35,703 35,794 35,928 35,896

*Sources: ESPN FC ([no date]a), ESPN FC ([no date]b), ESPN FC ([no date]c), ESPN FC ([no date]d), ESPN FC

([no date]e), ESPN FC ([no date]f), ESPN FC ([no date]g), ESPN FC ([no date]h), ESPN FC ([no date]i),

Average Top 100 players (Sedghi

and Arnett, 2014)

Club 2014 2013 2012

Average

Top 100

players

Real Madrid 9 9 10 9

FC Barcelona 10 11 12 11

Bayem Munich 12 11 10 11

Manchester United 6 4 5 5

Manchester City 6 6 8 7

Chelsea 9 8 8 8

Arsenal 4 4 1 3

Liverpool 3 1 1 2

Tottenham Hotspur 1 3 2 2

Average adult membership

Club Adult

Membership

prices

Average adult

membership price

Euro to GBP

(conversion rate

0.781302 on 9th

Jan 2015)

Real Madrid 30-65 euros € 47.50 £37.11

FC Barcelona 177 euros € 177.00 £138.26

Bayem Munich 40-60 euros € 50.00 £39.05

Manchester United £32.00 £32.00 £32.00

Manchester City £35.00 £35.00 £35.00

Chelsea 25-45 £35.00 £35.00

Arsenal 34-39 £36.50 £36.50

Liverpool 26.99-43.99 £35.49 £35.49

Tottenham Hotspur 42-57 £49.50 £49.50

*Sources: Real Madrid ([no date]a), FC Barcelona ([no date]b), FC Bayern Forum (no date),

Manchester United ([no date]b), Manchester City ([no date]b), Chelsea FC ([no date]b),

Arsenal ([no date]b), Liverpool FC ([no date]g), Tottenham Hotspur ([no date]b).](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-52-320.jpg)

![53

Appendix 2: Club accessibility

Club

Domestic

TV

subscripti

on

Dome

s-tic

TV

subscr

-iption

rating

Overseas

TV

subscripti

on

Overs-

eas TV

subscr

-iption

rating

On-

demand

subscripti

on

On-

deman

d

subscri

-ption

rating

Free

videos

and

highlig

-hts

Free

video

s and

highli

-ghts

rating

Total

rates

Real Madrid Yes (price

not known) 1 No 0 No 0 Yes 1 2

FC Barcelona Yes (price

not known) 1 No 0 No 0 Yes 1 2

Bayem Munich

No 0 No 0

Yes - 4

EUR 1 Yes 1 2

Manchester United

Yes - £6 1

Yes (some

countries) 1 No 0 Yes 1 3

Manchester City No 0 No 0 No 0 Yes 1 1

Chelsea

Yes - £6 1

Yes (some

countries) 1

Yes -

£5.99 1 Yes 1 4

Arsenal

No 0 No 0

Yes -

£3.99 1 Yes 1 2

Liverpool Yes - £7 1 No 0

Yes -

£4.99 1 Yes 1 3

Tottenham Hotspur No 0

Yes (some

countries) 1

Yes -

FREE 2 Yes 1 4

*Sources: Real Madrid ([no date]b), Barca TV (no date), FC Bayern (no date), Manchester United ([no

date]c), Manchester City ([no date]c), Chelsea FC ([no date]c), Arsenal (2011), Liverpool FC ([no date]h),

Tottenham Hotspur ([no date]c)](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-53-320.jpg)

![54

Appendix 3: TripAdvisor ratings (stadium visits)- accessed 8th January 2015

Club and stadium

Total

number

of

reviews

Total

number

of

'Excellent'

reviews

Total

number

of 'Very

good'

reviews

Total

number

of

'Average'

reviews

Total

number

of 'Poor'

reviews

Total

number

of

'Terrible'

reviews

Percentage

of

'excellent'

ratings

Real Madrid

(Bernabeu) 4,466 2,926 1,155 298 45 42 66%

FC Barcelona (Camp

Nou) 8,342 5,052 2,292 754 170 74 61%

Bayem Munich

(Allianz) 1,869 1,091 570 156 38 14 58%

Manchester United

(Old Trafford) 608 469 105 21 5 8 77%

Manchester City

(Etihad) 431 284 100 21 11 15 66%

Chelsea (Stamford

Bridge) 119 78 27 10 4 0 65%

Arsenal (Emirates) 742 523 170 30 8 11 70%

Liverpool (Anfield) 1,526 1,202 222 55 18 29 79%

Tottenham Hotspur

(White Hart Lane) 45 24 15 4 1 1 53%

*Sources: TripAdvisor ([no date]a), TripAdvisor ([no date]b), TripAdvisor ([no date]c), TripAdvisor ([no date]d),

TripAdvisor ([no date]e), TripAdvisor ([no date]f), TripAdvisor ([no date]g), TripAdvisor ([no date]h), TripAdvisor ([no

date]i)](https://image.slidesharecdn.com/559c8e84-fc0e-4ba0-b256-087244fa88db-150716121440-lva1-app6892/85/LFC-Case-Study-54-320.jpg)